Академический Документы

Профессиональный Документы

Культура Документы

SRP Setting Up Asset Reconstruction Companies in India

Загружено:

Prem Sagar MishraИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SRP Setting Up Asset Reconstruction Companies in India

Загружено:

Prem Sagar MishraАвторское право:

Доступные форматы

Title

Setting up & working of asset reconstruction companies in India- A

perspective on the impediments

Authors Divyesh Chaitalia Rishab Bengani Onkar Redkar

Source

Insight Inside

References

1. Securitization And Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, (SARFAESI Act) 2. Report Of High Level Expert Committee On Corporate Bonds & Securitization, December, 2005 3. RBI Guidelines on Securitization (RBI No. 2005-06/294,

DBOD.NO.BP.BC.60 / 21.04.048/2005-06), February, 2006 4. Asian Development Banks Report on Technical Assistance to India for Developing the Enabling Environment for and Structuring ARCs in India, October, 2002 5. www.vinodkothari.com 6. www.credit-deriv.com 7. www.arcil.co.in 8. BSE Indias Market Trend report Lakshmi Mohandas 9. Distressed Debt and Profiting from it Fitch Friday

Document Type Secondary Research Paper

Symbiosis Institute of Business Management, Pune

Subject

Finance

Date

November, 2006

Abstract

The Indian experience with asset reconstruction has been more bumpy than smooth. The article studies the business model and the need for asset reconstruction companies and a discussion and analysis of the regulatory frame work and various issues plaguing the system. The article gives the way forward with respect to ARC and the factors which need immediate attention to be successful in the near future.

Symbiosis Institute of Business Management, Pune

Exposition:

EXECUTIVE SUMMARY Asset Reconstruction Companies are special entities which use market forces to consolidate and attractively package lender interests and arrange funding for asset reconstruction. The need for Asset reconstruction arises in India from the bad loans emanating out of a systemic banking crisis.

ARCs in India adopt a trust structure, whereby issuing pass through securities or pay through securities. A generic business model of a typical ARC is to buy distressed assets from a Bank/Financial Institutions; and then choose between directly securitizing them or first reconstructing the asset and then securitizing it before sale to investors. Another opportunity to invest in the reconstruction exercise lies in partnering the ARC in reconstructing debt. The same is unavailable to retail investors & only Qualified Institutional Buyers can participate in it.

Any instrument issued by an ARC needs to possess certain features before it becomes palatable to the investors. These include marketability, credibility of the issuer & credit enhancer, transparency, wide distribution, homogeneity & the presence of a special purpose vehicle.

The regulatory framework under which asset reconstruction has evolved has been through a process of upheaval since the initial financial sector reforms. The essentials of debt recovery include the ascertainment of dues as reflected in Decree/Certificate and the execution of the same for realization of amount. The deficiency of the legal framework in both these regards has been in the center of attention of the authorities & regulators. However, successive legislations have failed to address this issue with success. Moreover, ambiguity & lack of clarity on various legal issues have further clouded the environment.

Symbiosis Institute of Business Management, Pune

The problem faced by ARCs, extend beyond just the regulatory framework. A number of issues like high incidence of stamp duties, taxation of SPVs, lack of a proper market for the instruments, pricing problems, allowing more participants, & credibility of current ARCs need to be addressed with great urgency. Without these reforms, expecting to develop a proper environment for setting up & working of ARCs would be a futile exercise.

INTRODUCTION

WHAT IS ASSET RECONSTRUCTION? Asset reconstruction refers to the acquisition by any securitization company or reconstruction company, of any right or interest of any bank or financial institution in financial assistance, for the purpose of realization of such financial assistance.

Asset reconstruction originates from the recommendation to set up a central Asset Reconstruction Fund in the Committee on the Financial System, 1991, ( or Narsimham Committee I) with money contributed by the Central Government, which was to be used by banks to bail them out of the bad loans in their portfolio (Non Performing Assets or NPA). This idea met with implementation difficulties and so Narsimham II recommended formation of asset reconstruction companies, the likes of which had already been successful in Malaysia, Korea and several other countries in the world.

Thus, Asset Reconstruction Companies (ARCs) are special entities (incentives being provided by the government/regulator) which use market forces to consolidate and attractively package lender interests and arrange funding for asset reconstruction.

WHY DO WE NEED ASSET RECONSTRUCTION?

