Академический Документы

Профессиональный Документы

Культура Документы

NVTC Newsletter070511

Загружено:

api-3695702Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

NVTC Newsletter070511

Загружено:

api-3695702Авторское право:

Доступные форматы

NextVIEW Traders Club Weekly Newsletter

Published by NextView Sdn. Bhd. (574271-D) Ph +6 03 27139388 Fax +6 03 27139366

Add B-9-12, Block B, Level 9, Megan Avenue II, 12 Jalan Yap Kwan Seng, 50450 Kuala Lumpur, Malaysia

Newsletter for the week ending 11 May 2007

THIS WEEK’S CONTENTS:

Page

1. Investment/Trading Related Articles:

Each Trade’s Risk to Reward …… 2

by Bennett McDowell

Weekend Food For Thoughts …… 4

by YH Wong, BH Global Advisers Sdn. Bhd.

2. Market Commentaries

i) Bursa Malaysia Kuala Lumpur Composite Index (KLCI) …….. 5

Additional KLCI Analysis by Nazri Khan, CFTe, MSTA …….. 6

ii) Singapore Straits Times Index (STI) …….. 8

Additional STI Analysis by Benny Lee …….. 9

iii) Thailand SET Index (SETI) …….. 10

Additional Thailand Analysis by Don Schellenberg …….. 11

iv) Hong Kong Hang Seng Index (HSI) …….. 14

Additional HSI Analysis by Benny Lee …….. 15

3. Regional Market Forecast Group …….. 16

4. Regional Traders Education Events …….. 17

Disclaimer and Copyright …….. 19

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 1

1. Trading Article:

Each Trade’s Risk to Reward

By Bennett McDowell, TradersCoach.com

The explanation of the concept of “Risk to Reward” in trading goes something like this:

Before you take a trade, the reward must be a certain percentage better than the risk.

This percentage is usually represented as a ratio. I am going to make a case for why this

type of analysis is flawed, and the traders who use it are kidding themselves.

So that I can show you how absurd this concept of risk to reward is, let’s start with an analogy. Let’s

say that if, before you get out of bed each morning, you ask yourself, “What is my risk of reward or

chances of success today if I get out of bed?” If your answer is “Poor”, you stay in bed; if it’s “Good”,

you get out of bed and start your day.

Now compare this to trading. Let’s say, before you decide on a trade, you say to yourself, “What is

my risk of reward today or chances of this trade being successful?” If the answer is “Poor”, you do

not take the trade; if, on the other hand, it is “Good”, you take the trade.

The problem with this thinking is that you may never get out of bed (or, in our trading example,

take a trade)! Because the analysis is dependent on how you see the world and how you perform

your analysis (which, in both examples, is subjective), it is flawed from the start!

We really do not know which day or trade will be good, so traders who use this risk-to-reward

approach are fooling themselves because we really cannot predict future price movement. In fact,

you will find that most traders who calculate the risk to reward for each trade are right about 50

percent of the time, which is the same as a coin toss.

But, traders use this concept of risk to reward because it makes them feel in control of the risk

inherent in trading. And, most traders need to feel they control the risk in trading. But, I will let you

in on a secret: No one controls the risk inherent in trading!

What I want you to think about is trading the realities of the market, flowing with markets and

accepting the inherent risk in trading, so you can profit. Basing trade entries and exits on the

realities of the market and then applying strict risk control methods that determine your “Trade

Size” for each trade is the way to embrace the risk in trading instead of denying it as so many

trading approaches seem to do.

Any time you try to predict future price movement based on your judgment and interpretation of

market dynamics, you are really just guessing!

Compare this with trading the realities of the market and basing trade decisions on market realities

so that you are trading with the market and not forming opinions about market direction or having

to interpret market news or mathematical logarithms.

We have to get out of bed each day and face the realities of the world we live in. Think about how

absurd it would be to base your decision of whether to get out of bed each day on a concept that

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 2

asks you to guess whether the day will be good or not. Is that any way to live your live your life?

NO!!!

