Академический Документы

Профессиональный Документы

Культура Документы

Zillow Initiating Coverage 8.10.11

Загружено:

Brian BolanАвторское право

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Zillow Initiating Coverage 8.10.11

Загружено:

Brian BolanАвторское право:

Equity Research

Brian Bolan Research

10 August 2011

Initiating Coverage

Company Overview and Key Data

Zillow (Nasdaq: Z)

Share Price: Price Target: 52-Week Range: Shares Outstanding: Market Capitalization: Dividend Yield: $27.37 $34 $25.12 - $60.00 26.9 million $736 million NA

BUY

Zillow (Nasdaq: Z)

Investment Concept

Zillow is a leading Real Estate information site that has a database of 100M US homes of which 28M have user updated information and added 60M photos. Zillow is best known for its Zestimate proprietary estimate of home values. The company also uses its platform to attract the ancillary services that revolve around the real estate market. Zillow provides rent Zestimates, as well as home value Zestimates, in serving the rental market. It provides advertising opportunities for home financing companies and similar opportunities to the home maintenance & improvement industry. Brian Bolan Research is initiating coverage of Zillow BUY rating and a $34 price target.

Zillow, Inc. (Zillow) is a real estate information marketplace. The Company provides information about homes, real estate listings and mortgages, through its Website and mobile applications, enabling homeowners, buyers, sellers and renters to connect with real estate and mortgage professionals. The Companys database has more than 100 million United States homes, including homes for sale, homes for rent and homes not currently on the market.

. .

Brian Bolan 1 773 413 0285

Twitter: @BBolan1 BBolan1@Gmail.com

10 August 2011

DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED AT THE END OF THE REPORT. Research as only a single factor in making their investment decision. Investors should consider Brian Bolan

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Inside

Investment Thesis Company Background Unique Users Marketplace Revenue Display Revenue Where the Growth Comes From Comparable Companies Industry Discussion Management Zestimate and Rent Zestimate Stock Trading Traffic Analysis Income Statement Marketplace Revenue Premier Agent Subscribers Revenue per Subscriber Display Revenue Unique Users Revenue per Unique User Approximate CPM Rates Cost of Sales Balance Sheet Investment Risks Recommendation and Valuation Screen shot comps Income Statement (Model) Annual Income Statement Balance Sheet Statement of Cash Flows Price Chart Disclosures

3 3 3 3 4 4 5 6 7 8 8 9 10 10 10 11 11 12 12 12 13 13 14 14 16 20 21 22 23 24 25

10 August 2011

Brian Bolan Research | 1 773 413 0285 | www.scribd.com

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Investment Thesis

Zillow addresses a highly fragmented market that has been in need of a technology overhaul for several decades. In building a nationwide database of 100M homes, Zillow takes it one step further and attempts to answer the question that is on the mind of homeowners and shoppers alike, what is that house worth? Beyond being a great resource to consumers that are looking for a home or a rental, Zillow presents opportunities for Real Estate Professionals and financing providers to advertise. Real Estate agents can advertise in specific zip codes and financing companies can use Zillow to generate new leads. This is clearly the early stage of the company and significant growth should be expected regardless of general market conditions. We believe that CPMs will increase over time, as will users and real estate professionals that will advertise. Over the course of the next several years, we believe other business lines will be added and aid in further growth of the company.

Company Background

On February 8, 2006, Zillow launched the initial version of the website, Zillow.com, providing Zestimates on approximately 40 million U.S. homes In November 2007, the company added listings feed program, allowing real estate brokerages to directly feed their listings to the website. In April 2008, the launch of Zillow Mortgage Marketplace. By February 2009, mortgage lenders had provided over one million marketplace loan quotes. Zillow began to charge mortgage lenders for participation in Zillow Mortgage Marketplace in January 2010. In October 2008, the company launched the Premier Agent program. By the end of March 2011, there were more than 10,000 paying Premier Agent subscribers. In April 2009, released first mobile application. Zillow now operates mobile real estate applications across iPhone, iPad, Android and BlackBerry. In December 2009, rental listings and the introduction of Rent Zestimates in March 2011. In December 2010, Zillow began collecting and displaying consumer-generated real estate agent ratings and reviews. By June 9, 2011, consumers had submitted more than 50,000 agent reviews.

Unique Users Measuring unique users is important because marketplace revenues depend in part on users to connect with real estate and mortgage professionals. Zillow counts a unique user the first time a computer or mobile device with a unique IP address accesses the Zillow website or one of the mobile applications during a calendar month. If an individual accesses the website or mobile applications using different IP addresses within a given month, the first access by each such IP address is counted as a separate unique user. This does allow for some double counting as any mobile device will have a high likelihood of being used outside of a home wifi network and thus producing multiple IP addresses. Marketplace Revenues. Marketplace revenues consist of subscriptions sold to real estate agents under the Premier Agent program and CPC advertising related to the Zillow Mortgage Marketplace sold to mortgage lenders.

