Академический Документы

Профессиональный Документы

Культура Документы

Form 16

Загружено:

Aruna Kadge JhaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form 16

Загружено:

Aruna Kadge JhaАвторское право:

Доступные форматы

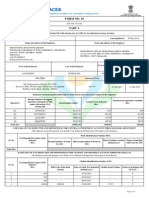

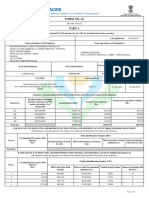

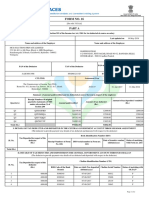

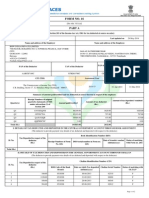

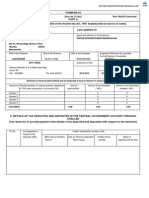

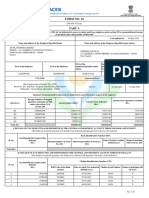

FORM 16 [See Rule 31(1)(a)]

CERTIFICATE UNDER SECTION 203 OF THE INCOME-TAX ACT, 1961 FOR TAX DEDUCTED AT SOU FROM INCOME CHARGEABLE UNDER THE HEAD SALARIES Name and Address of the Employer: Harison Motors (P) Ltd. Tanna tower, Office no. 201/202, 2nd Floor, Above Style Spa Showroom, 45/3 Law College Rd, Pune - 411004 PAN No. of the Deductor TAN No. of the Deductor PAN No. of the Employee

AACPG8727G

Name and Designation of the Employee Anil Gurjar Vice President - Admin & Finance.

Acknowledgement Nos. of all quarterly statements of TDS Period under sub-section (3) of section 200 as provided by From To TIN Facilitation Centre or NSDL web-site 16/12/2010 31/03/11 Quarter Acknowledgement No.

Assessmen

2011-1

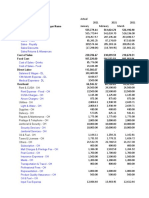

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED 1 Gross Salary * a) Salary as per provisions contained in section 17(1) b) Value of perquisites under section 17(2) (as per Form No.12BA, wherever applicable) c) Profits in lieu of salary under section 17(3) (as per Form No. 12BA, wherever applicable) d) Total 2 Less :Allowance to the extent exempt under Section 10 3 Balance 1-2 4 Deductions : a) Entertainment Allowance b) Tax on Employment 5 Aggregate of 4 (a) and (b) 6 Income chargeable under the head Salaries (3-5) 7 Add: Any other income reported by the employee a) Other Income 8 Gross total income (6+7) 9 Deductions under chapter VI-A Rs. Rs. Rs. 83,209 0 0 83,209Rs. 0 Rs. Rs. Rs. 0 900 Rs. 83,209 83,209

900 82,309 0 82,309 Deductible Amount (In Rs.) 0

Rs.

(A) Sections 80C,80CCC and 80CCD (B) Sections 80D - Mediclaim

Gross Amount (in Rs.) 0.0 0

Qualifying Amount (In Rs.) 0

10 Aggregate of deductible amount under chapter VI-A 11 Total income (8-10) 12 Tax on total income 13 Surcharge(on tax computed at S.No.12) 14 Education Cess(on tax at S.No.12 and Surcharge at S.No.13) 15 Tax payable (12 + 13 + 14) 16 Relief under section 89 (attach details) 17 Tax Payable (15 - 16) 18 Less: Tax deducted at source u/s 192(1) a) b) tax paid by the employer on behalf of the employee u/s 192 (1A) on perquisites u/s 17(2) 19 Tax payable/refundable (17 - 18) Sl.No DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT TDS Surcharge Education Total tax Cheque/ BSR Date on (Rs.) (Rs.) Cess(Rs.) deposited DD No. Code of which (Rs.) (if any) Bank tax branch deposit ed (dd/mm /yy) 6,252.00 6,252.00Rs. Rs. 0 0 6,252.00 6,252.00

Total:

Place : Pune Date : 21/05/2011

Signature of the person responsible for deduction of tax Full Name: Anil Shrikant Gurjar Designation : Vice President

* See section 15 and 16 and Rule 3. Furnish separate details of value of the perquisites and profits in lieu of or in addition to salary or

CTED AT SOURCE

he Employee:

nce.

mployee Assessment year 2011-12

TED

Rs.

83,209

Rs.

83,209

uctible ount (In Rs.)

Rs. Rs. Rs. Rs. Rs. Rs. Rs.

0.00 83,209 0 0 0 0 0.00 0

Rs. Rs.

0 0

ACCOUNT Date on Transfer which voucher/ tax Challan deposit Identificat ed ion No. (dd/mm /yy)

dition to salary or wages.

