Академический Документы

Профессиональный Документы

Культура Документы

Nike Q1 Earnings Forecast

Загружено:

Brian NichollsАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Nike Q1 Earnings Forecast

Загружено:

Brian NichollsАвторское право:

Доступные форматы

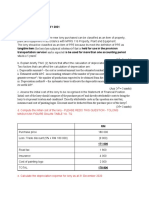

Nike Model

Last Qtr.

Sales Growth

Current Assets/ Sales

Current Liabilities/ Sales

Net Fixed Assets/ Sales

COGS/Sales

Depreciation Rate

Interest Rate on Debt

Tax Rate

Dividend payout ratio

Common Size

13.57%

195.92%

68.64%

36.68%

54.25%

0.61%

5.12%

23.16%

26.02%

Est. 31 Aug.- 11

6.18%

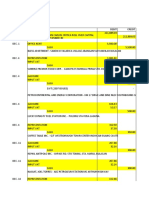

Income Statement (Industrial)

31-May-11

Final

Sales/Revenue

Est. 31 -Aug-11

All Assumed Constant

5,766.0

5494.720

Cost of Goods Sold (COGS) incl. D&A

3,219.0

55.83%

3071.83

COGS excluding D&A

3,128.0

54.25%

2980.83

91.0

1.58%

91.00

Gross Income

2,547.0

44.17%

2422.89

SG&A Expense

1,767.0

30.65%

1683.87

Depreciation & Amortization Expense

Other Operating Expense

0.0

EBIT (Operating Income)

780.0

13.53%

739.02

Nonoperating Income (Expense) - Net

4.0

0.07%

4.00

Interest Expense

4.0

0.07%

4.00

Unusual Expense (Income) - Net

7.0

0.12%

--

--

--

Reorganization and Restructure Expense

--

--

Goodwill Write Off

--

--

Other Intangible Assets Impairment

--

Other Unusual Expense

Pretax Income

High

5900

Consensus

1.21

Analyst Estimates

Low

1.13

High

1.38

--

-29.0

-0.50%

36.0

0.62%

--

773.0

13.41%

731.02

--

Income Taxes

179.0

3.10%

169.30

Net Income

594.0

10.30%

561.72

Net Income available to Common

594.0

10.30%

561.72

EPS (recurring)

1.251

0.2106%

1.183

EPS (basic)

1.270

0.2138%

1.203

EPS (diluted)

1.241

0.2089%

1.173

EBITDA

871.0

15.11%

1003.33

EBIT

780.0

13.53%

1094.33

91.0

1.58%

91.00

Depreciation & Amortization Expense

Analyst Estimates

Low

5640

0.00

Financial Assets Impairment

Unrealized Investment Loss (Gain)

Consensus

5750

Balance Sheet (Industrial)

31-May-11

Est. 31 -Aug-11

Final

Assets

Cash & ST Investments

4,538.0

78.70%

6464.27

Total Accounts Receivable

3,732.0

64.72%

3556.42

-124.0

-2.15%

-118.17

594.0

10.30%

566.05

2,715.0

47.09%

2587.26

312.0

5.41%

297.32

Bad Debt/Doubtful Accounts

Other Receivables

Inventories

Other Current Assets

--

--

5.41%

297.32

11,297.0

195.92%

12905.27

Net Property, Plant & Equipment

2,115.0

36.68%

2203.80

Accumulated Depreciation

2,791.0

48.40%

2882.00

692.0

12.00%

659.44

Prepaid Expenses

Miscellaneous Current Assets

Total Current Assets

Intangible Assets

-312.0

1926.27

Net Goodwill

205.0

3.56%

195.36

Net Other Intangibles

487.0

8.45%

464.09

Deferred Tax Assets

560.0

Other Assets

334.0

Total Assets

14,998.0

231.56

5.79%

318.29

260.11%

15854.28

856.28

Liabilities & Shareholders' Equity

ST Debt & Curr. Portion LT Debt

387.0

6.71%

368.79

Notes Payable

187.0

3.24%

178.20

Current Portion of LTD

200.0

3.47%

190.59

1,469.0

25.48%

1399.89

Accounts Payable

117.0

2.03%

111.50

Other Current Liabilities

1,985.0

34.43%

1891.61

Total Current Liabilities

3,958.0

68.64%

4140.58

Income Tax Payable

Long-Term Debt

276.0

276.00

Term Loans

270.0

270.00

Term Loans - Unsec.

Private Placement Notes - Unsec.

