Академический Документы

Профессиональный Документы

Культура Документы

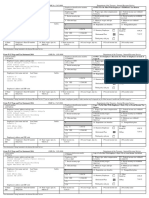

F 1040

Загружено:

Sue BosleyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

F 1040

Загружено:

Sue BosleyАвторское право:

Доступные форматы

1040

P R I N T C L E A R L Y

Form

Department of the TreasuryInternal Revenue Service

U.S. Individual Income Tax Return

Patrick M

If a joint return, spouses first name and initial

2010

(99)

IRS Use OnlyDo not write or staple in this space.

Name, Address, and SSN

See separate instructions.

For the year Jan. 1Dec. 31, 2010, or other tax year beginning Last name Your first name and initial

, 2010, ending

, 20

OMB No. 1545-0074 Your social security number

Bosley

Last name

Spouses social security number

Susan K

Bosley

Apt. no.

Home address (number and street). If you have a P.O. box, see instructions.

1912 Prairie Point

City, town or post office, state, and ZIP code. If you have a foreign address, see instructions.

Make sure the SSN(s) above and on line 6c are correct.

Presidential Election Campaign

O Fallon, MO 63368

Checking a box below will not change your tax or refund.

Check here if you, or your spouse if filing jointly, want $3 to go to this fund 1 2 3 6a b c Single Married filing jointly (even if only one had income) Married filing separately. Enter spouses SSN above and full name here. Spouse . Dependents: . . . . . . . . . . . . 4

You

Spouse

Filing Status

Check only one box.

Head of household (with qualifying person). (See instructions.) If the qualifying person is a child but not your dependent, enter this childs name here.

5 . . .

Qualifying widow(er) with dependent child

Exemptions

Yourself. If someone can claim you as a dependent, do not check box 6a . . . . .

(2) Dependents social security number (3) Dependents relationship to you

. .

. .

. .

. .

(1) First name

Last name

(4) if child under age 17 qualifying for child tax credit (see page 15)

Boxes checked on 6a and 6b No. of children on 6c who: lived with you

did not live with you due to divorce or separation (see instructions) Dependents on 6c not entered above

2 2

If more than four dependents, see instructions and check here

Shawn Keisha

Bosley Bosley

son daughter

Total number of exemptions claimed

. . . . .

. . . . .

. . .

. . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . . . .

. 7 8a 9a 10 11 12 13 14 15b 16b 17 18 19 20b 21 22

Add numbers on lines above

4

98

Income

Attach Form(s) W-2 here. Also attach Forms W-2G and 1099-R if tax was withheld.

7 8a b 9a b 10 11 12 13 14 15a 16a 17 18 19 20a 21 22 23 24 25 26 27 28 29 30 31a 32 33 34 35 36 37

Wages, salaries, tips, etc. Attach Form(s) W-2 . Taxable interest. Attach Schedule B if required . Tax-exempt interest. Do not include on line 8a . Ordinary dividends. Attach Schedule B if required

. . 8b . .

16247

Qualified dividends . . . . . . . . . . . 9b Taxable refunds, credits, or offsets of state and local income taxes Alimony received . . . . . . . . . . . . . . .

2680

73

If you did not get a W-2, see page 20. Enclose, but do not attach, any payment. Also, please use Form 1040-V.

Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . . Capital gain or (loss). Attach Schedule D if required. If not required, check here Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . .

IRA distributions . 15a b Taxable amount . . . 14706 23 b Taxable amount Pensions and annuities 16a . . . Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or (loss). Attach Schedule F . . . Unemployment compensation . . . . . . 23968 Social security benefits 20a . . . . . . . . . . . . . . . . 00 b Taxable amount . . . . . . . . .

Other income. List type and amount Combine the amounts in the far right column for lines 7 through 21. This is your total income Educator expenses . . . . . . . . . . 23 24 25 26 27 28 29 30 31a 32 33 34 . . . . . . . . . .

Adjusted Gross Income

55

00

Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 or 2106-EZ Health savings account deduction. Attach Form 8889 Moving expenses. Attach Form 3903 . . . . . One-half of self-employment tax. Attach Schedule SE Self-employed SEP, SIMPLE, and qualified plans . Self-employed health insurance deduction Penalty on early withdrawal of savings . . Alimony paid b Recipients SSN IRA deduction . . . . . . . Student loan interest deduction . . Tuition and fees. Attach Form 8917 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Domestic production activities deduction. Attach Form 8903 35 Add lines 23 through 31a and 32 through 35 . . . . . . . Subtract line 36 from line 22. This is your adjusted gross income

36 37

Form

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 11320B

1040

(2010)

Form 1040 (2010)

Page 2

Tax and Credits

38 39a b 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55

Amount from line 37 (adjusted gross income) Check if:

You were born before January 2, 1946, Spouse was born before January 2, 1946,

Blind. Blind.

