Академический Документы

Профессиональный Документы

Культура Документы

Hayman Bass 20081017

Загружено:

dylan555Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Hayman Bass 20081017

Загружено:

dylan555Авторское право:

Доступные форматы

October 17, 2008 Be Careful Buying American While I wholeheartedly respect my elders, Mr.

Buffets comments today in the NY Times worry me. I am going to both agree and respectfully disagree with him. The disagreement is fundamentally based upon timing. When referring to the Great Depression, the equity market crashed in October 1929. It fell from a level of 381.17 in September 1929 to 198.89 on November 15, 1929 (a decline of 48%). After a brief rally from November 1929 to April 1930, the market dropped ANOTHER 86%OVER THE NEXT THREE YEARS to a level of 41. If you bought stocks in mid 1929, you didnt get back to EVEN until 1954! I wonder how much money Mr. Buffett will cost people with his Op-Ed piece today? He says buy equities (one year into the largest levered bust the world has ever witnessed) without telling people exactly what happened to the markets back then. I believe his comments are, to a certain extent, incomplete. I believe that America is, and always will be, the best place to live, work, and invest. However, the financial innovation and excessive leverage employed by American and foreign corporations, asset managers, and even consumers will take many years and bankruptcies to solve. Many companies, individuals, and even countries will end up bankrupt. Take Mr. Buffet's comments in stride. He has recently invested in companies seemingly without doing ANY due diligence. His investments into GE and Goldman Sachs were announced the same day, admittedly hours after, the call to him was made pleading for investment. He has departed from his mantra of derivatives being the "financial weapons of mass destruction" to investing in one of the biggest financial bomb makers in the business. I am not attempting to knock Goldman Sachs here because I do believe they are the greatest Wall St. firm ever. I am trying to make a point on deep value investors buying perceived franchise value without understanding the explicit and implicit leverage levels in those businesses. Im sure you can dig up articles of multitudes of deep value investors investing in Fannie, Freddie, Bear Stearns, Lehman, Wamu, Wachovia, and AIG all the way to the Davy Jones Locker. That style of investing typically works when excessive amounts of leverage ARENT USED. The system is levered the most it has EVER been RIGHT NOW. There will be a time to buy stocks. My best guess is that time is a few years into the future when the strong have separated themselves from the weak...a time when unemployment has hit 10% and US GDP has dropped 4-5% (maybe more). Be wary of "trusted" individuals telling you everything is fine today and that it is safe to buy equities in general. Mr. Buffet has enough

money to be able to have his holdings drop 50% and still fly in his jets and live the way in which he has become accustomed. Do you have enough capital to take what you have left, cut it in half, and continue to live the way you have for the past few years? I don't. Remember Alan Greenspan called the bottom in housing in November 2006. Here is what he said back then: "I suspect that we are coming to the end of this downtrend, as applications for new mortgages, the most important series, have flattened out. I don't know, but I think the worst of this may well be over." He was a bit early on this call. Be careful buying ANYTHING today. For those of you historians, I have attached a chart of the market from 1/4/29 to 12/30/32. It is the period of 29 to 33 that Mr. Buffet has left out of his discussion in the Op-Ed piece. Now isnt the time.

2 2008HaymanAdvisorsL.P.

Respectfully,

J. Kyle Bass Managing Partner

The information set forth herein is being furnished on a confidential basis to the recipient and does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services. Such an offer may only be made to eligible investors by means of delivery of a confidential private placement memorandum or other similar materials that contain a description of material terms relating to such investment. The information and opinions expressed herein are provided for informational purposes only. An investment in the Hayman Funds is speculative due to a variety of risks and considerations as detailed in the confidential private placement memorandum of the particular fund and this summary is qualified in its entirety by the more complete information contained therein and in the related subscription materials. This may not be reproduced, distributed or used for any other purpose. Reproduction and distribution of this summary may constitute a violation of federal or state securities laws.

3 2008HaymanAdvisorsL.P.