Loans - Other Borrowings

Notes/Bonds

Other

62.0

62.00

130.0

130.00

78.0

78.00

206.1

206.10

--

--

--

Current Portion of LTD

-200.0

Deferred Tax Liabilities

309.0

5.97%

Other Liabilities

612.0

10.61%

Total Liabilities

5,155.0

5873.97

Preferred Stock (Carrying Value)

0.0

Redeemable Preferred Stock

0.0

0.0

0.0

9980.31

3.0

3760.75

6,216.56

-0.0

467.81

Common Equity

Common Stock Par/Carry Value

9,843.0

3.0

Additional Paid-In Capital/Capital Surplus

3,944.0

Retained Earnings

5,801.0

Cumulative Translation Adjustment/Unrealized For. Exch. Gain

Treasury Stock

Repurchased Stock Value

95.0

0.0

606.5

-200.00

328.09

583.21

Total Shareholders' Equity

9,843.0

9,980.3

Total Equity

9,843.0

9,980.3

14,998.0

15,854.28

Liabilities & Shareholders' Equity

415.56

146.1569687

-0.01

856.28

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Lecture Files For Quiz 1 PDFДокумент28 страницLecture Files For Quiz 1 PDFpppppОценок пока нет

- Photovoltaic (PV) Module Technologies: 2020 Benchmark Costs and Technology Evolution Framework ResultsДокумент66 страницPhotovoltaic (PV) Module Technologies: 2020 Benchmark Costs and Technology Evolution Framework ResultsOle Johan BondahlОценок пока нет

- Strong Performance in International Segment: Rallis IndiaДокумент13 страницStrong Performance in International Segment: Rallis IndiaAnurag JainОценок пока нет

- Lecture 1 Introduction To Engineering Economy PDFДокумент32 страницыLecture 1 Introduction To Engineering Economy PDFFrendick LegaspiОценок пока нет

- Setting Up A Company in GreeceДокумент11 страницSetting Up A Company in GreeceSvetlana DonchevaОценок пока нет

- Guidelines - 35 (2AB) OF IT ACT 1961 - May2014Документ29 страницGuidelines - 35 (2AB) OF IT ACT 1961 - May2014rupesh.srivastavaОценок пока нет

- Chapter 4 Investment PropertiesДокумент2 страницыChapter 4 Investment PropertiesHui XianОценок пока нет

- FinancialaspectДокумент18 страницFinancialaspectaileenОценок пока нет

- Direct Taxation PDFДокумент604 страницыDirect Taxation PDFSasank PacchaОценок пока нет

- Xi Accounting Set 2Документ6 страницXi Accounting Set 2aashirwad2076Оценок пока нет

- Long Quiz in Basic FinanceДокумент3 страницыLong Quiz in Basic FinanceJo MalaluanОценок пока нет

- Income Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpДокумент11 страницIncome Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpmoreОценок пока нет

- 73507bos59335 Inter p1qДокумент7 страниц73507bos59335 Inter p1qRaish QURESHIОценок пока нет

- Appraisal Assessment of Value at A Specific Point in Time Inherent Assumptions of Market ValueДокумент45 страницAppraisal Assessment of Value at A Specific Point in Time Inherent Assumptions of Market ValueJosue Sandigan Biolon SecorinОценок пока нет

- Aavas Financiers: Credit Growth Gaining Traction IT Transformation Happening As PlannedДокумент10 страницAavas Financiers: Credit Growth Gaining Traction IT Transformation Happening As PlannedrakeshОценок пока нет

- 3a Far210 Topic 3 - Discussion of Tutorial QuestionsДокумент5 страниц3a Far210 Topic 3 - Discussion of Tutorial QuestionsniklynОценок пока нет

- FINACC Chapter10Solutions (MultipComp)Документ3 страницыFINACC Chapter10Solutions (MultipComp)Ems DelRosarioОценок пока нет

- 5 Cost Accounting CycleДокумент16 страниц5 Cost Accounting CycleZenCamandang67% (3)

- H2 Big Water Refilling StationДокумент75 страницH2 Big Water Refilling StationLyncee BallescasОценок пока нет

- Final Report Aman DwivediДокумент48 страницFinal Report Aman Dwivediaman DwivediОценок пока нет

- Financial Analysis of Wipro LTD PDFДокумент101 страницаFinancial Analysis of Wipro LTD PDFAnonymous f7wV1lQKRОценок пока нет

- General Ledger Default AccountsДокумент4 страницыGeneral Ledger Default AccountsAhmed ElghannamОценок пока нет

- What Makes A Sound Quantum Analyst - Franco MastrandreaДокумент21 страницаWhat Makes A Sound Quantum Analyst - Franco MastrandreaSaravanan SekarОценок пока нет

- Paper Cup ProjectДокумент16 страницPaper Cup Projectperu197533% (6)

- 9706 w09 QP 41Документ8 страниц9706 w09 QP 41roukaiya_peerkhanОценок пока нет

- 12linsteel Book of Account DecemberДокумент54 страницы12linsteel Book of Account DecemberCarlos_CriticaОценок пока нет

- Home Office, Branch and Agency AccountingДокумент5 страницHome Office, Branch and Agency AccountingChincel G. ANIОценок пока нет

- Session 1 SolutionДокумент17 страницSession 1 SolutionAbhishek KamdarОценок пока нет

- Six Sigma KpiДокумент17 страницSix Sigma KpiJohn Cabrera Placente100% (2)

- Cash Flows Statement - HandoutДокумент15 страницCash Flows Statement - HandoutThanh UyênОценок пока нет