Академический Документы

Профессиональный Документы

Культура Документы

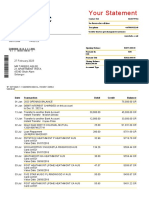

HBL Scheme For Staff

Загружено:

himadri_bhattacharjeИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

HBL Scheme For Staff

Загружено:

himadri_bhattacharjeАвторское право:

Доступные форматы

New Document

Page 1 of 5

PUNJAB NATIONAL BANK L&A Circular INTEGRATED RISK MANAGEMENT DIVISION No. 20/2011 (CREDIT POLICY SECTION) HO : 7, Bhikhaiji Cama Place

New Delhi 110607

CPY-61 February 28, 2011 TO ALL OFFICES

LOANS & ADVANCES CIRCULAR NO. 20 HOUSING LOAN SCHEME FOR THE MEMBERS OF STAFF Detailed guidelines regarding the Housing Loan Scheme for the members of staff have been advised vide L&A Circular No. 62 dated 9.6.2006 and subsequent circulars issued on the subject from time to time. Due to multifold increase in cost of housing units, some modifications were made in the guidelines and circulated vide L&A Circular No. 120 dated 30.10.2010. 2. Consequent upon issuance of above guidelines some references/ queries have been received from the Circle Offices seeking clarifications. References/ queries received from the field have been examined and clarifications on the same are given in the Annexure for guidance of the field functionaries. 3. 4. All other guidelines in the matter shall remain unchanged. All concerned are advised to note for compliance.

(K RAM MOHAN) GENERAL MANAGER

INDEX: HOUSING LOAN SCHEME FOR THE MEMBERS OF STAFF

ANNEXURE HOUSING LOAN SCHEME FOR THE MEMBERS OF STAFF

S.No.

Queries

Clarifications

https://www.pnbnet.in/itc/2011/rmdla/circulars/2011/la2011020.asp

9/13/2011

New Document

Page 2 of 5

In respect of housing loans sanctioned under staff scheme, whether rate of interest is to be changed at branch level in terms of Circular No. 120/10 or after getting approval of sanctioning authority In most of the cases, Sanctioning Authority is Circle Office/ Head Office. The approvals by Sanctioning Authority will lead to a large number of references and avoidable work load. The BMs where the loan is parked may be authorized to revise rate of interest and change of scheme from Public Scheme to Staff scheme. In respect of housing loans sanctioned under staff scheme, whether EMI is to be changed as per revised ROI or shall run as per existing repayment schedule. Whether repayment period/EMI is to be fixed afresh after conversion of house loan sanctioned under public scheme to staff scheme. If so, under which proportion of the remaining service. Whether margin is to be taken for additional loan only or project as a whole, if house loan is sanctioned/enhanced under staff scheme

The staff member may avail the benefit of revised rate of interest in existing housing loan account after getting approval of sanctioning authority. As the sanctioning authority has to satisfy itself about the eligibility, cadre wise limit of advance and other related aspects, it will be appropriate if the approval for revision in rate of interest and change of scheme from Public Scheme to Staff Scheme is accorded by the sanctioning authority.

Amount of monthly installment may be changed as per revised ROI by the sanctioning authority. However, existing (original) repayment period will remain unchanged. The sanctioning authority while approving conversion of the scheme, may fix the monthly installments in the ratio of 3:1 (Principal: Interest).

As per the earlier guidelines, no margin was stipulated under staff housing loan. Since the exposure is increasing significantly now, a uniform margin of 10% is stipulated. It is clarified that 10% margin may be maintained for additional housing loans sanctioned/ enhanced after 01.11.2010 under staff Housing Loan Scheme. Conversion of existing loan availed under Public Scheme may be permitted into Staff Housing Loan Scheme to the extent up to which the deductions in the monthly salary of the employee permit subject to current eligibility prescribed under the scheme. In case of conversion of loan

Whether additional housing loan availed under Public Scheme and repayable up to the age of 65 years can be converted into the Scheme for Housing Loan to Members of Staff and repayment period will remain the same

https://www.pnbnet.in/itc/2011/rmdla/circulars/2011/la2011020.asp

9/13/2011

New Document

Page 3 of 5

Whether a staff member can avail the loan in the above scheme if he has already availed house loan under staff scheme and has adjusted the same with the sale proceeds of his house.