10 August 2010 Brian Bolan Research | 773 413 0285 | www.scribd.com 3

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

The Premier Agent program allows local real estate agents to establish a persistent online and mobile presence on Zillow in the zip codes they serve. Pricing for the Premier Agent subscriptions varies by zip code. Subscription advertising revenues are recognized on a straight-line basis during the contractual period over which the advertising is delivered. Typical terms of Premier Agent subscription contracts range from six to 12 months. Zillow Mortgage Marketplace, participating qualified mortgage lenders make a prepayment to gain access to consumers interested in connecting with mortgage professionals. Consumers who request rates for mortgage loans in Zillow Mortgage Marketplace are presented with personalized lender quotes from participating lenders. Zillow will only charge mortgage lenders a fee when users click on their links for more information regarding a mortgage loan quote. Display Revenues Display revenues primarily consist of graphical web and mobile advertising sold on a CPM basis to advertisers primarily in the real estate industry, including real estate brokerages, home builders, mortgage lenders and home services providers.

Where the growth will come from

Ad dollars shifting from other sources to Online We believe that the general trend of increasing CPMs will continue to the benefit of Zillow. While the real estate market is still in a secular downturn, we are seeing businesses and Real Estate agents searching deeper for qualified leads. Zillow sits in between the consumers that are shopping for a new home or basic neighbourhood information and the advertisers that are looking for that specific demographic. Over time, we believe that pageviews and CPMs will increase. We have seen solid growth in the Premier Agents subscriptions over the last several quarters. On a year over year basis, subscriptions grew 211% for 1Q11. There are 10,710 real estate agents as subscribers at the end of 1Q11, and based on our projections, Zillow will reach a 1% penetration of all real estate agents some time during the 4Q11. This means there is a very large portion of the market that had yet to be addressed. Smaller revenue streams that will be added in the future could include vacation rentals (homeaway.com), home improvement segments and others. These future revenue streams will likely be developed the same way other products have been by Zillow.

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Comparable Companies Competition comes from numerous sources and could, in the future, come from new companies and divisions of old companies.

Move.com (NASDAQ: MOVE) - a leader in online real estate and operator of the Move Network of real estate web site for consumers and real estate professionals. The Move Network of websites captures more than 15 million monthly visitors and includes: REALTOR.com, Move.com, MortgageMatch.com, Moving.com, TOP PRODUCER Systems, ListHub, SocialBios.com, Builders Digital Experience, Featuredwebsite.com, Homefair.com, Newhomesource.com, SeniorHousingNet.com and HomeInsight. HomeAway.com (NASDAQ: AWAY) - leading online marketplace of vacation rentals, with sites representing more than 625,000 paid vacation rental home listings throughout more than 145 countries.

Trulia (Private) a Real Estate information resource that provides information on homes for sale and for rent. Providing many of the same RedFin (Private) Redfin is the industry's first online brokerage for buying and selling homes. Their goal is to change the real estate game in consumers' favor by offering more data, better-performing agents, and a commission refund. RedFin is available in select cities: Atlanta, Austin, Baltimore, Boston, Chicago, Dallas, Denver, Las Vegas, Los Angeles, New York, Orange County, Portland, OR, Phoenix, Sacramento, San Diego, San Francisco, Seattle, and Washington, DC.

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Industry Discussion

There are many components in the real estate market and most high level views will include a Case Shiller index on home values and sales rates. These are important indicators that investors can look to when looking at Zillow. We have included one of these charts, but believe the more important macro aspect to look at is number of real estate agents.

The number of realtors has dropped from highs just a few years ago as the decline in housing sales acted as a shakeout to rid the industry of weaker agents. With membership at the National Association of Realtors down more than 21% from 2006 levels, we believe that a bottom is in sight. New, younger realtors that replace the old will certainly look to market online as opposed to traditional off line sources.

It should be noted that not all realtors are members of the NAR, so the total number is closer to 1.8MM instead of the ~1.1MM that the NAR has for end of year 2010.

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

For decades, the MLS (Multiple Listing Service) was the only source of detailed information on real estate. It is still the anchor tool of the industry that no realtor can do without. Consumers, on the other hand, have had little in the way of information until the internet changed that with the launch of Zillow.com, Trulia, Realtor.com, and RedFin. When looking at these four information sources, consumers are just now beginning to get much of the same data that has always been available to realtors via MLS.

