Академический Документы

Профессиональный Документы

Культура Документы

Allahabad Bank

Загружено:

Angel BrokingИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Allahabad Bank

Загружено:

Angel BrokingАвторское право:

Доступные форматы

1QFY2012 Result Update | Banking

July 22, 2011

Allahabad Bank

Performance Highlights

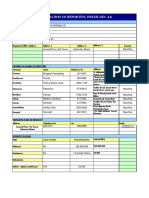

Particulars (` cr) NII Pre-prov. profit PAT

Source: Company, Angel Research

NEUTRAL

CMP Target Price

% chg (qoq) 2.1 14.0 62.3 1QFY11 850 705 347 % chg (yoy) 38.2 26.3 20.4

`218 -

1QFY12 1,176 890 418

4QFY11 1,151 780 258

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Banking 10,383 1.1 271/178 123,571 10 18,722 5,634 ALBK.BO ALBK@IN

For 1QFY2012, Allahabad Bank reported 20.4% yoy growth in its net profit to `418cr, ahead of our as well as streets estimates. Healthy business momentum with relatively lower compression in reported NIMs and stable asset quality were the key highlights of the result. We recommend Neutral on the stock. Advances momentum sustained with relatively lower dip in NIMs: The bank managed to buck the trend of a sequential decline in advances, displayed so far by its peers. The banks advances grew healthily by 5.5% qoq and 30.4% yoy. With the widening differential between the fixed deposit interest rates and savings account rate, the pace of growth in CASA deposits moderated further to 15.6% yoy from 20.7% in 4QFY2011. CASA ratio came off by ~150bp qoq to 32.0% as the bank had lower flows from government-related businesses. Considering the relatively lower share of CASA deposits base, the bank surprised positively by reporting just ~9bp sequential compression in reported NIM to 3.4% despite a 10bp qoq uptick in 4QFY2011. Faster growth in the high-yielding SME segments advances and lending rate hikes aided in increasing the overall yield on advances by 87bp qoq. Slippages for the quarter dipped (below normal levels in our view), with the annualised slippage ratio declining to 0.6% from the peak levels of 4.5% in 4QFY2011 (0.7% in 1QFY2011). Overall asset quality improved in 1QFY2012 with gross and net NPAs declining by 2.6% qoq and 20.1% qoq, respectively. Provision coverage ratio, including technical write-offs, improved ~400bp qoq to comfortable 79.9%. Outlook and valuation: Even taking into account the banks reasonably healthy retail deposits base, especially in the eastern hinterland, at 1.0x FY2013E ABV, the stock looks a tad expensive relative to peers. The pending switchover to system-based NPA recognition for agricultural loans (~14% exposure) and small loan accounts is likely to remain a near-term overhang on the stock. Hence, we recommend Neutral on the stock. Key financials

Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%)

Source: Company, Angel Research

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 58.0 15.8 14.6 11.7

Abs. (%) Sensex

Allahabad Bank

3m (4.5) (0.1)

1yr 3.4 22.4

3yr 32.7 277.9

FY2010 2,650 22.8 1,206 57.0 2.5 27.0 8.1 1.7 1.1 22.2

FY2011 4,022 51.8 1,423 18.0 3.0 29.9 7.3 1.4 1.0 21.0

FY2012E 4,672 16.2 1,588 11.6 2.9 33.3 6.5 1.2 1.0 19.2

FY2013E 5,051 8.1 1,696 6.8 2.7 35.6 6.1 1.0 0.9 17.8

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Shrinivas Bhutda

022 3935 7800 Ext: 6845 shrinivas.bhutda@angelbroking.com

Varun Varma

022 3935 7800 Ext: 6847 varun.varma@angelbroking.com

Please refer to important disclosures at the end of this report

Allahabad Bank | 1QFY2012 Result Update

Exhibit 1: 1QFY2012 performance

Particulars (` cr) Interest earned - on Advances / Bills - on investments - on balance with RBI & others - on others Interest Expended Net Interest Income Other income Other income excl. treasury - Fee Income - Treasury Income - Recoveries from written-off a/cs - Others Operating income Operating expenses - Employee expenses - Other Opex Pre-provision Profit Provisions & Contingencies - Provisions for NPAs - Provisions for Investments - Other Provisions PBT Provision for Tax PAT Effective Tax Rate (%)

