Академический Документы

Профессиональный Документы

Культура Документы

Balance of Payments

Загружено:

Sneha GehaniИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Balance of Payments

Загружено:

Sneha GehaniАвторское право:

Доступные форматы

Balance of Payments The balance of payments of a country is a systematic record of all economic transactions between the residents of the

reporting country and the residents of foreign countries during a given period of time. It is an important index, which reflects the true economic position of a country, whether the country is a creditor country or a debtor country, and whether its currency is rising or falling in its external value. There are various types of monetary transactions that take place between two countries: The export and import of a goods and services The international lending and borrowing Servicing of foreign debts and their final repayments. Components of Balance of Payments Balance of Payments is generally grouped under the following heads i) Current Account ii) Capital Account iii) Unilateral Payments Account iv) Official Settlement Account. Current Account The Current Account includes all transactions which give rise to or use up national income. The Current Account consists of two major items, namely: i) Merchandise exports and imports, and ii) Invisible exports and imports. Merchandise exports, i.e., the sale of goods abroad, are credit entries because all transactions giving rise to monetary claims on foreigners represent credits. On the other hand, merchandise imports , i.e., purchase of goods from abroad, are debit entries because all transactions giving rise to foreign money claims on the home country represent debits. Merchandise imports and exports form the most important international transaction of most of the countries .Invisible exports, i.e., sales of services, are credit entries and invisible imports, i.e. purchases of services, are debit entries. Important invisible exports include the sale abroad of such services as transport, insurance, etc., foreign tourist expenditure abroad and income paid on loans and investments (by foreigners)in the home country form the important invisible entries on the debit side. Capital Account The Capital Account consists of short- terms and long-term capital transactions A capital outflow represents a debit and a capital inflow represents a credit. For instance, if an American firm invests Rs.100 million in India, this transaction will be represented as a debit in the US balance of payments and a credit in the balance of payments of India. The payment of interest on loans and dividend payments are recorded in the Current Account, since they are really payment s for the services of capital. As has already been mentioned above, the interest paid on loans given by foreigners of dividend on foreign investments in the home country are debits for the home country, while, on the other hand, the interest received on loans given abroad and dividends on investments abroad are credits. Unilateral Transfers Account Unilateral transfers is one part of the current account of the balance of payments. It tracks the "one-way" transfer of funds from one country to another that are made without any counter flow or exchange or goods and services. These payments are merely gifts from one country to another. The gift might come

from a person, business, or (frequently) government. Foreign aid payments from one government to another are an important part of unilateral transfers.. These unilateral transfers include private remittances, government grants ,disaster relief, etc. Unilateral payments received from abroad are credits and those made abroad are debits. Official Settlements Accounts Official reserves represent the holdings by the government or official agencies of the means of payment that are generally accepted for the settlement of international claims

Balance of trade: The balance of trade (or net exports, sometimes symbolized as NX) is the difference between the monetary value of exports and imports of output in an economy over a certain period. It is the relationship between a nation's imports and export. A positive balance is known as a trade surplus if it consists of exporting more than is imported; a negative balance is referred to as a trade deficit or, informally, a trade gap. The balance of trade is sometimes divided into a goods and a services balance. The balance of trade forms part of the current account, which includes other transactions such as income from the international investment position as well as international aid. If the current account is in surplus, the country's net international asset position increases correspondingly. Equally, a deficit decreases the net international asset position.

