Академический Документы

Профессиональный Документы

Культура Документы

Tds Rate Chart Fy 11 12

Загружено:

Cma Atanu MohantyИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tds Rate Chart Fy 11 12

Загружено:

Cma Atanu MohantyАвторское право:

Доступные форматы

WWW.ITAXINDIA.

ORG

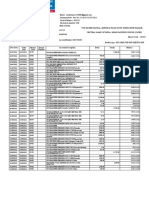

TDS RATE CHART FINANCIAL YEAR 2011-12 (ASSESSMENT YEAR 12-13) Sl. No . Section Of Act Nature of Payment in brief CUT OFF AMOUNT 01.07.201 0 Salary income must be more then exemption limit after deductions. 30.06.2010 1 2 3 4 4A 5 6 7 8 9 10 11 12 13 14 192 193 194 194A 194A 194B 194BB 194C(1) 194C(2) 194D 194EE 194F 194G 194H 194I Salaries Interest on Securities Deemed dividend u/s.2(22) (e) Dividends other than listed companies Interest other than Int on securities (by Bank) Interest other than Int. on securities (By others) Lottery / Cross Word Puzzle Winnings from Horse Race Contracts Sub-contracts/ Advertisements Insurance Commission Payments out of deposits under NSS Repurchase of units by MF/UTI Commission on sale of lottery tickets Commission or Brokerage Rent (Land & building) Rent (P & M , Equipment, furniture & fittings) Professional/Technical charges/Royalty & Noncompete fees Compensation on acquisition of immovable property Payment to non-residents 10000 5000 5000 2500 20000 20000 5000 2500 1000 1000 2500 120000 120000 20000 100000 10000 5000 10000 5000 30000 30000 20000 2500 1000 1000 5000 180000 180000 30000 100000 Rate % HUF/IN D OTHERS

Average Rate 10 10 10 10 30 30 1 1 10 20 20 10 10 10 2 10 10 Rates in force 10 10 10 10 30 30 2 2 10 20 10 10 10 2 10 10 Rates in force

15 16 17

194J 194LA 195/196 B/196C/ 196D/ 196E

http://www.itaxindia.org/2011/08/tds-rates-11-12-tds-rate-chart-cut-off.html

WWW.ITAXINDIA.ORG

TCS (tax collection at source rates fy 2011-12) Sl.No. Nature of Goods Rates in % 1. Alcoholic liquor for human Consumption 1 2. Tendu leaves 5 3. Timber obtained under forest lease 2.5 4. Timber obtained by any mode other than a forest 2.5 lease 5. Any other forest produce not being timber or tendu 2.5 leaves 6. Scrap 1 7. Parking lot 2 8. Toll plaza 2 9. Mining & Quarrying 2 Note:

1. Yearly Limit u/s 194C:Also where the aggregate of the amounts paid/credited or likely to

be paid/credited to Contactor or Sub-contractor exceeds Rs.75,000 during the financial year, TDS has to be made u/s 194C.

2. TDS at higher rate ie., 20% has to be made if the deductee does not provide PAN to the

deductor.(read detail u/s 206AA)

3. No TDS on Goods Transport :No deduction shall be made from any sum credited or paid

or likely to be credited or paid during the previous year to the account of a contractor during the course of business of plying, hiring or leasing goods carriages on furnishing of his Permanent Account Number, to the person paying or crediting such sum.(read details here No TDS on Goods Transport )

4. Surcharge on Income-tax is not deductible/collectible at source in case of individual/

HUF /Firm/ AOP / BOI/Domestic Company in respect of payment of income other than salary.

5. In the case of Company other than Domestic Company, the rate of surcharge is @ 2.5% of

Income-tax, where the income or the aggregate of such income paid or likely to be paid exceeds Rs.1,00,00,000.

6. NoCess on payment made to resident: Education Cess is not deductible /collectible at

source in case of resident Individual/HUF/Firm/ AOP/ BOI/ Domestic Company in respect of payment of income other than salary. Education Cess @ 2% plus secondary & Higher Education Cess @ 1% is deductible at source in case of non-residents and foreign company. TDS by Individual and HUF (Non Audit) case not deductible An Individual or a Hindu Undivided Family whose total sales, gross receipts or turnover from business or profession carried on by him does not exceeds the monetary limits(Rs.60,00,000 in case of business & Rs.15,00,000 in case of profession) under Clause (a) or (b) of Sec.44AB during the preceding financial year shall not be liable to deduct tax u/s.194A,194C, 194H, 194I & 194J.So no tax is deductible by HUF/Individual in first year of operations of business even sales/Fees is more than 60/15 Lakh.

http://www.itaxindia.org/2011/08/tds-rates-11-12-tds-rate-chart-cut-off.html

WWW.ITAXINDIA.ORG

Deposit of TDS: As a common rule tax is to be deposited with 7th of the immediate next month after deduction .However March tax is to be deposited by 30th April of the next financial year.For March ,2011 tds ,due date is 30.04.2011 and March 2012 due date is 30.04.2012. Rule is reproduced hereunder for your ready reference.(read full rule and notification 41/2010 dated 31.05.2010) Time and mode of payment to Government account of tax deducted at source or tax paid under sub section (1A) of section 192. Rule :30. (1) All sums deducted in accordance with the provisions of Chapter XVIIB by an office of the Government shall be paid to the credit of the Central Government

(a) on the same day where the tax is paid without production of an incometax challan; and (b) on or before seven days from the end of the month in which the deduction is made or incometax is due under subsection (1A) of section 192, where tax is paid accompanied by an incometax challan.