Source: Company, Angel Research

1QFY12 4QFY11 % chg (qoq) 1QFY11 % chg (yoy) 3,550 2,699 834 16 0 2,374 1,176 286 260 207 26 65 (12) 1,461 572 382 190 890 320 166 113 41 570 152 418 26.6 3,119 2,349 746 22 3 1,968 1,151 469 456 300 13 154 2 1,621 841 602 238 780 466 330 90 46 315 57 258 18.1 13.8 14.9 11.8 (25.5) (94.2) 20.7 2.1 (39.1) (43.1) (31.0) 100.0 (58.0) (9.8) (32.0) (36.6) (20.4) 14.0 (31.3) (49.8) 25.4 (9.4) 81.2 166.7 62.3 854bp 2,403 1,811 582 8 3 1,553 850 299 209 170 90 33 6 1,149 444 285 159 705 151 70 2 79 554 206 347 37.3 47.7 49.1 43.4 102.6 (94.1) 52.9 38.2 (4.2) 24.6 21.8 (71.1) 96.4 27.2 28.7 34.0 19.3 26.3 111.6 136.5 5,688.7 (47.9) 3.0 (26.4) 20.4 (1065)bp

Exhibit 2: 1QFY2012 Actual vs. estimates

Particulars (` cr) Net interest income Other income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Company, Angel Research

Actual 1,161 323 1,484 577 907 396 511 153 358

Estimates 1,176 286 1,461 572 890 320 570 152 418

Var. (%) 1.3 (11.5) (1.5) (0.9) (1.9) (19.3) 11.6 (0.9) 16.9

July 22, 2011

Allahabad Bank | 1QFY2012 Result Update

Exhibit 3: 1QFY2012 performance analysis

Particulars (` cr) Advances (` cr) Deposits (` cr) Credit-to-Deposit Ratio (%) Current deposits (` cr) Saving deposits (` cr) CASA deposits (` cr) CASA ratio (%) CAR (%) Tier 1 CAR (%) Profitability Ratios (%) Cost of deposits Yield on advances Yield on investments Yield on funds Cost of funds Reported NIM Cost-to-income ratio Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Provision Coverage Ratio (%) NPA prov. to avg. assets (%)

Source: Company, Angel Research

1QFY12 4QFY11 % chg (qoq) 1QFY11 % chg (yoy) 98,740 73.8 8,055 34,800 42,855 32.0 12.8 8.6 7.0 11.6 7.6 10.3 6.9 3.4 39.1 1,604 1.6 589 0.6 79.9 0.6 93,625 71.0 9,156 35,000 44,156 33.5 13.0 8.6 6.0 10.7 7.2 9.5 6.0 3.5 51.9 1,648 1.7 736 0.8 75.7 4.5 5.5 280bp (12.0) (0.6) (2.9) (146)bp (21)bp (2)bp 100bp 87bp 37bp 80bp 86bp (9)bp (1,274)bp (2.6) (12)bp (20.1) (19)bp 423bp (389)bp 75,718 69.9 7,698 29,369 37,067 34.2 13.6 8.2 5.6 10.3 6.8 8.8 5.7 3.1 38.7 1,139 1.5 308 0.4 85.4 0.7 30.4 23.5 388bp 4.6 18.5 15.6 (219)bp (80)bp 31bp 141bp 126bp 73bp 149bp 120bp 30bp 46bp 40.8 12bp 90.8 19bp (546)bp (1)bp 133,818 131,887 1.5 108,320

Healthy advances growth

The bank managed to buck the trend of a sequential decline in advances, displayed so far by its peers. The banks advances grew by healthy 5.5% qoq and 30.4% yoy, driven by strong 14.0% qoq (60.2% yoy) growth in SME advances. Retail credit also grew at a fairly brisk pace of 26.2% yoy. The bank plans to achieve credit growth of 25% in FY2012, buoyed by sanctions of ~`20,000cr.

