Академический Документы

Профессиональный Документы

Культура Документы

PCE Brochure en

Загружено:

thbrinkmannИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

PCE Brochure en

Загружено:

thbrinkmannАвторское право:

Доступные форматы

ProClassic/Enterprise Retail Banking Solution Suite

The modular software suite for your front office

A software suite that keeps pace with the future

Todays business demands a focus on process efficiency and sales optimization, increasingly forcing retail banks to reevaluate their business processes and IT. PC/E Retail Banking Solution Suite enables you to simplify complex IT landscapes across all delivery channels, strengthen sales and services, and optimize processes.

YOUR CHALLENGES | Charting the right course: the changing face of customer acquisition Retail banks are under pressure: Margins continue to dwindle, financial products are becoming more and more comparable and customer loyalty is declining. Todays consumers know exactly which products or services they want and are constantly on the lookout for the ideal offer. All the more reason for financial institutions to identify the current requirements of their customers and implement them in end-to-end sales and service concepts. Retail banks must improve the emotional quality of their customer address by providing offers and services that are tailored to each customers individual situation. In combination with process optimization and cost efficiency, this provides financial institutions with a decisive competitive advantage. | Set yourself apart through your sales and service strategies The bottom line is that retail banks can only remain competitive in a liberalized market if they pursue innovative sales and service strategies. Most importantly, they need groundbreaking process models and state-of-the-art IT that will enable them to implement these strategies.

| Added value from a process perspective Improved customer service Increased earnings through optimized sales and service processes Individual control of business processes Reusability of processes Rapid integration

Retail banking transform your business to meet the future! Using your existing structures as a foundation, PC/E Suite will help you transform your current accumulation of sales and service workflows into lean, modern business processes.

O U R VA L U E P R O P O S I T I O N | Discover the benefits of PC/E Suite: improved margin potential and reduced costs Wincor Nixdorf has developed a software suite especially for retail banks that will enable you to react flexibly to customer requirements and integrate innovative products rapidly. With different modules that can be combined to suit your needs, the ProClassic/Enterprise Retail Banking Solution Suite is scalable and enables you to adjust to changed conditions at any time. The payoff? Economic efficiency and optimized banking processes. Our PC/E Suite supports your financial institution in transforming current sales and service processes as well as the associated IT architecture into an expandable and future-proof retail banking business. Thanks to its modular and service-oriented multichannel approach, you will achieve two strategic goals: increased earnings through innovative sales strategies and reduced costs through standardized processes. This enables you to strike an ideal balance between rigorous customer orientation and optimized business processes!

The front office: The heart of the retail bank

The blueprint illustrates a holistic and process-oriented view of the retail banking world as well as the focus on the front office.

The earnings potential in the front office of a retail bank is enormous: This is where the staff meets, advises, and sells to its customers. Business processes should be available across delivery channels and with a clear, customercentered orientation. With its end-to-end support for sales and service processes in the front office, PC/E Retail Banking Solution Suite enables you to ensure a focus on your customers.

THE BLUEPRINT | New concepts and smart processes for financial services providers Faced with increasing cost pressure, financial institutions risk losing sight of what is really important in retail banking: sales and service. Ultimately, the underlying processes are the decisive factor for success in the retail banking business. They must be optimized end-to-end and designed with cost efficiency in mind.

| Added value from an IT perspective: Reusability Rapid integration Expandability | Der Mehrwert aus Business-Sicht: Increased earnings Reduced costs Investment protection and security for the future "Emotionalization" of retail banking

THE POSITIONING | Retail banks want processes that are customer-oriented If used correctly, IT can make a significant contribution toward automating and optimizing business processes. We designed our modular PC/E Suite with this objective in mind. Its different process-oriented solutions help your retail bank meet the twin challenges of dynamic market changes and the wishes of consumers. Since private customers are once again taking center stage, it is important to provide a uniform service experience across all channels that is also transparent for new customers. | In a nutshell: PC/E Retail Banking Solution Suite... ... is Wincor Nixdorfs modular software package for the optimization of sales and service processes in the front office. It enables retail banks in particular to design high-performance systems and use them flexibly a critical advantage for rapid time-to-market. With PC/E Suite, you strengthen your own sales force in all delivery channels and ensure that future added-value processes are more efficient.

| The blueprint offers an overview The blueprint illustrates our holistic and process-oriented view of the retail banking world. For this purpose, it is divided into three main processes: "Sales & Marketing" starts with the acquisition of a customer and accompanies you all the way to successful completion of a sale in the front office. The Service Processes" that follow comprise cash and non-cash services such as deposits, withdrawals, funds transfers and standing orders. And the Support Processes in the back office cover tasks from accounting and posting to controlling and reporting. Banking products and

services must be offered via the selfservice, front office, POS, Internet, call center and mobile delivery channels, ideally using an integrated multichannel platform.

