Академический Документы

Профессиональный Документы

Культура Документы

WARC Paper On Mobile Branding

Загружено:

Himanshu MishraИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

WARC Paper On Mobile Branding

Загружено:

Himanshu MishraАвторское право:

Доступные форматы

ESOMAR

Worldwide Multi Media Measurement (WM3), Budapest, June 2008

www.esomar.org

The mobile brand experience measuring advertising effectiveness on the mobile web

George Pappachen Market Development, Safecount, United States Kara Manatt CrossMedia, Dynamic Logic, United States INTRODUCTION This paper outlines a groundbreaking way to measure the branding efficacy of mobile advertising. While it is not novel to recruit panel respondents for mobile research, live recruitment via mobile device is. By employing custom technology in support of the reliable techniques utilized in quantifying Internet campaigns over the past nine years (4,000 studies), a previously unavailable read on branding impact was introduced. This approach, the control/exposed methodology, has been successfully tested and repeated across a number of mobile studies, allowing for an early look at the impact mobile ads have across traditional brand metrics (brand and ad awareness, message association, brand favorability, purchase/behavior intent). In addition, the approach can provide information on how consumers use their mobile devices, what their mobile web activities and behaviors are, and can deliver insights on target audiences. Especially if coordinated with reach and frequency data, this approach can help shape a fuller understanding of the effectiveness of mobile advertising and the audience it impacts. Data to be discussed will include early averages across the above mentioned attitudinal measures and comparisons to what is typically seen on the Internet when using the same methodology and metrics. OUR RESEARCH PHILOSOPHY: BRANDS AND ADVERTISING In the minds of a consumer, brands are defined by all its associations rational and emotional which generate interest, curiosity, and set up expectations on service or product experience. Good marketing communication is central to ensuring brand success and advertising is a leading communication tool. Advertising across all platforms creates brand memories that are stored. The more these associations are refreshed, the more permanent they become. Useful branding techniques for effective advertising may include clear symbols to identify the brand and insight into the distinct brand benefits, and promote positive feelings, good social values, and overall desirability. Will the ad get into the mental workspace (engagement)? Does the ad affect brand associations in the right way (association)? Do the promoted brand associations make it more desirable at key decision moments (motivation)? These are some of the questions that an effective campaign would deliberately address and utilize to maximize returns. While there's no magic formula to ensure advertising success, our experience shows that some basic principles should be observed: 1) distinctive creative is always key; 2) the creative idea should be intrinsically linked to the brand and its messages; 3) the communication should evoke a response which can be either rational or emotional and be personally relevant. A firm foundation in advertising research has formed the basis of our development of solutions to assess the impact of advertising in new and emerging technology platforms including mobile. THE MOBILE LANDSCAPE Worldwide mobile ad spending will grow from $2.7 billion in 2007 to $19.1 billion in 2012, according to an eMarketer report released in March of this year. This report also held that marketers are increasingly including mobile media in digital campaigns and that the average price for a mobile marketing campaign more than tripled to $100,000 in 2007. Mobile content assumes many forms, which include (in order of total usage): SMS/MMS text messages, Wireless Application Protocol (WAP) Internet, downloadable applications, and video (see Figure 1).

Figure 1: Active audience for key mobile marketing and ad modalities Mobile devices are increasingly gaining foothold in consumers' lives and routines. Browsing for movie times, purchasing music and digital content, and interacting on instant messenger are some of the typical entertainment related activities consumers routinely undertake using a cell-phone (see Figure 2).

Figure 2: Digital media activities of young adult mobile phone users worldwide These behaviors reflect growing consumer adoption of the handheld as a legitimate 'third screen' on the road to what optimistic mobile evangelists hope is an eventual battle for 'first screen status. Despite this tremendous growth trajectory, marketers are only now tapping into mobile's vast potential. And while effective mobile campaigns would capitalize on the medium's unique capabilities, marketers predictably expect mobile to offer the Internet's well touted advantages of measurement and accountability. So, part of the process of progressing mobile from exploratory budgets to full fledged contender for media dollars is to determine appropriate metrics for marketing success. In an age of disparate advertising platforms and fragmented media consumption, metrics to evaluate the impact of advertising in the mobile space are critical. Marketers would rightly expect to understand the return on their mobile spend or investment and as well, mobile's place in the marketing mix. In that vein, this paper reviews the process which enabled survey research to be conducted on a handheld, using a proven methodology that formed the foundation of over 4,000 Internet advertising studies. This paper seeks to contribute to the understanding of mobile advertising effectiveness in three areas: 1. 2. Suggesting standard brand metrics as an evaluative measure for marketing messages on the mobile web. Presenting a repeatable, scalable and proven method for measuring mobile advertising effectiveness Adlndex for Mobile.

