Академический Документы

Профессиональный Документы

Культура Документы

Quaterly Statment

Загружено:

Abhisekh TripathyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Quaterly Statment

Загружено:

Abhisekh TripathyАвторское право:

Доступные форматы

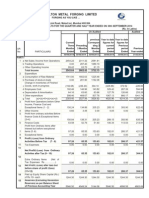

JUBILANT FOODWORKS LIMITED

Regd. Office : B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)

FINANCIAL RESULTS FOR THE QUARTER AND TWELVE MONTHS ENDED 31ST MARCH, 2011

(Figures-Rs. in Lacs, Unless Otherwise Stated)

STANDALONE

Sl.

No.

a)

b)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

feedback/ JFL

15.

Particulars

Net Sales/Income from Operations

Other Operating Income

Total Income (a+b)

Total Expenditure (a to g)

a) (Increase)/Decrease in Inventories

b) Consumption of Raw Materials & Provisions

c) Purchases of Traded Goods

d) Staff Cost

e) Depreciation

f) Rent

g) Others

Profit from Operations before Other Income,

Interest and Tax (1-2)

Other Income

Profit before Interest and Tax (3+4)

Interest Expense

Profit after Interest but before Tax (5-6)

Tax expense

- Current Tax & Deferred Tax

Net Profit for the Period (7-8)

Paid-up equity share capital (Face Value Rs.10/-)

Reserves (excluding Revaluation Reserves)

Basic EPS for the period ( Not Annualised) (in Rs.)

Diluted EPS for the period ( Not Annualised) (in Rs.)

Public Shareholding

- No of shares (Lacs)

- Percentage of shareholding

Promoters and Promoter Group Shareholding:

a Pledged/Encumbered

- No of Shares (Lacs)

- Percentage of Shares (as a % of total

shareholding of promoter and promoter group)

- Percentage of Shares (as a % of total share

capital of the company)

b Non-encumbered

- Number of shares (Lacs)

- Percentage of Shares (as a % of total

shareholding of promoter and promoter group)

- Percentage of Shares (as a % of total share

capital of the company)

3 Months Ended

31st March

12 Months Ended

31st March

Notes :

1

The above results were reviewed by the Audit committee and approved by the Board of Directors at their meeting held on

12th May, 2011.

CONSOLIDATED

The Company's business activity falls within a single business segment in terms of Accounting Standard 17 on Segment Reporting.

12 Months Ended

31st March

Following is the summary of Employees Stock Options [ESOP] existing, granted, exercised and cancelled during the quarter:

Particulars

2011

Unaudited

19,362.50

6.09

19,368.59

16,894.37

110.38

4,212.24

625.98

3,955.32

830.68

1,488.23

5,671.54

2010

Unaudited

12,405.54

12,405.54

11,252.30

22.86

2,570.95

526.63

2,449.74

692.30

1,109.86

3,879.96

2011

Audited

67,807.54

25.36

67,832.90

58,749.99

(25.26)

14,453.17

2,630.03

13,553.41

2,933.88

5,355.38

19,849.38

2010

Audited

42,393.14

23.56

42,416.70

38,291.83

(54.61)

8,997.23

1,553.12

8,046.25

2,434.50

3,968.65

13,346.69

2011

Audited

67,807.54

25.36

67,832.90

58,776.93

(25.26)

14,453.17

2,630.03

13,564.68

2,933.88

5,355.76

19,864.67

2010

Audited

42,393.14

23.56

42,416.70

38,291.83

(54.61)