PC/E Suite as an innovation model for retail banking

The open, modular and service-oriented multichannel approach enables you to create attractive sales and service processes for your customers. But your customers won't be the only ones to be delighted the multichannel approach is also extremely profitable for your retail bank.

PC/E SUITES PORTFOLIO | Software Suite that focuses on delivery channels and processes Thanks to PC/E Suites modular structure, everything can be tailored to your individual bank strategy in a gentle transformation process. You can start with one of the software products and expand your solution in steps to include other channels and processes. For example, you could (re-)discover the mobile delivery channel for your retail business and combine it with conventional channels. The software components mesh perfectly with each other. You can choose from four categories: Channel Delivery comprises solutions for all kinds of delivery channels, Security offers a holistic security strategy for self-service systems, branches and networks, Management & Optimization improves retail banking processes and reduces operating costs, and Banking Business Enabling includes cross-channel solutions for sales and marketing services as well as transaction and payment services for all delivery channels. | From analysis to management Our Professional Services are ready to support you through every phase of your IT project to ensure that you benefit immediately from the features and functions of our software. We provide end-to-end support from analysis and IT consulting to implementation and optimal application management.

| Added value from an architectural perspective Future security and investment protection thanks to a net-centric architecture Expandable, scalable IT enables a gentle transformation Reduced costs due to reuse of components Rapid integration Modular and flexible Multichannel capability

The IT architecture enables the provision of business processes across all delivery channels thanks to reusable business services.

PC/E SUITES ARCHITECTURE | Combinable and versatile through innovative services The suite's net-centric approach allows rapid implementation of new functions and services as well as centralized management of the IT infrastructure. PC/E Suite's IT architecture is ... open modular net-centric service-oriented multichannel-capable Our solutions can be used across all delivery channels along your retail banks entire process chain. You select the business services that support your added-value strategy. As you can see from the 3D representation above, the functions can be reused across several delivery channels in line with your banks portfolio. The services and delivery channels you use converge efficiently on the PC/E Suite platform. This enables you to convey for example the same advertising message in the Internet, at the ATM or via mobile phone with a consistent look and feel! On the following pages, you will discover how these technological features influence the four categories in our solution. 7

Channel Delivery: A single platform for all channels

Committed to the customer: Banks that tailor their sales activities precisely to their customers wishes are able to optimize customer relationships and increase revenues.

A banking portfolio is only successful with consumers if it is attractive and has a logical structure. Your customers must always have the feeling that they are with one and the same bank. Consistent processes across all channels reassure customers and make them feel welcome. As an added bonus, they make your bank more appealing to new customers. What this requires is the right foundation: the multivendor, multichannel platform of our PC/E Suite!

T H E C AT E G O R Y | Uniform service experience with a consistent look and feel Todays bank customers use financial services in a variety of different ways, alternating between the self-service zone, their home PCs and the teller. And they expect consistently good quality and a uniform appearance from every interface. For a successful dialog with the customer, all your delivery channels must be interlinked to ensure a homogeneous look and feel. But how can you ensure that functions are implemented in a process-oriented way across all your delivery channels?

| Your benefits of Channel Delivery Uniform customer address across all channels Higher service quality Support and promotion of your multichannel strategy Harmonious total solution with cross-channel processes Reduced costs thanks to reusable components and maximization of synergies Shorter time-to-market