The reality is that we just don’t know what each day will bring, but we do know that, to get what we

want from life, we need to get out of bed and try our best based on the realities of the day. We can

take risks based on known parameters and not on unknown or “un-grounded” assessments of what

may happen today.

So, if you are using the concept “risk to reward” in your trading, think about all the profitable trades

you missed because market dynamics did not go according to your guess. You may want to rethink

this very popular concept that lures many traders into the illusion of security.

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 3

Weekend Food For Thought

By YH Wong, BH Global Advisers Sdn Bhd

On the surface, the local economic figures look pretty decent but wage gains are evaporating as

inflation accelerates rapidly, helping explain why confidence in the local economy isn't soaring along

with growth. Rising inflation is bad news for local investors who keep a large portion of their wealth

in cash - crazy, I know.

The good news is that they are learning gradually about alternative asset classes. There are positive

signs more local investors may be breaking their hedge funds taboo, born of the belief that George

Soros and other hedge fund managers were responsible for the Asian financial crisis back in 1997.

Enough of Malaysia but I'm also getting tired of hearing about the China story. So today, I did what

I always do when I get tired of hearing about an investment or market. No, I don't go play golf and

forget about it. I go back to the raw analysis. I want to forget the hype, and see what's really

happening. China is not some special economy, but simply a classic fast-growth developing country

with a naturally violent economic cycle.

In the bigger picture, assume that we are all optimists and China's overheating economy and stock

market will end more like a fizzle something like a hiss of a leaking tire that could take decades.

This is because central bank act to ease the pain but it drags the pain out. However, I believe that

China will eventually end with a bang although timing is always an issue given the powerful liquidity

story.

Confidence is vital to the success of nearly any human endeavor. When it comes to investing,

however, the meaning of "confidence" needs to be defined with care. Emotional confidence may

help a sprinter win a gold medal in the 100-meter dash, but it can also be the undoing of the

investor who puts all his bets into the stock market because "I have a good feeling about this one."

Overconfidence in a particular investment or market can land you in trouble if you don't have a

good strategy plan.

Some chartists are all over me like a cheap suit, letting me know that Chinese equities are going to

rally further. In the short-term, I see no solid reason for any blow-ups in any equity markets.

However, that doesn't mean easy money will be made. We remain fully invested in stock markets

but have increased our hedged positions accordingly. Beyond the short-term, we still see the global

equity markets dipping significantly which could be bad news for a lot more Chinese IPOs over the

next few months.

A reminder here is that If China drops sharply, other markets would be impacted through the

psychology and I expect it would scare a lot of investors. A mini version of this happened in late

February of this year.

YH Wong is the Head of Strategy with BH Global Advisers Sdn. Bhd., a licensed

investment advisory firm. You may reach him or his team at (603) 2166 8896.

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 4

2. Market Commentaries

i) Bursa Malaysia Kuala Lumpur Composite Index (KLCI)

Technical Analysis as of 11/5/2007

Basic Price information

Close: 1,351.45

Trend Analysis

MACD (23.7086)

MACD is indicating that the current short term price trend is bearish. The momentum of the trend is Strong.

Moving Averages 10-day(1,344.7040), 30-day(1,308.8190), 60-day(1,260.8220), 100-day(1,211.3760).

SHORT-Term Trend: Very bullish

LONG-Term Trend: Very bullish

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 5

Support and Resistance Analysis

Immediate Support: 1,291.6400

Longer term Support: 1,090.3900

Immediate Resistance: 1,368.8700

Longer term Resistance: 1,368.8700

100 day SMA Support: 1,211.3760

200 day SMA Support: 1,096.5272

Stochastic(78.9805) is currently slightly overbought and is getting lower.

Price Reversals

Candesticks

Bullish Candlestick pattern: No bullish candlestick pattern detected in the last 3 days.

Bearish Candlestick pattern: No bearish candlestick pattern detected in the last 3 days.

