Академический Документы

Профессиональный Документы

Культура Документы

Power Saver Program

Загружено:

Marlon Benson QuintoИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Power Saver Program

Загружено:

Marlon Benson QuintoАвторское право:

Доступные форматы

CopyCache ID: 111885 Meta Title: FHA PowerSaver program helps wityh green improvements Meta Keywords: FHA,

HUD, home loan, mortgages, home equity loan Meta Description: FHA PowerSaver program can help you finance energy efficient home improvements Leader: With the Fannie-and Freddie-induced curtailment of the PACE program for financing energy improvements, homeowners have fewer options for improving their properties. FHA's pilot PowerSaver program, which provides up to $25,000per home for approved energy efficient enhancements, should take up some of the slack. Here's what you need to know to take advantage of this new program.

Power to the people: Improve your home with FHA's new PowerSaver program

HUD expects this new program to help 30,000 homeowners and create 3,000 jobs for builders and contractors. There may be additional benefit to communities as well. Dan Keller, Seattle FHA mortgage banker, says, "I think this program may help homeowners improve their homes, adding to the pre-housing crash 'pride of home ownership mentality' along with rehabilitating and improving local housing communities affected by foreclosures." Homes and homeowners must meet eligibility guidelines. The home must be a one-unit, detached property, used as your primary residence. You must have a credit score of 660 or better, and your debt-to-income ratio can't exceed 45%. You cannot have a bankruptcy or foreclosure in your past, and you must not have been late with your mortgage payment (by 30 or more days) more than once in the last twelve months. These guidelines are a bit stricter than FHA-insured first mortgages because second mortgages are considered riskier to lenders. What improvements can you make? Ideally, you'll choose improvements that save enough energy to cover or substantially offset your payment, increase your home's equity, or both. The funds can be used to finance any of a number of eligible projects, including installation of Energy Star rated replacement windows, insulation, energy-efficient doors, HVAC systems and water heaters, solar panels, duct sealing and geothermal systems. What's the cost?

HUD says that it expects the loan's cost to be a major selling point. In its FAQs for Consumers, the agency states: PowerSaver loans will be less expensive and easier to access than other kinds of financing for home improvements, such as credit cards and home equity loans. This is because FHA is providing mortgage insurance and other incentives to lenders to lower costs for homeowners. FHA does not set the program's mortgage rates; that's done by lenders competing for business. However, the presence of FHA mortgage insurance does lower the risk to lenders, making the loans more attractive to originate and keeping rates down. In addition to the interest, there is an annual mortgage insurance premium of 1% of the loan amount. The loan amortization takes place over a 15- to 20-year period, depending on the type of improvements chosen. There is no prepayment penalty and, because the funds are funneled into home improvement projects, the interest is tax-deductible for those who itemize. How is getting a PowerSaver loan different? Unlike other FHA loans, only an exterior inspection is required instead of a full appraisal. This reduces the cost of taking out a PowerSaver loan. Parties who profit from your improvement, like your builder or contractor, are allowed to pay for discount points, which would lower your home equity loan's interest rate. Your costs may be financed into your new loan if you have enough home equity.FHA strongly encourages a home energy audit prior to beginning a PowerSaver project. It can locate areas of potential savings and help you make the best choices in home improvements. PowerSaver loans are not for underwater homeowners. The combined total of the new PowerSaver loan plus the current first mortgage cannot exceed the appraised value of the property (the appraisal does include the added value of the prospective improvements). Where can you find a PowerSaver lender? The Powersaver is in its early stages, and will run as a pilot program for two years. Initially, eighteen lenders have been authorized to offer the PowerSaver loan as part of the pilot.FHA mortgage blogger John Burke says it defeats the purpose of the program when it isn't widely available. "The PowerSaver program simply it isn't offered on a wide scale," he says, "As of the April 21st, there are only 18 participating lenders and in my mind that's a problem. If you really want to help homeowners, don't restrict programs like this to only a handful of lenders." HUD says it limits the program to a few lenders initially because it wants to give the pilot the best chance of succeeding. The chosen FHA lenders meet several requirements, including a track record with similar lending initiatives, adequate computer systems and audit capabilities, and the demonstrated ability to work collaboratively with public sector agencies. The first eighteen lenders are:

