Академический Документы

Профессиональный Документы

Культура Документы

August 2011 DOR Follow-Up State Audit Report

Загружено:

Statesman Journal0 оценок0% нашли этот документ полезным (0 голосов)

2K просмотров9 страницThe Department of Revenue has made efforts to improve management of the filing enforcement and collections processes. This report provides the implementation status, as of July 2011, of the audit recommendations we made in our prior report.

Исходное описание:

Оригинальное название

August 2011 DOR Follow-up State Audit Report

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe Department of Revenue has made efforts to improve management of the filing enforcement and collections processes. This report provides the implementation status, as of July 2011, of the audit recommendations we made in our prior report.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

2K просмотров9 страницAugust 2011 DOR Follow-Up State Audit Report

Загружено:

Statesman JournalThe Department of Revenue has made efforts to improve management of the filing enforcement and collections processes. This report provides the implementation status, as of July 2011, of the audit recommendations we made in our prior report.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

Secretary of State Audit Report

Kate Brown, Secretary of State

Gary Blackmer, Director, Audits Division

Report Number 2011-17 August 2011

DOR Follow-up Page 1

Department of Revenue: Filing Enforcement and Collections

Recommendations Follow-up

In 2010 the Secretary of State Audits Division completed an audit

at the Department of Revenue (the department) focusing on two

main areas: 1) utilizing data resources to identify non-filers and

increase compliance, and 2) reviewing collection practices for

delinquent debt, especially as those practices related to the use of

private collection firms (PCFs). Our report (number 2010-20A)

concluded that the department could do more to develop a

systematic, strategic approach to identify or take action with non-

filers. The departments process for identifying non-filers was not

comprehensive or data-intensive. The report also concluded that

even though the department had increased its emphasis on

collections, it could improve by taking more timely collections

actions, using up-to-date information about the delinquent

taxpayers, better managing delinquent accounts, and effectively

using available technology.

This report provides the implementation status, as of July 2011, of

the audit recommendations we made in our prior report. Because

it is a follow-up report on previously issued recommendations, we

were not required to follow generally accepted government

auditing standards. The results of our follow-up work are included

in the table below. At the departments request, we also

performed preliminary work around the selection process for

personal income tax audits. However, since the department

recently implemented significant changes to the way audit cases

are selected and because performance data related to the new

process is not yet available, we chose to defer an audit of that

process to a later date.

Background

Results

Report Number 2011-17 August 2011

DOR Follow-up Page 2

Since the release of our report in April 2010, the department has

made efforts to improve management of the filing enforcement

and collections processes. As shown in the table below, we found

that management was in the process of addressing all the

recommendations we made. The table provides details about the

actions the department has taken, as well as information about

what is left to resolve the recommendations.

Most noteworthy are managements actions to update its filing

enforcement strategy by prioritizing the data sources it uses and

the way in which it works through non-filer leads. Moreover, DOR

also completed a project that involved sending notification to

potential non-filers for tax year 2008.

The department also took actions to improve its collections

process. For example, the collections section established

timeliness and results goals and is developing statistical reports to

track outcomes. According to the department, it began sending

debts to private collection firms weekly rather than monthly. In

addition, the department installed an automated call distributor

that routes calls for the collections unit to the first available

revenue agent, reducing the need to play phone tag with

taxpayers. Finally, the department compared its collections results

to those of the private collection firms, but we noted factors that

made the analysis inconclusive.

To quickly increase collections, the department implemented two

projects that involved staffing changes. One project involved

temporarily shifting employees from filing enforcement to

collections. The other project assigned higher-level revenue agents

to work on newer debts. According to the department, its

increased collection efforts resulted in over $30 million in

additional revenue as of June 2011. However, we also noted that

while the amount of collections increased, the outstanding balance

of delinquent accounts increased as well.

In addition to the above actions, the department began the

process to replace its core systems with a comprehensive tax

system, including data warehouse and business intelligence tools

such as accounting, case management, collections, audit case

selection, and tax returns processing. The request for proposals for

the core systems replacement project was released in June 2011,

and the department estimates that the system will be

implemented within about six years. Management also initiated

Rapid Process Improvement projects for the collections process

Report Number 2011-17 August 2011

DOR Follow-up Page 3

and several other departmental areas. These projects are an on-

going strategy for analyzing and improving operations.

