Академический Документы

Профессиональный Документы

Культура Документы

SPARC Annual Report FY09 Complete

Загружено:

GaneshИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SPARC Annual Report FY09 Complete

Загружено:

GaneshАвторское право:

Доступные форматы

CLINICAL RESEARCH THERAPEUTIC ANALOGUES PHARMACOLOGY DEVELOPMENT SEEKING INSIGHT MEDICINAL CHEMISTRY PHARMACEUTICS NEW DRUGS NOVEL DRUG

L DRUG DELIVERY SYSTEMS BIOSTATISTICS TOXICOLOGY DRUG BINDING ANIMAL STUDIES PRODRUGS TARGETED DRUG DELIVERY INNOVATION ACTIVE TRANSPORT MECHANISM BIOAVAILABILITY RESEARCH NANOSPHERES ANNUAL REPORT 2008-09 BIODEGRADABLE DEPOTS CLINICAL RESEARCH THERAPEUTIC ANALOGUES PHARMACOLOGY DEVELOPMENT MEDICINAL CHEMISTRY PHARMACEUTICS NEW

Clinical Research Therapeutic Analogues P h a r m a c o l o g y Development Medicinal Chemistry Pharmaceutics New Drugs Novel Drug Delivery Systems Biostatistics Toxicology Drug Binding Animal Studies Prodrugs Targeted Drug Delivery Innovation Active Transport Mechanism Bioavailability Research N a n o s p h e r e s Biodegradable Depots Clinical Research Therapeutic Analogues P h a r m a c o l o g y Development Medicinal Chemistry Pharmaceutics New Drugs Novel Drug Delivery Systems Biostatistics Toxicology Animal Studies Prodrugs Targeted Drug Delivery Innovation Active Transport Mechanism Bioavailability Research Nanospheres Biodegradable Depots Clinical Research Therapeutic Analogues P h a r m a c o l o g y Development Medicinal Chemistry Pharmaceutics New Drugs Novel Drug Delivery Systems Biostatistics Toxicology Drug Binding Animal Studies Prodrugs

Contents

Corporate Information Management Discussion and Analysis - New Chemical Entity projects (NCE) - Novel Drug Delivery System based projects (NDDS) Directors Report Auditors Report Balance Sheet Profit and Loss Account Cash Flow Statement Corporate Governance 10 16 18 19 20 33 01 02

Disclaimer: Statements in this Management Discussion and Analysis describing the Companys objectives, projections, estimates, expectations, plans or predictions or industry conditions or events may be forward looking statements within the meaning of applicable securities laws and regulations. Actual results, performance or achievements could differ materially from those expressed or implied. Important factors that could make a difference to the companys operations include global and Indian demand supply conditions, finished goods prices, feedstock availability and prices, and competitors pricing in the Companys principal markets, changes in Government regulations, tax regimes, economic developments within India and the countries within which the Company conducts businesses and other factors such as litigation and labour unrest or other difficulties. The Company assumes no responsibility to publicly update, amend, modify or revise any forward looking statements, on the basis of any subsequent development, new information or future events or otherwise except as required by applicable law. Unless the context otherwise requires, all references in this document to we, us or our refers to Sun Pharma Advanced Research Company Limited.

Annual Report 2008-09

Corporate Information

Board of Directors

Mr. Dilip S. Shanghvi Chairman & Managing Director

Offices Registered Office

Sun Pharma Advanced Research Centre (SPARC), Akota Road, Akota, Vadodara - 390 020.

Dr. T. Rajamannar Wholetime Director & Executive Vice President R&D

Mumbai Office

Mr. Sudhir V. Valia Director 17-B, Mahal Industrial Estate, Mahakali Caves Road, Andheri (East), Mumbai - 400 093. Prof. Dr. Andrea Vasella Director

Research Centres

F.P .27, Part Survey No.27, C.S. No. 1050, T.P No. 24, Village Tandalja, .S. District Vadodara - 390 020. 17-B, Mahal Industrial Estate, Mahakali Caves Road, Andheri (East), Mumbai - 400 093.

Prof. Dr. Goverdhan Mehta Director

Mr. S. Mohanchand Dadha Director

Company Secretary

Mr. Sunil R. Ajmera (upto 31st January, 2009)

Registrars & Share Transfer Agents

Link Intime India Pvt. Ltd. (Formerly Intime Spectrum Registry Ltd.) C/13, Pannalal Silk Mills Compound, L.B.S. Marg, Bhandup (West), Mumbai - 400 078. Tel: (022) 25963838 Fax: (022) 25946969 E-mail: sparc@intime.co.in rnt.helpdesk@linkintime.co.in

Ms. Meetal Sampat (w.e.f. 1st February, 2009)

Auditors

Deloitte Haskins & Sells Chartered Accountants Mumbai

Bankers

ICICI Bank Ltd. Indusind Bank Ltd. Citibank N. A. Bank of Baroda

1

Additional Collection Centre

201, Daver House, 197/199, Dr. D.N. Road, Mumbai - 400 001. Tel: (022) 22694127

Sun Pharma Advanced Research Company Ltd.

Management Discussion and Analysis

Clinical Research Therapeutic Analogues Pharmacology Development Medicina Toxicology Drug Binding Animal Studies Prodrugs Targeted Drug Delivery In Biodegradable Depots Clinical Research Therapeutic Analogues Pharmacology Delivery Systems Biostatistics Toxicology Drug Binding Animal Studies Prodrugs Research Nanospheres Biodegradable Depots Clinical Research Therapeutic

Industry Structure and Developments

With an industry history of a little over a decade, innovative Pharma R&D in the Indian industry is still in the early stages of evolution. Long standing expertise in chemistry, a large pool of professionals and untreated patients who are ideal for clinical research, have often been cited as factors that are working to India's advantage in pharma R&D. However, sufficient skills and large enough scientific pool in the area of biological sciences - molecular biology, pharmacology, toxicology, clinical pharmacology are still being learnt on the go as the industry evolves. Internationally, new developmental pipelines from inhouse R&D have been shrinking due to several factors such as: complexity of therapeutic targets, falling R&D productivity, escalating costs associated with developing new products, greater regulatory hurdles and increasing challenges of managing innovation. Since there are fewer replenishment candidates that can be sourced internally for large blockbusters that go off patent at Big Pharma, new molecules are often licensed in and/or acquired from smaller or boutique pharma companies, that have demonstrated either a delivery technology or new biology advantage. This arrangement seems to work well, since smaller companies appear to be adept at innovating,

2

while large phama companies, have the expertise in navigating the regulatory process. Based on current trend, it appears that 25% to 30% of research is outsourced by Big Pharma. Another data point: The US FDA approved 21 new molecular entities and two biologics in all of 2008. Strictly new products were estimated at less than 50% of the total new approvals. Of these, a large number originated outside the research laboratories of Big Pharma. The changes in the patent laws in India, bringing in the same level of intellectual property protection as in the developed nations, have been both the impetus and the reason for investments in innovation. These have forced Indian pharma companies to take a hard look at

Annual Report 2008-09

al Chemistry Pharmaceutics New Drugs Novel Drug Delivery Systems Biostatistics nnovation Active Transport Mechanism Bioavailability Research Nanospheres y Development Medicinal Chemistry Pharmaceutics New Drugs Novel Drug s Targeted Drug Delivery Innovation Active Transport Mechanism Bioavailability Analogues Pharmacology Development Medicinal Chemistry Pharmaceutics

innovation, as access to new molecules would be curtailed unless these are licensed in or developed in house. On the other hand, companies also recognize the value they can potentially generate as participants in the research process. In the long term, this trend to acquire molecules and technologies developed elsewhere, may work to India's advantage. Such partnering will bring in its own set of challenges. While the industry has proven skills in chemistry, we may still need to invest in upgrading our knowledge base in the areas of new biology, target validation, Good Laboratory Practice (GLP), Good Clinical Practice (GCP), that may be a prerequisite for any such transfer. The regulatory framework that needs to vet and validate trials and procedures, to the extent designed for and conducted in India, needs to be similar to that which exists internationally, with special allowances for our specific needs, and steps to create this framework are being taken. Formulation development capabilities, process chemistry expertise, state-of-the-art tertiary healthcare facilities, skilled work force and cheaper costs are the key factors that are quoted as working in India's favour as an R&D partner of choice. There are estimates that quote the cost of doing R&D in India as a fraction of the cost in an advanced country. Also, India offers an edge in costs over other low cost countries such as China. Quoting from a

3

paper by an industry expert - global R&D spend is about $60 billion, with a split of 1:2 in the non clinical to clinical spend. Current data indicates that fully loaded cost of non clinical operations in India is just a fraction of costs in US and Western Europe and even lower for clinical operations. We have seen two kinds of cost arbitration in India so farsourcing of clinical trial work from India using a Contract Research Organization (CRO) and outsourcing of preclinical research, co-developing or sourcing of molecules in the preclinical stage from Indian companies which is now beginning to pick up. We'd view this opportunity as a step up for companies, a learning opportunity with a lower risk, but one that offers a chance to learn skills for moving to the next stage of R&D.

