Академический Документы

Профессиональный Документы

Культура Документы

Audit Working Papers

Загружено:

Manisha LilaniИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Audit Working Papers

Загружено:

Manisha LilaniАвторское право:

Доступные форматы

THE AUDITING STANDARDS

ISA 230, Audit Documentation (Revised)1 contains the set of standards that deal with working papers. These standards2 are as follows: The auditor should prepare, on a timely basis, audit documentation that provides:

a. a sufficient appropriate record of the basis for the auditors report, and b. evidence that the audit was performed in accordance with ISAs and applicable legal and regulatory requirements.

The auditor should prepare the audit documentation so as to enable an experienced auditor, having no previous connection with the audit, to understand: a the nature, timing, and extent of the audit procedures performed to comply with ISAs and applicable legal and regulatory requirements b the results of the audit procedures and the audit evidence obtained, and c significant matters arising during the audit and the conclusions reached. In documenting the nature, timing, and extent of audit procedures performed, the auditor should record the identifying characteristics of the specific items or matters being tested. The auditor should document discussions of significant matters with management and others on a timely basis. If the auditor has identified information that contradicts or is inconsistent with the auditors final conclusion regarding a significant matter, the auditor should document how the auditor addressed the contradictions or inconsistency in forming the final conclusion. Where, in exceptional circumstances, the auditor judges it necessary to depart from a basic principle or an essential procedure that is relevant in the circumstances of the audit, the auditor

should document how the alternative audit procedures performed achieve the objective of the audit, and, unless otherwise clear, the reasons for the departure. In documenting the nature, timing, and extent of audit procedures performed, the auditor should record: a who performed the audit work and the date such work was completed, and b who reviewed the audit work and the date and extent of such review3. The auditor should complete the assembly of the final audit file on a timely basis after the date of the auditors report. After the assembly of the final audit file has been completed, the auditor should not delete or discard audit documentation before the end of its retention period. When the auditor finds it necessary to modify existing audit documentation or add new audit documentation after the assembly of the final file has been completed, the auditor should, regardless of the nature of the modifications or additions, document: a when and for whom they were made, and (where applicable) reviewed b the specific reasons for making them, and c their effect, if any, on the auditors conclusions. When exceptional circumstances arise after the date of the auditors report that require the auditor to perform new or additional audit procedures, or that lead the auditor to reach new conclusions, the auditor should document: a the circumstances encountered b the new or additional audit procedures performed, audit evidence obtained, and conclusions reached, and c when and by whom the resulting changes to audit documentation were made, and (where applicable) reviewed. These standards guide the auditor to produce audit documentation that is of an acceptable standard. Understanding and applying the standards will protect the auditor from unwelcome and unnecessary litigation. ISA 230 (Revised) is more comprehensive than its predecessor and is likely to prove very useful.

AUDIT WORKING PAPERS

y Purpose y Importance of Working Papers y Confidential Nature of Working Papers y Purposes Served by Working Papers y Planning and Preparing Working Papers y Principles and Methods of Documentation y Working Paper Format y Contents y Specific Standards for Each Workpaper y Review of Audit Workpapers y Arranging and Filing y Standardized Workpapers y Retirement of Audit Workpapers y Special Project Workpapers

Purpose

1. It prescribes the standards and procedures for the preparation, contents, use, retention, and disposition of audit working papers.

2. The diversity of audit assignments does not permit the establishment of a single system or design of working papers to be used throughout the auditor's office but conformity as to quality and standards should exist.

Importance of Working Papers

1. Working papers are instruments vital to the successful accomplishment of all audit assignments performed. The working papers provide documented evidence of an examination and evaluation and provide a connecting link between the work which is performed and the final audit report. Hence, their importance cannot be overly emphasized.

2. To a major extent, every auditor is judged by his skill and ability in preparing working papers. When working papers are prepared in good form with proper attention to layout, design, and legibility, with complete headings, explanations of sources, and verification of work performed, they create a feeling of confidence in the ability of the staff member. Working papers should always convey an impression of system and order and conscientious attention to detail, coupled with a clear distinction between the important and the trivial.

3. Another test of good working papers occurs when it is necessary for one staff member to leave

4. A partially completed assignment and turn it over to another staff member. If the latter can proceed without confusion then the working papers have stood the critical test of being able to stand on their own.

