Академический Документы

Профессиональный Документы

Культура Документы

pcc-2011 Tax

Загружено:

Heena NigamИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

pcc-2011 Tax

Загружено:

Heena NigamАвторское право:

Доступные форматы

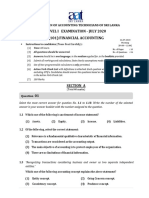

APPENDIX TO STUDENTS HAND BOOK ON TAXATION SUGGESTED ANSWERS - C.A.

PCC May 2011, EXAMINATION

Question No. 1 (a) Mr. Praveen engaged in retail trade, reports a turnover of Rs.58,50,000 for the financial year 2010-11. His income from the said business as per book of account is computed at Rs.2,90,000. Retail trade is the only source of income for Mr. Praveen. (i) Is Mr. Praveen eligible to opt for presumptive determination of his income chargeable to tax for the assessment year 2011-12 ? (ii) If so, determine his income from retail trade as per the applicable presumptive provision. (iii) In case, Mr. Praveen does not opt for presumptive taxation of income from retail trade, what are his obligations under the Income-tax Act, 1961? (iv) What is the due date for filing his return of income, under both the options? Solution: (i) Mr. Praveen is eligible to opt for Presumptive taxation u/s 44AD of the Income Tax Act, 1961 in respect of the business of retail trade carried on by him, since the total turnover does not exceed Rs. 60,00,000 in the previous year. (ii) As per Section 44AD, the presumptive income shall be 8% of the gross receipts or such higher income as may be declared by the assessee. In this case, 8% of the gross receipts is Rs. 4,68,000 ( 58,50,000 x 8% ). Since this sum is higher than the income declared by the assessee, Rs. 4,68,000 shall be offered as income from retail trade. (iii) In case Mr. Praveen does not opt for presumptive taxation, he shall maintain books as prescribed u/s 44AA and get the books audited u/s 44AB since the income computed on the basis of books of account is less than presumptive income u/s 44AD. (iv) Where the presumptive income taxation is opted for u/s. 44AD, the due date for filing return of income shall be on or before 31st of July, 2011. On the other hand where books of account are subject to audit u/s. 44AB, the return of income shall be furnished on or before 30th Sep, 2011. (b) Rahul holding 28% of equity shares in a company took a loan of Rs. 5,00,000 from the same company. On the date of granting the loan, the company had accumulated profit of Rs. 4,00,000. The company is engaged in some manufacturing activity. (i) Is the amount of loan taxable as deemed dividend in the hands of Rahul, if the company is a company in which the public are substantially interested? ci

cii

Suggested Answers for CA PCC May 2011 Examination (ii) What would be your answer, if the lending company is a private limited company (i.e.) a company in which the public are not substantially interested?

Solution: Refer to caption Dividend in chapter 8 Income from Other Sources. (i) Since the company is a company in which the public are substantially interested, deemed dividend as defined under section 2(22)(e) is not applicable and accordingly, the same is not taxable in the hands of the recipient. (ii) Since the company is a company in which the public are not substantially not interested, Section 2(22)(e) is applicable and accordingly, the loan taken is taxable as deemed dividend. However, the dividend so taxable shall be restricted to Rs. 4,00,000, being the amount of accumulated profits of the company. (c) Mr. Chandru transferred a vacant site on 28-10-2010 for Rs. 100 lakhs. The site was acquired for Rs. 9,99,300 on 30-06-2000. He deposited Rs. 50 lakhs in eligible bonds issued by Rural Electrification Corporation Ltd. (REC) on 20-03-2011. Again, he deposited Rs. 20 lakhs in eligible bonds issued by National Highways Authority of India (NHAI) on 16-04-2011. Compute the chargeable capital gain in the hands of Chandru for the assessment year 2011-12. Financial Year 2000 01 2010 11 Cost Inflation Index 406 711

Solution: Computation of Capital gains in the hands of Mr. Chandru for the assessment year 2011-12 Particulars Full Value of Consideration Less: Indexed cost of acquisition [9,99,300 X 711/406] 17,50,006 82,49,994 Less: Exemptions u/s 54EC Investment in REC Bonds on 20/03/2011 Investment in NHAI Bonds on 16/04/2011 Long Term Capital Gain chargeable to tax 50,00,000 20,00,000 70,00,000 12,49,994 Amount (Rs.) 1,00,00,000

Students Handbook on Taxation

ciii

Notes: 1. U/s 54EC of the Income Tax Act, 1961, exemption from long term capital gains shall be claimed if investment is made in specified bonds within 6 months from the date of transfer. Such exemption shall be restricted to the investment made in bonds. Also, investment made in such bonds shall be subject to a limit of Rs. 50,00,000 per financial year. 2. Since Chandru has invested in REC Bonds for Rs. 50,00,000 and in NHAI Bonds for Rs.20,00,000 in 2 financial years, and also such investments are made within 6 months of transfer, the investments are eligible for exemption U/S 54EC. (d) ABC & Co. furnishes the following information for the half-year ended 31-03-2011. (i) Amount received for services provided to UNICEF, (an international organization) Rs. 2,00,000. (ii) Advance money received from customers Rs. 4,00,600 in respect of which services were not rendered till 31-03-2011. (iii) Services billed during the half-year excluding item (i) and (ii) above, was Rs. 15,00,000 plus service tax and cess @ 10.3 %. It consists of the following: a) One customer X to whom a bill of Rs. 2,20,600 plus service tax and cess @ 10.3% raised, did not pay service tax and cess. b) Customer Y to whom a bill was raised for Rs. 1,00,000 plus service tax and cess has not paid the amount till 31.03.2011. c) The balance amounts billed during the year were realized fully. Compute the value of taxable service on which service tax is payable. Solution: Computation of Taxable Service value for the half year ended 31st March, 2011 Particulars i. ii. Services Rendered to UNICEF- exempt Advance received for which service is not yet rendered: (4,00,600 x 100/ 110.3) On services billed during the FY ending 3103-2011 Gross Billing Less: Amount Unrealised From X (2,20,600 X 10.3%) 22,722 16,54,500 Amount (Rs.) Nil 3,63,191

iii.

