Академический Документы

Профессиональный Документы

Культура Документы

Rural Mantra

Загружено:

jogipaulИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Rural Mantra

Загружено:

jogipaulАвторское право:

Доступные форматы

AVID Insight

Indias Financial Sector: Chanting the rural mantra

Indias Financial Sector: Chanting the rural mantra

Rural the word has become synonymous with growth in the emerging economies. More so in India, where over 65% of the population even today resides in villages. Hence, it has become imperative to align the nations business agenda along with the needs of this segment. Concurrently, the governments thrust to the development of the rural sector is creating a more favorable landscape for business in the countrys hinterland. Fast Moving Consumer Goods companies led by ITC and HLL, were the first to make a fortune in rural markets. Several major developments have taken place since then in this sector, leading to all types of businesses chanting the rural name as their success mantra. The potential is undeniable; rural India is finally venturing into light after years of abandonment.

A market waiting to happen

70% of Indian villagers do not have bank accounts

Although 70% of Indias villagers do not have bank accounts, financial products are not unknown to them; albeit the sources of supply are mainly informal savings are mostly in the form of gold, whereas loans come from bloodsucking village moneylenders. Taking a leaf out of the FMCG book,

AVID Information Search & Documents

August 2006

AVID Insight

Indias Financial Sector: Chanting the rural mantra

the Indian financial sector has started taking a serious look at low income segments in underbanked markets. The Government of India too, has shown some support in this regard. The Union Budget 2006-07 proposed a number of schemes for rural India, including creation of employment opportunities and a National Rural Health Mission. The government has also instructed banks to extend farm loans at a favorable rate of 7% to bring more farmers under the organized credit net, and take the overall farm credit to Rs. 1, 75,000 crore in 2006-07 (an increase of about Rs. 33,500 crore). According to Dr. Nachiket Mor1, Deputy Managing

Yearly demand for credit estimated at Rs.150,000 crores

Director, ICICI Bank, "The informal credit segment is about US$ 82 billion. Yearly demand for credit is estimated at about Rs 1, 50,000 crore, of which Rs 4,000 crore is actually met." In addition, banks are being asked to bring 50 lakh more farmers into the banking fold. To tap this potential, the RBI is considering other innovative measures like allowing banks to use village moneylenders to reach the rural populace. Moneylenders are said to control a third of all rural loans, and wield considerable strength, given their personal acquaintance with the local population and ubiquitous distribution network. Banks hope to leverage their low cost funds to lend to moneylenders, who can in turn give loans to the rural folk at far lower rates that the usual monstrous

RBI is considering allowing banks to work with village money lenders to reach the rural population

AVID Information Search & Documents

August 2006

AVID Insight

Indias Financial Sector: Chanting the rural mantra

60-70%!

This is also a ploy to bring the

moneylenders under the regulatory purview. That being said, it will be no less than a Herculean task to break the moneylenders stranglehold!

(Rural) Way to go!

Getting the poor to bank and bank profitably is the new motto! Indias largest bank, State Bank of India

SBI has a rural network of 6,600 with 972 specialized branches

(SBI), has a breathtaking rural branch network of 6,600 with 972 specialized branches. These branches have been set up in different parts of the country with the sole purpose of developing agriculture through credit deployment. In addition, SBI has also developed rural agricultural business units, education programmes for local farmers and kisan cards. State Bank of India has gradually evolved to become the leader in agricultural finance with a portfolio of Rs. 18,000 crore in loans to around 50 lakh farmers. One of their recent endeavors is the tie-up with National Agricultural Cooperative Marketing Federation (NAFED) to finance farmers for cultivation of various crops like soyabean, paddy, jute and potato. Private sector banks too, have geared up for a

ICICI Banks adopts the franchisee model for rural operations

piece of the cake. ICICI Bank, the countrys second largest bank, has adopted the franchise model of operation in rural markets. Unconventional indeed! A one man office (known as kendra) in the village forms an interface between the villager and the

AVID Information Search & Documents

August 2006

AVID Insight

Indias Financial Sector: Chanting the rural mantra

Banks products and facilities. Crop loans, housing loans, automobile loans, farm equipment, seed financing and insurance policies are all on offer. This is a scaleable model, says K.V.Kamath2, MD & CEO of ICICI Bank. The number of borrowers has risen from 130 in 2000 to over 42,000 today, and the rural loan book has crossed Rs. 16,000 crore. Whats more, the banks default rate in the rural retail sector is 1 2 % as compared to 2 3% in the rural wholesale sector and 5% for the banking sector as a whole. Other banks like Canara have launched aggressive grass-root level plans, in a bid to achieve 100% financial inclusion in 1,400 villages all over India, which could bring 7 lakh families into their net. Under this programme, every adult member of a rural household in the selected villages would be encouraged to open a 'No Frills' account with minimum entry-level formalities. Having spread their tentacles in urban markets,