Bar Chart Patterns

Bar Chart Bullish Price Reversal Pattern: No bar chart bullish price reversal detected for the last 3 days

Bar Chart Bearish Price Reversal Pattern : No bar chart bearish price reversal detected for the last 3 days

Stochastic

Stochastic Bullish Price Reversal : No bullish reversal in the last 2 days.

Stochastic Bearish Price Reversal : Stochastic crossed below its %D 2 days ago.

Volatility Analysis

Short term volatility: The 3-period ATR (14.4229) has increased therefore price action is more volatile

Longer Term volatility: The Bollinger Bands are contracting therefore price action is less volatile

Volume Analysis

Volume: 68,000 shares, 30-day average volume: 85,233 shares.

Volume strength is moderate. The On Balance Volume is declining, indicating distribution of shares in the

market.

________________________________________________________

Additional KLCI Analysis by Nazri Khan

EXPECT MARKET TO HIT 1400 AFTER HEALTHY CONSOLIDATION

By Nazri Khan, MSTA, CFTe, Certified Trainer / Consultant NextVIEW Investors Education

With last weeks slight losses, the Malaysian markets took a rest within their strong uptrend. Specifically, the KLCI

and the Syariah Index consolidated after carving out all-time highs, while the Mesdaq and the Second Board eased

off within a six month triangle congestion pattern. At Friday's close, the KLCI held just 18 points from an all-time

closing high. After edging above the 1350 mark last week, the KLCI drifted lower for five daily sessions. On Friday,

KLCI bottomed precisely at 1336 before rising to close at 1351. From current levels, strong support still holds in the

1332 and 1350 area. Meanwhile, the Syariah Index is also consolidating within a steady eight week uptrend. The

Syariah Index first support now holds right around 196 and next support pegged at 190. The Syariah Index

bottomed Friday at 196 before rising to close 2 points higher at 198. The weakest index is Mesdaq, not surprisingly

given the weak technology sector and absence of retail traders. The Mesdaq is still holding its six month sideways

consolidation. It rallied sharply from 115 support last March, and despite a shaky session during April, it has been

trading sideways. Note the index has notched five straight weekly closes around 134-144 band area. It closed

Friday at 135 after slipping five points.

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 6

As the chart illustrates, majority of Malaysian indices have taken a rest after staging a steep two-month rally.

Specifically, from the March low of 1090 to last week high of 1368, the KLCI has run 278 points or 25 % and

Syariah Index 45 points, or 28 %. After clearing the February high on April 25, the Malaysian bellwether index has

sustained its breakout for six weeks. Technically speaking, the most notable aspect of the recent run from the past

ten years is that it has coincided with a sustained break to all time highs. That means the Malaysian markets have

staged a technically valid break to multiyear highs. This has not been just one or two benchmarks briefly flirting with

record territory. Still, the recent run has created a tension between the near-term and longer-term time horizons.

Namely, the Malaysian markets are considerably overbought near-term, and due to pull in, while the longer-term

view is distinctly bullish. To highlight the tension, consider that KLCI has staged eleven consecutive positive months

without correction and note that virtually a third of the KLCI return since 1998 has occurred over the past six

months. That means despite strong two-month runs, on the truly longer-term view, the Malaysian markets are

unusually overbought. And that is likely contributed due to the KLCI rising on 39 of the past 46 weekly sessions. So

for the time being, last week shallow correction confirms the primary uptrend, and on a longer-term basis, the path

of least resistance remains higher. While the markets are on a strong uptrend, a shallow pullback - or at least a

sideways cooling off period - will be healthy to the market. Though this isn't the time to trade counter to the primary

trend, traders are advised to accumulate on correction and be cautious on any sharp pullback that may occur in the

near future.

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 7

ii) Singapore Straits Times Index (STI)

Technical Analysis as of 11/05/2007

Basic Price information

Close: 3,446.92

Trend Analysis

MACD (43.7357)

MACD has just crossed below its trigger line today, indicating a bearish reversal in the short term. MACD is

indicating that the current short term price trend is bearish. The momentum of the trend is Strong.

Moving Averages 10-day(3,439.9800), 30-day(3,382.5764), 60-day(3,272.6731), 100-day(3,186.7820).