civ

Suggested Answers for CA PCC May 2011 Examination From Y (1,00,000 + Service tax & Cess @ 10.3%) (15,21,478 X 100/110.3) Value of Taxable Service 1,10,300 15,21,478 13,79,400 17,42,591

Notes: (i) Services rendered to UNICEF are exempt vide Notification No.16/2002-ST dated 02/08/2002 . (ii) Service tax is payable on advance moneys collected also. Question No: 2 (a) Mr. Rajiv (aged 50 years) a resident individual and practicing Chartered Accountant furnishes you the receipts and payments account for the financial year 2010 11. Receipts and Payments Account Receipts Opening balance(01.04.2010) Cash on hand and at Bank Fee from professional services Rent Motor car loan from Canara Bank (@9% per annum) Rs. 12,000 9,38,000 50,000 2,50,000 Payments Staff salary, bonus and stipend to articled clerks Other administrative expenses Office rent Housing loan repaid to SBI (includes interest of Rs. 88,000 Life insurance premium Motor car (acquired in Jan. 2011) Medical insurance premium (for self and wife) Books bought of annual publications Computer acquired on 01.11.2010 (for professional use) Domestic drawings Public provident fund subscription Motor car maintenance Closing balance (31.03.2011) Rs. 1,50,000 48,000 30,000 1,88,000 24,000 4,25,000 18,000 20,000 30,000 2,72,000 20,000 10,000 15,000

Students Handbook on Taxation Cash on hand and at Bank 12,50,000 Following further information is given to you :

cv

12,50,000

(1) He occupies 50% of the building for own residence and let out the balance for residential use at a monthly rent of Rs. 5,000. The building was constructed during the year 1997 98. (2) Motor car was put to use both for official and personal purpose, One fifth of the motor car use is for personal purpose. No car loan interest was paid during the year. (3) The written down value of assets as on 01.04.2010 are given below : Amount (Rs.) 60,000 80,000 50,000

Particulars Furniture & Fittings Plant & Machinery (Air-conditioners, Photocopiers, etc.) Computers Note: Mr. Rajiv follows regularly the cash system of accounting. Compute the total income of Mr. Rajiv for the assessment year 2011 12. Solution: Computation of Total Income of Mr. Rajiv for AY 2011-12 Particulars Income from House Property (W.N-1) Profits & Gains from Business/ Profession (W.N-2) Gross Total Income (W.N-3) Chapter VI-A deductions (W.N-4) Total Income Working Note-1: Income from House Property Particulars Gross Annual Value Less: Municipal Taxes NAV Self Occupied (50%)

Amount (Rs.) (32,000) 5,99,500 5,67,500 1,15,000 4,52,500

Let Out (50%) 60,000 60,000

Nil -

cvi

Suggested Answers for CA PCC May 2011 Examination

Less: Deductions u/s 24 i) ii) Standard Deduction-30% of Net Annual Value Interest on borrowed capital (refer note) Income from House Property Taxable Income from House Property Nil 30,000 (30,000) 18,000 44,000 (2,000) (32,000)

Note: In a Case where property is constructed out of loan borrowed before 1st April 1999, interest u/s. 24 shall be restricted to Rs. 30,000. In the present case, since the property was constructed during the year 1997-98 (i.e. before 1st April 1999), interest shall be restricted to Rs. 30,000. Working Note-2: Profits & Gains for Business/ Profession: Particulars Professional Fees Less: Admissible Expenses i. ii. iii. iv. v. Salary, bonus & stipend Administration Expenses Office Rent Car Maintenance (10000 X 4/5) Depreciation (W.N 3) 1,50,000 48,000 30,000 8,000 1,02,500 3,38,500 Income from business income Working Note 3 Depreciation Particulars I Car 15% Opening WDV as on 1-04-2010 Additions More than 180 days II Plant & machinery 15% 80,000 III Furniture & Fittings 10% 60,000 IV Computers 60% 50,000 20,000 V Books 100% 5,99,500 Amount (Rs.) 9,38,000

Students Handbook on Taxation Less than 180 days Total Less: Depreciation Closing WDV as on 31-03-2011 425,000 425,000 25,500 399,500 80,000 12,000 68,000 60,000 6,000 54,000 30,000 80,000 39,000 41,000

cvii

20,000 20,000 Nil

Note: It is assumed that the addition made in books is more than 180 days. Working Note-4: Chapter VI A Deductions: 1. U/s 80C: 1. Housing loan repayment 1,00,000 24,000 20,000 1,44,000 18000 15,000 1,15,000 1,00,000 2. LIC Premium 3. PPF Contribution (Deduction Limited to) 2. U/s 80 D Deduction Limited to

