Академический Документы

Профессиональный Документы

Культура Документы

Pennsylvania Government Structural Reforms

Загружено:

Nathan BenefieldИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pennsylvania Government Structural Reforms

Загружено:

Nathan BenefieldАвторское право:

Доступные форматы

REFORMING THE GENERAL ASSEMBLY

Testimony of Nathan A. Benefield

Director of Policy Research, Commonwealth Foundation for Public Policy Alternatives

STRUCTURE OF THE GENERAL ASSEMBLY COMMITTEE April 14, 2011

Good evening. I am Nathan Benefield, Director of Policy Research for the Commonwealth Foundation. We are a nonprofit, independent public policy research and educational institute based in Harrisburg. At 253 members, Pennsylvanias state legislature is the 2nd largest in the country, trailing only New Hampshires 424-member body. However, as you know, New Hampshire has the epitome of a citizen legislature, where members receive only $100 per year for their parttime service. In addition to being the largest full-time legislature in the nation, the General Assembly is among four highly professionalized legislatures, according to the National Conference of State Legislatures (NCSL). This takes into account legislative pay, number of days in session, and staff per legislator. Pennsylvania has gone back and forth with California for the crown of having the most expensive state legislaturethe latest numbers put the Keystone State at number two on that dubious ranking. The current budget includes almost $300 million for the legislature, up from $88 million in 1984-85. Pennsylvania ranks third in legislative spending per capita, and first in legislative spending as a percentage of the General Fund, according to NCSL data. In additional to cost, the Pennsylvania legislature has a well-deserved reputation for a culture that fosters corruption. While there is no objective way to measure the true level of corruption, the Department of Justice ranks Pennsylvania seventh in the number of federal corruption convictions per capita. Furthermore, the Center for Public Integrity gave Pennsylvania an F for its limited disclosure of information about legislators assets, holdings, and other information that would reveal conflicts of interest. From the 2005 pay raise, to the conviction of former state Senator Vince Fumo, to the Bonusgate scandal, to ongoing investigations into a number of sitting lawmakers, the list of abuses is long enough to convince any citizen that the current system is broken. Given this landscape of high costs and low voter approval of our legislature, several legislative reform proposals have been introduced. Reducing Size Many lawmakers and advocates, including House Speaker Sam Smith recently, suggest that a smaller legislature will cost taxpayers less money and improve the legislative process. But barring other reforms, these savings will likely be minimal. For instance, if the legislative budget was reduced by 40%, the savings would amount to approximately $40 per

family of four in Pennsylvania. This is not totally insignificant, but far greater savings can be achieved through other, more substantive cost-cutting policy changes and reforms. Additionally, reducing the number of legislators would not automatically result in an equal reduction in either direct or indirect costs. It will not necessarily result in reductions (and may result in increase) in staff size, salary & benefits, or legislative accounts. The General Assemblys staff, which has grown from 1,430 in 1970 to 2,919 today, is the largest in the country. For perspective, Illinois and Ohio, the states closest in population to Pennsylvania, have 1,023 and 465 legislative staff, respectivelyabout one-third and oneeighth as many. Fewer legislators could result in a reduction of the number of staff (and translate into cost savings). However, increasing legislators constituents would increase their responsibilities and workload, and could lead to more staff per legislator. Many staff are assigned to caucuses, committees, or other support areasand may not be affected by a change in the number of lawmakers. At $79,623, the annual salary for rank-and-file Pennsylvania lawmakers is the fourthhighest in the nation, trailing only the salaries of lawmakers in California, Michigan, and New York. However, the total cost of each legislator includes much more than salary. Benefits, including pensions, health care, and mileage, add up to tens of thousands in additional costs per lawmaker. The House and Senate collectively spent almost $4 million in per diems last year, according to Democracy Rising PA. And legislative leadership accounts that can be used for everything from public service announcements and newsletters toat least until recentlybonuses total tens (if not hundreds) of millions of dollars. Addressing the cost of the General Assembly, through adjusting pay and benefits, reducing the size of the legislative staff, and cutting spending on unnecessary functions during the annual budget process would deal with the cost issue, absent any change to the number of legislators. The second area of possible impact is in legislative accountability and transparency. There are sound arguments both for and against the reduction of the legislature on reform grounds. A smaller legislature may increase the chances of making the legislative process more open, transparent, and independent of special interests by making legislators appeal to a wider group of constituents. It could also, however, empower statewide special interest groups and political action committees, as they would need to influence fewer lawmakers. It could improve representation, making lawmakers actions more visible to the local media and their constituents. However, it could reduce the ability of lawmakers to pay attention to individual constituents, and reduce the ability of voters to communicate with their lawmakers. A smaller legislature could make individual lawmakers more independent of leadership. But a counter-argument is that larger districts raise the barriers to running for the legislature, providing greater protection for incumbents, potentially concentrating power in the hands of fewer legislators.

