Академический Документы

Профессиональный Документы

Культура Документы

CASE 6-1 - Browning Manufacturing Company

Загружено:

Weng Torres AllonИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CASE 6-1 - Browning Manufacturing Company

Загружено:

Weng Torres AllonАвторское право:

Доступные форматы

BM 220 MANAGEMENT ACCOUNTING AND CONTROL ALLON, ROWENA T.

1997-65710

1.

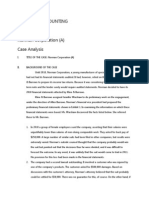

Browning Manufacturing Company Projected 2010 Statement of Cost of Goods Sold

Finished goods inventory, 1/1/10 Work in process inventory, 1/1/10 Materials used Plus: Factory expenses Direct manufacturing labor Factory overhead: Indirect manufacturing labor Power, heat and light Depreciation of plant Social Security taxes Taxes and insurance, factory Supplies Less: Work in process inventory, 12/31/10 Cost of goods manufactured (i.e. Completed) Less: Finished goods inventory, 12/31/10 Cost of goods sold

257,040.00 172,200.00 811,000.00 492,000.00 198,000.00 135,600.00 140,400.00 49,200.00 52,800.00 61,200.00

637,200.00 2,112,400.00 210,448.00 1,901,952.00 2,158,992.00 352,368.00 1,806,624.00

BM 220 MANAGEMENT ACCOUNTING AND CONTROL ALLON, ROWENA T. 1997-65710

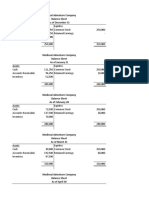

Browning Manufacturing Company Projected 2010 Income Statement

Sales Less: Sales returns and allowances Sales discounts allowed Cost of goods sold (per schedule) 19,200.00 49,200.00

2,562,000.00

Net Sales Less: Gross margin

68,400.00 2,493,600.00 1,806,624.00 686,976.00 522,000.00 164,976.00 38,400.00 126,576.00 58,000.00 68,576.00

Selling and Less: administrative expense Operating income Less: Interest expense Income before federal and state income tax Estimated income tax expense Less: Net income

BM 220 MANAGEMENT ACCOUNTING AND CONTROL ALLON, ROWENA T. 1997-65710

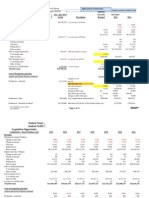

Browning Manufacturing Company Projected 2010 Balance Sheet

Assets Current Assets: Cash and marketable securities Accounts receivable (net of allowance for DA) Inventories: Materials Work in process Finished goods Supplies Prepaid taxes and insurance Total current assets Other assets: Manufacturing plant at cost Less: Accumulated depreciation Total Assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Notes payable Income taxes payable Deferred taxes payable Total current liabilities Shareholders' equity: Capital stock Retained earnings Total Liabilites and Shareholders' Equity

495,840.00 201,360.00 124,520.00 210,448.00 352,368.00 22,080.00

709,416.00 91,920.00 1,498,536.00

2,822,400.00 1,047,600.00

1,774,800.00 3,273,336.00

288,360.00 552,840.00 5,800.00 52,200.00 899,200.00 1,512,000.00 862,136.00

2,374,136.00 3,273,336.00

BM 220 MANAGEMENT ACCOUNTING AND CONTROL ALLON, ROWENA T. 1997-65710

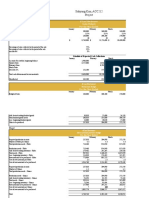

2. Accounts Sales Sales returns and allowances Sales discounts allowed Cost of goods sold (per schedule) Selling and administrative expense Interest expense Estimated income tax expense Cash and marketable securities Accounts receivable (net) Materials Work in process Finished goods Supplies Prepaid taxes and insurance Manufacturing plant at cost Accounts payable Notes payable Income taxes payable Capital stock Retained earnings 2009 2,295,600.00 17,640.00 43,920.00 1,568,280.00 437,160.00 34,080.00 89,520.00 118,440.00 311,760.00 110,520.00 172,200.00 257,040.00 17,280.00 66,720.00 2,678,400.00 185,760.00 288,840.00 9,000.00 1,512,000.00 829,560.00 2010 2,562,000.00 19,200.00 49,200.00 1,806,624.00 522,000.00 38,400.00 58,000.00 495,840.00 201,360.00 124,520.00 210,448.00 352,368.00 22,080.00 91,920.00 2,822,400.00 288,360.00 552,840.00 5,800.00 1,512,000.00 862,136.00 % 12% 9% 12% 15% 19% 13% -35% 319% -35% 13% 22% 37% 28% 38% 5% 55% 91% -36% 0% 4% Inc/Dec Increase Increase Increase Increase Increase Increase Decrease Increase Decrease Increase Increase Increase Increase Increase Increase Increase Increase Decrease Increase