(b) Ahmed & Co. of Srinagar rendered taxable services both within and outside the State of Jammu & Kashmir. It received Rs. 26,12,000 for the services rendered inside the State of Jammu & Kashmir and Rs. 18,00,000 for the services rendered outside the State of Jammu & Kashmir. Compute its taxable service value and service tax liability. In case, Ahmed & CO. was situated in Mumbai what would be value of its taxable service and service tax liability? Solution: Computation of Value of Taxable Services & ST Liability of Ahmed & Co. Chapter V of Finance Act, 1994, which deals with Service Tax, is applicable to the whole of India except the state of Jammu & Kashmir. Accordingly, services rendered within the state of Jammu & Kashmir are not taxable i.e. where the service receiver is inside Jammu & Kashmir. (i) In the present case, Ahmed & Co. situated in Jammu & Kashmir has rendered taxable services both within and outside the state. As discussed above, only services rendered outside the state of Jammu & Kashmir are taxable. The total amount received from such taxable

cviii

Suggested Answers for CA PCC May 2011 Examination

services is Rs. 18 Lakhs. Hence the amount of taxable services works out to Rs. 16,31,913 (18,00,000 x 100/110.3) and the Service Tax liability is Rs. 1,68,087.039 (16,31,913 x 10.3%) (ii) Incase Ahmed & Co was situated in Mumbai, the taxable value would have been the same, as charge of service tax depends on the place of rendering service and not place of the service provider. Question No: 3 (a) Shri Bala employed in ABC Co. Ltd. as Finance Manager gives you the list of perquisites provided by the company to him for the entire financial year 2010 11 : (i) Medical facility given to his family in a hospital maintained by the company. The estimated value of benefit because of such facility is Rs. 40,000. (ii) Domestic servant was provided at the residence of Bala. Salary of domestic servant is Rs. 1,500 per month. The servant was engaged by him and the salary is reimbursed by the company (employer). In case, the company has employed the domestic servant, what is the value of perquisite? (iii) Free education was provided to his two children Arty and Ashok in a school maintained and owned by the company. The cost of such education for Arthy is computed at Rs. 900 per month and for Ashok at Rs. 1,200 per month. No amount was recovered by the company for such education facility from Bala. (iv) The employer has provided movable assets such as television, refrigerator and airconditioner at the residence of Bala. The actual cost of such assets provided to the employee is Rs. 1,10,000. (v) A gift voucher worth Rs. 10,000 was given on the occasion of his marriage anniversary. It is given by the company to all employees above certain grade. State the taxability or otherwise of the above said perquisites and compute the total value of taxable perquisites. Solution: Computation of Taxable Perquisites for the FY 2010-11 Particulars i. Medical Facility Medical facility provided in a hospital belonging to the employer is not a perquisite. ii. Domestic servant salary: Reimbursement of domestic servants salary is taxable as a perquisite in Balas hands. The position is not altered even if the company has employed the domestic servant. Amount (Rs.)

Nil

18,000

Students Handbook on Taxation iii. Free use of educational facility: Arthy-Nil(not taxable as cost does not exceed Rs.1,000 p.m) Ashok-Rs.1,200 p.m (entire amount is taxable as cost exceeds Rs.1,000 p.m) (Where educational institution is maintained & owned by the employer, the value of perquisites shall be determined w/f to the reasonable cost of such education in a similar institution in or near the locality. However, if the cost of such education or value of such benefit per child does not exceed Rs.1,000 per month, nothing shall be taxed) iv. Use of Movable assets: (Use of movable assets is chargeable to tax as perquisite @ 10% of actual cost of such assets) v. Gift voucher (Gift is exempt only where the aggregate value is less than Rs. 5,000 in a year) Total taxable perquisites

cix

14,400

11,000

10,000 53,400

(b) 12

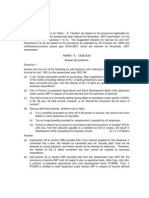

State whether filing of income-tax return is mandatory for the assessment year 2011-

In respect of the following cases: Particulars (i) Research association eligible for exemption under section 10(21) having total income (ii) Registered trade union eligible for exemption under section 10(24) having following incomes: Income from house property (computed) Income from other sources (computed) (iii) A charitable trust registered under section 12AA, having total income or (iv) A Limited Liability Partnership (LLP) with business loss of 60,000 40,000 1,90,000 1,30,000 Amount (Rs.) 2,10,000

