Академический Документы

Профессиональный Документы

Культура Документы

W2 2010

Загружено:

Rick NunnsИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

W2 2010

Загружено:

Rick NunnsАвторское право:

Доступные форматы

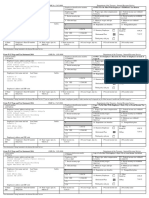

Form

W-2

Wage and Tax Statement

2010

1 OMB No. 1545-0008 7 Social security tips 3

Department of the Treasury Internal Revenue Service Wages, tips, other compensation 2 Federal income tax withheld

31766.45

Social security wages 4

174.38

Social security tax withheld

Copy B To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service c Employer's name, address, and zip

31766.45

8 Allocated tips 5 Medicare wages and tips 6

1969.52

Medicare tax withheld

HENRY FORD HEALTH SYSTEM ONE FORD PLACE DETROIT MI 48202

e Employee's name, address, and zip

31766.45

9 12a Advance EIC payment See instruction for box 12 10 12b Dependent care benefits 11 12c

460.61

Nonqualified plans

C

12d

124.28

13

Statutory emp Retirement plan Third-party sick pay

14

Other

ANNA M NUNNALLY 18600 FIVE POINTS REDFORD MI 48240 MI

15 State

X

b Employer identification number (EIN) a Employee's social security number

38-1357020 31766.45

16 State wages, tips, etc. 17

396-74-2134 31766.45

18 Local wages, tips, etc. 1

381357020

Employer's state ID number

918.08

State income tax

794.15

DETROIT

Form

W-2

Wage and Tax Statement

2010

19 Local income tax 20 Locality name Department of the Treasury Internal Revenue Service Wages, tips, other compensation 2 Federal income tax withheld

OMB No. 1545-0008 7 Social security tips 3

31766.45

Social security wages 4

174.38

Social security tax withheld

Copy C For EMPLOYEE'S RECORDS (See Notice to Employee on back of Copy B.) c Employer's name, address, and zip

31766.45

8 Allocated tips 5 Medicare wages and tips 6

1969.52

Medicare tax withheld

HENRY FORD HEALTH SYSTEM ONE FORD PLACE DETROIT MI 48202

e Employee's name, address, and zip

31766.45

9 12a Advance EIC payment See instruction for box 12 10 12b Dependent care benefits 11 12c

460.61

Nonqualified plans

C

12d

124.28

13

Statutory emp Retirement plan Third-party sick pay

14

Other

ANNA M NUNNALLY 18600 FIVE POINTS REDFORD MI 48240

X

b Employer identification number (EIN) a Employee's social security number

38-1357020

396-74-2134

This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

MI

15 State

381357020

Employer's state ID number 16

31766.45

State wages, tips, etc. 17

918.08

State income tax 18

31766.45

Local wages, tips, etc. 1 OMB No. 1545-0008

794.15

DETROIT

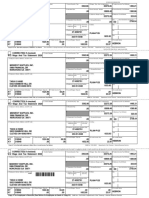

Form

W-2

Wage and Tax Statement

2010

19 Local income tax 20 Locality name Department of the Treasury Internal Revenue Service Wages, tips, other compensation 2 Federal income tax withheld

31766.45

3 Social security wages 4

174.38

Social security tax withheld

Social security tips

Copy 2 To Be Filed With Employee's State, City, or Local Income Tax Return c Employer's name, address, and zip

31766.45

8 9 12a Allocated tips Advance EIC payment See instruction for box 12 5 10 12b Medicare wages and tips 6 11 12c