38

Total boxes checked 39a 40 41 42 43 44 45 46

39b Itemized deductions (from Schedule A) or your standard deduction (see instructions) . . Subtract line 40 from line 38 . . . . . . . . . . . . . . . . . . . . . Exemptions. Multiply $3,650 by the number on line 6d . . . . . . . . . . . Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- . Tax (see instructions). Check if any tax is from: a Form(s) 8814 Alternative minimum tax (see instructions). Attach Form 6251 . . Add lines 44 and 45 . . . . . . . . . . . . . . . Foreign tax credit. Attach Form 1116 if required . . . .

Credit for child and dependent care expenses. Attach Form 2441

If your spouse itemizes on a separate return or you were a dual-status alien, check here

14600

00

. .

b . .

. .

Form 4972 . . . . . . . .

47 48 49 50 51

Education credits from Form 8863, line 23 . . . . . Retirement savings contributions credit. Attach Form 8880 Child tax credit (see instructions) . . . . . . . .

2000

00

Residential energy credits. Attach Form 5695 . . . . 52 3800 b 8801 c Other credits from Form: a 53 Add lines 47 through 53. These are your total credits . . . . . Subtract line 54 from line 46. If line 54 is more than line 46, enter -0Self-employment tax. Attach Schedule SE . . . . Unreported social security and Medicare tax from Form: a Form(s) W-2, box 9 b Schedule H Add lines 55 through 59. This is your total tax . c . . . . . . . a 4137

. . .

. . . b

. . .

. .

. .

. . . .

54 55 56 57 58 59 60

2000

00

Other Taxes

56 57 58 59 60 61 62 63 64a b 65 66 67 68 69 70 71 72

. . 8919 . .

. .

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required

Form 5405, line 16 . . . . . . 61 62 63 64a 65 66 67 68

Payments

If you have a qualifying child, attach Schedule EIC.

Federal income tax withheld from Forms W-2 and 1099 . . 2010 estimated tax payments and amount applied from 2009 return Making work pay credit. Attach Schedule M . . . . . . . Earned income credit (EIC) . . . . Nontaxable combat pay election 64b Additional child tax credit. Attach Form 8812 . . . . . . . . . . . . . . . . . .

. . . . . . . 1719 83

American opportunity credit from Form 8863, line 14 . First-time homebuyer credit from Form 5405, line 10 . Amount paid with request for extension to file . . .

Excess social security and tier 1 RRTA tax withheld

. . . . 69 Credit for federal tax on fuels. Attach Form 4136 . . . . 70 Credits from Form: a 2439 b 8839 c 8801 d 8885 71 Add lines 61, 62, 63, 64a, and 65 through 71. These are your total payments .

Refund

73

If line 72 is more than line 60, subtract line 60 from line 72. This is the amount you overpaid Amount of line 73 you want refunded to you. If Form 8888 is attached, check here . c Type: Routing number Checking Savings Account number Amount of line 73 you want applied to your 2011 estimated tax 75 Amount you owe. Subtract line 72 from line 60. For details on how to pay, see instructions

72 73 74a

Direct deposit? See instructions.

74a b d 75 76

Amount You Owe

76

Third Party Designee

77 77 Estimated tax penalty (see instructions) . . . . . . . Do you want to allow another person to discuss this return with the IRS (see instructions)?

Designees name Phone no.

Yes. Complete below.

No

Sign Here

Joint return? See page 12. Keep a copy for your records.

Personal identification number (PIN)

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Date

Your occupation

Daytime phone number

disabled

Date Spouses occupation

Spouses signature. If a joint return, both must sign.

secretary/teacher

Preparers signature Date Check if self-employed Firm's EIN Phone no. Form 1040 (2010) PTIN

Paid Preparer Use Only

Print/Type preparers name

Firms name

Firms address

Вам также может понравиться

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeОт EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeОценок пока нет

- 2014 Federal 1040 (Esther)Документ2 страницы2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- 1040 Tax Return SummaryДокумент2 страницы1040 Tax Return SummaryLinda100% (2)

- FTF1302745105156Документ5 страницFTF13027451051562sly4youОценок пока нет

- 1040 Tax Form SummaryДокумент2 страницы1040 Tax Form SummaryKevin RowanОценок пока нет

- FTF1327867575806Документ3 страницыFTF1327867575806erzahler0% (1)

- Form 1040A Tax Credit DetailsДокумент3 страницыForm 1040A Tax Credit DetailsYosbanyОценок пока нет

- TaxReturn PDFДокумент7 страницTaxReturn PDFChristine WillisОценок пока нет

- Schauer 2013 Tax ReturnДокумент3 страницыSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- 2015 TaxReturn GregAbbottДокумент14 страниц2015 TaxReturn GregAbbottDana ThompsonОценок пока нет