Sun Pharma Advanced Research Company Ltd.

Clinical Research Therapeutic Analogues Pharmacology Development Medicina Toxicology Drug Binding Animal Studies Prodrugs Targeted Drug Delivery In Biodegradable Depots Clinical Research Therapeutic Analogues Pharmacology Delivery Systems Biostatistics Toxicology Drug Binding Animal Studies Prodrugs Research Nanospheres Biodegradable Depots Clinical Research Therapeutic

Another emerging trend in recent years is that of pharma companies and venture capital or private equity funds partnering for specific projects or entire pipelines, in exchange for a stake. In such cases, several rounds of capital infusion happen before if and when, a product reaches market. Since R&D projects carry uncertain time frames and high risks, private equity companies typically invest in a portfolio of leads or companies in order to better balance the risks. With the recent crunch in the credit market, private equity companies have found their source of funds drying up. As a consequence, pharma companies have found it difficult to find funding for research. As per recent data, close to 60% of the small pharma/biotech companies pursuing R&D have less than two quarters of cash.

their reach. The second advantage here is the expertise that such funds bring to the table. There is a serious need for upgrading the quality of services that research requires, such as quality of background and ongoing training for scientists and quality of goods and services from local or supplementary vendors. There has been concern about whether our administrative setup for patents is capable of handling a large volume of patent applications in a timely manner. This must be set at rest as well. If India has to compete with developed markets for a share of the research pie, a renewed focus on speed across the concerned areas will be required. Regulatory lead time when applicable, speed of patient recruitment in clinical research, availability of high tech solutions such as high throughput instrumentation and remote data capture are other important factors that need to be considered for execution speed. Large enough capacities need to be built across the value chain in order to compete internationally, currently these are still very small by international standards. Capacities need to be built in genomics, molecular biology, in vitro studies and animal toxicology, biopharmaceutics, execution of phase I, II and III studies, data management and biostatistics.

4

Opportunities and Threats

Indian companies are addressing two areas: analog chemistry for new chemical entities with improved profiles of validated targets and development of novel drug delivery systems for existing/marketed molecules designed to offer a specific advantage. In recent times, innovative R&D in India has been attracting venture capital funds. This may help Indian pharma to work on innovative projects that typically have very large R&D budgets, which would otherwise be out of

Annual Report 2008-09

al Chemistry Pharmaceutics New Drugs Novel Drug Delivery Systems Biostatistics nnovation Active Transport Mechanism Bioavailability Research Nanospheres y Development Medicinal Chemistry Pharmaceutics New Drugs Novel Drug s Targeted Drug Delivery Innovation Active Transport Mechanism Bioavailability Analogues Pharmacology Development Medicinal Chemistry Pharmaceutics

allergic rhinitis study has also been completed in India. 1334 H will now be evaluated in certain critical human safety studies and chronic toxicology (non clinical) studies before undertaking extensive phase III studies in a larger patient population. This is an antihistamine with considerable advantages over available therapy.

Other NCE Programmes include the following:

SUN 461, an anti-inflammatory glucocorticoid for asthma and COPD has finished preclinical efficacy displaying high therapeutic window and safety studies are ongoing for IND filing. A threat that needs to be factored in for research is the unseen / unanticipated regulatory requirements that may cause delays, need for additional investments or requirement to make unexpected changes in the initial research plan. SUN 09 is a prodrug of a currently marketed drug used as a skeletal muscle relaxant for spasm related disorders; this has finished efficacy, toxicity and safety pharmacology studies. SUN 461, 44 and 09 are all at advanced preclinical stages.

5

SUN 44 is a prodrug of gabapentin for the treatment of neuropathy and seizures. Some non clinical toxicology and safety pharmacological studies have been completed.

Performance Highlights

Programmes: NCE

In order to better manage this risk, projects in therapeutic analogues or bioavailability modification have been chosen. The first of SPARC Ltds leads, SUN 1334 H has completed phase II studies in US for seasonal allergic rhinitis and in India for urticaria. Further phase II study for perennial

Sun Pharma Advanced Research Company Ltd.

Clinical Research Therapeutic Analogues Pharmacology Development Medicina Toxicology Drug Binding Animal Studies Prodrugs Targeted Drug Delivery In Biodegradable Depots Clinical Research Therapeutic Analogues Pharmacology Delivery Systems Biostatistics Toxicology Drug Binding Animal Studies Prodrugs Research Nanospheres Biodegradable Depots Clinical Research Therapeutic

Programmes: NDDS

Four delivery system based platforms and projects have been shared. NDDS programmes include : Dry Power Inhaler (DPI) SPARC has developed a Dry Powder Inhaler device (DPI) used for the treatment of asthma and COPD. Our device is far more efficient than comparable marketed devices. Currently available inhaler devices that deliver medication directly to the lungs have serious design shortcomings - a small fraction of the administered drug reaches the lungs while a large part of the dose is stuck in the throat lining from which it is absorbed. Based on this technology, a clinical efficacy study of one combination product is under progress in India. In most inhalers, the patient needs to make an effort to inhale the medication. This could be difficult when the patient has an asthma attack, or is very old or young. Also, on most current devices, there is no counter to indicate whether or not a dose has been administered, and this may result in repeat dosing and/or dose wastage. Our device addresses all these issues. A large part of the

6

drug that is inhaled is actually delivered to the lungshence it may be possible to reduce the dose administered. We believe that half the delivered dose can offer the same efficacy. This has advantages eg. it can facilitate steroid sparing if the formulation is a long acting bronchodilator + steroid combination. Our device complies completely with the US and European guidelines for inhalers - several marketed inhalers do not. Our device also offers an audible and visual feedback of a dose that has been administered. This device delivers similar dose across patient effort and hence, the very old and young can use it. Our device can be used to deliver currently available asthma medication, or new steroid molecules. One combination product based on DPI technology is likely to reach the Indian market by Q4 FY10.

Injectable Depot Technology

Nanoemulsion based delivery systems (nanotectons)

Particles in the size range 1100 nm are emerging as a class of therapeutics for cancer. Early clinical results suggest that nanoparticle therapeutics can show enhanced efficacy, while simultaneously reducing side

Annual Report 2008-09

al Chemistry Pharmaceutics New Drugs Novel Drug Delivery Systems Biostatistics nnovation Active Transport Mechanism Bioavailability Research Nanospheres y Development Medicinal Chemistry Pharmaceutics New Drugs Novel Drug s Targeted Drug Delivery Innovation Active Transport Mechanism Bioavailability Analogues Pharmacology Development Medicinal Chemistry Pharmaceutics

effects, owing to properties such as more targeted localization in tumours and active cellular uptake. It also protects the drug from premature degradation and elimination. Novel insoluble drug self-dispersing patented nanoparticle technology platform consists of composite nanoparticles of anticancer drug, polymer and lipid. Few difficult to formulate anticancer drugs are under development. The nanodispersion product characteristics are that the drug molecule is the same - it is not covalently bound to the excipients or altered. All excipients are US FDA approved having a long history of intravenous use. It does not contain any excipients that lead to safety issues. The encapsulation process developed by us offers spontaneous high degree of encapsulation of the drug. The product has a nanometric particle size with improved reconstitution stability. It does not require special infusion sets, in-line filters or aseptic mixing procedures during drug administration to a patient as required for existing marketed products. It is also not expected to use premedication before administration. It is a user friendly product.

Preclinical

studies

required for a dose finding human trial completed for two anticancer drugs. By nanoemulsion the

encapsulation,

circulation in blood is altered and selective accumulation of the drug into solid tumors is achieved, thus enhancing the efficacy and safety index of the drug. This nanoparticle platform technology is at a preclinical development stage, with demonstrated proof of concept. Two cytotoxic drug products are being developed based on this technology. Phase -1 human trials in India are continuing for one product and an other one is in pipeline.

Gastro Retentive Innovative Device (GRID, Baclofen GRS)

GRID is a controlled release system technology platform of

The product has shown improved toxicity profile in preclinical studies in rats and mice, highly significant antitumor activity as per standard criteria and improved tumor drug levels in nude mice implanted with tumors.

7

SPARC. This innovative system is a dosage form with specialized multiple coatings. On ingestion of the dosage form along

Sun Pharma Advanced Research Company Ltd.