Exhibit 4: Relatively faster credit growth

Adv. qoq chg (%) 10.0 8.0 6.0 4.0 69.9 72.2 71.8 Dep. qoq chg (%) CDR (%, RHS) 73.8 71.0 76.0 74.0 72.0 70.0

Exhibit 5: Moderating CASA deposits growth

CASA ratio 36.0 23.0 26.1 21.6 20.7 15.6 33.0 10.0 20.0 CASA yoy growth (%, RHS) 30.0

34.2

34.7

33.3

33.5

5.7 2.1

8.4 4.9

5.8 6.4

7.8 9.0

5.5 1.5

2.0

68.0 66.0 30.0

32.0

1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

Source: Company, Angel Research

Source: Company, Angel Research

July 22, 2011

Allahabad Bank | 1QFY2012 Result Update

On the deposits side, growth was slower at 1.5% qoq on the back of strong 9.0% qoq growth in 4QFY2011. With the widening differential between fixed deposit interest rates and savings account interest rates, the pace of growth in CASA deposits moderated further to 15.6% yoy from 20.7% in 4QFY2011. CASA ratio came off by ~150bp qoq to 32.0% as the bank had lower flows from governmentrelated businesses. Recently, the bank has secured a mandate from the West Bengal State Government for opening accounts for disbursal of salaries. The bank has also launched a campaign to open ~15 lakh saving accounts by 3QFY2012, in which it has already opened ~2lakh accounts. These initiatives are expected to at least sustain the CASA ratio at current levels.

NIM surprises positively

Considering the relatively lower share of CASA deposits base, the bank surprised positively by reporting just ~9bp sequential compression in reported NIM to 3.4% despite a 10bp qoq uptick in 4QFY2011. Faster growth in the high-yielding SME segments advances and lending rate hikes aided in increasing the overall yield on advances by 87bp qoq. The cost of deposits increased by 100bp qoq to 7.0%, offsetting the improvement in yield on advances. The 280bp qoq expansion in CD ratio to 73.8% also aided in arresting the qoq decline in reported NIM. Going forward, management expects NIM to sustain above the 3% mark. We have built in a 15bp decline for FY2012 NIM over FY2011 levels, considering the moderate deposit franchise of the bank.

Exhibit 6: Higher yield on advances...

(%) 12.0 11.6 10.7

Exhibit 7: ...largely offsets reported NIM compression

(%) 3.5 3.3 3.3 3.1 3.4 3.5 3.4

11.0 10.3 10.0 10.4

10.6

3.1 2.9 2.7

9.0 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

Source: Company, Angel Research

Source: Company, Angel Research

Slippages dip; could pick up going forward on switchover to system-based NPA recognition for agri and smaller loans

Overall asset quality of the bank improved in 1QFY2012 with gross and net NPAs declining by 2.6% qoq and 20.1% qoq, respectively. Provision coverage ratio, including technical write-offs, improved by ~400bp qoq to comfortable 79.9%. Slippages for the quarter dipped (below normal levels in our view), with the annualised slippage ratio declining to 0.6% from the peak levels of 4.5% in 4QFY2011 (0.7% in 1QFY2011). Recoveries from gross NPAs picked up pace, increasing from `69cr in 4QFY2011 to `115cr in 1QFY2012. During 1QFY2012, the bank recovered `260cr from gross NPAs, including written-off accounts, in-line with its target of achieving recovery of `1,000cr in FY2012.

July 22, 2011

Allahabad Bank | 1QFY2012 Result Update

The bank has migrated to system-based NPA recognition for accounts above `50lakhs. However, agricultural (gross NPAs of 4.1% as of FY2011) and smaller loans, where delinquencies tend to be higher, will be migrated in 2QFY2012. We expect slippages to be substantially higher, as witnessed in case of other banks. That said, the bank has a strong track record of recoveries, which can offset the larger expected slippages. The bank has a `13,700cr (13.9% of total advances) exposure to the power sector, of which `8,000cr`9,000cr is to State Electricity Boards (SEBs). Management sounded confident of averting any default on these loans as it has government guarantees as well as escrow accounts of these borrowers. During the quarter, one loan account of `270cr pertaining to the power sector was restructured. Management has guided that it is only due to technical reasons and it is not witnessing any asset-quality stress from power exposure.

Exhibit 8: PCR inches up ~400bp qoq

Gross NPAs (%) 2.0 1.5 1.0 0.5 85.4 81.0 80.2 75.7 79.9 Net NPAs (%) PCR (%, RHS) 90.0 85.0 80.0 75.0

Exhibit 9: Slippages dip

Slippages (%) 5.0 4.0 3.0 2.0 1.0 0.7 2.5 2.0 4.5 0.6 0.2 0.7 0.5 0.4 Credit cost (%, RHS) 0.9 1.0 0.8 0.6 0.4 0.2 -

1.5 0.4

1.8 0.6

1.8 0.6

1.7 0.8

1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

1.6 0.6

70.0 65.0

1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

Source: Company, Angel Research

Source: Company, Angel Research; Note: PCR incl. technical write-offs

Provisioning expenses for the quarter were more than double the amount in 1QFY2011, mainly on account of provisions for MTM losses on investments of `113cr as compared to `2cr in 1QFY2011. The bank provided `166cr towards NPA provisions, which was entirely towards the hike in regulatory provisioning requirements. The bank utilised the write-backs for marking provisions against fresh slippages. The bank also provided `29cr towards hike in regulatory provisioning requirement for restructured advances.