cx

Suggested Answers for CA PCC May 2011 Examination

Solution: (i) As per Section 139(4c), a research association eligible for exemption u/s. 10(21), whose total income before giving effect to exemption u/s 10 exceeds Rs. 1,60,000 has to mandatorily file its Return of Income. In the present case, the research association has to file the return of income as its total income exceeds the basic exemption limit. (ii) As per Section 139(4c), a registered trade union availing exemption u/s 10(24) shall file its return of income u/s. 139(1) if its total income is in excess of Rs. 1,60,000. In the present case, the registered trade union need not file Return of Income since its total income is less than the basic exemption limit. (iii) A charitable trust registered u/s. 12AA, shall file Return of Income if its income exceeds the maximum amount not chargeable to tax i.e. Rs. 1,60,000. In the present case, the trust has to file Return of Income as its income exceeds Rs. 1,60,000. (iv) A firm shall file its return of income irrespective of any amount of income or loss as per section 139(1). (c) State with reasons whether the following are liable for service tax : (i) Services rendered to Reserve Bank of India. (ii) Services rendered by a sub-contractor. (iii) Services provided to developed of special economic zone. (iv) Services rendered to associated enterprise. Solution: (i) Services rendered to Reserve Bank of India Not liable (ii) Services rendered by a sub-contractor - Liable (iii) Services provided to developed of special economic zone Not liable (iv) Services rendered to associated enterprise Liable. Refer to caption Exemptions Sec.93 in the chapter Service tax Miscellaneous. Question No: 4 (a) Decide the following transactions in the context of Income-tax Act, 1961: (i) Mr. B transferred 500 shares of Reliance Industries Ltd. to M/s B Co. (P) Ltd. on 10.10.2010 for Rs. 3,00,000 when the market price was Rs. 5,00,000. The indexed cost of acquisition of shares for Mr. B was computed at Rs. 4,45,000. The transfer was not subjected to securities transaction tax. Determine the income chargeable to tax in the hands of Mr. B and M/s B Co (P) Ltd. because of the above said transaction. Solution: Computation of Taxable Income in the hands of Mr. B Particulars Full Value of consideration (Refer Note 1) Less: Indexed Cost of acquisition Long Term Capital loss to be carried forward (Refer Note 2) Amount (Rs.) 3,00,000 4,45,000 1,45,000

Students Handbook on Taxation

cxi

Notes: i. See 56(2)(viia) is applicable only when the transferee and the shares transferred are of a closely held company. In the given case, as the shares are that of Reliance Ltd, a company in which the public are substantially interested, this clause is not applicable. ii. Since the transfer is not subject to STT, any gains would not have been exempt u/s. 10(38). Hence, the loss is available for set-off against income in future years. (ii) Ms. Chhaya transferred a vacant site to Ms. Dayama for Rs. 4,25,000. The stamp valuation authority fixed the value of vacant site for stamp duty purpose at Rs. 6,00,000. The total income of Chhaya and Dayama before considering the transfer of vacant site are Rs. 50,000 and Rs. 2,05,000 respectively. The indexed cost of acquisition of Ms. Chhaya in respect of vacant site is Rs. 4,00,000 (computed). Determine the total income of both Ms. Chhaya and Ms. Dayama taking into account the above said transaction. Solution: Computation of Total Income of Ms. Chhaya Particulars Full Value of consideration u/s 50C Less: Indexed cost of acquisition (given) Amount (Rs.) 6,00,000 4,00,000 2,00,000 Other Income(given) Total Computation of total income of Ms. Dayama Particulars Income from other sources (refer note) Other Income Amount (Rs.) Nil 2,05,000 2,05,000 Note: As per Section 56(2)(vii)(b), where any immovable property is received without consideration and the sale value exceeds Rs. 50,000 then the entire sale value shall be chargeable to tax. In the present case, since there is a consideration involved in the transaction, this clause does not apply. 50,000 2,50,000

cxii

Suggested Answers for CA PCC May 2011 Examination

(iii) Mr. Chezian is employed in a company with taxable salary income of Rs. 5,00,000. He received a cash gift of Rs. 1,00,000 from Atma Charitable Trust (registered under section 12AA) in December 2010 for meeting his medical expenses. Is the cash gift so received from the trust chargeable to tax in the hands of Mr. Chezian? Solution: Any amount of money received without consideration in aggregate of Rs. 50,000 is chargeable as gift u/s 56(2). However, where such sum is received from a charitable trust registered u/s 12AA, the same shall not be chargeable to tax. Hence, the Rs. 1,00,000 will be exempt in the hands of Mr. Chezian. (b) Balamurugan furnishes the following information for the year ended 31.03.2011: Amount (Rs.) (1,35,000) (15,000) 3,00,000 1,00,000 60,000 70,000

Particulars Income from business Income from house property Lottery winning (Gross) Speculation business income Income by way of Salary Long term capital gain Compute his total income, tax liability and advance tax obligations. Solution: Computation of Total income of Mr. Balamurugan for AY 2011-12 Particulars Income from Salaries Income from House Property Income from Business (Speculative) Less: Income from non-speculative business Rs.1,35,000 restricted to Rs. 1,00,000 Loss to be carried forward Income from Capital Gain Less: remaining loss set off against LTCG [1,35,000-1,00,000] Lottery winning Total 1,00,000 (1,00,000) 70,000 (35,000) Amount (Rs.)

Amount (Rs.) 60,000 (15,000)

Nil

35,000 3,00,000 3,80,000

Students Handbook on Taxation

cxiii

(c) A manufacturer sold goods to distributor for Rs. 20,000. The distributors sold the goods to the wholesaler for Rs. 24,000. The wholesaler sold the goods to the retailer for Rs. 30,000. The retailer sold the goods to the final consumer for Rs. 40,000. The VAT rate is 12.5% which is charged separately. Compute VAT liability under Invoice method. State why this method is preferable? Solution: Computation of VAT Liability: Stage 1. Particulars Manufacturers(first seller)sale price to distributor=Rs.20,000/- No local purchases. Therefore no credit. Distributor to Wholesaler =Rs.24,000 Wholesaler to Retailer= Rs.30,000 Retailer to consumer=Rs.40,000 Total Debit (VAT Payable) 2,500 Credit (Set- Off) Nil Net (Balance to Govt) 2,500

2. 3. 4.