5. Every auditor will be expected to continuously strive for the highest standards of excellence in the preparation of working papers.

Confidential Nature of Working Papers

1. Information obtained through audits should be treated as confidential not only as to outsiders but also as to employees of the entity audited who would not otherwise have access to the information. Further, the working papers include information concerning the scope of the examination and the extent of selective tests made, and this information should not be available to the staff of the audited entity. Therefore, audit working papers should be safeguarded at all times against the possibility of their being examined by unauthorized persons.

2. Client or outside agency request to review Audit and Management Services work papers must be approved by an appropriate official.

Purposes Served By Work Papers

1. Audit working papers serve four major purposes: A. They constitute a permanent record of the objectives and scope of the audit, as well as the work performed during the audit. Work papers organize and coordinate all phases of the audit. B. They contain the back-up material in support of the audit findings, conclusions, opinions, and comments. C. They contain the basic material from which the audit report is prepared. D. They reflect the quality and reliability of the work performed by the auditor and substantiate and explain in detail the opinions and findings presented to University management.

2. Working papers have a number of additional uses both during and after the audit. These are to control audit progress by showing the auditor what audit procedures have been completed and what audit procedures have not been completed. Working papers also provide: A. A basis for study of patterns and trends. B. Aid in the internal audit staff's professional development. C. Detailed supporting material for use in discussion with operating personnel. D. A source of evidence in litigation and in administrative actions. E. A basis for supervisory review and evaluation of audit performance. F. A permanent record for use in planning and carrying out future audits. G. Demonstrate that auditors have complied with the Standards for the Professional Practice of Internal Auditors.

Planning and Preparing Working Papers

1. The preparation of audit working papers must be planned. An audit program provides much help in the planning of working papers. The program reflects the objectives of the audit and the nature of the information required. Thus, many of the areas of inquiry are identified as well as the general types of working papers that will be needed to record the work performed in those areas. However, methods of operations are never precisely the same in two "like" organizational elements, nor are the circumstances under which the operations are carried out identical. For this reason, audits of similar organizations and activities should not be performed exactly alike nor should stereotyped working papers be prepared.

2. Each section of the working papers must be planned to satisfy some requirement of the audit program. When the audit is completed, the working papers should contain data needed to fulfill all of the objectives of the audit. Adequate planning of working papers requires the auditor to:

A. Determine the nature and extent of the information that will be needed to comply with the audit objectives and to plan the format and preparation of working papers that will be needed to record this information. B. Index and file all work papers according to Audit Workpaper Checklist. C. Devise legends (symbols) and a method of cross-referencing. Where applicable, the standard tickmarks developed by Audit and Management Services should be used.

3. Thought should be given in preparation of working papers to their potential use as exhibits in an audit report.

Principles and Methods of Documentation

1. Working papers are the basis on which the entire audit rests. Since these papers are, in fact, the documentation of the audit, thoroughness in their preparation is essential. 2. Describing the Work Performed. By fully describing the work you have performed in your working papers, you are able to render a complete accounting of the scope and depth of your coverage. Each working paper should identify the following: A. Scope. Your conclusions usually result from selective tests. By clearly showing the scope of the work performed, you are able to support your conclusions and where probability sampling is used, support the projection of conclusions drawn from selective tests to the entire subject area under audit. In the examination of documents, the scope must identify the size of the sample, the universe from which the sample is drawn, the method of selection, and the basis for these decisions. When sampling methods are used, the sampling plan must be carefully explained.

Working Paper Format

1. The diversity of audit assignment prevents the establishment of a single system or design of working papers to be used. Therefore, a uniform working paper format may not be

used but work papers for functional areas such as cash receipts should display conformity in various types of audits.

2. Workpapers may be in the form of paper, tapes, disks, diskettes, films, etc. There should be backup copies of electronically generated working papers. The backup copies should not be stored with the original copies.

Contents

Each audit working paper must be headed with the following information: The name of the client The period covered by the audit The subject matter The file reference The initials (signature) of the member of staff who prepared the working paper, and the date on which it was prepared In the case of audit papers prepared by client staff, the date the working papers were received, and the initials of the audit team member who carried out the audit work The initials of the member of staff who reviewed the working papers and the date on which the review was carried out Each audit paper should meet the characteristics of a good working paper, as detailed later in this article.