Вам также может понравиться

- Form 16Документ3 страницыForm 16Alla VijayОценок пока нет

- Kaushik Sarkar Form 16 DynProДокумент5 страницKaushik Sarkar Form 16 DynProKaushik SarkarОценок пока нет

- Form 16 651746Документ4 страницыForm 16 651746Arslan1112Оценок пока нет

- Form 16 Word FormatДокумент4 страницыForm 16 Word FormatVenkee SaiОценок пока нет

- Form 16 PDFДокумент5 страницForm 16 PDFJoshua Hicks100% (1)

- Form16Документ5 страницForm16er_ved06Оценок пока нет

- Form 16 SV PDFДокумент2 страницыForm 16 SV PDFPravin HireОценок пока нет

- Form 16 20-21 PartaДокумент2 страницыForm 16 20-21 PartaTEMPORARY TEMPОценок пока нет

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeДокумент2 страницыEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmОценок пока нет

- FS51853 KPMG PDFДокумент9 страницFS51853 KPMG PDFAman AgrawalОценок пока нет

- Form 16Документ2 страницыForm 16robin0903Оценок пока нет

- Form 16 Part - BДокумент3 страницыForm 16 Part - BdivanshuОценок пока нет

- Form 16 1Документ2 страницыForm 16 1Vijay JiíväОценок пока нет

- Form 16 AДокумент5 страницForm 16 Anisha_khanОценок пока нет

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryДокумент4 страницыForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedОценок пока нет

- Form 16Документ2 страницыForm 16SIVA100% (1)

- Pay Slip March 2017Документ4 страницыPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Form 16Документ2 страницыForm 16sowjanya0% (1)

- PrintTax14 PDFДокумент2 страницыPrintTax14 PDFarnieanuОценок пока нет

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAДокумент2 страницыAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishОценок пока нет

- QUA05242 Form16Документ5 страницQUA05242 Form16saurabhОценок пока нет

- Form 16Документ5 страницForm 16Jagdeep SinghОценок пока нет

- Form16 Till 14 Dec 2019Документ11 страницForm16 Till 14 Dec 2019Aviral SankhyadharОценок пока нет

- Form 26ASДокумент3 страницыForm 26ASHarshil MehtaОценок пока нет

- Aekpy3088c 2019Документ4 страницыAekpy3088c 2019Ajay YadavОценок пока нет

- Form No. 16: Part AДокумент2 страницыForm No. 16: Part AasifОценок пока нет

- DD ProjectДокумент2 страницыDD Projectjatin kuashikОценок пока нет

- Form No. 16: Part AДокумент5 страницForm No. 16: Part AHarish KumarОценок пока нет

- (A Government of India Enterprise) : Investment Details Details of Pending TY AdvancesДокумент1 страница(A Government of India Enterprise) : Investment Details Details of Pending TY AdvancesindianroadromeoОценок пока нет

- 255 PartA PDFДокумент2 страницы255 PartA PDFRamyaMeenakshiОценок пока нет

- Form 16 FYbilДокумент8 страницForm 16 FYbilBilalОценок пока нет

- Dbkps7123e - Ay 2017 18Документ5 страницDbkps7123e - Ay 2017 18Damodar SurisettyОценок пока нет

- Form 16 by Tcs PDFДокумент5 страницForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- A 40029127 Part-AДокумент2 страницыA 40029127 Part-Adeepak_cool4556Оценок пока нет

- Form 16 FY 18-19 PART - AДокумент2 страницыForm 16 FY 18-19 PART - Asai venkataОценок пока нет

- Form16 PDFДокумент9 страницForm16 PDFHarish KumarОценок пока нет

- Form 16 2020 21Документ6 страницForm 16 2020 21Manoj MahimkarОценок пока нет

- Form16 2021Документ8 страницForm16 2021Mahammad HachanОценок пока нет

- Payslip For 16831 (2daf)Документ1 страницаPayslip For 16831 (2daf)omkassОценок пока нет

- 1 1000 Form16Документ5 страниц1 1000 Form16Rakshit SharmaОценок пока нет

- Form No. 16: Part AДокумент6 страницForm No. 16: Part Asamir royОценок пока нет

- Form 16 - TCSДокумент3 страницыForm 16 - TCSBALAОценок пока нет

- Form No. 16: Part AДокумент8 страницForm No. 16: Part ANidhish AgrawalОценок пока нет

- Form 16 PDFДокумент3 страницыForm 16 PDFkk_mishaОценок пока нет

- Form 16 Part B 2016-17Документ4 страницыForm 16 Part B 2016-17atulsharmaОценок пока нет

- Form 16Документ6 страницForm 16anon_825378560Оценок пока нет

- 14374752Документ2 страницы14374752Anshul MehtaОценок пока нет

- Payslip SepДокумент1 страницаPayslip SepBrajesh PandeyОценок пока нет

- Form 16 20-21Документ2 страницыForm 16 20-21Mohammad AliОценок пока нет

- Geeta - Form 16 A 2022-23Документ2 страницыGeeta - Form 16 A 2022-23Sourabh PunshiОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kapil KaroliyaОценок пока нет

