Академический Документы

Профессиональный Документы

Культура Документы

Investment Analysis and Por Ti Folio MGT

Загружено:

Elvis Simon WamuziriИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Investment Analysis and Por Ti Folio MGT

Загружено:

Elvis Simon WamuziriАвторское право:

Доступные форматы

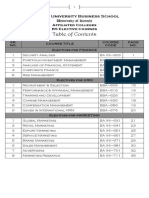

COURSE: INVESTMENT ANALYSIS AND PROTFOLIO MANAGEMENT INSTRUCTOR: WAMUZIRI SIMON ELVIS (MSc.

, BBA) SCHOOL: SCHOOL OF BUSINESS ADMINISTRATION LEVEL: MSC. ACCOUNTING AND FINANCE DEPARTMENT: ACCOUNTING AND FINANCE A: COURSE DESCRIPTION This course provides students with crucial concepts of investment decision-making, portfolio theory and valuation models of financial assets, especially bonds and common stocks. The mean and variance analysis is a basic principle leading students to understand the general feature of portfolios and asset pricing models. The course provides students with a thorough understanding of procedures involved in portfolio management- setting portfolio objectives, determining investment policy, formulating investment strategies, devising rules for updating portfolios. Topics include identifying investor objectives and constraint, recognizing risk and return characteristics of investment vehicles, developing strategic asset allocations among equity, fixed-income and risk-free assets, utilizing derivative securities to manage portfolio risk, and if possible, enhance portfolio returns, and evaluating portfolio and manager performance relative to investment objectives and appropriate benchmarks. B: GENERAL GOAL On completion of this course, students should be knowledgeable in investment management in preparation for careers in financial analysis and financial planning, investment banking and corporate finance. The student should specifically obtain a broad knowledge of the asset allocation process, security markets, market structures, the risk-return characteristics of investment products, and hedging applications with financial innovations through the course materials, lectures, discussions and assignments.

C: SPECIFIC OBJECTIVES/LEARNING OUTCOMES: After successfully completing this course students will be able to: 1. Develop investment policies based on investors objectives, constraints and altitude towards risk. 2. Undertake security analysis, asset allocation and construction of an optional investment portfolio. 3. Conduct portfolio revision in response to changes in market conditions or investors circumstances. 4. Understand taxation, legal and regulatory and ethical issues relevant to fund management. 5. Understand how to measure and manage risk exposure of a portfolio. 6. Evaluate the portfolio performance. 7. Critically examine both the active and the passive strategy of portfolio management. 8. Understand current empirical evidence and its implication in applying investment theory in practice. D: COURSE CONTENT Introduction.............................................................................................4hours 1 2 3 4 Definition of an investment The shareholder wealth maximization goal The agency theory Strategic planning and the investment decision

THE RELATIONSHIPS BETWEEN RISK AND RETURN8hours 1 2 3 2.3.1 2.3.2 Introduction Measurement of Expected Return and Risk on a single Asset. Portfolio theory: Markowitz theory Definition Factors considered in the choice of investments

2.3.3 Two-asset portfolios 2.3.4 Correlation and covariance 2.4 Portfolio theory and diversification

2.4.1 Investors preferences 2.4.2 Efficient portfolios 2.5 Introduction of a risk-free investment 2.5.1 The separation theorem 2.5.2 The market portfolio 2.6 2.7 Portfolio theory and investment decisions The Capital Market Line (CML)

3.0 THE CAPITAL ASSET PRICING MODEL (CAPM)4hours 3.1 Introduction 3.2 Assumptions 3.3 Systematic and Unsystematic Risk 3.4 The Empirical Evidence: Does the CAPM work? 3.5 The CAPM and share prices 3.6 The Beta Factor. 3.7 The Arbitrage Pricing Model (APT) 4.0 VALUATION OF SECURITIES8hour 4.1 Introduction 4.2 Valuation of Fixed-Income securities 4.2.1 Valuation of Bonds 4.2.2 Features of Bonds 4.3 Valuation of preference shares 4.4 Valuation of Equity shares 4.4.1 Problems with valuation of Equity shares 4.4.2 The Dividend Valuation Model (i) Dividend Capitalization Model (ii) Cum div and ex div share prices (iii) Dividend Growth Models Estimating growth rates-historic pattern The earnings retention model