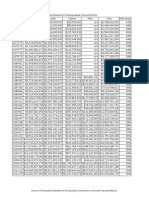

For these reasons, we emphasize that reducing the size of the legislature can only lead to increased accountability and transparency if it is complemented with other critical reforms. Recommendations: Part-Time Legislature, Term Limits, Spending Limits, I&R While reducing the size of the legislature has popular support, other reforms are more likely to influence policy outcomes. A number of academic studies comparing state legislative size to policy measures reach different conclusionssome find that states with smaller legislatures spend less per capita than states with large legislatures; other studies conclude that larger constituent size results in more spending (thus shrinking the legislature would lead to more state spending). Several studies, however, have found that state spending, tax burden, and economic freedom correlate much more closely with legislative professionalization than size. In our own analysis, shown in the chart below, we find no clear evidence linking legislative size with measures of state policy, such as economic freedom, spending per capita, or tax burden. On the other hand, the Professionalization Indexthe number of staff per lawmaker, the pay of lawmakers, and the time in sessionhas a strong correlation with the level of spending, taxes, and regulations enacted by state government. States with highly professionalized legislatures spend more per capita, have a higher state and local tax burden, and have a higher, more burdensome level of regulation than states with part-time, citizen-led legislatures. Specifically, each increase in the level of professionalization results in an estimated $441 increase in spending per person, and a 0.4% increase in taxes as a percentage of income. For highly professionalized legislatures, like Pennsylvania's, the effect is five times the effect for each level.

Regressions - State Legislators and Policy Outcomes

State and Local Spending Per Capita Number of Legislators Professionalization Index Term Limits

* Significant to 0.1; **Signficant to 0.01 Sources: *National Conference of State Legislatures, Tax Foundation, #Pacific Research Institute

State and Local Tax Burden 0.00% 0.44% ** -0.52% *

Economic Freedom Rank 0.0 8.2** -6.7

$2 $441 ** -$90 *

Consider the case of Texas. The Lone Star States has twice the population of Pennsylvania and is four times the size of the Keystone State geographically. Yet, the Texas legislature meets once every two years for 140 days to produce a biennial budget. When Texas lawmakers need to deal with emergency situations or revise their budget, they return