3,000 3,750 5,000 14,250

2,500 3,000 3,750 9,250

500 750 1,250 5,000

Refer to caption Invoice Method in chapter no.22 VAT Basic Concepts & Principles. Question No: 5 (a) Mr. Chaturvedi having gross total income of Rs.6,35,000 for the financial year 2010 11 furnishes you the following information : (i) Deposited Rs. 50,000 in tax saver deposit in the name of major son in a nationalized bank. (ii) Paid Rs. 25,000 towards premium on life insurance policy of his married daughter. (iii) Purchased approved long-term infrastructure bonds for Rs. 25,000 in January 2011. (iv) Contributed Rs. 10,000 to Prime Ministers National Relief Fund. (v) Donated Rs. 20,000 to a Government recognized institution for scientific research. Note: Assume that the gross total income of Mr. Chaturvedi does not include any income under the head profits and gains of business or profession. Compute the total income of Mr. Chaturvedi for the assessment year 2011 12. Solution: Computation of Total Income of Mr. Chaturvedi for the AY 2011-12

cxiv

Suggested Answers for CA PCC May 2011 Examination Amount(Rs.) Amount(Rs.) 6,35,000

Particulars Gross Total Income Less: Deductions u/s VI A U/s 80C LIC premium paid of married daughter-Eligible U/s 80CCF Long term infra bonds of Rs.25,000 restricted to U/s 80G - Prime Ministers National Relief Fund-100% eligible for deduction U/s 80GGA Donation to Scientific research institutions-100% eligible for deduction Total Income

25,000 20,000 10,000 20,000 75,000 5,60,000

(b) List any 5 instances where the tax deductible at source in terms of section 194A will not apply. Solution: Refer to caption Interest other than Interest on Securities in chapter 14 - Tax deduction at Source. (c) When does e-payment and e-filing of service tax return become mandatory ? Explain.

Solution: Refer to caption Payment of ST and Assessment and Returns in chapter 20 Registration, Payment of Service Tax and Filing of Return. Question No: 6 (a) X Co. (P) Ltd., converted into a Limited Liability Partnership (LLP) by name All Trade LLP, with effect from 01.04.2010. The following details are given to you: Particulars Asst. year 2003 04: Business loss brought forward Asst. year 2010 11: Business loss brought forward (These are related to erstwhile X Co. (P) Ltd.) Total income of All Trade LLP, for the financial year 2010 11 (Before set off of brought forward business losses of erstwhile company i.e. A Co. Ltd.) Amount (Rs.) 2,00,000 5,00,000

6,00,000

Assume that all the conditions prescribed in section 47 (xiiib) were satisfied by X Co. (P) Ltd. at the time of conversion in to LLP.

Students Handbook on Taxation

cxv

(i) Explain whether All Trade LLP can set off and carry forward the business loss of its predecessor i.e. A Co. (P) Ltd.? (ii) State whether any change in partners of All Trade LLP, at a later date would have any tax consequence? Solution: (i) Yes. U/s 72(6A), any brought forward loss of predecessor company shall deemed to be the loss of the successor LLP for the year in which the conversion took place. Hence, the business loss pertaining to AY 03-04 & 10-11 can be carried forward for a fresh period of 8 years. (ii) Refer to caption Change in Constitution and Succession in chapter 10- Aggregation of Income & Set Off or Carry Forward of Losses. (b) Ramamurthy had 4 heavy goods vehicles as on 01.04.2010. He acquired 7 heavy goods vehicles on 27.06.2010. He sold 2 heavy goods vehicles on 31.05.2010. He has brought forward business loss of Rs. 50,000 relating to assessment year 2007 08 of a discontinued business. Assuming that he opts for presumptive taxation of income as per section 44AE, compute his total income chargeable to tax for the assessment year 2011 12. Solution: Computation of Total Income of Mr. Ramamurthy for the AY 2011-12 Particulars Presumptive Income u/s. 44AE April-May : (4 x 5000 x 2 months) June-March : (9 x 5000 x 10 months) Less: loss brought forward Total Income 40,000 4,50,000 4,90,000 (50,000) 15,000 Amount(Rs.)

(c) Win Limited commenced the business of operating a three star hotel in Tirupati on 0104-2011. It furnishes you the following information: Particulars (i) Cost of land (acquired in June 2008) (ii) Cost of construction of hotel building Financial year 2008 09 Financial year 2009 10 30 lakhs 150 lakhs Amount (Rs.) 60 lakhs

cxvi

Suggested Answers for CA PCC May 2011 Examination 30 lakhs

(iii) Plant and Machineries (all new) Acquired during financial year 2009 10 [All the above expenditures were capitalized in the books of the company] (iv) Net profit before depreciation for the financial year 2010 11

80 lakhs

Determine the amount eligible for deduction under section 35AD of the Income-tax Act, 1961, for the assessment year 2011 12. Solution: Computation of eligible deduction u/s. 35AD of Win Ltd. for AY 2011-12 Particulars Cost of Land- Refer Note 1 Cost of Construction- Refer Note 2 Plant & Machinery (all new) Deduction u/s. 35AD Amount (Rs.inLakhs) Nil 180 30 210