Management Spencer M. Rascoff has served as Chief Executive Officer since September 2010. Mr. Rascoff joined Zillow as one of the founding employees in 2005 as Vice President of Marketing and Chief Financial Officer and served as Chief Operating Officer from December 2008 until he was promoted to Chief Executive Officer. From 2003 to 2005, Mr. Rascoff served as Vice President of Lodging for Expedia, Inc., an online travel company. In 1999, Mr. Rascoff co-founded Hotwire, Inc., an online travel company, and managed several of Hotwires product lines before Hotwire was acquired in 2003 by IAC/InterActiveCorp, a holding company of Internet businesses and Expedia, Inc.s parent company at the time. Mr. Rascoff graduated from Harvard University and he serves on Harvard Universitys Digital Community & Social Networking Advisory Group. Richard Barton is a co-founder and has served as Executive Chairman since September 2010. Mr. Barton has been a member of the board of directors since our inception in December 2004 and served as Chief Executive Officer from inception until September 2010. Mr. Barton founded Expedia as a group within Microsoft Corporation, a software company, in 1994, which Microsoft spun out as Expedia, Inc. in 1999 and Mr. Barton served as Expedias President, CEO and as a member of its board of directors from 1999 to 2003. Mr. Barton also co-founded and has served as Non-Executive Chairman of Glassdoor.com, a salaries and reviews website for companies, since January 2008 and TravelPost, a travel review website, since March 2010, and serves on the boards of directors of several other privately held companies. Mr. Barton holds a B.S. in General Engineering: Industrial Economics from Stanford University. Lloyd D. Frink is a co-founder and has served as Vice Chairman since March 2011, as a member of the board of directors since inception in December 2004, and as President since February 2005. From 1999 to 2004, Mr. Frink was at Expedia, Inc., where he held many leadership positions, including Senior Vice President, Supplier Relations, from 2003 to 2004. David A. Beitel has served as Chief Technology Officer since February 2005. From 1999 to 2005, Mr. Beitel was at Expedia, Inc., where he held many leadership positions, including Chief Technology Officer from 2003 to 2005 and Vice President of Product Development from 1999 to 2003. Amy Bohutinsky has served as Chief Marketing Officer since March 2011. Since joining Zillow in 2005, Ms. Bohutinsky has held many leadership positions, including Vice President of Marketing and Communications from September 2010 to March 2011, Vice President of Communications between August 2008 and September 2010, and Director of Communications between August 2005 and August 2008. Chad M. Cohen has served as Chief Financial Officer and Treasurer since March 2011. Mr. Cohen served as Controller from June 2006 to March 2011 and as Vice President of Finance from September 2010 to March 2011.. Mr. Cohen holds a B.S. in Business Administration from Boston University and is licensed as a CPA in California.

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Zestimate and Rent Zestimate.

The Zestimate and Rent Zestimate valuations are computed using complex, proprietary algorithms developed and refined through years of statistical analysis and technological development. A Zestimate is Zillows estimated current market value of a home. Zillow generates Zestimates using proprietary information, including:

Physical attributes: location, lot size, square footage, number of bedrooms and bathrooms and many other details. Tax assessments: property tax information, actual property taxes paid, exceptions to tax assessments and other information provided in the tax assessors records. Prior and current transactions: actual sale prices over time of the home itself and comparable recent sales of nearby homes.

A Rent Zestimate is Zillows estimated current monthly rental price of a home, computed using similar automated valuation models designed to address the unique attributes of a rental home. Zillow estimates rental prices on nearly 100 million homes, including apartments, single-family homes, condominiums and townhomes.

Stock Trading IPO Underwriters first priced the Zillow offering at 12-14, later upping the range to 17-19 before finally pricing the IPO at $20. This gave the company a $x valuation based on 28M shares outstanding. After tripling, the stock has come back to reality and presently trades at $26. There was a clause in the S-1 that stated if the share price was 33% over the IPO for 20 consecutive days, then certain share lock ups would unlock. This seemed unnecessary, as two of the venture backers in the company were buyers in the IPO. The company will report 2Q11 earnings on Wednesday, August 24, 2011 at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time).

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Traffic Analysis Taking a look at the traffic estimates for Zillow, we see some differing data points. Quantcast.com estimates that Zillow has not seen that much growth since the beginning of the year.

Compete.com has data that suggests solid growth from the beginning of the year.

Quantcast clearly indicates that its data is a rough estimate and the company has noted that there was 22M uniques in June 2011. The difference could be the double / triple counting that Zillow may witness if a user accesses the site via iPad, iPhone and computer but only seen as a single visit by third party measurement sites. To round out the idea of looking at traffic here are the sources of traffic. The clickstream is the basically where a visitor was before the target site and after the target site. The data is provided by Alexa, a division of Amazon.

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

The clickstream can show some important information and give an idea as to where users are coming to Zillow from and where they are going to. The upstream flow from Google is significant, and could present a diversification problem for the company. What the clickstream tells us is that most consumers are going to research the four real estate sites, Trulia, Realtor.com, Redfin and Zillow.

Income Statement Without having had a significant discussion with management on how to think about modelling the company out, we adopted a use everything approach to come to our estimates Our estimates are based on a number of moveable parts in the Zillow model, including but not limited to: 1) Marketplace revenue 2) number of agent subscribers 3) revenue per subscriber 4) Display Revenues 5) Unique users 6) revenue per unique user and 7) Approximate CPM rates. We have limited data on other important data points such as mobile pageviews and mortgage loan requests and hope to incorporate those into our projections in the future

Marketplace Revenue Hockey sticks went out of fashion a few years back, but our expectations of growth for Zillow are not overly aggressive and still produce a sizable curve. We believe that our expectations are achievable and merely suggest that Zillow maintain or slightly accelerate growth over the next 16 months.