The need for Asset reconstruction arises from the need to resolve the bad loans emanating out of a systemic banking crises. A systemic banking crisis arises out of a domino effect of bad loans and their interdependence causing more such defaults in the banking system

Symbiosis Institute of Business Management, Pune

creating a vicious circle. The banking regulators or governments try to bail out the banking system of a systematic accumulation of bad loans which acts as a drag on their liquidity, balance sheets and generally the health of banking. They can do so by two approaches: 1) Leave the banks to manage their own bad loans by giving them incentives,

legislative powers, or special accounting or fiscal advantages. (Decentralized Approach) 2) To manage these bad loans on a concerted, central level, through a centralized

agency or agencies. (Centralized Approach). ARCs are examples of this approach. The advantages of the Centralized Approach are as follows: More clout and controllability as bad loans in one or a few hands Easier and Safer to give special legislative powers to a single (few) firms than the whole banking system Regular banking unaffected with lesser burden on their balance sheets Economies of scale, it can mix up good assets with bad ones and make a sale which is palatable to buyers. Funding is easier for an ARC than banks themselves

THE BUSINESS MODEL Most securitizations in India adopt a trust structure. In this structure the underlying assets being transferred by way of a sale to a trustee, who holds it in trust. A trust is not a legal entity in law but a trustee is entitled to hold property which is distinct from the property of the trustee or other trust properties held by it.

The Trust issues securities which are either pass through securities or pay through securities. In case of pass through securities, the investors owning/buying these securities acquire beneficial interest in the underlying assets held by the trustee. While, pay through securities are different as investors holding them acquire beneficial interest only in the cash flows realized from the underlying assets and that too in the order of and to the extent of the obligation contracted with the holders of the respective senior and subordinated tranches of pay through securities.

Symbiosis Institute of Business Management, Pune

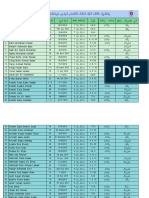

A generic business model of a typical ARC is to buy distressed assets from a Bank/Financial Institutions; and then either directly securitize the asset or first reconstruct the asset and then securitize it to sell it to investors. The schematic representation of the business model is presented below. It shows the various transactional flows between various participants, which are described below. The following are the participants in a typical Asset Reconstruction Transaction:

1)

Banks/FIs : They sell their distressed assets to the ARC & are also referred to the

originators 2) ARC/ Trust: The ARC forms a SPV (Special Purpose Vehicle) which can issue

security receipts which are Pass through Certificates for the cash flows from the assets 3) Investors: They are of different classes, and thus the ARC structures the cash

flows into different schemes to suit these classes. They are the final owners of the cash flows from assets 4) distress Borrower: It is the company which had borrowed the money and is in financial

Symbiosis Institute of Business Management, Pune

The Source of Profitability of an ARC is arises from: 1) Direct remuneration for restructuring and debt servicing of the company, if successful, or indirectly as the ARC would have a stake in the company by means of owning some part of the assets. (Not all are transferred to investors). So as the assets turn profitable after resolutions they earn their share, if at all. 2) Margin charges in offering security receipt returns for provision of credit enhancements.

FUNCTIONING OF AN ARC The functioning of a typical ARC in stages with respect to a timeline is as shown in the diagram. (Note: ARC here refers to the separate entity (a Trust) to which the ARC transfers the proceeds. It is the trust that issues securities)

1)

The first step which initiates the process is the selling of distressed debt/asset

(NPA) by the bank to an ARC. 2) The banks transfer the security receipts to the ARC. This essentially means that

the cash flows from the sold off debt belong to the ARC. 3) The ARC, in the second stage, involves itself into the resolution stage, may/may

not get involved in the Management (by a complete buyout). It restructures the capital structure and arranges various kinds of investments for servicing the debt for the

Symbiosis Institute of Business Management, Pune

company in distress. This represents the 1st investment opportunity (discussed shortly in the next section). 4) In the last stage, the company comes out with a debt issue for the credit enhanced company (enhancement done in 2nd stage) to the risk-averse investors. Thus the trust gets back the investment (or a part of it), that it had made initially in buying the assets from the bank.

INVESTMENT OPPORTUNITIES

As described in the functioning in the earlier section, the Banks transfer their assets/Debts/NPA to the trust of ARCs. The ARC can now offer the asset directly to investors (i.e. without any credit enhancements at a higher rate of return), or offer them after a credit enhancement or resolution (at lower rates). The credit enhancement can be provided either by the ARC itself or by a 3rd party. The resolution procedure similarly may have participation from 3rd party players like Private Equities etc., apart from the ARC.