Specific Standards for Each Workpaper

1. Descriptive Heading. Each working paper shall be fully identified by a heading at the top center containing: A. Name of the University. B. Name of the department of activity being audited.

C. Subject matter of information presented (specific activity audit procedure or other subdivision of the functional area to which the working paper pertains).

2. Auditor's Name and Date. Each working paper shall contain the initials of the staff member preparing it and the date of preparation. This information should be placed in the space provided in the upper right-hand corner of the standard working paper. These dates will correspond to the sign-off procedures used for the audit program.

3. Source of Data. Source of information appearing on the working paper should be shown in the upper left corner of the working paper. If information is supplied by operating personnel or results from your observation, show this in the working paper. (Use initials PBC-Prepared by Client). If you prepare information from records on file, identify these records. 4. Purpose and Scope of Audit Work Performed. The purpose of each audit working paper is to be specifically stated unless otherwise clearly evident from its title.

5. Auditors Verification Procedures. The nature of verification work performed by the staff member must be disclosed for each working paper. Mere copying of figures from the records is not, in itself, verification. The verification procedures performed must be described in such a manner so as to clearly show what verification procedures were accomplished. Colored tick marks serve this purpose well when adequately explained under the "legend".

6. Auditor's Conclusions. Working papers must contain a conclusion with respect to each objective of the audit whether or not adverse conditions are disclosed. The formulation of conclusions is one of the most important functions of the auditor. The conclusions are the basis for the recommendations. They must never be a product of a predisposed mind. All evaluations should be made with an attitude of professional skepticism. They must spring from information contained in the auditor's working papers. Conclusions are trustworthy only if they are reasonable deductions from relevant information developed during the audit. They are strong only to the extent to which they are buttressed by supporting data.

7. Evidence of Review. Working papers must contain evidence of review by supervisory personnel. The reviewer's satisfaction with work performed and agreement with conclusions reached should be documented. The evidence of review can be documented by (1) initialing and dating each workpaper or (2) initialing and dating the audit binder that contains the workpapers. A combination of methods 1 & 2 are also permissible. In addition, each reviewer shall prepare Audit Workpaper Review notes which will document any questions raised by the reviewer. Ordinarily, the reviewer should not make any changes in the working papers. The review notes should be discussed between the reviewer and the auditor to answer the questions raised by the reviewer. Any corrections made as a result of this review should be noted on the workpaper. The review notes can and should be a valuable tool in supervising and training our auditors.

8. Other Standards. A. Working papers should be prepared on the front side only. B. To avoid confusion and complications in filing, only one subject should be dealt with on a working paper. C. Index numbers are to be indicated on the lower center of the page. The index number should be placed on the outside of folded workpapers. The papers should be indexed according to the Audit Workpaper Checklist. When numbering a given area consecutive numbers are to be used (i.e. 2-1, 2-2, 3-1, 3-2, etc.). D. Indexing audit fieldwork workpapers should contain the objective letter between the index number (20) and the workpaper number (i.e. 20-F-1, 20-F-2, 20-G-1, 20-G-2, etc.) E. Working papers should leave no unanswered questions, open points, incomplete notes or other evidence of unfinished work. Working papers should be legible and neat. Sloppy workpapers may lose their worth as documented evidence. G. Where necessary, workpapers should be cross-referenced to the appropriate source. H. For electronic files, the file naming standards listed in Exhibit 8-8 should be utilized.

Review of Audit Workpapers 1. An important standard applicable to all of our work is that the evidence of work performed is to be reviewed on all assignments. The review process is important and must not be carried out in a superficial or perfunctory manner.

2. The following instructions apply to all of our audit work, including accounting system evaluations, surveys, and special studies.

A. Purpose of review of audit workpapers. Audit working papers will be reviewed to assure due regard has been given to such factors as: (1) Adequacy of audit coverage, including compliance with the audit program and any other specific instructions given. (2) Accuracy, reliability, relevancy and adequacy of the work performed and the acceptability of the related working papers as evidence of such work. (3) Validity, reasonableness, and adequacy of working paper support for the findings, conclusions, and recommendations made. (4) Development into findings of weakness in procedures or other deficiencies disclosed in the working papers, or inclusion in the working papers of the reasons why findings were not developed. (5) Conformity with standards and requirements as set forth in this chapter. (6) Due professional care was exercised by the Auditors assigned to the audit.