* Admirals Bank * AFC First Financial Corporation * Bank of Colorado * City of Boise, Idaho * Energy Finance Solutions * Enterprise Cascadia * HomeStreet Bank * Neighbor's Financial Corporation * Paramount Equity Mortgage, Inc. * Quicken Loans * SOFCU Community Credit Union * Stonegate Mortgage Corporation * Sun West Mortgage Company, Inc. * The Bank at Broadmoor * University of Virginia Community Credit Union, Inc. * Viewtech Financial Services, Inc. * WinTrust Mortgage * W. J. Bradley Mortgage Capital Corporation Other programs offered by a larger number of lenders include FHA Energy-Efficient Mortgages (EEMS) and 203(k) rehabilitation loans. With the huge variety of homeowner financial positions and needs, additional financing options can help increase the number of home energy improvements nationwide. For many homeowners and communities, the PowerSaver loan may offer the most appealing choice. Gina Pogol Gina Pogol has been writing about mortgage and finance since 1994. In addition to a decade in mortgage lending, she has worked as a business credit systems consultant for Experian and as an accountant for Deloitte. She graduated with High Distinction from the University of Nevada with a BS in Financial Management. Industry fact sheet http://portal.hud.gov/ http://portal.hud.gov/hudportal/documents/huddoc?id=DOC_12645.pdf http://Interview, Dan Keller http://Interview, John Burke FAQs for comsumers http://portal.hud.gov http://portal.hud.gov/hudportal/documents/huddoc?id=DOC_12643.pdf

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- InstructionДокумент1 страницаInstructionMarlon Benson QuintoОценок пока нет

- COC 3 - Setup Computer Servers TutorialДокумент8 страницCOC 3 - Setup Computer Servers TutorialMarlon Benson QuintoОценок пока нет

- Automated Identification Card Generating SystemДокумент15 страницAutomated Identification Card Generating SystemMarlon Benson QuintoОценок пока нет

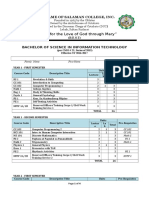

- BSIT Curriculum 2016-2017Документ4 страницыBSIT Curriculum 2016-2017Marlon Benson QuintoОценок пока нет

- DISMДокумент1 страницаDISMMarlon Benson QuintoОценок пока нет

- BSIT Curriculum 2016-2017Документ4 страницыBSIT Curriculum 2016-2017Marlon Benson QuintoОценок пока нет

- ServicesДокумент1 страницаServicesMarlon Benson QuintoОценок пока нет

- Chapter I-IVДокумент40 страницChapter I-IVMarlon Benson QuintoОценок пока нет

- RFID ProposalДокумент2 страницыRFID ProposalMarlon Benson QuintoОценок пока нет

- GPU-Z Sensor LogДокумент89 страницGPU-Z Sensor LogMarlon Benson QuintoОценок пока нет

- Database OnlineДокумент1 страницаDatabase OnlineMarlon Benson QuintoОценок пока нет

- Automated Identification Card Generating SystemДокумент15 страницAutomated Identification Card Generating SystemMarlon Benson QuintoОценок пока нет

- RFID ProposalДокумент2 страницыRFID ProposalMarlon Benson QuintoОценок пока нет

- ServicesДокумент1 страницаServicesMarlon Benson QuintoОценок пока нет

- Marlon B. Quinto, Mit Notre Dame of Isulan, Inc. Contract AgreementДокумент3 страницыMarlon B. Quinto, Mit Notre Dame of Isulan, Inc. Contract AgreementMarlon Benson QuintoОценок пока нет

- Summary Report For School Equipment IN ICT 2019: RFID & ID Equipment and ConsumablesДокумент14 страницSummary Report For School Equipment IN ICT 2019: RFID & ID Equipment and ConsumablesMarlon Benson QuintoОценок пока нет

- Summary Report For School Equipment IN ICT 2019: RFID & ID Equipment and ConsumablesДокумент14 страницSummary Report For School Equipment IN ICT 2019: RFID & ID Equipment and ConsumablesMarlon Benson QuintoОценок пока нет

- Chapter I-IVДокумент40 страницChapter I-IVMarlon Benson QuintoОценок пока нет

- Chapter I-IVДокумент40 страницChapter I-IVMarlon Benson QuintoОценок пока нет

- Summary Report For School Equipment IN ICT 2019: RFID & ID Equipment and ConsumablesДокумент14 страницSummary Report For School Equipment IN ICT 2019: RFID & ID Equipment and ConsumablesMarlon Benson QuintoОценок пока нет

- Chapter 3Документ3 страницыChapter 3Marlon Benson QuintoОценок пока нет

- LogoДокумент1 страницаLogoMarlon Benson QuintoОценок пока нет

- TransactionДокумент1 страницаTransactionMarlon Benson QuintoОценок пока нет

- Engr. Amir M. Ampao, MPS, DMДокумент4 страницыEngr. Amir M. Ampao, MPS, DMMarlon Benson QuintoОценок пока нет

- Online JobsДокумент1 страницаOnline JobsMarlon Benson QuintoОценок пока нет

- Trial Class Sched2Документ6 страницTrial Class Sched2Marlon Benson QuintoОценок пока нет