Clinical Research Therapeutic Analogues Pharmacology Development Medicina Toxicology Drug Binding Animal Studies Prodrugs Targeted Drug Delivery In Biodegradable Depots Clinical Research Therapeutic Analogues Pharmacology Delivery Systems Biostatistics Toxicology Drug Binding Animal Studies Prodrugs Research Nanospheres Biodegradable Depots Clinical Research Therapeutic

with food, it 'FLOATS' instantaneously on the contents of the stomach which is an attribute of its innovative design.The interactive coatings of the GRID are activated by the gastro intestinal fluids leading to expansion and swelling. In-vitro data indicates that it swells to about 8 -11 times its initial volume.

period of time indicating the utility of this dosage form as a once a day system. The product Liofen XL (Baclofen XL) in various strengths has been launched in India based on this system. Few other molecules which will benefit by incorporating in

The innovative features of GRID enable it to maintain physical integrity, expanded size and floatation thus leading to gastric retention of this dosage form for the longer period. Evidence from In-vivo studies for a drug having a narrow absorption window show plasma concentrations in the therapeutic range for a prolonged

the GRID system are under study.

Wrap Matrix

Wrap Matrix is an Oral Controlled Release System of SPARC. The technology is based on modification of surface area for tailoring of drug release profiles. The

Annual Report 2008-09

al Chemistry Pharmaceutics New Drugs Novel Drug Delivery Systems Biostatistics nnovation Active Transport Mechanism Bioavailability Research Nanospheres y Development Medicinal Chemistry Pharmaceutics New Drugs Novel Drug s Targeted Drug Delivery Innovation Active Transport Mechanism Bioavailability Analogues Pharmacology Development Medicinal Chemistry Pharmaceutics

system consists of a coated bilayer tablet which modifies surface area in situ. The system uses US FDA approved excipients in acceptable quantities. Various release profiles like Zero order controlled release, Immediate release (IR) + Controlled Release (CR), IR + CR + IR and many other options are possible with this system. This system can handle high drug loads and thus is also suitable for drugs with large doses and having a high water solubility. This system is successfully scaled up to commercial scale and a few products like Prolomet XL (Metoprolol ER) and Bupron OD (Bupropion OD) are launched in Indian market. Few ANDA and NDDS products are under development using this system.

possible on our own in the development lifecycle is our way learning the ropes. We are satisfied with the progress observed on our projects so far. Some projects are closer to market than they were a year ago. Some of the NDDS technologies have successfully moved beyond the proof of concept and have been used to file products for India, the emerging markets as well as ANDAs for the US.

Risks and Concerns

Since research is inherently a high risk area, it is likely that an investment may go waste if a project has to be abandoned at a later stage in its development. A project may need a much higher investment or longer time frame than initially visualized. New tests or trials may require much greater investment than originally envisaged. A competing technology or product might diminish the potential that we anticipate for NCE or NDDS.

Outlook

From a strategic perspective, inventing (new drugs, technologies etc) and learning the intricacies of the regulatory process (phase I to IV) are both equally important. Taking a product as ahead as quickly as

Sun Pharma Advanced Research Company Ltd.

Directors Report

Your Directors take pleasure in presenting the Fourth Annual Report and Audited Accounts for the year ended 31st March, 2009.

Financial Result

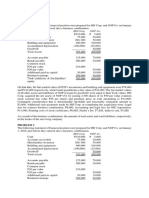

(Rs. in Thousands) Year ended 31st March, 2009 Total Income Profit/(Loss) before Depreciation & Tax Depreciation Profit/(Loss) before Tax Provision for Tax (includes Deferred tax, Wealth tax & Fringe Benefit Tax) Profit/(Loss) after Tax Balance brought forward from Previous Year Balance carried to Balance Sheet (33,508) (91,405) (98,701) (190,106) 3,212 (48,827) (49,874) (98,701) 352,436 (106,549) 18,364 (124,913) Year ended 31st March, 2008 375,413 (32,941) 12,674 (45,615)

Dividend

In view of loss incurred during the year under review, your Directors do not recommend any dividend for the year under review.

Directors

Mr. Dilip S. Shanghvi and Mr. Sudhir V. Valia, Directors of the Company, retire by rotation at the ensuing Annual General Meeting, and being eligible offer themselves for reappointment.

Management Discussion and Analysis

The management discussion and analysis on the operations of the Company is provided in a separate section and forms a part of this report.

Corporate Governance Report

Report on Corporate Governance and Certificate of the Auditors of your Company regarding compliance of the conditions of Corporate Governance as stipulated in Clause 49 of the Listing Agreement with the Stock Exchanges, are enclosed.

10

Annual Report 2008-09

Human Resources

SPARC, which is committed to do quality research work, has a dedicated team of 210 highly qualified and experienced scientists comparable to those existing internationally. SPARC is among the very few Indian pharmaceutical companies engaged in new drug discovery, drug delivery systems, process development and analytical research as per national/international standards and regulations. Your Directors recognize the team's valuable contribution and place on record their appreciation for Team SPARC. Information as per Section 217(2A) of the Companies Act, 1956, read with the Companies (Particulars of Employees) Rules, 1975 as amended, is available at the Registered Office of your Company. However, as per the provisions of Section 219(1)(b)(iv) of the said Act, the Report and Accounts are being sent to all shareholders of the Company and others entitled thereto excluding the aforesaid information. Any shareholder interested in obtaining a copy of this statement may write to the Company Secretary at the Mumbai Office or Registered Office address of the Company.

Public Deposits

The Company has not accepted any deposit from the Public during the year under review, under the provisions of the Companies Act, 1956 and the rules framed thereunder.

Information on Conservation of Energy, Technology Absorption, Foreign Exchange Earning and Outgo

The additional information relating to energy conservation, technology absorption, foreign exchange earning and outgo, pursuant to Section 217(1)(e) of the Companies Act 1956 read with the Companies (Disclosure of Particulars in the Report of the Board of Directors) Rules, 1988, is given in Annexure and forms part of this Report.

Internal Control Systems and their Adequacy

Your Company has adequate internal controls for its business processes across departments to ensure efficient operations, compliance with internal policies, applicable laws and regulations, protection of resources and assets and accurate reporting of financial transactions. The Company also has an internal audit system which is conducted by the independent firms of Chartered Accountants so as to cover various operations on a continuous basis. Summarised Internal Audit Observations/Reports are reviewed by the Audit Committee on a regular basis. The finance and accounts functions of the Company are well staffed with qualified and experienced members.

11

Sun Pharma Advanced Research Company Ltd.

Directors' Responsibility Statement

Pursuant to the requirement under Section 217(2AA) of the Companies Act, 1956, with respect to Directors' Responsibility Statement, it is hereby confirmed: (I) that in the preparation of the annual accounts for the financial year ended 31st March, 2009, the applicable accounting standards have been followed along with proper explanation relating to material departures; (ii) that the Directors have selected appropriate accounting policies and applied them consistently and made judgements and estimates that were reasonable and prudent so as to give a true and fair view of the state of affairs of the Company at the end of the financial year and on the loss of the Company for the year under review; (iii) that the Directors have taken proper and sufficient care for the maintenance of adequate accounting records in accordance with the provisions of the Companies Act, 1956 for safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities; and, (iv) that the Directors have prepared the annual accounts for the financial year ended 31st March, 2009 on a 'going concern' basis.

Auditors

Your Company's auditors, M/s. Deloitte Haskins & Sells, Chartered Accountants, Mumbai, retire at the conclusion of the forthcoming Annual General Meeting. Your Company has received a letter from them to the effect that their reappointment, if made, will be in accordance with the provisions of Section 224(1-B) of the Companies Act, 1956.

Acknowledgements

Your Directors wish to thank all stakeholders and business partners - your Company's bankers, medical profession and business associates for their continued support and valuable co-operation. The Directors also wish to express their gratitude to investors for the faith that they continue to repose in the Company.

