Академический Документы

Профессиональный Документы

Культура Документы

Ag990 Instructions

Загружено:

Daniel_Johnson_1322Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ag990 Instructions

Загружено:

Daniel_Johnson_1322Авторское право:

Доступные форматы

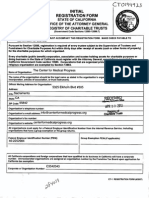

OFFICE OF THE ATTORNEY GENERAL STATE OF ILLINOIS Lisa Madigan Attorney General

ATTENTION: CHARITABLE ORGANIZATIONS

NOTICE OF AMENDMENT TO SECTION 4 OF THE SOLICITATION FOR CHARITY ACT (Public Act 096-0488)

Effective January 1, 2010 the audit threshold for charitable organizations whose fund-raising functions are carried on solely by staff and volunteers will be raised from $150,000 to $300,000. (225 ILCS 460/4) The new $300,000 audit threshold applies to annual reports that are due (without considering any extension granted) after the January 1, 2010 effective date of the amendment. The audit threshold of $25,000 for charitable organizations who use the services of a paid professional fundraiser has not been changed. (225 ILCS 460/4)

Office of the Illinois Attorney General Charitable Trusts Bureau 100 W. Randolph Street, 11th Floor Chicago, IL 60601-3175 (312) 814 - 2595

Form AG990-IL.INS Revised 0 /0

ILLINOIS CHARITABLE ORGANIZATION B FORM AG990-IL FILING INSTRUCTIONS

LISA MADIGAN ATTORNEY GENERAL

A COMPLETE ANNUAL FINANCIAL REPORT (AG990-IL with all required attachments and applicable fees) is due within six months after the organization's fiscal year end. A REPORT WILL NOT BE CONSIDERED FILED UNLESS IT IS COMPLETE. A COMPLETE ANNUAL FINANCIAL REPORT must include the following items: 1. $15 Annual Filing Fee - Make check or money order payable to "ILLINOIS CHARITY BUREAU FUND." An annual financial report

submitted without proper fees will not be considered filed. Soliciting Organizations are required to pay a $15 Annual Report Filing Fee if gross contributions are greater than $15,000 or assets are greater than $25,000. Trust Organizations registered under the Charitable Trust Act only are required to pay a $15 Annual Report Filing Fee if gross revenues or assets are greater than $25,000.

2. Form AG990-IL - Complete all sections and line items applicable to the organization. See 6 below for Simplified Filing Option for Small Organizations.

An annual financial report submitted with an incomplete Form AG 990-IL will not be considered filed. A. B. C. CO#: Include CO# on the Form AG 990-IL. Correct any incorrect name or address information if using preprinted form and highlight any corrections. SIGNATURES: The Form AG 990-IL must be signed by two different officers (president or other authorized officer and the chief fiscal officer) or by two trustees. One signature shall be accepted if there is only one trustee. A Form AG 990-IL without required signatures is incomplete. Part I, Line D: Report "contributions" as defined by the Solicitation for Charity Act. The Solicitation for Charity Act defines "contributions" to include the gross amounts of cash donations as well as gross sums paid by the public for merchandise, special events, rights or services of the organization. A Form AG 990-IL that fails to report "contributions" as defined by the Solicitation for Charity Act is incomplete. (A complete definition of "contribution" under the Solicitation for Charity Act is shown on the back of these instructions.) Part II, Line J1: Report all program costs associated with a combined fund-raising appeal to the extent such was allocated to Charitable Program Service Expense and entered on line J as Charitable Program Service Expense. The amount should equal the amount reported on the back of the AG990-IL form, question 7b(ii). You must have and maintain the documentation to support the allocations made. Part III, Line S: Report fees paid to all fund-raising consultants during the year. Attach a list identifying each consultant by name and address and specify the amount paid to each. Part V, Lines W, X, Y Program Service Codes: Select up to three codes from those on back of these instructions which best describe the program service(s) for which the organization spent funds.

D.

E. F.

3. IRS Return or Report - IRS form 990 (excluding Schedule B), 990EZ (excluding Schedule B), 990PF, 1041, 1120 or other, must be attached if required by

the IRS. If the organization did not file a federal return or report, attach explanation. An annual financial report submitted without the required federal return or report is incomplete.