Factors that can affect the balance of trade include: The cost of production (land, labor, capital, taxes, incentives, etc.) in the exporting economy vis-vis those in the importing economy; The cost and availability of raw materials, intermediate goods and other inputs; Exchange rate movements; Multilateral, bilateral and unilateral taxes or restrictions on trade; Non-tariff barriers such as environmental, health or safety standards; The availability of adequate foreign exchange with which to pay for imports; and Prices of goods manufactured at home (influenced by the responsiveness of supply)

Difference between BOT and BOP Balance of trade and balance of payment are two commonly used terms in international economics. These terms are different but related to each other as Balance of trade is a component of Balance of Payment. BOT include as current item in balance of payment and described as:

It is the sum of the balance of trade (net earnings on exports payments for imports), factor income (earnings on foreign investments payments made to foreign investors) and cash transfers. Its called the current account as it covers transactions in the "here and now" those that do not give rise to future claims Balance of trade can be in deficit or surplus as per the tangible business transactions of one country to another. If imports of a country increase to its exports the balance of payment will be negative or deficit, and if country has more exports than its imports the balance of trade will be considered positive or surplus. The deficit or surplus balance of trade cannot represent or guarantee the economic growth of a country. When the economy is in expansion phase there may be positive economic indicators with deficit or negative balance of trade.

Adding all receipts and subtracting payment the outcome deficit or surplus figure is called Balance of Payment. Normally these statistics represent one year economic activities of a country. It is a broader term includes trade of physical goods, services and capital employment. BOP of a country must be equal to zero even if the payment and receipts are not equal. For example if the imports are excessive to exports and country has to pay the balance amount, it will pay by incomes earned from investments overseas, form its reserves or even by borrowing form other countries. International trades imbalances can be problematic of not as per economic condition and trade cycle of the country. Balance of trade has a current account affect in Balance of Payment. The Equation of Balance of Payment by IMF is as under: BOP = Current AccountFinancial Account Capital Account +Balancing Item The BOP account records the payments and receipt in terms of current account (Tangible goods), services (intangible goods) and foreign investments of the residents of the country in their transactions with residents of other countries. The balance of these receipts and payments must be equal. Any apparent inequality simply leaves one country acquiring assets of the others. Gross national income Gross national income (GNI) comprises the value of all products and services generated within a country in one year (i.e., its gross domestic product), together with its net income received from other countries (notably interest and dividends).[1] The GNI consists of: the personal consumption expenditures, the gross private investment, the government consumption expenditures, the net income from assets abroad (net income receipts), and the gross exports of goods and services, after deducting two components: the gross imports of goods and services, and the indirect business taxes. The GNI is similar to the gross national product (GNP), except that in measuring the GNP one does not deduct the indirect business taxes.

Gross national expenditure

Combined amount of all expenditures to include those which are public and private. Gross national expenditure differs from Gross Domestic Product in that expenditures on exports are not included.

Factors affecting forex:

Exchange rate, is the price of one currency in terms of another currency. In other words, it is the rate at which two currencies can be exchanged. There are several factors which affect and decide the exchange rate of currencies, causing frequent fluctuations in the rate. Sometimes the exchange rate may change over a period of some months or years and sometimes fluctuations occur within a span of some hours and days. Theoretically, in a free market, the rate of exchange is determined by the demand for and supply of foreign currency. The equilibrium rate of exchange is attained at the point where demand for foreign currency is exactly equal to its supply. The demand and supply of foreign currency arise from international trade, investments and other international transactions. For example- If India imports some goods from the US, India will require US dollars to pay for those imports. This is demand for dollars and supply of Rupees in exchange, in the foreign exchange, market. India will buy dollars, against Rupees to pay for its imports. Whereas, if India exports some goods or services to the US, there will be a demand for Indian Rupees by the US to pay for its imports from India. This is basic economics, that demand and supply keep adjusting till they become equal and the equilibrium rate is achieved. But this ideal equilibrium rate is difficult to achieve because demand and supply are affected by several factors, which cause frequent fluctuations and adjustments in the exchange rate, fixing it at a rate which may not be the equilibrium rate. Factors influencing the rate of exchange1. International trade- Trade of goods and services between countries is the major reason for the demand and supply of foreign currencies. The value or strength or weakness of a countries currency in terms of other currencies depends on its trade with those countries. If a countrys imports are higher, the demand for foreign currency in this country will be high. Higher demand for foreign currency means high value of foreign currency and low value of the domestic currency. This is a typical case for underdeveloped countries which rely on imports for development needs. The current account balance (deficit or surplus) thus reflects the strength and weakness of the domestic currency. 2. Capital movements- International investments in the form of Foreign direct investment (FDI) and Foreign institutional investments (FII) have become the most important factors affecting the exchange rate in todays open world economy. Countries which attract large capital inflows through foreign investments, will witness an appreciation in its domestic currency as its demand rises. Outflow of capital would mean a depreciation of domestic currency.