Premier Agent Subscribers The Premier Agent Subscribers metric is a key metric that can give insight into how professionals in the industry view the value of Zillow. On a recent Move.com earnings call, it was noted that due to the downturn, there are not that many new real estate agents entering the field and established agents are spending shrewdly on advertising. The growth of agents for Zillow was a robust 193% in 2010 vs. 2009 and projected to grow 154% in 2011 from 2010. The growth from 2009 to 2008, 1,106% is not something likely to be repeated.

10 August 2010 Brian Bolan Research | 773 413 0285 | www.scribd.com 10

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Revenue per Subscriber After bottoming out in 4Q09, monthly revenue per subscriber has been growing on a consistent basis. We view this metric as one of the most important in model as it represents what a real estate agent pays on average per month. During the roadshow, management noted that the price point is lower than the cost of one successful sale. Channel checks we did suggest that Zillow advertising which can range from $200-$300 a month provides an average of 20 leads. Some agents believed that al leads were good and others believed that none were good, but most would say that one or two would be high in quality.

Display Revenue Our Display Revenue growth expectations are based on the increase of both unique users and a slight decrease in CPMs. CPMs will likely rise over time, but our estimates are relatively aggressive across the board and needed to be tempered. We believe that if growth rates maintain or accelerate slightly, these estimates are achievable. A broad secular rally in the real estate market would only serve to push users and CPMs much higher.

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

11

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Unique users Our unique user estimates were previously calling for sequential growth of 30% or more. We have since brought our estimates down substantially based on the Federal Reserve statement on interest rates on 8/9/11 (holding rates low at least through mid 2013). This is a clear positive for the housing industry, but liquidity and consumers abilities to get mortgages remain hurdles. Our 5% sequential growth rate through 2012 is achievable.

Revenue per Unique users Revenue per Unique user is a metric that can see wild swings. We are modelling in a continued slight decline in this metric as users increase a rate faster than the company can monetize them. This metric will give good insights into how management is running the business.

Approximate CPM rates Our estimates for Zillow CPMs shows a decline in each of the last three quarters. We extended the trend as the Real Estate market is likely going to be weak in the coming quarters and advertisers will not be willing to throw more money at fewer leads.

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

12

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Cost of Sales Without much in the way of guidance from management, we are calling for a slight decline from the previous quarters gross profit. Future quarters are modelled at 82%,83% and 84%, implying minimal increases over the next year and a half.

Balance Sheet At the end of 1Q11 the company had $15.5M in cash, up from $13.7 million at the end of 4Q10. The increase of 12.9% will pale in comparison to the cash on hand at the end of 3Q10 which will see the boost from the IPO.

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

13

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Investment Risks

If the company experiences any or all of the following risk factors, as well as others, the companys stock price may be affected. Several macro-economic indicators could damage the broader industry. The real estate industry is subject to several macro indicators that could serve to diminish demand. Prolonged high rates of unemployment, increases in inventory and lack of liquidity in the market may keep some consumers out of the market . A better advertising platform is developed for the real estate market. Competition can be found all over the web, Tulia, Realtor.com and RedFin are among the strongest in the space. Another website that incorporates more completely with MLS could prove to be a formidable competitor. Prolonged Value Erosion is keeping many market participants on the sidelines. With home values falling on a consistent basis since 2007, there are many participants waiting for the broader market to recover before they re-enter the market. . Zillow must also add new streams of revenue. The company has two segments that drive revenue, the marketplace and subscription business. The addition of vacation home rentals or other ancillary businesses in the real estate industry Loss of key management. The loss of either co-founder or the CEO would be harmful to the stock. The companys leadership has done well in the short life of the company, their loss would be a negative for shareholders.. One major shareholder could sell. One of the positives of the tight float and small number of shares outstanding is that supply tends to be smaller than demand. The same thing can happen when a seller wants to shed shares to buyers in a market is not looking to bid up the stock. Update speeds need to increase. In speaking with several realtors who use the site daily, their lone complaint tended to be the speed of the updates. When a listing is removed or repriced, the sellers and agents believe that the changes need to be more instantaneous than the potential 48 hour potential wait that is currently the norm. Recommendation and Valuation With Zillow coming out to an auspicious start trading at 3x its IPO pricing a few moments into its public stock life, some strong expectations were automatically attached to the stock. While $60 was too high for right now, $27 is too low. We believe there is value in both the long term and the short term for Zillow and initiate coverage with a BUY rating and price target of $34. We arrived at our price target via a multiple of 8.8x the next 12 month sales. Our earnings estimate makes our price target a healthy 124x next twelve months. This seems like a lofty PE, but we are reminded of the LinkedIn PE of 1000+ and the promise of social networking. Regardless of the metric used, the float and low number of shares outstanding will be the ultimate drivers in a supply and demand equation that will work in favour of Zillow shareholders as long as the company continues to deliver good growth metrics.

