Академический Документы

Профессиональный Документы

Культура Документы

Tire City Inc

Загружено:

Afrin FarhanaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tire City Inc

Загружено:

Afrin FarhanaАвторское право:

Доступные форматы

Tire City Inc.

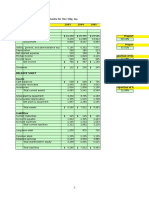

Current Financial Health Profitability Tire City has shown strong sales growth from 1993-1995. Sales increased 25.42% in 1994, and15.48% in 1995 respectively. They have improved their profit margin in every year, 1993 had a profit margin of 4.81%, 1994 4.90%, while 1995 has improved to 5.06%. Contributing to this improving margin was a decrease in Cost of Goods Sold as a % of sales, and interest expense as a % of sales. Tire Citys gross profit margin has improved slightly through the years, 1994 saw41.55% while 1995 saw 42.05% suggesting that Tire City may be charging slightly higher prices or have found cheaper suppliers of tires. Interest expense as a % of sales has decreased due to how they are paying off their original warehouse loan in $125,000 increments. Asset Turnover Assisting the improving profit margin Tire City has seen an improved asset turnover ratio. It has increased every year from 2.47x in 1993, 2.60x in 1994, and 2.62x in 1995. The main improvement for this increase is fixed asset turnover, which improved in 1995 to 9.65x, from8.93x in 1994. The increase is a result of decreasing planet & equipment as a % of sales. One can conclude that the company purchased a little more plant & equipment; however sales increased significantly thereby increasing fixed asset turnover. A slightly offsetting factor was A/R turnover, it has decreased slightly from 6.58x in 1994, to 6.44x times in 1995. This is due to a longer collection time, which has rose from 55.5 days in 1994, to 56.7 days in 1995. Tire Citys inventory turnover has also slightly declined, from 6.47 in 1994, to 6.22 in 1995. This is due to a higher inventory period, in 1994 inventory was sold off in 56.4 days, in 1995 this has slightly increased to 58.7

days. This is a result of a higher inventory as a % of sales in 1995 compared to1994, in 94 inventories were 9.03% of sales, in 95 they were 9.32%. Financial Leverage Tire City has moved to reduce its financial leverage, its assets to equity ratio has decreased every year from 2.01 in 1993, 1.92 in 1994, and 1.79 in 1995. This signals that they are reducing their risk levels and improving their solvency. Tire City has strong operating cash flows to fund its day to day operations and pay down its warehouse loan. They have yet to borrow from the line of credit established with Mid bank. Its times interested earned has improved significantly from18.16x in 1994, to 23.50 in 1995. This has been a result of higher net income and decreased interest expense. Tire Citys cash conversion cycle has increased from 71.2 days in 1994 to 76.8days in 1995. This is due to a higher collection period and shortened payable period compared to1994. Liquidity Tire City has improving current and quick ratios from 1994, in 1995 the current ratio was 2.03(from 1.92) and a quick ratio of 1.35 (from 1.29). They are having no problem generating cash from operations , in 1994 operating cash flows were $989,000, and $830,000 in 1995. This reduction in cash flows was due to an increase in spending on inventory to support its sales growth. Future Financial Health Profitability

After predicting future sales growth of 20% in subsequent years of 1996 and 1997. My proforma income and balance sheet predicts that the profit margin will rise in 1996 to 5.16%, and then fallback to 4.98% in 1997. Contributing to the rise in 1996 is a falling depreciation expense as a percentage of sales and a slightly lower interest expense as a percentage of sales. Contributing to the fall of the profit margin in 1997 is an increased depreciation expense as a percentage of sales, since Tire City is allowed to write off 5% of the planned warehouse expansion that year. Another reason is that interest expense as a percentage of sales has increased due to larger amount of debt that has been taken on to fund the expansion of the warehouse. Asset Turnover Tire City will see a declining asset turnover ratio in 1996 and 1997. They managed a ratio of 2.62x in 1995, which later falls to 2.55x in 1996, and then 2.47 in 1997. Dragging down the ratiois a slower fixed asset turnover which has resulted in the companys big investment in fixed assetin 96 being the warehouse. In 1995 fixed assets were 27.11% of total assets (10.36% of sales),in 1996 they were 34.64% of assets (14.97% of sales). Offsetting this slower fixed asset turnover is an improved inventory ratio, inventory is now being turned over 10.05 times a year compared to 6.22 times in 1995. This has been due to the company raising $565,000 in 1996 by selling off a significant amount of their inventory which has resulted in a more efficient turnover. In 1997inventories come back to their previous levels in proportion to sales, which in turn takes the inventory turnover