3.

Providing an early look at how mobile campaigns are performing, with a case study and early mobile averages.

To create a research solution for measuring the effectiveness of mobile advertising, Dynamic Logic adapted its Adlndex methodology, previously employed on the Internet, and applied it to the mobile Web space (see Figure 3).

Figure 3: Control/exposed methodology for mobile web Introducing research on the mobile web, however, had clear technological challenges, such as an inapplicable Internet recruitment model; incompatible Internet survey platforms; non-transferable Internet tracking capabilities; and misaligned mobile ad serving/WAP-site technologies. The path to progress tackled every technical obstacle with a relentless focus. To be responsible to the still developing mobile ecosystem, respondent interface with the custom mobile survey platform was carefully managed. The rules of engagement were narrowly tailored to fit the unique mobile environment and its distinctive capabilities industry best practices were strictly observed. The survey platform not only enabled custom integration with differing ad server technologies, but also delivered an innovative results exchange. Partnerships with carriers, ad servers, and other mobile enterprises were negotiated and leveraged to test and trial tracking technologies to identify and separate control and exposed cells. Research on research was conducted to discern handset market penetration and to learn other information on critical technical components of this initiative. Beyond behavioral measures, such as clicks and view-throughs, AdIndex for Mobile evaluates the impact of mobile advertising on attitudinal measures and, as a result, advances the knowledge of the industry in these key areas:

q

Quantifies advertising effectiveness for mobile advertising using traditional brand metrics such as awareness, brand favorability, ad recall, and purchase intent, and compares these metrics from a given campaign back to ad effectiveness averages culled from prior campaigns. Enables visibility into the following aspects of user experience and consumer media consumption habits these elements are selectively incorporated in collaboration with media partners and are customized to study objectives:

r

how consumers perceive and react to mobile advertising; optimize mobile advertising placement, reach and frequency levels using consumer-supplied data points; identify points in the decision-making process where consumers are most receptive to mobile advertising; investigate if mobile complements an advertiser's marketing mix.

Prior to the introduction of Adlndex for Mobile, the research community relied on panel-based approaches and measurement built solely on user recall of mobile advertising. This was not an ideal approach for many reasons prohibitive cost, inaccuracy of self-reported exposure, and difficulty of recruiting respondents exposed to advertising due to the relatively low reach of mobile campaigns, just to name a few. The solution outlined in this presentation is based on live, in-market measurement of advertising exposure and was designed to deal with these issues. METHODOLOGY: QUANTIFYING MOBILE PERFORMANCE Adlndex for Mobile uses a control/exposed methodology to gauge the impact of mobile ad campaigns as they run live across WAP site(s). Campaign ads are tracked through either a mobile ad server or by our proprietary AdScout Mobile technology. This tracking allowed for the distinguishing of two cells of mobile users: those who have been exposed to the specific advertising campaign and those who have not been exposed to it. Mobile users are randomly recruited on their mobile device using a banner invitation or text link and are guided to a survey which is taken directly on their mobile device. The survey platform reads from a library of devices and renders optimally to the device in question. Both the control group and the exposed group are given the exact same survey and their responses are compared. The survey consists of approximately 10 questions ranging from mobile usage to brand awareness and purchase intent. The basic survey question structure is held consistent across research studies for the purpose of building a normative database for mobile advertising; however, customized questions are developed to measure the specific brand's attributes or unique campaign messages.

Simultaneous recruitment of control and exposed respondents controls for outside influences (i.e. seasonality, offline media, etc.) and ensures that the only statistical difference between the control and exposed groups is exposure to the advertising. As a result, any differences in survey responses between the two groups can be attributed to the impact of the mobile advertising. As a standard practice, 300 control respondents and 300 exposed respondents are sampled, and a two-tailed t-test is used to determine statistically significant differences. This methodology provides media companies, agencies and advertisers with much needed research to assess the effectiveness of mobile advertising. AN EARLY LOOK AT MOBILE PERFORMANCE Early averages from 14 measured mobile ad campaigns across a variety of industries suggest that mobile advertising is a highly effective medium for raising top and bottom funnel brand metrics (see Figure 4).