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

14

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

15

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

In comparing the four major real estate information sites, we Googled a specific property that we knew was recently listed for sale and was subsequently re-priced. The search results showed the listing on the four major sites. What follows is a screen capture from each of the big four.

We note that Trulia did not have the updated price when we pulled the listing the day before or the day of this test. Realtor.com and RedFin.com had the accurate price information the day before and the day of the test. Zillow did not have the correct price the day before but was updated in time for this particular test.

The timeliness of updates is key to what realtors were concerned with from the information sources on the web. We also wanted to point out the importance of working with the realtor that has the listing and that Zillow has the realtor pictured prominently at the top and bottom of the page. This will bring more realtors to the site who may advertise with Zillow in the future.

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

16

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

17

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

18

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

19

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Appendix

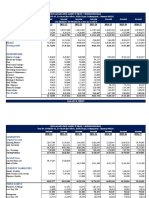

Zillow Income Statement Forecast

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

20

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Annual Income Statement

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

21

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Balance Sheet

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

22

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Statement of Cash Flow

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

23

Brian Bolan Research

Zillow (Nasdaq Global Markets: Z)

Zillow (Nasdaq GM: Z) Historical Price Chart

Source: Yahoo!

10 August 2010

Brian Bolan Research | 773 413 0285 | www.scribd.com

24

Brian Bolan Research Important disclosures:

Zillow (Nasdaq Global Markets Z)

Analyst Certification:

The following analysts hereby certify that their views about the companies and securities discussed in this report are accurately expressed and that they have not received and will not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this report: Brian Bolan. As of the date of this report, the analyst has no financial interest in any companies mentioned in this report.

Ratings:

Buy: The stocks total return is expected to exceed 15% over the next 6-12 months. Hold: The stock is expected to have a positive return of less than 15% over the next 6-12 months. Sell: The stock is expected to have a negative return over the next 6-12 months.

Disclosures:

None

13 June 2011

Brian Bolan | 773 413 0285 | www.scribd.com

25

Вам также может понравиться

- Zillow Case StudyДокумент7 страницZillow Case Studybtharun2008Оценок пока нет

- What Can You Do at Zillow?Документ2 страницыWhat Can You Do at Zillow?Vivek SinghОценок пока нет

- Mastering Zillow: How To Get The Most Out of The Largest Real Estate Network On The WebДокумент40 страницMastering Zillow: How To Get The Most Out of The Largest Real Estate Network On The WebmlsliОценок пока нет

- AgregationДокумент7 страницAgregationSantos MotaОценок пока нет

- Real Estate Media White Paper 2016Документ4 страницыReal Estate Media White Paper 2016Akila Devdayan WeerasingheОценок пока нет

- Letter To FTC From U.S. Senators On Real Estate and AntitrustДокумент2 страницыLetter To FTC From U.S. Senators On Real Estate and AntitrustGeekWireОценок пока нет

- Achieving Wealth Through Real Estate: A Definitive Guide To Controlling Your Own Financial Destiny Through a Successful Real Estate BusinessОт EverandAchieving Wealth Through Real Estate: A Definitive Guide To Controlling Your Own Financial Destiny Through a Successful Real Estate BusinessОценок пока нет

- Zillow 2Q22 Shareholders' LetterДокумент17 страницZillow 2Q22 Shareholders' LetterGeekWireОценок пока нет

- LIME 7 Case Study Housing - Com - SPJIMRДокумент4 страницыLIME 7 Case Study Housing - Com - SPJIMRPranav SiddharthОценок пока нет

- Zillow's Q4 2021 Shareholder LetterДокумент20 страницZillow's Q4 2021 Shareholder LetterGeekWireОценок пока нет

- Zillow Trulia Final BДокумент11 страницZillow Trulia Final BnabsОценок пока нет

- Zillow Short ThesisДокумент5 страницZillow Short ThesisWriteMyCollegePaperForMeJackson100% (2)

- Zillow's 4Q21 Shareholder LetterДокумент20 страницZillow's 4Q21 Shareholder LetterGeekWireОценок пока нет

- Openland (Formerly Statecraft) - YC Interview AnswersДокумент7 страницOpenland (Formerly Statecraft) - YC Interview AnswersDevansh SharmaОценок пока нет

- Airbnb Business ModelДокумент13 страницAirbnb Business ModelYeshwanth BabuОценок пока нет

- ReachLocal Equity Research ReportДокумент30 страницReachLocal Equity Research ReportBrian Bolan100% (1)

- SH Letter Final and FormattedДокумент14 страницSH Letter Final and FormattedOliverОценок пока нет

- Kwelia Investment Deck 020812Документ15 страницKwelia Investment Deck 020812John NjokuОценок пока нет

- Singapore Property Weekly Issue 251Документ12 страницSingapore Property Weekly Issue 251Propwise.sgОценок пока нет