back to 6.22x a year, this contributes to the declining asset turnover in 1997.However in 1997 fixed asset turnover picks up again as a smaller investment in fixed assets is made and sales increase 20%, as opposed to a huge increased in fixed asset in 1996.

Financial Leverage Tire City will see a fairly moderate increase in financial leverage through 1996 and 1997. Asset to equity in 1995 was 1.79, the same ratio found in 1996, and in 1997 the ratio is 1.82, a slight increase. Tire City makes a substantial operating cash flow of $2,122,000, which can be attributed to them selling off a majority of their inventory. In 1997 operating cash flows make a cliff dive down to $354,000, this can be traced to re-buying a large amount of inventories to make them proportioned to sales like they were in 1995. Times interest earned makes a rise in1996 to 24.34x then falls back to 19.50x in 1997. The rising sales and lack of an increasing depreciation expense in 1996 attributed to the gain as well as a lower interest expense as a percentage of sales, while in 1997 depreciation expense increased and interest expense as a percentage of sales increased to .48% from .38% in 1996 Liquidity

Tire Citys current ratio decreased in 1996 to 1.79x from 2.03x in 1995, this ratio however improves in 1997 to 2.06. Quick ratios remain around the same levels in

1995. The current ratio is reduced in 1996 due to the selling off inventories to fund operations in 1996, when the levels go back to normal in 1997, this is what improves the current ratio Tire Citys current ratio decreased in 1996 to 1.79x from 2.03x in 1995, this ratio however improves in 1997 to 2.06. Quick ratios remain around the same levels in 1995. The current ratio is reduced in 1996 due to the selling off inventories to fund operations in 1996, when the levels go back to normal in 1997, this is what improves the current ratio.

Overall Id have to say that Tire City will be in a weaker financial position in 1997 compared to 1995.Looking at it from a DuPont decomposition standpoint, you can see how ROE has decreased, the profit margin has fallen, a slower asset turnover, and increased financial leverage. As a lender I would be willing to loan Tire City the funds needed to expand their warehouse, they are showing positive operating cash flows on my pro-forma, and remain profitable. The times interest earned ratio remains high and provides some safety in knowing they can cover their interest costs 19.50 times over in 1997.

Вам также может понравиться

- Tire City IncДокумент12 страницTire City Incdownloadsking100% (1)

- Tire City IncДокумент12 страницTire City IncMahesh Kumar Meena100% (1)

- Tire City, Inc - Examen FinalДокумент3 страницыTire City, Inc - Examen Finalmacro_jОценок пока нет

- Apollo Tyres - Group 12Документ5 страницApollo Tyres - Group 12Pallav PrakashОценок пока нет

- Tire City Case 1Документ28 страницTire City Case 1Srikanth VasantadaОценок пока нет

- Tire City Inc.Документ6 страницTire City Inc.Samta Singh YadavОценок пока нет

- Tire City AssignmentДокумент6 страницTire City AssignmentXRiloXОценок пока нет

- Tire City Case AnalysisДокумент10 страницTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)Оценок пока нет

- Tire CityДокумент3 страницыTire CityenypurwaningsihОценок пока нет

- Tire City SolutionДокумент4 страницыTire City SolutionUmeshKumarОценок пока нет

- Tire City CaseДокумент12 страницTire City CaseAngela ThorntonОценок пока нет

- Tire RatiosДокумент7 страницTire Ratiospp pp100% (1)

- Skyview Manor CaseДокумент3 страницыSkyview Manor CaseNisa SasyaОценок пока нет

- BBCДокумент10 страницBBCdashanОценок пока нет

- Toy World Case ExhibitsДокумент24 страницыToy World Case ExhibitsFrancisco Aguilar PuyolОценок пока нет