T H E S O F T WA R E P R O D U C T S | The right solution for every delivery channel You can put together an individual software package from three following groups: Branch We offer a comprehensive front-office solution for your specific branch IT requirements that ensures customer-friendly and efficient processes. Whats more, PC/E Suite also provides special additional applications: an ATS solution for optimized cash processes and a peripherals solution for control and administration in the frontoffice environment. Self-service Self-service terminals must be managed flexibly in a single IT environment. Since todays self-service networks are complex and heterogeneous, Wincor Nixdorf offers two innovative applications: a flexible and vendor-independent fat client solution and an equally adaptable and server-based smart client solution. Mobile Retail banks are increasingly supplementing their traditional delivery channels with additional customer contact points. We offer a state-of-the-art solution for integrating mobile banking in your multichannel strategy that enables you to provide your existing Internet banking services over every type of mobile device.

| Customer contacts bring higher earnings when efficiently networked What banks need is a consistent multichannel strategy. Wincor Nixdorf has software solutions for your individual sales and service processes that will enable you to address your customers consistently, so that they can orient themselves in all your applications such as when using input screens for transactions and use them easily and comfortably. By providing a uniform look and feel across all delivery channels and taking each channels specific requirements into consideration, you

will improve your customer service and thus increase customer loyalty and revenues. PC/E Suite provides you with the software architecture you need to achieve this objective. With our intelligent solutions, sales and service processes become more target-oriented and efficient. At the same time, the integrated multichannel platform enables transparency in customer banking transactions.

Security: Confidence as the trademark of retail banking End-to-end IT security is an absolute must for retail banks. Poor service availability and data loss can have serious technical, financial and legal consequences and entail a loss of image and customer confidence as well. This is why our PC/E Retail Banking Solution Suite includes security solutions to ensure the security of your business processes.

T H E C AT E G O R Y | IT security in retail banks the tightrope between demand and reality Retail banking processes must be supported by powerful IT systems. This fact has resulted in the development, over time, of extremely complex IT networks. Ensuring their availability is a formidable challenge for financial institutions, but it must be met to ensure continuously secure business processes. This is the reason why retail banks have broadened their field of vision: Beyond the security of the technology itself, they are also concerned with the security of business processes and confidential data. Individual protective measures are increasingly yielding to holistic IT security management. Every process-oriented measure impacts systems, applications and communication as a whole. | Secure transactions make customers feel at ease Protected IT structures, business processes and transactions are the basis for successful sales processes, because data loss through software manipulation is expensive and damaging to the banks image. That is why it is so important to balance efficient IT with the required security across all your delivery channels.

| Security benefits Image protection through secure service processes Increased availability thanks to proactive security mechanisms Compliance with international legislation Time and cost savings through automated terminal master key management

10

Comprehensive security protection is what you get with our PC/E Suite. We support your risk management by providing optimal burglary and access protection as well as legally compliant key management.

T H E S O F T WA R E P R O D U C T S | Value protection, profit generation To enable you to protect sensitive business processes and data reliably while simultaneously automating processes, our PC/E Retail Banking Solution Suite is based on a modular security concept. In addition to process-oriented security solutions, we also offer our holistic security solution concept ProTect for active risk management that includes risk analysis, minimization and control. Channel Security With our tamper-proof software, you can protect your self-service systems against network and local attacks. We provide proactive protection against potential system failures and data loss even in the case of brand-new and as yet undetected viruses, worms or Trojans. Our solution also prevents modifications and manipulations using local storage media. In addition, we offer software products for the centralized automation of terminal master key management to ensure secure encoded communication and authentication between terminals and the host system.

11

Management & Optimization: Proactive control of business processes

Transparency and efficiency With our software solutions, higher availability and lower costs are both possible!

Retail banks must concentrate on their core competencies without losing sight of costs. Our retail banking solutions ensure high system availability and transparent operation. And our software optimizes cash handling processes to make your cash management more efficient.

T H E C AT E G O R Y | Transparent operation The complexity of today's business processes often means a loss in the transparency you need to analyze and optimize service and sales processes. Yet the necessary process efficiency can only be attained through a powerful self-service network that guarantees highly available services. This is particularly important for customer satisfaction, which can quickly deteriorate if an ATM runs out of cash or is out of service, for example. That makes it critical to deploy solutions that analyze and monitor your networks to ensure efficient IT management and optimized end-to-end processes.