Foreign banks villageward

look

foreign Banks like Citibank, HSBC and Standard Chartered are now looking villageward. Citi is reported to be in the hunt for several rural branch licenses. There is a new focus on the SME segment as well.

AVID Information Search & Documents

August 2006

AVID Insight

Indias Financial Sector: Chanting the rural mantra

Other financial products making their way into villages include IFFCO-Tokios weather insurance product, Barish Bima Yojana for farmers in Rajasthan and ICICI Lombards medical insurance scheme Sanjeevini for farmers in Punjab besides commodity futures and weather derivatives. An important shift is underway in banking credit portfolios, which are no longer merely crop loans, but are increasingly used for financing investment. This is a sign of the beginning of maturity in these markets. However, we are still at the tip of the iceberg, and it will take a lot more effort in terms of product innovation, distribution development and awareness generation, before the needs of the rural market are adequately served.

Whither the Regional Rural Bank?

Ironically, as their urban counterparts are marshalling their efforts to penetrate the rural

Shortsighted Govt policy fails to look at the specific needs of regional rural banks

market, the Regional Rural Banks (RRBs) are bowing out. RRBs (also known as Gramin Banks) were set up with the objective of catering to the rural segment. However, they were undone by shortsighted government policy, which failed to take cognizance of their specific needs. Financial liberalization has placed both RRBs and other commercial banks on the same platform. Similar treatment, in terms of regulations, capital adequacy norms, and other compliance requirements, has

AVID Information Search & Documents

August 2006

AVID Insight

Indias Financial Sector: Chanting the rural mantra

been meted out, overlooking the fact that rural banks face hurdles in terms of higher transaction costs and difficult credit deployment and loan recovery. Recently, the government has initiated moves to merge these banks with their sponsor banks; as a result their numbers have quickly dwindled. The roadmap for Indias banking sector envisions the emergence of a clutch of mega banks, each the size of SBI, formed by the merger of existing banks, to be in place by 2009 when the doors will be thrown open to foreign competition. The absorption of RRBs can be viewed as the prelude to the main act.

An imperative for the future

To echo the thoughts of C.K. Prahlad, the bottom of the pyramid segments will be the growth drivers

Bottom of the pyramid segments will be the future growth drivers

of the future this is certainly being borne out by the market revolution that is taking place in Indias villages. Side by side, the Indian financial services industry is in a stage of transition, as it prepares for the inevitable onslaught of competition, once the barriers are dismantled in a few years. Therefore, it is critical that efforts are made to expand the overall market. Developing the rural financial market not only achieves this purpose, it will also give existing players a competitive edge in distribution which will be hard to beat.

AVID Information Search & Documents

August 2006

AVID Insight

Indias Financial Sector: Chanting the rural mantra

Resources:

(1) India Brand Equity Foundation (2) Business Today ICICI Banks Rural Thrust,4th June 2006 Frontline Saving The Regional Rural Banks, Volume 23 Issue 03, Jan. 28 - Feb. 10, 2006 IGIDR - New Products, Processes And Technology For Rural Access To Finance In India Reserve Bank of India Population Group-wise Distribution of Number of Offices, Aggregate Deposits and Gross Bank Credit, All Scheduled Commercial Banks, Reserve Bank of India.(2001 2006 ) The Economic Times News articles

AVID Information Search & Documents

August 2006

AVID Insight

Indias Financial Sector: Chanting the rural mantra

AVID

AVID Information Search and Documents is a fast growing company based in Bangalore, specializing in business research and information management. For more information about this document, contact Madhumita at madhumita.peddinti@avidinformation.com and Hemalatha at hemalatha.d@avidinformation.com . To know more about AVID, visit www.avidinformation.com

AVID Information Search & Documents

August 2006

Вам также может понравиться

- Rural Finance Study - Finance Presence in Rural India by RC&M IndiaДокумент54 страницыRural Finance Study - Finance Presence in Rural India by RC&M Indiarcmindia_videoОценок пока нет