Вам также может понравиться

- Ghazi ValueInvestingCongress 100112Документ70 страницGhazi ValueInvestingCongress 100112VALUEWALK LLC100% (1)

- Lisa Rapuano Finding Your Way Along The Many Paths of ValueДокумент29 страницLisa Rapuano Finding Your Way Along The Many Paths of ValueValueWalk100% (1)

- Ed Thorp - A Mathematician on Wall StreetДокумент3 страницыEd Thorp - A Mathematician on Wall StreetgjangОценок пока нет

- Mark Yusko LetterДокумент43 страницыMark Yusko LetterValueWalk100% (2)

- 2009 Annual LetterДокумент5 страниц2009 Annual Letterppate100% (1)

- Third Point Q2 2010 Investor LetterДокумент9 страницThird Point Q2 2010 Investor Lettereric695Оценок пока нет

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketОт EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketОценок пока нет

- Name 1: Date: Score: Name 2: Name 3: Name 4: Name 5: Name 6: Name 7: Name 8: Name 9: Name 10Документ3 страницыName 1: Date: Score: Name 2: Name 3: Name 4: Name 5: Name 6: Name 7: Name 8: Name 9: Name 10Katherine Borja100% (2)

- Distressed Debt InvestingДокумент5 страницDistressed Debt Investingjt322Оценок пока нет

- AVM Ranger Returns 29.1% in 2016Документ6 страницAVM Ranger Returns 29.1% in 2016ChrisОценок пока нет

- H. Kevin Byun's Q4 2013 Denali Investors LetterДокумент4 страницыH. Kevin Byun's Q4 2013 Denali Investors LetterValueInvestingGuy100% (1)

- Amitabh Singhvi L MOI Interview L JUNE-2011Документ6 страницAmitabh Singhvi L MOI Interview L JUNE-2011Wayne GonsalvesОценок пока нет

- Scott Miller of Greenhaven Road Capital: Long On Zix CorpДокумент0 страницScott Miller of Greenhaven Road Capital: Long On Zix CorpcurrygoatОценок пока нет

- Klarman Yield PigДокумент2 страницыKlarman Yield Pigalexg6Оценок пока нет

- Boyar's Intrinsic Value Research Forgotten FourtyДокумент49 страницBoyar's Intrinsic Value Research Forgotten FourtyValueWalk100% (1)

- Allan Mecham Interview PDFДокумент6 страницAllan Mecham Interview PDFRajeev BahugunaОценок пока нет

- Thomas Russo: Global Value Investing - Richard Ivey School of Business, 2013Документ34 страницыThomas Russo: Global Value Investing - Richard Ivey School of Business, 2013Hedge Fund ConversationsОценок пока нет

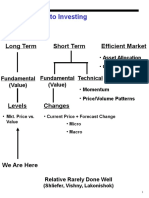

- Approaches To Investing: Long Term Short Term Efficient MarketДокумент71 страницаApproaches To Investing: Long Term Short Term Efficient MarketPeter WarmeОценок пока нет

- Clear Thinking About Share RepurchaseДокумент29 страницClear Thinking About Share RepurchaseVrtpy CiurbanОценок пока нет

- The 400% Man: How A College Dropout at A Tiny Utah Fund Beat Wall Street, and Why Most Managers Are Scared To Copy HimДокумент5 страницThe 400% Man: How A College Dropout at A Tiny Utah Fund Beat Wall Street, and Why Most Managers Are Scared To Copy Himrakeshmoney99Оценок пока нет

- Transcription of David Tepper's 2007 Presentation to Carnegie Mellon Undergraduate StudentsДокумент7 страницTranscription of David Tepper's 2007 Presentation to Carnegie Mellon Undergraduate StudentsPattyPattersonОценок пока нет

- Austrian Economics & InvestingДокумент20 страницAustrian Economics & InvestingRaj KumarОценок пока нет

- Aquamarine Fund PresentationДокумент25 страницAquamarine Fund PresentationVijay MalikОценок пока нет

- Bob Robotti - Navigating Deep WatersДокумент35 страницBob Robotti - Navigating Deep WatersCanadianValueОценок пока нет

- East Coast Q1 2015 MR Market RevisitedДокумент17 страницEast Coast Q1 2015 MR Market RevisitedCanadianValue0% (1)

- East Coast Asset Management (Q4 2009) Investor LetterДокумент10 страницEast Coast Asset Management (Q4 2009) Investor Lettermarketfolly.comОценок пока нет

- Promontory Investment Research Spring 2020Документ37 страницPromontory Investment Research Spring 2020Promontory Investment ResearchОценок пока нет

