Академический Документы

Профессиональный Документы

Культура Документы

Analysis of Ceat Limited's Annual Report

Загружено:

Abhijeet IyerИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Analysis of Ceat Limited's Annual Report

Загружено:

Abhijeet IyerАвторское право:

Доступные форматы

Study of a Mfg. Co. from Annual Report Company Name: H.O.

Location: Factory Location: CEO: Products Manufactured: Ceat Limited. Worli, Mumbai Mumbai, Nasik and Halol Mr. Paras Chowdhary, MD Automative Tyres, Tubes, and Flaps for Trucks & Buses(T&B), Light Commercial Vehicles(LCBs), Passenger Cars(PCs), Tractors and Trailers, Two Wheelers and three wheelers, Off the road OTR()vehicles, Industrial vehicles

Capacity Analysis Product Name Automative Tyres Automative Tubes Automative Flaps

2009-10 Units License d Capacit y 49.47 49.47 Installe d Capacit y 47.26 %Cap utilization Production Gross Sales 88.70 94.84 26.58 YOY

Nos in Lacs Nos in Lacs Nos in Lacs

84.50 70.56 25.20

Financial Analysis ( All fig. in Rs Lacs. except employees) 08-09 % of 09-10 Sales 251369.2 ----- 285042.6 5 8 170428.5 68% 175934.3 1 4 16069.27 6.4 19633.07 5000 21941.63 9053.99 6844.75 2561.73 49017 68357.43 (1611.16) ---8.7 3.6 2.7 1.02 19.5 27.19 0.7 5215 41719.90 11126.71 6430.18 2749.33 47700 66135.56 16104.15 % of sales -----61.7 6.9 ----14.6 3.9 2.3 0.9 16.73 23.2 5.65 YoY % Change +13.40 % +3.3% +22.18 % +4.3% +90% +23% (6%) 7.3% (2.69%) (3.25%) 899%

Net Sales (Excluding other income) Rs. Material Cost Employee Cost No. of Employees (write whether assumed or actual ?) Inventory held on yr. end Power & Fuel Cost Interest paid Depreciation Exports Imports Net Profit (NOPAT) Average Earning of Employee Revenue generated /Employee ( Sales / No. of Emps.) Inventory/Turn-Over ratio E.P.S. (Rs.)

Rs. 3.21 L/Yr Rs. 50.27---- L ---11.46Times (4.71)

Rs.3.69 L/Yr Rs. 54.66---- L 6.832----- Times 47.03

1. Capacity Utilization: How is Production and Sell w r t Installed Capacity? Is there improvement w r t last year.? Is company moving with market trends ? 2. Productivity, Quality Revenue per employee has increased from 50.27 lac 2008-09 to 54.66 in 200910

3. Inventory Management: Inventory turnover ratio in 2009-10 is 6.8 times as compare to 11.46 times in 2008-09 There is no improvement in inventory turn over .

4. Profitability : Net profit margin in 2009-10 is 5.65 % as compare to loss of -.7 % in 2008 2009 Return on capital employed 30.06% in 2009-10 as compare to 4.29 % in 200809 Return on networth 26.29% 2009-10 as compare to -3.33 % in 2008-09 This was achieved due to smart and strategic raw material procurement, substantial reduction in interest burdenon account of efficient working management and numerous cost reduction initiatives with higher productivity.

5. Management effectiveness :5 year Avg ROI and ROE are 6.3 and 14.37 respectivly . This compares well against the industry average of -3.15 and -12.88 .

6. Ratio Analysis : Current ratio is .84 as compare to industry avg of .80 Quick ratio is .60 as compare to industry Avg of .83 While the company is close to industry average large part of company current asset are tied up with slow moving inventory and slow paying debts so the firm may find difficult to pay its current libility .

5. Future Plans With a new manufacturing facility at halol with a capacity of 130TPD and additional capacity Nasik facility, the total capacity will increase to 570TPD by end of 2011-12. Partnering with OEM for new developments. Develop alternate recipes Developments in passenger radial segment i.e winter tyres, energy saver tyres and eco friendly tyres. The company should introduce Wheel Management Centres to expand reach and customer contact across the country. This will provide services like wheel alignment, tyre repair etc. The company should also tap replacements segment that accounts for 60% of the total tyre industry. The company should double exclusive outlets from the present 80, by opening them in tier-2 and 3 cities to expand reach. The industry is highly raw material sensitive. So the company should look for acquiring raw materials from other centres than East Asian countries. Sharp increase in raw material prices and depreciation due to new capacity creation will pressurize the bottom line margins but topline growth is expected to be robust due to overall increase in demand from automotive industry.