For and on behalf of the Board of Directors

Dilip S. Shanghvi Chairman & Managing Director Place : Mumbai Date : 23rd May, 2009

12

Annual Report 2008-09

Annexure to Directors Report

CONSERVATION OF ENERGY Power and Fuel Consumption Our operations are not Energy intensive. However the Company has endeavored to optimise the use of energy resources and taken adequate steps to avoid wastage & use latest technology & equipments, wherever feasible, to reduce energy consumption. TECHNOLOGY ABSORPTION A. Research and Development 1. Specific areas in which R&D is carried out by the Company Sun Pharma Advanced Research Company Ltd (SPARC Ltd) works on innovation and new product development for global markets. It undertakes projects in innovative research and technology for new chemical entities (NCEs) or new molecules, and novel drug delivery systems (NDDS). New Chemical Entities (NCEs) The thrust areas of research programs for new molecules or new chemical entities (NCEs) are: > Design and development of therapies for Allergy Inflammation > Design and development of pro-drugs (chemical delivery systems) for currently marketed drugs that have poor oral absorption profile. Allergy SUN-1334H is a novel selective histamine H1 receptor antagonist for the therapy of allergic disorders such as seasonal and perennial allergic rhinitis, urticaria, etc. This molecule has finished phase II clinical studies in USA. Inflammation SUN-461 is a locally acting anti-inflammatory glucocorticoid receptor agonist in pre-clinical development for use in the treatment of asthma and COPD. It belongs to the category called soft steroids. Pro-drugs Anticonvulsant/ Modification of absorption Our lead molecule, SUN-44 is a pro-drug of the currently marketed drug gabapentin which is used for the treatment of neuropathy and seizures. SUN-44 is currently under pre-clinical development. Muscle relaxant/ Modification of absorption Our lead SUN-09 is a pro-drug of a currently marketed drug used as a skeletal muscle relaxant for the treatment of spasms related to CNS disorders. SUN-09 is currently under pre-clinical development. Novel Drug Delivery Systems (NDDS) In the drug delivery systems research (NDDS) platform technologies that are being developed are: > Novel device for inhaled drugs > Controlled release systems Gastric retention systems (GRS) Matrix system (wrap-matrix) > Targeted drug delivery Nanoemulsions > Biodegradable injections/ implants

13

Sun Pharma Advanced Research Company Ltd.

Novel device for inhaled drugs A newly engineered dry powder inhalation device is under development which would enable convenient and uniform dose administration of drugs for asthma and COPD. The device would be small, convenient to carry and have a simple three step operating sequence - open-inhale-close. The device is being developed to comply with the US and European FDA requirements. Controlled release systems Gastro retentive innovative device (GRID) An innovative gastro retentive system (GRS) has been devised that allows longer retention of drugs in the stomach and improves gastrointestinal absorption of drugs that have a narrow absorption window. The mechanism for gastroretention is based on flotation, size expansion and mucoadhesion. Wrap matrix system A novel platform technology, with a core and coat has been developed that offers gradual and controlled release of medicines that are highly soluble and are required to be administered in high doses. Based on this technology a few ANDAs for controlled release dosage form have been filed with US FDA. Targeted drug delivery Nanoemulsion Nanotechnology based delivery systems (Nanotectons) enable selective delivery of cytotoxic drugs to cancerous tissues. In this technology, drugs are encapsulated within nanoscale carriers derived from biocompatible/ biodegradable polymers and lipids. This nanoparticle platform technology is at a preclinical development stage, with demonstrated proof of concept. Biodegradable injections/ implants Depot formulations using biodegradable polymers obviate the requirement of frequent injections of certain drugs in case of ailments such as hormone dependant cancers. The depot technology developed by us uses long-acting microparticles. Two peptide drugs formulations using this technology are in development. 2. Benefits derived as a result of the above R&D These are long term projects, with a higher risk profile compared to generic projects., and typically take 8-10 years to reach market, if at all. NCEs upon commercialization are expected to provide patients with better treatment options or safer side effect profile for the disorders for which these therapies are being developed. The new drug delivery systems that are being developed are platform technologies that can be used for several different drugs. The eventual commercialization of the products based on these technologies would provide patients with newer dosage forms that are safer, more effective in terms of availability in the body, and easier for the patient to take or to administer. 3. Future plan of action New Chemical Entities (NCEs) Allergy SUN-1334H - Complete ongoing phase II human trials in the USA for season allergic rhinitis - Complete studies on cardiovascular safety,metabolism, toxicity etc required for phase III trials - Carinogenicity study initiation Inflammation SUN-461 - Complete the required preclinical and toxicity studies for Investigational New Drug (IND) application - IND filing with US FDA in 2009 - Obtain regulatory approval and commence phase I human studies Pro-drug SUN-44 - Complete the required preclinical and toxicity studies for Investigational New Drug (IND) application - IND filing in India in 2009 - Obtain regulatory approval and commence phase I human studies

14

Annual Report 2008-09

Pro-drug SUN-09 - Complete the required preclinical and toxicity studies for Investigational New Drug (IND) application - IND filing in India in 2009 - Obtain regulatory approval and commence phase I human studies Novel Drug Delivery Systems (NDDS) Novel device for inhaled drugs - Design and validation of device - Clinical trials in humans for semi-regulated markets - Launch in semi-regulated markets in 2010 - IND filing with US FDA in 2009 Gastro retentive innovative device (GRID) - Likely IND filing with US FDA in 2009, the product has already been launched in India. Wrap matrix system - Launch controlled release products based on wrap matrix technology after approval is obtained for the ANDAs that Sun Pharma has filed with US FDA, To develop innovative products based on this technology, take through clinical trials and file these products Technology overview was presented to US regulatory agencies for one of the ANDA filed with FDA Nanoemulsion - To Complete technology development for two cytotoxic products that are being studied Phase 1 for one cytotoxic, the first in human study has been initiated, for the second cytotoxic, first in human study is likely in 2010. Biodegradable injections/ implants - Clinical trials in humans in India completed. - Launch in semi-regulated markets in 2010 - Complete preclinical studies for depot injection of GnRH analogue that is being developed. likely take it for Clinical trials in humans 4. Expenditure on R&D Year ended 31st March, 2009 Rs in Thousand 224,185 456,558 680,743 193.7% Year ended 31st March, 2008 Rs in Thousand 38,876 408,219 447,095 119.3%

a) b) c) d)

Capital Revenue Total Total R&D expenditure as % of Total Turnover

B. Technology Absorption, Adaptation and Innovation 1. Efforts in brief, made towards technology absorption, adaptation and innovation The Company continues its endavour for research in the area of Innovative and Novel Drug Delivery System with latest technology and skilled scientific team. 2. Benefits derived as a result of the above efforts e.g. Product improvement, cost reduction, product development, import substitution Innovative NCE and NDDS programs being undertaken by the company will help in making available new and effective products. These products when commercialised will improve quality of life of patients. 3. Your company has not imported technology since its inception. C. Foreign Exchange Earnings and Outgo 1. Earnings 2. Outgo 323,014 263,948 365,895 148,027

15

Sun Pharma Advanced Research Company Ltd.

Auditors Report

1. We have audited the attached Balance Sheet of Sun Pharma Advanced Research Company Limited (the Company) as at March 31, 2009 and also the Profit and Loss Account and the Cash Flow Statement for the year ended annexed thereto. These financial statements are the responsibility of the Companys management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in India. Those Standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. As required by the Companies (Auditors Report) Order, 2003 issued by the Central Government of India in terms of subsection (4A) of section 227 of the Companies Act, 1956, we enclose in the Annexure, a statement on the matters specified in paragraphs 4 and 5 of the said Order. Further to our comments in the Annexure referred to above, we report that: (i) we have obtained all the information and explanations, which to the best of our knowledge and belief were necessary for the purposes of our audit; (ii) in our opinion, proper books of account as required by law have been kept by the Company so far as appears from our examination of those books; (iii) in our opinion, the Balance Sheet, Profit and Loss Account and the Cash Flow Statement dealt with by this report comply with the accounting standards referred to in sub-section (3C) of Section 211 of the Companies Act, 1956; (iv) on the basis of written representations received from directors as on March 31, 2009 and taken on record by the Board of Directors, we report that none of the directors is disqualified as on March 31, 2009 from being appointed as a director in terms of clause (g) of sub-section (1) of Section 274 of the Companies Act, 1956; (v) in our opinion and to the best of our information and according to the explanations given to us, the said accounts read together with the significant accounting policies and notes thereon give the information required by the Companies Act, 1956, in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India: (a) in the case of the Balance Sheet, of the state of affairs of the Company as at March 31, 2009; (b) in the case of the Profit and Loss Account, of the loss for the year ended on that date; and (c) in the case of the Cash Flow Statement, of the Cash Flows for year ended on that date.

2.

3.

4.