- Project On Rural Banking in India 15-01-2023Документ74 страницыProject On Rural Banking in India 15-01-2023Praveen ChaudharyОценок пока нет

- Rural BankingДокумент22 страницыRural BankingGungun KumariОценок пока нет

- Project of SyndicaticДокумент42 страницыProject of SyndicaticSaad KalaveОценок пока нет

- Icici Rural ExpansionДокумент10 страницIcici Rural ExpansionANiket BharadiyaОценок пока нет

- Project Report On Indian Banking SectorДокумент15 страницProject Report On Indian Banking SectorAbhishek MohantyОценок пока нет

- IciciДокумент3 страницыIciciOm PrakashОценок пока нет

- Introduction To Banking Sector & SbiДокумент106 страницIntroduction To Banking Sector & Sbiaparajitha lalasaОценок пока нет

- Priyanka GaikwadДокумент17 страницPriyanka GaikwadSANDIP GAIKWADОценок пока нет

- Credit Appraisal in Sbi Bank Project6 ReportДокумент106 страницCredit Appraisal in Sbi Bank Project6 ReportVenu S100% (1)

- KGSGДокумент7 страницKGSGAnonymous V9E1ZJtwoEОценок пока нет

- Yes Bank Mainstreaming Development Into Indian BankingДокумент20 страницYes Bank Mainstreaming Development Into Indian Bankinggauarv_singh13Оценок пока нет

- Rural Banking in India: A Study of Regional Rural BanksДокумент10 страницRural Banking in India: A Study of Regional Rural BanksNaresh KhutikarОценок пока нет

- Recent Trends in BankingДокумент16 страницRecent Trends in BankingManisha S. BhattОценок пока нет

- Introduction To Banking Sector: Marketing Strategies of ICICI BankДокумент32 страницыIntroduction To Banking Sector: Marketing Strategies of ICICI BankTanoj PandeyОценок пока нет

- Untitled DocumentДокумент11 страницUntitled Documentsakshiludbe28Оценок пока нет

- Regional Rural Banking in India - 230326 - 110221Документ72 страницыRegional Rural Banking in India - 230326 - 110221Shubham YadavОценок пока нет

- This Paper Entitled 'RURAL FINANCING' Throws Light On The Following AspectsДокумент6 страницThis Paper Entitled 'RURAL FINANCING' Throws Light On The Following AspectshazursaranОценок пока нет

- Untitled DocumentДокумент11 страницUntitled Documentsakshiludbe28Оценок пока нет

- Rural Marketing Assignment PDFДокумент6 страницRural Marketing Assignment PDFSriram RajasekaranОценок пока нет

- Lovely Professional University Department of ManagementДокумент23 страницыLovely Professional University Department of ManagementNishant SharmaОценок пока нет

- Introduction To Banking Sector & SbiДокумент107 страницIntroduction To Banking Sector & SbiTanushreeОценок пока нет

- Regional Rural BanksДокумент27 страницRegional Rural BanksBhavika Gupta100% (1)

- BTL Presentations, Below The Line BTL PPT - RC&M India Experiential Marketing FirmДокумент22 страницыBTL Presentations, Below The Line BTL PPT - RC&M India Experiential Marketing Firmrcmindia_videoОценок пока нет

- Indian Banking Industry Profile: Evolution, Key Players & Future OutlookДокумент54 страницыIndian Banking Industry Profile: Evolution, Key Players & Future OutlookRhea SrivastavaОценок пока нет

- Credit Appraisal Techniques in State Bank of India in Dharwad District - A Case StudyДокумент12 страницCredit Appraisal Techniques in State Bank of India in Dharwad District - A Case StudyakshayОценок пока нет

- Untitled DocumentДокумент5 страницUntitled Documentsakshiludbe28Оценок пока нет

- Rural Banking - SCRIPTДокумент16 страницRural Banking - SCRIPTArchisha GargОценок пока нет

- Credit Appraisal ProjectДокумент109 страницCredit Appraisal ProjectAshwath KodaguОценок пока нет

- Project Report On Regional Rural Banks (RRBS)Документ14 страницProject Report On Regional Rural Banks (RRBS)Dhairya JainОценок пока нет

- Regional Rural BankДокумент26 страницRegional Rural BankVijayeta Nerurkar100% (1)