8,997.23

1,553.12

8,046.25

2,434.50

3,968.65

13,346.69

2,474.22

94.08

2,568.30

2,568.30

1,153.24

6.35

1,159.59

118.11

1,041.48

9,082.91

194.17

9,277.08

34.21

9,242.87

4,124.87

13.48

4,138.35

833.43

3,304.92

9,055.97

194.60

9,250.57

34.21

9,216.36

4,124.87

13.48

4,138.35

833.43

3,304.92

635.54

1,932.76

6,453.22

1.08

1,040.40

6,362.17

3.00

2.94

1.75

1.70

2,042.80

7,200.07

6,453.22

12,715.57

11.20

11.01

7.95

3,296.97

6,362.17

5,261.40

5.54

5.40

2,042.85

7,173.51

6,453.22

12,686.25

11.16

10.96

7.95

3,296.97

6,362.17

5,261.40

5.54

5.40

256.63

39.77%

241.29

37.93%

256.63

39.77%

241.29

37.93%

256.63

39.77%

241.29

37.93%

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

388.69

394.93

388.69

394.93

388.69

394.93

100%

100%

100%

100%

100%

100%

60.23%

62.07%

60.23%

62.07%

60.23%

62.07%

(a) Options outstanding at the beginning of the quarter

1,366,551

(b) New options granted during the quarter

Nil

(c) Options exercised during the quarter

74,164

(d) Options cancelled during the quarter

NIL

(e) Options outstanding at the end of the quarter

1,292,387

At the date of grant of ESOP, the Company had opted for intrinsic value method for valuation of Employee Stock options as per

which the fair value of shares is less than the Exercise Price.

4

During the current quarter, 91,864 Equity Shares of Rs. 10 each were alloted under the Dominos Stock Option Plan at a

premium in accordance with the Plan.

Detail of number of investor complaints for the quarter ended 31st March, 2011 : Beginning - NIL, Received - 4, Resolved - 4 and

Pending - NIL.

The wholly owned subsidiary was incorporated in Sri-Lanka on 14th September 2010 hence figures have been consolidated in

these financial statements from that date onwards and previous year figures for subsidiary are not applicable.

The Statement of Assets and Liabilities as required under Clause 41 of the Listing Agreement is as follows;

Particulars

SHAREHOLDER'S FUNDS

a) Capital

b) Share Application Money Pending Allotment

c) Reserve & Surplus

LOAN FUNDS

TOTAL

FIXED ASSETS

INVESTMENTS

DEFERRED TAX ASSETS

CURRENT ASSETS, LOANS AND ADVANCES

a) Inventories

b) Sundry Debtors

c) Cash and Bank balances

d) Other current assets

e) Loans and Advances

LESS: CURRENT LIABILITIES AND PROVISIONS

a) Liabilities

b) Provisions

NET CURRENT ASSETS

PROFIT AND LOSS ACCOUNT DEBIT BALANCE

TOTAL

STANDALONE

12 Months Ended

CONSOLIDATED

12 Months Ended

2011

Audited

2010

Audited

2011

Audited

2010

Audited

6,453.22

12,715.57

19,168.79

19,168.79

18,376.55

2,164.36

306.69

6,362.17

120.32

9,291.63

15,774.12

859.05

16,633.17

14,287.70

3.06

-

6,453.22

12,686.25

19,139.47

19,139.47

18,452.70

2,049.08

306.69

6,362.17

120.32

9,291.63

15,774.12

859.05

16,633.17

14,287.70

3.06

-

1,421.86

446.03

888.49

86.00

6,972.19

9,814.57

705.68

294.80

703.94

2.40

3,620.46

5,327.28

1,421.86

446.03

897.54

86.00

6,984.24

9,835.67

705.68

294.80

703.94

2.40

3,620.46

5,327.28

10,848.22

645.16

11,493.38

(1,678.81)

19,168.79

6,628.17

386.93

7,015.10

(1,687.82)

4,030.23

16,633.17

10,859.51

645.16

11,504.67

(1,669.00)

19,139.47

6,628.17

386.93

7,015.10

(1,687.82)

4,030.23

16,633.17

8 Previous year / quarters figures have been regrouped and /or re-arranged wherever necessary.

For and on behalf of the Board of Directors

Place : Noida

Date : 12th May, 2011

Sd/Shyam S. Bhartia

Chairman

Sd/Ajay Kaul

CEO CUM

Whole time Director

Вам также может понравиться

- Franchise Value - A Modern Approach To Security Analysis. (2004.ISBN0471647888)Документ512 страницFranchise Value - A Modern Approach To Security Analysis. (2004.ISBN0471647888)Favio C. Osorio PolarОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Документ4 страницыUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikОценок пока нет

- Result Q-1-11 For PrintДокумент1 страницаResult Q-1-11 For PrintSagar KadamОценок пока нет