Notes: (i) As per Section 35AD, 100% deduction is allowed in respect of any capital expenditure other than acquisition of land, goodwill and financial instruments, incurred by an assessee. (ii) Where the expenditure was incurred prior to to commencement of operation of the specified business, then deduction shall be allowed in the year of commencement of such business. (d) How excess payment of service tax would be adjusted against service tax liability of subsequent periods ? State the applicable conditions. Solution: Refer Caption Excess Payment of Service Tax under Registration, Payment of Service Tax and Filing of Returns. Question No: 7 (a) (i) What are the conditions to be satisfied for the allowability of expenditure under section 37 of the Income-tax Act, 1961? Solution: Refer to caption General-Section 37 in chapter Profits & Gains of Business or Profession (ii) Answer the following with reference to the provisions of the Income-tax Act, 1961 : (a) Bad debt claim disallowed in an earlier assessment year, recovered subsequently. Is the sum recovered, chargeable to tax? (b) Return of income of a company was signed, by the Company Secretary. Is the return a valid return?

Students Handbook on Taxation

cxvii

(c) Tax deducted at source on salary paid to employees not remitted till the due date for filing the return prescribed in section 139. Is the expenditure to be disallowed under section 40a(ia) ? (d) X Co. Ltd. paid Rs. 120 lakhs as compensation as per approved Voluntary Retirement Scheme (VRS) during the financial year 2010 11. How much is deductible under section 35 DDA for the assessment year 2011 12 ? Solution: (a) No, As per Section 41(4), any amount recovered by the assessee against bad debts earlier allowed as deduction shall be taxed as income in the year in which it is recovered. Since in the given case the deduction was not allowed in the earlier assessment year the same shall not be chargeable to tax at the time of receipt. (b) No, As per Section 140, Return of Income of the Company has to be signed by: a) Managing Director b) any other director incase MD is not available c) liquidator if company is in liquidation. (c) No, Section 40(a)(ia) does not disallow salary for non remittance of TDS u/s 192. (d) As per Section 35DDA, 1/5th of amount paid under a VRS scheme is allowed as eligible expenditure.. Therefore, the amount allowed will be 24 lakhs, being 1/5th of Rs.120 lakhs. (iii) Ashwin doing manufacture and wholesale trade furnishes you the following information : Total turnover for the financial year 2009 10 2010 11 Rs. 45,00,000 Rs. 55,00,000

State whether tax deduction at source provisions are attracted for the below said expenses incurred during the financial year 2010 11: Particulars Interest paid to UCO Bank Contract payment to Raj (2 contracts of Rs.12,000 each) Shop rent paid (one payee) Commission paid to Balu Solution: Amount (Rs.) 41,000 24,000 1,90,000 7,000

cxviii

Suggested Answers for CA PCC May 2011 Examination

(i) As the turnover of Mr. Ashwin during the previous Financial Year 2009-10 (Rs.45 lakhs) exceeds the limit specified in Section 44AB (Rs. 40 Lakhs for AY 2010-11), deduction of tax at source shall be applicable. (ii) Applicability of TDS provisions for the FY 2010-11 in each of the given cases: Particulars Interest Paid to UCO Bank Contract Payment to Raj Shop Rent (remarks)Applicability N.A as per Section 194A N.A as the expenditure incurred is within the limits of Section 194C Applicable as the expenditure incurred exceeds the limit of Rs.1,80,000/- specified U/S 194I Applicable as the expenditure incurred exceeds the limit of Rs.5,000/- specified U/S 194H

Commission to Balu

(iv) Y Co. Ltd. furnishes you the following information for the year ended 31.03.2011. Particulars Total turnover of Unit A located in Special Economic Zone Profit of the business of Unit A Export turnover of Unit A Total turnover of Unit B located in Domestic Tariff Area (DTA) Profit of the business of Unit B Compute deduction under section 10AA for the assessment year 2011 12. Solution: Computation of deductions u/s. 10AA of Y Co.Ltd for the AY 2011-12: Particulars Profit of Chit A (SEZ) Less: Exempt u/s 10AA Export Turnover of Unit X Profit of the Unit/Total Turnover of Unit 50 X 30 / 100 15 Amount (Rs.) 30 200 lakhs 20 lakhs Amount (Rs.) 100 lakhs 30 lakhs 50 lakhs

Students Handbook on Taxation

cxix

(b) Briefly state the contents of VAT invoice (any 8 items). Solution: Refer to caption VAT Invoice in chapter Input Tax Credit, Composition Scheme & Procedures

Вам также может понравиться

- Business Plan For Fertilizers DistributorsДокумент20 страницBusiness Plan For Fertilizers DistributorsRanjan Shetty94% (17)

- © The Institute of Chartered Accountants of IndiaДокумент56 страниц© The Institute of Chartered Accountants of IndiaTejaОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Chapter 10 Test Bank PDFДокумент33 страницыChapter 10 Test Bank PDFCharmaine CruzОценок пока нет

- A Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseДокумент6 страницA Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseSpend ThriftОценок пока нет

- Project Cutover PlanДокумент9 страницProject Cutover PlanPrashant KumarОценок пока нет

- Five Ways That ESG Creates Value PDFДокумент12 страницFive Ways That ESG Creates Value PDFAtifKhan100% (1)

- Jcpenney Analysis: Background StoryДокумент13 страницJcpenney Analysis: Background StoryAakarshan MundraОценок пока нет

- Scanner Ipcc Paper 4Документ34 страницыScanner Ipcc Paper 4Meet GargОценок пока нет