Opex to remain high on employee benefits-related provisions; branch expansion likely to be back-ended

Staff expenses rose by 34.0% yoy due to amortisation of employee benefit provisions. However, overall cost ratios remained stable on a yoy basis. The bank added just a single branch in 1QFY2012. The bank plans to open up 155 branches in FY2012, which is likely to be back-ended, in economically stronger states such as Gujarat, Maharashtra (particularly Mumbai), Haryana, Karnataka and Andhra Pradesh. This will also enable the bank to geographically establish a wider branch network, as it is hardly present in these states.

July 22, 2011

Allahabad Bank | 1QFY2012 Result Update

Exhibit 10: Muted branch expansion

2,450 2,402 2,400 2,364 2,350 2,300 2,250 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2,316 2,415 2,416

Exhibit 11: Improvement in cost ratios

Cost-to-income ratio (%) 60.0 45.0 30.0 1.4 1.7 1.5 Opex to average assets (%, RHS) 2.3 2.5 1.5 2.0 1.5 1.0

38.7

40.5

39.8

51.9

39.1

15.0 -

0.5 -

1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

Source: Company, Angel Research

Source: Company, Angel Research

Investment arguments

Healthy retail deposit base and moderate fee income

Allahabad Bank has a strong ~41% of its branches in the CASA deposit-rich rural areas, which ensure relatively higher sustainability of the low-cost deposits reservoir, also reflected in the strong 24.0% CAGR in its saving account deposits over FY200911. Although the banks CASA market share reduced by 16bp over FY200610 to 2.4%, the decline in market share has been one of the lowest in its peer group. Also the bank has a relatively lower share of wholesale deposits and CDs at 14.0%. Recently, the bank has secured a mandate from the West Bengal State Government for opening accounts for disbursal of salaries. The bank has also launched a campaign to open ~15 lakh saving accounts by 3QFY2012, in which it has already opened ~2lakh accounts. These initiatives are expected to at least sustain the CASA ratio at current levels. The bank is now planning to diversify its branch network by expanding in the economically vibrant states of Gujarat, Maharashtra (particularly Mumbai), Haryana, Karnataka and Andhra Pradesh. The banks relatively better CASA ratio, of 3335%, is also likely to help in moderating the expected NIM pressures. As compared to peers such as IOB, OBC, Corporation Bank and UCO Bank, the bank has a higher structural CASA share, which is expected to sustain calculated NIM of 2.9% and 2.7% for FY2012 and FY2013, respectively as compared to 3.0% in FY2011. Also, growth in fee income (other income excluding treasury income) has been strong at a 45.8% CAGR over FY200911 (0.9% of average assets for FY2011). However, we have factored in a lower growth in fee income than peers, as a large part of the banks high fee income was driven by above average recoveries from written-off accounts (0.24% of average assets for FY2011), which could decline going forward.

Outlook and valuation

Even taking into account the banks reasonably healthy retail deposits base, especially in the eastern hinterland, at 1.0x FY2013E ABV, the stock looks a tad expensive relative to peers. Historically, the bank has traded at 0.61.2x one-year forward ABV with a median of 1.0x. The pending switchover to system-based NPA

July 22, 2011

Allahabad Bank | 1QFY2012 Result Update

recognition for agricultural loans (~14% exposure) and small loan accounts is likely to remain a near-term overhang on the stock. Hence, we recommend Neutral on the stock.