4.5 Convertible debentures and warrants. 3

5.0 ANALYSIS OF DERIVATIVE SECURITIES.8hours 5.1 Option Strategies 5.2 Option Valuation using binomial option pricing and Black-Scholes 5.3 Forwards, Futures and Swaps. 5.4 Hedging using derivatives 6.0 MARKET EFFICIENCY HYPOTHESES4hours 6.1 Concept of an Efficient Market 6.2 Evidence on Market Efficiency 6.3 Implications of efficient market Hypothesis (EMH) 6.3.1 Fundamental Analysts 6.3.2 Technical analysts 7.0 INTERNATIONAL DIVERSIFICATION4hours 7.1 Risk and Return of Foreign Security 7.2 Exchange Rate and Purchasing Power Parity Theory 7.3 Hedging Exchange Rate Risk 8.0 PORTFOLIO MANAGEMENT4hours 8.1 Passive Portfolio Management 8.1.1 Index Fund Construction Technique 8.1.2 Dollar Cost Averaging 8.2 Active Portfolio Management 9.0 INVESTMENT DECISION8hours 9.1 Why Cash flows rather than Profits? 9.2 Relevant cash flows for investment Purposes 9.3 The use of the DCF analysis 9.3.1 The NPV approach 9.3.2 The IRR approach 9.4 Taxation in investment appraisal

9.5 Inflation and project evaluation 9.6 Risk analysis in capital budgeting decisions 9.7 International capital budgeting

READING LIST: ACCA (2001) Strategic Financial Management Foulks Lynch ACCA (2004) Strategic Financial Management Foulks Lynch Bodies, Z, Kane, & Marcus, A.J. (2001) Investment, McGraw-Hill Inc. Boston Bodies, Z. Kane, A, Marcus, A. Perrakis, S., & Ryan, P. (2005) Investments, 5th Canadian edition, McGraw-Hill Ryerson. Campbell, J (2000) Asset pricing at the Millennium; Journal of finance, Vol.55, PP 1515-1567. Elton, E.J. & Gruber, M.J (1995); Modern Portfolio Theory and Investment Analysis. John Wiley and sons, Inc. New York. Fama, E.F. & French, K.R. (2004); The capital asset pricing Model: Theory and evidence, Journal of Economic Perspectives, Vol. 18, PP 25-46. Francis, J.C (1991); Investments Analysis and Management, McGraw-Hill, Inc. New York. Levy, H. & Post, T. (2005) Investments. Pearson Education Limited Malkiel, B.B. (2007) A Random Walk Down Wall Street; 9th edition, W.W. Norton and Company. Radcliff, R.C. (1994); Investment; concepts. Analysis and Strategy. Harper. Collins College Publishers. Reilly, F.K. & Keith, C.B. (2006); Investment Analysis and portfolio Management 8th edition, Thomson South-Western.

Вам также может понравиться

- Elective Courses SyllabusДокумент37 страницElective Courses SyllabusAsif WarsiОценок пока нет

- Portfolio Management - Course OutlineДокумент3 страницыPortfolio Management - Course Outlinejusper wendoОценок пока нет

- Achieving Investment Excellence: A Practical Guide for Trustees of Pension Funds, Endowments and FoundationsОт EverandAchieving Investment Excellence: A Practical Guide for Trustees of Pension Funds, Endowments and FoundationsОценок пока нет

- Investment Analysis & Portfolio ManagementДокумент23 страницыInvestment Analysis & Portfolio ManagementUmair Khan Niazi67% (3)

- BBA IV Investment AnanalysisДокумент9 страницBBA IV Investment Ananalysisshubham JaiswalОценок пока нет