- Emerging Markets Commercial Real EstateДокумент37 страницEmerging Markets Commercial Real EstatessuttoniiОценок пока нет

- Real Estate Business IdeasДокумент18 страницReal Estate Business IdeasSulat AprileamjomaressОценок пока нет

- Real Estate Development Business PlanДокумент5 страницReal Estate Development Business PlanA. FranciscoОценок пока нет

- Valeria Gamarts PaperДокумент4 страницыValeria Gamarts PaperValeria GamartОценок пока нет

- Retail: ResearchДокумент4 страницыRetail: ResearchAnonymous Feglbx5Оценок пока нет

- Government Urged To Allocate More FundsДокумент7 страницGovernment Urged To Allocate More FundsJayson LagmanОценок пока нет

- The Future in Digital MediaДокумент148 страницThe Future in Digital MediaAntoine GananciaОценок пока нет

- Home Junction Investor Snapshot v2 44Документ4 страницыHome Junction Investor Snapshot v2 44api-107014102Оценок пока нет

- M&A Snapshot Q3 2012Документ12 страницM&A Snapshot Q3 2012ArchitectPartnersОценок пока нет

- 1000watt Top Ten Real Estate Brokerage WebsitesДокумент35 страниц1000watt Top Ten Real Estate Brokerage WebsitesBrian Boero100% (18)

- Furniture Rental Startups - A Financial Perspective - Vinod Kothari ConsultantsДокумент3 страницыFurniture Rental Startups - A Financial Perspective - Vinod Kothari ConsultantsGagsОценок пока нет

- SparkLabs Global Ventures' Technology and Internet Market Bi-Monthly Review 1027 2014Документ10 страницSparkLabs Global Ventures' Technology and Internet Market Bi-Monthly Review 1027 2014SparkLabs Global VenturesОценок пока нет

- Mastering Rent 2 Rent: Your Ultimate Guide to Building Passive IncomeОт EverandMastering Rent 2 Rent: Your Ultimate Guide to Building Passive IncomeОценок пока нет

- 360 Pano: National Institute of Design Indian Institute of Management AhmedabadДокумент12 страниц360 Pano: National Institute of Design Indian Institute of Management AhmedabadntadbmОценок пока нет

- Robinhood:Buying A Stock As Quickly As You'd Post An Instagram PhotoДокумент3 страницыRobinhood:Buying A Stock As Quickly As You'd Post An Instagram PhotoHarshil JhaveriОценок пока нет

- Single Tenant Net Lease Investment OverviewДокумент30 страницSingle Tenant Net Lease Investment OverviewCassidy TurleyОценок пока нет

- Real Estate Law Research Paper TopicsДокумент8 страницReal Estate Law Research Paper Topicsudmwfrund100% (1)

- February 2nd - February 15th, 2013: Rising Demand Propels Warehouse Market To Strong 2012 FinishДокумент4 страницыFebruary 2nd - February 15th, 2013: Rising Demand Propels Warehouse Market To Strong 2012 FinishAnonymous Feglbx5Оценок пока нет

- Digital Real Estate in IndiaДокумент16 страницDigital Real Estate in IndiaSiddhartha SanapathiОценок пока нет

- Advertising Agency Business PlanДокумент52 страницыAdvertising Agency Business Plana1an_wong78% (9)

- Chapter-1: Introduction of OrganizationДокумент11 страницChapter-1: Introduction of OrganizationViswajitОценок пока нет

- Zillow Group Q3'21 Shareholder LetterДокумент20 страницZillow Group Q3'21 Shareholder LetterGeekWireОценок пока нет

- Singapore Property Weekly Issue 259Документ11 страницSingapore Property Weekly Issue 259Propwise.sgОценок пока нет

- Singapore Property Weekly Issue 256Документ11 страницSingapore Property Weekly Issue 256Propwise.sgОценок пока нет

- Singapore Property Weekly Issue 229Документ10 страницSingapore Property Weekly Issue 229Propwise.sgОценок пока нет

- Industry AnalysisДокумент10 страницIndustry Analysisapi-497949503Оценок пока нет

- Free Social Networking Website Business Plan: Free VC Directory Free VC DirectoryДокумент9 страницFree Social Networking Website Business Plan: Free VC Directory Free VC DirectorytroubledsoulОценок пока нет

- Business Plan - X Real Estate CompanyДокумент13 страницBusiness Plan - X Real Estate Companyzainu27Оценок пока нет

- A Millennial's Guide to Investing in Cash Flowing Rental PropertiesОт EverandA Millennial's Guide to Investing in Cash Flowing Rental PropertiesОценок пока нет

- ACCO 30043 Case Study 2Документ5 страницACCO 30043 Case Study 2Cyra EllaineОценок пока нет

- NFLX EarningsMiss NoSurpise2015!10!20Документ5 страницNFLX EarningsMiss NoSurpise2015!10!20kunalwarwickОценок пока нет

- Urban Lux Realty GroupДокумент10 страницUrban Lux Realty GroupUrban LuxОценок пока нет

