Академический Документы

Профессиональный Документы

Культура Документы

AccountingMethods CWIP

Загружено:

subhash_sap999Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AccountingMethods CWIP

Загружено:

subhash_sap999Авторское право:

Доступные форматы

Accounting Methods 4 Methods

WHEN to Recognize (or report) Profit and Loss on Your Income Statement 1: Cash 2: Accrual 3: Completed Contract 4: Percentage of Completion 1 - CASH METHOD: Report Revenues when they are received Report Costs when they are paid Does NOT matter whether the Revenues are Earned OR What other Costs are incurred Cash Method just records Deposits and Checks 2 - ACCRUAL METHOD: Report Revenues When They are EARNED (usually when billed) Report Costs When They are INCURRED Does NOT matter whether Cash Transaction has taken place Accrual Method records Monies Due From Customers to Company AND Monies Due From Company to Suppliers and Contractors

Accrual Method Provides More Timely and Accurate Financials but for most home builders may not be giving a true picture of the companys financial position. Builders often prepare Front End Loaded Billings to customers that unrelated to costs incurred.

Accounting Methods - continued

3 Completed Contract: Revenue and Expenses are NOT recorded on Income Statement until the contract is complete. During Progress of Job: Customer Payments are Recorded as Liabilities Construction Costs are recorded as a Work In Progress Asset

Completed Contract Method may be good for tax purposes because builder can defer paying taxes on a project until it is complete, but does not give tools to manage the business.

4 Percentage of Completion: Revenues are recorded on the Income Statement based on a periodic measure of progress (when they are actually Earned). (as opposed to when they are received or billed) Construction Costs are recorded as they are incurred.

Percentage of Completion is the most desirable for projects that span over several months because it more accurately matches costs with revenues (or net profit and loss) for a given period.

Compare the Methods

Contract: $500,000 Estimated Costs: $400,000 Est. Profit: $100,000 First Progress Billing Prepared for $50,000 (not received yet) Cash Paid for Plans, Permits, Fees, etc. of $5,000 Invoice Received from Foundation Company for $15,000 Cash Method Revenue Basic Accrual $50,000 Amt Billed $5,000 Paid Gross Profit -$5,000 $20,000 Incurred $30,000 Completed Contract $0 Percentage of Completion *$25,000 Calculated $20,000 Incurred $5,000

Costs

$0 $0

*Calculate Percentage of Completion Revenue: 1: Calculate Percent Complete: $20,000 Costs / $400,000 Est. Costs = 5% Complete 2: Multiply Percent Complete times Contract: $500,000 X 5% = $25,000

Percentage of Completion BEST reflects the companys Revenues, Costs, and Gross profit for the period. Cash method will make you think you are losing money. Accrual Method makes owner think company is really prospering! Completed Contract shows nothing until job is done. Weird spread for company owner over 12 months 4 months lose money, 5th month make big profit! To quote Steve Maltzman, consultant to Builder 20 clubs The Percentage of Completion method gives best picture, but is STILL ONLY an ESTIMATE. It requires that the contract and total costs are properly estimated, AND that the job cost system is accurate, up-to-date, and is easily compared to the cost estimate. The builder MUST HAVE the ability to easily produce the information necessary to make a reasonable estimate as to the progress of the job.

Percentage of Completion Entry Method

ASSETS Cash WIP Constr Costs Costs Recognized Accts Payable LIABILITIES Contract Deposits Revenues Recognized Equity Owner Equity Income Stmt Revenues Costs of Sales/ Overhead

Owner Invest Customer Pmt Received Pay Job Costs Pay Overhead Expenses Foundation Bill TOTALS At End Of Period: Recognize Costs % Complete Revenue TOTALS

30,000 50,000 -5,000 -4,000 15,000 71,000 20,000 -15,000 -15,000 -50,000 5,000 -50,000

-30,000

4,000

-30,000

4,000

-20,000 25,000 71,000 20,000 -20,000 -15,000 -50,000 25,000 -30,000 -25,000 -25,000

20,000

24,000

Percentage of Completion Financial Statements Using Contra Accounts

Contra Accounts - Purpose: To Keep Track of Totals In Original Accounts A Contra Account REDUCES the normal total for a Group of Accounts. Its contradictive!

BALANCE SHEET As Of End of Period ASSETS Cash 71,000 WIP Construction Costs 20,000 Costs Recognized -20,000 Totals Assets $71,000 LIABILITIES Accounts Payable Contract Deposits Revenues Recognized Total Liabilities INCOME STATEMENT For the Period Sales Cost Of Sales Gross Profit Operating Expenses List of Expenses Total Expenses $40,000 Net Income (or Loss) 25,000 20,000 $5,000

15,000 50,000 -25,000

4,000 $4,000 $1,000

OWNERS EQUITY Investment 30,000 Current Period Earnings 1,000 Total Owners Equity $31,000 Total Liabilities & Owners Equity

$71,000

End of the month: $50,000 Contract Deposit Less $25,000 EARNED represents a Liability due to the Customer of $25,000 for amount that has not been earned yet! If the job failed right now, you would owe the Customer $25,000. Next Month: Do the Same Thing! Costs Recognized and Revenues Recognized are CONTRA accounts.

Percentage of Completion (ongoing entries)

If you dont have an accounting software that will calculate Percentage of Completion for you, set up contra accounts in your accounting software to gather totals. Then create an Excel spreadsheet with formulas that will do the calculation on your totals from the accounts.