- Investment & Portfolio Mgt. SyllabusДокумент7 страницInvestment & Portfolio Mgt. SyllabusEmi YunzalОценок пока нет

- Toulouse Business School: C O U R S E C O N T E N TДокумент28 страницToulouse Business School: C O U R S E C O N T E N TlocoОценок пока нет

- Syllabus For Investment Analysis and Portfolio ManagementДокумент5 страницSyllabus For Investment Analysis and Portfolio Managementవెంకటరమణయ్య మాలెపాటి0% (1)

- Performance Evaluation and Attribution of Security PortfoliosОт EverandPerformance Evaluation and Attribution of Security PortfoliosРейтинг: 5 из 5 звезд5/5 (1)

- Investment SyllabusДокумент6 страницInvestment SyllabusAshish MakraniОценок пока нет

- What's Your MBA IQ?: A Manager's Career Development ToolОт EverandWhat's Your MBA IQ?: A Manager's Career Development ToolРейтинг: 5 из 5 звезд5/5 (1)

- Course Outline For Portfolio TheoryДокумент4 страницыCourse Outline For Portfolio Theoryshariz500Оценок пока нет

- PAM Outlines 07012021 042154pmДокумент7 страницPAM Outlines 07012021 042154pmzainabОценок пока нет

- Iapm Course Outline UpdatedДокумент2 страницыIapm Course Outline UpdatedKumar PrashantОценок пока нет

- FINA2220Документ4 страницыFINA2220Himal Salika HeenatigalaОценок пока нет

- 00 Syllabus 2024 Investments MS+readingsДокумент5 страниц00 Syllabus 2024 Investments MS+readingsxinluli1225Оценок пока нет

- Syllabus - IPPMДокумент3 страницыSyllabus - IPPMSarose ThapaОценок пока нет

- BMT6135 - Security-Analysis-And-Portfolio-Management - TH - 1.0 - 55 - BMT6135 - 54 AcpДокумент2 страницыBMT6135 - Security-Analysis-And-Portfolio-Management - TH - 1.0 - 55 - BMT6135 - 54 AcpM AnuradhaОценок пока нет

- Course Outline - Security and Portfolio ManagementДокумент6 страницCourse Outline - Security and Portfolio ManagementYeshwanth BabuОценок пока нет

- Applied Security Analysis 2023 - Bidding SyllabusДокумент4 страницыApplied Security Analysis 2023 - Bidding SyllabusTrialОценок пока нет

- M19MC3250 - Sapm UNIT 2 - 00365Документ60 страницM19MC3250 - Sapm UNIT 2 - 00365ashishОценок пока нет

- PM1Документ3 страницыPM1hardikjain1819Оценок пока нет

- Af 602Документ2 страницыAf 602Haseeb KhanОценок пока нет

- The Portfolio Management Revolution Maximize Your Profits TodayОт EverandThe Portfolio Management Revolution Maximize Your Profits TodayОценок пока нет

- Economics for Investment Decision Makers: Micro, Macro, and International EconomicsОт EverandEconomics for Investment Decision Makers: Micro, Macro, and International EconomicsОценок пока нет

- Buss 621 Advance Concepts in Corporate FinanceДокумент3 страницыBuss 621 Advance Concepts in Corporate Financeinsha aroojОценок пока нет

- BAC3684 SIPM March 2011Документ7 страницBAC3684 SIPM March 2011chunlun87Оценок пока нет

- Business & Corporate FinanceДокумент5 страницBusiness & Corporate Financearbaz khanОценок пока нет

- ECON 363-Economics of Investment and FinanceДокумент3 страницыECON 363-Economics of Investment and FinanceMalik AminОценок пока нет

- IAPMДокумент7 страницIAPMrossОценок пока нет

- 17Mb213 Security Analysis and Portfolio Management: Course ObjectiveДокумент2 страницы17Mb213 Security Analysis and Portfolio Management: Course ObjectiveAkash BОценок пока нет