4. Audited Financial Statements must be attached by a public charity if contributions exceeded $300,000 or if the public charity raised contributions in

excess of $25,000 through the services of professional fund-raiser. The Solicitation for Charity Act defines "contributions" to include the gross amounts of cash donations as well as gross sums paid by the public for merchandise, special events, rights or services of the organization. (A complete definition of "contribution" under the Solicitation for Charity Act is shown on the back of these instructions.) An annual financial report without required audited financial statements is incomplete.

5. Form IFC - Report of Individual Fundraising Campaign - If the organization used a paid professional fund-raiser, a separate Form IFC is required for each

campaign, and each must be signed by both the professional fund-raiser and an officer or director of the organization. An annual financial report without the required Form IFC is incomplete.

6. Simplified Filing Option for Small Organizations:

Soliciting Organizations with gross contributions and assets of $25,000 or less during the fiscal year may file an AG990-IL with all required signatures, disclosing only total revenue, total expenditures, and assets at the fiscal year end (Line A, G and O of the AG990-IL). A $15 annual report filing fee is due only if gross contributions were more than $15,000. Trust Organizations registered solely under the Charitable Trust Act with gross revenue and assets of $25,000 or less during the fiscal year may file an AG990-IL with all required signatures, disclosing only total revenue, total expenditures, and assets at the fiscal year end (Line A, G and O of the AG990-IL). A $15 annual report filing fee is not due. 60 DAY EXTENSION and LATE REPORT FILING FEES: A 60 day extension will be granted only upon the filing of a written request with the Attorney General prior to the report due date. If a proper and complete annual report (AG990-IL with all required attachments and applicable fees) or a written extension request is not received prior to the due date, a $100 late report filing fee (checks payable to the AIllinois Charity Bureau Fund@) is required by Illinois law. The report cannot be accepted and will not be considered filed if it is late and the late fee is not paid. Submit the complete annual financial report (AG990-IL with all required attachments and applicable fees) or written extension request to: OFFICE OF THE ATTORNEY GENERAL CHARITABLE TRUST BUREAU ATTN: ANNUAL REPORT SECTION 100 WEST RANDOLPH STREET, 11th FLOOR CHICAGO, ILLINOIS 60601-3175 (312) 814-2595

Section 1(b) of the Solicitation for Charity Act defines contributions as follows: "Contribution." The promise or grant of any money or property of any kind or value, including the promise to pay, except payments by union members of an organization. Reference to the dollar amount of "contributions" in this Act means in the case of promises to pay, or payments for merchandise or rights of any other description, the value of the total amount promised to be paid or paid for such merchandise or rights and not merely that portion of the purchase price to be applied to a charitable purpose. Contribution shall not include the proceeds from the sale of admission tickets by any not-for-profit music or dramatic arts organization which establishes, by such proof as the Attorney General may require, that it has received an exemption under Section 501(c)(3) of the Internal Revenue Code [26 U.S.C. @ 501 et seq.] and which is organized and operated for the presentation of live public performances of musical or theatrical works on a regular basis. For purposes of this subsection, union member dues and donated services shall not be deemed contributions. (225 ILCS 460/1(b))

Part V Lines W, X, Y Program Service Codes:

Charitable activity code numbers (select up to three codes which best describe the activity and/or the program service for which your organization expends funds). Enter in Part V of the first page of the AG 990-IL. Enter first the code which most accurately identifies you.

SCHOOLS 001 Pre-School 002 Elemcntary or High Schools 003 College & Universities 004 Trade Schools, Vocational Schools & Job Training PUBLIC EDUCATION OTHER THAN SCHOOLS 010 Public Education by Mail 011 Seminars and Conferences 012 Other Educational Materials for the Public RELIGIOUS ACTIVITIES 020 Church, Synagogue, etc. 021 Missionary Activities CULTURAL AND HISTORICAL 030 Performing Arts (Ballet, Symphony, Theatre) 031 Art and/or Literature 032 Museum 033 Library 034 Historical Societies RECREATIONAL & SOCIAL ACTIVITIES 040 Youth 041 Adult 042 Music Groups & Youth Bands 043 Youth Clubs (i.e. Boy Scouts, Girl Scouts, 4-H, Boys Club, etc.) 044 Community Recreational facilities RESEARCH 050 Scientific Research 051 Heart Disease Research 052 Cancer Research 053 Other Medical and Disease Research HEALTH FACILITIES 060 Hospitals 061 Nursing Homes 062 Health Clinics 063 HMO 064 Hospice ANIMAL WELFARE 070 Animal Shelter, Humane Society and/or Anti-cruelty Society 071 Wildlife Preservation & Shelter for Wildlife ENVIRONMENT 080 Preservation & Conservation of Natural Resources 081 Prevention of Pollution CIVIC ACTIVITIES 090 Legal Services and legalAid 091 Civil Rights Activities