- Role of Regional Rural Banks in Jammu and Kashmir: Huma Naz, Sarita PariharДокумент3 страницыRole of Regional Rural Banks in Jammu and Kashmir: Huma Naz, Sarita PariharinventionjournalsОценок пока нет

- Rural Banking ProjectДокумент55 страницRural Banking ProjectDelisa Misquitta0% (1)

- Report On Rural Banking in IndiaДокумент15 страницReport On Rural Banking in IndiaJain AkshatОценок пока нет

- COMPARATIVE_STUDY_ON_REGIONAL_RURAL_BANKДокумент8 страницCOMPARATIVE_STUDY_ON_REGIONAL_RURAL_BANKzoyaansari11365Оценок пока нет

- Project SynopsisДокумент8 страницProject SynopsisKaushik AdhikariОценок пока нет

- Role of Banks in Generating Employment in IndiaДокумент4 страницыRole of Banks in Generating Employment in IndiaGangadhara RaoОценок пока нет

- Proect Rural Banking in IndiaДокумент108 страницProect Rural Banking in IndiaRohitRana100% (5)

- Small Finance Bank and Financial Inclusion - A Case Study of Ujjivan Small Finance BankДокумент10 страницSmall Finance Bank and Financial Inclusion - A Case Study of Ujjivan Small Finance BankNavneet LohchabОценок пока нет

- 11 Chapter 1Документ39 страниц11 Chapter 1Divyanshi JainОценок пока нет

- Bba ProjectДокумент47 страницBba ProjectAayush SomaniОценок пока нет

- Insurance & Banking ProjectДокумент15 страницInsurance & Banking Projectfundoo16Оценок пока нет

- Project II Study On Rural Banking in IndiaДокумент53 страницыProject II Study On Rural Banking in IndiaSujeet Pandey100% (3)

- Authored By: VM Sai Kamalesh Edida, PGDM, Mats, Bangalore, Co-Authored By: Jitendra Mehta, Mats, BangaloreДокумент9 страницAuthored By: VM Sai Kamalesh Edida, PGDM, Mats, Bangalore, Co-Authored By: Jitendra Mehta, Mats, BangaloreKamalesh EdidaОценок пока нет

- Role of RRBs in developing rural IndiaДокумент4 страницыRole of RRBs in developing rural IndiaAnonymous bIDNbP9Z3Оценок пока нет

- Promoting Financial Inclusion: Lets Connect Everyone'Документ22 страницыPromoting Financial Inclusion: Lets Connect Everyone'Faruk SuryaОценок пока нет

- History of Banking IndustryДокумент66 страницHistory of Banking IndustryJissy ShravanОценок пока нет

- Small Finance Indian Book PDFДокумент84 страницыSmall Finance Indian Book PDFrajeshraj0112Оценок пока нет

- Executive Summery SONALI 11111111Документ68 страницExecutive Summery SONALI 11111111idealОценок пока нет

- A Study On Challenges of Banking in Rural India: Immaniyelu YepuriДокумент8 страницA Study On Challenges of Banking in Rural India: Immaniyelu YepuriNIKHIL KUMAR AGRAWALОценок пока нет

- Rural Banking in IndiaДокумент15 страницRural Banking in IndiaSant KumarОценок пока нет

- The Microfinance Industry in IndiaДокумент3 страницыThe Microfinance Industry in IndiaPrashant Upashi SonuОценок пока нет

- Role of Banks in The Development of Indian Economy: Prof. Jagdeep KumariДокумент4 страницыRole of Banks in The Development of Indian Economy: Prof. Jagdeep KumariJOEL JOHNОценок пока нет

- Presented by Anupama Mukherjee Archisha GargДокумент18 страницPresented by Anupama Mukherjee Archisha GargLalit ShahОценок пока нет

- TASK - 13 Qualitative AnalysisДокумент4 страницыTASK - 13 Qualitative AnalysisBijosh ThomasОценок пока нет

- Indian Banking SystemДокумент11 страницIndian Banking SystemRahul TandonОценок пока нет

- SBI Sponsored RRBs Financial Inclusion StudyДокумент6 страницSBI Sponsored RRBs Financial Inclusion StudyAafrinОценок пока нет

- Banking India: Accepting Deposits for the Purpose of LendingОт EverandBanking India: Accepting Deposits for the Purpose of LendingОценок пока нет

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeОт EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeОценок пока нет

- Access to Finance: Microfinance Innovations in the People's Republic of ChinaОт EverandAccess to Finance: Microfinance Innovations in the People's Republic of ChinaОценок пока нет