- Course CodeДокумент1 страницаCourse CodeKirti KambojОценок пока нет

- Mastery in Markets: Advanced Strategies for Seasoned Investors: Investing, #3От EverandMastery in Markets: Advanced Strategies for Seasoned Investors: Investing, #3Оценок пока нет

- Hedge Funds: Quantitative InsightsОт EverandHedge Funds: Quantitative InsightsРейтинг: 3.5 из 5 звезд3.5/5 (3)

- Security Analysis (Mauboussin) SP2020Документ13 страницSecurity Analysis (Mauboussin) SP20201601vaibhavОценок пока нет

- M14 - Final Exam & RevisionДокумент43 страницыM14 - Final Exam & RevisionJashmine Suwa ByanjankarОценок пока нет

- Iap SyllabusДокумент3 страницыIap SyllabusSUKHIL REDDYОценок пока нет

- Modern Portfolio Theory: Foundations, Analysis, and New DevelopmentsОт EverandModern Portfolio Theory: Foundations, Analysis, and New DevelopmentsОценок пока нет

- Implementing Enterprise Risk Management: From Methods to ApplicationsОт EverandImplementing Enterprise Risk Management: From Methods to ApplicationsОценок пока нет

- Course Pack For AgBus 174 Investment Management Module 1Документ31 страницаCourse Pack For AgBus 174 Investment Management Module 1Mark Ramon MatugasОценок пока нет

- Australian School of Business School of Banking and Finance: FINS2624 P MДокумент13 страницAustralian School of Business School of Banking and Finance: FINS2624 P MMathew MarcОценок пока нет

- Security Analysis (Mauboussin) SP2016 PDFДокумент14 страницSecurity Analysis (Mauboussin) SP2016 PDFdarwin12100% (1)

- Portfolio TutorialДокумент77 страницPortfolio TutorialJason Lim100% (3)

- Advanced Financial ModelingДокумент4 страницыAdvanced Financial ModelingAQEELA MUNIRОценок пока нет

- Business Finance II B Lecture 1 March 01, 2021Документ16 страницBusiness Finance II B Lecture 1 March 01, 2021AhsanОценок пока нет

- Investment Management 2015-16Документ6 страницInvestment Management 2015-16Udayan BhattacharyaОценок пока нет

- Investment Management: A Modern Guide to Security Analysis and Stock SelectionОт EverandInvestment Management: A Modern Guide to Security Analysis and Stock SelectionОценок пока нет

- Financial Management 2 Course Outline 2021Документ7 страницFinancial Management 2 Course Outline 2021Shannan RichardsОценок пока нет

- AFW369E 2016-17 Courseoutline HooyCWДокумент5 страницAFW369E 2016-17 Courseoutline HooyCWwilliamnyxОценок пока нет

- GSM687Документ11 страницGSM687icdawar0% (1)

- EMBA Derivatives (Zurack) FA2016Документ6 страницEMBA Derivatives (Zurack) FA2016veda20Оценок пока нет

- Security Analysisand Portfolio ManagementДокумент3 страницыSecurity Analysisand Portfolio ManagementSenthil KumarОценок пока нет

- Aimr - Investing Separately Alpha and Beta PDFДокумент102 страницыAimr - Investing Separately Alpha and Beta PDFAnonymous Mgq9dupCОценок пока нет

- Course Contents: Nvestment Portfolio Analysis Expert in This Practical Course With RДокумент2 страницыCourse Contents: Nvestment Portfolio Analysis Expert in This Practical Course With RNoush NazmiОценок пока нет

- Sapm IvДокумент7 страницSapm IvShivangi BhasinОценок пока нет

- MBA 662 Financial Institutions and Investment ManagementДокумент4 страницыMBA 662 Financial Institutions and Investment ManagementAli MohammedОценок пока нет