under staff loan scheme, repayment period shall also be fixed as per staff scheme. As per extant guidelines (Para 2.B of Annexure C of L&A Cir No. 62/06) the facility of Additional Housing Loan to the members of staff can be granted as one time measure by the sanctioning authority for the purposes and the extent stated below : Purpose : i) For purchase/construction of a house/flat after selling the existing one. ii) Where the existing house/flat has already been sold and other one is proposed to be purchased/constructed. Extent of Additional Housing Loan: The maximum amount of Additional Housing Loan for the above purposes will be as under: 1. Difference between the current eligibility and the amount of Housing Loan availed plus extent of outstanding of principal amount repaid in lump sum at the time of adjustment of previous housing loan. OR 2. Cost of the house/flat proposed to be purchased/constructed, whichever is less, subject to current eligibility prescribed under the scheme.

In addition to the above, extant guidelines contained in Para 2.C of Annexure C of L&A Cir No. 62/06 must also be complied with which stipulate that sale proceeds of the existing house/flat together with the funds to be made available to the staff member with the additional amount of the loan are utilized in full

https://www.pnbnet.in/itc/2011/rmdla/circulars/2011/la2011020.asp

9/13/2011

New Document

Page 4 of 5

for acquiring/constructing the other house/flat.

In case, the cost of house/flat to be purchased/constructed is less than the sale proceeds of the existing house/flat together with the funds to be made available to the staff member with the additional housing loan, the amount of additional housing loan will be reduced to the extent of unutilized sales proceeds of the existing house/flat. However, a uniform margin of 10% is to be maintained apart from ensuring compliance of all terms & conditions stipulated under the scheme. 8 Whether the enhancement in housing loan is permitted as one time measure only for conversion of Public Scheme loan to Staff Scheme Loan OR for all purposes like additional construction, renovation etc. Whether benefit of revised guidelines/scheme can be passed on to members of staff who have availed housing loan under public scheme for purchase of 2nd house. Whether staff member whose housing loan taken under Staff Scheme has been adjusted and he/she has not disposed/ sold the house and again taken housing loan under Public Scheme for acquiring another house, are eligible for conversion of such housing loan taken under Public Scheme into Staff Scheme as per his eligibility in terms of Cir No. L&A 120/10 Whether such facility of enhanced housing loan at concessional rate of Interest may also be extended to those staff members who had already availed staff housing loan In terms of extant guidelines, additional housing loan to members of staff can be granted for specified purposes as one time measure as mentioned in Para 2.B & 2.C of Annexure C of L&A Cir No. 62/06. As per extant guidelines (Para 5 of Annexure C of L&A Cir No. 62/06), Housing Loan for the second time is not permissible under Housing Loan Scheme for the Members of Staff.

10

As above

11

As above

https://www.pnbnet.in/itc/2011/rmdla/circulars/2011/la2011020.asp

9/13/2011

New Document

Page 5 of 5

12

under public scheme for the second house. Whether the enhancement in housing loan may be permitted for purchase of 2nd house in case the existing Staff Housing Loan has been adjusted fully and earlier house is not sold.

As above

https://www.pnbnet.in/itc/2011/rmdla/circulars/2011/la2011020.asp

9/13/2011

Вам также может понравиться

- CH 16 - Staff Loans - Provisions BGVBДокумент17 страницCH 16 - Staff Loans - Provisions BGVBpritt2010Оценок пока нет

- KD Sacco Human Resource PolicyДокумент37 страницKD Sacco Human Resource PolicyMwikirize Alban100% (1)

- Housing Loan Interest Subsidy - 2017 PDFДокумент3 страницыHousing Loan Interest Subsidy - 2017 PDFBHUVANESH KUMAR0% (1)

- Internship Report On Mercantile BankДокумент39 страницInternship Report On Mercantile BankIubianОценок пока нет

- CTS Medical Emergencies Loan PolicyДокумент5 страницCTS Medical Emergencies Loan PolicyshaannivasОценок пока нет

- Annexure - Flexible Benefit PlanДокумент3 страницыAnnexure - Flexible Benefit PlanpvkmanoharОценок пока нет

- Employee Benefits IndiaДокумент2 страницыEmployee Benefits Indiabaskarbaju1Оценок пока нет

- 03 Certification PolicyДокумент7 страниц03 Certification PolicyThasleem NazeerОценок пока нет

- Using A Retention BondДокумент2 страницыUsing A Retention Bondvivekjn100% (1)