For Deloitte Haskins & Sells Chartered Accountants

Place: Mumbai Date: May 23, 2009

K. A. Katki Partner (Membership No. 038568)

16

Annual Report 2008-09

Annexure to the Auditors Report

(Referred to in paragraph 3 of our report of even date) Sun Pharma Advanced Research Company Limited 1. 2. In our opinion and according to the information and explanations given to us, the nature of the Companys activities, is such that clauses viii, x, xii, xiii, xiv, xviii, xix and xx of Paragraph 4 of Companies (Auditors Report) Order, 2003 are not applicable to the Company. In respect of its fixed assets: (a) The Company has maintained proper records showing full particulars, including quantitative details and situation of fixed assets. (b) As explained to us, some of the fixed assets of the Company have been physically verified during the year by the management in accordance with a phased programme of verification designed to cover all assets over a period of three years, which in our opinion, is reasonable having regard to the size of the Company and the nature of its assets. The discrepancies noticed on such verification were not material and have been properly dealt with in the books of account. (c) Although some of the fixed assets have been disposed off during the year, in our opinion and according to the information and explanations given to us, the ability of the Company to continue as a going concern is not affected. 3. 4. 5. According to the information and explanations given to us, the Company did not have any inventory during the year. The Company had not granted or taken any loan, secured or unsecured, to or from Companies, firms or other parties covered in the register maintained under section 301 of the Companies Act 1956. In our opinion and according to the information and explanations given to us, there are adequate internal control systems commensurate with the size of the Company and nature of its business with regard to purchase of consumables and fixed assets and for sale of goods (technology) and services and we have not observed any continuing failure to correct major weaknesses in such internal control systems. In respect of contracts or arrangements entered in the register maintained in pursuance of section 301 of the Companies Act, 1956, to the best of our knowledge and belief and according to the information and explanations given to us: (a) The particulars of contract or arrangements referred to in Section 301 that needed to be entered into the register, maintained under the said section have been so entered. (b) Where each such transaction (excluding loans reported under paragraph 4 above) is in excess of Rs. 5 lakhs in respect of any party, the transactions have been made at prices which are prima facie reasonable having regard to prevailing market prices at the relevant time, except that reasonableness could not be ascertained where comparable quotations are not available having regards to the specialized nature of some of the transactions of the Company. 7. In our opinion and according to the information and explanations given to us, the Company has not accepted any deposits from public within the meaning of Section 58A and 58AA or any other relevant provisions of the Companies Act, 1956 and the Companies (Acceptance of Deposits) Rules, 1975 with regard to deposits accepted from the public. No order has been passed by the Company Law Board or National Company Law Tribunal or Reserve Bank of India or any Court or any other Tribunal. In our opinion, the internal audit functions carried out during the year by firms of Chartered Accountants appointed by the management have been commensurate with the size of the Company and the nature of its business. According to the information and explanations given to us, in respect of statutory dues: (a) the Company has been regular in depositing undisputed statutory dues, including, Provident Fund, Employees State Insurance, Income tax, Sales tax, Wealth Tax, Service Tax, Custom Duty, Excise Duty, cess and other material statutory dues with the appropriate authorities during the year. There were no dues payable in respect of Investor Education and Protection Fund, during the year. There were no undisputed dues that were outstanding as at March 31, 2009 for a period of more than six months from the date they became payable. (b) there were no disputed dues in respect of Income Tax, Sales Tax, Wealth Tax, Service Tax, Custom Duty, Excise Duty, Cess and other material statutory dues during the year. 10. 11. 12. 13. In our opinion and according to the information and explanation given to us, the Company has not defaulted in repayment of dues to banks. The Company has not obtained any borrowings from financial institutions or by way of debentures. In our opinion and according to the information and explanation given to us, the Company has not given any guarantees for loans taken by others from banks and financial institutions. To the best of our knowledge and belief and according to the information and explanations given to us, in our opinion, during the period of our audit, the Company has not availed any term loans. According to the information and explanations given to us and on an overall examination of the balance sheet of the company, we report that the Company has, prima facie, used funds raised on short term basis through bank overdraft facility along with the reduction in the current assets and increase in current liabilities aggregating to Rs. 25,887 Thousand, towards long term investment in fixed assets. To the best of our knowledge and belief and according to the information and explanation given to us, no fraud on or by the Company was noticed or reported during the year. For Deloitte Haskins & Sells Chartered Accountants K. A. Katki Partner (Membership No. 038568)

6.

8. 9.

14.

Place: Mumbai Date: May 23, 2009

17

Sun Pharma Advanced Research Company Ltd.

Balance Sheet as at 31st March, 2009

Rs in Thousand As at 31st March SOURCES OF FUNDS Shareholders Funds Share Capital Reserves and Surplus Loan Funds Unsecured Loan Deferred Tax Liability (Net) TOTAL APPLICATION OF FUNDS Fixed Assets Gross Block Less: Depreciation Net Block Capital Work-in-Progress (including Advances on Capital Account) Current Assets, Loans and Advances Sundry Debtors Cash and Bank Balances Loans and Advances 6 7 8 5 599,721 71,328 528,393 44,376 5,086 5,227 32,445 42,758 Less: Current Liabilities and Provisions Current Liabilities Provisions 9 231,122 10,443 241,565 Net Current Assets Profit and Loss account (Debit Balance) TOTAL SIGNIFICANT ACCOUNTING POLICIES AND NOTES TO THE FINANCIAL STATEMENTS Schedules referred to herein form an integral part of the Financial Statements As per our report of even date attached For and on behalf of the Board DILIP S. SHANGHVI Chairman & Managing Director For Deloitte Haskins & Sells Chartered Accountants K. A. KATKI Partner Mumbai, 23rd May 2009 MEETAL S. SAMPAT Company Secretary Mumbai, 23rd May 2009 SUDHIR V. VALIA Director Mumbai, 23rd May 2009 Dr. T. RAJAMANNAR Wholetime Director San Francisco - U.S.A., 23rd May 2009 15 (198,807) 190,106 564,068 117,073 11,412 128,485 154,748 98,701 585,306 572,769 379,377 53,732 325,645 6,212 244,810 1,120 37,303 283,233 331,857 1 2 207,116 339,766 546,882 3 4 17,186 564,068 207,116 339,766 546,882 4,296 34,128 585,306 Schedules 2009 2008

18

Annual Report 2008-09

Profit and Loss Account for the year ended 31st March, 2009

Rs in Thousand Year ended 31st March INCOME Income from operations Other Income 10 11 351,419 1,017 352,436 EXPENDITURE Materials consumed Personnel Cost Operating and Other Expenses Depreciation Bank Interest 12 13 14 93,777 164,301 198,480 18,364 2,427 477,349 LOSS BEFORE TAXATION Provision for Taxation - Current Tax (Wealth Tax) - Deferred Tax Expense / (Credit) (Net) - Fringe Benefit Tax LOSS AFTER TAX BALANCE OF LOSS BROUGHT FORWARD BALANCE OF LOSS CARRIED TO BALANCE SHEET EARNING PER SHARE (Refer Note B.8 of Schedule 15) Basic (Rs.) Diluted (Rs.) face value per share Re. 1 SIGNIFICANT ACCOUNTING POLICIES AND NOTES TO THE FINANCIAL STATEMENTS Schedules referred to herein form an integral part of the Financial Statements 15 (0.44) (0.44) (0.25) (0.25) (124,913) 100 (34,128) 520 (91,405) (98,701) (190,106) 68,618 133,271 206,330 12,674 135 421,028 (45,615) 74 2,638 500 (48,827) (49,874) (98,701) 374,629 784 375,413 Schedules 2009 2008

As per our report of even date attached

For and on behalf of the Board DILIP S. SHANGHVI Chairman & Managing Director

For Deloitte Haskins & Sells Chartered Accountants K. A. KATKI Partner Mumbai, 23rd May 2009 MEETAL S. SAMPAT Company Secretary Mumbai, 23rd May 2009

SUDHIR V. VALIA Director Mumbai, 23rd May 2009 Dr. T. RAJAMANNAR Wholetime Director San Francisco - U.S.A., 23rd May 2009

19

Sun Pharma Advanced Research Company Ltd.

