Академический Документы

Профессиональный Документы

Культура Документы

Cords Cable Base

Загружено:

SatishИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cords Cable Base

Загружено:

SatishАвторское право:

Доступные форматы

GICS Industry: Electrical Equipment l Sub Industry: Electrical Components & Equipment l Website: www.cordscable.

com

Cords Cable Industries Ltd

Key Stock Indicators

NSE Ticker: Bloomberg Ticker: Face value / Share: Div. Yield (%): CORDSCABLE CORD: IN 10.0 3.3 CMP (as on 21 Jan 2011Rs/share): 52-week range up to 21 Jan 2011 (Rs) (H/L): Market Cap as on 21 Jan 2011 (Rs mn): Enterprise Value as on 21 Jan 2011 (Rs mn): Div. Yield (%): 0.0 35.7 54.00/32.80 407 820 Shares outstanding (mn): Free Float (%): Average daily volumes (12 months): Beta (2 year): 11.4 46.0 35,187 1.2

Established in 1987, Cords Cable Industries Ltd (CCIL) is engaged in providing solutions to various electrical connectivity requirements. It is engaged in manufacturing of specialized cables. Its products include electrical wire and cables and continuous cast copper wire rod. The company caters to a majority of core industries such as power, cement, chemicals, petrochemicals, steel etc.

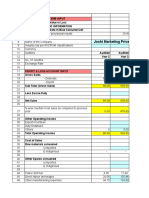

Key Financial Indicators

Revenue (Rs mn) EBITDA ma rgins (%) PAT (Rs mn) PAT ma rgins (%) Gea ring (x) EPS (Rs /s ha re) PE (x) P/BV (x) RoCE (%) RoE (%) EV/EBITDA (x)

n.m: Not meaningful

KEY HIGHLIGHTS

Strong global presence CCIL is a leading global player providing products and services offering comprehensive solutions to the electrical connectivity requirements of businesses as well as domestic users. It is focusing aggressively on export markets and its export turnover has gone up by 54% to Rs 415 mn in FY10 from Rs 269 mn in FY09. As on date, almost 50% of the order book of the company comprises of export orders. Countries to which CCIL majorly export are Oman, Kazakhastan, Egypt, UAE. During FY10, new export clients added are Modern Petrotech LLC, International Cable Management, Yokogaa Middle East BSC, Israel Electric Corp. Ltd, Faist Aniagenbav Gmbh and Metito (Overseas) Ltd. Diverse customer base CCIL customers are from diverse industries such as power generation (thermal, nuclear, gas, hydel), electricity transmission and distribution, oil refining and distribution, petrochemicals, iron and steel, chemicals, fertilizers, cement etc., thus testifying to diverse applications of its products. The companys clientele includes blue chip companies like BHEL, L&T, NTPC, Reliance Energy Ltd, IOCL, SAIL and others.

Mar-08 1,699.0 15.7 94.1 5.5 0.5 8.2 10.3 1.2 26.0 20.4 3.8

Mar-09 2,226.6 9.7 71.3 3.2 0.7 6.2 5.4 0.5 14.6 8.8 3.1

Mar-10 2,206.5 9.1 41.9 1.9 0.9 3.7 9.7 0.5 11.2 4.9 4.1

Shareholding (As on September 30, 2010)

Others 43% DII 3% FII 0%

KEY RISKS

Volatility in raw material prices such as copper, aluminum, steel etc. Foreign exchange fluctuations as exports contributed ~18% of total revenues in FY10 Non availability of skilled manpower

Promoter 54%

Indexed price chart Stock Performances vis--vis market

Returns (%) YTD CORDSCABLE NIFTY

Note: 1) YTD returns are since April 1, 2010 to 21 Jan 2011. 2) 1-m, 3-m and 12-m returns are up to 21 Jan 2011.