- ID SystemДокумент1 страницаID SystemMarlon Benson QuintoОценок пока нет

- Name of Students Boys 50 25% Assignment 10% Recitation Series No. QuizДокумент6 страницName of Students Boys 50 25% Assignment 10% Recitation Series No. QuizMarlon Benson QuintoОценок пока нет

- Concept ProposalДокумент2 страницыConcept ProposalImran AhmadОценок пока нет

- PDFДокумент2 страницыPDFMarlon Benson QuintoОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Role of Cognitive Abilities On Financial Literacy NewДокумент51 страницаThe Role of Cognitive Abilities On Financial Literacy NewZainab EhsanОценок пока нет

- Executives Summary of ProjectДокумент28 страницExecutives Summary of Projectgemechu100% (1)

- CH 4 Income From House PropertyДокумент89 страницCH 4 Income From House PropertyPratyashОценок пока нет

- Module 3 BAC 6Документ33 страницыModule 3 BAC 6Shela Mae Plaza TanqueОценок пока нет

- Financial StatementsДокумент20 страницFinancial StatementsOmnath BihariОценок пока нет

- Research Thesis On Inflation by ShoaibДокумент14 страницResearch Thesis On Inflation by Shoaibgrimshobi75% (16)

- Cost Sheet - Cost Accounting T. Y. B. Com. Sem V 1644476726Документ42 страницыCost Sheet - Cost Accounting T. Y. B. Com. Sem V 1644476726Yugapreetha R100% (1)

- Go Tong Electrical Supply Co., Inc. vs. BPIДокумент12 страницGo Tong Electrical Supply Co., Inc. vs. BPIVincent OngОценок пока нет

- LiabilityДокумент28 страницLiabilityJzjzkxmxkkxklОценок пока нет

- International Economics II Chapter 2Документ29 страницInternational Economics II Chapter 2Härêm ÔdОценок пока нет

- Unemployment, Inflation and Economic FluctuationsДокумент124 страницыUnemployment, Inflation and Economic FluctuationsElla MaeОценок пока нет

- 2013-Trujillo-Ponce-What Determines The Profitability of Banks-Evidence From Spain-Accounting & FinanceДокумент26 страниц2013-Trujillo-Ponce-What Determines The Profitability of Banks-Evidence From Spain-Accounting & Financewrecker_scorpionОценок пока нет

- Banerjee and Duflo - 2007 - The Economic Lives of The PoorДокумент36 страницBanerjee and Duflo - 2007 - The Economic Lives of The PoorKelmaisteisWandersonОценок пока нет

- Effect of Capital Structure Determinants On The Production and The Service Sector of PakistanДокумент54 страницыEffect of Capital Structure Determinants On The Production and The Service Sector of PakistanWaji Ul HassanОценок пока нет

- Blackstone BREIT Notice To StockholdersДокумент3 страницыBlackstone BREIT Notice To StockholdersZerohedgeОценок пока нет

- Law - Obligation of The VendeeДокумент3 страницыLaw - Obligation of The VendeeIris Grace CulataОценок пока нет

- Using Technology To Generate An Amortization Table: InquireДокумент5 страницUsing Technology To Generate An Amortization Table: InquireAdam MikitzelОценок пока нет

- 401 Midterm PracticeДокумент15 страниц401 Midterm PracticeNilanjona BalikaОценок пока нет

- Yuvraj Scope of Capital Market in IndiaДокумент59 страницYuvraj Scope of Capital Market in IndiaNeha ChafeОценок пока нет

- Pan Pacific Vs EquitableДокумент14 страницPan Pacific Vs EquitableKhayzee AsesorОценок пока нет

- Ch14 Required QuestionsДокумент31 страницаCh14 Required QuestionsMaha M. Al-MasriОценок пока нет

- Project On Innovative Banking Service To NRIДокумент77 страницProject On Innovative Banking Service To NRIShubham Shukla29% (7)

- Merchant Bank, Credit Rating, Debentures, SEBIДокумент9 страницMerchant Bank, Credit Rating, Debentures, SEBIClinton FernandesОценок пока нет

- Inheritence ExcerciseДокумент3 страницыInheritence Excercisemuhammad zubair20% (5)

- Chapter Six 2024Документ15 страницChapter Six 2024Romario KhaledОценок пока нет

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Документ32 страницы4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiОценок пока нет

- Tax Deducted at SourceДокумент37 страницTax Deducted at SourceasanjeevaОценок пока нет

- Defining and Prioritizing Stakeholders: Chapter OutlineДокумент25 страницDefining and Prioritizing Stakeholders: Chapter Outlinekhoi anisa0% (1)

- (FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaДокумент16 страниц(FAQ On ODI Updated Till 28.02.2019, RBI Website) Direct Investments Outside IndiaUditanshu MisraОценок пока нет

- ECO AssignmentДокумент2 страницыECO AssignmentChin-Chin AbejarОценок пока нет