Cash Flow Statement for the year ended 31st March, 2009

Rs in Thousand Year ended 31st March Particulars Cash Flow From Operating Activities: Loss before Tax Adjustments for: Depreciation (Profit) / Loss on Sale of Fixed Assets Interest Expenses Interest Income Provision for compensated absences Unrealised Foreign Exchange (Gain) / Loss Operating Loss Before Working Capital changes Adjustments for changes in Working Capital: (Increase) / Decrease in Sundry Debtors (Increase) / Decrease in Other Receivables Increase / (Decrease) in Trade payable and Other Liabilities Cash Generated / (used in) from Operations Taxes Paid Net Cash generated from (used in) Operating Activities Net Cash Flow from Investing Activities: Amount received pursuant to the scheme of demerger Interest received Purchase of Fixed Assets / CWIP Sale Proceeds of Fixed Asset Net Cash Generated from (used in) Investing Activities Cash Flow From Financing Activities: Interest Paid Bank Overdraft Facility Net Cash Flow generated from Financing Activities Net Increase in Cash or Cash Equivalents Cash and Cash equivalents at the beginning of the year Cash and Cash equivalents at the close of the year NOTES TO CASH FLOW STATEMENT 1 Cash and Cash equivalents included in cash flow statement comprise of the following: Cash on hand and balances with Bank Cash and Cash equivalents 5,227 5,227 For and on behalf of the Board DILIP S. SHANGHVI Chairman & Managing Director For Deloitte Haskins & Sells Chartered Accountants K. A. KATKI Partner Mumbai, 23rd May 2009 MEETAL S. SAMPAT Company Secretary Mumbai, 23rd May 2009 SUDHIR V. VALIA Director Mumbai, 23rd May 2009 Dr. T. RAJAMANNAR Wholetime Director San Francisco - U.S.A., 23rd May 2009 1,120 1,120 (124,913) 18,364 2,353 2,427 (730) (979) 1,070 (102,408) 238,288 8,395 114,415 258,690 (4,147) 254,543 730 (262,349) 720 (260,899) (2,427) 12,890 10,463 4,107 1,120 5,227 (45,615) 12,674 105 135 (745) 3,933 (1,085) (30,598) (243,385) (28,439) 100,136 (202,286) (1,634) (203,920) 244,929 745 (45,089) 166 200,751 (135) 4,296 4,161 992 128 1,120 2009 2008

As per our report of even date attached

20

Annual Report 2008-09

Schedules to the Financial Statements

CAPITAL 1 SHARE CAPITAL

As at 31st March Authorised 266,500,000 (Previous Year 266,500,000) Equity Shares of Re. 1 each Issued, Subscribed and Paid Up 207,116,391 (Previous Year 207,116,391) Equity Shares of Re. 1 each, fully paid up Notes: Of the above : 192,260,055 (*) (Previous Year 192,260,055) Equity Shares of Re. 1 each fully paid up were issued to Shareholders of Sun Pharmaceutical Industries Limited Pursuant to scheme of demerger. 14,856,336 (*) (Previous Year 14,856,336) Equity Shares of Re.1 each were allotted to the holders of Zero Coupon Foreign Currency Convertible Bonds of Sun Pharmaceutical Industries Limited upon exercise of conversion option. ( * ) (All of above Equity Shares were allotted for consideration other than cash) 207,116 207,116 2009 Rs in Thousand 2008

266,500 207,116

266,500 207,116

2 RESERVES AND SURPLUS

As at 31st March General Reserve Balance as per last Balance Sheet Less : Utilised for issuance of share capital to the holders of Zero Coupon Foreign Currency Convertible Bonds of Sun Pharmaceutical Industries Limited 2009 339,766 339,766 2008 353,481 13,715 339,766

3 UNSECURED LOAN

As at 31st March Bank Overdraft (Secured by Corporate Guarantee given by a company under the same management) 2009 17,186 17,186 2008 4,296 4,296

TAX 4 DEFERRED TAX LIABILITY (NET)

(Refer Note No.B.4 to Schedule 15) As at 31st March Deferred Tax Liability Depreciation on Fixed Assets Deferred Tax Assets Provision for compensated absences Unabsorbed losses (Restricted to the extent of deferred tax liability on depreciation on account of virtual certainity) 2009 135,908 3,541 132,367 135,908 2008 38,002 3,874 3,874 34,128

21

Sun Pharma Advanced Research Company Ltd.

Schedules to the Financial Statements

5 FIXED ASSETS

GROSS BLOCK (At Cost) PARTICULARS As at Additions 01.04.2008 during the year 159,566 211,728 6,316 1,767 379,377 340,923 13,263 201,033 8,514 1,375 224,185 38,876 Deletions DEPRECIATION NET BLOCK As at As at Deletions 31.03.2009 01.04.2008 For the As at As at As at year 31.03.2009 31.03.2009 31.03.2008

TANGIBLE ASSETS Buildings Equipments Vehicles Furniture and Fixtures TOTAL Previous Year 2,643 1,198 3,841 422 172,829 410,118 13,632 3,142 599,721 379,377 10,192 41,164 1,881 495 53,732 41,209 482 286 768 151 2,675 14,575 949 165 18,364 12,674 12,867 55,257 2,544 660 71,328 53,732 159,962 354,861 11,088 2,482 528,393 325,645 44,376 572,769 149,374 170,564 4,435 1,272 325,645 6,212 331,857

Capital Work-in-Progress (including advances on capital account)

SUNDRY DEBTORS 6 SUNDRY DEBTORS

As at 31st March (Unsecured-Considered Good, unless stated otherwise) Debts due less than Six Months (Refer Note B.13 of Schedule 15) 2009 5,086 5,086

Rs in Thousand 2008 244,810 244,810

7 CASH AND BANK BALANCES

As at 31st March Cash in hand Balances with Scheduled Banks in : Current Accounts Deposit Accounts 2009 584 4,625 18 5,227 2008 242 863 15 1,120

LO ADV 8 LOANS AND ADVANCES

As at 31st March (Unsecured-Considered Good, unless stated otherwise) Loans to Employees Advances Recoverable in cash or in kind or for value to be received Balance with Custom and Excise Authorities Advance Income Tax/ Tax deducted at source (Net of Provisions Rs.102 Thousand (Previous year Rs.42 Thousand)) Advances to Suppliers 2009 8,851 3,112 11,529 4,603 4,350 32,445 2008 9,375 753 7,502 1,066 18,607 37,303

22

Annual Report 2008-09

Schedules to the Financial Statements

9 CURRENT LIABILITIES AND PROVISIONS

As at 31st March Current Liabilities Sundry Creditors Dues to micro and small enterprises Dues to others Advances from customers Security Deposits Other Liabilities 2009 Rs in Thousand 2008

72,117 123,716 923 34,366 231,122

84,893 855 31,325 117,073

Provisions Provision for Fringe Benefit Tax [Net of Advance FBT of Rs.1,004 Thousand (Previous year Rs. 494 Thousand)] Provision for compensated absences

26 10,417 10,443 241,565

16 11,396 11,412 128,485

OPERATIONS 10 INCOME FROM OPERATIONS

Year ended 31st March Sale of Technology / Knowhow Fees / Service Charges 2009 323,014 28,405 351,419 2008 354,845 19,784 374,629

OTHER 11 OTHER INCOME

Year ended 31st March Interest on Loan / Deposit [TDS Rs.Nil (Previous year Rs. Nil )] Miscellaneous Income 2009 730 287 1,017 2008 745 39 784

12 MATERIALS CONSUMED MATERIALS

Year ended 31st March R&D Material consumed 2009 93,777 93,777 2008 68,618 68,618

23

Sun Pharma Advanced Research Company Ltd.

Schedules to the Financial Statements

13 PERSONNEL COST

Year ended 31st March Salaries, Wages, Bonus and Benefits Contribution to Provident and Other Funds Staff Welfare Expenses 2009 149,253 6,449 8,599 164,301 Rs in Thousand 2008 114,163 6,962 12,146 133,271

OPERATING OTHER 14 OPERATING AND OTHER EXPENSES

Year ended 31st March Power and Fuel Rates and Taxes Insurance Repairs - Building - Plant & Machinery - Others Printing and Stationery Travelling and Conveyance Testing Communication Loss on sale of fixed assets Customer Entertainment License and Fees Labour Charges Maintenance Charges Membership Fees and Subscription Professional Charges Donation Auditors Remuneration (net of service tax ) - Audit Fees Miscellaneous Expenses 2009 24,994 1,237 407 2,247 22,894 2,182 732 12,696 980 2008 22,987 521 669

27,323 2,725 6,513 17,175 2,464 2,353 1,664 4,732 6,885 1,952 2,116 91,179 700 4,061 198,480

14,408 2,028 5,514 12,707 3,874 105 1,741 18,137 5,723 1,359 715 110,154 31 700 4,957 206,330

24

Annual Report 2008-09

Schedules Forming Integral part of the Financial Statements as at March 31, 2009

15

A I

SIGNIFICANT ACCOUNTING POLICIES AND NOTES TO FINANCIAL STATEMENTS

Significant Accounting Policies Basis of Preparation of Financial Statements These financial statements are prepared under historical cost convention on an accrual basis in accordance with the Generally Accepted Accounting Principles in India and the Accounting Standards (AS) as notified under Companies (Accounting Standards) Rules, 2006. Use of Estimates The presentation of financial statements in conformity with the generally accepted accounting principles requires estimates and assumptions to be made that affect the reported amount of assets and liabilities on the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Difference between the actual result and estimates are recognised in the period in which the results are known / materalised. Fixed Assets and Depreciation Fixed Assets are stated at historical cost less accumulated depreciation/amortisation thereon and impairment losses, if any. Depreciation is provided on Straight Line Method at the rates specified in Schedule XIV to The Companies Act, 1956. Assets costing Rs.5,000/- or less are depreciated at hundred percent rate on prorata basis in the year of purchase. Research and Development Revenue expenditure including purchase of materials related to Research and Development are charged to the Profit and Loss Account. Revenue Recognition Sales of products (rights, licenses and other intangibles) are recognised when performance obligation is completed and risk and rewards of ownership of the products are passed on to the customers, which is generally as per agreement. Royalty income is recognised on accrual basis as per relevant agreement. Sales includes Sales tax / VAT, excluding Service Tax and are stated net of returns, if any. Foreign Currency Transactions Transactions denominated in foreign currencies are recorded at the exchange rate prevailing at the date of transaction. Monetary items denominated in foreign currency at the year end are translated at year end rate. The exchange differences arising on settlement / translation are recognised in the Profit and Loss Account.