SHORT-Term Trend: Very bullish

LONG-Term Trend: Very bullish

Support and Resistance Analysis

Immediate Support: 3,338.5100

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 8

Longer term Support: 2,931.6299

Immediate Resistance: 3,523.4099

Longer term Resistance: 3,523.4099

100 day SMA Support: 3,186.7820

200 day SMA Support: 2,904.3430

Stochastic(65.7783) is currently in neutral zone and is getting lower.

Price Reversals

Candesticks

Bullish Candlestick pattern: No bullish candlestick pattern detected in the last 3 days.

Bearish Candlestick pattern: No bearish candlestick pattern detected in the last 3 days.

Bar Chart Patterns

Bar Chart Bullish Price Reversal Pattern: No bar chart bullish price reversal detected for the last 3 days

Bar Chart Bearish Price Reversal Pattern : No bar chart bearish price reversal detected for the last 3 days

Stochastic

Stochastic Bullish Price Reversal : No bullish reversal in the last 2 days.

Stochastic Bearish Price Reversal : No bearish reversal in the last 2 days.

Volatility Analysis

Short term volatility: The 3-period ATR (46.6972) has increased therefore price action is more volatile

Longer Term volatility: The Bollinger Bands are expanding therefore price action is more volatile

Volume Analysis

Volume: 238,000 shares, 30-day average volume: 180,100 shares.

Volume strength is moderate. The On Balance Volume is increasing, indicating accumulation of shares in the

market.

________________________________________________________

Additional STI Analysis by Benny Lee

Minor correction took place and the STI went into uncertainty after climbing 100 points the previous

week. On a weekly basis, the STI remains sideways. The STI still maintains above the 3350 bullish

support level and therefore the projection of 3800 is still valid. Short term trend remains strong.

However, the reversal on the MACD indicates that the momentum of the up trend is weakening.

Increasing ATR indicates daily price ranges are widening as uncertainty looms. With increasing

volatility, it is better to stay out of the market until the market stabilizes. However, if you are

looking for intraday trading opportunities, this is a good time.

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 9

iii) Thailand SET Index

Technical Analysis as of 11/05/2007

Basic Price information

Close: 706.90

Trend Analysis

MACD (6.7415)

MACD is indicating that the current short term price trend is very bullish. The momentum of the trend is

however, weak.

Moving Averages 10-day(705.0130), 30-day(692.1293), 60-day(686.7565), 100-day(678.8452).

SHORT-Term Trend: Very bullish

LONG-Term Trend: Very bullish

Support and Resistance Analysis

Immediate Support: 685.1600

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 10

Longer term Support: 665.0400

Immediate Resistance: 717.9300

Longer term Resistance: 717.9300

100 day SMA Support: 678.8452

200 day SMA Support: 694.0565

Stochastic(66.0157) is currently in neutral zone and is getting lower.

Price Reversals

Candesticks

Bullish Candlestick pattern: No bullish candlestick pattern detected in the last 3 days.

Bearish Candlestick pattern: Long Upper Shadow was detected yesterday

Bar Chart Patterns

Bar Chart Bullish Price Reversal Pattern: No bar chart bullish price reversal detected for the last 3 days

Bar Chart Bearish Price Reversal Pattern : No bar chart bearish price reversal detected for the last 3 days

Stochastic

Stochastic Bullish Price Reversal : No bullish reversal in the last 2 days.

Stochastic Bearish Price Reversal : No bearish reversal in the last 2 days.

Volatility Analysis

Short term volatility: The ATR has declined therefore price action is less volatile

Longer Term volatility: The Bollinger Bands are expanding therefore price action is more volatile

Volume Analysis

Volume: 222,454,000 shares, 30-day average volume: 170,996,240 shares.

Volume strength is moderate. The On Balance Volume is declining, indicating distribution of shares in the

market.

________________________________________________________

Additional STI Analysis by Don Schellenberg

SETI.TH Commentary

There have been a few down days in Thailand’s Stock Index during the past week. As I wrote in my

commentary a week ago – “…It will not even be a surprise if the market turns down soon to test the

previous high of 701.85 before it rises higher”.