From the table above, it is noted that there is a remarkable increase in the Cash and marketable securities account by 319%. Further, there is also a decrease in the Accounts receivable account, which means that there is a increase in cash because of the collections forecasted. On the other hand, the accounts and notes payable accounts also increased by 55% and 91%, respectively.

3.

Вам также может понравиться

- Case 6 1Документ10 страницCase 6 1cashmerehitОценок пока нет

- Problem 4-4 Dindorf CompanyДокумент5 страницProblem 4-4 Dindorf Companymelati50% (4)

- Chapter 8-1 Group Report - NormanДокумент6 страницChapter 8-1 Group Report - Normanvp_zarate100% (1)

- Case 6-1 BrowningДокумент7 страницCase 6-1 BrowningPatrick HariramaniОценок пока нет

- Medieval Adventures CompanyДокумент6 страницMedieval Adventures Companylouiegoods24100% (2)

- List of Case Questions: Case #5: Fonderia Di Torino S.P.A Questions For Case PreparationДокумент4 страницыList of Case Questions: Case #5: Fonderia Di Torino S.P.A Questions For Case Preparationdd100% (2)

- Control Case 1 PC DepotДокумент8 страницControl Case 1 PC DepotAbs PangaderОценок пока нет

- Case Study 4 3 Copies ExpressДокумент7 страницCase Study 4 3 Copies Expressamitsemt100% (2)

- CASE 4-1 PC DepotДокумент7 страницCASE 4-1 PC Depotkimhyunna75% (4)

- Browning Manufacturing CompanyДокумент7 страницBrowning Manufacturing CompanyajsibalОценок пока нет

- Joan Holtz's Case AnalysisДокумент2 страницыJoan Holtz's Case AnalysisIan Gumapac0% (1)

- Chap004 SolutionsДокумент7 страницChap004 Solutionsdavegeek100% (1)

- 11-1 Medieval Adventures CompanyДокумент8 страниц11-1 Medieval Adventures CompanyWei DaiОценок пока нет

- PC DepotДокумент2 страницыPC DepotJohn Carlos WeeОценок пока нет

- 6 - Browning MFTG Company Case SolutionДокумент12 страниц6 - Browning MFTG Company Case Solutionjenice joy100% (2)

- 11-1 Medieval Company - AssignmentДокумент3 страницы11-1 Medieval Company - AssignmentOkta Paulia100% (2)

- Butterfly + Broken Wing ButterflyДокумент4 страницыButterfly + Broken Wing ButterflyMrityunjay KumarОценок пока нет

- Case Report - Grenell FarmДокумент5 страницCase Report - Grenell Farmajsibal100% (1)

- ACCOUNTING STERN CORPORATION (A) AnswerДокумент4 страницыACCOUNTING STERN CORPORATION (A) AnswerPradina RachmadiniОценок пока нет

- Accounting: Stern CorporationДокумент12 страницAccounting: Stern CorporationCamelia Indah Murniwati100% (3)

- QED Electronics - Problem 3.7Документ1 страницаQED Electronics - Problem 3.7ivanyongforexОценок пока нет

- PC Depot (Accounting)Документ4 страницыPC Depot (Accounting)Ange Buenaventura Salazar100% (2)

- Accounting Case Study: PC DepotДокумент7 страницAccounting Case Study: PC DepotPutri Saffira YusufОценок пока нет

- CHAPTER 11 Answer KeyДокумент8 страницCHAPTER 11 Answer KeyEnsot Soriano33% (3)

- Fabm 2 Edited Lesson 1 SFPДокумент16 страницFabm 2 Edited Lesson 1 SFPJhon Jhon100% (1)

- Case-Study-2 - Browning Manufacturing Company - Delaraga-Yocson - FranciscoДокумент10 страницCase-Study-2 - Browning Manufacturing Company - Delaraga-Yocson - Franciscoabigail franciscoОценок пока нет

- Lewis Corporation Assignment Case 6-2 KTMДокумент7 страницLewis Corporation Assignment Case 6-2 KTMSudeep ShahОценок пока нет