1969.52

Medicare tax withheld

HENRY FORD HEALTH SYSTEM ONE FORD PLACE DETROIT MI 48202

e Employee's name, address, and zip

31766.45

Dependent care benefits

460.61

Nonqualified plans

C

12d

124.28

13

Statutory emp Retirement plan Third-party sick pay

14

Other

ANNA M NUNNALLY 18600 FIVE POINTS REDFORD MI 48240

X

b Employer identification number (EIN) a Employee's social security number

38-1357020

396-74-2134

MI

15 State

381357020

Employer's state ID number 16

31766.45

State wages, tips, etc. 17

918.08

State income tax 18

31766.45

Local wages, tips, etc. 1 OMB No. 1545-0008

794.15

DETROIT

Form

W-2

Wage and Tax Statement

2010

19 Local income tax 20 Locality name Department of the Treasury Internal Revenue Service Wages, tips, other compensation 2 Federal income tax withheld

31766.45

3 Social security wages 4

174.38

Social security tax withheld

Social security tips

Copy 2 To Be Filed With Employee's State, City, or Local Income Tax Return c Employer's name, address, and zip

31766.45

8 Allocated tips 5 Medicare wages and tips 6

1969.52

Medicare tax withheld

HENRY FORD HEALTH SYSTEM ONE FORD PLACE DETROIT MI 48202

e Employee's name, address, and zip

31766.45

9 12a Advance EIC payment See instruction for box 12 10 12b Dependent care benefits 11 12c

460.61

Nonqualified plans

C

12d

124.28

13

Statutory emp Retirement plan Third-party sick pay

14

Other

ANNA M NUNNALLY 18600 FIVE POINTS REDFORD MI 48240 MI

15 State

X

b Employer identification number (EIN) a Employee's social security number

38-1357020 31766.45

16 State wages, tips, etc. 17

396-74-2134 31766.45

18 Local wages, tips, etc. 19

381357020

Employer's state ID number

918.08

State income tax

794.15

Local income tax

DETROIT

20 Locality name

Notice to Employee Refund. Even if you do not have to file a tax return, you should file to get a refund if box 2 shows federal income tax withheld or if you can take the earned income credit. Earned income credit (EIC). You must file a tax return if any amount is shown in box 9. You may be able to take the EIC for 2010 if (a) you do not have a qualifying child and you earned less than $13,460 ($18,470 if married filing jointly), (b) you have one qualifying child and you earned less than $35,535 ($40,545 if married filing jointly), (c) you have two qualifying children and you earned less than $40,363 ($45,373 if married filing jointly), or (d) you three or more qualifying children and you earned less than $43,352 ($48,362 if married filing jointly). You and any qualifying children must have valid social security numbers (SSNs). You cannot take the EIC if your investment income is more than $3,100. Any EIC that is more than your tax liability is refunded to you, but only if you file a tax return. If you have at least one qualifying child, you may get as much as $1,830 of the EIC in advance by completing Form W-5, Earned Income Credit Advance Payment Certificate, and giving it to your employer. Clergy and religious workers. If you are not subject to social security and Medicare taxes, see publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers. Corrections. If your name, SSN, or address is incorrect, correct Copies B, C, and 2 and ask your employer to correct your employment record. Be sure to ask the employer to file Form W-2c, Corrected Wage and Tax Statement, with the Social Security Administration (SSA) to correct any name, SSN, or money amount error reported to the SSA on Form W-2. If your name and SSN are correct but are not the same as shown on your social security card, you should ask for a new card that displays your correct name at any SSA office or by calling 1-800-772-1213. You may also visit the SSA at www.socialsecurity.gov. Credit for excess taxes. If you had more than one employer in 2010 and more than $6,621.60 in social security and/or Tier I railroad retirement (RRTA) taxes were withheld, you may be able to claim a credit for the excess against your federal income tax. If you had more than one railroad employer and more than $3,088.80 in Tier II RRTA tax was withheld, you also may be able to claim a credit. See your Form 1040 or Form 1040A instructions and Publication 505, Tax Withholding and Estimated Tax. Instructions (continued from the back of Copy B.) Note. If a year follows code D through H, S, Y, AA, or BB, you made a make-up pension contribution for a prior year(s) when you were in military service. To figure whether you made excess deferrals, consider these amounts for the year shown, not the current year. If no year is shown, the contributions are for the current year. AUncollected social security or RRTA tax on tips. Include this tax on Form 1040. See "Total Tax" in the Form 1040 instructions. BUncollected Medicare tax on tips. Include this tax on Form 1040. See "Total Tax" in the Form 1040 instructions. CTaxable cost of group-term life insurance over $50,000 (included in boxes 1, 3 (up to social security wage base), and 5) DElective deferrals to a section 401(k) cash or deferred arrangement. Also includes deferrals under a SIMPLE retirement account that is part of a section 401(k) arrangement. EElective deferrals under a section 403(b) salary reduction agreement FElective deferrals under a section 408(k)(6) salary reduction SEP GElective deferrals and employer contributions (including non elective deferrals) to a section 457(b) deferred compensation plan HElective deferrals to a section 501(c)(18)(D) tax-exempt organization plan. See "Adjusted Gross Income" in the Form 1040 instructions for how to deduct. JNontaxable sick pay (information only, not included in boxes 1, 3, or 5) K20% excise tax on excess golden parachute payments. See "Total Tax" in the Form 1040 instructions. LSubstantiated employee business expense reimbursements (nontaxable) MUncollected social security or RRTA tax on taxable cost of group-term life insurance over $50,000 (former employees only). See "Total Tax" in the Form 1040 instructions. NUncollected Medicare tax on taxable cost of group-term life insurance over $50,000 (former employees only). See "Total Tax" in the Form 1040 instructions.