Even with the departments efforts to date, much work remains to

be done before the recommendations are fully implemented.

Department management cited a lack of personnel resources and

an antiquated, cumbersome information technology system as

barriers. Moreover, we acknowledge that the recommendations

will require a long-term effort and commitment, and that full

implementation may not have been feasible in the time since the

release of our audit report.

In light of the six-year timeline for the core systems replacement

project, we encourage department management to ensure

resources are made available to continue its work on improving the

filing enforcement and collections processes. Management should

also consider formally implementing key tools (e.g., ACL or other

data analysis software) and metrics to improve information for

decision-making and maximize the effectiveness of filing

enforcement and collections. Specifically, department

management should take the following actions when implementing

the recommendations from our prior audit:

Develop and document a comprehensive strategy for identifying

non-filers. This strategy should address specific uses of currently

available technology and a timeline for implementation.

Given the increasing balance of delinquent accounts, consider how

private collection firms (PCFs) could be better utilized to reduce the

collections backlog. Although the department reports a better

collection rate than that of the PCFs, the true cost of DOR

collections, as well as the cost of sending accounts to PCFs, should

be measured and considered when developing a collections

strategy. This will insure comparable collections data is used when

calculating and comparing collection rates.

To measure progress and enhance decision making, develop and

routinely monitor valid and useful metrics for filing enforcement

and collections.

Recommendations to the Oregon Department of Revenue

Report Number 2011-17 August 2011

DOR Follow-up Page 4

Audit Recommendations

Related to Filing Enforcement

Status of

Recommendations

Additional Comments

Develop and implement a comprehensive and timely approach to

identify non-filers every tax period.

In Process

The department updated its filing enforcement strategy to

emphasize higher priority data sources for determining non-filer

leads and now focuses on the most current tax years. However,

the process still relies heavily on manual identification of

potential non-filers. In addition, the department now has access

to sophisticated analysis software, ACL, but the use of this tool as

part of a comprehensive strategy for identifying non-filers has not

been fully implemented.

Develop and implement strategies to bring non-filers quickly into

compliance for future tax years.

In Process The department reported implementing a project that involved

sending letters to potential non-filers for tax year 2008. About

91% of the letters sent received no response, 7% resulted in filed

returns and the remaining 2% were determined not required to

file. In cases where no response was received, leads were added

to the filing enforcement tracking system and are now going

through the normal filing enforcement process.

Report Number 2011-17 August 2011

DOR Follow-up Page 5

Audit Recommendations

Related to Collections

Status of

Recommendations

Additional Comments

Establish and track timeliness and results goals for DOR personnel

to better achieve prompt contacts and successful collection of

each liability.

In Process The department developed timeliness and results goals for

collections and is developing statistical reports to track outcomes.

However, the department reported that these metrics have not

been fully implemented due to difficulties posed by their

antiquated and non-integrated IT systems, and limits on IT

staffing resources. In addition, department management began

completing quarterly performance evaluations to set goals and

measure results of collections employees work.

Periodically analyze information on agency strategies, efforts and

results to enhance collections results.

In Process The department initiated Rapid Process Improvement projects (an

ongoing strategy for analyzing operations) for collections and

several other processes. In addition, department management

re-assigned employees to better leverage staff expertise.

Transfer liabilities to PCFs based upon case characteristics to

obtain the most DOR revenues.

In Process When DOR compared its collection results to that of the private

collection firms, DOR determined it was more successful than the

firms. However, we noted some factors that could make

comparability inconclusive. The department is still in the process

of determining which types of cases are the best sent to PCFs.

Pursue skiptracing alternatives and integrate the use of advanced

research tools into the DOR collection process.

In Process The department acquired access to two skiptrace tools. Use of

one tool is limited to the skip trace agent while the second tool is

also available to certain revenue agents. In addition, the

department is researching the possibility of other online research

tools, such as social networking sites.

Automate the processes of assigning accounts to PCFs, reconciling

payments, and providing account balance updates.

In Process The department reported implementing a few semi-automated

processes utilizing macros to send some information to private

collection firms. However, any further automation will be part of

the core systems replacement project. A request for proposals for

the core systems replacement project was issued in late June

2011.

Report Number 2011-17 August 2011

DOR Follow-up Page 6

Explore ways to increase sharing information with PCFs to

enhance collections.