Thus there are two Investment opportunities for the Investors at the Trust level: 1) Pre Resolution (High risk, high returns) 2) Post Resolution (Credit enhanced, low risk, lower returns) Another opportunity exists at the Company level, where a 3rd party investor like a Private equity comes in for Capital provisioning in restructuring the company, partnering the ARC, might also exist.

REQUIREMENTS FOR AN ARC INSTRUMENT

An ARC instrument for being palatable for investors must have a certain set of characteristics. The ones discussed below were among the major requirements that an ARC instrument would need.

Symbiosis Institute of Business Management, Pune

Marketability: It is the very purpose for which an ARC exists, i.e. to create liquidity for the otherwise illiquid assets of the banking system. The concept involves two postulates, one regarding the legal issues and legal feasibility of marketing the instrument & the other being existence of a market for the instrument.

Credibility in the issuer & Credit enhancer: The investor demand of the securitized receipts depends on the credibility of an ARC and of the credit enhancements if provided by the 3rd party. This is requires the ARCs to have successfully established themselves and generated enough trust in the investment community. Transparency: The transparency of the issuer with respect to disclosure of the distressed debt and its restructuring process to ensure investor trust is important.

Wide Distribution: To achieve greater penetration the extent of distribution which the originator would like to achieve is based on a comparative analysis of the costs and the benefits achieved thereby. The benefits of wider distribution are that its able to market the product with lower return, and hence, lower financial cost. While the cost involved are that of distribution and servicing.

Homogeneity: To be marketable, the instrument should be packaged as into homogenous lots. Most securitized instruments are sliced into smaller lots such that they are affordable to the marginal investor. Thus the minimum denomination becomes relative to the needs of the smallest investor.

Special Purpose Vehicle: In most cases the securitization involves assets or claims which need to be integrated and differentiated, that is, unless it is a direct and unsecured claim on the issuer, the issuer will need an intermediary agency to act as a repository of the asset or claim which is being securitized. For this purpose, the issuer will bring in a mediating agency whose basic function is to hold the security charge on behalf of the investors, and issue certificates to the investors of beneficial interest in the charge held by the intermediary.

Symbiosis Institute of Business Management, Pune

REGULATORY FRAMEWORK & ISSUES IT FACES

INDIAN BANKING & NPAS The reform process which began in 1991-92 in India was widespread across different sectors. However, the financial sector reforms, as elucidated by the first Narsimhan Committee, always merit a special mention. The report made a note on the condition of the Banking system, especially the large NPAs plaguing the whole banking industry. It recommended increasing the number of Debt Recovery Tribunals & setting up of an Asset Reconstruction fund to tackle the problems of NPAs. The Fund never took off but the DRTs, which were set up did not quite meet their expectations.

The essentials of debt recovery rely on two aspects; the first being the adjudication/ ascertainment of dues as reflected in Decree/Certificate and the second being execution of Decree/Certificate for realization of amount stated in Decree/Certificate. To successfully realize the money it was necessary, that an Act of law addressed both of them together & equally. Before 1993, the Banks had to approach Civil Courts for recovery of dues. The process of law guided by the Code of Civil Procedure, 1908 was time consuming and was unable to adapt to the changing demands of the economy.

RDDBFI ACT, 1993 The disconnect between the law and economics of the Civil Court era, is easily palpable, as shown by the 15 lakhs cases filed by the Banks and Financial Institutions which were pending. The fund blocked in the process of litigation was to the tune of Rs.5622crores of Public Sector Banks and Rs.391crores of Financial Institutions. Civil Courts failed to deliver both in the ascertainment of dues & the execution of decree. Hence came the Recovery of Debts Due to Banks and Financial Institutions Act, 1993 (RDDBFI Act). The desired results did not come from this Act either. It certainly brought down the time spent on adjudication of dues but however, failed to execute the Decree/Certificate in an effective way. This becomes evident from the fact that till about 30th September, 2001, 22 Debt Recovery Tribunals (DRTs) of the country had adjudicated 9814 cases, issuing the Certificate/Decree for Rs.6265crores, whereas the actual recoveries were only of

Symbiosis Institute of Business Management, Pune

Rs.1864crores. Of the two ills of the Civil Courts era, the non ascertainment of dues in an expeditious manner was cured by the RDDBFI Act, but it failed miserably in effectively executing the decree.