- 2008 2009 - 31 Mar 2009Документ3 страницы2008 2009 - 31 Mar 2009Nishit PatelОценок пока нет

- Superhouse Limited: Email: Share@superhouse - in Url: HTTP://WWW - Superhouse.inДокумент7 страницSuperhouse Limited: Email: Share@superhouse - in Url: HTTP://WWW - Superhouse.inAmrut BhattОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For December 31, 2016 (Result)Документ6 страницStandalone Financial Results, Auditors Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- 2000 5000 Corp Action 20220525Документ62 страницы2000 5000 Corp Action 20220525Contra Value BetsОценок пока нет

- Year Ended (Audited) Quarter Ended (Unaudited) Nine Months Ended (Unaudited)Документ1 страницаYear Ended (Audited) Quarter Ended (Unaudited) Nine Months Ended (Unaudited)Jatin GuptaОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Q1FY22Документ8 страницQ1FY22Anjalidevi TОценок пока нет

- Rain Calcining Limited: Audited Financial Results For The Quarter Ended June 30, 2004Документ1 страницаRain Calcining Limited: Audited Financial Results For The Quarter Ended June 30, 2004nitin2khОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- ICICI Financial StatementsДокумент9 страницICICI Financial StatementsNandini JhaОценок пока нет

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerДокумент9 страницBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARОценок пока нет

- Devyani International Q3 ResultsДокумент9 страницDevyani International Q3 ResultsSaurabh AggarwalОценок пока нет

- 748foodfile FinancialResultsДокумент4 страницы748foodfile FinancialResultsPrashant VaishnavОценок пока нет

- HPCL Audited Results31Mar2013Документ1 страницаHPCL Audited Results31Mar2013Pranav DesaiОценок пока нет

- Havells Annual ReportДокумент1 страницаHavells Annual ReportSatyaki DeyОценок пока нет

- Financial Highlights: Hinopak Motors LimitedДокумент6 страницFinancial Highlights: Hinopak Motors LimitedAli ButtОценок пока нет

- Standalone Financial Results For The Quarter / Year Ended On 31st March 2012Документ9 страницStandalone Financial Results For The Quarter / Year Ended On 31st March 2012smartashok88Оценок пока нет

- Standalone Financial Results For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Q1FY2013Документ1 страницаQ1FY2013Suresh KumarОценок пока нет

- Gujarat State Petronet LTD.: (Standalone & Consolidated) Along With The Limited Review Reports Is Enclosed HerewithДокумент20 страницGujarat State Petronet LTD.: (Standalone & Consolidated) Along With The Limited Review Reports Is Enclosed HerewithGhano GhayalОценок пока нет

- Registered Office: Plot No. 11, Block D-1, MIDC, Chinchwad, Pune 411 019 Unaudited Financial Results (Provisional) For The Quarter Ended 30th June, 2007Документ1 страницаRegistered Office: Plot No. 11, Block D-1, MIDC, Chinchwad, Pune 411 019 Unaudited Financial Results (Provisional) For The Quarter Ended 30th June, 2007Jatin GuptaОценок пока нет

- Segment Reporting (Rs. in Crore)Документ8 страницSegment Reporting (Rs. in Crore)Tushar PanhaleОценок пока нет

- Financial Performance: 10 Year RecordДокумент1 страницаFinancial Performance: 10 Year RecordnitishОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Central Release of Last Year But Received During The Current Year Actual O.B. As On 1st April of The YearДокумент6 страницCentral Release of Last Year But Received During The Current Year Actual O.B. As On 1st April of The YearmridanishjОценок пока нет

- 2022 04 Q4-2022 PR2-New-roomДокумент10 страниц2022 04 Q4-2022 PR2-New-roomTejpal SainiОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- 6month Audited ResultsДокумент2 страницы6month Audited ResultsJessica HarveyОценок пока нет

- Sintex Industries LimitedДокумент14 страницSintex Industries Limitednaresh kayadОценок пока нет

- Financial Results of Hardwyn India Sept 2023Документ9 страницFinancial Results of Hardwyn India Sept 2023prashant_natureОценок пока нет