PUBLIC POLICY 100 Legislative and Political Activities 101 Lobbying & Advocacy 102 Consumer Interest Group (non-education) 103 Peace 104 Other Public Policy HUMAN SERVICES 110 Day Care Centers 111 Family and Individual Services 112 Neighborhood and Community Development 113 Nursing Services (i.e. Home Care) 114 Programs for Minority Advocacy 115 Programs for Needy Children 116 Rescue and Emergency Service 117 Services for the Aged 118 Services for Alcohol or Drug Abuse 119 Services for Blind Adults 120 Services for Blind Children 121 Services for Developmentally Disabled Adults 122 Services for Developmentally Disabled Children 123 Services for Handicapped Adults 124 Services for Handicapped Children 125 Services for the Hearing Impaired 126 Services for the Poor 127 Services for Veterans HOUSING 130 Housing for Youth 131 Housing for the Poor 132 Housing for the Aged 133 Women Shelter 134 Housing for the Disabled BENEFITTING PUBLIC SAFETY EMPLOYEES & FAMILY 140 Firemen & Families 141 Law Enforcement Personnel & Families ACTIVITIES INVOLVING OTHER ORGANIZATIONS 150 Grants to Other Charitable Organizations 151 Fumished Services or Facilities to Other Organizations 152 Umbrella Parent Organization OTHER PROGRAM SERVICES 200 Scholarships and Student loans MISCELLANEOUS PROGRAM SERVICES 300 (Write in Description)

Вам также может понравиться

- Bloomberg 2012Документ316 страницBloomberg 2012josephlordОценок пока нет

- UFCW 1776 2012 Financials Wendell YoungДокумент38 страницUFCW 1776 2012 Financials Wendell YoungbobguzzardiОценок пока нет

- Philantropic IntermediariesДокумент44 страницыPhilantropic IntermediariesSofiaОценок пока нет

- Center For Medical Progress California RegistrationДокумент10 страницCenter For Medical Progress California RegistrationelicliftonОценок пока нет

- Clinton Foundation MasterДокумент42 страницыClinton Foundation MasterNika Knight100% (2)

- Notes On Non-Profit OrganizationsДокумент6 страницNotes On Non-Profit OrganizationsJonathanTipayОценок пока нет

- 26 USC 170 - CharitableДокумент6 страниц26 USC 170 - Charitablehelpinghandoutreach100% (1)

- 07 Jul2014 GSДокумент80 страниц07 Jul2014 GSmiguelplenoОценок пока нет

- Finance Fundamentals for Nonprofits: Building Capacity and SustainabilityОт EverandFinance Fundamentals for Nonprofits: Building Capacity and SustainabilityОценок пока нет

- Download Form 990 for Don and Mary Mitchell FoundationДокумент1 страницаDownload Form 990 for Don and Mary Mitchell FoundationSarah SportingОценок пока нет

- Instructions For Form 1099-MISC: Future DevelopmentsДокумент9 страницInstructions For Form 1099-MISC: Future Developmentspiz84Оценок пока нет

- Fundraising Plan Template GuideДокумент3 страницыFundraising Plan Template GuideHari Sandeep ReddyОценок пока нет

- Form 990 HighlightsДокумент10 страницForm 990 HighlightsValerie F. LeonardОценок пока нет

- Tax2 Bar QsДокумент7 страницTax2 Bar QsAlex RabanesОценок пока нет

- Lecture 4 - Project Proposal Writing and RESOURCE MOBILIZATIONДокумент23 страницыLecture 4 - Project Proposal Writing and RESOURCE MOBILIZATIONJuliet Kabahenda100% (1)

- Post Event PPT-1Документ33 страницыPost Event PPT-1gemmahagan920% (1)

- Fundraising For NGOsДокумент12 страницFundraising For NGOsyammu86Оценок пока нет

- Charitable organizations annual financial report instructionsДокумент9 страницCharitable organizations annual financial report instructionsMary GallagherОценок пока нет