The second Narsimhan Committee too, stressed that a strong and efficient financial system was necessary to strengthen the domestic economy and make it more efficient simultaneously enabling it to meet the challenges posed by financial globalization. It suggested the setting up ARCs rather than a fund to meet the challenges of NPAs. This set the ground work for planning a structure & setting up of a legal framework for ARCs in India.

SARFAESI ACT, 2002 The genesis of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (Securitization Act/SARFAESI Act) as we know lay in the earlier failure of the legal system to meet the demands exacted on it. This act, which came to effect on the 21st of June 2002, aimed to lay emphasis on recovery of the money, even without the intervention of Court. The Act provides for a number of matters including the registration and empowerment of asset reconstruction companies, as well as the regulation of the marketplace for non-performing assets.

The Act empowers ARCs to employ all methods available for asset reconstruction and recoveries including restructuring, settlement and sale of assets through enforcement of security rights. It also provides additional rights regarding sale/lease of management and business of the borrower. The Banks were empowered under Section 13(4)4 of Securitization Act to take possession of Secured Assets of the borrower including the right to transfer by way of lease, assignment or sale for realizing the Secured Asset.

The earlier experience in terms of delays due to court intervention had soured the recovery of NPAs by financial institutions. Thus role of the Court was limited to challenge the measures under Section 13(4), which talks about the Enforcement of Security Interest. In essence the Securitization Act, 2002 concentrated only on the

Symbiosis Institute of Business Management, Pune

executing the decrees rather than the recovery or ascertainment of dues. The recovery aspect further received a set back when Supreme Court in Mardia Chemicals Vs. The Union of India struck down the condition for pre-deposit of 75% of amount ascertained by the Banks & not Courts of law as ultra vires of the Constitution. This effectively made the Act redundant for recovery of dues.

The Act no doubt addressed an important need of the financial system when it set up a whole framework under which securitization & asset reconstruction would take place in India. The Act empowered banks to dispose of their bad assets & keep a clean balance sheet. Section 13 of the Act came as a boon to the banks who had been burdened as much by the systemic (read legal & procedural) delays as by the NPAs themselves. However, the Mardia Chemical judgment dampened spirits when the provision of deposit of 75% of the amount before appeal was struck down. The confusion & complications created have once again made appeals a cheap alternative for the erring borrowers. This today is one of the major impediments in the reconstruction of assets in India.

RBI GUIDELINES In February, 2006, based on the response it received on its draft guidelines on Securitization of Assets, the RBI came out with its final guidelines on securitization. The guidelines as a whole have been viewed critically at large & have put on hold securitization plans of most banks.

The Guidelines deal a double blow to banks by requiring them not to recognize any gains on sale, at the same time, require full capital against first and second loss pieces held by the originators. The motivation provided by the ability to capture origination profits on loan pools, and capital arbitrage stays no more, as the gain on sale has been prohibited under the Guidelines. Moreover the 100% capital requirement for first loss pieces leaves no substantial capital arbitrage possibility unless a significant mezzanine market develops. The market will, therefore, have to search for alternatives. One clear indication is that a mezzanine market has to be developed to minimize the size of first loss pieces.

Symbiosis Institute of Business Management, Pune

The true sale precondition in guidelines put by the RBI, also adds ambiguity to the document. True sale is a substance over form question, and in appropriate circumstances, true sale will have to depend on determination by a court. Hence it becomes neither necessary nor appropriate for a regulator to lay down what true sales involve. The regulators guidelines thus are at best, illustrative of what the RBIs understanding of true sale is.

As regard to the transfer of risks & reward, the guidelines say: The originator should effectively transfer all risks/ rewards and rights/ obligations pertaining to the asset and shall not hold any beneficial interest in the asset after its sale to the SPV. An agreement entitling the originator to any surplus income on the securitized assets at the end of the life of the securities issued by the SPV would not be deemed as a violation of the true sale criteria. This statement goes counter to a number of other stipulations made in the Guidelines. First of all, the fact that the buyer of receivables is accountable to the seller for any surplus is itself one of the factors that goes against a true sale as held by several rulings both in the US and UK. Second, if we talk about an arms length transaction at fair values, the seller has received all that he was supposed to receive, and there is no question of being entitled to residual surplus. One of the common ways of recapturing residual surplus is by setting a deferred sale consideration, but the Guidelines themselves provide that the entire consideration for transfer should be received immediately and in cash.