Exhibit 12: Key assumptions

Particulars (%) Credit growth Deposit growth CASA ratio NIMs Other income growth Growth in staff expenses Growth in other expenses Slippages Treasury gain/(loss) (% of investments)

Source: Angel Research

Earlier estimates FY2012 20.0 16.0 33.5 2.9 0.3 15.0 2.4 0.2 FY2013 18.0 16.0 33.4 2.7 12.4 15.0 15.0 2.4 0.1

Revised estimates FY2012 22.0 18.0 32.9 2.9 (0.8) 14.0 2.4 0.1 FY2013 18.0 16.0 32.8 2.7 13.4 15.0 15.0 2.4 0.1

Exhibit 13: Change in estimates

Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Angel Research

Earlier estimates

4,672 1,374 6,046 2,455 3,591 1,320 2,271 681 1,590

FY2012 FY2013 Revised Revised Earlier Var. (%) Var. (%) estimates estimates estimates

4,672 1,360 6,032 2,448 3,585 1,316 2,268 680 1,588 0.0 (1.0) (0.2) (0.3) (0.2) (0.3) (0.1) (0.1) (0.1) 5,053 1,545 6,598 2,824 3,774 1,263 2,511 815 1,696 5,051 1,542 6,592 2,815 3,777 1,267 2,511 815 1,696 (0.1) (0.2) (0.1) (0.3) 0.1 0.3 (0.0) (0.0) (0.0)

July 22, 2011

Allahabad Bank | 1QFY2012 Result Update

Exhibit 14: P/ABV band

Price (`) 350 300 250 200 150 100 50 0 0.3x 0.6x 0.9x 1.2x 1.5x

Aug-08

Dec-10

Apr-06

Mar-09

Oct-09

Jul-11

Nov-06

Source: Company, Angel Research

Exhibit 15: Recommendation summary

Company AxisBk FedBk HDFCBk ICICIBk* SIB YesBk AllBk AndhBk BOB BOI CanBk CentBk CorpBk DenaBk IDBI# IndBk IOB J&KBk OBC PNB SBI* SynBk UcoBk UnionBk UtdBk VijBk Reco. Buy Accumulate Neutral Buy Accumulate Accumulate Neutral Accumulate Accumulate Buy Neutral Reduce Buy Buy Neutral Accumulate Buy Neutral Accumulate Accumulate Accumulate Accumulate Neutral Buy Accumulate Neutral CMP (`) 1,297 458 501 1,068 24 329 218 137 901 415 523 127 521 88 135 235 144 862 351 1,170 2,494 122 88 309 96 70 Tgt. price (`) 1,648 483 1,355 26 353 145 1,017 498 120 640 107 255 166 392 1,235 2,845 139 357 107 Upside (%) 27.1 5.6 26.8 8.9 7.1 5.7 12.8 19.9 (5.8) 22.9 21.0 8.4 15.1 11.7 5.6 14.1 13.9 15.4 12.0 FY2013E P/ABV (x) 2.1 1.2 3.4 1.9 1.2 2.1 1.0 0.9 1.2 1.1 1.0 0.8 0.8 0.6 0.8 0.9 0.9 0.9 0.8 1.3 1.9 0.8 1.0 1.1 0.8 0.9 FY2013E Tgt P/ABV (x) 2.7 1.3 2.5 1.4 2.3 1.0 1.4 1.3 0.8 1.0 0.8 1.0 1.0 0.9 1.4 2.1 0.9 1.3 0.9 FY2013E P/E (x) 10.7 9.2 17.4 15.4 7.4 11.1 6.1 5.7 6.8 6.2 5.6 5.8 4.8 4.4 6.2 5.0 5.5 5.7 5.3 6.7 9.2 5.1 5.0 6.3 6.4 6.8 FY2011-13E EPS CAGR (%) 20.9 20.2 30.5 24.5 11.6 19.1 9.2 3.1 10.5 21.6 1.0 (10.9) 6.1 5.1 14.3 10.4 23.5 8.8 13.7 11.7 44.2 14.6 18.9 22.9 6.1 8.6 FY2013E RoA (%) 1.5 1.3 1.7 1.5 0.9 1.2 0.9 1.0 1.1 0.8 1.0 0.5 0.9 0.8 0.7 1.4 0.7 1.2 1.0 1.1 1.1 0.7 0.6 0.9 0.5 0.5 FY2013E RoE (%) 21.0 14.1 20.9 15.6 17.2 20.6 17.8 16.8 19.5 18.5 18.1 15.1 17.9 15.7 14.5 20.4 16.6 17.0 15.8 21.3 22.6 17.0 17.6 18.7 12.5 12.8

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), #Without adjusting for SASF