- Tire City AssignmentДокумент7 страницTire City AssignmentShivam Kanojia100% (1)

- Tire - City AnalysisДокумент17 страницTire - City AnalysisJustin HoОценок пока нет

- Alfa, Beta, GamaДокумент20 страницAlfa, Beta, GamaRitu SharmaОценок пока нет

- 93-Tire-City 22 22Документ26 страниц93-Tire-City 22 22Daniel InfanteОценок пока нет

- Tire City AssignmentДокумент6 страницTire City AssignmentderronsОценок пока нет

- Toy WorldДокумент4 страницыToy WorldDhirendra Kumar Sahu100% (1)

- Tire City Spreadsheet SolutionДокумент8 страницTire City Spreadsheet SolutionsuwimolJОценок пока нет

- Clarkson Lumber Analysis - TylerДокумент9 страницClarkson Lumber Analysis - TylerTyler TreadwayОценок пока нет

- The Home Depot: QuestionsДокумент13 страницThe Home Depot: Questions凱爾思Оценок пока нет

- Clarkson Lumber CaseДокумент27 страницClarkson Lumber CaseGovardan SureshОценок пока нет

- Case 1Документ18 страницCase 1Amit Kanti RoyОценок пока нет

- Tire City CaseДокумент14 страницTire City CaseXRiloXОценок пока нет

- Case Analysis - Compania de Telefonos de ChileДокумент4 страницыCase Analysis - Compania de Telefonos de ChileSubrata BasakОценок пока нет

- AnswersДокумент1 страницаAnswersChetan AdsulОценок пока нет

- Southport SlidesДокумент12 страницSouthport SlidesAshutosh Shukla0% (1)

- Tire City Spreadsheet SolutionДокумент7 страницTire City Spreadsheet SolutionSyed Ali MurtuzaОценок пока нет

- Bunker Company Negotiated A Lease With Gilbreth Company That BeginsДокумент1 страницаBunker Company Negotiated A Lease With Gilbreth Company That Beginstrilocksp SinghОценок пока нет

- Clarkson Lumber Case QuestionsДокумент2 страницыClarkson Lumber Case QuestionsJeffery KaoОценок пока нет

- S2 G9 Hanson CaseДокумент2 страницыS2 G9 Hanson CaseShraddha PandyaОценок пока нет

- Modern Pharma PDFДокумент2 страницыModern Pharma PDFPG-04Оценок пока нет

- Tire City IncДокумент3 страницыTire City IncAlberto RcОценок пока нет

- Case Study Free Cash FlowДокумент5 страницCase Study Free Cash FlowShayan ZafarОценок пока нет

- Tire CityДокумент3 страницыTire Cityrahulchohan2108Оценок пока нет

- A1.2 Roic TreeДокумент9 страницA1.2 Roic TreemonemОценок пока нет

- Lady M Exercises-3Документ6 страницLady M Exercises-3MOHIT MARHATTAОценок пока нет

- Apollo TyresДокумент37 страницApollo TyresBandaru NarendrababuОценок пока нет

- Netscape ProformaДокумент6 страницNetscape ProformabobscribdОценок пока нет

- Dell CaseДокумент22 страницыDell CaseShaikh Saifullah KhalidОценок пока нет

- Case 5Документ12 страницCase 5JIAXUAN WANGОценок пока нет

- New Heritage Doll CompanyДокумент4 страницыNew Heritage Doll Companyvenom_ftwОценок пока нет

- Modern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingДокумент7 страницModern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingbansalparthОценок пока нет

- Multi Tech Case AnalysisДокумент4 страницыMulti Tech Case AnalysissimplymesmОценок пока нет

- Tata Motors ValuationДокумент38 страницTata Motors ValuationAkshat JainОценок пока нет

- Turnkey Case StudyДокумент20 страницTurnkey Case Studyharsh kumarОценок пока нет

- Case Study: Asahi Glass LimitedДокумент11 страницCase Study: Asahi Glass LimitedRohan RoyОценок пока нет

- Nova Case Course HeroДокумент10 страницNova Case Course HerolibroaklatОценок пока нет

- Marriott Solutions WACC LodgingДокумент3 страницыMarriott Solutions WACC LodgingPabloCaicedoArellanoОценок пока нет