B. Responsibility for review prior to issuance of audit report: All working papers will be reviewed for compliance with our prescribed standards for audit working papers.

Arranging and Filing

1. Working papers for each audit will be retained in two standard files. A. Permanent File, where warranted. B. Current File.

A. Permanent File. This file provides information which may be used to advantage in conducting subsequent examinations relating to the same department or activity. It also supplies new staff members, supervisory personnel and others with a summary of the auditer's current policies and procedures and organization structure. It should be maintained on a current basis by updating the file as additional information is obtained as a result of the audit. This file is predominantly used for the annual reviews performed by our office.

B. Current File. This file consists of working papers containing information primarily related to the purposes of the current audit. The organization of the files should be tailored to each specific assignment. The primary test is convenience in use and ease with which material can be located and reviewed. Generally, audit work papers should be filed as follows:

A. Planning Folder B. Preliminary Survey Work papers C. System Understanding Work papers D. Audit Fieldwork Papers Audits involving several organizational elements and functional areas may require that the current file be divided into subsections for each of the principal segments of the audit. Generally, in more complex audits, individual segment section files will be set up for the following: A. Each organizational unit to be audited. B. Each major functional area within such units to be reviewed during the audit.

Standardized Workpapers

The following standardized workpapers should be used during audit assignments. 1. Audit Workpaper Checklist - The Audit Workpaper Checklist is to be completed by the auditor in-charge and approved by the Director. The checklist is used to ensure that the standard segments of each audit have been performed.

2.

Matters For Attention of Director - The Matters for Attention of Director is to be completed by the auditor-in-charge of each engagement. Administratively, the form is used to record, the auditors assigned to the review, client personnel participating in the review, and any major concern noted during the review. (See Exhibit 10-2).

3. Audit Findings - During each phase of the audit (i.e. preliminary survey, systems understanding, and fieldwork), potential findings should be documented on finding sheets. The auditor-in-charge should submit the finding sheets to the department head, discuss the findings with the department head (via meeting, phone call, e-mail, etc.), and document discussions on the finding sheets At the conclusion of each phase, findings will be reviewed by the Audit Director.

Retirement of Audit Workpapers

1. Permanent File. Review this file and update it before the completion of each audit. To keep the active file from becoming too bulky, noncurrent material worth retaining should be removed, identified, reasons for removal noted and transferred to an "Inactive" permanent file. Noncurrent material not worth retaining should be removed and referred to the Director.

2. Current Working Papers Files. Upon completion of an audit, working papers for the prior audit should be discarded. However, prior working papers relating to an objective not performed in the current audit should be carried forward to the current working papers file. Also, care should be taken to ensure that all relevant material in the preliminary survey has been carried forward to the current working papers.

Special Project Workpapers

When Audit and Management Services is asked to perform a review which has not been scheduled as part of the audit plan approved by the Audit Committee, the review is called a Special Project.

Special Project requests can come from the Audit Committee, other Board of Visitors Members, the President, University Vice Presidents, and other University Managers. The Director of Audit and Management Services must approve all Special Projects. Due to the inherent nature of a special project, the working papers that must be prepared to complete the project depend upon the objectives of the project. However, regardless of the nature of the project, working papers that document the planning of the engagement, the information or evidence obtained, the conclusions reached, the audit work paper review process, the audit report or memorandum, and subsequent follow-up review, if applicable, should be included in the file. The Audit Workpaper Checklist should be utilized to document the standard workpapers that were completed and those that were not applicable.

Characteristics of a good working paper

On the basis of the discussion above, a good working paper should meet the requirements of ISA 230 by displaying the following characteristics: It should state a clear audit objective, usually in terms of an audit assertion (for example, to ensure the completeness of trade creditors). It should fully state the year/period end (eg 31 October 2006), so that the working paper is not confused with documentation belonging to a different year/period. It should state the full extent of the test (ie how many items were tested and how this number was determined). This will enable the preparer, and any subsequent reviewers, to determine the sufficiency of the audit evidence provided by the working paper. Where there is necessary reference to another working paper, the full reference of that other working paper must be given. A statement that details of testing can be found on another working paper is insufficient. The working paper should clearly and objectively state the results of the test, without bias, and based on the facts documented. The conclusions reached should be consistent with the results of the test and should be able to withstand independent scrutiny. The working paper should be clearly referenced so that it can be filed appropriately and found easily when required at a later date.