- Balance Sheet: Titan Industries LimitedДокумент4 страницыBalance Sheet: Titan Industries LimitedShalini ShreyaОценок пока нет

- Nesco 19.05.20Документ19 страницNesco 19.05.20Miku DhanukaОценок пока нет

- MSSL Results Quarter Ended 31st December 2011Документ4 страницыMSSL Results Quarter Ended 31st December 2011kpatil.kp3750Оценок пока нет

- Q2 09 ConsolidateДокумент1 страницаQ2 09 ConsolidatecayogeshguptaОценок пока нет

- Ger S G, Eejeeb Y We S,: Crjsi"Документ5 страницGer S G, Eejeeb Y We S,: Crjsi"Suraj KediaОценок пока нет

- ITC Presentation2.1Документ10 страницITC Presentation2.1Rohit singhОценок пока нет

- SPIL Q2FY22 Financial ResultsДокумент10 страницSPIL Q2FY22 Financial ResultsKARANОценок пока нет

- q209 - Airtel Published FinancialsДокумент7 страницq209 - Airtel Published Financialsmixedbag100% (2)

- Financial Analysis of Top Pakistan Cement CompaniesДокумент21 страницаFinancial Analysis of Top Pakistan Cement CompaniesSyedFaisalHasanShahОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ6 страницFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Bajaj Auto Limited: Page 1 of 7Документ7 страницBajaj Auto Limited: Page 1 of 7DPH ResearchОценок пока нет

- Wim Plast LTD.: CelloДокумент5 страницWim Plast LTD.: CelloAbhishek RanjanОценок пока нет

- Balance SheetДокумент2 страницыBalance Sheetgagandeepdb2Оценок пока нет

- Garware-Wall Ropes Limited: Audited Financial Results For The Year Ended 31St March, 2009Документ1 страницаGarware-Wall Ropes Limited: Audited Financial Results For The Year Ended 31St March, 2009Jatin GuptaОценок пока нет

- 4.varroc Consolidated Result Sheet June 2021 SignedДокумент3 страницы4.varroc Consolidated Result Sheet June 2021 SignedA kumarОценок пока нет

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINДокумент3 страницыPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Документ7 страницStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Q1-Results Bal 2019-20Документ5 страницQ1-Results Bal 2019-20Krish PatelОценок пока нет

- TTR RRL: LimitedДокумент5 страницTTR RRL: LimitedShyam SunderОценок пока нет

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Документ30 страницWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawaneОценок пока нет

- Gmat Handbook PDFДокумент20 страницGmat Handbook PDFVishal GolchaОценок пока нет

- Scaled Score Percentile: GMAT DiagnosticДокумент4 страницыScaled Score Percentile: GMAT DiagnosticAbhisekh TripathyОценок пока нет

- A Study On Consumers Perception Towards Micromax MobilesДокумент91 страницаA Study On Consumers Perception Towards Micromax MobilesAbhisekh Tripathy100% (1)

- Bangalore Bus RoutesДокумент12 страницBangalore Bus RoutesAbhisekh TripathyОценок пока нет

- Business QuestionsДокумент27 страницBusiness QuestionsAbhisekh TripathyОценок пока нет

- Introduction To Nabard National Bank For Agriculture and Ruraldevelopment (Nabard) Was Established by Anact of The Parliament On 12 July1982.Документ6 страницIntroduction To Nabard National Bank For Agriculture and Ruraldevelopment (Nabard) Was Established by Anact of The Parliament On 12 July1982.Abhisekh TripathyОценок пока нет

- IRP Rough 3Документ103 страницыIRP Rough 3Abhisekh TripathyОценок пока нет

- Company Law in IndiaДокумент26 страницCompany Law in IndiaKNOWLEDGE CREATORSОценок пока нет

- Adidas MKTG Industry Analysis (India)Документ12 страницAdidas MKTG Industry Analysis (India)Anuj100% (13)

- Iv Report%2Документ64 страницыIv Report%2yashОценок пока нет

- Part 2 Basic Accounting Journalizing LectureДокумент11 страницPart 2 Basic Accounting Journalizing LectureKong Aodian100% (2)

- Share Application Doc MEGI AGRO PDFДокумент1 страницаShare Application Doc MEGI AGRO PDFcarthik19Оценок пока нет