- CA IPCC Taxation Mock Test Series 1 - Sept 2015Документ7 страницCA IPCC Taxation Mock Test Series 1 - Sept 2015Ramesh GuptaОценок пока нет

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100Документ8 страницTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100TejTejuОценок пока нет

- 106 1648004706 PDFДокумент15 страниц106 1648004706 PDFMohd AmanullahОценок пока нет

- 4) TaxationДокумент25 страниц4) TaxationvgbhОценок пока нет

- Bosmtpinterp 4 QДокумент12 страницBosmtpinterp 4 QUrvi MishraОценок пока нет

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationДокумент6 страницTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyОценок пока нет

- Advanced Tax Laws and Practice: PP-ATLP-June 2011 20Документ18 страницAdvanced Tax Laws and Practice: PP-ATLP-June 2011 20Murugesh Kasivel EnjoyОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент0 страниц© The Institute of Chartered Accountants of IndiaP VenkatesanОценок пока нет

- f6pkn 2011 Dec QДокумент11 страницf6pkn 2011 Dec Qabby bendarasОценок пока нет

- Financial Accounting: Level I Examination - July 2020Документ10 страницFinancial Accounting: Level I Examination - July 2020jamespotheadОценок пока нет

- Tax Management and Practice RTPДокумент122 страницыTax Management and Practice RTPNitin CОценок пока нет

- Income Tax Model PaperДокумент5 страницIncome Tax Model PaperSrinivas YerrawarОценок пока нет

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Документ8 страницCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- IncomeTax-IIДокумент7 страницIncomeTax-IIAditya .cОценок пока нет

- Intermediate Group I Test Papers FOR 2014 DECДокумент88 страницIntermediate Group I Test Papers FOR 2014 DECwaterloveОценок пока нет

- Institute of Actuaries of India: ExaminationsДокумент8 страницInstitute of Actuaries of India: ExaminationsRushikesh AravkarОценок пока нет

- Financial Accounting: The Institute of Chartered Accountants of PakistanДокумент4 страницыFinancial Accounting: The Institute of Chartered Accountants of PakistanShakeel IshaqОценок пока нет

- Tax Laws: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate To TheДокумент8 страницTax Laws: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate To ThePriya MalhotraОценок пока нет

- Aditya Sharma - MBA Dual - CTMДокумент10 страницAditya Sharma - MBA Dual - CTMAditya SharmaОценок пока нет

- Taxation (Nov. 2007)Документ17 страницTaxation (Nov. 2007)P VenkatesanОценок пока нет

- Ipcc Advance Accounting Practice Question 2Документ5 страницIpcc Advance Accounting Practice Question 2Shahnawaz Shaikh100% (1)

- Aditya Sharma - II Mid Term Paper Shikha MamДокумент9 страницAditya Sharma - II Mid Term Paper Shikha MamAditya SharmaОценок пока нет

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingДокумент27 страницQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarОценок пока нет

- 29234rtp May13 Ipcc Atc 1Документ50 страниц29234rtp May13 Ipcc Atc 1rahulkingdonОценок пока нет

- 101 Fac EngДокумент23 страницы101 Fac EngjamespotheadОценок пока нет

- Tax MCQsДокумент173 страницыTax MCQsHarleen Kaur100% (1)

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionДокумент9 страницTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarОценок пока нет

- Institute of Cost and Management Accountants of Pakistan Winter (November) 2011 ExaminationsДокумент4 страницыInstitute of Cost and Management Accountants of Pakistan Winter (November) 2011 ExaminationsHaseeb KhanОценок пока нет

- Gurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesДокумент16 страницGurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesBhavin PathakОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент38 страниц© The Institute of Chartered Accountants of IndiaSarah HolmesОценок пока нет

- IPCC Taxation Guideline Answer Nov 2015 ExamДокумент16 страницIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaОценок пока нет

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Документ36 страницCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanОценок пока нет

- Accountancy Set 3 QPДокумент6 страницAccountancy Set 3 QPKunal Gaurav100% (2)

- Requirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Документ5 страницRequirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Srikrishna DharОценок пока нет

- The Figures in The Margin On The Right Side Indicate Full MarksДокумент16 страницThe Figures in The Margin On The Right Side Indicate Full MarksJatin GalaОценок пока нет

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionДокумент7 страницCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhОценок пока нет

- Accountancy Term-2 Practical QuestionsДокумент3 страницыAccountancy Term-2 Practical QuestionsAnoushka ReddyОценок пока нет

- Paper 1: AccountingДокумент30 страницPaper 1: Accountingsuperdole83Оценок пока нет

- IPCC - November 2014Документ11 страницIPCC - November 2014suhaib1282Оценок пока нет

- Paper 1: AccountingДокумент30 страницPaper 1: AccountingSatyajit PandaОценок пока нет

- DT MCQs CombinedДокумент148 страницDT MCQs Combinedspam mailОценок пока нет

- 11 CaipccaccountsДокумент19 страниц11 Caipccaccountsapi-206947225Оценок пока нет

- CAF 2 TAX Spring 2020Документ5 страницCAF 2 TAX Spring 2020duocarecoОценок пока нет

- PGBP Kyc Ay 23-24Документ7 страницPGBP Kyc Ay 23-24Siddhi ShahОценок пока нет

- Mock Paper-4 (With Answer)Документ18 страницMock Paper-4 (With Answer)RОценок пока нет