In Process The department reported that it now sends debts to private

collection firms weekly rather than monthly. Further information

sharing is dependent on the core systems replacement project.

Prudently plan, acquire and implement a comprehensive

information technology system that will support automating

processes, prioritizing work and managing performance.

In Process The department issued an RFP in late June, 2011 to begin the core

systems replacement project. The new core system will be a

comprehensive tax system including data warehouse and

business intelligence tools.

Develop and implement a plan to quickly increase collections,

which could include more outsourcing efforts, until the backlog is

reduced.

In Process The department implemented two different projects to quickly

increase collections. One project involved shifting employees

from filing enforcement to collections. The other project had

higher-level revenue agents working on newer debts. The

department reported that the projects increased collections.

However, the data provided also shows an increase in the balance

of delinquent accounts.

In addition, the department installed an automated call

distributor that routes calls for the collections unit to the first

available revenue agent, reducing the need to play phone tag

with debtors.

Department of Revenue

-Oregon

955 Center St NE

Salem, OR 97301-2555

John A. Kitzhaber, MD, Governor

www.oregon.gov/ dor

August 16, 2011

Gary Blackmer, Director

Secretary of State, Audits Division

255 Capital Street NE, Suite 500

Salem, OR 97301

Dear Mr. Blackmer,

This letter is our management response to the Department of Revenue: Filing Enforcement and

Collections Recommendations Follow-up. We greatly appreciate the work of your staff from the

Division of Audits, and for their collaborative effort while following up on the recommendations

made as a part of last year's Secretary of State audit to improve the collections and filing

enforcement functions at the Department of Revenue.

As noted in the follow-up audit, the department has made efforts to improve management of the

filing enforcement and collections processes, and management is in the process of addressing all

the recommendations that were made. The findings and recommendations within the original

audit provided the basis for numerous changes in the way we do our work, and validated process

improvements we were working on at the time of the audit. Thank you.

Please accept the following comments on the follow-up actions directed to department

management when implementing the recommendations from your prior audit:

Recommendation:

Develop and document a comprehensive strategy for identifying non-filers. This strategy should

address specific uses of currently available technology and a timeline for implementation.

Response:

Management agrees. By December 31, 2011, management will develop a comprehensive

strategy for identifying non-filers.

Recommendation:

Given the increasing balance of delinquent accounts, consider how private collection firms

(PCFs) could be better utilized to reduce the collections backlog. Although the department

reports a better collection rate than that of the PCFs, the true cost of DOR collections, as well as

the cost of sending accounts to PCFs, should be measured and considered when developing a

collections strategy. This will insure comparable collections data is used when calculating and

comparing collection rates.

150-800-075 (Rev. 1-11)

Response:

Management agrees with the recommendation and will consider this guidance when developing

collections strategy.

Recommendation:

To measure progress and enhance decision making, develop and routinely monitor valid and

useful metrics for filing enforcement and collections.

Response:

Management agrees with the intent of the recommendation. We have identified the high level

outcomes and performance measures for both the collections and non-filer functions. As noted in

the follow-up report, DOR relies on an antiquated, cumbersome information technology system

that has slowed the final implementation of a management model driven by these performance

metrics. (The request for proposals for DOR's core systems replacement project was released in

June 2011.)

Thank you for the opportunity to respond.

Sincerely,

Department of Revenue

955 Center St. NE

Salem, OR 97301-2555

Report Number 2011-17

DOR Follow-up

About the Secretary of State Audits Division

The Oregon Constitution provides that the Secretary of State shall be, by

virtue of her office, Auditor of Public Accounts. The Audits Division exists to

carry out this duty. The division reports to the elected Secretary of State

and is independent of the Executive, Legislative, and Judicial branches of

Oregon government. The division audits all state officers, agencies, boards,

and commissions and oversees audits and financial reporting for local

governments.

