Академический Документы

Профессиональный Документы

Культура Документы

Bet Fair

Загружено:

Arihant BhutoriaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bet Fair

Загружено:

Arihant BhutoriaАвторское право:

Доступные форматы

BetfairBetfair is the worlds largest international online sports betting company and the worlds biggest betting community.

The company has over three million registered users who bet on sports events and play online games including poker. Betfair is the worlds largest betting exchange handling 1,000 bets a second and completing 5m transactions a day, which is more than all European stock exchanges, combined. The company floated on 22st October 2010 at an issue price of 1,300p, raising 211 million and gave the company a market capitalization of 1.4 billion. Ticker Date of listing Issuer Mid Industry Price range Offer price Percentage share capital in offer Over-allotment option Estimated gross proceeds Market capitalization at offer price BET 22nd October 2010 Casinos & Gaming 11 to 14 and was later narrowed to 12.50 to 13 1,300p 15.2% (16,227,462 shares) 1,750,322 shares 211.0 million 1.4 billion

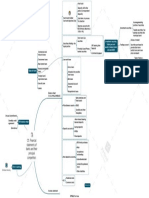

Reason for IPO

At the time of listing Betfair had 151m of cash so there was little need to raise further funds in an IPO, so the main reason for the listing was to-provide an exit for investors and to provide opportunities for acquisitions by creating liquidity around Betfairs stock. The rationale for IPO was to1. Provide exit for the investors. 2. Provide flexibility to react to a developing and consolidating online betting and gaming Industry. 3. Develop international operations through the enhanced transparency and reputational benefits of being a publicly listed company and will therefore enable Betfair to grow more quickly than it could as an unlisted company. 4. Provide ongoing flexibility and liquidity for existing Shareholders.

Pricing (Auction) method followed

100% Book Building process

IPO issue price

Betfair does not pay any dividends and does not plan to pay any this year. In the prospectus they have indicated that they will target an initial payout ratio of approximately 20 per cent. With no historical dividends we have used the DCF to value the offer price. Our valuation calculates the share price at 17.65, which is a 35.77% discount to the 13.00 offer price. The issue price valued Betfair at 1.4 billion, which is 4X sales and 93X net income. Unlike other gambling companies, Betfairs valuation is more inline with technology companies such as Google, eBay, and Yahoo. Valuation method used here is FCFF. Assumptions under this method1. Risk free rate is taken 3.5 % from UK treasury bills and risk premium is taken to be 5.5%. Beta has been taken to be 0.61. 2. Terminal growth rate is taken to be 22.22% which is around the CAGR for sales. 3. Most of the calculations for future cash flows has been done by taking CAGR for past 3 years and projecting it further.

Post Listing PerformanceOn the 22nd October 2010, Betfair started conditional trading on the London Stock Exchange at an opening price of 1,300p, the shares hit an intraday high of 1,620p before closing at 1,550p an increase of 19%. When the shares began unconditional trading on 27 th October Morgan Stanley exercised an over-allotment option on its shares (representing an additional 1.6% of total shares). After the strong first day increase the shares traded above their opening price of 1,300p for over a month until the end of November 2010. Since December 2010 the share price has been in constant decline, which is in sharp contrast to the FTSE All Share index, which has been relatively stable over the same time period.

IPO PERFORMANCEDate Issue Price End of day 1 End of week 1 End of month 1 Today 18/08/11 Price 1300p 1550p 1435p 1453p 615.50p % Movement +19.23% +10.38% +11.76% -52.65%

The above graph gives comparison of Betfair from the day of its start to date with respect to FTSE index. It shows it has given has been low returns in comparison to the index and Betfairs stock has kept on decreasing.

IBs involved and their specific roles

Name of IB Goldman Sachs Morgan Stanley Barclays Capital Numis Securities Limited Role Joint Book Runner, Joint Sponsor, Underwriter Joint Book Runner, Joint Sponsor, Underwriter Co-Lead Manager, Underwriter Co-Lead Manager, Underwriter

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Statement Summary: Statement Period Account NumberДокумент5 страницStatement Summary: Statement Period Account NumberSharon JonesОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- JPM CDO Research 12-Feb-2008Документ20 страницJPM CDO Research 12-Feb-2008Gunes KulaligilОценок пока нет