Figure 4: Early mobile averages * An average increase of +20.4 percentage-points in Mobile Ad Awareness suggests that these campaigns generally cut-through and grab users' attention. Increases in Brand Favorability and Purchase Intent of +3.4 and +4.1 percentage-points, respectively, support the ability of mobile advertising to significantly change consumers' attitudes towards a brand and act as a sales vehicle. CASE STUDY: MOBILE ADS FOR THE GOLDEN COMPASS FILM DEMONSTRATE BRANDING IMPACT OF MOBILE ADVERTISING To generate excitement for its new film, The Golden Compass, New Line Cinema commissioned Greystripe, an ad-supported mobile game and application distributor, to launch a marketing campaign. The purpose of the campaign was to engage mobile users in a gaming environment to raise awareness of the film, raise their interest, and ultimately drive movie-goers to the box office. Greystripe commissioned Dynamic Logic's Adlndex for Mobile to measure the success of the campaign in reaching these goals. Study scoping revealed that given the technical nature of mobile gaming, the control cell had to be recruited just prior to the start of campaign to ensure adequate recruitment of respondents who had not seen The Golden Compass campaign ad. Exposed respondents were recruited from the Greystripe network between November 8 and December 6, 2007, while the campaign was in-market. Due to the lack of uniform standards for mobile technology in general and for ad serving in particular, some of our early studies reflect a precontrol/exposed testing, as in this case, rather than the typical simultaneous exposed/control testing employed in other campaigns. Respondents for this study were surveyed on their mobile phones about their movie-going habits, awareness of The Golden Compass movie, attitudes towards it, and intent to see it at a theater. Results show that the campaign reached an extremely relevant audience. Two-thirds of the sample reported having seen a movie in a theater in the past two months, and about a third use their mobile device to find theaters and movie times, watch movie trailers, and visit movie WAP sites. The campaign also made an impressive impact in marketing The Golden Compass movie (see Figure 5).

Figure 5: Mobile ads for The Golden Compass raise awareness & interest among overall respondents Users exposed to the campaign showed a +19.3 percentage-point increase in awareness of the title and a +59.7 percentage-point increase in awareness of the mobile ad. In terms of shifting attitudes, exposure to the campaign generated a +9.5 increase in Movie Interest. In other words, 9.5% of people who became interested or very interested in the film would otherwise not have been. All three metrics surpassed Dynamic Logic's early mobile averages for these measures (see Figure 6).

Figure 6: Golden Compass greystripe vs. mobile averages * RELEVANT MESSAGING IS KEY It is no surprise that consumers may be wary of advertising on their mobile devices. This may result in consumers' rejection of advertising on a device that is considered very personal. It is possible that people may not yet see the value in mobile ads at this stage. The perception may be that ads on mobile phones will be intrusive and interruptive, more like SPAM, so there is an opportunity for advertisers and brands to change this perception by connecting with their audience when the message is relevant. Relevance is critical to the adoption of mobile advertising. While advertisers are testing the mobile ad waters with WAP display formats like banners, the real potential of mobile marketing lies in the mobile marketing efforts that are relevant and offer value to consumers when they want and need it. CONCLUSIONS: WHERE DO WE GO FROM HERE? While there's still much to learn, initial research demonstrates mobile advertising campaigns can generate a strong branding impact across a wide range of industries across low and high-consideration categories. Mobile advertising campaigns have the power to significantly impact top and bottom funnel brand metrics, from brand awareness all the way down to purchasing. In order to provide some context around the brand performance of mobile campaigns (while not an ideal comparison), early mobile averages are higher than those typically seen from similar campaigns on the Internet across most brand metrics. While novelty of medium likely contributes to the higher averages, advertising in a new medium does present an opportunity to influence viewers in a fresh, less-cluttered environment. While it is clear that mobile web is a technology that users are heavily interacting with,

differences between mobile and other media may flatten over time as the medium becomes more commonplace. Advertisers should consider leveraging this new medium early on to optimize impact. REFERENCE du Pre Gauntt, John. (2008). Mobile Advertising: After the Growing Pains, eMarketer: March 2008.