- TISS Sample Paper - MA in Development Studies Part 2 Set 1Документ12 страницTISS Sample Paper - MA in Development Studies Part 2 Set 1bhustlero0oОценок пока нет

- Invoice 4699103696Документ1 страницаInvoice 4699103696Deepak MarketingОценок пока нет

- Macro and Micro Economics of MalaysiaДокумент13 страницMacro and Micro Economics of MalaysiaGreyGordonОценок пока нет

- Brand Strategy Road MapДокумент2 страницыBrand Strategy Road MapOwais AhmedОценок пока нет

- People As Infrastructure in Johanesburg - AbdouMaliq SimoneДокумент24 страницыPeople As Infrastructure in Johanesburg - AbdouMaliq SimoneFredrik Edmund FirthОценок пока нет

- Bank Fund Assignment 2Документ19 страницBank Fund Assignment 2Habiba EshaОценок пока нет

- Job Letter For Opening Bank AccountДокумент4 страницыJob Letter For Opening Bank Accountseoerljbf100% (2)

- EMIS Company Profile 7108284 PDFДокумент1 страницаEMIS Company Profile 7108284 PDFMadhusmita pattanayakОценок пока нет

- Q4/21 Preview & 2022-2023 Commodity Prices Deck Update: Global Equity ResearchДокумент23 страницыQ4/21 Preview & 2022-2023 Commodity Prices Deck Update: Global Equity ResearchForexliveОценок пока нет

- Pricing StrategyДокумент12 страницPricing StrategyGemma Lopez100% (1)

- Part H 2 - CIR vs. Procter GambleДокумент2 страницыPart H 2 - CIR vs. Procter GambleCyruz TuppalОценок пока нет

- Capacity Can Be Defined As The Ability To HoldДокумент6 страницCapacity Can Be Defined As The Ability To HoldAlex Santito KoK'sОценок пока нет

- MAS - 1 - Basic Concepts and Recent Developments - TBPДокумент5 страницMAS - 1 - Basic Concepts and Recent Developments - TBPFederico Angoluan Socia Jr.Оценок пока нет

- Strategy, Organization Design and EffectivenessДокумент16 страницStrategy, Organization Design and EffectivenessJaJ08Оценок пока нет

- The Other Face of Managerial AccountingДокумент20 страницThe Other Face of Managerial AccountingModar AlzaiemОценок пока нет

- Bambu Sebagai Alternatif Penerapan Material Ekologis: Potensi Dan TantangannyaДокумент10 страницBambu Sebagai Alternatif Penerapan Material Ekologis: Potensi Dan Tantangannyaaldi9aОценок пока нет

- Factors in Engineering Economy Excel FunctionsДокумент12 страницFactors in Engineering Economy Excel FunctionsHerliaa AliaОценок пока нет

- L6 - Customer Role in Service DeliveryДокумент23 страницыL6 - Customer Role in Service DeliveryRishab Jain 2027203Оценок пока нет

- Key Partners (Wrong)Документ8 страницKey Partners (Wrong)Gail CuaresmaОценок пока нет

- m1 InstДокумент28 страницm1 Instdpoole99Оценок пока нет

- A Study On Financial Statement Analysis of HDFC BankДокумент11 страницA Study On Financial Statement Analysis of HDFC BankOne's JourneyОценок пока нет

- Fintech FinalДокумент34 страницыFintech FinalanilОценок пока нет

- GCG MC 2017-03, Implementing Rules and Guidelines of EO No 36, S 2017Документ13 страницGCG MC 2017-03, Implementing Rules and Guidelines of EO No 36, S 2017bongricoОценок пока нет

- Exhibit 1 Unitary Sec. Cert. - Domestic CorporationДокумент2 страницыExhibit 1 Unitary Sec. Cert. - Domestic Corporationthesupersecretsecret40% (5)

- Franchise Comprehensive Prob PDF FreeДокумент6 страницFranchise Comprehensive Prob PDF FreetrishaОценок пока нет

- Corporate Finance Project On Descon in PakistanДокумент43 страницыCorporate Finance Project On Descon in PakistanuzmazainabОценок пока нет