- YourForm16 2022Документ8 страницYourForm16 2022BHARATH MPОценок пока нет

- Summary of Tax Deducted at Source: TotalДокумент2 страницыSummary of Tax Deducted at Source: Totaladithya604Оценок пока нет

- Form No. 16: Details of Salary Paid and Any Other Income and Tax DeductedДокумент2 страницыForm No. 16: Details of Salary Paid and Any Other Income and Tax DeductedSundaresan ChockalingamОценок пока нет

- Form 16, Tax Deduction at Source... Income Tax of IndiaДокумент2 страницыForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilОценок пока нет

- Form 16Документ2 страницыForm 16orkid2100Оценок пока нет

- Form 16Документ2 страницыForm 16Hari Krishnan ElangovanОценок пока нет

- Form 16Документ1 страницаForm 16Manish Varghese MathewОценок пока нет

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОт EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОценок пока нет

- IESE GlovoДокумент17 страницIESE GlovoBill Jason Duckworth100% (1)

- Case Study Project Income Statement BudgetingДокумент186 страницCase Study Project Income Statement BudgetingKate ChuaОценок пока нет

- Corporate Personality Assignment 1Документ12 страницCorporate Personality Assignment 1Gareth Wilcox100% (1)

- Crude Oil MethodologyДокумент63 страницыCrude Oil MethodologyKingsuk BurmanОценок пока нет

- Profit. Planning and ControlДокумент16 страницProfit. Planning and ControlNischal LawojuОценок пока нет

- Carolina Industries vs. CMS Stock Brokerage PDFДокумент42 страницыCarolina Industries vs. CMS Stock Brokerage PDFdanexrainierОценок пока нет

- Informations Systems and Operations ManagementДокумент9 страницInformations Systems and Operations Managementprivilege1911Оценок пока нет

- Chapter FiveДокумент14 страницChapter Fivemubarek oumerОценок пока нет

- KPMG Advisory Services Private Limited Designation - SAP ConsultantДокумент8 страницKPMG Advisory Services Private Limited Designation - SAP ConsultantDhanad AmberkarОценок пока нет

- Ahs Org OrgchartДокумент2 страницыAhs Org OrgchartДрагослав БјелицаОценок пока нет

- HR Team Day Out - May 2012 v3Документ61 страницаHR Team Day Out - May 2012 v3sashaОценок пока нет

- Top Qualities of A Successful BusinessmanДокумент40 страницTop Qualities of A Successful Businessmansufyanbutt007Оценок пока нет

- SWAD 3D Printing Challenge GatewayДокумент2 страницыSWAD 3D Printing Challenge GatewayMuhammad AdilОценок пока нет

- Assignment On Case 1.1 and Case 1.2: Submitted ToДокумент4 страницыAssignment On Case 1.1 and Case 1.2: Submitted ToEhsan AbirОценок пока нет

- Banking Notes (With Digests From Kriz P) - Cha MendozaДокумент570 страницBanking Notes (With Digests From Kriz P) - Cha Mendozacmv mendozaОценок пока нет

- Buying and MerchandisingДокумент155 страницBuying and MerchandisingMJ100% (2)

- Sy0 601 01Документ17 страницSy0 601 01SABRINA NUR AISHA AZAHARI100% (1)

- Business PlanДокумент6 страницBusiness PlanAshley Joy Delos ReyesОценок пока нет

- MIS Group 1 Sec F Assignment 2Документ2 страницыMIS Group 1 Sec F Assignment 2Debasmita KumarОценок пока нет

- A Great CEOДокумент2 страницыA Great CEOnochip10100% (1)

- Chapter Two: A Market That Has No One Specific Location Is Termed A (N) - MarketДокумент9 страницChapter Two: A Market That Has No One Specific Location Is Termed A (N) - MarketAsif HossainОценок пока нет

- 02-Enterprise Resource Planning Business SystemsДокумент4 страницы02-Enterprise Resource Planning Business SystemsAhmad AliОценок пока нет

- Cma Format For Bank-3Документ40 страницCma Format For Bank-3technocrat_vspОценок пока нет

- How To Earn $200 Per Day in Passive Income by 2022 - 6 Ideas - by Claudiu - 072355Документ5 страницHow To Earn $200 Per Day in Passive Income by 2022 - 6 Ideas - by Claudiu - 072355Alvaro LaraОценок пока нет

- SIP Soumik BhattacharyaДокумент93 страницыSIP Soumik BhattacharyaSoumik BhattacharyaОценок пока нет

- Project Report On B2B Strategy Making and PlanningДокумент74 страницыProject Report On B2B Strategy Making and Planningmughees992Оценок пока нет

- Customer Relatioship ManagementДокумент6 страницCustomer Relatioship ManagementsundivanaОценок пока нет

- Accounting For Business TransactionsДокумент13 страницAccounting For Business TransactionsAkp Wewen GensayaОценок пока нет

- AFM Important QuestionsДокумент2 страницыAFM Important Questionsuma selvarajОценок пока нет