3. Change in prices- Domestic inflation, or deflation affects the exchange rate by affecting the demand and supply of domestic currency in the foreign exchange market. For example, if prices in India go up, making Indian goods costlier, the demand for Indian goods will do down. When exports go down, the demand for rupee will fall, causing depreciation in its exchange value, . 4. Speculations- Uncertainties are always there in the financial market. Speculators predict about the future exchange rate based on various happenings in the world, in various countries. Speculators study the various ups and downs of a country and its resilience to international happenings and forecast the possible future exchange rate based on a particular countries economic strengths and weaknesses. If the speculators expect a fall in the value of a currency, in the near future, they will sell that currency and start buying the other currency that they expect to appreciate. The selling of the former currency will thus increase its supply in the foreign exchange market and bring down its value. The other currency appreciates as its demand increases. 5. Strength of the economy- If the economic fundamentals of a country are strong, the exchange rate of its domestic currency remains stable and strong. Fiscal balance, international current account balance, international liabilities, foreign exchange reserves, resilience to international trade fluctuations, GDP, inflation rate all are indicators of a countrys economic strength. 6. Government policies- In countries where there is fixed or managed float, the central bank becomes an important player in the foreign exchange market. The bank influences the value of the currency by its market operations like buying and selling of bills and currencies. The bank rate also influences the exchange rate by influencing investments and thereby the demand and supply of the domestic currency. 7. Stock exchange operations- Stock exchange operations in foreign securities, debenture, s, stocks and shares, influence the demand and supply of related currencies, thus influencing their exchange rate. 8. Political factors- Political scenario of the country ultimately decides the strength of the country. Stable efficient government at the centre will encourage positive development in the country, creating investor , confidence and a good image in the international market. An economy with a strong, positive image will obviously have a strong domestic currency. This is the reason why speculations rise considerably during the parliament elections, with various predictions, of the future government and its policies. In 1998, the Indian rupee depreciated against the dollar due to the American sanctions after India conducted the Pokharan nuclear test. Value of a currency is thus not a simple result of its demand and supply, but a complex mix of multiple factors influencing the demand and supply. Its a tight rope walk for any country to maintain a strong, stable currency, with policies taking care of conflicting demands like inflation and export promotion, welcoming foreign investments and avoiding an appreciation of the domestic currency, all at the same time.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Module Handbook MSC Economics Freiburg Sept 2020Документ82 страницыModule Handbook MSC Economics Freiburg Sept 2020starОценок пока нет

- Contemporary World Lesson 3 EvaluateДокумент2 страницыContemporary World Lesson 3 Evaluatejasslyne100% (2)

- 12 Macro Economics Key Notes CH 03 Money and BankingДокумент5 страниц12 Macro Economics Key Notes CH 03 Money and BankingKarsin ManochaОценок пока нет

- Applied Economics DLL WK 1Документ3 страницыApplied Economics DLL WK 1Veneranda del Mundo100% (2)

- Review UAS Introduction To Economics PDFДокумент3 страницыReview UAS Introduction To Economics PDFGharda AdityaОценок пока нет

- Full Download Macroeconomics Williamson 5th Edition Test Bank PDF Full ChapterДокумент36 страницFull Download Macroeconomics Williamson 5th Edition Test Bank PDF Full Chapterythrowemisavize.blfs2100% (19)