12

| Management & Optimization benefits Maximum availability of systems and cash holdings Cost and time savings thanks to automated, efficient processes Optimized service quality Optimized amount of cash in circulation High degree of transparency thanks to continuous monitoring and analyses/forecasts Data hub for further solutions such as Incident Management, etc.

T H E S O F T WA R E P R O D U C T S | Process optimization through end-to-end process management Efficient, effective business processes increase your banks service quality. These software products ensure highly available, customer-friendly and cost-optimized processes: Management Our solutions administer, monitor and control even the most complex self-service networks. Remote monitoring enables you to access transparent information around the clock. Potential system failures can therefore be detected proactively. As a data hub for retail banking management, these software products play an important role. Optimization If you want to optimize your cash holdings in addition to controlling them, then you have come to the right place: Our solution strikes an ideal balance between cash services and cash costs. Detailed analyses and reliable forecasts enable you to optimize the replenishment volumes and intervals of your cash points across branches, and manage your cash-in-transit operators efficiently.

| Availability adds value Continuous and centralized monitoring allows you to keep an eye on your selfservice networks performance and efficiency. A central overview and extensive data enable faults to be eliminated quickly and used proactively as a basis for optimization. This is important since productivity and customer satisfaction suffer greatly from disrupted business processes. IT management is a very complex task, especially where large and widespread self-service and branch networks are concerned. That much is obvious if you

consider the effort involved in checking the cash holdings of your cash points or analyzing their frequency of use. Processes must be automated and the amount of manual work reduced in order to ensure cost-effective control of the cash cycle in branches and off-premise locations, including cash-in-transit services. With Wincor Nixdorfs solutions, your retail bank will be able to manage its systems efficiently and, at the same time, optimize business processes.

13

Banking Business Enabling: a new customer proximity in sales and service

Innovative business models depend on innovative sales concepts that require the availability of all processes across all delivery channels. With solutions from our PC/E Retail Banking Solution Suite, your sales and marketing activities gain new momentum for profitable cross-selling processes and higher revenues in your retail bank.

| Commitment to bank customers is on the rise Retail banking is characterized by international competition. To meet todays challenges, banks need to reorient their sales strategies, focusing above all on improving customer proximity. Only retail banks with innovative multichannel concepts will capture the interest of their customers and increase earnings with attractive offers. The key is to develop emotional consulting services and make the right offers in the right way at the right time in line with the customer's individual situation. This is precisely what PC/E Suites solutions help you achieve. They homogenize your process flows across all channels and, at the same time, make them more efficient.

| Flexible and efficient handling of payment transactions In this day and age, competitiveness also depends on cost-efficient, highly available transaction handling. If core functions are designed efficiently and synergy potential is exploited to the full extent, attractive margins and reduced costs are possible despite the considerable requirements of excellent payment services.

| Benefits of Banking Business Enabling Added value and higher earnings with new business ideas and emotional banking Improved customer contacts through customer typing Image boost thanks to innovative cross-channel services Flexible transaction services in the original core business Automation of standard services that frees up staff for sales

14

Marketing as a service With its Banking Business Enabling module, PC/E Suite looks into the question of what customers really want. Because if there's one thing that characterizes todays successful banks, it is this: they address their customers in a target-oriented and emotional way that reflects their individual situations. With our solutions, you will be able to optimize your transaction-related customer services cost-efficiently and across all delivery channels.

T H E S O F T WA R E P R O D U C T S | Contact is capital Our solutions help you enhance customer services relating to transaction business and optimize your sales activities. Sales & Marketing Services Here, we offer you a solution that uses attractive add-on offers to help generate new sales potential via the self-service and Internet channels. An additional software solution is available to address customers directly and create holistic marketing campaigns across all delivery channels. Transaction & Payment Services With our solutions for assisted self-service or cardless cash withdrawals via mobile devices, cash and account-related transactions can be implemented efficiently and with a high degree of customer-friendliness. We also offer a high performance and secure solution for the authorization, switching and routing of payment transactions.