In fact, even a drop down to test the high of two weeks ago, at 693. would not damage the newly

born up-trend as long as value does not drop below that area.

The Index has briefly stopped it’s upward climb precisely at an area of fairly minor resistance that

also includes a down-sloping trend line, as shown on the chart. It is my view that this should not

prevent the Index from soon breaking the trend-line and resuming it’s upward climb to test the

larger resistance area at 750.

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 11

The December 19th downward gap in the Index opened at a value of 730.55. That gap will most

likely be closed in the fairly near future.

TECHNICALS:

The Index has moved in a down-sloping channel for several months already and appears ready to

break above the channel soon.

Li’s Preferred Ichimoku – I have placed an advanced type of Indicator, adapted and improved by my

NextView colleague, Mr. Li. It is my observation that the Index has upward momentum and support

as it moves to test the trend-line at 720.

R1 and R2 – nearby areas of resistance.

S1 – 695. Here is near term key support for the next upward move.

BIGC.TH : LESSON ON INVESTING/TRADING

Today I’m offering you a little lesson in how experienced traders and investors might look at stock

charts to make decisions whether to buy, sell or hold. We’ll use BIGC.TH as an example.

BIGC.th has been in a steady, strong uptrend for about four years. In fact, it hasn’t experienced a

significant correction for a very long time. By most long-term measures, BIGC.th is Overbought and

within the next few months will be due for a correction.

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 12

NOTE: The chart I’m showing you today is a long term chart showing monthly data. The indicator

I’ve put on the chart is called a Bollinger Band. Price has constantly been above it’s center band for

three years, and it’s been hugging the upper band for most of that time. This is a very strong

uptrend.

However, a strong uptrend does not mean we should just immediately buy. It would be much safer

and probably much more profitable to wait for a correction to the trend, if we plan to invest for a

long period of time. The correction might bring price down to the center band or even the lower

band.

For a shorter term investment, or trade, one should look at shorter term charts, like daily and hourly,

for example. And then use some of the same concepts on the shorter term charts that I’ve

demonstrated on the monthly chart.

I’ve also drawn in a couple of horizontal lines that show potential support and resistance (at the R

and the S). All of these things are useful in helping to make investment decisions.

Of course, there’s more to know than just this, but this might at least be a start for you to become a

smarter more profitable investor.

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 13

iv) Hong Kong Hang Seng Index (HSI)

Technical Analysis as of 11/05/2007

Basic Price information

Close: 20,468.21

Trend Analysis

MACD (160.2238)

MACD is indicating that the current short term price trend is bearish. The momentum of the trend is Strong.

Moving Averages 10-day(20,641.8887), 30-day(20,412.1934), 60-day(20,068.8320), 100-

day(20,032.7715).

SHORT-Term Trend: Very bullish

LONG-Term Trend: Very bullish

Support and Resistance Analysis

Immediate Support: 20,130.1094

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 14

Longer term Support: 18,659.2305

Immediate Resistance: 21,070.2109

Longer term Resistance: 21,070.2109

100 day SMA Support: 20,032.7715

200 day SMA Support: 18,937.7246

Stochastic(59.1756) is currently in neutral zone and is getting lower.

Price Reversals

Candesticks

Bullish Candlestick pattern: No bullish candlestick pattern detected in the last 3 days.

Bearish Candlestick pattern: No bearish candlestick pattern detected in the last 3 days.

Bar Chart Patterns

Bar Chart Bullish Price Reversal Pattern: No bar chart bullish price reversal detected for the last 3 days

Bar Chart Bearish Price Reversal Pattern : No bar chart bearish price reversal detected for the last 3 days

Stochastic

Stochastic Bullish Price Reversal : No bullish reversal in the last 2 days.

Stochastic Bearish Price Reversal : Stochastic crossed below its %D 2 days ago.