It should be signed by the person who prepares it so that queries can be directed to the appropriate person. It should be signed and dated by any person who reviews it, in order to meet the quality control requirements of the review. The reviewer of audit working papers should ensure that every paper has these characteristics. If any relevant characteristic is judged absent, then this should result in an audit review point (ie a comment by the reviewer directing the original preparer to rectify the fault on the working paper).

CONCLUSION

Working papers provide evidence that an effective, efficient, and economic audit has been carried out. They should therefore be prepared with care and skill. They should be sufficiently detailed and complete so that an auditor with no previous experience of that audit can understand the working papers in terms of the work completed, the conclusions reached, and the reasoning behind these conclusions.

Вам также может понравиться

- 10chap Audit Working PapersДокумент10 страниц10chap Audit Working PapersZahar Zahur Kaur Bhullar100% (1)

- Audit Working PapersДокумент5 страницAudit Working PapersDlamini SiceloОценок пока нет

- Audit Working PapersДокумент49 страницAudit Working Paperscgarcias7675% (4)

- 13 Audit Procedure For Manufacturing CompaniesДокумент3 страницы13 Audit Procedure For Manufacturing CompaniesManish Kumar Sukhija67% (3)

- Substantive Test of PPE and Other Noncurrent AssetsДокумент65 страницSubstantive Test of PPE and Other Noncurrent Assetsjulia4razoОценок пока нет

- Inventory Audit Work ProgramДокумент19 страницInventory Audit Work ProgramAdnan MohammedОценок пока нет

- Sample Audit Programs ManualДокумент30 страницSample Audit Programs ManualAldrin Jeff Alejandro Subia100% (3)

- Internal Control and Cash Management Manual and Questionnaires November 1995Документ18 страницInternal Control and Cash Management Manual and Questionnaires November 1995Anonymous VtsflLix1100% (2)

- Audit Manual For CMA FirmsДокумент123 страницыAudit Manual For CMA FirmsSajid Ali100% (1)

- The Operational Auditing Handbook: Auditing Business and IT ProcessesОт EverandThe Operational Auditing Handbook: Auditing Business and IT ProcessesРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- Audit Program-MSBPLДокумент21 страницаAudit Program-MSBPLTasdik MahmudОценок пока нет

- Internal Audit Sample ProblemsДокумент10 страницInternal Audit Sample ProblemsCarson GardnerОценок пока нет

- IIA Working PapersДокумент4 страницыIIA Working Papersboludu100% (1)

- Internal Control QuestionnaireДокумент9 страницInternal Control QuestionnaireEricaОценок пока нет

- Internal Audit Plan Report 2019 - 20 v1.3Документ49 страницInternal Audit Plan Report 2019 - 20 v1.3Toygar SavkinerОценок пока нет

- PSP by AccountsДокумент23 страницыPSP by AccountsatuanainiОценок пока нет

- Ch5 Acc 014 - Audit PlanningДокумент46 страницCh5 Acc 014 - Audit PlanningLouierose Geronimo100% (1)

- Test of Controls and Substantive ProceduresДокумент16 страницTest of Controls and Substantive ProceduresAdeel Sajjad100% (5)

- A. Purpose For Planning The EngagementДокумент5 страницA. Purpose For Planning The EngagementJaniña Natividad100% (2)

- Internal Control Questionnaire For SalesДокумент1 страницаInternal Control Questionnaire For SalesJustine Ann VillegasОценок пока нет

- Audit Working PapersДокумент28 страницAudit Working Papersmoon2fielОценок пока нет

- Audit Program PurchasesДокумент3 страницыAudit Program PurchasesCristina Rosal100% (6)

- Audit Manual Part1Документ250 страницAudit Manual Part1Romer Lesondato100% (2)

- Internal Audit ProceduresДокумент15 страницInternal Audit ProceduresTaremba MushatiОценок пока нет

- Audit Programme 1Документ20 страницAudit Programme 1Neelam Goel0% (1)

- Audit of Cash On Hand and in BankДокумент2 страницыAudit of Cash On Hand and in Bankdidiaen100% (1)

- C.1 AP-2 AR Substantive Audit ProgramДокумент3 страницыC.1 AP-2 AR Substantive Audit Programs1mz100% (4)

- FINANCING CYCLE AuditДокумент12 страницFINANCING CYCLE AuditEl Yang100% (1)