- FTF1301242185129Документ3 страницыFTF1301242185129Donna SchatzОценок пока нет

- W-2 Forms SummaryДокумент4 страницыW-2 Forms SummaryScott Harrison0% (1)

- StatementДокумент2 страницыStatementLuis HarrisonОценок пока нет

- Steven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Документ21 страницаSteven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Thomas Horne100% (1)

- Income Tax Return For Single and Joint Filers With No DependentsДокумент3 страницыIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンОценок пока нет

- I Pay Statements ServncoДокумент2 страницыI Pay Statements ServncoPablito Padilla100% (2)

- ChecksДокумент2 страницыChecksbranch_dawnОценок пока нет

- Selection 26 144Документ1 страницаSelection 26 144Anonymous fu1jUQОценок пока нет

- SC Tax ReturnДокумент12 страницSC Tax ReturnCeleste KatzОценок пока нет

- W2 2010Документ2 страницыW2 2010Rick Nunns100% (2)

- w22009 167305638-1Документ1 страницаw22009 167305638-1Jamie-Rose Michie0% (1)

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramДокумент10 страницFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyОценок пока нет

- Selection-26 - 55 PDFДокумент1 страницаSelection-26 - 55 PDFAnonymous fu1jUQОценок пока нет

- 2008 Form 1040 Tax ReturnДокумент5 страниц2008 Form 1040 Tax ReturnJackie Page100% (2)

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Документ2 страницыFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waites100% (2)

- 2014 TaxReturnДокумент25 страниц2014 TaxReturnNguyen Vu CongОценок пока нет

- 2014 Turbo Tax ReturnДокумент85 страниц2014 Turbo Tax ReturnBrayan Picoy ValerioОценок пока нет

- Kaisers 10Документ41 страницаKaisers 10camillealyssa100% (1)

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramДокумент10 страницFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramRhaxma ConspiracyОценок пока нет

- Tax ReturnДокумент2 страницыTax ReturnJack.A1100% (1)

- PDF W2Документ1 страницаPDF W2John LittlefairОценок пока нет

- W-2 Preview ADPДокумент4 страницыW-2 Preview ADPRyan AllenОценок пока нет

- FTF1299519215531Документ3 страницыFTF1299519215531Leslie Washington100% (1)

- Veera Credit Card ScanДокумент2 страницыVeera Credit Card ScanJagan Mohan Reddy PalnatyОценок пока нет

- Lance Dean 2013 Tax Return - T13 - For - RecordsДокумент57 страницLance Dean 2013 Tax Return - T13 - For - Recordsjessica50% (4)

- CSC Credit Card Authorization Form PDFДокумент1 страницаCSC Credit Card Authorization Form PDFAnonymous 688bqE100% (1)

- Resume of Msnetty42Документ2 страницыResume of Msnetty42api-25122959Оценок пока нет

- Federal Electronic Filing Instructions: Tax Year 2018Документ13 страницFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielОценок пока нет

- W2Документ1 страницаW2Flavia BegazoОценок пока нет

- 15 1 03 003887Документ1 страница15 1 03 003887Aryan ChaudharyОценок пока нет

- WFB 092010Документ12 страницWFB 092010Simon Fong100% (1)

- Fernando Vazquez567935467Документ21 страницаFernando Vazquez567935467Richivee100% (2)

- SNДокумент2 страницыSNEddy Rafizal100% (1)

- ChecksДокумент30 страницChecksYam Eelazzej OcilОценок пока нет

- Your Benefit Statement Tax Year 2019Документ2 страницыYour Benefit Statement Tax Year 2019sloweddie salazar100% (1)

- 2011 Federal 1040Документ2 страницы2011 Federal 1040Swati SarangОценок пока нет

- Tax InfoДокумент5 страницTax InfoAdoumbia100% (1)

- Tax Sentry Organizer 2016 PDFДокумент9 страницTax Sentry Organizer 2016 PDFAnonymous 3KHnP6s20YОценок пока нет

- 2018 TaxReturn PDFДокумент6 страниц2018 TaxReturn PDFDavid LeeОценок пока нет

- Six Hundred and Sixty-Six Social Security Number of Jesus ChristДокумент1 страницаSix Hundred and Sixty-Six Social Security Number of Jesus ChristChristopher Michael Simpson100% (1)

- Fasfa DocsДокумент10 страницFasfa DocsKira Rivera100% (1)

- Eddie Salazar PDFДокумент11 страницEddie Salazar PDFsloweddie salazar0% (1)

- Personal Details ProfileДокумент1 страницаPersonal Details ProfileSalman PatelОценок пока нет

- Michelle Morrison - TransUnion Personal Credit ReportДокумент23 страницыMichelle Morrison - TransUnion Personal Credit ReportchfthegodОценок пока нет