II

III

IV

VI

VII Taxes on Income Provision for taxation comprises of Current Tax, Deferred Tax and Fringe Benefit Tax. Current Tax provision has been made on the basis of reliefs and deductions available under the Income Tax Act, 1961. Deferred tax resulting from timing differences between taxable and accounting income is accounted for using the tax rates and laws that are enacted or substantively enacted as on the balance sheet date. The deferred tax asset is recognised and carried forward only to the extent that there is a reasonable certainty that the assets can be realised in future. However, where there is unabsorbed depreciation or carry forward losses under taxation laws, deferred tax assets are recognised only if there is virtual certainty of realisation of such assets. Deferred tax assets are reviewed as at each Balance sheet date. The Fringe Benefits tax has been calculated and accounted for in accordance with the provisions of the Income Tax Act, 1961. VIII Employee Benefits (a) The Companys contribution in respect of provident fund is charged to Profit and Loss Account each year. (b) With respect to gratuity liability, Company contributes to Life Insurance Corporation of India (LIC) under LICs Group Gratuity policy. Gratuity liability as determined on actuarial basis by the independent valuer is charged to Profit and Loss Account. (c) Liability for accumulated compensated absences of employees is ascertained on actuarial basis by the independent valuer and provided for as per company rules.

25

Sun Pharma Advanced Research Company Ltd.

Schedules Forming Integral part of the Financial Statements as at March 31, 2009

IX Provisions, Contingent Liabilities and Contingent Assets Provisions are recognised only when there is a present obligation as a result of past events and when a reliable estimate of the amount of the obligation can be made. Contingent liability is disclosed for (i) Possible obligations which will be confirmed only by future events not wholly within the control of the company or (ii) Present obligations arising from past events where it is not probable that an outflow of resources will be required to settle the obligation or a reliable estimates of the amount of the obligation cannot be made. Contingent Assets are not recognised in the financial statements since this may result in the recognition of the income that may never be realised. Notes to accounts Year ended 31st March 2009 Rs in Thousand 1 REMUNERATION TO DIRECTORS Managerial Remuneration U/s 198 of The Companies Act, 1956 Salaries and Allowances Contribution to Provident and Superannuation Funds Perquisites and Benefits 11,507 547 23 12,077 8,707 457 13 9,177 Year ended 31st March 2008 Rs in Thousand

The above remuneration has been approved by the share holders of the company and by the Central Government vide its letter No.:12/901/2007-CL-VII dated 17th January 2008, 16th February 2008 and 4th March 2008. Directors sitting fees of Rs.1,400 Thousand (Previous Year Rs. 1,020 Thousand) paid to Non-Executive Directors is not included in above. No Commission was paid to Directors during the year accordingly, computation of net profits in accordance with Section 309(5) read with Section 349 of the Companies Act, 1956 has not been given. The remuneration reported above excludes contributions to Gratuity Fund, since the same is ascertained on an aggregated basis for the Company as a whole by way of actuarial valuation and separate values attributable to Directors are not available. 2 3 Estimated amount of contracts remaining to be executed on capital account [net of advances]. INCOME/EXPENDITURE IN FOREIGN CURRENCY Income Sales / Income from operations Expenditure Material (CIF basis) Capital Goods (CIF basis) Spares and Components (CIF basis) Professional charges Overseas Travel License Fees Others 4 323,014 31,911 123,243 11,028 95,126 1,252 1,388 365,895 14,675 19,755 3,684 95,480 1,150 12,482 801 6,136 22,061

The timing differences relating mainly to unabsorbed depreciation and carried forward losses under the Income Tax Act, 1961, results in a deferred tax asset as per AS-22 on Accounting for Taxes on Income. Deferred tax asset has been recognised in respect of business losses to the extent that future taxable income will be available from future reversal of any deferred tax liability recognised at the balance sheet date and is restricted to the extent of such liabilities. As a prudent measure, the excess of deferred tax asset (net) of Rs. 1,35,384 Thousand (Privious year Rs. NIL) in relation to the above has not been recognised in the accounts as there is no virtual certainty supported by convincing evidence that sufficient future taxable income will be available against which such deferred tax assets can be realised.

26

Annual Report 2008-09

Schedules Forming Integral part of the Financial Statements as at March 31, 2009

5 6 The net exchange gain of Rs.6,963 Thousand (Previous Year Rs. 1,790 Thousand) is included under respective heads of Profit and Loss Account. There are no Micro, Small and Medium Enterprises, as defined in the Micro, Small and Medium Enterprises Development Act, 2006 to whom the Company owes dues on account of principal amount together with interest and accordingly no additional disclosures have been made. The above information regarding Micro, Small and Medium Enterprises has been determined to the extent such parties have been identified on the basis of information available with the Company. This has been relied upon by the auditors. 7 Accounting Standard (AS-17) on Segment Reporting (a) Primary Segment The Company has identified Pharmaceuticals Research & Development as the only primary reportable business segment. (b) Secondary Segment (by Geographical Segment ) Year ended 31st March 2009 Rs in Thousand Sales India Sales Outside India Total Sales 8 Accounting Standard (AS-20) on Earnings Per Share Loss used as Numerator for calculating Earnings per Share Weighted Average number of Shares used in computing basic earnings per share Weighted Average number of shares used in computing diluted Earnings per Share Nominal Value Per Share (in Rs.) Basic Earnings Per Share (in Rs.) Diluted Earnings Per Share (in Rs.) Note: *Dilution in earnings per share on account of further issue of equity shares to holders of Zero Coupon Foreign Currency Convertible Bonds has not been considered, as they are anti-dilutive. 9 10 Other information required under para 3 and information with regard to matters specified in paragraph 4 of Part II to Schedule VI of the Companies Act, 1956 is stated to the extent applicable to the Company. As per the best estimate of the management, no provision is required to be made as per Accounting Standards (AS29) as notified by Companies (Accounting Standard) Rules, 2006 in respect of any present obligation as a result of a past event that could lead to probable outflow of resources, which would be required to settle the obligation. Disclosure with respect to Accounting Standards (AS-18) on related party disclosure, as notified by Companies (Accounting Standard) Rules, 2006, is as per Annexure - A annexed. 91,405 207,116,391 207,116,391 1 (0.44) (0.44) 48,827 199,159,782 207,116,391 1 (0.25) *(0.25) 28,405 323,014 351,419 Year ended 31st March 2008 Rs in Thousand 8,734 365,895 374,629

11

27

Sun Pharma Advanced Research Company Ltd.

Schedules Forming Integral part of the Financial Statements as at March 31, 2009

12 The Company has not entered into any forward exchange contracts being derivative instruments. As at the year end, foreign currency exposures that have not been hedged by a derivative instrument or otherwise are given below : a) Amounts receivable in foreign currency on account of the following : Currency Exports of Goods & Services Reimbursement of expenses US Dollar Euro As at 31st March, 2009 Amount in Thousand 61.6 INR 4,162 As at 31st March, 2008 Amount in Thousand $ 5,930.0 $ 197.4 38.40 3.9 INR 236,133 INR 7,860 INR 2,422 INR 306

b) Amounts payable in foreign currency on account of the following : Import of Goods & Services US Dollar $ 253.5 INR 12,893 Swiss Franc CHF 14.0 INR 623 Euro 96.3 INR 6,504 Pound 116.9 INR 8,520 JPY JPY 725.9 INR 377 13 Outstanding due from Company under same management. Balance As at Maxi. Balance 31st March, 2009 2008-09 Rs. in Thousand Amount due pursuant to the Scheme of Demerger Sun Pharmaceutical Industries Limited Sun Pharma Global Inc. BVI 14 Accounting Standard (As-15) on Employee Benefits 252,826

Balance As at Maxi. Balance 31st March, 2008 2007-08 Rs. in Thousand 236,133 244,929 256,532

Contributions are made to Recognised Provident Fund/ Government Provident Fund, Family Pension Fund, ESIC and other Statutory Funds which covers all regular employees. While both the employees and the Company make predetermined contributions to the Provident Fund and ESIC, contribution to the Family Pension Fund are made only by the Company. The contributions are normally based on a certain proportion of the employees salary. Amount recognised as an expense in respect of these defined contribution plans, aggregate to Rs. 7,027 Thousand (Previous Year Rs 5,501 Thousand). Year ended 31st March 2009 Rs in Thousand Contribution to Provident Fund Contribution to Employees State Insurance Scheme (E.S.I.C.) Contribution to Labour Welfare Fund 6,973 52 2 Year ended 31st March 2008 Rs in Thousand 5,336 163 2

Contributions made to LIC of Indias Recognised Group Gratuity Fund scheme in respect of gratuity is in excess by Rs. 675 Thousand (Previous Year 2,795 Thousand) as compared to the actuarial valuation obtained from independent actuary as at the year end. Actuarial Valuation for Compensated Absences is done as at the year end and the provision is made as per Company rules amounting to Rs. 325 Thousand (Previous Year Rs. 4,834 Thousand) and it covers all regular employees. Major drivers in actuarial assumptions, typically, are years of service and employee compensation. Commitments are actuarially determined using the Projected Unit Credit method. Gains and losses on changes in actuarial determination are accounted for in the Profit and Loss account.