Another problem lies with the insistence of the RBI on the receiving of the consideration immediately & that too on a cash basis. The originating bank may want to keep the securities on the shelf, that is transfer to the SPV but sell to the investors only at an appropriate time. The SPV on the other hand might pay the originator in the form of securities. The guideline puts a spanner to the whole process. With provisions regarding the first & second losses having being already made, it makes little sense to prevent the originator from holding the securities. Similarly, limiting the originator to participate to the extent of only 10% of the original amount of issue in the SPV, after it meets the

Symbiosis Institute of Business Management, Pune

minimum capital requirements seems unreasonable. The insistence of these being at least investment grade is still understandable.

The guidelines on the treatment of credit enhancements provided by an originator too raise many a question. If a credit enhancement is provided by the originator himself, the distinction between the first and second loss, unless related to ratings of the pieces, is meaningless. Notably, the guidelines require up to 9% capital for the first loss and unlimited capital for the second loss. Hence the originator would be foolish not to hold the first and second loss pieces together, as a first loss piece resulting in a capital requirement of only 9%. In other words, it does not make any sense for the originator to split his retained subordinated interest into first and second loss piece anyway.

Further the guidelines also stipulate a compulsory rating of all security, the enforcement of the same is not possible, since all securities need not necessarily be rated. As regard to the accounting treatment too, RBI seems to entering an area, which is not its domain. It tries through the guidelines to supersede the accounting standards, thereby creating a further mess.

Though what we have talked about makes the guidelines seem a depressing read, it is not so. The objective of the exercise was to project our thoughts on what we felt was lacking or what we felt was wrong in the guidelines put forward by the RBI. The widespread criticism on them as really slowed down & in fact stopped any asset reconstruction that was happening. The RBI, we feel should take a lead in clearing out ambiguities & problems with its guidelines soon. The financial markets at large being dynamic & new in this regard right now, need active participation of the regulator rather than inhibiting the growth.

CONCLUSION

PROBLEMS WITH ARCS IN INDIA & THE WAY AHEAD

Symbiosis Institute of Business Management, Pune

The Indian experience with asset reconstruction has been more bumpy than smooth. While studying the regulatory framework we talked about the various issues plaguing the system. However, the problems do stop within the specific legal framework of the SARFAESI Act & the RBI guidelines that we discussed earlier. A number of structural issues still remain unresolved. Within our ambit of reach, we will try finally to assimilate them while simultaneously provide our thoughts on the same.

A major hindrance towards the development of securitization in the country has been the high incidence of stamp duty. The duty is payable on any instrument which seeks to transfer any rights or receivables, whether by way of assignment or by any other mode. The instrument of transfer attracts stamp duty at an ad valorem rate, ranging from 0.1% to 8%. The existence of this range arises from the variability in the stamp duty across states. Hence, the process of transfer of the receivables from an originator to the SPV involves an outlay on account of stamp duty, which can make securitization commercially unviable in several states. To top it all, depending on the structure of the transaction, the risk of stamp duty being levied again, on the issue of securitized instruments to investors by the SPV looms at large. An instrument evidencing indebtedness would be considered a debenture or a bond and consequentially would be subject to stamp duty.

If on the other hand, the instrument being structured as a pass-through certificate which merely evidences title to the receivables, would not attract stamp duty as it is excluded from the charging provisions. With markets developing & a large number non vanilla instruments being structured, the ambiguity that can arise, due the above, is a deterrent to the growth of this market. The prospect of a double levy of stamp duty on the same underlying receivables would end up making securitization deals unviable. In addition to stamp duty, the instruments need to be registered under the Indian Registration Act, 1908, which further adds on to the costs of the transaction. Since stamp duty is a concurrent subject, it becomes prerogative of the Central Government to ensure a more balanced approach towards the same is formed in consultation with the states. Moreover, the need for a consensus across states akin to the

Symbiosis Institute of Business Management, Pune

inter-state agreement on value-added tax is also emphasized in our opinion. This will prevent any impediment to this market.