(index) 140

('000) 700 600 500 400 300 200 100 0 Nov-10 Apr-10 Mar-10 May-10 Dec-10 NIFTY Aug-10

1-m 6 -4

3-m -15 -5

12-m -31 9

120 100 80 60 40 20 0 Feb-10 Sep-10 Jun-10 Oct-10 Jan-10 Jul-10

-15 8

Volumes (RHS)

CORDSCABLE

CRISIL COMPANY REPORT | 1

Cords Cable Industries Ltd

BACKGROUND

CCIL is mainly engaged in providing service and solutions to its customers regarding electricity requirements. It offers extensive expertise in design, development and manufacture of high quality power, control, instrumentation, thermocouple extension/compensating and communication cables conforming to Indian/international standards and customer specifications. CCIL products includes: Low tension (LT) Power Cables, LT Control Cables, Instrumentation Cables, Thermocouple Extension Cables, Compensating Cables, Coaxial Cables, Telephone Cables, Panel Wires / Household Wires & Networking Cables. The company has diverse customer base catering to a majority of core industries such as power, cement, chemicals, petrochemicals, steel etc. The company clientele includes blue chip companies like BHEL, L&T, NTPC, Reliance Energy Ltd and others. CCIL largely exports its products to Oman, Kazakhastan, Egypt, and UAE. Exports contributed ~18% of the total sales in FY10.

COMPETITIVE POSITION

Peer Comparison

Revenue (Rs mn) EBITDA ma rgins (%) PAT (Rs mn) PAT ma rgins (%) Gea ring (x) EPS (Rs /s ha re) PE (x) P/BV (x) RoCE (%) RoE (%) EV/EBITDA (x)

n.m: Not meaningful

Cords Cable Universal Cables Industries Ltd Ltd. Mar-10 Mar-10 2,206.5 4,993.5 9.1 10.8 41.9 271.4 1.9 5.4 0.9 0.7 3.7 11.7 9.7 6.7 0.5 1.0 11.2 15.3 4.9 15.1 4.1 5.7

Torrent Cables Ltd. Mar-10 1,723.8 5.5 105.0 6.1 0.1 7.5 11.3 0.5 6.9 8.0 8.0

KEI Industries Ltd. Mar-10 9,096.8 6.9 142.3 1.6 1.7 2.2 13.0 0.8 10.3 6.8 8.2

FINANCIAL PROFILE

Top-line declines in FY10; operating margins too remain under pressure

Key Financial Indicators Units Revenue Rs mi ll ion Rs mi ll ion Per cent Per cent Per cent Times Per cent Per cent EBITDA ma rgins Per cent PAT PAT ma rgins EBITDA growth PAT growth Gea ring RoCE RoE

Mar-08

1,699.0 15.7 94.1 5.5 85.1 93.2 34.3 0.5 26.0 20.4

Mar-09

2,226.6 9.7 71.3 3.2 31.1 -19.1 -24.3 0.7 14.6 8.8

Mar-10

2,206.5 9.1 41.9 1.9 -0.9 -6.6 -41.3 0.9 11.2 4.9

CCILs top-line in FY10 remained at similar levels as that of FY09 and stood at Rs 2.2 bn. This is mainly on account of drop in sales in electric wire and cables by ~4% on yo-y basis. The operating margins remained under pressure in FY10 and stood at 9.1% as compared to 9.7% in FY09 mainly on account of increase in raw material and employee costs. Net margins dropped from 3.2% in FY09 to 1.9% in FY10, largely on account of increase in interest and depreciation costs by ~35% and ~28% respectively on y-o-y basis.

Revenue growth Per cent

INDUSTRY PROFILE

Power cables The growth of the power cables and conductors industry depends on the capacity additions in the generation segment and concomitant additions in the transmission and distribution segment. The estimated size of the power cables and conductors industry in 2009-10 was around Rs 135 billion. Foreign trade is not significant as exports stand at 5-7 per cent of the current market size, while imports are at 3-4 per cent of the total market size. Power cables and conductors is a low capital-intensive business. However, it requires continuous short-term funding to meet working capital requirements. Over 80 per cent of the operating costs are raw material costs. Aluminium, PVC resins and XLPE are the primary raw materials. The industry is fragmented with several players. The players need to have good project execution skills to maintain margins. There may be delays in collections because of liquidity issues faced by various SEBs.