- Foreign Direct Investment Determinants in The Manufacturing Sectors in MalaysiaДокумент14 страницForeign Direct Investment Determinants in The Manufacturing Sectors in MalaysiaGlobal Research and Development ServicesОценок пока нет

- Mankiw10e Lecture Slides ch07Документ38 страницMankiw10e Lecture Slides ch07Afny HnpiОценок пока нет

- Coursenotes BFB4133-090212 102219Документ101 страницаCoursenotes BFB4133-090212 102219Makisha NishaОценок пока нет

- How Is National Income Distributed To The FactorsДокумент26 страницHow Is National Income Distributed To The FactorsSaurav kumar0% (2)

- Chapter 8. Business Cycles. Overhead.F2016Документ13 страницChapter 8. Business Cycles. Overhead.F2016sutoraifuviiОценок пока нет

- 2016 May TZ2Документ3 страницы2016 May TZ2SeoHyun KIMОценок пока нет

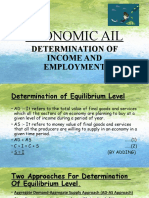

- Economic Ail: Determination of Income and EmploymentДокумент12 страницEconomic Ail: Determination of Income and EmploymentYo SenpaiОценок пока нет

- BUS324TEST1Документ15 страницBUS324TEST1mellisa samooОценок пока нет

- Macroeconomics Assignment 2Документ4 страницыMacroeconomics Assignment 2reddygaru1Оценок пока нет

- 23.23 AppendixДокумент48 страниц23.23 AppendixikhjnОценок пока нет

- ECO121 - Individua - assignment - Nguyễn Như Cường - HS153103Документ3 страницыECO121 - Individua - assignment - Nguyễn Như Cường - HS153103Nguyen Thanh Tung (K15 HL)Оценок пока нет

- National Income Final 1Документ90 страницNational Income Final 1bhavishabhanuОценок пока нет

- Handout 11Документ5 страницHandout 11Yosra BaazizОценок пока нет

- Quick Notes On Growth: Professor: Alan G. Isaac February 3, 2017Документ60 страницQuick Notes On Growth: Professor: Alan G. Isaac February 3, 2017Thk RayyОценок пока нет

- Money Demand, The Equilibrium Interest Rate, and Monetary PolicyДокумент29 страницMoney Demand, The Equilibrium Interest Rate, and Monetary PolicyAbood AlissaОценок пока нет

- Macro Bess 2022Документ202 страницыMacro Bess 2022Lans Gabriel GalineaОценок пока нет

- 533Документ30 страниц533fadoОценок пока нет

- Impact of Public Debt On Economic GrowthДокумент18 страницImpact of Public Debt On Economic GrowthHajra AОценок пока нет

- 1.2 Introduction To Labour Economics and Personnel Economics.Документ6 страниц1.2 Introduction To Labour Economics and Personnel Economics.Iheti SamОценок пока нет

- Chapter in A Nutshell: After You Study This Chapter, You Should Be Able ToДокумент18 страницChapter in A Nutshell: After You Study This Chapter, You Should Be Able ToAsif WarsiОценок пока нет

- Analysis of Monetary Policy of IndiaДокумент18 страницAnalysis of Monetary Policy of IndiaShashwat TiwariОценок пока нет

- 2.1 - The Level of Overall Economic ActivityДокумент7 страниц2.1 - The Level of Overall Economic ActivityAryan KalyanamОценок пока нет

- Eduardo Maldonado-Filho - Release and Tying Up of Productive Capital and The 'Transformation Problem'Документ16 страницEduardo Maldonado-Filho - Release and Tying Up of Productive Capital and The 'Transformation Problem'kmbence83Оценок пока нет

- Chapter 9: FOREX MARKET Key PointsДокумент6 страницChapter 9: FOREX MARKET Key PointsDanica AbelardoОценок пока нет