- Accounting Books - Ledgers and JournalsДокумент30 страницAccounting Books - Ledgers and JournalsAbegail BoqueОценок пока нет

- Portfolio Investment ProcessДокумент17 страницPortfolio Investment ProcessPrashant DubeyОценок пока нет

- Clydesdale Bank statement summaryДокумент13 страницClydesdale Bank statement summarytrustar14100% (1)

- M1B Insider Trading and Securities Law QuestionsДокумент14 страницM1B Insider Trading and Securities Law QuestionsMegan PangОценок пока нет

- Time Value of Money Practice Problems and SolutionsДокумент12 страницTime Value of Money Practice Problems and Solutionsalice horanОценок пока нет

- Statement: Branch Details Your Current Details Period 10 May 2019 To 10 June 2019Документ2 страницыStatement: Branch Details Your Current Details Period 10 May 2019 To 10 June 2019Ali RAZAОценок пока нет

- Union PDFДокумент2 страницыUnion PDFsv32611Оценок пока нет

- HDFC Bank - Bernestein - HDFC BankДокумент18 страницHDFC Bank - Bernestein - HDFC BankjoycoolОценок пока нет

- Equity Risk Management PolicyДокумент4 страницыEquity Risk Management PolicymkjailaniОценок пока нет

- Financial Statement Analysis: Course DescriptionДокумент4 страницыFinancial Statement Analysis: Course DescriptionMohsin RazaОценок пока нет

- Interest Rate Risk and Bond PricesДокумент61 страницаInterest Rate Risk and Bond PricesMarwa HassanОценок пока нет

- Multiplier Effect ExplanationДокумент5 страницMultiplier Effect Explanationfreaky mintyОценок пока нет

- Neeraj Joshi's bank statement summaryДокумент9 страницNeeraj Joshi's bank statement summaryNeeraj JoshiОценок пока нет

- Cash Management Calculations for Naim BerhadДокумент15 страницCash Management Calculations for Naim BerhadDayana SyazwaniОценок пока нет

- C5. Financial Statements of Banks and Their Principal CompetitorsДокумент1 страницаC5. Financial Statements of Banks and Their Principal CompetitorsNguyen Hoai HuongОценок пока нет

- Cba Sonia Ustinov 010318 - 260518Документ3 страницыCba Sonia Ustinov 010318 - 260518Ranji SoulОценок пока нет

- W6 Module 5 - Fringe Benefits and Dealings in PropertyДокумент13 страницW6 Module 5 - Fringe Benefits and Dealings in PropertyElmeerajh JudavarОценок пока нет

- Financial Statement Analysis GuideДокумент55 страницFinancial Statement Analysis GuideGizaw BelayОценок пока нет

- Maf603 Topic 2 Portfolio Management N Asset Pricing TheoryДокумент75 страницMaf603 Topic 2 Portfolio Management N Asset Pricing Theory2022920039Оценок пока нет

- Meaning of E-Banking: 3.2 Automated Teller MachineДокумент16 страницMeaning of E-Banking: 3.2 Automated Teller Machinehuneet SinghОценок пока нет

- Agrani Bank 2010Документ78 страницAgrani Bank 2010Shara Binte Hamid100% (1)

- Viva. The Free Banking Package For Young People and StudentsДокумент3 страницыViva. The Free Banking Package For Young People and StudentsYoussef SaidОценок пока нет

- Mekidelawit Tamrat MBAO9550.14BДокумент4 страницыMekidelawit Tamrat MBAO9550.14BHiwot GebreEgziabherОценок пока нет

- Unit 1 ActvitiesДокумент6 страницUnit 1 ActvitiesLeslie Mae Vargas ZafeОценок пока нет

- Equity ValuationДокумент32 страницыEquity Valuationprince455Оценок пока нет

- Difference Between Coupon and Yield To MaturityДокумент2 страницыDifference Between Coupon and Yield To MaturitySACHINОценок пока нет

- APICS - CPIM - 2019 - PT 2 - Mod 1 - SecFДокумент23 страницыAPICS - CPIM - 2019 - PT 2 - Mod 1 - SecFS.DОценок пока нет

- STUDY MATERIAL ON MONEY MARKET AND FINANCIAL SYSTEMДокумент25 страницSTUDY MATERIAL ON MONEY MARKET AND FINANCIAL SYSTEMPrateek VyasОценок пока нет