Another aspect needing an urgent review is the deepening & widening of the secondary market for the securities issued by the ARCs. The legal framework in Indian securitization has brought about much ambiguity & prevents the fostering of a vibrant market. The market at present has too few players to merit effectiveness. The forbidding of retail investors in the market is understandable as they are construed to be ill informed with the nitty-gritty of the product. But the absence of large wholesale investors is unmerited. With a view to deepen the investor base of Qualified Institutional Buyers (QIBs) which can invest in Security Receipts (SR) of ARCs, large sized NBFCs and nonNBFCs corporate bodies established in India with net own funds in excess of, say, Rs.50crores, could be permitted to invest in SR as QIBs. Similarly, private equity funds registered with SEBI as venture capital funds may also be permitted to invest in SRs within similar limits that are applicable for investment by venture capital funds into corporate bonds.

The RH Patil Committee Report on Corporate Bonds & Securitization (December, 2005) also suggests enlarging the scope of the market. One measure it puts forward is the modification of the Mutual Fund Regulations by SEBI to permit wholesale investors to invest in and hold units of a closed-ended passively managed mutual fund scheme whose sole objective is to invest its funds into Pass through Certificates (PTCs) and SRs of the designated NPA Securitization Trust. This coupled with the ability of SPVs to issue PTCs and SRs to mutual funds would enable development of a wholesale market for securitized assets outside current QIBs.

The RBI guidelines enabling FDI in equity SPVs to 49% is a positive move. It would go on to increase participation in the SPVs; however FDI interest would not be forthcoming unless vibrancy is domestically visible. The FIIs however are still prevented from equity participation for the fear of the sudden withdrawals rattling a nascent market. FIIs can however, invest up to 49 % of each tranche of scheme of Security Receipts subject to

Symbiosis Institute of Business Management, Pune

condition that investment of a single FII in each tranche of scheme of SRs shall not exceed 10 per cent of the issue.

Continuing from the development of the market arise the need for pricing of the instruments. A clarity regarding the same is yet to develop in the absence of a proper Corporate Bond & Debt market in the country. The lack of surrogate measures increases the difficulty of pricing. Our talks with professionals within the industry reflected this opinion largely.

The tax treatment of the SPV Trusts is still unclear. Currently, they are proceeding on the premise that the investors (that is, PTC and SR holders) would pay income-tax on the income distributed by the SPV Trust, and on that basis, the trustee would make income pay outs to the PTC holders without any payment or withholding of tax. However, this view is yet to be judicially adjudicated, and thus does not represent the final position on law. This leaves open an arguable possibility of the SPV Trust being taxed as an Association of Persons (AOP) on the premise that, by agreeing to participate in the SPV Trust conceived solely for the purpose of inviting such participation for an investment in the Trust, the investors come together for a common purpose of earning income. This could be give rise to the trust being taxed as an AOP with a distinct tax entity. As an AOP, the applicable tax rate on all the income of the SPV Trust would come to be the maximum marginal rate applicable to any of the PTC holders under the Finance Act for the relevant year. A limited life entity such as the SPV Trust cannot live with such basic tax uncertainty particularly when it can give rise to tax litigation that can last for many years beyond the life of the SPV Trust, exposing the Trustee to contingent tax liabilities that it has no viable means to recover from the beneficiaries once the life of the SPV Trust has expired and the PTC holders or SR holders paid off. This necessitates a formal clarification by the authorities & sort out confusion.

A startling fact which came to light was the absence of a major ARC in India with the exception of Arcil. GE did start with one, but it shut down sooner than later. Others like Standard Chartered Bank amongst others, who have been trying to set up ARCs, have not

Symbiosis Institute of Business Management, Pune

gone much ahead. One reason we see is the absence of establishment of credibility. Arcil might be the only ARC working at a substantial level in the country, but it is yet to develop credibility. Various quarters reflected this opinion during our research. Some went to the extent of pointing out that the SRs issued by Arcil, even post rating were looked with wonder rather than confidence.

If the Indian experience with ARCs is to be termed as successful in the near future, there needs to be focused attention on part of all stakeholders, especially the regulatory authorities. Our research led us to varied opinions on issues regarding the securitization of distressed assets. Some said the market was being stymied on purpose as the regulatory authorities feared that foreign banks would transfer their NPAs, pack their bags & go home. Others felt it was plain lethargy & at times simply incompetence. We, on a personal note feel that though the attempt to fine tune issues regarding ARCs is being undertaken consistently, the speed of reform is in a pathetic state. The changes in the regulatory framework over time have taken place but the pace of them drags down the system as a whole. With the financial system developing & evolving at a break neck speed in India & across the world, it has become all the more important that speed with which problems are sorted out increases exponentially. Only then will we see a proper market emerging which can take the problems of NPAs head on.