- Communiques - DP - DP 668 Securities Admitted With CDSL 15112023Документ10 страницCommuniques - DP - DP 668 Securities Admitted With CDSL 15112023Mudit NawaniОценок пока нет

- Strategic ManagementДокумент17 страницStrategic Managementfuture tradeОценок пока нет

- U3A5 - Transactions With HST - TemplateДокумент2 страницыU3A5 - Transactions With HST - TemplateJay Patel0% (1)

- SindzaBG - N1 - Represented by Stefan TzvetkovДокумент18 страницSindzaBG - N1 - Represented by Stefan Tzvetkovdusandjordjevic011Оценок пока нет

- Katanga Mining Limited Annual Information Form For The Year Ended DECEMBER 31, 2017Документ68 страницKatanga Mining Limited Annual Information Form For The Year Ended DECEMBER 31, 2017badrОценок пока нет

- CHAPTER-I INTRODUCTIONДокумент66 страницCHAPTER-I INTRODUCTIONMohan JohnnyОценок пока нет

- Contract DocumentsДокумент5 страницContract DocumentsPaul MachariaОценок пока нет

- Blank Finance Budgets and Net WorthДокумент24 страницыBlank Finance Budgets and Net WorthAdam100% (6)

- Book Invoice PDFДокумент1 страницаBook Invoice PDFnoamaanОценок пока нет

- Finnifty Sum ChartДокумент5 страницFinnifty Sum ChartchinnaОценок пока нет

- Lone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Документ142 страницыLone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Texas WatchdogОценок пока нет

- Chapter 3.auditing Princples and Tools RevДокумент122 страницыChapter 3.auditing Princples and Tools RevyebegashetОценок пока нет

- Session 7 - Cost Allocation - Canvas - TeachingДокумент57 страницSession 7 - Cost Allocation - Canvas - Teaching長長Оценок пока нет

- Real Estate Economics PDFДокумент88 страницReal Estate Economics PDFTekeba BirhaneОценок пока нет

- Buy Back Article PDFДокумент12 страницBuy Back Article PDFRavindra PoojaryОценок пока нет

- Revivalofairindia 1pp02Документ10 страницRevivalofairindia 1pp02Quirking QuarkОценок пока нет

- DLF Cost Sheet PlotsДокумент6 страницDLF Cost Sheet PlotsTobaОценок пока нет

- Trust Deed FormatДокумент6 страницTrust Deed Formatchandraadv100% (4)

- Different Borrowers Types ExplainedДокумент15 страницDifferent Borrowers Types Explainedmevrick_guyОценок пока нет

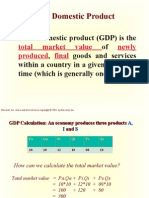

- Lec-2 - Chapter 23 - Nation's IncomeДокумент33 страницыLec-2 - Chapter 23 - Nation's IncomeMsKhan0078Оценок пока нет

- Finman Chap3Документ66 страницFinman Chap3Jollybelleann MarcosОценок пока нет

- Wiley Chapter 11 Depreciation Impairments and DepletionДокумент43 страницыWiley Chapter 11 Depreciation Impairments and Depletion靳雪娇Оценок пока нет

- Instructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloДокумент14 страницInstructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloLindaCruzykeaz100% (80)

- Case 10 - Office Depot, Inc - 2011Документ27 страницCase 10 - Office Depot, Inc - 2011Tan Theam Ping100% (6)

- Earnings Deductions: Eicher Motors LimitedДокумент1 страницаEarnings Deductions: Eicher Motors LimitedBarath BiberОценок пока нет

- Review 105 - Day 17 P1: How Much of The Proceeds From The Issuance of Convertible Bonds Should Be Allocated To Equity?Документ10 страницReview 105 - Day 17 P1: How Much of The Proceeds From The Issuance of Convertible Bonds Should Be Allocated To Equity?Pola PolzОценок пока нет

- Transfer AgreementДокумент2 страницыTransfer AgreementHuntnPeteОценок пока нет

- Pro FormaДокумент8 страницPro FormaZhiXОценок пока нет

- Daro Nacar Vs Gallery Frames DigestДокумент4 страницыDaro Nacar Vs Gallery Frames DigestMyra MyraОценок пока нет

- Ratio Analysis of Sainsbury PLCДокумент4 страницыRatio Analysis of Sainsbury PLCshuvossОценок пока нет