CRISIL COMPANY REPORT | 2

Cords Cable Industries Ltd

ANNUAL RESULTS

Income Statement (Rs million ) Net Sales Operating Income EBITDA EBITDA Margin Depreciation Interest Other Income PBT PAT PAT Margin No. of shares (Mn No.) Earnings per share (EPS) Cash flow (Rs million ) Pre-tax profit Total tax paid Depreciation Change in working capital Cash flow from operating activities Capital Expenditure Investments and others Balance sheet (Rs million ) Equity share capital Reserves and surplus Tangible net worth Deferred tax liablity:|asset| Long-term debt Short-term-debt Total debt Current liabilities Total provisions Total liabilities Gross block Net fixed assets Investments Current assets Receivables Inventories Cash Total assets Ratio Mar-08 211.1 -64.5 8.8 -107.7 47.7 -416.8 -59.5 Mar-09 111.1 -30.6 28.6 -138.4 -29.3 -218.3 23.0 Mar-10 62.3 -18.3 36.7 -159.2 -78.5 -77.7 36.5 Revenue growth (%) EBITDA growth(%) PAT growth(%) EBITDA margins(%) Tax rate (%) PAT margins (%) Dividend payout (%) Dividend per share (Rs) BV (Rs) Return on Equity (%) Return on capital employed (%) Gearing (x) Interest coverage (x) Debt/EBITDA (x) Asset turnover (x) Current ratio (x) Gross current assets (days) Mar-08 85.1 93.2 34.3 15.7 38.5 5.5 14.2 1.2 68.2 20.4 26.0 0.5 4.8 1.2 5 1.7 199 Mar-09 31.1 -19.1 -24.3 9.7 27.5 3.2 18.8 1.2 73.3 8.8 14.6 0.7 2.6 2.2 4 1.4 160 Mar-10 -0.9 -6.6 -41.3 9.1 29.4 1.9 31.9 1.2 75.8 4.9 11.2 0.9 1.8 2.9 3 1.2 228

Mar-08 1,695.5 1,699.0 266.2 15.7 8.8 56.0 9.6 167.5 94.1 5.5 11.4 8.2

Mar-09 2,223.8 2,226.6 215.3 9.7 28.6 83.6 8.1 111.1 71.3 3.2 11.4 6.2

Mar-10 2,204.1 2,206.5 201.2 9.1 36.7 112.9 10.7 62.3 41.9 1.9 11.4 3.7

Mar-08 114.3 665.0 779.3 16.8 232.7 94.1 326.8 380.6 23.0 1,526.5 508.2 539.7 59.5 927.3 376.5 198.9 284.9 1,526.5

Mar-09 114.3 722.9 837.2 26.1 205.5 270.8 476.3 381.9 19.3 1,740.8 681.5 729.4 36.5 974.9 432.8 223.7 196.5 1,740.8

Mar-10 114.3 751.4 865.7 28.2 186.4 389.6 576.0 655.6 20.4 2,145.9 699.3 770.4 0.0 1,375.5 568.0 394.3 163.0 2,145.9

Cash flow from investing activities Equity raised/(repaid) Debt raised/(repaid) Dividend (incl. tax) Others (incl extraordinaries)

-476.3 501.2 85.3 -13.4 10.3

-195.3 0.0 149.5 -13.4 0.0

-41.2 0.0 99.7 -13.4 0.0

Cash flow from financing activities Change in cash position Opening cash Closing cash

n.m : Not meaningful;