15

Published by Wincor Nixdorf International GmbH Heinz-Nixdorf-Ring 1 D-33106 Paderborn Phone: +49 (0)5251 6933301 Fax: +49 (0)5251 6935918 www.wincor-nixdorf.com info.banking@wincor-nixdorf.com

Wincor Nixdorf International GmbH

All product names are registered trademarks of Wincor Nixdorf International GmbH. All rights, including rights created by patent grant or registration of a utility model, are reserved. Delivery subject to availability. Subject to change for technical reasons. Order no.: R10801-J-Z740-2 Printed in Germany, March 2011

Cover picture: Atomium, Brussels

Вам также может понравиться

- Finacle Universal Banking Solution PDFДокумент12 страницFinacle Universal Banking Solution PDFSsemwogerere TomОценок пока нет

- Finacle CRMДокумент12 страницFinacle CRMNitika Gupta100% (1)

- Finacle: Detailed Solution DescriptionДокумент4 страницыFinacle: Detailed Solution DescriptionVibhor JoshiОценок пока нет

- What Problems Need To Be Solved? in Spite of Predictions That Retail Banking Branches Would BeДокумент2 страницыWhat Problems Need To Be Solved? in Spite of Predictions That Retail Banking Branches Would BeTwinkal chakradhariОценок пока нет

- S1 TellerДокумент2 страницыS1 TellerAvinash PoddarОценок пока нет

- CRM SolutionДокумент8 страницCRM SolutionNitika GuptaОценок пока нет

- FinnacleДокумент8 страницFinnaclesamjoechandyОценок пока нет

- TCS BaNCS Brochure Core Banking 1212-1Документ8 страницTCS BaNCS Brochure Core Banking 1212-1Muktheshwar ReddyОценок пока нет

- Universal Banking SolutionДокумент8 страницUniversal Banking SolutionSwaroop DasОценок пока нет

- Finacle Core Banking SolutionДокумент8 страницFinacle Core Banking SolutionInfosysОценок пока нет

- Corporate E-Banking SolutionДокумент8 страницCorporate E-Banking SolutionFriedrich NeitzscheОценок пока нет

- Sap® For Telecommunications: Industry OverviewДокумент8 страницSap® For Telecommunications: Industry OverviewUmasankar_ReddyОценок пока нет

- IILProduct Bro 140710Документ20 страницIILProduct Bro 140710ankitkothari0Оценок пока нет

- ERP For The BanksДокумент11 страницERP For The BanksDeepjyot DevdharaОценок пока нет

- WP Tech-of-Insurance EN Feb09 ENT2913080903 PDFДокумент12 страницWP Tech-of-Insurance EN Feb09 ENT2913080903 PDFJohn C. YoungОценок пока нет

- Solution Offerings For Retail Industry RCTG ReportДокумент11 страницSolution Offerings For Retail Industry RCTG ReportSurendra Kumar NОценок пока нет

- CRMДокумент6 страницCRMMohit GuptaОценок пока нет

- Core Banking SolutionДокумент12 страницCore Banking SolutionMamta Grover100% (1)

- Core Banking RajeshДокумент8 страницCore Banking RajeshRajeev SinghОценок пока нет

- Digital Banking FrameworkДокумент20 страницDigital Banking FrameworkTanaka MbotoОценок пока нет

- FamacyДокумент15 страницFamacyfanam75Оценок пока нет

- Retail Banking Solutions: Innovation Is The Key To Competitive AdvantageДокумент4 страницыRetail Banking Solutions: Innovation Is The Key To Competitive AdvantageDeepak MartinОценок пока нет

- Management Accounting Systems Used by DCB BankДокумент3 страницыManagement Accounting Systems Used by DCB BankBeverly D'costaОценок пока нет

- E-Commerce AnswersДокумент7 страницE-Commerce AnswersSatyamОценок пока нет

- MIS - Report On CRM VendorsДокумент19 страницMIS - Report On CRM VendorsvishnihalaniОценок пока нет

- Retail Loans in IndiaДокумент4 страницыRetail Loans in IndiaJoy MukherjeeОценок пока нет

- 4458 Bank Fusion Universal Banking Business Factsheet Bank Master Customers - April 10Документ4 страницы4458 Bank Fusion Universal Banking Business Factsheet Bank Master Customers - April 10Sachin ChauhanОценок пока нет

- Tcs Bancs DigitalДокумент4 страницыTcs Bancs Digitalspiritual pfiОценок пока нет

- Nucleus PresentationДокумент4 страницыNucleus Presentationachopra14Оценок пока нет