Symbiosis Institute of Business Management, Pune

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Future of Freedom: Illiberal Democracy at Home and AbroadДокумент2 страницыThe Future of Freedom: Illiberal Democracy at Home and AbroadRidho Shidqi MujahidiОценок пока нет

- Brunon BradДокумент2 страницыBrunon BradAdamОценок пока нет

- Comprehensive Problem Excel SpreadsheetДокумент23 страницыComprehensive Problem Excel Spreadsheetapi-237864722100% (3)

- .. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiДокумент3 страницы.. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiLisleОценок пока нет

- Resume-Pam NiehoffДокумент2 страницыResume-Pam Niehoffapi-253710681Оценок пока нет

- Singles Inferno SpreekexamensДокумент10 страницSingles Inferno SpreekexamensIlhamОценок пока нет

- Pentesting ReportДокумент14 страницPentesting Reportazeryouness6787Оценок пока нет

- Tecson VS Glaxo LaborДокумент2 страницыTecson VS Glaxo LaborDanyОценок пока нет

- Pte Links N TipsДокумент48 страницPte Links N TipsKuljinder VirdiОценок пока нет

- GHMC Results, 2009Документ149 страницGHMC Results, 2009UrsTruly kotiОценок пока нет

- An Assessment On The Impact of Indutrialization On Economic Growth in Nigeria PDFДокумент49 страницAn Assessment On The Impact of Indutrialization On Economic Growth in Nigeria PDFSebastian GroveОценок пока нет

- Budo Hard Style WushuДокумент29 страницBudo Hard Style Wushusabaraceifador0% (1)

- Philippine National Development Goals Vis-A-Vis The Theories and Concepts of Public Administration and Their Applications.Документ2 страницыPhilippine National Development Goals Vis-A-Vis The Theories and Concepts of Public Administration and Their Applications.Christian LeijОценок пока нет

- Final Draft RTS On SAДокумент84 страницыFinal Draft RTS On SAjose pazОценок пока нет

- D Matei About The Castra in Dacia and THДокумент22 страницыD Matei About The Castra in Dacia and THBritta BurkhardtОценок пока нет

- The Call For The Unity of Religions (Wahdatul Adyaan) A False and Dangerous Call. - An Elimination of The Truth by DR - Saleh As-SalehДокумент52 страницыThe Call For The Unity of Religions (Wahdatul Adyaan) A False and Dangerous Call. - An Elimination of The Truth by DR - Saleh As-SalehMountainofknowledge100% (1)

- MPERSДокумент1 страницаMPERSKen ChiaОценок пока нет

- Open Quruan 2023 ListДокумент6 страницOpen Quruan 2023 ListMohamed LaamirОценок пока нет

- Adobe Scan 03-May-2021Документ22 страницыAdobe Scan 03-May-2021Mohit RanaОценок пока нет

- Q1Документ16 страницQ1satyamОценок пока нет

- Case 3 - Ecuadorean Rose IndustryДокумент6 страницCase 3 - Ecuadorean Rose IndustryMauricio BedonОценок пока нет

- Dam Water SensorДокумент63 страницыDam Water SensorMuhammad RizalОценок пока нет

- ISE II Sample Paper 1 (With Answers)Документ13 страницISE II Sample Paper 1 (With Answers)Sara Pérez Muñoz100% (1)

- 05 Vision IAS CSP21 Test 5Q HIS AM ACДокумент17 страниц05 Vision IAS CSP21 Test 5Q HIS AM ACAvanishОценок пока нет

- Glossary of Important Islamic Terms-For CourseДокумент6 страницGlossary of Important Islamic Terms-For CourseibrahimОценок пока нет

- Correctional Case StudyДокумент36 страницCorrectional Case StudyRaachel Anne CastroОценок пока нет

- Shop Decjuba White DressДокумент1 страницаShop Decjuba White DresslovelyОценок пока нет

- Ekotoksikologi Kelautan PDFДокумент18 страницEkotoksikologi Kelautan PDFMardia AlwanОценок пока нет

- The Tragedy of Karbala by Dr. Israr AhmedДокумент13 страницThe Tragedy of Karbala by Dr. Israr AhmedMehboob Hassan100% (2)

- Garrido Vs TuasonДокумент1 страницаGarrido Vs Tuasoncmv mendozaОценок пока нет