583.4 154.8 130.0 284.9

136.1 -88.5 284.9 196.5

86.3 -33.4 196.5 163.0

QUARTERLY RESULTS

Profit and loss account (Rs million) No of Months Revenue EBITDA Interes t Depreci a tion PBT PAT Sep-10 3 627.5 64.3 34.2 9.4 20.7 13.7 100.0 10.2 5.4 1.5 3.3 2.2 % of Rev Sep-09 3 474.0 50.2 28.6 10.2 11.3 7.2 100.0 10.6 6.0 2.2 2.4 1.5 % of Rev Sep-10 6 1,067.2 108.3 56.0 18.9 33.4 22.0 100.0 10.1 5.3 1.8 3.1 2.1 % of Rev Sep-09 6 833.7 87.8 47.0 19.2 21.6 14.0 100.0 10.5 5.6 2.3 2.6 1.7 % of Rev

CRISIL COMPANY REPORT | 3

Cords Cable Industries Ltd

FOCUS CHARTS & TABLES

Rs mn 900 800 700 600 500 400 300 200 100 0 Dec-07

Quarterly sales & y-o-y growth

Dec-07

Dec-08

Dec-09

Sep-08

Sep-09

Mar-08

Mar-09

Dec-08

Dec-09

Sep-08

Sep-09

Mar-08

Mar-09

Mar-10

Sep-10

Sales

Sales growth y-o-y (RHS)

Net Profit

Net profit growth y-o-y (RHS)

Rs/share 6 5 4 3 2 1 0 Dec-06 Dec-07

EPS

Per cent 20 18 16 14 12 10 8 6 4 2 0 Dec-06 Mar-07 Dec-08 Dec-09 Sep-09 Mar-09 Mar-10 Sep-10

Movement in operating and net margins

Dec-07

Dec-08

Mar-10

Dec-09 Sep-09

Sep-07

Sep-08

Sep-10

Mar-10 Sep-10

Per cent 160 140 120 100 80 60 40 20 0 -20 -40

Rs mn 60 50 40 30 20 10 0

Quarterly PAT & y-o-y growth

Per cent 1,400 1,200 1,000 800 600 400 200 0 -200

Mar-08

Sep-07

Mar-07

Mar-08

Sep-08

OPM

Mar-09

NPM

Shareholding Pattern (Per cent) Dec 2009 Mar 2010 Promoter 52.1 53.9 DII 5.5 4.8 Others 42.4 41.2

Jun 2010 54.0 4.8 41.1

Board of Directors Sep 2010 Director Name 54.0 Na veen Sa whney (Mr.) 2.9 43.0 Devender Kuma r Pra s ha r (Mr.) Na ra s ingha pura m Kri s hna s wa my Ba l a s ubra ma ni a n (Mr.) Om Pra ka s h Bha nda ri (Mr.) Aji t Kuma r Sa ha y (Mr.)

Designation Ma na gi ng Di rector, Whol etime Director, Promoter-Director Jt.Ma na ging Director, Whol eti me Director, Promoter-Director Non-Executive Di rector

Non-Executive Di rector Non-Executive Di rector

Additional Disclosure This report has been sponsored by NSE - Investor Protection Fund Trust (NSEIPFT). Disclaimer This report is based on data publicly available or from sources considered reliable. CRISIL Ltd. (CRISIL) does not represent that it is accurate or complete and hence, it should not be relied upon as such. The data / report is subject to change without any prior notice. Opinions expressed herein are our current opinions as on the date of this report. Nothing in this report constitutes investment, legal, accounting or tax advice or any solicitation, whatsoever. The subscriber / user assume the entire risk of any use made of this data / report. CRISIL especially states that, it has no financial liability whatsoever, to the subscribers / users of this report. This report is for the personal information only of the authorised recipient in India only. This report should not be reproduced or redistributed or communicated directly or indirectly in any form to any other person especially outside India or published or copied in whole or in part, for any purpose. CRISIL is not responsible for any errors and especially states that it has no financial liability whatsoever to the subscribers / users / transmitters / distributors of this report. For information please contact 'Client Servicing' at +91-22-33423561, or via e-mail: clientservicing@crisil.com.