Imp. Instructions 1. Group Assignment of 2 students, hence interaction for analysis / comments is expected. Anyone may be called for viva. 2. Time for Submission : 1 week (- ve marks, if delayed) 3. Copying strictly prohibited Both parties will get 0 marks

4. 5. 6. 7.

Following is a template. The same format must be followed. No copy-pasting from the report. Analysis in own wording is expected. Follow the same format. Do not make any change. Only 2 pages, no 3rd page, no folder. Any non-compliance of above will result into negative marks.

Вам также может понравиться

- Marketing Strategy Opted by The Apollo Tyres1Документ90 страницMarketing Strategy Opted by The Apollo Tyres1Shivalya MehtaОценок пока нет

- Retail Research: Precision Camshafts Limited (PCL) - IPO NoteДокумент8 страницRetail Research: Precision Camshafts Limited (PCL) - IPO NoteshobhaОценок пока нет

- Financial Ratio Analysis of Indus MotorsДокумент31 страницаFinancial Ratio Analysis of Indus MotorsAli Husanen100% (1)

- Cost Management Hero MotoCorpДокумент6 страницCost Management Hero MotoCorpNiraj AgarwalОценок пока нет

- Industry Analysis of Ceat Lt1Документ9 страницIndustry Analysis of Ceat Lt1santosh panditОценок пока нет

- Business Paper - 3 Mock - October 2022Документ8 страницBusiness Paper - 3 Mock - October 2022Rashedul HassanОценок пока нет

- Cost Reduction Techniques FinalДокумент75 страницCost Reduction Techniques FinalJig HiraniОценок пока нет

- BMS Auto Platform Automobile Industry-Key Market TrendsДокумент8 страницBMS Auto Platform Automobile Industry-Key Market TrendsMohnish HasrajaniОценок пока нет

- F5 2013 Dec Q PDFДокумент7 страницF5 2013 Dec Q PDFcatcat1122Оценок пока нет

- Financial Performance Analysis of Exide IndustriesДокумент11 страницFinancial Performance Analysis of Exide IndustriesAnupriya SenОценок пока нет

- Welingkar WE Girls General MotorsДокумент10 страницWelingkar WE Girls General MotorsSmita NayakОценок пока нет

- Maruti Suzuki India Limited Operations Management ReportДокумент15 страницMaruti Suzuki India Limited Operations Management ReportGajananОценок пока нет

- LGB ResearchNote 28march2012Документ14 страницLGB ResearchNote 28march2012equityanalystinvestorОценок пока нет

- Industry AnalysisДокумент6 страницIndustry AnalysisMichael SapriioОценок пока нет

- Saa P5Документ12 страницSaa P5smartguy0Оценок пока нет

- Project Report: Cost Analysis of Automotive Companies Using Regression AnalysisДокумент5 страницProject Report: Cost Analysis of Automotive Companies Using Regression AnalysisvishalpahariyaОценок пока нет

- Jamna AutoДокумент5 страницJamna AutoSumit SinghОценок пока нет

- HeropptДокумент37 страницHeropptNikita GheradeОценок пока нет

- APOLLO TYRES SWOT - Internal AnalysisДокумент8 страницAPOLLO TYRES SWOT - Internal Analysisshazia ahmadОценок пока нет

- "Automobile Maintenance Workstation (Amw) " Business Development PlanДокумент54 страницы"Automobile Maintenance Workstation (Amw) " Business Development PlankalisuryОценок пока нет

- Pinki Project ReportДокумент63 страницыPinki Project ReportRaja KumarОценок пока нет

- Company Analysis Note TACLДокумент8 страницCompany Analysis Note TACLmadhu vijaiОценок пока нет

- Project Report on Metro Tyres LimitedДокумент37 страницProject Report on Metro Tyres LimitedAnmolDhillonОценок пока нет

- Ashish Pundir Report (A-01)Документ28 страницAshish Pundir Report (A-01)Navdeep Singh YadavОценок пока нет

- Increase in Turnover by 33%Документ15 страницIncrease in Turnover by 33%Saahil LedwaniОценок пока нет

- Business and Management: Extended EssayДокумент35 страницBusiness and Management: Extended EssayAkshat ChaturvediОценок пока нет

- Mayank Mohan (10BM60048) Prashant Saurabh (10BM60062) Sudeep Yadav (10BM60089)Документ14 страницMayank Mohan (10BM60048) Prashant Saurabh (10BM60062) Sudeep Yadav (10BM60089)Aritra Ravenor JanaОценок пока нет