for a limited, special session. During its 2007 session, Texas' legislature passed 1,672 bills, while Pennsylvania's full-time General Assembly passed less than one-fifth that number. With a part-time legislature, lawmakers could be doctors, farmers, and small business owners who come to Harrisburg for a few weeks each year to make laws, and then go home to live and work under the laws they created. If this were the reality, only the most pressing issues would be addressed, leaving greater freedom for the Commonwealth to prosper. Likewise, legislative term limits seem to result in lower state and local spending and taxes. Legislative term limits were included in the Articles of Confederation, the Virginia Plan for the U.S. Constitution, and even the original Pennsylvania Constitution of 1776. The clich, we already have term limits: elections ignores the fact we do not have competitive elections, which is why incumbents in Congress and many state legislatures get re-elected over 90 percent of the time. Incumbents have erected strong barriers for challengers to overcome, such as the gerrymandering of political boundary lines and fundraising restrictions that make it extremely difficult for challengers to raise money. Incumbents lavish upon themselves a number of electoral advantages, such as mailing promotional newsletters, calendars, maps and other items to their constituents, courtesy of the taxpayers. Term-limits would help restore the ideas of a citizen legislature, would reduce the incentives for corruption and rules favoring incumbents, and evidence indicates would lead to lower taxes and spending. Another reform the Commonwealth Foundation has advocated for is state spending limits. Spending limits would cap the growth of state government spending to its current level plus inflation and population growth. This cap could be exceeded with voter approval. Alternative versions would limit spending growth to state personal income growth, or would allow the cap to be exceeded with a super-majority vote of both houses. Pennsylvania lawmakers previously passed spending caps modeled off of Coloradosin fact, in 2006, a version passed each chamber, but no compromise language was adopted. In a 2010 poll, two-thirds (66%) of Pennsylvania voters favored legislation that would limit state spending growth to inflation and population growth. This support transcends all demographics tested, including region and party registration. These results parellel previous polling of this question commissioned by the Commonwealth Foundation in 2005 and 2008. If spending had been limited to inflation plus population growth since 2003, the state would have had a surplus this yeareven without federal stimulus fundsrather than facing a multi-billion dollar hole. Over the past decades, state budgets across the country have exceeded the rate of inflationa rate sustainable during boom times, but which requires tax hikes or spending cuts when the economy invariably declines again. One exception was Colorado, in which the Taxpayer Bill of Rights was adopted in the 1990s. Colorado went from ranking near the bottom on economic growth, as Pennsylvania is now, to near the top, while refunding billions of dollars to taxpayers. Strict spending limits have shown to hold state spending and taxes in check, while fostering economic growth.

Finally, to address these reforms, many have suggested a state Constitutional Convention. The Commonwealth Foundation is not opposed to such a measure, but believes a better processboth to address the current structure of the General Assembly and going forwardis Initiative & Referendum. Article I, Section 2 of the Pennsylvania Constitution recognizes the right of the citizens to "alter, reform or abolish their government in such manner as they may think proper." It is past time to exercise this right, but the General Assembly and Governor have not provided the means to do so. Today, 24 states have adopted I&R. The structure of statewide I&R is simple. Initiative allows citizens to petition to place a constitutional or statutory measure on the ballot, for voters to approve or reject by majority vote. A referendum allows the electorate to reject or affirm laws passed by the legislature. Citizens in Charge, a Washington, D.C.-based I&R advocacy group, recently released a study comparing the fiscal climate in states with I&R compared to those without the process. The study found that, on average, states with I&R have lower taxes. In a 2010 poll question commissioned by the Commonwealth Foundation, an overwhelming 75% of Pennsylvania votersincluding 81% of Republicans and 69% of Democratsexpressed support for enacting citizen-driven initiative and referendum. Indeed, in states that have enacted term-limits, session limits on legislators, and spending limits, almost all cases were done through the initiative process. Thank you again for the opportunity to testify, and I am happy to try to answer any questions from the committee.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Gov. Wolf's Tax ProposalsДокумент7 страницGov. Wolf's Tax ProposalsNathan BenefieldОценок пока нет

- Charter Testimony (Benefield)Документ5 страницCharter Testimony (Benefield)Nathan BenefieldОценок пока нет

- Benefield Testimony AttachmentsДокумент18 страницBenefield Testimony AttachmentsNathan BenefieldОценок пока нет

- Benefield Testimony AttachmentsДокумент18 страницBenefield Testimony AttachmentsNathan BenefieldОценок пока нет

- Testimony To PA Funding Reform CommissionДокумент8 страницTestimony To PA Funding Reform CommissionNathan BenefieldОценок пока нет

- PSEA Political MailerДокумент2 страницыPSEA Political MailerNathan BenefieldОценок пока нет

- PSEA Mailer For Tom WolfДокумент2 страницыPSEA Mailer For Tom WolfNathan BenefieldОценок пока нет

- Fireproofing Pennsylvania'S Economy:: P L Isttbdt2012 Pennsylvania State Budget 2012Документ25 страницFireproofing Pennsylvania'S Economy:: P L Isttbdt2012 Pennsylvania State Budget 2012Nathan BenefieldОценок пока нет