Audit Team

Deputy Director, Will Garber, CGFM, MPA

Audit Manager, James E. Scott, MM

Principal Auditor, Amy Palacios, CPA

Staff Auditor, Wendy Kam, MBA

Staff Auditor, Shawna Binning, MBA

This report, a public record, is intended to promote the best possible

management of public resources. Copies may be obtained from:

internet: http://www.sos.state.or.us/audits/index.html

phone: 503-986-2255

mail: Oregon Audits Division

255 Capitol Street NE, Suite 500

Salem, OR 97310

The courtesies and cooperation extended by officials and employees of the

Department of Revenue during the course of this follow-up were

commendable and sincerely appreciated.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

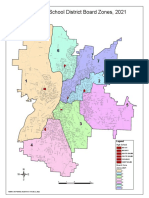

- School Board Zones Map 2021Документ1 страницаSchool Board Zones Map 2021Statesman JournalОценок пока нет

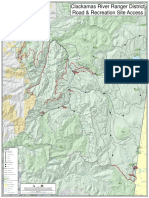

- Matthieu Lake Map and CampsitesДокумент1 страницаMatthieu Lake Map and CampsitesStatesman JournalОценок пока нет

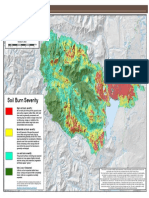

- Cedar Creek Vegitation Burn SeverityДокумент1 страницаCedar Creek Vegitation Burn SeverityStatesman JournalОценок пока нет

- Letter To Judge Hernandez From Rural Oregon LawmakersДокумент4 страницыLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalОценок пока нет

- Roads and Trails of Cascade HeadДокумент1 страницаRoads and Trails of Cascade HeadStatesman JournalОценок пока нет

- Cedar Creek Fire Soil Burn SeverityДокумент1 страницаCedar Creek Fire Soil Burn SeverityStatesman JournalОценок пока нет

- Cedar Creek Fire Sept. 3Документ1 страницаCedar Creek Fire Sept. 3Statesman JournalОценок пока нет

- Mount Hood National Forest Map of Closed and Open RoadsДокумент1 страницаMount Hood National Forest Map of Closed and Open RoadsStatesman JournalОценок пока нет

- Cedar Creek Fire Aug. 16Документ1 страницаCedar Creek Fire Aug. 16Statesman JournalОценок пока нет

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Документ4 страницыComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalОценок пока нет

- Social-Emotional & Behavioral Health Supports: Timeline Additional StaffДокумент1 страницаSocial-Emotional & Behavioral Health Supports: Timeline Additional StaffStatesman JournalОценок пока нет

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationДокумент1 страницаSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalОценок пока нет

- LGBTQ Proclaimation 2022Документ1 страницаLGBTQ Proclaimation 2022Statesman JournalОценок пока нет

- Salem Police 15-Year Crime Trends 2007 - 2021Документ10 страницSalem Police 15-Year Crime Trends 2007 - 2021Statesman JournalОценок пока нет

- BG 7-Governing StyleДокумент2 страницыBG 7-Governing StyleStatesman JournalОценок пока нет

- Revised Closure of The Beachie/Lionshead FiresДокумент4 страницыRevised Closure of The Beachie/Lionshead FiresStatesman JournalОценок пока нет

- Windigo Fire ClosureДокумент1 страницаWindigo Fire ClosureStatesman JournalОценок пока нет

- WSD Retention Campaign Resolution - 2022Документ1 страницаWSD Retention Campaign Resolution - 2022Statesman JournalОценок пока нет

- Salem Police 15-Year Crime Trends 2007 - 2015Документ10 страницSalem Police 15-Year Crime Trends 2007 - 2015Statesman JournalОценок пока нет

- Failed Tax Abatement ProposalДокумент8 страницFailed Tax Abatement ProposalStatesman JournalОценок пока нет

- Salem Police Intelligence Support Unit 15-Year Crime TrendsДокумент11 страницSalem Police Intelligence Support Unit 15-Year Crime TrendsStatesman JournalОценок пока нет

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedДокумент1 страницаProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalОценок пока нет

- All Neighborhoods 22X34Документ1 страницаAll Neighborhoods 22X34Statesman JournalОценок пока нет

- Salem-Keizer Discipline Data Dec. 2021Документ13 страницSalem-Keizer Discipline Data Dec. 2021Statesman JournalОценок пока нет

- Oregon Annual Report Card 2020-21Документ71 страницаOregon Annual Report Card 2020-21Statesman JournalОценок пока нет

- All Neighborhoods 22X34Документ1 страницаAll Neighborhoods 22X34Statesman JournalОценок пока нет

- Crib Midget Day Care Emergency Order of SuspensionДокумент6 страницCrib Midget Day Care Emergency Order of SuspensionStatesman JournalОценок пока нет

- SIA Report 2022 - 21Документ10 страницSIA Report 2022 - 21Statesman JournalОценок пока нет