- 140.national Investment and Development Corp. vs. AquinoДокумент18 страниц140.national Investment and Development Corp. vs. Aquinovince005Оценок пока нет

- University of The Cordilleras Accounting 1/2 Lecture AidДокумент3 страницыUniversity of The Cordilleras Accounting 1/2 Lecture AidJesseca JosafatОценок пока нет

- Accounting Quetion Paper 2022Документ12 страницAccounting Quetion Paper 2022Almeida Carlos MassingueОценок пока нет

- Asian Currencies Sink in 1997Документ3 страницыAsian Currencies Sink in 1997majidpathan208Оценок пока нет

- Good ThingsДокумент16 страницGood ThingsculwavesОценок пока нет

- Government Owned and Controlled CorporationsДокумент34 страницыGovernment Owned and Controlled CorporationsKenneth Delos SantosОценок пока нет

- Chapter One Extinction of ObligationsДокумент46 страницChapter One Extinction of ObligationsHemen zinahbizuОценок пока нет

- Charrie Mae MДокумент2 страницыCharrie Mae MRaymond GanОценок пока нет

- k17 Sol Ch18Документ129 страницk17 Sol Ch18nam hảiОценок пока нет

- FeasibilityДокумент23 страницыFeasibilityNimona BultumОценок пока нет

- Company Master Data: ChargesДокумент2 страницыCompany Master Data: ChargesNaresh KarmakarОценок пока нет

- Chattel Mortgage Without Separate Promissory NoteДокумент2 страницыChattel Mortgage Without Separate Promissory NoteJson GalvezОценок пока нет

- HLB Annual Report 2023Документ452 страницыHLB Annual Report 2023limkq-wb20Оценок пока нет

- SOA TemplateДокумент20 страницSOA TemplateNrkОценок пока нет

- Kellogg's Financial Statement Case StudyДокумент10 страницKellogg's Financial Statement Case StudyKhoa Huynh67% (6)

- Solution Manual of Chapter 5 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C Brewer Pages DeletedДокумент25 страницSolution Manual of Chapter 5 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C Brewer Pages DeletedSkfОценок пока нет

- 2AДокумент14 страниц2ADarshan gowdaОценок пока нет

- 7.1 Completing The Cycle SampleДокумент4 страницы7.1 Completing The Cycle SampleKena Montes Dela PeñaОценок пока нет

- Brisbane Land ValuationsДокумент8 страницBrisbane Land ValuationsW Martin Canales AyalaОценок пока нет

- 2022 Term 2 JC 2 H1 Economics SOW (Final) - Students'Документ5 страниц2022 Term 2 JC 2 H1 Economics SOW (Final) - Students'PROgamer GTОценок пока нет

- CHINAMART 1 - PresentationДокумент6 страницCHINAMART 1 - PresentationRetro GirlОценок пока нет

- Business Studies Formula Sheet - AS PDFДокумент4 страницыBusiness Studies Formula Sheet - AS PDFAdnan Haider NoorОценок пока нет

- Form 26QB: Your E-Tax Acknowledgement Number Is AG5312381Документ2 страницыForm 26QB: Your E-Tax Acknowledgement Number Is AG5312381anon_275845789Оценок пока нет

- Ifsfm M2Документ98 страницIfsfm M2Cally CallisterОценок пока нет

- Retail Sector in Sri LankaДокумент13 страницRetail Sector in Sri LankaJegan SJОценок пока нет

- Financial StatementДокумент6 страницFinancial StatementCeddie UnggayОценок пока нет

- Journal EntriesДокумент12 страницJournal Entriesg81596262Оценок пока нет

- Peachtree 1ST Trading Assignment (Bbsydp) PDFДокумент29 страницPeachtree 1ST Trading Assignment (Bbsydp) PDFsaira purkiОценок пока нет

- Partnership Firm in PakistanДокумент17 страницPartnership Firm in PakistanMuzaffar Iqbal33% (3)

- Busines PlanДокумент23 страницыBusines Planteme beyaОценок пока нет