Instructions for Employee Box 1. Enter this amount on the wages line of your tax return. Box 2. Enter this amount on the federal income tax withheld line of your tax return. Box 8. This amount is not included in boxes 1, 3, 5, or 7. For information on how to report tips on your tax return, see your Form 1040 instructions. Box 9. Enter this amount on the advance earned income credit payments line of your Form 1040 or Form 1040A. Box 10. This amount is the total dependent care benefits that your employer paid to you or incurred on your behalf (including amounts from a section 125 (cafeteria) plan). Any amount over $5,000 is also included in box 1. You must complete Schedule 2 (Form 1040A) or Form 2441, Child and Dependent Care Expenses, to compute any taxable and nontaxable amounts. Box 11. This amount is (a) reported in box 1 if it is a distribution made to you from a nonqualified deferred compensation or nongovernmental section 457(b) plan or (b) included in box 3 and/or 5 if it is a prior year deferral under a nonqualified or section 457(b) plan that became taxable for social security and Medicare taxes this year because there is no longer a substantial risk of forfeiture of your right to the deferred amount. Box 12. The following list explains the codes shown in box 12. You may need this information to complete your tax return. Elective deferrals (codes D, E, F, and S) and designated Roth contributions (codes AA and BB) under all plans are generally limited to a total of $16,500 ($11,500 if you only have SIMPLE plans; $19,500 for section 403(b) plans if you qualify for the 15-year rule explained in Pub. 71). Deferrals under code G are limited to $16,500. Deferrals under code H are limited to $7,000. However, if you were at least age 50 in 2010, your employer may have allowed an additional deferral of up to $5,500 ($2,500 for section 401(k)(11) and 408(p) SIMPLE plans). This additional deferral amount is not subject to the overall limit on elective deferrals. For code G, the limit on elective deferrals may be higher for the last 3 years before you reach retirement age. Contact your plan administrator for more information. Amounts in excess of the overall elective deferral limit must be included in income. See the "Wages, Salaries, Tips, etc." line instructions for Form 1040. (Instructions for Employee on the back of Copy C.)