Copyright ESOMAR 2008

European Association of Communications Agencies 152 Blvd. Brand Whitlock, Brussels 1200, Belgium Tel: +32 (0)27 40 0711, Fax: +32 (0)27 40 0717 All rights reserved including database rights. This electronic file is for the personal use of authorised users based at the subscribing company's office location. It may not be reproduced, posted on intranets, extranets or the internet, e-mailed, archived or shared electronically either within the purchasers organisation or externally without express written permission from World Advertising Research Center.

www.warc.com

Вам также может понравиться

- Mobile Mastery: The Ultimate Guide to Successful Mobile Marketing CampaignsОт EverandMobile Mastery: The Ultimate Guide to Successful Mobile Marketing CampaignsОценок пока нет

- 1.1 Background To Study: Influence of Smartphone Application Based Advertisement On Purchase IntentionДокумент45 страниц1.1 Background To Study: Influence of Smartphone Application Based Advertisement On Purchase IntentionsaratkarvivekОценок пока нет

- PANCHAVARNAMДокумент8 страницPANCHAVARNAMbaranidharan .kОценок пока нет

- MOBILE MARKETING COMES OF AGEДокумент48 страницMOBILE MARKETING COMES OF AGEGaurav SaklaniОценок пока нет

- Unit 7 OMBE 307 - Digital MarketingДокумент12 страницUnit 7 OMBE 307 - Digital MarketingJibandaanPharmacy Doctors ChamberОценок пока нет

- Mobile & Email Marketing Opportunities With Reference To Retail IndustryДокумент54 страницыMobile & Email Marketing Opportunities With Reference To Retail IndustryManan TyagiОценок пока нет

- What Is Mobile Marketing?Документ21 страницаWhat Is Mobile Marketing?Pawan SachanОценок пока нет

- Final RMT ProposalДокумент13 страницFinal RMT ProposalNazish JavedОценок пока нет

- Research PaperДокумент17 страницResearch PaperIshan ShankerОценок пока нет

- Study Effectiveness Online Marketing IMCДокумент16 страницStudy Effectiveness Online Marketing IMCManu GCОценок пока нет

- Mobile Advertising: A Framework and Research Agenda: SciencedirectДокумент12 страницMobile Advertising: A Framework and Research Agenda: SciencedirectfarahОценок пока нет

- Marketing Analytics222Документ18 страницMarketing Analytics222Wazed AliОценок пока нет

- Final ContДокумент42 страницыFinal ContUppandhraa NОценок пока нет

- Mobile Marketing: 7 Easy Steps to Master Mobile Strategy, Mobile Advertising, App Marketing & Location Based MarketingОт EverandMobile Marketing: 7 Easy Steps to Master Mobile Strategy, Mobile Advertising, App Marketing & Location Based MarketingОценок пока нет

- MobileApp Based MarketingДокумент40 страницMobileApp Based MarketingRavi Chugh67% (3)

- Sample 1Документ9 страницSample 1Deepti GuptaОценок пока нет

- How To Create A Mobile Marketing Strategy?Документ3 страницыHow To Create A Mobile Marketing Strategy?Aditi ShuklaОценок пока нет

- IMC Report KhushalДокумент3 страницыIMC Report KhushalKanexongОценок пока нет

- Mobile Marketing: A Synthesis and Prognosis: Venkatesh Shankar & Sridhar BalasubramanianДокумент12 страницMobile Marketing: A Synthesis and Prognosis: Venkatesh Shankar & Sridhar BalasubramanianSaujanya PaswanОценок пока нет

- Measureabiltiy and Online AdsДокумент41 страницаMeasureabiltiy and Online AdsdejannikolovskiОценок пока нет

- Mobile Advertising HandbookДокумент24 страницыMobile Advertising HandbookCristea GianiОценок пока нет

- SIP Brand PromoДокумент23 страницыSIP Brand PromosidОценок пока нет

- Attitude of Youth Towards Mobile Advertising in Higher EducationДокумент9 страницAttitude of Youth Towards Mobile Advertising in Higher EducationInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Mobile Markerting - Soukaina Labiad - 19998Документ22 страницыMobile Markerting - Soukaina Labiad - 19998Soukaina LabiadОценок пока нет

- What Does Online Marketing Mean?: Low CostsДокумент127 страницWhat Does Online Marketing Mean?: Low CostsRami RohanОценок пока нет

- Topic 02Документ14 страницTopic 02Whatsapp stutsОценок пока нет

- Mobile Marketing Final To PrintДокумент97 страницMobile Marketing Final To Printrapols9Оценок пока нет