July 22, 2011

May-10

Feb-12

Jun-07

Jan-08

Allahabad Bank | 1QFY2012 Result Update

Income statement

Y/E March (` cr) Net Interest Income - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. & Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Prov. for Taxation - as a % of PBT PAT - YoY Growth (%) FY07 1,751 11.0 376 (22.0) 2,127 3.3 1,027 (0.8) 1,100 7.4 265 (17.2) 835 18.5 85 10.2 750 6.2 FY08 1,672 (4.5) 965 156.3 2,637 24.0 1,158 12.7 1,480 34.5 357 35.1 1,122 34.3 147 13.1 975 29.9 FY09 2,159 29.1 1,142 18.4 3,301 25.2 1,399 20.9 1,901 28.5 825 131.0 1,076 (4.1) 307 28.6 769 (21.1) FY10 2,650 22.8 1,516 32.7 4,166 26.2 1,618 15.6 2,549 34.1 777 (5.9) 1,772 64.7 565 31.9 1,206 57.0 FY11 4,022 51.8 1,370 (9.6) 5,393 29.4 2,338 44.5 3,055 19.9 1,124 44.7 1,931 9.0 508 26.3 1,423 18.0 FY12E 4,672 16.2 1,360 (0.8) 6,032 11.9 2,448 4.7 3,585 17.3 1,316 17.1 2,268 17.5 680 30.0 1,588 11.6 FY13E 5,051 8.1 1,542 13.4 6,592 9.3 2,815 15.0 3,777 5.4 1,267 (3.8) 2,511 10.7 815 32.4 1,696 6.8

Balance sheet

Y/E March (` cr) Share Capital Reserves & Surplus Deposits - Growth (%) Borrowings Tier 2 Capital Other Liab. & Prov. Total Liabilities Cash Balances Bank Balances Investments Advances - Growth (%) Fixed Assets Other Assets Total Assets - Growth (%) FY07 447 4,030 22.8 257 1,582 1,804 4,068 874 FY08 447 4,774 20.3 1,792 1,862 2,448 6,289 753 FY09 447 5,405 18.6 937 2,912 2,975 5,115 1,521 29,651 58,802 18.3 1,110 1,449 17.7 FY10 447 6,306 24.8 1,424 4,012 3,455 7,184 1,984 38,429 71,605 21.8 1,118 1,379 24.6 FY11 476 8,031 24.4 3,006 3,912 3,974 7,901 3,126 43,247 93,625 30.8 1,148 2,239 24.3 FY12E 476 9,259 18.0 3,559 4,773 5,394 10,116 3,582 47,199 22.0 1,318 2,650 18.4 FY13E 476 10,568 16.0 4,128 5,632 6,410 11,734 4,155 52,512 18.0 1,484 3,074 16.0

59,544 71,616

84,972 106,056 131,887

155,627 180,527

67,664 82,939

97,648 121,699 151,286

179,087 207,741

18,746 23,400 41,290 49,720 41.7 1,056 1,629 22.4 20.4 1,071 1,705 22.6

114,222 134,782

67,664 82,939

97,648 121,699 151,286

179,087 207,741

July 22, 2011

Allahabad Bank | 1QFY2012 Result Update

Ratio analysis

Y/E March Profitability ratios (%) NIMs Cost to Income Ratio RoA RoE B/S ratios (%) CASA Ratio Credit/Deposit Ratio CAR - Tier I Asset Quality (%) Gross NPAs Net NPAs Slippages Loan Loss Prov./Avg. Assets Provision Coverage Per Share Data (`) EPS ABVPS DPS Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis (%) NII (-) Prov. Exp. Adj. NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes RoA Leverage (x) RoE

FY07 3.0 48.3 1.2 22.6 38.0 69.3 12.5 8.1 2.6 1.1 1.9 0.1 57.0 16.8 76.0 3.0 13.0 2.9 1.4 2.8 0.4 2.4 (0.1) 2.4 0.7 3.0 1.7 1.4 0.1 1.2 18.5 22.6

FY08 2.3 43.9 1.3 24.6 36.0 69.4 12.0 7.7 2.0 0.8 1.5 0.4 58.6 21.8 93.5 3.5 10.0 2.3 1.6 2.2 0.5 1.7 0.6 2.4 0.7 3.0 1.5 1.5 0.2 1.3 19.0 24.6

FY09 2.5 42.4 0.9 16.5 34.6 69.2 12.2 7.5 1.8 0.7 1.7 0.3 59.5 17.2 107.7 2.5 12.7 2.0 1.1 2.4 0.9 1.5 0.6 2.1 0.6 2.7 1.5 1.2 0.3 0.9 19.4 16.5