PExcludable moving expense reimbursements paid directly to employee (not included in boxes 1, 3, or 5) QNontaxable combat pay. See the instructions for Form 1040 or Form 1040A for details on reporting this amount. REmployer contributions to your Archer MSA. Report on Form 8853, Archer MSAs and Long-Term Care Insurance Contracts. SEmployee salary reduction contributions under a section 408(p) SIMPLE (not included in box 1) TAdoption benefits (not included in box 1). You must complete Form 8839, Qualified Adoption Expenses, to compute any taxable and nontaxable amounts. VIncome from exercise of nonstatutory stock option(s) (included in boxes 1, 3 (up to social security wage base), and 5) WEmployer contributions to your Health Savings Account. Report on Form 8889, Health Savings Accounts (HSAs). QNontaxable combat pay. See the instructions for Form 1040 or Form 1040A for details on reporting this amount. YDeferrals under a section 409A nonqualified deferred compensation plan. ZIncome under section 409A on a nonqualified deferred compensation plan. This amount is also included in box 1. It is subject to an additional 20% tax plus interest. See "Total Tax" in the Form 1040 instructions. AADesignated Roth contributions under a section 401(k) plan BBDesignated Roth contributions under a section 403(b) plan CC (For employer use only)HIRE exempt wages and tips Box 13. If the "Retirement plan" box is checked, special limits may apply to the amount of traditional IRA contributions that you may deduct. Note. Keep Copy C of Form W-2 for at least 3 years after the due date for filing your income tax return. However, to help protect your social security benefits, keep Copy C until you begin receiving social security benefits, just in case there is a question about your work record and/or earnings in a particular year. Compare the Social Security wages and the Medicare wages to the information shown on your annual (for workers over 25) Social Security Statement.

Вам также может понравиться

- W-2 Forms SummaryДокумент4 страницыW-2 Forms SummaryScott Harrison0% (1)

- Selection 26 144Документ1 страницаSelection 26 144Anonymous fu1jUQОценок пока нет

- FTF1302745105156Документ5 страницFTF13027451051562sly4youОценок пока нет

- PDF W2Документ1 страницаPDF W2John LittlefairОценок пока нет

- F 1040Документ2 страницыF 1040Sue BosleyОценок пока нет

- StatementДокумент2 страницыStatementLuis HarrisonОценок пока нет

- Elina Shinkar w2 2014Документ2 страницыElina Shinkar w2 2014api-318948819Оценок пока нет

- I Pay Statements ServncoДокумент2 страницыI Pay Statements ServncoPablito Padilla100% (2)

- Income Tax Return For Single and Joint Filers With No DependentsДокумент3 страницыIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンОценок пока нет

- W-2 Preview ADPДокумент4 страницыW-2 Preview ADPRyan AllenОценок пока нет

- Selection-26 - 55 PDFДокумент1 страницаSelection-26 - 55 PDFAnonymous fu1jUQОценок пока нет

- 1040 Tax Form SummaryДокумент2 страницы1040 Tax Form SummaryKevin RowanОценок пока нет

- W2Документ1 страницаW2Flavia BegazoОценок пока нет

- SC Tax ReturnДокумент12 страницSC Tax ReturnCeleste KatzОценок пока нет

- Steven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Документ21 страницаSteven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Thomas Horne100% (1)

- W21225760934 0 PDFДокумент2 страницыW21225760934 0 PDFAnonymous czHLQeLPB4Оценок пока нет

- Evans W-2sДокумент2 страницыEvans W-2sAlmaОценок пока нет

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramДокумент10 страницFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyОценок пока нет

- Tax FormsДокумент2 страницыTax Formswilliam schwartz50% (2)

- 2014 Turbo Tax ReturnДокумент85 страниц2014 Turbo Tax ReturnBrayan Picoy ValerioОценок пока нет

- Tax ReturnДокумент2 страницыTax ReturnJack.A1100% (1)

- 1040 Tax Return SummaryДокумент2 страницы1040 Tax Return SummaryLinda100% (2)

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Документ3 страницыAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisОценок пока нет

- FTF1327867575806Документ3 страницыFTF1327867575806erzahler0% (1)

- AutoPay Output Documents PDFДокумент2 страницыAutoPay Output Documents PDFAnonymous QZuBG2IzsОценок пока нет

- 2018 TaxReturn PDFДокумент6 страниц2018 TaxReturn PDFDavid LeeОценок пока нет

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramДокумент10 страницFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramRhaxma ConspiracyОценок пока нет

- 2014 TaxReturnДокумент25 страниц2014 TaxReturnNguyen Vu CongОценок пока нет

- TAXES w2 REGAL HospitalityДокумент2 страницыTAXES w2 REGAL Hospitalityoskar_herrera2012Оценок пока нет

- DDDDДокумент21 страницаDDDDRed Rapture67% (3)

- Tax 2020 PDFДокумент7 страницTax 2020 PDFAshley Morales100% (4)

- Eddie Salazar PDFДокумент11 страницEddie Salazar PDFsloweddie salazar0% (1)

- 2019 W2 2020120235817 PDFДокумент3 страницы2019 W2 2020120235817 PDFJamyia Nowlin Kirts100% (3)

- 2008 Form 1040 Tax ReturnДокумент5 страниц2008 Form 1040 Tax ReturnJackie Page100% (2)

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsДокумент2 страницыW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Документ2 страницыFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waites100% (2)

- Printw2 PDFДокумент1 страницаPrintw2 PDFJhhghiОценок пока нет

- FTF1299519215531Документ3 страницыFTF1299519215531Leslie Washington100% (1)

- Kaisers 10Документ41 страницаKaisers 10camillealyssa100% (1)

- Dan Simon 2016 W2 PDFДокумент2 страницыDan Simon 2016 W2 PDFAnonymous ndTTXL80MnОценок пока нет

- Income Tax Return 2019Документ9 страницIncome Tax Return 2019Sh'Nanigns X3Оценок пока нет

- Marie Aladin 2019 Tax PDFДокумент60 страницMarie Aladin 2019 Tax PDFPrint Copy100% (1)

- Form 1040A Tax Filing BasicsДокумент2 страницыForm 1040A Tax Filing BasicsesvrasОценок пока нет

- 2014 Federal 1040 (Esther)Документ2 страницы2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnДокумент5 страницCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- WFB 092010Документ12 страницWFB 092010Simon Fong100% (1)

- Resume of Msnetty42Документ2 страницыResume of Msnetty42api-25122959Оценок пока нет

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnДокумент11 страницElectronic Filing Instructions For Your 2019 Federal Tax ReturnCoughman Matt67% (3)

- W 2Документ1 страницаW 2Raj SharmaОценок пока нет

- Dawn Income Tax 2019-07-21 - 1563756758720 PDFДокумент6 страницDawn Income Tax 2019-07-21 - 1563756758720 PDFDawn Smith100% (1)

- CreditCard8590Final2 12Документ1 страницаCreditCard8590Final2 12Joseph Puntureri100% (1)

- Img 20140203 0001Документ5 страницImg 20140203 0001Brandon MooreОценок пока нет

- 2018 Coleman Tax Return PDFДокумент46 страниц2018 Coleman Tax Return PDFJonathan Brinton100% (1)

- Kim Gilbert 2018 PDFДокумент25 страницKim Gilbert 2018 PDFKim Gilbert50% (2)

- Your Benefit Statement Tax Year 2019Документ2 страницыYour Benefit Statement Tax Year 2019sloweddie salazar100% (1)

- 2018 W-2 and Earnings SummaryДокумент2 страницы2018 W-2 and Earnings SummaryAdam Olsen100% (1)

- 2019 W-2 and Earnings SummaryДокумент1 страница2019 W-2 and Earnings SummaryGeorge LucasОценок пока нет

- Income Tax and Benefit ReturnДокумент8 страницIncome Tax and Benefit Returnapi-457375876Оценок пока нет

- Full Download Test Bank For Abnormal Psychology 17th Edition 17th Edition PDF Full ChapterДокумент36 страницFull Download Test Bank For Abnormal Psychology 17th Edition 17th Edition PDF Full Chapterpoleytallierbuj0cf100% (16)

- Watchtaxes 2008Документ31 страницаWatchtaxes 2008RobertОценок пока нет

- HowTo TDS 88 India in SAP B1Документ89 страницHowTo TDS 88 India in SAP B1Satish Prabhakar DokeОценок пока нет