- Rms Policy DocumentДокумент6 страницRms Policy DocumentAshish TripathiОценок пока нет

- A Worker Was Charge Sheeted For Misconduct Asks To Reply Within Two Days of The Receipt of The SameДокумент1 страницаA Worker Was Charge Sheeted For Misconduct Asks To Reply Within Two Days of The Receipt of The SamefahimОценок пока нет

- PSC Circular 52 - Graduate Trainee Scheme Policy in The Public Service PDFДокумент9 страницPSC Circular 52 - Graduate Trainee Scheme Policy in The Public Service PDFManoa Nagatalevu TupouОценок пока нет

- FY08 Car Lease Document V2Документ3 страницыFY08 Car Lease Document V2Swanidhi SinghОценок пока нет

- Agreement For Refund of Training Fees If Employee Does Not Remain in Employment For Specified PeriodДокумент5 страницAgreement For Refund of Training Fees If Employee Does Not Remain in Employment For Specified PeriodIkem IsiekwenaОценок пока нет

- Bonus Shares and EsopДокумент4 страницыBonus Shares and EsopRon FlemingОценок пока нет

- Incentives and BenefitsДокумент14 страницIncentives and BenefitsAditya PandeyОценок пока нет

- 2022 Everise Agent B Benefits GuideДокумент55 страниц2022 Everise Agent B Benefits GuideEricaОценок пока нет

- Bonus PolicyДокумент4 страницыBonus PolicyJacen BondsОценок пока нет

- 03 - Quality Metrics Used in InfosysДокумент16 страниц03 - Quality Metrics Used in InfosysSaloni Chhapolia100% (1)

- Developing Sales Compensation Plan: Presented By: Raouf Hussain Roll No. 40Документ19 страницDeveloping Sales Compensation Plan: Presented By: Raouf Hussain Roll No. 40Sayima HabibОценок пока нет

- Iwc Article 2Документ11 страницIwc Article 2anthonyzaller100% (1)

- Shift Allowance PolicyДокумент5 страницShift Allowance PolicyRiyas MohamedОценок пока нет

- Npcil Plis SchemeДокумент9 страницNpcil Plis SchemeSubhashis Chatterjee0% (1)

- Bonus and Profit SharingДокумент14 страницBonus and Profit SharingJoshy JoseОценок пока нет

- Strategic Plan 2016-2020Документ56 страницStrategic Plan 2016-2020brienahОценок пока нет

- Deed of TrustДокумент19 страницDeed of Trustshakhawat_cОценок пока нет

- Adobe India Maternity Paternity FAQДокумент5 страницAdobe India Maternity Paternity FAQMohit BansalОценок пока нет

- Whichever Is Lower Is Exempt From Tax. For ExampleДокумент13 страницWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedОценок пока нет

- Raising The Minimum Wage: The Effects On Employment, Businesses and ConsumersДокумент8 страницRaising The Minimum Wage: The Effects On Employment, Businesses and ConsumersALEC100% (3)

- Taxation Chapter - 6: Income From SalaryДокумент17 страницTaxation Chapter - 6: Income From SalaryAl SukranОценок пока нет

- How To Process Loan PolicyДокумент2 страницыHow To Process Loan PolicyGretta FernandesОценок пока нет

- Teletech Customer Care Management Philippines, IncДокумент8 страницTeletech Customer Care Management Philippines, Incelle maxОценок пока нет

- Labor Law in Bangladesh Project Law200Документ6 страницLabor Law in Bangladesh Project Law200Md. Sabbir Sarker 1611386630Оценок пока нет

- Flexible Benefits: Cost Optimization & Talent RetentionДокумент36 страницFlexible Benefits: Cost Optimization & Talent RetentionAndrew100% (1)

- Practical HRДокумент3 страницыPractical HRSameera BandaraОценок пока нет

- Presented To:-Presented By: - Roll No #Документ25 страницPresented To:-Presented By: - Roll No #Aamir AttariОценок пока нет

- ECMS User Manual - : PAN IndiaДокумент70 страницECMS User Manual - : PAN IndiaKrishОценок пока нет

- VPF FormДокумент1 страницаVPF Formraghu obulОценок пока нет

- Daksh Leave Policy (India)Документ12 страницDaksh Leave Policy (India)ajithk75733Оценок пока нет