- DPW Fact Sheet On Medicaid ExpansionДокумент3 страницыDPW Fact Sheet On Medicaid ExpansionNathan BenefieldОценок пока нет

- Bleeding GreenДокумент1 страницаBleeding GreenNathan BenefieldОценок пока нет

- PSEA Campaign Mailer 2012 PrimaryДокумент2 страницыPSEA Campaign Mailer 2012 PrimaryNathan BenefieldОценок пока нет

- Constitutionality of School Choice in PennsylvaniaДокумент2 страницыConstitutionality of School Choice in PennsylvaniaNathan BenefieldОценок пока нет

- Trans $ by State 2010Документ1 страницаTrans $ by State 2010Nathan BenefieldОценок пока нет

- PLCB Wine Kiosk Cover UpДокумент7 страницPLCB Wine Kiosk Cover UpNathan BenefieldОценок пока нет

- 2011-12 PA Budget Deal SpreadsheetДокумент17 страниц2011-12 PA Budget Deal SpreadsheetNathan BenefieldОценок пока нет

- Pennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationДокумент22 страницыPennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationNathan BenefieldОценок пока нет

- More Taxpayer Funded Lobbying Against School ChoiceДокумент2 страницыMore Taxpayer Funded Lobbying Against School ChoiceNathan BenefieldОценок пока нет

- PA Pension Reform PresentationДокумент21 страницаPA Pension Reform PresentationNathan BenefieldОценок пока нет

- Shippensburg Prevailing Wage ResolutionДокумент1 страницаShippensburg Prevailing Wage ResolutionNathan BenefieldОценок пока нет

- Pennsylvania State Union ContractsДокумент2 страницыPennsylvania State Union ContractsNathan BenefieldОценок пока нет

- Letter To Pitt FamilyДокумент2 страницыLetter To Pitt FamilyNathan BenefieldОценок пока нет

- 2010 School Choice Poll - PAДокумент5 страниц2010 School Choice Poll - PANathan BenefieldОценок пока нет

- Pennsylvania State Budget PresentationДокумент20 страницPennsylvania State Budget PresentationNathan BenefieldОценок пока нет

- Cabot Oil and Gas Letter Sent To DEPДокумент6 страницCabot Oil and Gas Letter Sent To DEPNathan BenefieldОценок пока нет

- Toomey Vs Sestak On JobsДокумент1 страницаToomey Vs Sestak On JobsNathan BenefieldОценок пока нет

- PA Transportation SpendingДокумент1 страницаPA Transportation SpendingNathan BenefieldОценок пока нет

- Gasland DebunkedДокумент2 страницыGasland DebunkedNathan BenefieldОценок пока нет

- Comparing States Severance TaxДокумент1 страницаComparing States Severance TaxNathan BenefieldОценок пока нет

- Memo On AEPS ReportДокумент1 страницаMemo On AEPS ReportNathan BenefieldОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- PJMA Consti.Документ7 страницPJMA Consti.Ayla Devi OnneОценок пока нет

- Justice Leonen's Dissenting Opinion On Juan Ponce Enrile Vs Sandiganbayan, and People of The Philippines G.R. No 213847Документ29 страницJustice Leonen's Dissenting Opinion On Juan Ponce Enrile Vs Sandiganbayan, and People of The Philippines G.R. No 213847Jhay Rocas100% (3)

- Gravador v. MamigoДокумент2 страницыGravador v. MamigoGenevieve Kristine ManalacОценок пока нет

- Heirs of Mario Malabanan Vs RepДокумент2 страницыHeirs of Mario Malabanan Vs RepLovelle Marie Role100% (1)

- Cass Sunstein - Constitutions and Democracies An EpilogueДокумент30 страницCass Sunstein - Constitutions and Democracies An EpilogueMilos JankovicОценок пока нет

- Cojuangco, Jr. vs. Presidential Commission On Good Gov't.Документ37 страницCojuangco, Jr. vs. Presidential Commission On Good Gov't.Rustom IbañezОценок пока нет

