Академический Документы

Профессиональный Документы

Культура Документы

PVC Anti Dump Paste Asia - Russia

Загружено:

Ankur ShahИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

PVC Anti Dump Paste Asia - Russia

Загружено:

Ankur ShahАвторское право:

Доступные форматы

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)] GOVERNMENT OF INDIA MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE) Notification No.66 /2011-Customs New Delhi, 26th July, 2011 G.S.R. (E). - Whereas in the matter of imports of Poly Vinyl Chloride Paste Resin (hereinafter referred to as the subject goods), falling under sub- heading 3904 22 10 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred as the said Customs Tariff Act), originating in, or exported from, Peoples Republic of China, Japan, Republic of Korea, Malaysia, Russia, Taiwan and Thailand (hereinafter referred as the subject countries) and imported into India, the designated authority in its preliminary findings vide notification No.14/36/2009-DGAD, dated the 11th June, 2010, published in the Gazette of India, Extraordinary, Part I, Section 1, dated the 11th June, 2010, had come to the conclusion that(a) the subject goods had been exported to India from the subject countries below associated normal values, thus resulting in dumping of the subject goods; (b) the domestic industry had suffered material injury in respect of the subject goods; (c) the material injury to the domestic industry had been caused by the dumped imports of the subject goods from the subject countries; and had recommended imposition of provisional anti-dumping duty on the imports of subject goods, originating in, or exported from, the subject countries; And whereas, on the basis of the aforesaid findings of the designated authority, the Central Government had imposed provisional anti-dumping duty on the subject goods vide notification No. 77/2010-Customs, dated 26th July, 2010, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R.633(E), dated the 26 th July, 2010; And whereas, the designated authority, in its final findings vide notification No. 14/36/2009DGAD, dated 2nd May, 2011, published in the Gazette of India, Extraordinary, Part I, section 1, dated the 2nd May,2011, had come to the conclusion that,-

(a) the product under consideration had been exported to India from the subject

countries ( except Japan), below their associated normal values, except in the cases wherein the dumping margin has been found to be negative. (b) the domestic industry had suffered material injury in respect of the product under consideration. (c ) the material injury to the domestic industry had been caused by the dumped imports of the subject goods from the subject countries(except Japan). Now, therefore, in exercise of the powers conferred by sub-section (1) read with subsection (5) of section 9A of the said Customs Tariff Act, read with rules 18 and 20 of the Customs Tariff (Identification, Assessment and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, the Central Government, on the basis of the aforesaid findings of the designated authority, hereby imposes on the subject goods, the description of which is specified in column (3) of the Table below, falling under sub-heading of the First Schedule to the said Customs Tariff Act as specified in the corresponding entry in column (2), originating in the countries as specified in the corresponding entry in column (4), and exported from the countries as specified in the corresponding entry in column (5), and produced by the producers as specified in the corresponding entry in column (6), and exported by the exporters as specified in the corresponding entry in column (7), and imported into India, an anti-dumping duty at a rate which is equivalent to the difference between, the reference price as specified in the corresponding entry in column (8), in the currency as

specified in the corresponding entry in column (10) and per unit of measurement as specified in the corresponding entry in column (9), of the said Table, and the landed value of such imported goods in like currency per like unit of measurement. Sl. No . (1) 1 Subheading (2) 39042190 , 3904 22 10 39042190 , 3904 22 10 Descriptio n of goods (3) Poly Vinyl Chloride Paste Resin Poly Vinyl Chloride Paste Resin Country of origin (4) China PR China PR Country of exports (5) China PR Any country other than subject countrie s China PR Table Producer Exporter Referenc e price (8) 1707 Uni t (9) MT Currenc y (10) US Dollar

(6) Any

(7) Any

Any

Any

1707

MT

US Dollar

39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin

39042190 , 3904 22 10 39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin Poly Vinyl Chloride Paste Resin