- Livre Hock 2019 English Part 1Документ162 страницыLivre Hock 2019 English Part 1Agrawal Tutor100% (1)

- Audit Working Papers: By: Tariq MahmoodДокумент38 страницAudit Working Papers: By: Tariq MahmoodMazhar Hussain Ch.Оценок пока нет

- Top 10 Internal Audit Interview Questions & AnswersДокумент3 страницыTop 10 Internal Audit Interview Questions & AnswersmedianОценок пока нет

- Working Paper TemplatesДокумент9 страницWorking Paper TemplatesTroisОценок пока нет

- Accounts Receivable, Credit and Collections Audit Report - Sample 2Документ29 страницAccounts Receivable, Credit and Collections Audit Report - Sample 2Audit Department100% (2)

- 2011 11 16 - SMRC - Sales and Marketing - Audit ReportДокумент10 страниц2011 11 16 - SMRC - Sales and Marketing - Audit ReportNayan GuptaОценок пока нет

- Cash Receipts Audit ProgramДокумент2 страницыCash Receipts Audit ProgramVineet Jain100% (3)

- AUDIT PROGRAM For Cash Disbursements 2Документ5 страницAUDIT PROGRAM For Cash Disbursements 2Yvonne Granada0% (1)

- Audit Program Acc. ReceivableДокумент1 страницаAudit Program Acc. ReceivableAdiet D' MatamariesОценок пока нет

- Audit SamplingДокумент10 страницAudit SamplingJayson Manalo GañaОценок пока нет

- Sample Internal Control QuestionnaireДокумент114 страницSample Internal Control QuestionnaireJessa Mae Muñoz0% (2)

- Engagement Letter ExampleДокумент3 страницыEngagement Letter ExamplemerrillvanОценок пока нет

- Chapter 10.audit ProceduresДокумент43 страницыChapter 10.audit Proceduresnychan99100% (10)

- Part I - ICPAU Audit ManualДокумент166 страницPart I - ICPAU Audit Manualsamaan100% (3)

- Audit Program For Inventory Legal Company Name Client: Balance Sheet DateДокумент3 страницыAudit Program For Inventory Legal Company Name Client: Balance Sheet DateHannah TudioОценок пока нет

- 5.0 Audit For InventoriesДокумент20 страниц5.0 Audit For InventoriesChristine JotojotОценок пока нет

- Internal Control InventoryДокумент13 страницInternal Control Inventoryabbyplexx100% (3)

- Audit Program For Inventory RisksДокумент4 страницыAudit Program For Inventory RisksCrystal Chow100% (1)

- Audit PlanningДокумент9 страницAudit PlanninggumiОценок пока нет

- Audit Working Papers-2Документ28 страницAudit Working Papers-2Joseph PamaongОценок пока нет

- Audit Working Paper StandardДокумент15 страницAudit Working Paper StandardYus CeballosОценок пока нет

- Independent Auditor's ReportДокумент5 страницIndependent Auditor's ReportNathan Calms100% (1)

- Audit Procedures For Accounts PayableДокумент3 страницыAudit Procedures For Accounts PayableSweet Emme100% (1)

- Sample Audit ProceduresДокумент44 страницыSample Audit ProceduresNetra Sharma100% (1)

- Physical Inventory Observation ChecklistДокумент10 страницPhysical Inventory Observation Checklistফয়সাল হোসেন50% (2)

- Corruption, Fraud and Its Impact On SocietyДокумент13 страницCorruption, Fraud and Its Impact On SocietyManisha LilaniОценок пока нет

- All About NanotechnologyДокумент18 страницAll About NanotechnologyManisha LilaniОценок пока нет

- Offshore Banking FinalДокумент75 страницOffshore Banking FinalManisha Lilani100% (4)

- Offshore Banking FinalДокумент39 страницOffshore Banking FinalManisha LilaniОценок пока нет

- Frontier Fiesta Association Scholarships: University of Houston Incoming FreshmanДокумент1 страницаFrontier Fiesta Association Scholarships: University of Houston Incoming Freshmanapi-269999191Оценок пока нет

- Read The Five Text Items 1 - 5. Then Read The Headlines A - J. Decide Which Headline A - J Goes Best With Which TextДокумент9 страницRead The Five Text Items 1 - 5. Then Read The Headlines A - J. Decide Which Headline A - J Goes Best With Which TextVeronika HuszárОценок пока нет