- Mobile Advertising: 3-in-1 Guide to Master SMS Marketing, Mobile App Advertising, LBM & Mobile Games MarketingОт EverandMobile Advertising: 3-in-1 Guide to Master SMS Marketing, Mobile App Advertising, LBM & Mobile Games MarketingОценок пока нет

- Mobile Marketing A Literature Review On Its Value For Consumers and RetailersДокумент8 страницMobile Marketing A Literature Review On Its Value For Consumers and RetailersafmzrdqrzfasnjОценок пока нет

- The Ultimate Guide To Digital Marketing: Strategies and Tactics for SuccessОт EverandThe Ultimate Guide To Digital Marketing: Strategies and Tactics for SuccessОценок пока нет

- The Effectiveness of Internet Advertising: Paper 1Документ12 страницThe Effectiveness of Internet Advertising: Paper 1Zeeshan SindhuОценок пока нет

- Millennial Media Making Impressions Count Mobile Viewability enДокумент10 страницMillennial Media Making Impressions Count Mobile Viewability enNguyễn Hoàng Vân AnhОценок пока нет

- DIGITAL MARKETING (Unit 4)Документ9 страницDIGITAL MARKETING (Unit 4)sharmapranav780Оценок пока нет

- Integrated Marketing CommunicationsДокумент17 страницIntegrated Marketing CommunicationsHarshala ChoudharyОценок пока нет

- Planning and Implementing Effective Mobile Marketing ProgramsДокумент3 страницыPlanning and Implementing Effective Mobile Marketing ProgramsGeetika KhandelwalОценок пока нет

- Chapter - I Mobile & E-Mail Marketing Opportunities With Refrence To Retail IndustryДокумент35 страницChapter - I Mobile & E-Mail Marketing Opportunities With Refrence To Retail IndustryManiKandanОценок пока нет

- Research Proposal - v1Документ13 страницResearch Proposal - v1Thesis IndiaОценок пока нет

- Research Paper On Digital AdvertisingДокумент8 страницResearch Paper On Digital Advertisingskpcijbkf100% (1)

- Claro Assignment 1 Module 1 AdvertisingДокумент4 страницыClaro Assignment 1 Module 1 AdvertisingSteffi Anne D. ClaroОценок пока нет

- AppsFlyer and TikTok Best Practices PlaybookДокумент49 страницAppsFlyer and TikTok Best Practices Playbooksans.pabloОценок пока нет

- Digital Advertising Platforms' Effects On Consumers' Buying BehaviourДокумент8 страницDigital Advertising Platforms' Effects On Consumers' Buying BehaviourInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- MGT 447Документ10 страницMGT 447Yaqoob UsmanОценок пока нет

- Ass 2Документ3 страницыAss 2amrahmed0159Оценок пока нет

- Brand Promotion and Antivirus Usage StudyДокумент55 страницBrand Promotion and Antivirus Usage StudysidОценок пока нет

- Final Asigment of BRM .. NomiДокумент13 страницFinal Asigment of BRM .. NomiWasif AliОценок пока нет

- Research On The Impact of Advertisement On Consumer BehaviorДокумент5 страницResearch On The Impact of Advertisement On Consumer BehaviorChhandogya PatilОценок пока нет

- DM-Unit 5Документ20 страницDM-Unit 5theworkingangel2Оценок пока нет

- Adv. TestДокумент3 страницыAdv. TestSahil SinglaОценок пока нет

- Marketing Terminologies: Digital, E-commerce, Influencer, and Email Marketing TermsОт EverandMarketing Terminologies: Digital, E-commerce, Influencer, and Email Marketing TermsОценок пока нет

- ONLINE VS OFFLINE MARKETINGДокумент4 страницыONLINE VS OFFLINE MARKETINGMrunal WaghchaureОценок пока нет

- Iab Australia MeasurementДокумент8 страницIab Australia MeasurementAlex SistiОценок пока нет

- Unit 5 MM Students NotesДокумент26 страницUnit 5 MM Students NotesN.NevethanОценок пока нет

- Sports Marketing Trends & PerceptionsДокумент12 страницSports Marketing Trends & PerceptionsHimanshu MishraОценок пока нет

- Akamai Sky Italia Content Delivery Case StudyДокумент2 страницыAkamai Sky Italia Content Delivery Case StudyHimanshu MishraОценок пока нет

- Development of The Attitude Towards Women - S Sports Scale (ATWS)Документ36 страницDevelopment of The Attitude Towards Women - S Sports Scale (ATWS)Himanshu MishraОценок пока нет