- FSA Sears Vs WalmartДокумент8 страницFSA Sears Vs WalmartAbhishek Maheshwari100% (2)

- Case Report FinalДокумент12 страницCase Report Finalsimplyabeer100% (3)

- Sweet Dreams Inc. Case AnalysisДокумент13 страницSweet Dreams Inc. Case Analysisdontcare3267% (3)

- Executive Summary HarleyДокумент25 страницExecutive Summary HarleyYusra Iqbal100% (1)

- Business Model Analysis of Wal Mart and SearsДокумент3 страницыBusiness Model Analysis of Wal Mart and SearsAndres IbonОценок пока нет

- SearsvswalmartДокумент7 страницSearsvswalmartXie KeyangОценок пока нет

- By: Taruna Vaibhav Vinika Vishal YogendraДокумент21 страницаBy: Taruna Vaibhav Vinika Vishal YogendraVaibhav RastogiОценок пока нет

- KohinoorДокумент31 страницаKohinoorMuhammad BilalОценок пока нет

- Nefas Silk Poly Technic College: Learning GuideДокумент20 страницNefas Silk Poly Technic College: Learning GuideNigussie BerhanuОценок пока нет

- PT Gihon Telekomunikasi Indonesia TBK Dan Entitas Anak / and SubsidiaryДокумент81 страницаPT Gihon Telekomunikasi Indonesia TBK Dan Entitas Anak / and SubsidiaryDINDA NUR HALIZAОценок пока нет

- AP4-3A KeyДокумент2 страницыAP4-3A KeySindy1121Оценок пока нет

- Assets, Liabilities, and Owner'S Equity: Tle 9 ReviewerДокумент3 страницыAssets, Liabilities, and Owner'S Equity: Tle 9 ReviewerDavidОценок пока нет

- AdvancedДокумент8 страницAdvancedElaine YapОценок пока нет

- Demonstration Exercises For Unit 5Документ5 страницDemonstration Exercises For Unit 5Ash ChandОценок пока нет

- Jiran Bina SDN BHDДокумент6 страницJiran Bina SDN BHDkumanqatarОценок пока нет

- Homework Week 1Документ9 страницHomework Week 1ela kikay100% (1)

- HBC 2101Документ5 страницHBC 2101mimiОценок пока нет

- Teresita Buenaflor ShoesДокумент23 страницыTeresita Buenaflor ShoesRonnie Lloyd Javier78% (32)

- Practical Accounting 2 Business Combination Lecture NotesДокумент2 страницыPractical Accounting 2 Business Combination Lecture NotesPatricia Ann TamposОценок пока нет

- Accounting For Business Combination - Practice MaterialДокумент2 страницыAccounting For Business Combination - Practice MaterialZYRENE HERNANDEZОценок пока нет

- Fancy Phone Trust - Trust - Financial StatementsДокумент15 страницFancy Phone Trust - Trust - Financial Statementsjerry dela cruzОценок пока нет

- Godrej Consumer Products Limited 44 QuarterUpdateДокумент9 страницGodrej Consumer Products Limited 44 QuarterUpdateKhushboo SharmaОценок пока нет

- National Accounting Standard For Commercial Organisations 1 "Presentation of Financial Statements"Документ15 страницNational Accounting Standard For Commercial Organisations 1 "Presentation of Financial Statements"azimovazОценок пока нет

- Ratio Analysis of TATA MOTORSДокумент8 страницRatio Analysis of TATA MOTORSmr_anderson47100% (8)

- Feasibility Study2 - TailoringДокумент1 страницаFeasibility Study2 - TailoringLycaОценок пока нет

- DBB2104 Unit-08Документ24 страницыDBB2104 Unit-08anamikarajendran441998Оценок пока нет

- Assignment 2. Estimating Adidas' Equity ValueДокумент4 страницыAssignment 2. Estimating Adidas' Equity Valuefasihullah1995Оценок пока нет

- PT Masi - 31 Dec 2020Документ67 страницPT Masi - 31 Dec 2020jf testОценок пока нет

- Gesco Kabab: Worksheet For The Month Ended in December 31, 2021Документ20 страницGesco Kabab: Worksheet For The Month Ended in December 31, 2021TanjinОценок пока нет