Any country other than subject countrie s Malaysi a

Any

Any

1707

MT

US Dollar

Malaysi a

Malaysi a

39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin

39042190 , 3904 22 10 39042190 , 3904 22 10 39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin Poly Vinyl Chloride Paste Resin Poly Vinyl Chloride Paste Resin

Any country other than subject countrie s Korea RP

Any country other than subject countrie s Malaysi a

M/s Mitsui & Co (Asia Pacific) Pte. Ltd., Malaysia Any other than Sl.No.4

M/s Kaneka Paste Polymers Sdn., Japan

1471

MT

US Dollar

1471

MT

US Dollar

Any

Any

1471

MT

US Dollar

Korea RP

Korea RP Korea RP

Korea RP Any country other than subject countrie s

M/s Hanwha Chemical Corporatio n M/s LG Chem Ltd.

M/s Hanwha Chemical Corporatio n M/s LG Chem Ltd.

NIL

MT

US Dollar

NIL

Any other than Sl.No.7 and 8

1706

MT

US Dollar

10

39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin

11

39042190 , 3904 22 10 39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin Poly Vinyl Chloride Paste Resin

Any country other than subject countrie s Taiwan

Korea RP

Any

Any 1706

MT

US Dollar

Taiwan

M/s Formosa Plastics Corporation

12

Taiwan

13

39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin

14

15

39042190 , 3904 22 10 39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin Poly Vinyl Chloride Paste Resin

Any country other than subject countrie s Russia

Any country other than subject countrie s Taiwan

M/s Formosa Plastics Corporatio n Any other than Sl.No.11

MT NIL

US Dollar

MT 1701

US Dollar

Any

Any 1701

MT

US Dollar

Russia

Any

Any 1701

MT

US Dollar

Russia

16

39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin

17

18

39042190 , 3904 22 10 39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin Poly Vinyl Chloride Paste Resin

Any country other than subject countrie s Thailand

Any country other than subject countrie s Russia

Any

Any 1691

MT

US Dollar

Any

Any

1691

MT

US Dollar

Thailand

Any

Any 1551

MT

US Dollar

Thailand

19

39042190 , 3904 22 10

Poly Vinyl Chloride Paste Resin

Any country other than subject countrie s

Any country other than subject countrie s Thailand

Any

Any 1551

MT

US Dollar

Any

Any 1551

MT

US Dollar

Explanation.- For the purposes of this notification, Poly Vinyl Chloride Paste Resin shall not include Blending resin, Co-polymers of PVC paste resin, Battery separator resin and PVC paste resin of K value below 60. 2. The anti-dumping duty imposed under this notification shall be effective for a period of five years (unless revoked, superseded or amended earlier) from the date of imposition of provisional duty, that is, the 26th July, 2010 and shall be payable in Indian currency. Explanation. For the purpose of this notification,(a) Landed value of imports shall be the assessable value as determined under the Customs Act, 1962 and includes all duties of customs except duties levied under Sections 3, 3A, 8B, 8C, 9 and 9A of the said Customs Tariff Act. (b) rate of exchange applicable for the purposes of calculation of such anti-dumping duty shall be the rate which is specified in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), issued from time to time, in exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and the relevant date for the determination of the rate of exchange shall be the date of presentation of the bill of entry under section 46 of the said Customs Act. [F.No.354/107/2010 TRU (Pt-1)] (Sanjeev Kumar Singh) Under Secretary to the Government of India.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- InstitutionalismДокумент15 страницInstitutionalismLowel DalisayОценок пока нет

- Act of State DoctrineДокумент6 страницAct of State Doctrineaquanesse21Оценок пока нет

- Squatting Problem and Its Social Ills in MANILAДокумент10 страницSquatting Problem and Its Social Ills in MANILARonstar Molina TanateОценок пока нет

- Cases NOvember 21Документ31 страницаCases NOvember 21Wilfredo Guerrero IIIОценок пока нет