- (Management Marketing) Youth Motivations To Watch Sports in Indian Context Exploring Cross-Nationality and Cross-Gender DifferencesДокумент11 страниц(Management Marketing) Youth Motivations To Watch Sports in Indian Context Exploring Cross-Nationality and Cross-Gender DifferencesHimanshu MishraОценок пока нет

- 2016 Entertainment and Media TrendsДокумент16 страниц2016 Entertainment and Media Trendsjojee2k6Оценок пока нет

- EY 6 Trends That Will Change The TV Industry PDFДокумент24 страницыEY 6 Trends That Will Change The TV Industry PDFFaizahKadirОценок пока нет

- Edinburgh TV FestivalДокумент12 страницEdinburgh TV FestivalHimanshu MishraОценок пока нет

- Why OTT Providers Aren't Concerned With Churn - and Why They Should Be Cartesian July2016Документ6 страницWhy OTT Providers Aren't Concerned With Churn - and Why They Should Be Cartesian July2016Himanshu MishraОценок пока нет

- WW MSN How Colgate Could Optimize Its Total 2003Документ2 страницыWW MSN How Colgate Could Optimize Its Total 2003Himanshu MishraОценок пока нет

- BARC India's Viewership Data For Channels With Plus1 Hour Delayed Viewing Feature - Sept 2016Документ1 страницаBARC India's Viewership Data For Channels With Plus1 Hour Delayed Viewing Feature - Sept 2016Himanshu MishraОценок пока нет

- Binary Logistic Regression Schueppert 2009Документ25 страницBinary Logistic Regression Schueppert 2009Türk Psikolojik Travma AkademisiОценок пока нет

- Chap10 Media Planning and StrategyДокумент30 страницChap10 Media Planning and StrategyDang NguyenОценок пока нет

- Consultation Paper On Broadband 24sep2014 PDFДокумент78 страницConsultation Paper On Broadband 24sep2014 PDFHimanshu MishraОценок пока нет

- Ali Samman New+Media Impac116v3i7aДокумент11 страницAli Samman New+Media Impac116v3i7aVishal BalaniОценок пока нет

- A Basic Introduction To CHAIDДокумент4 страницыA Basic Introduction To CHAIDanilkumarnnОценок пока нет

- Bootstrap Method PDFДокумент14 страницBootstrap Method PDFodie99Оценок пока нет

- Tips For Giving A Stellar PresentationДокумент4 страницыTips For Giving A Stellar PresentationHimanshu MishraОценок пока нет

- CEB MKTG B2B Digital Evolution PDFДокумент46 страницCEB MKTG B2B Digital Evolution PDFAbdullah MaherОценок пока нет

- 2 Digital Marketing Strategy Quirk Textbook 5Документ14 страниц2 Digital Marketing Strategy Quirk Textbook 5stanleyjebakumar2100% (1)

- Future of TV FinalДокумент28 страницFuture of TV FinalHimanshu MishraОценок пока нет

- Battle of Bihar Election 2015: Stories, Statistics & InsightsДокумент104 страницыBattle of Bihar Election 2015: Stories, Statistics & InsightsHimanshu MishraОценок пока нет

- Bayesi An InferenceДокумент21 страницаBayesi An InferenceHimanshu MishraОценок пока нет

- Churn AnalyticsДокумент46 страницChurn AnalyticsHimanshu MishraОценок пока нет

- 06 Demographic Indicators 2011Документ24 страницы06 Demographic Indicators 2011Himanshu MishraОценок пока нет

- Tree Structured Data Analysis: AID, CHAID and CART TechniquesДокумент10 страницTree Structured Data Analysis: AID, CHAID and CART TechniquesHimanshu MishraОценок пока нет

- 2008 Tåg - Essays On PlatformsДокумент112 страниц2008 Tåg - Essays On PlatformsHimanshu MishraОценок пока нет

- KoolChart 1.5 UserДокумент141 страницаKoolChart 1.5 UserHimanshu MishraОценок пока нет

- Itl RFP 09 Technical ProposalДокумент20 страницItl RFP 09 Technical ProposalHimanshu MishraОценок пока нет

- Our Fascination With All Things CircularДокумент9 страницOur Fascination With All Things CircularHimanshu MishraОценок пока нет