WIP Construction Costs End of Current Period Total in Costs Recognized at End of Previous Period Costs to Recognize End of Current Period Divided by Estimated Construction Costs Revenue Earned Percent Times the Total Contract Price Revenue to Recognize End of Current Period

60,000 -20,000 $40,000 / 400,000 = 10% X 500,000 $50,000

A B C (A-B) D E (C/D) F G (F X E)

Journal Entries Entries on the Accounting Books Costs Recognized (reduces Assets) Cost of Sales (reduces Income) -40,000 Credit (Contra Account) 40,000 Debit

Revenues Recognized (reduces Liabilities) Revenues (increases Income)

50,000 Debit (Contra Account) -50,000 Credit

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Optional Credit RemovalДокумент3 страницыOptional Credit RemovalKNOWLEDGE SOURCEОценок пока нет

- NajmДокумент2 страницыNajmAthar KhanОценок пока нет

- Phoenix Pallasio Lucknow Presentation 04-09-2019Документ41 страницаPhoenix Pallasio Lucknow Presentation 04-09-2019T PatelОценок пока нет

- Luxreal Detail Marketing Plan (2019) UsdДокумент32 страницыLuxreal Detail Marketing Plan (2019) UsdTawanda Tirivangani100% (2)

- PUGEL 'Scale Economies Imperfect Competition and Trade' INTERNATIONAL ECONOMICS 6ED - Thomas Pugel - 001 PDFДокумент29 страницPUGEL 'Scale Economies Imperfect Competition and Trade' INTERNATIONAL ECONOMICS 6ED - Thomas Pugel - 001 PDFPraba Vettrivelu100% (1)

- 2011 - PSEP 01 Main Report PDFДокумент204 страницы2011 - PSEP 01 Main Report PDFNaveed ChandioОценок пока нет

- Annotated BibliographyДокумент9 страницAnnotated Bibliographyapi-309971310100% (2)

- Solow Growth ModelДокумент15 страницSolow Growth ModelSamuel Elias KayamoОценок пока нет

- Measuring Elasticity of SupplyДокумент16 страницMeasuring Elasticity of SupplyPetronilo De Leon Jr.Оценок пока нет

- Proposal HydrologyДокумент4 страницыProposal HydrologyClint Sunako FlorentinoОценок пока нет

- Healthcare Industry in India PESTEL AnalysisДокумент3 страницыHealthcare Industry in India PESTEL AnalysisAASHNA SOOD 1827228Оценок пока нет

- Theory and Estimation of CostДокумент27 страницTheory and Estimation of CostGaurav BharadwajОценок пока нет

- Dairy TemplateДокумент3 страницыDairy TemplateSK FoodnBeveragesОценок пока нет

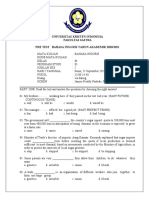

- Pre Test of Bahasa Inggris 21 - 9 - 2020Документ5 страницPre Test of Bahasa Inggris 21 - 9 - 2020magdalena sriОценок пока нет

- Critique Paper BA211 12 NN HRM - DacumosДокумент2 страницыCritique Paper BA211 12 NN HRM - DacumosCherBear A. DacumosОценок пока нет

- Design and ArchitectureДокумент26 страницDesign and ArchitecturesaifazamОценок пока нет

- Directory of Cao 01042018Документ154 страницыDirectory of Cao 01042018Shyam SОценок пока нет

- Container Corporation India LTD - Initiating Coverage - Dalal and Broacha - BuyДокумент15 страницContainer Corporation India LTD - Initiating Coverage - Dalal and Broacha - BuyvineetwinsОценок пока нет

- 3 02.03.2020 NCLT Court No - IiiДокумент5 страниц3 02.03.2020 NCLT Court No - IiiVbs ReddyОценок пока нет

- LCA Book - Chapter 1 IntroductionДокумент31 страницаLCA Book - Chapter 1 IntroductionzaiОценок пока нет

- Ceiling heating system guideДокумент4 страницыCeiling heating system guideUday Kiran100% (1)

- Economics Notes For - Test - NovemberДокумент2 страницыEconomics Notes For - Test - NovemberWai HponeОценок пока нет

- E@@e ®@@e ®@@e: M.A. ECONOMICS (With Specialization in World Economy)Документ27 страницE@@e ®@@e ®@@e: M.A. ECONOMICS (With Specialization in World Economy)SimeonОценок пока нет

- Akpk SlideДокумент13 страницAkpk SlideizzatiОценок пока нет

- Chapter One - Part 1Документ21 страницаChapter One - Part 1ephremОценок пока нет

- Questions With Answers On is-LM ModelДокумент12 страницQuestions With Answers On is-LM ModelAkshay Singh67% (3)

- Audi Power To Gas News (Media)Документ3 страницыAudi Power To Gas News (Media)asmecsiОценок пока нет

- IBM - Multiple Choice Questions PDFДокумент15 страницIBM - Multiple Choice Questions PDFsachsanjuОценок пока нет

- Ashmore Dana Obligasi Nusantara: Fund Update Jul 2019Документ2 страницыAshmore Dana Obligasi Nusantara: Fund Update Jul 2019Power RangerОценок пока нет

- Managerial EconomicsДокумент16 страницManagerial EconomicsHarshitPalОценок пока нет