- Aquamarine - 2013Документ84 страницыAquamarine - 2013sb86Оценок пока нет

- The Beekeepers' Guide to Investing: Focusing on Business Fundamentals Over Emotions in Volatile MarketsДокумент13 страницThe Beekeepers' Guide to Investing: Focusing on Business Fundamentals Over Emotions in Volatile Marketscrees25Оценок пока нет

- 8th Annual New York: Value Investing CongressДокумент53 страницы8th Annual New York: Value Investing CongressVALUEWALK LLCОценок пока нет

- Decision-Making For Investors: Theory, Practice, and PitfallsДокумент20 страницDecision-Making For Investors: Theory, Practice, and PitfallsGaurav JainОценок пока нет

- Graham - Doddsville - Issue 40 - v19 PDFДокумент61 страницаGraham - Doddsville - Issue 40 - v19 PDFRofiq 4 NugrohoОценок пока нет

- Investor Insight Brenton 2020Документ10 страницInvestor Insight Brenton 2020BobОценок пока нет

- David Einhorn NYT-Easy Money - Hard TruthsДокумент2 страницыDavid Einhorn NYT-Easy Money - Hard TruthstekesburОценок пока нет

- GMO JanuaryДокумент9 страницGMO JanuaryZerohedgeОценок пока нет

- Distressed Debt Investing: Seth KlarmanДокумент4 страницыDistressed Debt Investing: Seth Klarmanjt322Оценок пока нет

- Letter About Carl IcahnДокумент4 страницыLetter About Carl IcahnCNBC.com100% (1)

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementДокумент70 страницMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comОценок пока нет

- Graham and Doddsville - Issue 9 - Spring 2010Документ33 страницыGraham and Doddsville - Issue 9 - Spring 2010g4nz0Оценок пока нет

- GMO Grantham Quarterly Apr10Документ14 страницGMO Grantham Quarterly Apr10careyescapitalОценок пока нет

- Berkshire Anaysis Moi201505 - BRKДокумент117 страницBerkshire Anaysis Moi201505 - BRKCarlos TresemeОценок пока нет

- Graham Doddsville Issue 24Документ61 страницаGraham Doddsville Issue 24CanadianValueОценок пока нет

- Office Hours With Warren Buffett May 2013Документ11 страницOffice Hours With Warren Buffett May 2013jkusnan3341Оценок пока нет

- Value Investing Congress NY 2010 AshtonДокумент26 страницValue Investing Congress NY 2010 Ashtonbrian4877Оценок пока нет

- 8th Annual New York: Value Investing CongressДокумент46 страниц8th Annual New York: Value Investing CongressVALUEWALK LLCОценок пока нет

- Gmo Quarterly LetterДокумент16 страницGmo Quarterly LetterAnonymous Ht0MIJ100% (2)

- The Art of Vulture Investing: Adventures in Distressed Securities ManagementОт EverandThe Art of Vulture Investing: Adventures in Distressed Securities ManagementОценок пока нет

- Financial Fine Print: Uncovering a Company's True ValueОт EverandFinancial Fine Print: Uncovering a Company's True ValueРейтинг: 3 из 5 звезд3/5 (3)

- Competitive Advantage in Investing: Building Winning Professional PortfoliosОт EverandCompetitive Advantage in Investing: Building Winning Professional PortfoliosОценок пока нет

- Against the Herd: 6 Contrarian Investment Strategies You Should FollowОт EverandAgainst the Herd: 6 Contrarian Investment Strategies You Should FollowОценок пока нет

- Mauldin February 26Документ9 страницMauldin February 26richardck61Оценок пока нет

- December 2009 Charleston Market ReportДокумент25 страницDecember 2009 Charleston Market ReportbrundbakenОценок пока нет

- T. Rowe Price: The Man, The Company, and The Investment PhilosophyОт EverandT. Rowe Price: The Man, The Company, and The Investment PhilosophyРейтинг: 4 из 5 звезд4/5 (1)

- Mauldin September 24Документ12 страницMauldin September 24richardck61Оценок пока нет

- A 2Документ6 страницA 2dylan555Оценок пока нет

- Elite Team ContractДокумент1 страницаElite Team Contractdylan555Оценок пока нет

- Elite Team ContractДокумент1 страницаElite Team Contractdylan555Оценок пока нет

- Stanford GSB Campus MapДокумент2 страницыStanford GSB Campus Mapdylan555Оценок пока нет