- Accounting For Merchandising OperationsДокумент53 страницыAccounting For Merchandising OperationsTanvirОценок пока нет

- MODULE 3 - The Adjusting ProcessДокумент41 страницаMODULE 3 - The Adjusting ProcessFRANCES JEANALLEN DE JESUSОценок пока нет

- Supriya Lifesciences Q4 FY23 Investor PresentationДокумент38 страницSupriya Lifesciences Q4 FY23 Investor PresentationHarish SubramaniamОценок пока нет

- Partnership Liquidation ExercisesДокумент11 страницPartnership Liquidation ExercisesEUSTAQUIO JR., Felix C.Оценок пока нет

- Review of The Accounting ProcessДокумент10 страницReview of The Accounting ProcessFranz TagubaОценок пока нет

- Review of The Accounting Process Straight Problems Problem 1Документ13 страницReview of The Accounting Process Straight Problems Problem 1angielynОценок пока нет

- Power Point (Working Capital)Документ71 страницаPower Point (Working Capital)Varun TayalОценок пока нет

- CHAPTER 3 Trial BalanceДокумент7 страницCHAPTER 3 Trial Balancesaksaman74Оценок пока нет

- Topic 3 Accounting For ManagersДокумент47 страницTopic 3 Accounting For ManagersJack BlackОценок пока нет

- Preclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1От EverandPreclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Рейтинг: 5 из 5 звезд5/5 (1)

- Improve Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersОт EverandImprove Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersРейтинг: 4 из 5 звезд4/5 (14)

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersОт EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersОценок пока нет

- CUNY Proficiency Examination (CPE): Passbooks Study GuideОт EverandCUNY Proficiency Examination (CPE): Passbooks Study GuideОценок пока нет

- Certified Professional Coder (CPC): Passbooks Study GuideОт EverandCertified Professional Coder (CPC): Passbooks Study GuideРейтинг: 5 из 5 звезд5/5 (1)

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessОт EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessРейтинг: 4.5 из 5 звезд4.5/5 (17)

- The CompTIA Network+ & Security+ Certification: 2 in 1 Book- Simplified Study Guide Eighth Edition (Exam N10-008) | The Complete Exam Prep with Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First Attempt!От EverandThe CompTIA Network+ & Security+ Certification: 2 in 1 Book- Simplified Study Guide Eighth Edition (Exam N10-008) | The Complete Exam Prep with Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First Attempt!Оценок пока нет

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsОт EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsРейтинг: 4.5 из 5 звезд4.5/5 (77)

- Clinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2От EverandClinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2Рейтинг: 3 из 5 звезд3/5 (1)

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideОт Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideРейтинг: 3.5 из 5 звезд3.5/5 (7)

- Note Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusОт EverandNote Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusРейтинг: 3.5 из 5 звезд3.5/5 (10)

- Check Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreОт EverandCheck Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreРейтинг: 5 из 5 звезд5/5 (1)

- The Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)От EverandThe Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)Рейтинг: 4 из 5 звезд4/5 (1)

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeОт EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeРейтинг: 3.5 из 5 звезд3.5/5 (3)

- College Level Anatomy and Physiology: Essential Knowledge for Healthcare Students, Professionals, and Caregivers Preparing for Nursing Exams, Board Certifications, and BeyondОт EverandCollege Level Anatomy and Physiology: Essential Knowledge for Healthcare Students, Professionals, and Caregivers Preparing for Nursing Exams, Board Certifications, and BeyondОценок пока нет

- NASM CPT Study Guide 2024-2025: Review Book with 360 Practice Questions and Answer Explanations for the Certified Personal Trainer ExamОт EverandNASM CPT Study Guide 2024-2025: Review Book with 360 Practice Questions and Answer Explanations for the Certified Personal Trainer ExamОценок пока нет

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASОт EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASОценок пока нет

- USMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewОт EverandUSMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Summary of Sapiens: A Brief History of Humankind By Yuval Noah HarariОт EverandSummary of Sapiens: A Brief History of Humankind By Yuval Noah HarariРейтинг: 1 из 5 звезд1/5 (3)