- REPUBLIC ACT No. 11479 - Anti Terrorism For Powerpoint PresentationДокумент30 страницREPUBLIC ACT No. 11479 - Anti Terrorism For Powerpoint PresentationHendrix TilloОценок пока нет

- VLT - Go MS 90Документ2 страницыVLT - Go MS 90Raghu Ram100% (3)

- Bpats Enhancement Training ProgramДокумент1 страницаBpats Enhancement Training Programspms lugaitОценок пока нет

- Cash Flow StatementДокумент11 страницCash Flow StatementDuke CyraxОценок пока нет

- Iba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesДокумент30 страницIba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesSomil KumarОценок пока нет

- 64 Zulueta Vs PAN-AMДокумент3 страницы64 Zulueta Vs PAN-AMShaira Mae CuevillasОценок пока нет

- University of ZimbabweДокумент21 страницаUniversity of ZimbabweMotion ChipondaОценок пока нет

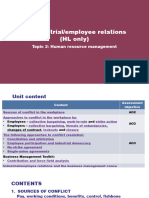

- 2.7 Industrial and Employee RelationДокумент65 страниц2.7 Industrial and Employee RelationadhityakinnoОценок пока нет

- In This Chapter : Me, ShankarДокумент20 страницIn This Chapter : Me, ShankarPied AvocetОценок пока нет

- Safety Data Sheet: Ubstance and Ource DentificationДокумент6 страницSafety Data Sheet: Ubstance and Ource DentificationMuhОценок пока нет

- Historical Background of The PNPДокумент1 страницаHistorical Background of The PNPGloria AsuncionОценок пока нет

- K-8 March 2014 Lunch MenuДокумент1 страницаK-8 March 2014 Lunch MenuMedford Public Schools and City of Medford, MAОценок пока нет

- Retainer Contract - Atty. AtoДокумент2 страницыRetainer Contract - Atty. AtoClemente PanganduyonОценок пока нет

- Computer Networks Notes (17CS52) PDFДокумент174 страницыComputer Networks Notes (17CS52) PDFKeerthiОценок пока нет

- Week 4, 5, 6 Adjustments and Financial Statement Prep - ClosingДокумент61 страницаWeek 4, 5, 6 Adjustments and Financial Statement Prep - ClosingAarya SharmaОценок пока нет

- Sworn Statement - TemarioДокумент1 страницаSworn Statement - Temariozyphora grace trillanesОценок пока нет

- Knecht Vs UCCДокумент2 страницыKnecht Vs UCCXing Keet LuОценок пока нет

- Fundamentals of Criminal Investigation and IntelligenceДокумент189 страницFundamentals of Criminal Investigation and IntelligenceGABRIEL SOLISОценок пока нет

- The Family Code of The Philippines PDFДокумент102 страницыThe Family Code of The Philippines PDFEnrryson SebastianОценок пока нет

- UOK-Ph.D. Fee StructureДокумент2 страницыUOK-Ph.D. Fee StructureNeeraj MeenaОценок пока нет

- Department of Education: Republic of The PhilippinesДокумент6 страницDepartment of Education: Republic of The PhilippinesRoderick MalubagОценок пока нет

- Samuel Newton v. Weber CountyДокумент25 страницSamuel Newton v. Weber CountyThe Salt Lake TribuneОценок пока нет

- PAS 7 and PAS 41 SummaryДокумент5 страницPAS 7 and PAS 41 SummaryCharles BarcelaОценок пока нет

- Imm5786 2-V1V20ZRДокумент1 страницаImm5786 2-V1V20ZRmichel fogueОценок пока нет

- Salary and Leave Policy in IndiaДокумент7 страницSalary and Leave Policy in IndiaAditya SrivastawaОценок пока нет

- Anatolia Cultural FoundationДокумент110 страницAnatolia Cultural FoundationStewart Bell100% (3)