- Jewish Guild For The Blind 2008 TaxesДокумент77 страницJewish Guild For The Blind 2008 TaxesSteven ThrasherОценок пока нет

- Jewish Guild For The Blind 2010 TaxesДокумент92 страницыJewish Guild For The Blind 2010 TaxesSteven ThrasherОценок пока нет

- Clinton Foundation Revised Filing 2013Документ108 страницClinton Foundation Revised Filing 2013Daily Caller News FoundationОценок пока нет

- Williams CFE SeptДокумент7 страницWilliams CFE SeptKenneth Ryan JamesОценок пока нет

- Period Covered Filing DeadlineДокумент10 страницPeriod Covered Filing DeadlineHaftari HarmiОценок пока нет

- Reporting Requirements For Charities and Not For Profit OrganizationsДокумент15 страницReporting Requirements For Charities and Not For Profit OrganizationsRay Brooks100% (1)

- The Delta Chi Fraternity, IncДокумент4 страницыThe Delta Chi Fraternity, IncKevin CammОценок пока нет

- Question #1: (AICPA.110589FAR)Документ5 страницQuestion #1: (AICPA.110589FAR)iceman2167Оценок пока нет

- Annual Form 990 Filing Requirements For Tax-Exempt OrganizationsДокумент2 страницыAnnual Form 990 Filing Requirements For Tax-Exempt OrganizationsAngalakurthy Vamsi KrishnaОценок пока нет

- Instructions for Form 1099-MISCДокумент10 страницInstructions for Form 1099-MISCFrancis Wolfgang UrbanОценок пока нет

- Ohio Charitable Trust Act Information SheetДокумент1 страницаOhio Charitable Trust Act Information SheetMary GallagherОценок пока нет

- Southeast Missouri (SEMO) Drug Task Force (2012)Документ3 страницыSoutheast Missouri (SEMO) Drug Task Force (2012)raydownsrftОценок пока нет

- Fomtnp RRF 2015Документ2 страницыFomtnp RRF 2015L. A. PatersonОценок пока нет

- NCJC 561348186 - 201112 - 990Документ30 страницNCJC 561348186 - 201112 - 990A.P. DillonОценок пока нет

- Caa RRF 2014Документ1 страницаCaa RRF 2014L. A. PatersonОценок пока нет

- SCC RRF 2005Документ3 страницыSCC RRF 2005L. A. PatersonОценок пока нет

- BSHS373 BSHS 373 Week 3 Individual Assignment Accounting Short Answer QuestionsДокумент8 страницBSHS373 BSHS 373 Week 3 Individual Assignment Accounting Short Answer QuestionsTasha Thatruth TalbertОценок пока нет

- Nyrr 2010Документ89 страницNyrr 2010Steven ThrasherОценок пока нет

- ICIRR Money and OrganizationsДокумент73 страницыICIRR Money and OrganizationsOmar Jonathan Pérez MoralesОценок пока нет

- I. Taxation & Tax Rebates For Donors: F & R I P N - P O IДокумент19 страницI. Taxation & Tax Rebates For Donors: F & R I P N - P O IdpfsopfopsfhopОценок пока нет

- Public Accounts 2010-2011 Saskatchewan Government Details of Revenue & ExpensesДокумент277 страницPublic Accounts 2010-2011 Saskatchewan Government Details of Revenue & ExpensesAnishinabe100% (1)

- 2010 LM-2 (AFSCME Council 5)Документ28 страниц2010 LM-2 (AFSCME Council 5)Jonathan BlakeОценок пока нет

- Finals ReviewerДокумент9 страницFinals ReviewerAira Jaimee GonzalesОценок пока нет

- CDC Director Thomas Frieden, COO Sherri Berger apparently covering-up misappropriated $3.33 million awarded to scandal-ridden Chicago nonprofit whose corporate treasurer was a career CDC executive; correspondence to date (8/30/12)Документ27 страницCDC Director Thomas Frieden, COO Sherri Berger apparently covering-up misappropriated $3.33 million awarded to scandal-ridden Chicago nonprofit whose corporate treasurer was a career CDC executive; correspondence to date (8/30/12)Peter M. HeimlichОценок пока нет

- Tax Deductions Under Section 80 GGBДокумент8 страницTax Deductions Under Section 80 GGBAnamika VatsaОценок пока нет

