Академический Документы

Профессиональный Документы

Культура Документы

Fema C

Загружено:

api-3712367Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Fema C

Загружено:

api-3712367Авторское право:

Доступные форматы

Shyamala Gopinath: Foreign exchange regulatory regimes in India - from

control to management

Address by Ms Shyamala Gopinath, Deputy Governor of the Reserve Bank of India, at the Conference

organised by the Forum for Free Enterprise, Mumbai, 25 January 2005.

The assistance of S/Shri H. Bhattacharya, Vinay Baijal, Deepak Kumar, and Partha Ray in preparation of this address is

gratefully acknowledged.

* * *

Shri Minoo Shroff, Mr Gazaria, Mr. Thakkar, ladies and gentlemen.

I am delighted to be here in Forum of Free Enterprise to deliver the keynote address at this

programme on FEMA for executives and professionals. The Forum of Free Enterprise has been

engaged in educating public focusing special attention on the youth with a view to helping today’s

younger generation to become good, responsible, active and well informed citizens of tomorrow.

Towards that end stalwarts like the late A.D. Shroff, the late Murarji J. Vaidya, the late Nani Palkhiwala

and the late M. R. Pai had played a great role.

In my address, I would like to set out the rationale of the liberalisation and simplification of process and

procedures for foreign exchange transactions. What has been the philosophy behind India’s policies in

regard to the external sector? What are the current challenges for India as it integrates with the global

economy? What has been the policy measures taken for simplification and liberalisation of process

and procedures for foreign exchange transactions? In the present address I intend to cover some of

these questions.

Context of foreign exchange regulations

There is a German word called zeit-geist which, I am told, can broadly be translated as the ‘spirit of

time’. Nothing better describes the evolution of foreign exchange regulation in India. Let me start with

a brief brush of history. Soon after independence, a complex web of controls were imposed for all

external transactions through a legislation i.e., Foreign Exchange Regulation Act (FERA), 1947. These

were put into a more rigorous framework of controls through FERA, 1973. Severe restrictions on

current account transactions had continued till mid-1990s when relaxations were made in the

operations of the FERA, 1973. The control framework was essentially transaction based in terms of

which all transactions in foreign exchange including those between residents and non-residents were

prohibited, unless specifically permitted.

Control- to- management: FERA-to-FEMA

In the 1990s, consistent with the general philosophy of economic reforms a sea change relating to the

broad approach to reform in the external sector took place. The Report of the High Level Committee

on Balance of Payments (Chairman: Dr. C. Rangarajan, 1993) set the broad agenda in this regard.

The Committee recommended, inter alia, the introduction of a market-determined exchange rate

regime within limits; liberalisation of current account transactions leading to current account

convertibility; compositional shift in capital flows away from debt to non debt creating flows; strict

regulation of external commercial borrowings, especially short-term debt; discouraging volatile

elements of flows from non-resident Indians; full freedom for outflows associated with inflows (i.e.,

principal, interest, dividend, profit and sale proceeds) and gradual liberalisation of other outflows; and

dissociation of Government in the intermediation of flow of external assistance, as in the 1980s,

receipts on capital account and external financing were confined to external assistance through

multilateral and bilateral sources.

The sequence of events in the subsequent years generally followed these recommendations. In 1993,

exchange rate of rupee was made market determined; close on the heels of this important step, India

accepted Article VIII of the Articles of Agreement of the International Monetary Fund in August 1994

and adopted the current account convertibility. In June 2000 a legal framework, with implementation of

FEMA, has also been put into effect to ensure convertibility on the current account. As emphasized by

the Rangarajan Committee that there could be capital outflows from residents in the guise of current

BIS Review 9/2005 1

account transactions after current account convertibility, certain safeguards were also built into the

system after FEMA came into effect. For example:

• First, the requirement of repatriation and surrender of export proceeds was continued, with

provision of Exchange Earners Foreign Currency (EEFC) account for use by exchange

earners.

• Second, all authorized dealers were allowed to sell foreign exchange for underlying current

account transactions supported by documentary evidence.

• Third, a proactive approach in the development of money, government securities and forex

markets has been adopted.

• Fourth, effort has been made to improve the information base on transactions in the forex

markets with respect to its nature and magnitude through reports and statements. The

insistence on adequate and timely reporting requirements from authorised dealers for

various foreign exchange transactions also helped in simplification and liberalisation

process.

• Fifth, as a general rule, genuine hedging of exposures under specified conditions is allowed.

This consistent approach has lent credibility to the liberalisation process of both current and capital

account transactions.