- Banking Sector Reforms: by Bhupinder NayyarДокумент18 страницBanking Sector Reforms: by Bhupinder NayyarPraveen SinghОценок пока нет

- Cash Flow StatementДокумент11 страницCash Flow StatementDuke CyraxОценок пока нет

- National Police Commission: Interior and Local Government Act of 1990" As Amended by Republic Act No. 8551Документ44 страницыNational Police Commission: Interior and Local Government Act of 1990" As Amended by Republic Act No. 8551April Elenor Juco100% (1)

- Al Awasim Min Al Qawasim (AbuBakr Bin Al Arabi)Документ199 страницAl Awasim Min Al Qawasim (AbuBakr Bin Al Arabi)Islamic Reserch Center (IRC)Оценок пока нет

- PAS 7 and PAS 41 SummaryДокумент5 страницPAS 7 and PAS 41 SummaryCharles BarcelaОценок пока нет

- Best of Best As of May 15, 2019 330pmДокумент34 страницыBest of Best As of May 15, 2019 330pmBpsmu Rmfb XI100% (1)

- Complaint LettersДокумент3 страницыComplaint LettersPriyankkaa BRОценок пока нет

- Week 4, 5, 6 Adjustments and Financial Statement Prep - ClosingДокумент61 страницаWeek 4, 5, 6 Adjustments and Financial Statement Prep - ClosingAarya SharmaОценок пока нет

- Combizell MHEC 40000 PRДокумент2 страницыCombizell MHEC 40000 PRToXiC RabbitsОценок пока нет

- Cunanan V CA and BasaranДокумент6 страницCunanan V CA and BasaranMarielle ReynosoОценок пока нет

- DENTAL JURIS - Dental Legislation PDFДокумент2 страницыDENTAL JURIS - Dental Legislation PDFIsabelle TanОценок пока нет

- Recio Garcia V Recio (Digest)Документ3 страницыRecio Garcia V Recio (Digest)Aljenneth MicallerОценок пока нет

- How Jesus Transforms The 10 CommandmentsДокумент24 страницыHow Jesus Transforms The 10 CommandmentsJohn JiangОценок пока нет

- The Hamas CharterДокумент16 страницThe Hamas CharterFrancesca PadoveseОценок пока нет

- Vak Dec. '21 PDFДокумент28 страницVak Dec. '21 PDFMuralidharanОценок пока нет

- SEPsim Installation Guide - V2.1Документ12 страницSEPsim Installation Guide - V2.1Shamini GnanasothyОценок пока нет

- 1 3 01 Government InstitutesДокумент6 страниц1 3 01 Government InstitutesRog CatalystОценок пока нет

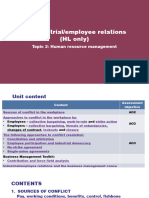

- 2.7 Industrial and Employee RelationДокумент65 страниц2.7 Industrial and Employee RelationadhityakinnoОценок пока нет

- Celebration of International Day For Street ChildrenДокумент3 страницыCelebration of International Day For Street ChildrenGhanaWeb EditorialОценок пока нет

- 86A141FH16-iCare InstallationДокумент26 страниц86A141FH16-iCare Installationaccel2008Оценок пока нет

- SinДокумент26 страницSinAJОценок пока нет

- Homework For Non Current Assets Held For SaleДокумент2 страницыHomework For Non Current Assets Held For Salesebosiso mokuliОценок пока нет

- Sample QP 1 Jan2020Документ19 страницSample QP 1 Jan2020M Rafeeq100% (1)

- Bookkeeping Exercises 2022Документ6 страницBookkeeping Exercises 2022Anne de GuzmanОценок пока нет

- Ess Check ListДокумент2 страницыEss Check ListBabu Viswanath MОценок пока нет

- (DHA-1738) Form 8: Department of Home Affairs Republic of South AfricaДокумент20 страниц(DHA-1738) Form 8: Department of Home Affairs Republic of South AfricaI QОценок пока нет

- Tugas BPFДокумент2 страницыTugas BPFRichard JapardiОценок пока нет

- CHAPTER 7:, 8, & 9 Group 3Документ25 страницCHAPTER 7:, 8, & 9 Group 3MaffyFelicianoОценок пока нет