- Bottled WaterДокумент4 страницыBottled Waternkathiriya9Оценок пока нет

- ProjectДокумент74 страницыProjectvinayhv1350% (4)

- Community Investment Strategy PDFДокумент32 страницыCommunity Investment Strategy PDFLexico InternationalОценок пока нет

- Chapters 1-2 Practice Test: Nguyễn Thị Thu Thủy - SAMI - HUSTДокумент2 страницыChapters 1-2 Practice Test: Nguyễn Thị Thu Thủy - SAMI - HUSTThanh NgânОценок пока нет

- MwigaДокумент89 страницMwigamichael richardОценок пока нет

- Comparative Study of ULIP & Traditional PlansДокумент39 страницComparative Study of ULIP & Traditional PlansbawamatharooОценок пока нет

- Management Business: - Swot - BMC - USP - Cyber SecurityДокумент18 страницManagement Business: - Swot - BMC - USP - Cyber Securityjashwini100% (1)

- Disclaimer PDFДокумент2 страницыDisclaimer PDFJustin EnriquezОценок пока нет

- Unscoped DCT Report on Maintenance Special RequirementsДокумент5 страницUnscoped DCT Report on Maintenance Special RequirementsshaggipcОценок пока нет

- Reading 42.1 Standards of Professional Conduct Guidance For Standards I - AnswersДокумент25 страницReading 42.1 Standards of Professional Conduct Guidance For Standards I - Answerstristan.riolsОценок пока нет

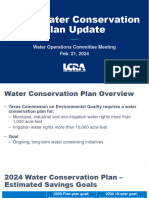

- Lcra Water Conservation Plan Update Pres 2024-02-21Документ11 страницLcra Water Conservation Plan Update Pres 2024-02-21Anonymous Pb39klJОценок пока нет

- IFRS 17 Insurance Contracts - SummaryДокумент8 страницIFRS 17 Insurance Contracts - SummaryEltonОценок пока нет

- IBP For Supply Optimizer - Cookbook - v2Документ29 страницIBP For Supply Optimizer - Cookbook - v2Marcos LimaОценок пока нет

- Minimizing Storage Cost - Storing Inventory May Be Extremely Expensive For Any OperationДокумент4 страницыMinimizing Storage Cost - Storing Inventory May Be Extremely Expensive For Any OperationKazi FahimОценок пока нет

- Activity 5Документ8 страницActivity 5Marielle UyОценок пока нет

- SAES-A-205 Change Contact NameДокумент27 страницSAES-A-205 Change Contact Namesaleem naheed100% (1)

- Ethiopia Road Design Manual Complementary InterventionsДокумент32 страницыEthiopia Road Design Manual Complementary InterventionsHannaОценок пока нет

- CA Itt Training.Документ26 страницCA Itt Training.Bhargav DudhatraОценок пока нет

- Assignment 1Документ2 страницыAssignment 1Eden teklemariamОценок пока нет

- B36LNДокумент2 страницыB36LNfarukh azeemОценок пока нет

- Compound Interest DLLДокумент5 страницCompound Interest DLLOmengMagcalas100% (1)

- Proposal For Legal ServicesДокумент4 страницыProposal For Legal Servicesaaksial0150% (2)

- Regristration Form Regristration Form: No.002 - No.002Документ1 страницаRegristration Form Regristration Form: No.002 - No.002flailaОценок пока нет

- Social Media Content Strategy TemplateДокумент29 страницSocial Media Content Strategy TemplateAreeba AlkaafОценок пока нет

- QNAS HOTEL Registration FormДокумент1 страницаQNAS HOTEL Registration FormAnnalyn PeñaОценок пока нет

- Calculate ROI for XYZ Energy CaseДокумент27 страницCalculate ROI for XYZ Energy CaseWei ZhangОценок пока нет

- CHA LiabilitiesДокумент6 страницCHA Liabilitiesprachi30Оценок пока нет

- Experienced Welder CVДокумент4 страницыExperienced Welder CVDavid Barimbing100% (1)

- BCSaturday Team Assignment 1 Group 5 FeedbackДокумент2 страницыBCSaturday Team Assignment 1 Group 5 FeedbackTâm Lê Hồ HỒNGОценок пока нет

- International Trade - Competition and Cooperation 2009Документ94 страницыInternational Trade - Competition and Cooperation 2009api-235209117Оценок пока нет

- Exercises in MerchandisingДокумент10 страницExercises in MerchandisingJhon Robert BelandoОценок пока нет