- Analyzing The Attributes in Customer Purchase Decision of Apartments Towards Technicraft DevelopersДокумент73 страницыAnalyzing The Attributes in Customer Purchase Decision of Apartments Towards Technicraft DevelopersNischith GowdaОценок пока нет

- Mcgill Personal Finance Essentials Transcript Module 7: The Realities of Real Estate, Part 1Документ5 страницMcgill Personal Finance Essentials Transcript Module 7: The Realities of Real Estate, Part 1shourav2113Оценок пока нет

- C R E R C: Ommercial Eal State E ApДокумент2 страницыC R E R C: Ommercial Eal State E ApAnonymous Feglbx5Оценок пока нет

- Competitive AnalysisДокумент10 страницCompetitive AnalysisVikrant SinghОценок пока нет

- NovaX Report - Beyond BitcoinДокумент8 страницNovaX Report - Beyond BitcoinHanson AboagyeОценок пока нет

- Singapore Property Weekly Issue 239Документ12 страницSingapore Property Weekly Issue 239Propwise.sgОценок пока нет

- NP000421 CT098 3 2Документ8 страницNP000421 CT098 3 2Sushil PaudelОценок пока нет

- Metropoly Whitepaper.2f2bbf5b62b19e4afb0dДокумент45 страницMetropoly Whitepaper.2f2bbf5b62b19e4afb0dGi KayОценок пока нет

- Zillow 3Q11Документ17 страницZillow 3Q11Brian BolanОценок пока нет

- Zillow 2Q11Документ13 страницZillow 2Q11Brian BolanОценок пока нет

- ReachLocal Equity Research ReportДокумент30 страницReachLocal Equity Research ReportBrian Bolan100% (1)

- ReachLocal Update 8.8.11Документ13 страницReachLocal Update 8.8.11Brian BolanОценок пока нет

- RLOC 3Q11 ReviewДокумент12 страницRLOC 3Q11 ReviewBrian BolanОценок пока нет

- Home Run Investor Newsletter 2/25/13Документ5 страницHome Run Investor Newsletter 2/25/13Brian BolanОценок пока нет

- RLOC ReachLocal 2Q11 Earnings ReviewДокумент12 страницRLOC ReachLocal 2Q11 Earnings ReviewBrian BolanОценок пока нет

- RLOC Coverage Free Version 6.13.11 ReachLocal Research ReportДокумент30 страницRLOC Coverage Free Version 6.13.11 ReachLocal Research ReportBrian BolanОценок пока нет

- GOOG 1Q11 Earnings PreviewДокумент11 страницGOOG 1Q11 Earnings PreviewBrian BolanОценок пока нет

- Williams Capital Research: Yahoo! (Nasdaqgs: Yhoo) Google (Nasdaqgs: Goog)Документ11 страницWilliams Capital Research: Yahoo! (Nasdaqgs: Yhoo) Google (Nasdaqgs: Goog)Brian BolanОценок пока нет

- RLOC Initiation 6710Документ14 страницRLOC Initiation 6710Brian BolanОценок пока нет

- EXPE Earnings 4Q10Документ10 страницEXPE Earnings 4Q10Brian BolanОценок пока нет

- GOOG 1Q11 Earnings ReviewДокумент9 страницGOOG 1Q11 Earnings ReviewBrian BolanОценок пока нет

- PCLN Initiation 1-19-2011 FinalДокумент20 страницPCLN Initiation 1-19-2011 FinalBrian BolanОценок пока нет

- GM: Yhoo) Yahoo! Inc. (Nasdaq: Ept Investment ConcДокумент17 страницGM: Yhoo) Yahoo! Inc. (Nasdaq: Ept Investment ConcBrian BolanОценок пока нет

- GOOG 4Q 2010 Earnings Bolan 1-21-11 FinalДокумент12 страницGOOG 4Q 2010 Earnings Bolan 1-21-11 FinalBrian BolanОценок пока нет

- OWW Initiation 1-19-2011 FINALДокумент16 страницOWW Initiation 1-19-2011 FINALBrian BolanОценок пока нет

- EBAY 04.23.09 Earnings Review and UpgradeДокумент12 страницEBAY 04.23.09 Earnings Review and UpgradeBrian BolanОценок пока нет

- Yhoo 2Q06 QFLДокумент4 страницыYhoo 2Q06 QFLBrian BolanОценок пока нет

- EXPE - Initiation 1-19-2011 FINALДокумент19 страницEXPE - Initiation 1-19-2011 FINALBrian BolanОценок пока нет

- Ebay 01 22 09Документ20 страницEbay 01 22 09Brian BolanОценок пока нет

- GOOG InitiationДокумент16 страницGOOG InitiationBrian BolanОценок пока нет

- Ebay 05 14 09Документ12 страницEbay 05 14 09Brian BolanОценок пока нет

- Google Inc. (Nasdaq GM: GOOG) : Mid Quarter UpdateДокумент10 страницGoogle Inc. (Nasdaq GM: GOOG) : Mid Quarter UpdateBrian BolanОценок пока нет