- A Seminar Report On "Automobile Sector of India"Документ33 страницыA Seminar Report On "Automobile Sector of India"Mohammad Anwar Ali100% (1)

- Analysis & Financial Performnce of AccДокумент25 страницAnalysis & Financial Performnce of Accneeks818100% (1)

- Mid Term P&OДокумент5 страницMid Term P&OHADLIZAN BIN MOHZAN (B19361012)Оценок пока нет

- Sundaram Clayton Case Study ExcellenceДокумент25 страницSundaram Clayton Case Study ExcellenceSathyanarayana A Engineering MechanicalОценок пока нет

- Standalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaДокумент126 страницStandalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaGourav VermaОценок пока нет

- History:: BSC (Hon) Research and Analysis ProjectДокумент9 страницHistory:: BSC (Hon) Research and Analysis ProjectMaria MumtazОценок пока нет

- A New Car Design Under Discussion With The Top Management at The R&D Centre, GurgaonДокумент10 страницA New Car Design Under Discussion With The Top Management at The R&D Centre, GurgaonPrachi JindalОценок пока нет

- Car Industry Dissertation TopicsДокумент6 страницCar Industry Dissertation TopicsIWillPayYouToWriteMyPaperCanada100% (1)

- Ford's Financial ProblemsДокумент6 страницFord's Financial Problemsbunta420Оценок пока нет

- Performance Evaluation - A Study With Reference To Tata MotorsДокумент6 страницPerformance Evaluation - A Study With Reference To Tata MotorsRio HongKongОценок пока нет

- Ashok LeylandДокумент22 страницыAshok LeylandKopal Jain33% (3)

- The Case Study of ToyotaДокумент12 страницThe Case Study of ToyotaVimala Selvaraj Vimala100% (1)

- Presented by Nagraj Naveenkumar Manjukiran Rajesh RaghunandanДокумент20 страницPresented by Nagraj Naveenkumar Manjukiran Rajesh RaghunandanbharathandcompanyОценок пока нет

- IMT 15 Production and Operation Management M3Документ4 страницыIMT 15 Production and Operation Management M3solvedcareОценок пока нет

- Managerial Accounting: Hero MotocorpДокумент22 страницыManagerial Accounting: Hero MotocorpAnil KumarОценок пока нет

- Maruti Suzuki, Tata Motors, and Mahindra & Mahindra Firm ComparisonДокумент9 страницMaruti Suzuki, Tata Motors, and Mahindra & Mahindra Firm Comparisongbulani11Оценок пока нет

- Supply Chain Project-Maruti Suzuki India Limited: Operations ManagementДокумент15 страницSupply Chain Project-Maruti Suzuki India Limited: Operations Managementvijay singhОценок пока нет

- Research Paper On Tata MotorsДокумент8 страницResearch Paper On Tata Motorsgz8pjezc100% (1)

- Executive SummaryДокумент20 страницExecutive SummarySachin UmbarajeОценок пока нет

- Ar Tatamotors 2009 2010 18082010121500Документ121 страницаAr Tatamotors 2009 2010 18082010121500sonalsinghiОценок пока нет

- GRI Report 08 09Документ58 страницGRI Report 08 09Enrique Medina GarcíaОценок пока нет

- SGC Report Maruti SuzukiДокумент18 страницSGC Report Maruti SuzukiKehar Singh80% (5)

- PLM in The Automotive IndustryДокумент11 страницPLM in The Automotive IndustryHussam AliОценок пока нет

- Adavanced Accounting-Iii Project: Made By:-Satwik Chaudhary TYA ROLL No. 3042Документ20 страницAdavanced Accounting-Iii Project: Made By:-Satwik Chaudhary TYA ROLL No. 3042Suyash KumarОценок пока нет

- Proton Full Report From Proton Case StudyДокумент7 страницProton Full Report From Proton Case Studyilyaninasir91Оценок пока нет

- Strategic ManagementДокумент3 страницыStrategic Managementpoda_getlostОценок пока нет

- General MotorsДокумент23 страницыGeneral Motorsharshmaroo100% (1)

- Research Report On Hero Motocorp Limited: General OverviewДокумент4 страницыResearch Report On Hero Motocorp Limited: General OverviewAditya JainОценок пока нет

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationОт EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationОценок пока нет

- A Study of the Supply Chain and Financial Parameters of a Small BusinessОт EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessОценок пока нет

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessОт EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessОценок пока нет

- Trail/Beaver Valley/Rossland Pennywise May 15, 2018Документ48 страницTrail/Beaver Valley/Rossland Pennywise May 15, 2018Pennywise PublishingОценок пока нет

