Академический Документы

Профессиональный Документы

Культура Документы

3 Stock Exchange

Загружено:

Trishanku PaulИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

3 Stock Exchange

Загружено:

Trishanku PaulАвторское право:

Доступные форматы

18

1. Ans:-

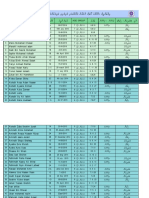

What is Stock Exchange? Write about the nation wide stock exchanges. Stock Exchanges are the exclusive centers for trading of securities. It is also called as body of persons, whether incorporated or not, constituted for the purpose of assisting, regulating or controlling the business of buying, selling or dealing in securities. There are two Stock Exchanges nation wide. They are: Exchange Type NSE BSE Full Name National Stock Exchange Bombay Stock Exchange Trading System National Exchange Automated Trading (NEAT System). BSE on Line Trading (BOLT System).

2. Ans:-

What is Stock Index? Write about the computation of the Stock Index? Index is an indicator of broad market. Any index is an average of its constituents. Stock index represents the changes in value of a set of stocks which constitute the index over a base year. The Stock Index is computed in two ways: a) Price Index: - The price index is a simple arithmetical average of share prices with a base date. This index gives the idea about the general price movement of the Constituents that reflects the entire market. b) Wealth Index: - In wealth index price are weighted by market capitalization. In this index, the base period values are adjusted for subsequent rights & bonus offers.

3.

Write about the two index of NSE & BSE? Write the main factors that different between the two Index.

Ans:- The indexes of two Stock Exchanges of India are: Stock Exchanges a) National Stock Exchange (NSE) b) Bombay Stock Exchange (BSE) Indexes a) Nifty b) Sensex

19

The differences between the two indexes are: a) The Number of the Component Stock: It influences the behavior of index. If the number of the component Stock is larger, it would be a representative sample capable of reflecting the market movement. b) The Composition of the Stocks: It reflects the market movement as well as the macro economic changes. So it changes the composition of the index to reflect the market movement. c) The Weights: It also influences the movement of index. The indices may be weighted with the price or value. The stocks with higher price influence the index more than the low priced stock. d) Base year: The time period from which relative levels of index are measured. The choice of Base year also leads to variations among the index. The Base year differs from each other in the various indices. The base year should be free from any unnatural fluctuation in the market. The Sensex has the base year as 1978-1979 & the S & P CNX Nifty has the base year as November 1995.

4.

What is the usefulness of index? (1) (2) (3) (4) Indices help to recognize the broad trends in the market. Index can be used as a benchmark for evaluating the investors portfolio. Indices function as a status report on the general economy. Impacts of the various economic policies are reflected on the Share Market. The investor can use the indices to allocate funds rationally among stocks. To earn returns on par with the market returns, he can choose the stock that reflect market movement.

Ans:- Usefulness of index:-

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Relative Clauses: A. I Didn't Know You Only Had OnecousinДокумент3 страницыRelative Clauses: A. I Didn't Know You Only Had OnecousinShanti AyudianaОценок пока нет

- Consolidated Terminals Inc V Artex G R No L 25748 PDFДокумент1 страницаConsolidated Terminals Inc V Artex G R No L 25748 PDFCandelaria QuezonОценок пока нет

- AJWS Response To July 17 NoticeДокумент3 страницыAJWS Response To July 17 NoticeInterActionОценок пока нет

- Shell - StakeholdersДокумент4 страницыShell - StakeholdersSalman AhmedОценок пока нет

- D Matei About The Castra in Dacia and THДокумент22 страницыD Matei About The Castra in Dacia and THBritta BurkhardtОценок пока нет

- Developing A Business Plan For Your Vet PracticeДокумент7 страницDeveloping A Business Plan For Your Vet PracticeMujtaba AusafОценок пока нет

- Letter Regarding Neil Green To UHP, District AttorneyДокумент4 страницыLetter Regarding Neil Green To UHP, District AttorneyWordofgreenОценок пока нет

- Juegos 360 RGHДокумент20 страницJuegos 360 RGHAndres ParedesОценок пока нет

- Open Quruan 2023 ListДокумент6 страницOpen Quruan 2023 ListMohamed LaamirОценок пока нет

- BLR - Overall Attendance Report - 22mar24Документ64 страницыBLR - Overall Attendance Report - 22mar24Purahar sathyaОценок пока нет

- Chapter 2 - AuditДокумент26 страницChapter 2 - AuditMisshtaCОценок пока нет

- CDR Questionnaire Form: of The Project I.E. How The Objectives of The Project Was Accomplished in Brief.)Документ2 страницыCDR Questionnaire Form: of The Project I.E. How The Objectives of The Project Was Accomplished in Brief.)NASEER AHMAD100% (1)

- José Mourinho - Defensive Organization PDFДокумент3 страницыJosé Mourinho - Defensive Organization PDFIvo Leite100% (1)

- BCLTE Points To ReviewДокумент4 страницыBCLTE Points To Review•Kat Kat's Lifeu•Оценок пока нет

- Quiet Time Guide 2009Документ2 страницыQuiet Time Guide 2009Andrew Mitry100% (1)

- A Brief Ion of OrrisaДокумент27 страницA Brief Ion of Orrisanitin685Оценок пока нет

- Form Audit QAV 1&2 Supplier 2020 PDFДокумент1 страницаForm Audit QAV 1&2 Supplier 2020 PDFovanОценок пока нет

- NZAA ChartsДокумент69 страницNZAA ChartsA340_600100% (5)

- Chillers, Fcu'S & Ahu'S: Yasser El Kabany 35366866 010-9977779 35366266Документ31 страницаChillers, Fcu'S & Ahu'S: Yasser El Kabany 35366866 010-9977779 35366266mostafaabdelrazikОценок пока нет

- Project ManagementДокумент37 страницProject ManagementAlfakri WaleedОценок пока нет

- EIB Pan-European Guarantee Fund - Methodological NoteДокумент6 страницEIB Pan-European Guarantee Fund - Methodological NoteJimmy SisaОценок пока нет

- Kaalabhiravashtakam With English ExplainationДокумент2 страницыKaalabhiravashtakam With English ExplainationShashanka KshetrapalasharmaОценок пока нет

- 4-Cortina-Conill - 2016-Ethics of VulnerabilityДокумент21 страница4-Cortina-Conill - 2016-Ethics of VulnerabilityJuan ApcarianОценок пока нет

- DepEd Red Cross 3 4 Seater Detached PoWs BoQsДокумент42 страницыDepEd Red Cross 3 4 Seater Detached PoWs BoQsRamil S. ArtatesОценок пока нет

- You Are The Light of The WorldДокумент2 страницыYou Are The Light of The WorldKathleen Lantry100% (1)

- Literacy Technology of The IntellectДокумент20 страницLiteracy Technology of The IntellectFrances Tay100% (1)

- Christian Biography ResourcesДокумент7 страницChristian Biography ResourcesAzhar QureshiОценок пока нет

- Philippine Literature During Spanish ColonizationДокумент4 страницыPhilippine Literature During Spanish ColonizationCharisel Jeanne CasalaОценок пока нет

- International Introduction To Securities and Investment Ed6 PDFДокумент204 страницыInternational Introduction To Securities and Investment Ed6 PDFdds50% (2)

- Fillomena, Harrold T.: ObjectiveДокумент3 страницыFillomena, Harrold T.: ObjectiveHarrold FillomenaОценок пока нет