FY10 2.5 38.8 1.1 22.2 34.5 67.5 12.7 7.6 1.7 0.7 2.1 0.8 61.5 27.0 128.0 5.5 8.1 1.7 2.5 2.4 0.7 1.7 0.5 2.2 0.9 3.1 1.5 1.6 0.5 1.1 20.2 22.2

FY11 3.0 43.4 1.0 21.0 33.5 71.0 12.0 8.0 1.7 0.8 2.4 0.6 52.4 29.9 152.7 6.0 7.3 1.4 2.8 2.9 0.8 2.1 0.1 2.2 0.9 3.1 1.7 1.4 0.4 1.0 20.2 21.0

FY12E 2.9 40.6 1.0 19.2 32.9 73.4 12.0 7.8 2.9 1.1 2.4 0.7 74.0 33.3 185.3 6.5 6.5 1.2 3.0 2.8 0.8 2.0 0.0 2.1 0.8 2.9 1.5 1.4 0.4 1.0 20.0 19.2

FY13E 2.7 42.7 0.9 17.8 32.8 74.7 12.0 7.6 3.7 1.3 2.4 0.6 73.0 35.6 211.1 7.0 6.1 1.0 3.2 2.6 0.7 2.0 0.0 2.0 0.8 2.8 1.5 1.3 0.4 0.9 20.3 17.8

July 22, 2011

10

Allahabad Bank | 1QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Allahabad Bank No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

July 22, 2011

11

Вам также может понравиться

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertДокумент4 страницыRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingОценок пока нет

- International Commodities Evening Update September 16 2013Документ3 страницыInternational Commodities Evening Update September 16 2013Angel BrokingОценок пока нет

- Daily Metals and Energy Report September 16 2013Документ6 страницDaily Metals and Energy Report September 16 2013Angel BrokingОценок пока нет

- WPIInflation August2013Документ5 страницWPIInflation August2013Angel BrokingОценок пока нет

- Oilseeds and Edible Oil UpdateДокумент9 страницOilseeds and Edible Oil UpdateAngel BrokingОценок пока нет

- Daily Agri Tech Report September 14 2013Документ2 страницыDaily Agri Tech Report September 14 2013Angel BrokingОценок пока нет

- Daily Agri Report September 16 2013Документ9 страницDaily Agri Report September 16 2013Angel BrokingОценок пока нет

- Derivatives Report 8th JanДокумент3 страницыDerivatives Report 8th JanAngel BrokingОценок пока нет

- Market Outlook: Dealer's DiaryДокумент13 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Currency Daily Report September 16 2013Документ4 страницыCurrency Daily Report September 16 2013Angel BrokingОценок пока нет

- Daily Metals and Energy Report September 12 2013Документ6 страницDaily Metals and Energy Report September 12 2013Angel BrokingОценок пока нет

- Daily Agri Tech Report September 16 2013Документ2 страницыDaily Agri Tech Report September 16 2013Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Документ4 страницыDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingОценок пока нет

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateДокумент6 страницTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingОценок пока нет

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressДокумент1 страницаPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingОценок пока нет

- Market Outlook: Dealer's DiaryДокумент12 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Currency Daily Report September 13 2013Документ4 страницыCurrency Daily Report September 13 2013Angel BrokingОценок пока нет

- Metal and Energy Tech Report Sept 13Документ2 страницыMetal and Energy Tech Report Sept 13Angel BrokingОценок пока нет

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechДокумент4 страницыJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingОценок пока нет

- Metal and Energy Tech Report Sept 12Документ2 страницыMetal and Energy Tech Report Sept 12Angel BrokingОценок пока нет

- Daily Agri Tech Report September 12 2013Документ2 страницыDaily Agri Tech Report September 12 2013Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Документ4 страницыDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Market Outlook: Dealer's DiaryДокумент13 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Currency Daily Report September 12 2013Документ4 страницыCurrency Daily Report September 12 2013Angel BrokingОценок пока нет

- Daily Agri Report September 12 2013Документ9 страницDaily Agri Report September 12 2013Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Документ4 страницыDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Pengantar Akuntansi Pertemuan Ke 3Документ85 страницPengantar Akuntansi Pertemuan Ke 3Denny ramadhanОценок пока нет