CRISIL COMPANY REPORT | 4

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- NasdaqДокумент21 страницаNasdaqSaadat ShaikhОценок пока нет

- Trading Forex The Forex Profit SystemДокумент10 страницTrading Forex The Forex Profit Systemapi-3732851100% (1)

- Accounting Case StudyДокумент14 страницAccounting Case StudyRenz PamintuanОценок пока нет

- Delhi NCR ReportДокумент154 страницыDelhi NCR ReportNAVEDОценок пока нет

- Currency Trading - How To Access and Trade The World's Biggest MarketДокумент315 страницCurrency Trading - How To Access and Trade The World's Biggest MarketSaleel Mohammed100% (4)

- My Trading ManifestoДокумент31 страницаMy Trading ManifestojehaniasОценок пока нет

- AP - LiabilitiesДокумент4 страницыAP - LiabilitiesEarl Donne Cruz100% (4)

- Bse Vs NasdaqДокумент56 страницBse Vs NasdaqBhavesh Bajaj100% (2)

- Banking Law and PracticeДокумент8 страницBanking Law and PracticewasoooОценок пока нет

- Strategy Builder User Guide MT4Документ68 страницStrategy Builder User Guide MT4Eduardo TogoroОценок пока нет

- 64-File Utama Naskah-134-1-10-20180508Документ5 страниц64-File Utama Naskah-134-1-10-20180508Aldy HidayatОценок пока нет

- Npcil - 2.2 GCC - Supply1Документ67 страницNpcil - 2.2 GCC - Supply1srama_narayanan100% (1)

- CSR Corporate GovernanceДокумент28 страницCSR Corporate GovernanceJapjiv SinghОценок пока нет

- Asset Liability ApproachДокумент16 страницAsset Liability ApproachJanitscharenОценок пока нет

- Utility - Initiation of CoverageДокумент15 страницUtility - Initiation of CoverageMariana IgnácioОценок пока нет

- SEB Annual Report 2000Документ92 страницыSEB Annual Report 2000SEB GroupОценок пока нет

- Purchasing Power ParityДокумент8 страницPurchasing Power Paritygazi faisalОценок пока нет

- Week 13 Chapter-25 FixДокумент29 страницWeek 13 Chapter-25 FixTrisula Nurulfajri PandunitaОценок пока нет

- Summary of Preferred Hedge Fund Terms: OverviewДокумент4 страницыSummary of Preferred Hedge Fund Terms: OverviewsmasarikОценок пока нет

- Securities Law PDFДокумент7 страницSecurities Law PDFGabril AsadeОценок пока нет

- Book Building IPOДокумент2 страницыBook Building IPOSarada NagОценок пока нет

- English Wheat LeafletДокумент2 страницыEnglish Wheat LeafletVasantha NaikОценок пока нет

- IpoДокумент71 страницаIpoBhumi GhoriОценок пока нет

- CMA Joshi Marketing-1Документ53 страницыCMA Joshi Marketing-1Satish TomerОценок пока нет

- Forex Training Class Stage 2Документ43 страницыForex Training Class Stage 2Ibrahim AbdulateefОценок пока нет

- Management Programme: MFP-1: Equity MarketsДокумент2 страницыManagement Programme: MFP-1: Equity MarketsDivey GuptaОценок пока нет

- Introduction To Foreign Exchange MarketsДокумент16 страницIntroduction To Foreign Exchange MarketsMalik BilalОценок пока нет

- GFMP Presentation CustomisedДокумент46 страницGFMP Presentation Customisedsowmya_bОценок пока нет

- Annex F Short-Term Loans: Page 32 of 100Документ1 страницаAnnex F Short-Term Loans: Page 32 of 100lajefa lajefaОценок пока нет

- Margin Jargon Cheat Sheet: BalanceДокумент8 страницMargin Jargon Cheat Sheet: Balancevalkar75Оценок пока нет