- XII Accounts Test With SolutionДокумент12 страницXII Accounts Test With SolutionKritika Mahalwal100% (1)

- Taxation (India) : Monday 2 June 2008Документ9 страницTaxation (India) : Monday 2 June 2008jtemu_1Оценок пока нет

- CA (Final) Financial Reporting: InstructionsДокумент4 страницыCA (Final) Financial Reporting: InstructionsNakul GoyalОценок пока нет

- Bcoc 136Документ4 страницыBcoc 136Pranav KarwaОценок пока нет

- Caf-6 TaxДокумент4 страницыCaf-6 TaxaskermanОценок пока нет

- P5 Syl2012 InterДокумент27 страницP5 Syl2012 InterViswanathan SrkОценок пока нет

- 105 DepaДокумент12 страниц105 DepaLA M AEОценок пока нет

- PCC May 2008 Held On 7/5/2008: Answer All QuestionsДокумент17 страницPCC May 2008 Held On 7/5/2008: Answer All Questionsapi-206947225Оценок пока нет

- Accounting For Government and Non Profit Organizations - ASSESSMENTSДокумент21 страницаAccounting For Government and Non Profit Organizations - ASSESSMENTSArn KylaОценок пока нет

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОт EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОценок пока нет

- MB0050Документ8 страницMB0050Heena NigamОценок пока нет

- MB0053 SLM Unit 01Документ24 страницыMB0053 SLM Unit 01meesam1Оценок пока нет

- TCS Test PatternДокумент51 страницаTCS Test PatternHeena NigamОценок пока нет

- Piezoelectricit BuzzerДокумент16 страницPiezoelectricit BuzzerHeena NigamОценок пока нет

- 8 Bit Code SwitchДокумент12 страниц8 Bit Code SwitchHeena NigamОценок пока нет

- 4G Mobile Communication SystemДокумент30 страниц4G Mobile Communication SystemKala AnushaОценок пока нет

- Retail Management Chapter 1Документ30 страницRetail Management Chapter 1Earvin John MedinaОценок пока нет

- Lecture 1 - Introduction of Financial ManagementДокумент18 страницLecture 1 - Introduction of Financial ManagementMaazОценок пока нет

- Aligning Products With Supply Chain Processes and StrategyДокумент26 страницAligning Products With Supply Chain Processes and StrategyAntony Ticse BaquerizoОценок пока нет

- Latha Data Analyst Resume..Документ3 страницыLatha Data Analyst Resume..KIRAN KIRANОценок пока нет

- Doing Business in BruneiДокумент67 страницDoing Business in BruneiAyman MehassebОценок пока нет

- PsuДокумент2 страницыPsuManas KapoorОценок пока нет

- Thwe Theint Resume FixДокумент1 страницаThwe Theint Resume Fixapi-629194398Оценок пока нет

- Pas 38Документ7 страницPas 38elle friasОценок пока нет

- 2208PCDFCAДокумент64 страницы2208PCDFCAPCB GatewayОценок пока нет

- ICAB Knowledge Level Accounting May-Jun 2016Документ2 страницыICAB Knowledge Level Accounting May-Jun 2016Bizness Zenius HantОценок пока нет

- Application of ComputerДокумент5 страницApplication of ComputerKavita SinghОценок пока нет

- George Brown Business CoursesДокумент5 страницGeorge Brown Business CoursesKadirOzturkОценок пока нет

- WEEK 4 - Topic Overview - CN7021Документ20 страницWEEK 4 - Topic Overview - CN7021RowaОценок пока нет

- Balance Sheet For Mahindra & Mahindra Pvt. LTD.: Assets Amount (In Crores) Non-Current AssetsДокумент32 страницыBalance Sheet For Mahindra & Mahindra Pvt. LTD.: Assets Amount (In Crores) Non-Current AssetsAniketОценок пока нет

- Kap 1 Workbook Se CH 1Документ32 страницыKap 1 Workbook Se CH 1Zsadist20Оценок пока нет

- C V Umair ShahidДокумент5 страницC V Umair ShahidHaris HafeezОценок пока нет

- To Study The Customer Satisfaction Level Towards Coca-Cola Products in LucknowДокумент5 страницTo Study The Customer Satisfaction Level Towards Coca-Cola Products in LucknowChandan SrivastavaОценок пока нет

- Acct Statement - XX2055 - 09102022Документ4 страницыAcct Statement - XX2055 - 09102022Medhanshu KaushikОценок пока нет

- Accounting VoucherДокумент2 страницыAccounting VoucherRavanan v.sОценок пока нет

- OTCEIДокумент11 страницOTCEIvisa_kpОценок пока нет

- Chapter 7 - Dynamics of Financial Crises in Emerging Economies and ApplicationsДокумент49 страницChapter 7 - Dynamics of Financial Crises in Emerging Economies and ApplicationsJane KotaishОценок пока нет

- Modern Systems Analysis and Design: Structuring System Process RequirementsДокумент45 страницModern Systems Analysis and Design: Structuring System Process RequirementsBhavikDaveОценок пока нет

- Session 31Документ25 страницSession 31Yashwanth Reddy AnumulaОценок пока нет

- FINANCE Interview QuestionsДокумент3 страницыFINANCE Interview Questionssakthi80856595Оценок пока нет