- YHOO Upgrade To HOLD From SELL 8-30-07Документ7 страницYHOO Upgrade To HOLD From SELL 8-30-07Brian BolanОценок пока нет

- YHOO Initiating Coverage JSДокумент17 страницYHOO Initiating Coverage JSBrian BolanОценок пока нет

- J S, LLC: Ackson EcuritiesДокумент8 страницJ S, LLC: Ackson EcuritiesBrian BolanОценок пока нет

- YHOO Lowers Guidance QFLДокумент4 страницыYHOO Lowers Guidance QFLBrian BolanОценок пока нет

- YHOO Estimate Update 043007Документ5 страницYHOO Estimate Update 043007Brian BolanОценок пока нет

- Pr. 4-146-Income StatementДокумент13 страницPr. 4-146-Income StatementElene SamnidzeОценок пока нет

- Performance EvaluationДокумент13 страницPerformance EvaluationErikaОценок пока нет

- Football Organisational Structure CanadaДокумент18 страницFootball Organisational Structure CanadaAntonio Jose Calero SanchisОценок пока нет

- Business Model of "Sweetest Scent": Group 9Документ8 страницBusiness Model of "Sweetest Scent": Group 9camillaОценок пока нет

- Financial Management Full Kossan Top GloveДокумент22 страницыFinancial Management Full Kossan Top Glovemohd reiОценок пока нет

- Bata Ratio AnalysisДокумент22 страницыBata Ratio Analysissaba_spice0% (1)

- Module 1 - Nature and Scope of Managerial EconomicsДокумент30 страницModule 1 - Nature and Scope of Managerial Economicswrongthing9025100% (1)

- Government Accounting Test BankДокумент23 страницыGovernment Accounting Test BankMyles Ninon LazoОценок пока нет

- Revenue Recognition MethodsДокумент14 страницRevenue Recognition MethodsPiyushE63Оценок пока нет

- Leasing Company Financial ModelДокумент2 679 страницLeasing Company Financial ModelFadi GhassanОценок пока нет

- On Standard CharteredДокумент11 страницOn Standard Charterednitin01.snetОценок пока нет

- Fito Company Frutarom Company OverviewДокумент40 страницFito Company Frutarom Company OverviewprocopiodelllanoОценок пока нет

- CH 4 - Intermediate Accounting Test BankДокумент51 страницаCH 4 - Intermediate Accounting Test BankCorliss Ko100% (11)

- ANSWER TO AGEC 562 Lab #2Документ6 страницANSWER TO AGEC 562 Lab #2wondater MulunehОценок пока нет

- RETScreen Expert - Feasibility ReportДокумент16 страницRETScreen Expert - Feasibility ReportMohammed EL-bendaryОценок пока нет

- Ratio Analysis of L&T InfotechДокумент36 страницRatio Analysis of L&T Infotechrajwindernijjar1100% (1)

- BIR Form No. 1701Документ4 страницыBIR Form No. 1701blesypОценок пока нет

- Submitted By: Sibeesh Sreenivasan 200700091: Case Study: Continental AirlinesДокумент45 страницSubmitted By: Sibeesh Sreenivasan 200700091: Case Study: Continental AirlinesSibeeshCSree67% (6)

- NFProfit Health Care ProvidersДокумент6 страницNFProfit Health Care ProvidersRie CabigonОценок пока нет

- Unit VIII Accounting For Long Term Construction ContractsДокумент8 страницUnit VIII Accounting For Long Term Construction ContractsNovylyn AldaveОценок пока нет

- Fitch RatingsДокумент7 страницFitch RatingsTareqОценок пока нет

- Business Combinations - ASPEДокумент3 страницыBusiness Combinations - ASPEShariful HoqueОценок пока нет

- ProjectionДокумент3 страницыProjectionPrabhu SОценок пока нет

- Income Statement and Statement of Financial Position: Slide 4-1Документ34 страницыIncome Statement and Statement of Financial Position: Slide 4-1Bich VietОценок пока нет

- PT Mahaka Media Tbk. (Formerly PT Abdi Bangsa TBK) : Summary of Financial StatementДокумент2 страницыPT Mahaka Media Tbk. (Formerly PT Abdi Bangsa TBK) : Summary of Financial StatementRhady Sesat DipesbookОценок пока нет

- Westlake Lanes Case AnalysisДокумент10 страницWestlake Lanes Case AnalysisTony JosephОценок пока нет

- Dehydrated Vegtables ProcessingДокумент25 страницDehydrated Vegtables ProcessingEsayas MekonnenОценок пока нет

- MCQs For AuditingДокумент10 страницMCQs For AuditingSajid AliОценок пока нет

- Unit 9: Management Accounting: Costing and BudgetingДокумент18 страницUnit 9: Management Accounting: Costing and Budgetingnhungnnguyen1480% (1)

- Admin Level6Документ16 страницAdmin Level6Ivan ClarkОценок пока нет