(2) All sums deducted in accordance with the provisions of Chapter XVIIB by deductors other than an office of the Government shall be paid to the credit of the Central Government

(a) on or before 30th day of April where the income or amount is credited or paid in the month of March; and (b) in any other case, on or before seven days from the end of the month in which

1. 2.

the deduction is made; or incometax is due under subsection (1A) of section 192.

CONSEQUENCES OF DEFAULT Failure to deduct or remit TDS /TCS(full or part)

Interest:Interest at the rates in force (12% p.a.) from the date on which tax was deductible / collectible to the date of payment to Government Account is chargeable. The Finance Act 2010 amended interest rate wef 01.07.2010 and created a separate class of default in respect of tax deducted but not paid to levy interest at a higher rate of 1.5 per cent per month, i.e. 18 per cent p.a. as against 1 per cent p.m., i.e. 12 per cent p.a., applicable in case the tax is deducted late after the due date. The rationale behind this amendment is that the tax once deducted belongs to the government and the person withholding the same needs to be penalized by charging higher rate of interest Penalty equal to the tax that was failed to be deducted/collected or remitted is leviable. In case of failure to remit the tax deducted/collected, rigorous imprisonment ranging from 3 months to 7 years and fine can be levied. Dis allowance of Expense for non deposit of TDS -Section 40(a)(ia)

http://www.itaxindia.org/2011/08/tds-rates-11-12-tds-rate-chart-cut-off.html

WWW.ITAXINDIA.ORG

Person required to file ETDS Return Filing due Dates NOTIFICATION No. 238/2007, dated 30-8-2007.Now following person are liable to file etds/etcs return. 1. All Government department/office or 2. All companies.or 3. All person required to get his accounts audited under section 44AB in the immediately preceding financial year; or 4 The number of deductees records in a quarterly statement for any quarter of the immediately preceding financial year is equal to or more than fifty, The Due Dates for filing Quarterly Statements for TDS/TCS are as under For quarter Due Dates ended 30/06/2011 15/07/2011 30/09/2011 31/12/2011 31/03/2012 15/10/2011 15/01/2012 15/05/2012

DUTIES OF TAX DEDUCTOR/COLLECTOR

1. To apply for Tax Deduction Account Number (TAN) in form 49B, in duplicate at the

designated TIN facilitation centers of NSDL(please see www.incometaxindia.gov.in), within one month from the end of the month in which tax was deducted.

2. To quote TAN (10 digit reformatted TAN) in all TDS/TCS challans, certificates,

statements and other correspondence.

3. To deduct/collect tax at the prescribed rates at the time of every credit or payment,

whichever is earlier, in respect of all liable transactions.

4. To remit the tax deducted/collected within the prescribed due dates by using challan no.

ITNS 281 by quoting the TAN and relevant section of the Income-tax Act.

5. To issue TDS/TCS certificate, complete in all respects, within the prescribed time in Form

No.16(TDS on salaries), 16A(other TDS) 27D( TCS).

6. To file TDS/TCS quarterly statements within the due date. 7. To mention PAN of all deductees in the TDS/TCS quarterly statements. http://www.itaxindia.org/2011/08/tds-rates-11-12-tds-rate-chart-cut-off.html

WWW.ITAXINDIA.ORG

Failure to apply for TAN in time or Failure to quote allotted TAN or Wrong quoting of TAN :Penalty of Rs.10,000 is leviable u/s.272BB(for each failure) Failure to issue TDS/TCS certificate in time or Failure to submit form 15H/15G in time or Failure to furnish statement of perquisites in time or Failure to file Quarterly Statements in time: For each type of failure, penalty of Rs.100/- per day for the period of default is leviable. Maximum penalty for each failure can be up to the amount of TDS/TCS.

GENERAL INFORMATION

1. Deduction at lower or nil rate requires certificate u/s.197, which will take effect from the

day it is issued. It cannot be used retrospectively.

2. If TDS/TCS certificate is lost, duplicate may be issued on a plain paper giving necessary

details marking it as duplicate.