- Siebel Insurance SolutionsДокумент2 страницыSiebel Insurance SolutionsKalyana Chakravarti TangiralaОценок пока нет

- Agile Customer ExperiencesДокумент5 страницAgile Customer ExperiencesIntense Technologies LimitedОценок пока нет

- Improving Enterprise Customer Experience Through Intelligent Digital TransformationДокумент2 страницыImproving Enterprise Customer Experience Through Intelligent Digital TransformationSurachaiОценок пока нет

- IBM ECM EMEA Partner Solution Handbook v3Документ102 страницыIBM ECM EMEA Partner Solution Handbook v3Ihab HarbОценок пока нет

- Digital Banking & Delivery Channels SyllabusДокумент102 страницыDigital Banking & Delivery Channels SyllabusPriya Raj100% (1)

- Process (Pius Pinto S) :: Among The Demonstrated Outcomes AreДокумент5 страницProcess (Pius Pinto S) :: Among The Demonstrated Outcomes Arepius pintoОценок пока нет

- Project Financial ServicesДокумент46 страницProject Financial ServicesMahfooz Alam ShaikhОценок пока нет

- HP TrueviewДокумент12 страницHP TrueviewozovoОценок пока нет

- Amdocs FSДокумент4 страницыAmdocs FSlionrudrams81Оценок пока нет

- Transformation.: Major ApplicationsДокумент7 страницTransformation.: Major ApplicationsBhagyashree MohiteОценок пока нет

- Netsuite Services IntegrationДокумент6 страницNetsuite Services IntegrationAashna Cloud TechОценок пока нет

- Core BankingДокумент12 страницCore BankingPriyanka GovalkarОценок пока нет

- Company ProfileДокумент13 страницCompany Profileraman deepОценок пока нет

- Brochure Guidewire BillingCenter PDFДокумент4 страницыBrochure Guidewire BillingCenter PDFSaiKiran TanikantiОценок пока нет

- Dynamics AX2009 FS OverviewДокумент2 страницыDynamics AX2009 FS Overviewkuttyma15Оценок пока нет

- Build Brochure FinalДокумент7 страницBuild Brochure FinalMadhusudhanchowdary KoneruОценок пока нет

- IT Solution & Custom Software Development PartnerДокумент8 страницIT Solution & Custom Software Development PartnerColab ITОценок пока нет

- ClarifyДокумент5 страницClarifyVikash Kr SinghОценок пока нет

- 1001tech IPvox - OverviewДокумент6 страниц1001tech IPvox - Overview1001techОценок пока нет

- Real World ApplicationДокумент9 страницReal World ApplicationER Kavilesh ChandraОценок пока нет

- CSP Frequently Asked QuestionsДокумент70 страницCSP Frequently Asked QuestionsjoseОценок пока нет

- Solution & Service Portfolio For The Telco Market.: BillingДокумент8 страницSolution & Service Portfolio For The Telco Market.: BillingMohamed DarqaouiОценок пока нет

- ERP DocumentДокумент10 страницERP DocumentNirmal DaveОценок пока нет

- 1 IND GLOBAL TECHNOLOGIES PVT Company ProfileДокумент7 страниц1 IND GLOBAL TECHNOLOGIES PVT Company ProfileKrishna Pradeep LingalaОценок пока нет

- Panasonic Partner Program OverviewДокумент8 страницPanasonic Partner Program OverviewMd SaquibОценок пока нет

- Bulletin PB20160197 - Introducing Mitel and ASC Technologies 1-2Документ10 страницBulletin PB20160197 - Introducing Mitel and ASC Technologies 1-2lykorianОценок пока нет

- The MSP’s Guide to the Ultimate Client Experience: Optimizing service efficiency, account management productivity, and client engagement with a modern digital-first approach.От EverandThe MSP’s Guide to the Ultimate Client Experience: Optimizing service efficiency, account management productivity, and client engagement with a modern digital-first approach.Оценок пока нет

- Digital Success: A Holistic Approach to Digital Transformation for Enterprises and ManufacturersОт EverandDigital Success: A Holistic Approach to Digital Transformation for Enterprises and ManufacturersОценок пока нет

- DepEd Camarines Norte Daily Lesson PlanДокумент5 страницDepEd Camarines Norte Daily Lesson PlanjuriearlОценок пока нет