- SB Presentation SIA 2020-21 Annual Report 11-9-21Документ11 страницSB Presentation SIA 2020-21 Annual Report 11-9-21Statesman JournalОценок пока нет

- Zone Alternates 2Документ2 страницыZone Alternates 2Statesman JournalОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Biapps 11 1 1 10 2 3093800Документ21 страницаBiapps 11 1 1 10 2 3093800Muhammad SalikОценок пока нет

- Oracle Retail Store Inventory Management: Release Notes Release 13.0Документ12 страницOracle Retail Store Inventory Management: Release Notes Release 13.0varachartered283Оценок пока нет

- OBIEE Step by Step INSTALL HintsДокумент11 страницOBIEE Step by Step INSTALL HintsconnorjacksonОценок пока нет

- How JollibeeДокумент5 страницHow JollibeelourenpabriaОценок пока нет

- Fusion - Financial Reports PDFДокумент502 страницыFusion - Financial Reports PDFDUNNA PAVITRAОценок пока нет

- Environmental Analysis Part 3 Business PlanДокумент23 страницыEnvironmental Analysis Part 3 Business PlanAllyville YuОценок пока нет

- GrabCAD Print The WhyДокумент30 страницGrabCAD Print The WhyAqil GhaffarОценок пока нет

- Ezelbayraktasdasd BRДокумент20 страницEzelbayraktasdasd BRHazem ElseifyОценок пока нет

- Next Generation Business Analytics Technology TrendsДокумент17 страницNext Generation Business Analytics Technology TrendsLightship Partners100% (3)

- Fundamentals of Information Systems, Seventh Edition: Database Systems, Data Centers, and Business IntelligenceДокумент63 страницыFundamentals of Information Systems, Seventh Edition: Database Systems, Data Centers, and Business IntelligenceTawanda MahereОценок пока нет

- Bayo Business Intelligence Solution To Sprocket Central Pty LTD Dataset-123dwscДокумент5 страницBayo Business Intelligence Solution To Sprocket Central Pty LTD Dataset-123dwscAthar AbbasОценок пока нет

- Business Intelligence DefinitionДокумент6 страницBusiness Intelligence DefinitionShikhar DabralОценок пока нет

- BusinessIntДокумент370 страницBusinessIntAd Las100% (1)

- PDF Nick Johnston Wide Eyes in The Dark DLДокумент196 страницPDF Nick Johnston Wide Eyes in The Dark DLBrayan Rodriguez100% (1)

- BI Analytics OverviewДокумент60 страницBI Analytics OverviewNazar GabirОценок пока нет

- Business Development Manager Resume ExampleДокумент1 страницаBusiness Development Manager Resume ExampleSifiso MasheleОценок пока нет

- MS SQL Server Business IntelligenceДокумент6 страницMS SQL Server Business IntelligenceJulie RobertsОценок пока нет

- NEPHU Data Analyst PDДокумент5 страницNEPHU Data Analyst PDVictor ChocОценок пока нет

- Spend AnalysisДокумент2 страницыSpend AnalysisKaran100% (1)

- Data AnalyticsДокумент13 страницData AnalyticsSagnik Chakraborty100% (1)

- BIDW ConceptsДокумент56 страницBIDW Conceptsajujan100% (1)

- Mastering ExcelДокумент259 страницMastering ExcelLuis Fernando Ospina100% (8)

- Big Data Report 2012Документ103 страницыBig Data Report 2012bileshОценок пока нет

- Chapter 1 - Closing Case PDFДокумент2 страницыChapter 1 - Closing Case PDFJohnny Abou YounesОценок пока нет

- BI Questions and AnswersДокумент14 страницBI Questions and AnswersvikОценок пока нет

- Buisness IntelligenceДокумент23 страницыBuisness IntelligencesanjivrmenonОценок пока нет

- Sap DownloadsДокумент33 страницыSap DownloadsspicychaituОценок пока нет

- Power BI GuideДокумент33 страницыPower BI GuideAnonymous gLnqfDJeОценок пока нет

- Week 9 - Problem Solving Through Information SystemДокумент75 страницWeek 9 - Problem Solving Through Information SystemSharifah RubyОценок пока нет

- LCIA BigData Opportunities ValueДокумент20 страницLCIA BigData Opportunities ValueNathaniel MillerОценок пока нет