- Chemalite SolutionHBSДокумент10 страницChemalite SolutionHBSManoj Singh0% (1)

- Chaper 1 - FS AuditДокумент12 страницChaper 1 - FS AuditLouie De La Torre60% (5)

- Case 4-1 PC DepotДокумент5 страницCase 4-1 PC Depotamitsemt67% (3)

- Waltham Oil and Lube WorkingsДокумент5 страницWaltham Oil and Lube WorkingsGaurav Sahu100% (1)

- Browning Manufacturing CaseДокумент6 страницBrowning Manufacturing CaseChleo EsperaОценок пока нет

- Manufacturing AccountsДокумент11 страницManufacturing Accountslukamasia100% (1)

- Full Assignment Purchasing Management and Supply ChainДокумент105 страницFull Assignment Purchasing Management and Supply ChainMaizurah AbdullahОценок пока нет

- CASE 6-1 - Browning Manufacturing Company - 2Документ7 страницCASE 6-1 - Browning Manufacturing Company - 2Weng Torres AllonОценок пока нет

- English For Logistics VocabularyДокумент2 страницыEnglish For Logistics VocabularyOla WodaОценок пока нет

- AkuntansiДокумент3 страницыAkuntansier4sallОценок пока нет

- Case 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalДокумент5 страницCase 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalCyd Marie VictorianoОценок пока нет

- Medieval Case SolutionДокумент7 страницMedieval Case SolutionTarry BerryОценок пока нет

- Case 9-2 Innovative Engineering CoДокумент4 страницыCase 9-2 Innovative Engineering CoFaizal PradhanaОценок пока нет

- Genmo CorporationДокумент12 страницGenmo CorporationAarushi Pawar100% (1)

- Case 8-1 Norman Corp, Patrick AnalysisДокумент2 страницыCase 8-1 Norman Corp, Patrick AnalysisPatrick HariramaniОценок пока нет

- Grennell Farm SolutionДокумент6 страницGrennell Farm SolutionMichael TorresОценок пока нет

- Browning Manufactur Company C6-1Документ18 страницBrowning Manufactur Company C6-1Faizal Pradhana100% (1)

- Maynard CompanyДокумент2 страницыMaynard CompanyArchin Padia100% (1)

- Stafford Press SolvedДокумент2 страницыStafford Press SolvedMurali DharanОценок пока нет

- Waltham Oil and Lube CentreДокумент5 страницWaltham Oil and Lube CentreAnirudh Singh0% (2)

- Accounting Case 2Документ3 страницыAccounting Case 2ayushishahОценок пока нет

- Case Analysis 3 1 Maynard BusinessДокумент6 страницCase Analysis 3 1 Maynard BusinessDAVE RYAN DELA CRUZОценок пока нет

- Problem 13-1 - Chapter 13 - SolutionДокумент6 страницProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- Case Summary WalthamДокумент2 страницыCase Summary WalthamAnurag ChatarkarОценок пока нет

- Amerbran CompanyДокумент1 страницаAmerbran CompanyJalad Mukerjee100% (1)

- Case 7 3 StaffordДокумент5 страницCase 7 3 StaffordArjun Khosla0% (2)

- Case Study 4 - 3 Copies ExpressДокумент8 страницCase Study 4 - 3 Copies ExpressJZ0% (1)

- Dupont AnalysisДокумент5 страницDupont AnalysisNoraminah IsmailОценок пока нет

- Case 6 1 Browning Manufacturing Company 2 PDF FreeДокумент7 страницCase 6 1 Browning Manufacturing Company 2 PDF FreeLia AmeliaОценок пока нет

- Marion Boat - GroupДокумент8 страницMarion Boat - GroupgvermaravОценок пока нет

- Fonderia Di Torina SpAДокумент10 страницFonderia Di Torina SpARoberta AyalingoОценок пока нет

- Financial Aspect-Manufacturing - Cash Transactions OnlyДокумент14 страницFinancial Aspect-Manufacturing - Cash Transactions OnlyAllan Paul AnguloОценок пока нет

- Financial Aspect ManufacturingДокумент21 страницаFinancial Aspect ManufacturingRicel CriziaОценок пока нет

- Cash Accounts Receivable Notes Receivable Prepaid Insurance: GivenДокумент6 страницCash Accounts Receivable Notes Receivable Prepaid Insurance: GivenPedro PelaezОценок пока нет