- Local Undergraduate Loan Application: (Fomu Ya Maombi Ya Mkopo Kwa Wanafunzi Wa Shahada Ya Kwanza Ndani Ya Nchi)Документ8 страницLocal Undergraduate Loan Application: (Fomu Ya Maombi Ya Mkopo Kwa Wanafunzi Wa Shahada Ya Kwanza Ndani Ya Nchi)athumanmavumila360Оценок пока нет

- HSE Procedure For Developing Policies, Procedures, Protocols and GuidelinesДокумент26 страницHSE Procedure For Developing Policies, Procedures, Protocols and GuidelinesgiovadiОценок пока нет

- All You Wanted To Know About Bajaj Finance Flexi LoanДокумент6 страницAll You Wanted To Know About Bajaj Finance Flexi LoanAwadhesh Kumar KureelОценок пока нет

- Wage Revision 8.5.Документ9 страницWage Revision 8.5.aanand007Оценок пока нет

- Internal Job Application PolicyДокумент3 страницыInternal Job Application PolicyAaron Rapha RosalesОценок пока нет

- Selection of Dip Aprrentices For Adani EletricityДокумент3 страницыSelection of Dip Aprrentices For Adani EletricityFiroz AminОценок пока нет

- Compensation FixationДокумент25 страницCompensation FixationAtiya RahmanОценок пока нет

- Approaches To International Compensation: There Are Two Main Options in The Area of International CompensationДокумент24 страницыApproaches To International Compensation: There Are Two Main Options in The Area of International CompensationPraveen KumarОценок пока нет

- Annual Leave Policy of University of YorkДокумент15 страницAnnual Leave Policy of University of YorkJohn Son100% (1)

- IHRM - Compensation ManagementДокумент36 страницIHRM - Compensation ManagementVinay Krishna H VОценок пока нет

- Ssinc Employee Manual 4-17-13Документ17 страницSsinc Employee Manual 4-17-13api-20374706Оценок пока нет

- Performance Appraisal Letter FormatДокумент8 страницPerformance Appraisal Letter FormatHarry olardoОценок пока нет

- FaqДокумент5 страницFaqG MОценок пока нет

- CARE Credit and Savings Source Book, Methodology ChapterДокумент53 страницыCARE Credit and Savings Source Book, Methodology ChaptermufeesmОценок пока нет

- HRM - Benefits and ServicesДокумент39 страницHRM - Benefits and ServicesJuli Gupta0% (1)

- ANNEX A - Compensation & Benefits (FT Agents) 12012019 PDFДокумент1 страницаANNEX A - Compensation & Benefits (FT Agents) 12012019 PDFRovic OrdonioОценок пока нет

- Retirement Policy TbgiДокумент3 страницыRetirement Policy TbgiCamille FloresОценок пока нет

- Employee Compensation and BenefitsДокумент46 страницEmployee Compensation and BenefitsJuanito Cabiles JrОценок пока нет

- Performance Management Course Facilitator: Sana Mumtaz - Mohammad Junaid Hussain REG# (1735202) Rahat Jaan Mohammad REG# (1835148) MBA (36-E)Документ26 страницPerformance Management Course Facilitator: Sana Mumtaz - Mohammad Junaid Hussain REG# (1735202) Rahat Jaan Mohammad REG# (1835148) MBA (36-E)Rahat JaanОценок пока нет

- EHL - Modifications - 331-2010Документ5 страницEHL - Modifications - 331-2010antcbeОценок пока нет

- Increased in SFF Limits For OfficersДокумент6 страницIncreased in SFF Limits For Officershimadri_bhattacharjeОценок пока нет

- Jayalalitha's PalaceДокумент8 страницJayalalitha's Palacehimadri_bhattacharjeОценок пока нет

- Latest Circular For Payment of Interest Free Festival Advance To StaffДокумент1 страницаLatest Circular For Payment of Interest Free Festival Advance To Staffhimadri_bhattacharjeОценок пока нет

- Charges Sheet Served On Himadri Shekhar BhattacharjeeДокумент42 страницыCharges Sheet Served On Himadri Shekhar Bhattacharjeehimadri_bhattacharjeОценок пока нет

- CVC Guidelines On Timely Completion of Disciplinary Proceedings.Документ2 страницыCVC Guidelines On Timely Completion of Disciplinary Proceedings.himadri_bhattacharjeОценок пока нет