- Speaking Culturally n3Документ16 страницSpeaking Culturally n3Mai FalakyОценок пока нет

- s7 1500 Compare Table en MnemoДокумент88 страницs7 1500 Compare Table en MnemoPeli JorroОценок пока нет

- Utility TheoryДокумент43 страницыUtility TheoryMuhammad BilalОценок пока нет

- Hastelloy B2 Alloy B2 UNS N10665 DIN 2.4617Документ3 страницыHastelloy B2 Alloy B2 UNS N10665 DIN 2.4617SamkitОценок пока нет

- TarminatinДокумент102 страницыTarminatingmnatigizawОценок пока нет

- Critical Success FactorsДокумент12 страницCritical Success Factorsmoon1377Оценок пока нет

- DFA and DOLE Not Liable for Repatriation Costs of Undocumented OFWДокумент80 страницDFA and DOLE Not Liable for Repatriation Costs of Undocumented OFWdhanty20Оценок пока нет

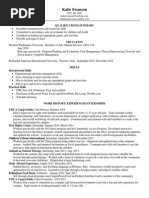

- Katie SwansonДокумент1 страницаKatie Swansonapi-254829665Оценок пока нет

- Cabarroguis CLUP SEA ReportДокумент91 страницаCabarroguis CLUP SEA ReportAlvin Lee Cucio Asuro100% (3)

- Factory Overhead - RFDДокумент32 страницыFactory Overhead - RFDSamantha DionisioОценок пока нет

- M S Ramaiah Institute of Technology Department of CIVIL ENGINEERINGДокумент10 страницM S Ramaiah Institute of Technology Department of CIVIL ENGINEERINGPrashant SunagarОценок пока нет

- Our Solar System Lesson PlanДокумент20 страницOur Solar System Lesson PlanDean EqualОценок пока нет

- Cinnamomum Cassia - Twig: 1. ScopeДокумент3 страницыCinnamomum Cassia - Twig: 1. ScopeTaufik HidayatullohОценок пока нет

- Mastering Physics CH 14 HW College Physics I LCCCДокумент24 страницыMastering Physics CH 14 HW College Physics I LCCCSamuel100% (5)

- Chapter 1Документ19 страницChapter 1Shehzana MujawarОценок пока нет

- 3D MapsДокумент1 128 страниц3D MapsjoangopanОценок пока нет

- Wands and StavesДокумент4 страницыWands and StavesSarah Jean HEADОценок пока нет

- CLMD4A CaregivingG7 8Документ25 страницCLMD4A CaregivingG7 8Antonio CaballeroОценок пока нет

- DR Bob Jantzen's Differential GeometryДокумент485 страницDR Bob Jantzen's Differential GeometryBGMoney5134Оценок пока нет

- Prime-Hrm Forum 2017 - PMДокумент34 страницыPrime-Hrm Forum 2017 - PMsuzette100% (3)

- Grade 2 math lesson plan compares mass in grams & kilogramsДокумент3 страницыGrade 2 math lesson plan compares mass in grams & kilogramskristine arnaiz80% (10)

- Chapter 4 BTE3243Документ76 страницChapter 4 BTE3243Muhammad Shafiq Bin Abdul KarimОценок пока нет

- ETE Micro ProjectДокумент7 страницETE Micro ProjectPadale MoneshОценок пока нет

- Non-Ferrous Metal SmeltingДокумент47 страницNon-Ferrous Metal SmeltinggtdomboОценок пока нет

- Linux InstallationДокумент4 страницыLinux InstallationRayapudi LakshmaiahОценок пока нет

- NCP For PneumoniaДокумент3 страницыNCP For PneumoniaKahMallari100% (10)

- Advance Accountancy Inter PaperДокумент14 страницAdvance Accountancy Inter PaperAbhishek goyalОценок пока нет

- Dr. Amen Penquin AnalogyДокумент64 страницыDr. Amen Penquin AnalogyStephanie StarkОценок пока нет

- Legal Citation: Legal Research Atty. Patricia Gail Cayco-Magbanua Arellano University School of LawДокумент47 страницLegal Citation: Legal Research Atty. Patricia Gail Cayco-Magbanua Arellano University School of LawShan AdriasОценок пока нет