- Assignment No. 1 C& M AccountingДокумент2 страницыAssignment No. 1 C& M AccountingAnkur JainОценок пока нет

- Forecast AnalysisДокумент15 страницForecast AnalysisscotthnguyenОценок пока нет

- Project 1 Sukyung KimДокумент14 страницProject 1 Sukyung Kimapi-3418701680% (1)

- Doc-20231224-Wa0004 231224 094151 240126 071702Документ25 страницDoc-20231224-Wa0004 231224 094151 240126 071702zaneledubenОценок пока нет

- G.R. No. L-24059 - C. M. Hoskins & Co., Inc. v. Commissioner of Internal RevenueДокумент3 страницыG.R. No. L-24059 - C. M. Hoskins & Co., Inc. v. Commissioner of Internal RevenueMegan AglauaОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент12 страницStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancesrikanthreddy6036Оценок пока нет

- Level II - Derivatives: Pricing and Valuation of Forward CommitmentsДокумент52 страницыLevel II - Derivatives: Pricing and Valuation of Forward CommitmentsDerrick NyakibaОценок пока нет

- Foreign Trade PolicyДокумент1 страницаForeign Trade PolicyShakeeb HashmiОценок пока нет

- Chapter 5 Bonds and Stock ValuationДокумент16 страницChapter 5 Bonds and Stock ValuationEstores Ronie M.Оценок пока нет

- Outer-Rim CantinaДокумент19 страницOuter-Rim CantinaJoão Pedro ValeОценок пока нет

- Atlanta Anijane TemplateДокумент27 страницAtlanta Anijane TemplateSixtus OkoroОценок пока нет

- CH 1 Micro Economics Class 11Документ20 страницCH 1 Micro Economics Class 11Rahul GuptaОценок пока нет

- Scarcity, Choice and Opportunity Cost Factors of Production Different EconomiesДокумент14 страницScarcity, Choice and Opportunity Cost Factors of Production Different EconomiesSaajid MustunОценок пока нет

- External Analysis Pesttrs 1. Is Barbie Brand Well Defined To Be Successful in The Following Years? What Has To Be Changed?Документ7 страницExternal Analysis Pesttrs 1. Is Barbie Brand Well Defined To Be Successful in The Following Years? What Has To Be Changed?Ana Jordán MarquésОценок пока нет

- Elegant & Luxury Project Proposal XL by SlidesgoДокумент87 страницElegant & Luxury Project Proposal XL by SlidesgoH ramadanОценок пока нет

- Engaging With The Danish Young GenerationДокумент26 страницEngaging With The Danish Young GenerationQuang Minh NguyenОценок пока нет

- Coimbatore Cuddalore: 10:30 PM 5:00 AMДокумент4 страницыCoimbatore Cuddalore: 10:30 PM 5:00 AMSathiswebОценок пока нет

- GST Rahul 1 Project WorkДокумент29 страницGST Rahul 1 Project Workanjali baria100% (5)

- 60mun'23 G-20 Study GuideДокумент15 страниц60mun'23 G-20 Study GuideFSAL MUNОценок пока нет

- Minn NC DeyДокумент13 страницMinn NC Deyjob infoОценок пока нет

- Market Research For Microfinance Participant S Manual 1Документ41 страницаMarket Research For Microfinance Participant S Manual 1Hannah Mae SarzaОценок пока нет

- Company Profile: Bajaj Capital's Mission StatementДокумент9 страницCompany Profile: Bajaj Capital's Mission Statementadani9Оценок пока нет

- Castro, Aletteya, HW5Документ2 страницыCastro, Aletteya, HW5aletteya castroОценок пока нет

- IB Economics IA 2Документ4 страницыIB Economics IA 2SpicyChildrenОценок пока нет

- Chapter 16Документ25 страницChapter 16Wedaje AlemayehuОценок пока нет

- Soil Compactor 1Документ2 страницыSoil Compactor 1JD SОценок пока нет

- Wa0037.Документ2 страницыWa0037.Arshal AzeemОценок пока нет

- MCQ Test 1 On Capital Budgeting and Cost Benefit AnalysisДокумент6 страницMCQ Test 1 On Capital Budgeting and Cost Benefit AnalysisManthan DesaiОценок пока нет

- CZAR FARMS IAM EnhancementДокумент23 страницыCZAR FARMS IAM EnhancementAbdulsalam ZainabОценок пока нет