- Wage Agreements of The Past - Critical Observations.Документ1 страницаWage Agreements of The Past - Critical Observations.himadri_bhattacharjeОценок пока нет

- Charter of Demand-2Документ49 страницCharter of Demand-2himadri_bhattacharjeОценок пока нет

- Reimbursement of Medical Expenses-Annual Medical AidДокумент4 страницыReimbursement of Medical Expenses-Annual Medical Aidhimadri_bhattacharjeОценок пока нет

- Signed Copy of Common Charter of Demands - PDF 30.10.12Документ38 страницSigned Copy of Common Charter of Demands - PDF 30.10.12himadri_bhattacharjeОценок пока нет

- A Note On Salary Package of Bank OfficersДокумент2 страницыA Note On Salary Package of Bank OfficersPrayas GargОценок пока нет

- Schedule For Reimbursement of Hospitalisation ExpensesДокумент13 страницSchedule For Reimbursement of Hospitalisation Expenseshimadri_bhattacharjeОценок пока нет

- Wage Revision As Per Guidelines of 9th BipartiteДокумент28 страницWage Revision As Per Guidelines of 9th Bipartitehimadri_bhattacharjeОценок пока нет

- Rbi ChequeДокумент4 страницыRbi ChequeShital KiranОценок пока нет

- Terminal Benefits in Case of CRSДокумент4 страницыTerminal Benefits in Case of CRShimadri_bhattacharjeОценок пока нет

- RBD 27 Staff Incentive On DepositsДокумент2 страницыRBD 27 Staff Incentive On Depositshimadri_bhattacharjeОценок пока нет

- Resist This Farcical PromotionДокумент4 страницыResist This Farcical Promotionhimadri_bhattacharjeОценок пока нет

- Sabbatical Leave Scheme For Women EmployeesДокумент11 страницSabbatical Leave Scheme For Women Employeeshimadri_bhattacharje0% (1)

- Agitation of United Forum of PNB Employees in Kanpur Circle.Документ4 страницыAgitation of United Forum of PNB Employees in Kanpur Circle.himadri_bhattacharjeОценок пока нет

- Entertainment Expenses For Officers As Well As Special AssistantsДокумент2 страницыEntertainment Expenses For Officers As Well As Special Assistantshimadri_bhattacharjeОценок пока нет

- Hospitalisation Scheme For Retired EmployeesДокумент4 страницыHospitalisation Scheme For Retired Employeeshimadri_bhattacharjeОценок пока нет

- Revision of Rental Limits For OfficersДокумент3 страницыRevision of Rental Limits For Officershimadri_bhattacharjeОценок пока нет

- Fitment Chart For Sub Staff Promoted To Clerical Cadre.Документ8 страницFitment Chart For Sub Staff Promoted To Clerical Cadre.himadri_bhattacharje0% (1)

- Fitment Chart For Sub Staff Promoted To Clerical Cadre.Документ8 страницFitment Chart For Sub Staff Promoted To Clerical Cadre.himadri_bhattacharje0% (1)

- Replies To The Brief of The POwith Annexures and DEsДокумент156 страницReplies To The Brief of The POwith Annexures and DEshimadri_bhattacharjeОценок пока нет

- Charter of Demand 10 Bps Prepared by National Union of Bank EmployeesДокумент96 страницCharter of Demand 10 Bps Prepared by National Union of Bank Employeeshimadri_bhattacharje100% (1)

- Samadhan Solution To The Plight of A BankerДокумент2 страницыSamadhan Solution To The Plight of A Bankerhimadri_bhattacharjeОценок пока нет

- Musings of LifeДокумент2 страницыMusings of Lifehimadri_bhattacharjeОценок пока нет

- TA DA To Employees, Retired Employees, Dismissed Employees For Attending Departmental ProceedingsДокумент2 страницыTA DA To Employees, Retired Employees, Dismissed Employees For Attending Departmental Proceedingshimadri_bhattacharjeОценок пока нет

- Fitment To JMG Scale I, On Promotion of Clerks and Special AssistantsДокумент9 страницFitment To JMG Scale I, On Promotion of Clerks and Special Assistantshimadri_bhattacharjeОценок пока нет

- Communications Under RTI Act 2005Документ6 страницCommunications Under RTI Act 2005himadri_bhattacharjeОценок пока нет