28

Annual Report 2008-09

Schedules Forming Integral part of the Financial Statements as at March 31, 2009

In respect of gratuity (Funded): Reconciliation of liability recognised in the Balance sheet Present value of commitments (as per Actuarial Valuation) Fair value of plans assets Net Asset / (Liability) in the Balance sheet Movement in net liability recognised in the Balance sheet Net liability as at beginning of the year Net expense recognised in the Profit and Loss account Contribution during the year Net Asset / (Liability) as at the end of the year Expense recognised in the Profit and Loss account Current service cost Interest cost Expected return on plan assets Actuarial (gains)/ losses Expense charged to the Profit and Loss account Return on plan assets Expected return on plan assets Actuarial (gains)/ losses Actual return on plan assets Reconciliation of defined-benefit commitments Commitments as at the beginning of the year 7,547 5,180 827 126 953 761 73 834 927 604 (827) 1,416 2,120 1,027 414 (761) 982 1,662 (2,795) 2,120 675 (4,328) 1,662 (129) (2,795) (10,565) 11,240 675 (7,547) 10,342 (2,795) Rs. in Thousand (Dr/ (Cr))

Current service cost

Interest cost Paid benefits Actuarial (gains)/ losses Commitments as at the end of the year Reconciliation of plan assets Plan assets as at beginning of the year Expected return on plan assets Contributions during the year Paid benefits Actuarial (gains)/ losses Plan assets as at the end of the year

927

604 (55) 1,541 10,564

1,027

414 (129) 1,055 7,547

10,342 827 (55) 126 11,240

9,508 761 129 (129) 73 10,342

The actuarial calculations used to estimate commitments and expenses in respect of gratuity are based on the following assumptions which if changed, would affect the commitments size, funding requirements and expense. Discount rate Expected return on plan assets Expected Retirement age of employees (years) 7.75% 7.75% 8.00% 8.00%

58/60 Years; as applicable LIC (1994-96) Ultimate

29

Sun Pharma Advanced Research Company Ltd.

Schedules Forming Integral part of the Financial Statements as at March 31, 2009

Rs in Thousand (Dr / (Cr)) Year ended 31st March 2009 Experience adjustment On plan liabilities On plan assets Present value of benefit obligation Fair value of plan assets Excess of (obligation over plan assets) / plan assets over obligation Category of Plan Assets The Companys Plan Assets in respect of Gratuity are funded through the Group Schemes of the Life Insurance Corporation of India. The estimate of future salary increases, considered in the actuarial valuation, taken on account of inflation, seniority, promotion and other relevant factors such as supply and demand factors in the employment market. Contribution expected to be made by the Company during financial year ending March 31, 2010 has not been ascertained. As, this is the second year in which the AS-15 has been applied, the amounts of the present value of the obligation, fair value of plan assets, surplus or deficit in the plan and experience adjustment arising on plan liabilities and plan assets for the previous four years have not been furnished. 15 Previous years figures are restated / regrouped / rearranged wherever necessary in order to confirm to current years groupings and classifications. 417 126 (10,565) 11,240 675 31st March 2008 957 73 (7,547) 10,342 2,795

30

Annual Report 2008-09

Schedules Forming Integral part of the Financial Statements as at March 31, 2009

Accounting Standard (AS-18) Related Party Disclosure April 1, 2008 to March 31, 2009 Annexure : A Rs in Thousand April 1, 2007 to March 31, 2008 Particulars Enterprises under Significant Influence of Key Management Personnel: Sun Pharmaceutical Industries Ltd Reimbursement of Expenses Purchase of Materials / DEPB Fees for use of Technology Reimbursement of Expenses incurred Corporate Guarantee given to bank Outstanding Balance Receivable / (Payable) (Net) Sun Pharma Global Inc. BVI Sale of Technology Outstanding Balance Receivable / (Payable) (Net) Sun Pharma Global (FZE) Sale of Technology Outstanding Balance Receivable / (Payable) (Net) Sun Pharmaceutical Industries Purchase of Materials Fees for use of Technology Reimbursement of Expenses incurred Outstanding Balance Receivable / (Payable) (Net) Key Management Personnel: Remuneration to Directors Note : Names of related parties and description of relationship 1. Key Management Personnel 2. Enterprise under significant Influence of Key Management Personnel Mr. Dilip S. Shanghvi Dr. T. Rajamannar Sun Pharmaceutical Industries Ltd. Sun Pharma Global Inc. BVI. Sun Pharma Global FZE Sun Pharmaceutical (Bangladesh) Ltd. Sun Pharma De Mexico S. A. DE C.V. SPIL De Mexico S.A. DE C.V. Sun Farmaceutica Ltda Brazil Sun Pharmaceutical Industries Inc., USA Sun Pharmaceuticals UK Ltd ALKALOIDA Chemical Company exclusive group Limited Caraco Pharmaceutical Laboratories Ltd U.S.A. Universal Enterprise Pvt. Ltd. Zao Sun Pharma Industries Limited Russia Sun Pharmaceutical Peru S.A.C. Sun Petrochemical Pvt Ltd. Sun Speciality Chemicals Pvt Ltd. Navjivan Rasayan (Gujarat) Pvt Ltd. Sun Pharma Exports Sun Pharmaceutical Industries OOO Sun Pharmaceutical Industries Ltd. Sun Pharmaceutical Industries (Australia) PTY Ltds. Sun Pharmaceuticals France Sun Pharmaceuticals Germany GmbH Aditya Acquisition Company Limited Israel Sun Pharmaceuticals Italia S.R.L. Sun Pharmaceutical Industries Europe BV Sun Pharmaceutical Spain, SL. Sun Pharmaceuticals (SA) (Pty) Ltd-South Africa Sun Development Corporation I Chattem Chemical Inc. Sun Pharma Sikkim 26,068 11,286 13,139 2,588 125,000 (26,746) 46,036 276,978 (123,716) 491 14,458 2 395 12,077 67,913 7,468 125,000 (65,833) 352,759 234,709 224 5,734 5,463 9,177

31

Sun Pharma Advanced Research Company Ltd.

Balance Sheet Abstract and Companys General Business Profile

Information required as per Part IV of Schedule VI to The Companies Act, 1956 I Registration Details Registration No.

04/047837

Balance Sheet Date

31st March, 2009 Right Issue NIL Private Placement NIL

State Code

04

II

Capital Raised during the year (Rs in Thousand)

Public Issue NIL Bonus Issue NIL

III Position of Mobilisation and Deployment of Funds (Rs in Thousand)

Total Liabilities 564068 Sources of Funds Paid-up Capital 207116 Secured Loans NIL Application of Funds Net Fixed Assets 572769 Net Current (Liabilities) / Assets (198807) Total Assets 564068 Reserves and Surplus 339766 Unsecured Loans 17186 Investments NIL Miscellaneous Expenditure NIL Accumulated Losses 190106

IV Performance of the Company (Rs in Thousand)

Total Income 352436 Profit/ (Loss) Before Tax (124913) Earning per share Rs. (0.44) Total Expenditure 477349 Profit / (Loss) After Tax (91405) Dividend Rate NIL

Generic Names of Three Principal Products of the Company (as per monetary terms)

N.A.

For and on behalf of the Board DILIP S. SHANGHVI Chairman & Managing Director SUDHIR V. VALIA Director Mumbai, 23rd May 2009 MEETAL S. SAMPAT Company Secretary Mumbai, 23rd May 2009 Dr. T. RAJAMANNAR Wholetime Director San Francisco - U.S.A., 23rd May 2009

32

Annual Report 2008-09

Corporate Governance