- Shubham ResumeДокумент3 страницыShubham ResumePhanindra GaddeОценок пока нет

- Day 1 Financial ManagementДокумент7 страницDay 1 Financial ManagementEricka DeguzmanОценок пока нет

- Marilou B. Franco San Francisco, Agusan Del Sur: (In Philippine Pesos)Документ6 страницMarilou B. Franco San Francisco, Agusan Del Sur: (In Philippine Pesos)ATRIYO ENTERPRISESОценок пока нет

- Getting Started With GST Unit 2 8 Mark QuestionsДокумент2 страницыGetting Started With GST Unit 2 8 Mark Questionsmanoharchary157Оценок пока нет

- History of Accounting-WPS OfficeДокумент10 страницHistory of Accounting-WPS OfficeLea PasquinОценок пока нет

- Bank Version Personal Financial StatementДокумент9 страницBank Version Personal Financial StatementJk McCrea100% (1)

- FINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationДокумент17 страницFINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationAiron Keith Along100% (1)

- MBA-IB 2021-23: Pre-Read MaterialДокумент17 страницMBA-IB 2021-23: Pre-Read MaterialSIDDHI KANSAL MBA 2021-23 (Delhi)Оценок пока нет

- Wells Fargo Credit Reporting CodesДокумент4 страницыWells Fargo Credit Reporting CodesGoodStuff140% (1)

- Management Information System of Allied BankДокумент29 страницManagement Information System of Allied BankFahad Khan LangahОценок пока нет

- acctng-1-Quiz-FS Begino, Vanessa Jamila DДокумент4 страницыacctng-1-Quiz-FS Begino, Vanessa Jamila DVanessa JamilaОценок пока нет

- Dwnload Full Fundamentals of Advanced Accounting 7th Edition Hoyle Solutions Manual PDFДокумент35 страницDwnload Full Fundamentals of Advanced Accounting 7th Edition Hoyle Solutions Manual PDFjacobriceiv100% (4)

- Wells Fargo Everyday Checking: Important Account InformationДокумент4 страницыWells Fargo Everyday Checking: Important Account InformationPatricia100% (2)

- Bankers Confidential ReportДокумент1 страницаBankers Confidential ReportBappa ChakrabortyОценок пока нет

- T24 Internal Account - Close AccountДокумент7 страницT24 Internal Account - Close AccountlolitaferozОценок пока нет

- Instructions:: Assignmnet 2 - Chapter 7 (Petty Cash & Bank Reconciliation)Документ5 страницInstructions:: Assignmnet 2 - Chapter 7 (Petty Cash & Bank Reconciliation)Success LibraryОценок пока нет

- ITC Corporate ValuationДокумент6 страницITC Corporate ValuationSakshi Jain Jaipuria JaipurОценок пока нет

- Format SoplДокумент2 страницыFormat Soplhumairayazid12Оценок пока нет

- Internship Report HBLДокумент79 страницInternship Report HBLNadeem100% (1)

- Business Combinations : Ifrs 3Документ45 страницBusiness Combinations : Ifrs 3alemayehu100% (1)

- Solution NIngДокумент3 страницыSolution NIngfahim tusarОценок пока нет

- Loan CalculatorДокумент4 страницыLoan CalculatorSumit GuptaОценок пока нет

- Sanulac Nutricion Colombia S.A.S. (Colombia) : SourceДокумент2 страницыSanulac Nutricion Colombia S.A.S. (Colombia) : SourceCatalina Echeverry AldanaОценок пока нет

- Instructions For BiddingДокумент3 страницыInstructions For BiddingEye RobeОценок пока нет

- Sit Land Holdings LTDДокумент2 страницыSit Land Holdings LTDnooneОценок пока нет

- FINA3020 Assignment3Документ5 страницFINA3020 Assignment3younes.louafiiizОценок пока нет

- Week 1 Topic Tutorial Solutions CB2100 - 1920AДокумент6 страницWeek 1 Topic Tutorial Solutions CB2100 - 1920ALily TsengОценок пока нет

- Horizontal and Vertical Analysis of Wallmart 10kДокумент9 страницHorizontal and Vertical Analysis of Wallmart 10kKelly Milagros Orozco Rosales100% (1)

- A Step by Step Guide For Loans AUPДокумент2 страницыA Step by Step Guide For Loans AUPDerek RobbinsОценок пока нет