- Local Budget Circular No. 111 - Manual On The Setting Up and Operation of Local Economic Enterprises (Lees)Документ3 страницыLocal Budget Circular No. 111 - Manual On The Setting Up and Operation of Local Economic Enterprises (Lees)Glaiza RafaОценок пока нет

- TOC of Pre Feasibility Report On Five Star HotelДокумент6 страницTOC of Pre Feasibility Report On Five Star Hotelbrainkrusherz0% (1)

- 2022 October LNUДокумент16 страниц2022 October LNUShari AngelОценок пока нет

- Valuation Examination - Hitting The Jackpot !!: (How To Be An Ace Registered Valuer)Документ90 страницValuation Examination - Hitting The Jackpot !!: (How To Be An Ace Registered Valuer)Ram IyerОценок пока нет

- SRReport 1571660751494Документ2 страницыSRReport 1571660751494Áĺí Áhméđ ŤhəbôОценок пока нет

- ACCT 6011 Assignment #1 TemplateДокумент8 страницACCT 6011 Assignment #1 Templatepatel avaniОценок пока нет

- Shareholder's EquityДокумент31 страницаShareholder's EquityAmmie Lemie100% (2)

- Public Policy Course Outline Prof. Tarun DasДокумент32 страницыPublic Policy Course Outline Prof. Tarun DasProfessor Tarun DasОценок пока нет

- Financial Transcations Analysis: Under The Guidance of Dr. Nisha ShankarДокумент4 страницыFinancial Transcations Analysis: Under The Guidance of Dr. Nisha ShankarRUTVIKA DHANESHKUMARKUNDAGOLОценок пока нет

- Export Advance Payment - Branch ProposalДокумент2 страницыExport Advance Payment - Branch ProposalKumar SwamyОценок пока нет

- AssignmentДокумент13 страницAssignmentAftab UddinОценок пока нет

- Harvey - On Planning The Ideology of PlanningДокумент20 страницHarvey - On Planning The Ideology of PlanningMacarena Paz Cares VerdugoОценок пока нет

- Myanmar Health Care SystemДокумент13 страницMyanmar Health Care SystemNyein Chan AungОценок пока нет

- Oracle Hyperion Planning Training ConceptsДокумент99 страницOracle Hyperion Planning Training ConceptsAsad HussainОценок пока нет

- Week5 Debt MKT 1: You Have CompletedДокумент8 страницWeek5 Debt MKT 1: You Have CompletedDerek LowОценок пока нет

- Bank Statement TareeqДокумент2 страницыBank Statement TareeqIzza NabbilaОценок пока нет

- Chapter 7 - Dynamics of Financial Crises in Emerging Economies and ApplicationsДокумент49 страницChapter 7 - Dynamics of Financial Crises in Emerging Economies and ApplicationsJane KotaishОценок пока нет

- Muh. SyukurДокумент6 страницMuh. SyukurDrawing For LifeОценок пока нет

- Disposal of Unserviceable AssetsДокумент6 страницDisposal of Unserviceable AssetsJOHAYNIEОценок пока нет

- Legal RiskДокумент7 страницLegal RiskOmprakash MaheshwariОценок пока нет

- Additonal CVP QuestionsДокумент2 страницыAdditonal CVP QuestionsDianne Madrid0% (1)

- 03 04 Analysis Financial StatementДокумент216 страниц03 04 Analysis Financial StatementShanique Y. Harnett100% (1)

- Lecture 2 Tutorial SoluitionДокумент3 страницыLecture 2 Tutorial SoluitionEleanor ChengОценок пока нет

- IC Accounts Payable Ledger Template Updated 8552Документ2 страницыIC Accounts Payable Ledger Template Updated 8552M Monjur MobinОценок пока нет

- 4th Sem All Model Answers (Agrounder)Документ111 страниц4th Sem All Model Answers (Agrounder)Words You Can FeelОценок пока нет

- Management AccountingДокумент2 страницыManagement AccountingkabilanОценок пока нет

- 94dd PATH Basemap 2023 12 FINALДокумент1 страница94dd PATH Basemap 2023 12 FINALeoin01Оценок пока нет

- Public FinanceДокумент24 страницыPublic FinanceingridОценок пока нет

- ABC of VSA Signs of Weakness PDFДокумент17 страницABC of VSA Signs of Weakness PDFPiet Nijsten100% (1)

- Financial Management and Accounting ProceduresДокумент23 страницыFinancial Management and Accounting Proceduressidra akramОценок пока нет