- CreditCard8590Final2 12Документ1 страницаCreditCard8590Final2 12Joseph Puntureri100% (1)

- Langford Market Corp Form W-2Документ4 страницыLangford Market Corp Form W-2sohcuteОценок пока нет

- Evans W-2sДокумент2 страницыEvans W-2sAlmaОценок пока нет

- W21225760934 0 PDFДокумент2 страницыW21225760934 0 PDFAnonymous czHLQeLPB4Оценок пока нет

- NATH f1040Документ2 страницыNATH f1040Spencer NathОценок пока нет

- U.S. Individual Income Tax ReturnДокумент2 страницыU.S. Individual Income Tax Returnapi-173610472Оценок пока нет

- 1558063928887q2LhA3o4bMk7ldb6 PDFДокумент2 страницы1558063928887q2LhA3o4bMk7ldb6 PDFsravanОценок пока нет

- Rahul 123456789Документ2 страницыRahul 123456789Rahul KumarОценок пока нет

- Individual Customer Relation Form: ApplicationДокумент7 страницIndividual Customer Relation Form: ApplicationJay JaniОценок пока нет

- E-Way Bill SystemДокумент1 страницаE-Way Bill SystemGST OTPОценок пока нет

- Implications of Rera and GST On Builders and DevelopersДокумент52 страницыImplications of Rera and GST On Builders and DevelopersPratik Umakant MashaleОценок пока нет

- Mobile Wallet InteroperabilityДокумент8 страницMobile Wallet InteroperabilityFred aspenОценок пока нет

- Final Year Project The Project Is MadeДокумент42 страницыFinal Year Project The Project Is Madetejas padhyeОценок пока нет

- Advantages of Direct TaxesДокумент3 страницыAdvantages of Direct TaxesIryna HoncharukОценок пока нет

- F 1040 SeДокумент2 страницыF 1040 SeseihnОценок пока нет

- PAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)Документ5 страницPAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)sourabh6chakrabort-1Оценок пока нет

- CtaДокумент31 страницаCtaDominique VasalloОценок пока нет

- Class AssignmentДокумент3 страницыClass AssignmentZen JoaquinОценок пока нет

- Notas Localizacion ARg 1Документ2 страницыNotas Localizacion ARg 1Viviana E. EstradaОценок пока нет

- 2000 Revenue Regulations - The Lawphil ProjectДокумент4 страницы2000 Revenue Regulations - The Lawphil ProjectCherry ursuaОценок пока нет

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Документ29 страницSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samОценок пока нет

- Forum 1Документ1 страницаForum 1Nurul AryaniОценок пока нет

- A Practical Guide To GST - Adv. Sanjay Dwivedi (2017 Edition)Документ435 страницA Practical Guide To GST - Adv. Sanjay Dwivedi (2017 Edition)Sanjay DwivediОценок пока нет

- The lack of effectiveness of tax exemption policies in achieving development on the Algerian economyДокумент27 страницThe lack of effectiveness of tax exemption policies in achieving development on the Algerian economyHamid HathatiОценок пока нет

- Broward County Clerk's Daughter Arrest in RICO CaseДокумент46 страницBroward County Clerk's Daughter Arrest in RICO CaseAndreaTorres100% (1)

- Barangay clearance and certification fee ordinanceДокумент2 страницыBarangay clearance and certification fee ordinanceGiezlRamos-PolcaОценок пока нет

- 2306 Manila WaterДокумент6 страниц2306 Manila WaterRegina Raymundo AlbayОценок пока нет

- Student Fee Ledger ReportДокумент9 страницStudent Fee Ledger ReportAnonmity worldОценок пока нет

- Dubai - Emiratesvisa.co - Uk ContentДокумент4 страницыDubai - Emiratesvisa.co - Uk ContentDubai Visa ServicesОценок пока нет

- Electricity Bill: Consumption Data Billing DetailsДокумент1 страницаElectricity Bill: Consumption Data Billing DetailsAchongo Ambetsa0% (1)

- Scorpio N (FBD)Документ1 страницаScorpio N (FBD)Rishabh MahajanОценок пока нет

- Bam031 Sas 15 PDFДокумент4 страницыBam031 Sas 15 PDFIan Eldrick Dela CruzОценок пока нет

- CP575Notice 1645023110303Документ2 страницыCP575Notice 1645023110303MannatechESОценок пока нет

- N28 TU2 Yljhuo PV 7 GДокумент15 страницN28 TU2 Yljhuo PV 7 GVishal BawaneОценок пока нет

- Bill PDFДокумент1 страницаBill PDFMaroshia MajeedОценок пока нет

- P4-3 WPДокумент4 страницыP4-3 WPAna LailaОценок пока нет