- Drivetrains: - . - . - . - . - . - . - . - . - . - . 1 Manual TransmissionsДокумент10 страницDrivetrains: - . - . - . - . - . - . - . - . - . - . 1 Manual TransmissionsPaul BridgesОценок пока нет

- Customer Satisfaction Survey For Maruti SuzukiДокумент17 страницCustomer Satisfaction Survey For Maruti SuzukiGuman SinghОценок пока нет

- 2011 KSAE Annual Conference and ExhibitionДокумент1 страница2011 KSAE Annual Conference and ExhibitionKaustubh GandhiОценок пока нет

- JNSДокумент23 страницыJNSdeepak4uОценок пока нет

- Accord Tourer Accessories 2012Документ4 страницыAccord Tourer Accessories 2012AOCUKОценок пока нет

- 2012 Jacksonville Jaguars Media GuideДокумент157 страниц2012 Jacksonville Jaguars Media GuidepauldОценок пока нет

- Jeep Cherokee Service Manual 2000Документ1 528 страницJeep Cherokee Service Manual 2000pitchao1100% (9)

- Robinson R22 IPCДокумент636 страницRobinson R22 IPCJelly MortonОценок пока нет

- Operating Instructions for KMK5110 Truck CraneДокумент187 страницOperating Instructions for KMK5110 Truck Cranesilvia martinezОценок пока нет

- Résumé Dinesh Gangadharan: ObjectiveДокумент3 страницыRésumé Dinesh Gangadharan: ObjectiveKumar ShenthilОценок пока нет

- Yamaha XT600E Workshop Manual - Verysmall PDFДокумент351 страницаYamaha XT600E Workshop Manual - Verysmall PDFrobi robi100% (1)

- Chalmers #1Документ4 страницыChalmers #1jessОценок пока нет

- Sheet Metal IndustriesДокумент27 страницSheet Metal IndustriesvbbusenesssОценок пока нет

- Action plan for competitive sustainable automotive industryДокумент10 страницAction plan for competitive sustainable automotive industryfahro1998Оценок пока нет

- AppendixДокумент4 страницыAppendixGokul KrishnanОценок пока нет

- Testers For Electric Motors and All Kinds of Windings: Product GuideДокумент29 страницTesters For Electric Motors and All Kinds of Windings: Product GuideMohamedОценок пока нет

- Dorian Auto production model with either-or constraints optimizationДокумент1 страницаDorian Auto production model with either-or constraints optimizationyanurarzaqaОценок пока нет

- Genba Safety Patrol TC Oktober 2019 Edisi 2Документ2 страницыGenba Safety Patrol TC Oktober 2019 Edisi 2Ahmad Abu Basil Izzuddin Nur Al AslamОценок пока нет

- Audi quattro AWD EvolutionДокумент50 страницAudi quattro AWD Evolutionstefanovicana1100% (1)

- 1993-1997 Toyota Corolla Transmissions and Axles.a240 PDFДокумент6 страниц1993-1997 Toyota Corolla Transmissions and Axles.a240 PDFDwy Bagus N0% (1)

- Kinetic Engineering - History of Motorcycles & Scooters DevelopmentДокумент119 страницKinetic Engineering - History of Motorcycles & Scooters DevelopmentShivakumar KumasiОценок пока нет

- Slogans & TaglinesДокумент15 страницSlogans & TaglinesKunj ShahОценок пока нет

- Marketing VolkswagenДокумент9 страницMarketing VolkswagenYuvraaj YadavОценок пока нет

- Toyota SynopsisДокумент22 страницыToyota SynopsisGunjan AroraОценок пока нет

- 1 - ISO 9001 2015 All PlantsДокумент3 страницы1 - ISO 9001 2015 All PlantsSathish Kumar RockkzzОценок пока нет

- The Loadmac 225 R: Powerful Compact VersatileДокумент9 страницThe Loadmac 225 R: Powerful Compact Versatilecitty2007Оценок пока нет

- PTT Devtool Parameter DescriptionДокумент1 383 страницыPTT Devtool Parameter DescriptionHarlinton descalzi92% (12)

- Handstands Promo v. Advance Auto Parts - ComplaintДокумент68 страницHandstands Promo v. Advance Auto Parts - ComplaintSarah BursteinОценок пока нет

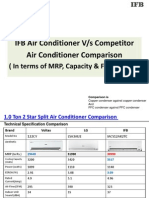

- IFB AC ComparisonДокумент26 страницIFB AC ComparisonVidhya JeyaramanОценок пока нет