- Patterns of Philippine ExpendituresДокумент13 страницPatterns of Philippine ExpendituresTrisha AlmonteОценок пока нет

- Britannia Industries Financial ReportДокумент15 страницBritannia Industries Financial ReportKunal DesaiОценок пока нет

- Bake Parlor ReportДокумент40 страницBake Parlor Reportmaham_t_qureshi86% (7)

- Philippine Christian University Tax ExamДокумент5 страницPhilippine Christian University Tax Examleo pigafetaОценок пока нет

- Co-founder & Director at KAMAP ConsultancyДокумент2 страницыCo-founder & Director at KAMAP ConsultancyParas ShahОценок пока нет

- Penang Realty Case Against IRBДокумент15 страницPenang Realty Case Against IRBsimson singawahОценок пока нет

- Benevolent Fund Application Form: Private & ConfidentialДокумент6 страницBenevolent Fund Application Form: Private & ConfidentialThe Origin EditОценок пока нет

- Refunds: Chapter - 19Документ28 страницRefunds: Chapter - 19Ashma KhanalОценок пока нет

- Construction Financial Business MangmentДокумент14 страницConstruction Financial Business MangmentMAGED MOHMMED AHMED QASEMОценок пока нет

- WEB Brachenbild ENGL Wasserwirtschaft 2015 A4 25062015Документ84 страницыWEB Brachenbild ENGL Wasserwirtschaft 2015 A4 25062015BapiUdhayaОценок пока нет

- Bangladesh National Budget Review FY24Документ27 страницBangladesh National Budget Review FY24Asif MahmudОценок пока нет

- THESIS Survey QuestionnaireДокумент3 страницыTHESIS Survey QuestionnaireArianne June AbarquezОценок пока нет

- Acc802 Tut Topc 7 QuestionsДокумент3 страницыAcc802 Tut Topc 7 Questionssanjeet kumarОценок пока нет

- Tax Integration CookbookДокумент76 страницTax Integration CookbookM.Medina100% (1)

- Copy1 Paystub 1Документ1 страницаCopy1 Paystub 1raheemtimo1Оценок пока нет

- PD 2026Документ2 страницыPD 2026Lv AvvaОценок пока нет

- Sample Balance Sheet Concierge Service IndustryДокумент12 страницSample Balance Sheet Concierge Service IndustrykpsrikanthvОценок пока нет

- Instant Download Ebook PDF Fundamental Accounting Principles Volume 2 15th Canadian Edition PDF ScribdДокумент41 страницаInstant Download Ebook PDF Fundamental Accounting Principles Volume 2 15th Canadian Edition PDF Scribdjudi.hawkins744100% (37)

- Financial Services: An OverviewДокумент13 страницFinancial Services: An OverviewKarthick KumarОценок пока нет

- Emerging Trends in Retail BankingДокумент6 страницEmerging Trends in Retail Bankinganandsree12345100% (3)

- Chapter 4 Activity Assignment 2Документ9 страницChapter 4 Activity Assignment 2Amir ShahzadОценок пока нет

- Plan Fiscal Del CRIMДокумент34 страницыPlan Fiscal Del CRIMEl Nuevo DíaОценок пока нет

- Tax Administration NegiriaДокумент10 страницTax Administration NegiriaBhagya ChowdaryОценок пока нет

- Public Finance and Public Policy 5th Edition Gruber Solutions ManualДокумент9 страницPublic Finance and Public Policy 5th Edition Gruber Solutions Manualmagnusorborneshw5Оценок пока нет

- Kubatana Newsletter 210817Документ85 страницKubatana Newsletter 210817Wendy ZongeОценок пока нет

- Tax on Ethiopian Coffee ExportsДокумент3 страницыTax on Ethiopian Coffee ExportsSamОценок пока нет

- Your Investment Property GuideДокумент24 страницыYour Investment Property GuideCoana ArtistОценок пока нет