- Peasants Revolts PDFДокумент3 страницыPeasants Revolts PDFPriyadharshini AОценок пока нет

- Diane Hunt's Letter To Jacinda ArdernДокумент1 страницаDiane Hunt's Letter To Jacinda ArdernStuff NewsroomОценок пока нет

- Essential Question: - What Caused World War I?Документ13 страницEssential Question: - What Caused World War I?naeem100% (1)

- Critique of Nationalism by TagoreДокумент3 страницыCritique of Nationalism by TagoreSimran GuptaОценок пока нет

- Bir Seminar Letter-2 PicpaДокумент1 страницаBir Seminar Letter-2 PicpaMi MingkaiОценок пока нет

- Civil Military RelationsДокумент2 страницыCivil Military RelationsSunaina ZakiОценок пока нет

- Peole Vs Antonio Z. Oanis and Alberto Galanta G.R. No. L-47722Документ2 страницыPeole Vs Antonio Z. Oanis and Alberto Galanta G.R. No. L-47722Jen DioknoОценок пока нет

- Roberto Brillante v. CAДокумент2 страницыRoberto Brillante v. CAanalyn100% (2)

- G.R. No. 78164 July 31, 1987 - TERESITA TABLARIN, ET AL. v. ANGELINA S. GUTIERREZ: July 1987 - Philipppine Supreme Court DecisionsДокумент31 страницаG.R. No. 78164 July 31, 1987 - TERESITA TABLARIN, ET AL. v. ANGELINA S. GUTIERREZ: July 1987 - Philipppine Supreme Court DecisionsJeunice VillanuevaОценок пока нет

- Thayer Yearly Activities Report 2013Документ31 страницаThayer Yearly Activities Report 2013Carlyle Alan ThayerОценок пока нет

- Special Power of AttorneyorcrДокумент2 страницыSpecial Power of AttorneyorcrRM ManitoОценок пока нет

- Globalization and Prospects of The World Society - SzentesДокумент16 страницGlobalization and Prospects of The World Society - SzentesVincent Hansheng LiОценок пока нет

- 2.2 - Conference of Maritime Manning Agencies, Inc. v. POEA PDFДокумент11 страниц2.2 - Conference of Maritime Manning Agencies, Inc. v. POEA PDFFlorence RoseteОценок пока нет

- Jurisdiction of Family Courts in Criminal ActionsДокумент2 страницыJurisdiction of Family Courts in Criminal ActionsnomercykillingОценок пока нет

- Area 6 Correctional AdministrationДокумент54 страницыArea 6 Correctional Administrationcriminologyalliance100% (1)

- 2 Perez v. CatindigДокумент5 страниц2 Perez v. Catindigshlm bОценок пока нет

- TUGAS 3 Bahasa Inggris Niaga HeriadiДокумент2 страницыTUGAS 3 Bahasa Inggris Niaga HeriadiSari Yahya0% (1)

- 17 - CIR V Philippine Health Care ProvidersДокумент2 страницы17 - CIR V Philippine Health Care ProvidersCamille AngelicaОценок пока нет

- Eminent DomainДокумент168 страницEminent DomainJayne CabuhalОценок пока нет

- The Law On Adverse Possession in KenyaДокумент21 страницаThe Law On Adverse Possession in KenyaFREDRICK WAREGAОценок пока нет

- Ramon Magsaysay S Tribute To Land ReformДокумент37 страницRamon Magsaysay S Tribute To Land ReformZarah JeanineОценок пока нет

- GR 155831 Domingo Vs RayalaДокумент16 страницGR 155831 Domingo Vs RayalaJay B. Villafria Jr.Оценок пока нет

- General Assembly: United NationsДокумент15 страницGeneral Assembly: United NationsSachumquОценок пока нет

- Memorandum in Opposition To NFL Concussion Litigation Settlement by Former Players.Документ9 страницMemorandum in Opposition To NFL Concussion Litigation Settlement by Former Players.George ConkОценок пока нет