- Equity Market Volatility and Equity Risk PremiumДокумент42 страницыEquity Market Volatility and Equity Risk PremiumhaginileОценок пока нет

- RETAIL BANKING EVOLUTIONДокумент25 страницRETAIL BANKING EVOLUTIONTarun MaheshwariОценок пока нет

- BMW Financial Statement Analysis Reveals Profitability and Liquidity TrendsДокумент27 страницBMW Financial Statement Analysis Reveals Profitability and Liquidity Trendssaurabhm707Оценок пока нет

- Chapter 14 PPT - Holthausen & Zmijewski 2019Документ141 страницаChapter 14 PPT - Holthausen & Zmijewski 2019royОценок пока нет

- CMPT 16103Документ289 страницCMPT 16103Pratheesh KurupОценок пока нет

- Valuation of Shares PDFДокумент45 страницValuation of Shares PDFkgsanghavi67% (3)

- Information Guide For TARGET2 Users - Version 8.1Документ163 страницыInformation Guide For TARGET2 Users - Version 8.1pieoiqtporetqeОценок пока нет

- Rcube Systematic Alpha Fund PresentationДокумент32 страницыRcube Systematic Alpha Fund PresentationcyberichОценок пока нет

- Preference SharesДокумент1 страницаPreference SharesRishab MehtaОценок пока нет

- BEC - CryptocurrencyДокумент2 страницыBEC - CryptocurrencyCalОценок пока нет

- Investment in Equity Securities - IA1Документ17 страницInvestment in Equity Securities - IA1dumpyforhimОценок пока нет

- OF BST CHAPTER 11 (Marketing Management)Документ49 страницOF BST CHAPTER 11 (Marketing Management)ac20092006Оценок пока нет

- Volatility Seminar Notes on Variance SwapsДокумент12 страницVolatility Seminar Notes on Variance SwapsanuragОценок пока нет

- CorporationДокумент7 страницCorporationDo RaemondОценок пока нет

- Chapter 31Документ25 страницChapter 31Wedaje AlemayehuОценок пока нет

- The 5 Secrets To Highly Profitable Swing Trading: Introduction - Why So Many Pros Swing TradeДокумент3 страницыThe 5 Secrets To Highly Profitable Swing Trading: Introduction - Why So Many Pros Swing TradeSweety DasОценок пока нет

- PAS 21 EFFECTS OF FOREIGN EXCHANGE RATESДокумент7 страницPAS 21 EFFECTS OF FOREIGN EXCHANGE RATESElizabeth DumawalОценок пока нет

- Format of Business Plan PDFДокумент15 страницFormat of Business Plan PDFkeithcacay82Оценок пока нет

- IPru SmartKid Online BrochureДокумент23 страницыIPru SmartKid Online BrochureActuary Trần Thị Thu PhươngОценок пока нет

- 33 Sanjay PyasiДокумент8 страниц33 Sanjay PyasiEneng Panyang sibohОценок пока нет

- Chapter 23Документ21 страницаChapter 23RanDy JunaedyОценок пока нет

- Financial Modelling HandbookДокумент76 страницFinancial Modelling Handbookreadersbusiness99Оценок пока нет

- We Believe Lexinfintech Holdings Ltd. (Nasdaq: LX) Is A Leverage Time Bomb About To ExplodeДокумент32 страницыWe Believe Lexinfintech Holdings Ltd. (Nasdaq: LX) Is A Leverage Time Bomb About To ExplodeAndy HuffОценок пока нет

- Multiple Bank Account Mapping Request Form PDFДокумент1 страницаMultiple Bank Account Mapping Request Form PDFSantosh MashalОценок пока нет

- Satish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: International FinanceДокумент4 страницыSatish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: International FinancePranali Ahirrao 360iResearch™Оценок пока нет

- Term Paper of International Financial InstitutionДокумент35 страницTerm Paper of International Financial InstitutionFairuz SadafОценок пока нет

- Retail Management Chapter 1Документ30 страницRetail Management Chapter 1Earvin John MedinaОценок пока нет

- MT5 Quick GuideДокумент33 страницыMT5 Quick GuideKambadur KarthikeyОценок пока нет

- Equity Analysis Equity Analysis - Daily DailyДокумент7 страницEquity Analysis Equity Analysis - Daily Dailyapi-198466611Оценок пока нет