Volatility Analysis

Short term volatility: The 3-period ATR (241.2856) has increased therefore price action is more volatile

Longer Term volatility: The Bollinger Bands are contracting therefore price action is less volatile

Volume Analysis

Volume: 1,440,579,968 shares, 30-day average volume: 1,357,238,272 shares.

Volume strength is moderate. The On Balance Volume is declining, indicating distribution of shares in the

market.

________________________________________________________

Additional HSI Analysis by Benny Lee

The HSI tried to break above the 21000 resistance level and managed to achieve it intraday on

Monday. However, it failed to close above it and close near the low. It formed a Japanese

Candlestick reversal pattern, the Inverted Hammer. The HSI failed to follow up to challenge the

resistance again in the following days of the week. On Friday the HSI gapped down more 250 points,

reacting to the bearish move on the Dow. There was no clear direction after the gap down.

On Friday evening Asian time, the Dow regained its bullishness again. The HSI is expected to

rebound technically and may challenge the 21000 resistance level again this week.

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 15

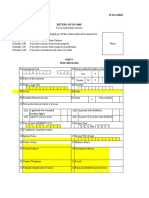

3. Regional Market Forecast Group

Note:

Forecast Direction

S = Sideway

U = Up

D = Down

Sideway market is considered if the index falls between 0.4% of the index close on Friday

Sideway Range Calculation Close Sideway Range

KLCI 1351.5 1346.0 to 1356.9

STI 3446.9 3433.1 to 3460.7

HSI 20468.2 20386.3 to 20550.1

SETI 706.9 704.1 to 709.7

Direction is based on next Fridays close. If next Friday's close is above the sideway range, direction is considered up and vice versa for price below

sideway range

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 16

4. Regional Traders Education Events this week

MALAYSIA

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 17

SINGAPORE

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 18

________________________________________________________________________________________

DISCLAIMER AND COPYRIGHT NextView Sdn. Bhd. (574271-D) and NextView Traders Club (NVTC) are NOT a licensed

investment advisors. This publication, which is generally available to members of NVTC, falls under Media Advice provisions. These

analysis notes are based on our experience of applying technical analysis to the market and are designed to be used as a tutorial showing

how technical analysis can be applied to a chart example based on recent trading data. This newsletter is a tool to assist you in your

personal judgment. It is not designed to replace your Licensed Financial Consultant, your Stockbroker. It has been prepared without

regard to any particular person's investment objectives, financial situation and particular needs because readers come from diverse

backgrounds, with diverse objectives and financial situations. This information is of a general nature only so you should seek advice from

your broker or other investment advisors as appropriate before taking any action. The decision to trade and the method of trading is for

the reader alone to decide. The author, contributors and publisher expressly disclaim all and any liability to any person, whether the

purchase of this publication or not, in respect of anything and of the consequences of any thing done or omitted to be done by any such

person in reliance, whether whole or partial, upon the whole or any part of the contents of this publication. Neither NextView Sdn Bhd

(including offices in other countries) nor its officers, employees and agents, will be liable for any loss or damage incurred by any person

directly or indirectly as a result of reliance on the information contained in this publication. The information contained in this newsletter is

copyright and for the sole use of NVTC Members. It cannot be circulated to other readers without the permission of the publisher. This is

not a newsletter of stock tips. Case study trades are notional and analyzed in real time on a weekly basis. NextView Sdn Bhd does not

receive any commission or benefit from the trading activities undertaken by readers, or any benefit or fee from any of the stocks reviewed

in the newsletter. NextView Sdn Bhd is an independent financial education organization and research is supported by NVTC annual

membership fees.

OFFICES;

Head Office Malaysia: B-9-12, Block B, Level 9 Megan Avenue II, 12 Jalan Yap Kwan Seng, 50450 Kuala Lumpur, Malaysia. Singapore: 5 Shenton Way,

#02-03/05 UIC Building, Singapore 068808. Thailand: The Millennia Tower, 18th Floor, Unit 1806, 62 Langsuan Road, Lumphini, Pathumwan Bangkok,

10330, Thailand. Hong Kong: Room B, 16/F, Crawford Tower, 99 Jervois Street, Sheung Wan, Hong Kong. China: 59 Yunnan North Road , Liu He

Building Unit 20-03 Postal Code 200001, Shanghai , China.