3. Refund can be claimed by the deductee on filing of return of income. 4. Even if the recipient of payment has shown it in his income-tax return and paid the taxes

thereon, the deductor/collector who has failed to deduct/collect tax will be liable to pay interest and penalty. This brochure should not be construed as an exhaustive statement of law. In case of doubt, reference should always be made to the relevant provisions of Income Tax Act, Rules or Notifications.

http://www.itaxindia.org/2011/08/tds-rates-11-12-tds-rate-chart-cut-off.html

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Capital Budgeting Cash Flows1Документ37 страницCapital Budgeting Cash Flows1Mofdy MinaОценок пока нет

- Regional ImbalanceДокумент20 страницRegional Imbalancesujeet_kumar_nandan7984100% (8)

- NISM XA - Investment Adviser 1 Short Notes PDFДокумент41 страницаNISM XA - Investment Adviser 1 Short Notes PDFSAMBIT SAHOO100% (1)

- Unit 1 Challenge 1: D.) Unethical Behavior by Major Companies Prompted The Government To Create The Sarbanes-Oxley ActДокумент16 страницUnit 1 Challenge 1: D.) Unethical Behavior by Major Companies Prompted The Government To Create The Sarbanes-Oxley ActMeredith Eckard100% (1)

- Risk and Return Analysis of Equity Mutual FundДокумент90 страницRisk and Return Analysis of Equity Mutual Fundmajid_khan_4Оценок пока нет

- AuditingДокумент99 страницAuditingWen Xin GanОценок пока нет

- BUS670 O GradyДокумент5 страницBUS670 O GradyIndra ZulhijayantoОценок пока нет

- Sample Memorandum of AgreementДокумент3 страницыSample Memorandum of AgreementDivina Gammoot100% (1)

- INVESTMENT JOURNEY - Kiran Dhanawada - VP CHINTAN BAITHAK - GOA 2015Документ11 страницINVESTMENT JOURNEY - Kiran Dhanawada - VP CHINTAN BAITHAK - GOA 2015sureshvadОценок пока нет

- LeasingДокумент19 страницLeasingJHONОценок пока нет

- HDFC Apr To As On DateДокумент10 страницHDFC Apr To As On DatePDRK BABIUОценок пока нет

- 2023-DOA Leasing BG-SBLC CreditДокумент18 страниц2023-DOA Leasing BG-SBLC Creditelite.immo.80Оценок пока нет

- The Coal Mines (Nationalisation) Act, 1973Документ65 страницThe Coal Mines (Nationalisation) Act, 1973shashwat kumarОценок пока нет

- Statement of Profit or Loss and Other Comprehensive IncomeДокумент3 страницыStatement of Profit or Loss and Other Comprehensive IncomePatricia San Pablo100% (1)

- Checklist For TakeoverДокумент17 страницChecklist For Takeoverpreeti211100% (1)

- Transaction AnalysisДокумент33 страницыTransaction AnalysisIzzeah RamosОценок пока нет

- Singapore Property Weekly Issue 156Документ12 страницSingapore Property Weekly Issue 156Propwise.sg100% (1)

- Contemporary Mathematics For Business and Consumers, Third EditionДокумент6 страницContemporary Mathematics For Business and Consumers, Third EditionAphelele JadaОценок пока нет

- Accounting For Debt Srvice FundДокумент10 страницAccounting For Debt Srvice FundsenafteshomeОценок пока нет

- U.S. Individual Income Tax Return: (See Instructions.)Документ2 страницыU.S. Individual Income Tax Return: (See Instructions.)Daniel RamirezОценок пока нет

- Accounting For Installment SalesДокумент16 страницAccounting For Installment SalesLeimonadeОценок пока нет

- ExerciseДокумент4 страницыExercisemuneeraaktharОценок пока нет

- Deposits Training DocumentДокумент29 страницDeposits Training DocumentKarthikaОценок пока нет

- AccountStatement 3286686240 Aug04 185310 PDFДокумент2 страницыAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekОценок пока нет

- Reading Roy - 2010 - Poverty Capital - Microfinance and The Making of Development - CHДокумент15 страницReading Roy - 2010 - Poverty Capital - Microfinance and The Making of Development - CHgioanelaОценок пока нет

- A Literature Study On The Capital Asset Pricing MoДокумент5 страницA Literature Study On The Capital Asset Pricing Momarcel XОценок пока нет

- The Use of CML and SML in Taking Investments Decisions by An Investor On His/her Risk PreferenceДокумент4 страницыThe Use of CML and SML in Taking Investments Decisions by An Investor On His/her Risk PreferenceChanuka Perera100% (1)

- Grofin BrochureДокумент5 страницGrofin Brochurerainmaker1978Оценок пока нет

- Mountain State With NotesДокумент12 страницMountain State With NotesKeenan SafadiОценок пока нет

- Peranan Bank Perkreditan Rakyat Binaan Bank Nagari Terhadap Kinerja Usaha Kecil Di Sumatera BaratДокумент200 страницPeranan Bank Perkreditan Rakyat Binaan Bank Nagari Terhadap Kinerja Usaha Kecil Di Sumatera BaratPapan AjaОценок пока нет