- LACMA 990 Tax Form 2011Документ79 страницLACMA 990 Tax Form 2011Shane FerroОценок пока нет

- Charitable Obligations of The WalrusДокумент47 страницCharitable Obligations of The WalrusCANADALANDОценок пока нет

- Responsive Document - CREW: IRS: Regarding 501c Correspondence and Work Plan - 3/11/14Документ41 страницаResponsive Document - CREW: IRS: Regarding 501c Correspondence and Work Plan - 3/11/14CREWОценок пока нет

- Public Accounts 2011-2012 Saskatchewan Government Details of Revenue & ExpensesДокумент291 страницаPublic Accounts 2011-2012 Saskatchewan Government Details of Revenue & ExpensesAnishinabe100% (1)

- Fomtnp RRF 2013Документ2 страницыFomtnp RRF 2013L. A. PatersonОценок пока нет

- Tax on NGOs, Charities and ClubsДокумент5 страницTax on NGOs, Charities and ClubsSaneej SamsudeenОценок пока нет

- Accounting For Fiduciary Activities - Agency and Trust FundsДокумент44 страницыAccounting For Fiduciary Activities - Agency and Trust Fundsመስቀል ኃይላችን ነውОценок пока нет

- Annual Form 990 Filing Requirements For Tax-Exempt OrganizationsДокумент2 страницыAnnual Form 990 Filing Requirements For Tax-Exempt OrganizationsmwandrusОценок пока нет

- US Internal Revenue Service: I1099msc - 2000Документ6 страницUS Internal Revenue Service: I1099msc - 2000IRSОценок пока нет

- Clinton Foundation Before NY StateДокумент99 страницClinton Foundation Before NY StateDaily Caller News FoundationОценок пока нет

- Detailed Chart of AccountsДокумент7 страницDetailed Chart of AccountsarthurmathieuОценок пока нет

- Audit of Trusts and Societies for Tax ComplianceДокумент17 страницAudit of Trusts and Societies for Tax ComplianceTACS & CO.Оценок пока нет

- Nonprofit Law in The Philippines Council On FoundationsДокумент1 страницаNonprofit Law in The Philippines Council On Foundationsemployee assistanceОценок пока нет

- Annual Report Small CooperativeДокумент6 страницAnnual Report Small CooperativeGift MesaОценок пока нет

- Ch4 SmithvilleДокумент7 страницCh4 SmithvilleLica Dapitilla Perin33% (3)

- Ag990 AnnualreportДокумент2 страницыAg990 AnnualreportDaniel_Johnson_1322Оценок пока нет

- Deduction 80gga by Anmol Gulati 2013360 Mcom PDFДокумент18 страницDeduction 80gga by Anmol Gulati 2013360 Mcom PDFAnmol GulatiОценок пока нет

- Silicon Valley Community Foundation 2009 990Документ220 страницSilicon Valley Community Foundation 2009 990TheSceneOfTheCrime100% (1)

- NCCF 990Документ235 страницNCCF 990Anita LiОценок пока нет

- Nonprofit Law in The Philippines: International Center For Not-for-Profit Law Lily LiuДокумент15 страницNonprofit Law in The Philippines: International Center For Not-for-Profit Law Lily LiuAlexaОценок пока нет

- LLC Franchise Tax Board of CA InfoДокумент5 страницLLC Franchise Tax Board of CA InfoLeah WilsonОценок пока нет

- Public Accounts 2013-14 SaskatchewanДокумент270 страницPublic Accounts 2013-14 SaskatchewanAnishinabeОценок пока нет

- Higher Ed Financial Transparency BillДокумент2 страницыHigher Ed Financial Transparency BillmelissamattisonОценок пока нет

- The Law of Tax-Exempt Healthcare Organizations 2016 SupplementОт EverandThe Law of Tax-Exempt Healthcare Organizations 2016 SupplementОценок пока нет

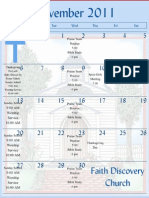

- November 2011Документ1 страницаNovember 2011Daniel_Johnson_1322Оценок пока нет

- October 2011Документ1 страницаOctober 2011Daniel_Johnson_1322Оценок пока нет

- Charity or LoveДокумент3 страницыCharity or LoveDaniel_Johnson_1322Оценок пока нет