© 2006 - 2007 NextView Investors Education Group. All rights reserved. 19

Вам также может понравиться

- NV Traders Group Newsletter ArchiveДокумент15 страницNV Traders Group Newsletter Archiveapi-3695702Оценок пока нет

- Benny Fat Part2Документ13 страницBenny Fat Part2api-3695702100% (1)

- NVTC Newsletter070824Документ17 страницNVTC Newsletter070824api-3695702Оценок пока нет

- NV Traders Group Newsletter ArchiveДокумент15 страницNV Traders Group Newsletter Archiveapi-3695702Оценок пока нет

- Benny Intraday Intro Part1Документ9 страницBenny Intraday Intro Part1api-3695702Оценок пока нет

- Benny Fat Part1Документ13 страницBenny Fat Part1api-3695702Оценок пока нет

- NVTC Newsletter070810Документ20 страницNVTC Newsletter070810api-3695702Оценок пока нет

- Benny Intraday Intro Part2Документ10 страницBenny Intraday Intro Part2api-3695702Оценок пока нет

- NV Traders Group Newsletter ArchiveДокумент15 страницNV Traders Group Newsletter Archiveapi-3695702Оценок пока нет

- NVTC Newsletter080613Документ19 страницNVTC Newsletter080613api-3695702Оценок пока нет

- Benny Emotions MyДокумент12 страницBenny Emotions Myapi-3695702Оценок пока нет

- Bbands MyДокумент27 страницBbands Myapi-3695702Оценок пока нет

- NV Traders Group Newsletter ArchiveДокумент15 страницNV Traders Group Newsletter Archiveapi-3695702Оценок пока нет

- NVTC Newsletter071116Документ19 страницNVTC Newsletter071116api-3695702Оценок пока нет

- NVTC Newsletter070803Документ22 страницыNVTC Newsletter070803api-3695702Оценок пока нет

- NV Traders Group Newsletter ArchiveДокумент15 страницNV Traders Group Newsletter Archiveapi-3695702Оценок пока нет

- NV Traders Group Newsletter ArchiveДокумент15 страницNV Traders Group Newsletter Archiveapi-3695702Оценок пока нет

- NVTC Newsletter080201Документ16 страницNVTC Newsletter080201api-3695702Оценок пока нет

- NVTC Newsletter071109Документ20 страницNVTC Newsletter071109api-3695702Оценок пока нет

- NV Traders Group Newsletter ArchiveДокумент15 страницNV Traders Group Newsletter Archiveapi-3695702Оценок пока нет

- NV Traders Group Newsletter ArchiveДокумент15 страницNV Traders Group Newsletter Archiveapi-3695702Оценок пока нет

- NVTC Newsletter071102Документ22 страницыNVTC Newsletter071102api-3695702Оценок пока нет

- NV Traders Group Newsletter ArchiveДокумент15 страницNV Traders Group Newsletter Archiveapi-3695702Оценок пока нет

- NVTC Newsletter080118Документ18 страницNVTC Newsletter080118api-3695702Оценок пока нет

- NV Traders Group Newsletter ArchiveДокумент15 страницNV Traders Group Newsletter Archiveapi-3695702Оценок пока нет

- Microsoft Word - NVTC - Newsletter070727Документ23 страницыMicrosoft Word - NVTC - Newsletter070727api-3695702Оценок пока нет

- ATIC2008HCMC TruthchartsДокумент20 страницATIC2008HCMC Truthchartsapi-3695702Оценок пока нет

- ATIC2008HCMC RidingtrendsДокумент12 страницATIC2008HCMC Ridingtrendsapi-3695702Оценок пока нет

- NVTC Newsletter071026Документ23 страницыNVTC Newsletter071026api-3695702Оценок пока нет

- Cimb 24may2008 HoДокумент26 страницCimb 24may2008 Hoapi-3695702Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Exam 1 PDFДокумент4 страницыExam 1 PDFFiraa'ool YusufОценок пока нет