- Constitution (Active) Letter SizeДокумент8 страницConstitution (Active) Letter SizeDaniel_Johnson_1322Оценок пока нет

- August 2011 Calendar FDCДокумент1 страницаAugust 2011 Calendar FDCDaniel_Johnson_1322Оценок пока нет

- Ag990 AnnualreportДокумент2 страницыAg990 AnnualreportDaniel_Johnson_1322Оценок пока нет

- Constitution (Active) Letter SizeДокумент8 страницConstitution (Active) Letter SizeDaniel_Johnson_1322Оценок пока нет

- Church Transformation by Paul BordenДокумент12 страницChurch Transformation by Paul BordenDaniel_Johnson_1322Оценок пока нет

- The Champion: 2020 High School Football PreviewДокумент17 страницThe Champion: 2020 High School Football PreviewDonna S. SeayОценок пока нет

- Angela Schifani ResumeДокумент1 страницаAngela Schifani Resumeapi-253359553Оценок пока нет

- Fundraising ProjectДокумент29 страницFundraising ProjectMCОценок пока нет

- Inspire Change and Build a Better Future with UpliftConnectДокумент34 страницыInspire Change and Build a Better Future with UpliftConnectshounik joshiОценок пока нет

- Northside Achievement Zone - Chief Advancement Officer - Position ProfileДокумент12 страницNorthside Achievement Zone - Chief Advancement Officer - Position ProfileLars LeafbladОценок пока нет

- Guia TP2018Документ22 страницыGuia TP2018Apuntes Isi Utn-frreОценок пока нет

- 2022 Ndaga Ed Job DescriptionДокумент2 страницы2022 Ndaga Ed Job Descriptionapi-522547631Оценок пока нет

- 162:dharma Tanna: MET Institute of Management Prof. Shannon Sir Presented by 144: Shweta ShahДокумент15 страниц162:dharma Tanna: MET Institute of Management Prof. Shannon Sir Presented by 144: Shweta Shahyogeshdhuri22Оценок пока нет

- MCF Yellow Book V9 - WEBДокумент19 страницMCF Yellow Book V9 - WEBLeonardo BorgesОценок пока нет

- Director Development Marketing Arts in Seattle WA Resume Amanda BakkeДокумент2 страницыDirector Development Marketing Arts in Seattle WA Resume Amanda BakkeAmandaBakkeОценок пока нет

- Andersons Prom Planner PDFДокумент24 страницыAndersons Prom Planner PDFongchamchi96Оценок пока нет

- This Year's Best Discount Is Now Open!: Home Sample Proposals How To Write Proposals More Resources AboutДокумент8 страницThis Year's Best Discount Is Now Open!: Home Sample Proposals How To Write Proposals More Resources AboutAlemat RedaeОценок пока нет

- OneCause Guide To Nonprofit Event Marketing EBДокумент16 страницOneCause Guide To Nonprofit Event Marketing EBAlexandra GonzálezОценок пока нет

- 1 1 Discussion - EditedДокумент4 страницы1 1 Discussion - EditedProfessor MutaliОценок пока нет

- CMIS351v12 - Ivey Publishing - Case - Calgary Drop in Centre - Product No 9B17E003 - ReadingДокумент9 страницCMIS351v12 - Ivey Publishing - Case - Calgary Drop in Centre - Product No 9B17E003 - ReadingAfra AbiyatОценок пока нет

- Claremont COURIER 10.27.10Документ28 страницClaremont COURIER 10.27.10Claremont CourierОценок пока нет

- PLANNING GUIDE FOR EFFECTIVE ROTARY CLUBSДокумент8 страницPLANNING GUIDE FOR EFFECTIVE ROTARY CLUBSAnonymous qplfFzОценок пока нет

- Stay Relevant by Almabase PDFДокумент48 страницStay Relevant by Almabase PDFSri Lakshmi Swetha ViriyalaОценок пока нет

- WK1 - MTTI Budgets Pack ExcelДокумент7 страницWK1 - MTTI Budgets Pack ExcelBinay BhandariОценок пока нет

- Thanks For EverythingДокумент17 страницThanks For Everythingnfpsynergy100% (4)

- Yummy N TummyДокумент27 страницYummy N TummyMa Jemaris SolisОценок пока нет

- Format Phillip GrahamДокумент2 страницыFormat Phillip Grahamcox_brandoОценок пока нет