- Whittington Audit Chapter 17 Solutions ManualДокумент16 страницWhittington Audit Chapter 17 Solutions ManualIam AbdiwaliОценок пока нет

- Types and Techniques of ReinsuranceДокумент21 страницаTypes and Techniques of Reinsuranceradhay mahajan100% (2)

- Ghana Banks FailureДокумент5 страницGhana Banks Failurems mbaОценок пока нет

- Practice Problems 263Документ5 страницPractice Problems 263GОценок пока нет

- Fin621 MC110201011Документ2 страницыFin621 MC110201011AbbasKhanОценок пока нет

- FINS 3616 Lecture Notes-Week 1Документ38 страницFINS 3616 Lecture Notes-Week 1joannamanngoОценок пока нет

- Finance Ratios of ToyotaДокумент4 страницыFinance Ratios of ToyotaMaryam KhalidОценок пока нет

- MGMT3048 Course Outline SemII 2012Документ4 страницыMGMT3048 Course Outline SemII 2012Justine PowellОценок пока нет

- What Ails Us About High Frequency Trading - Final 2 10-5-09Документ4 страницыWhat Ails Us About High Frequency Trading - Final 2 10-5-09prasadpatankar9Оценок пока нет

- I. Company Profile: BPIДокумент7 страницI. Company Profile: BPIspicycdeОценок пока нет

- MPSELДокумент20 страницMPSELSridhar ReddyОценок пока нет

- Difference Between Niti Aayog and Planning CommissionДокумент1 страницаDifference Between Niti Aayog and Planning CommissionRia BahetiОценок пока нет

- 6941 Ais - Database.model - file.LampiranLain TUGAS PERTEMUAN 12Документ4 страницы6941 Ais - Database.model - file.LampiranLain TUGAS PERTEMUAN 12Amirah rasyidahОценок пока нет

- United States Court of Appeals, Ninth CircuitДокумент9 страницUnited States Court of Appeals, Ninth CircuitScribd Government DocsОценок пока нет

- Chapter IIIДокумент32 страницыChapter IIIFobe Lpt Nudalo100% (2)

- SBI-Home-Loan-Maxgain Calculation SheetДокумент6 страницSBI-Home-Loan-Maxgain Calculation SheetPATIL GAURAV0% (1)

- ADR CasesДокумент122 страницыADR Casesmae krisnalyn niezОценок пока нет

- BuenaventuraEJ Corporation ActivityДокумент5 страницBuenaventuraEJ Corporation ActivityAnonnОценок пока нет

- Financial Performance Analysis of Steel Authority of India Limited (Sail)Документ10 страницFinancial Performance Analysis of Steel Authority of India Limited (Sail)hunrisha nongdharОценок пока нет

- C 1 Miheer H Mafatlal V MafatlalДокумент47 страницC 1 Miheer H Mafatlal V Mafatlalshashank advОценок пока нет

- Meaning and Nature of Accounting Principle: Veena Madaan M.B.A (Finance)Документ25 страницMeaning and Nature of Accounting Principle: Veena Madaan M.B.A (Finance)JenniferОценок пока нет

- Revolution in Egypt Case StudyДокумент2 страницыRevolution in Egypt Case StudyJohn PickleОценок пока нет

- Sample Article of IncorporationДокумент15 страницSample Article of IncorporationMagne Joy Binay - AlcantaraОценок пока нет

- Primary MKTДокумент24 страницыPrimary MKTdanbrowndaОценок пока нет

- NISM-Series-V-A Mutual Fund Distributors Certification ExaminationДокумент5 страницNISM-Series-V-A Mutual Fund Distributors Certification ExaminationinvestorfirstОценок пока нет

- Form 4042Документ3 страницыForm 4042IqbalAsifОценок пока нет

- It 11ga2016Документ17 страницIt 11ga2016shiblu39100% (1)

- Written Recitation - AnswerДокумент2 страницыWritten Recitation - AnswerJoovs JoovhoОценок пока нет