In 1997, the Tarapore Committee on Capital Account Convertibility (CAC), constituted by the Reserve

Bank, had indicated the preconditions for Capital Account Convertibility. The three crucial

preconditions were fiscal consolidation, a mandated inflation target and, strengthening of the financial

system. Drawing from the lessons of international experience, the Committee noted that, in general,

countries which initiated the move to CAC on the basis of strong fundamentals were able to modulate

the pace of instituting CAC without undertaking large and dramatic shifts in the stance of macro

economic policies. Furthermore, these countries were less vulnerable to backtracking and the

reimposition of controls in the face of exogenous shocks. In fact, the pursuit of reforms in other areas

by these countries instilled confidence in the process of opening up of the capital account. Countries

with weak initial conditions have to adopt drastic measures in macro economic policies to facilitate the

move to CAC. Some of these countries had to face interruptions and reintroduction of capital controls

in the evolution of CAC. In this context, I recall the observations of former Governor, Dr. Bimal Jalan

and I quote, “...It must be understood that merely by lifting all capital controls, the markets of a

developing country do not get as deeply integrated as a developed country’s markets. As such, each

country would need to decide on its own path of capital account liberalization with regard to the timing

and sequencing”.

The Tarapore Committee had also recommended change in the legislative framework governing

foreign exchange transactions. Accordingly, the Foreign Exchange Regulation Act (FERA) which

formed the statutory basis for exchange control in India was repealed and replaced by the new

Foreign Exchange Management Act (FEMA) with effect from June 2000. The philosophical approach

has shifted from that of conservation of foreign exchange to one of facilitating trade and payments as

well as developing orderly foreign exchange market. This definitive shift in the objectives of foreign

exchange management could be seen in the preamble to the new legislation.

FEMA provided a de jure status to the shift in the policies with regard to the external sector reforms

that began in 1990-91. Further and more importantly, FEMA has diluted the rigorous enforcement

provisions which were the hallmark of the erstwhile legislation. Unlike in FERA, the prosecution has to

prove the guilt of the accused person. Further, under FEMA only monetary penalty are provided for

contraventions. The categorisation of offences under FEMA as civil and not criminal constitutes one of

the most important differences between the two statutes. Contravention of FEMA provisions are dealt

with under civil law procedures, for which separate administrative procedure and mechanism in the

form of Compounding Rules, Adjudicating Authority, Special Director (Appeals) and Appellate Tribunal

have been established. Another significant change has been that for each process of law a time-frame

has been provided in the Act. For example, the process of compounding is required to be completed

within 180 days.

The concept of compounding in FEMA is another distinguishing feature, especially from the

perspective of customers. Under FERA, all violations were subject to separate investigation and

adjudication of the Directorate of Enforcement. However, FEMA provides for an opportunity of seeking

compounding of contraventions, in terms of which a contravener has a suo moto opportunity of making

2 BIS Review 9/2005

an application to the compounding authority seeking the contravention to be compounded. The

compounding authority is required under the Act to dispose of the application within 180 days. The

Government of India, in one of its recent Notifications, has designated the Reserve Bank as the

compounding authority for all contraventions, except for those involving hawala transactions for which

the Directorate of Enforcement would be the compounding authority. The Reserve Bank is in the

process of issuing the necessary direction for implementation of the process for compounding of

contravention under FEMA. I am sure the new procedure will go a long way in providing a quick and

hassle-free disposal of cases involving contravention(s) of FEMA.

Having delineated the context let me now turn to specifics of capital account liberalisation and the

accompanying challenges.

Capital account liberalization approach

Globalization of the world economy is a reality that makes opening up of the capital account and

integration with global economy an unavoidable process. Today capital account liberalization is not a

choice. Governor, Dr. Reddy once commented that, “capital account liberalisation is a process and it

has to be managed keeping in view the elasticity in the economy, and vulnerabilities or potential for

shocks. These include fiscal, financial, external, and even real sector say, oil prices and monsoon

conditions for India.”1

The capital account liberalization primarily aims at liberalizing controls that hinder the international

integration and diversification of domestic savings in a portfolio of home assets and foreign assets and

allows agents to reap the advantages of diversification of assets in the financial and real sector.

However, the benefits of capital mobility come with certain risks which should be categorized and

managed through a combination of administrative measures, gradual opening up of prudential

restrictions and safeguards to contain these risks.

The discussion on capital flows and monetary policy inevitably begins with the well-known “trilemma”

or the impossible trinity in the sense that a country can choose no more than two of the following three

features of its policy regime: (1) free capital mobility across borders, (2) a fixed exchange rate, and (3)

an independent monetary policy. Various combinations of these features have dominated world

monetary arrangements in different eras. The question of how developing and emerging-market

countries like ours should resolve the trilemma is very crucial. At best a medium-term goal of achieving

free capital mobility could be set with measured steps and optimal control.

Recent policy initiatives

India adopted a gradualist approach while initiating a process of gradual capital account liberalisation

in the early 1990s and treated it as a process rather than an event. In recent past, there has seen

significant changes in the external sector policy of the Reserve Bank. The Department concerned of

the Reserve Bank has been rechristened from the Exchange Control Department to Foreign Exchange

Department, highlighting the change in the intent and content of the policy framework. Let me assure

you that this change is not just a matter of semantics but is reflective of the changed mind-set. The

focus of the measures has been to dismantle controls and provide an enabling environment to all

entities engaged in external transactions. The current approach to liberalisation has been

characterized by greater transparency, data monitoring and information dissemination and to move

away from micro-management of foreign exchange transactions to macro management of forex flows

and forex market. The emphasis of the Reserve Bank has been to ensure that procedural formalities

are minimised so that exporters and others are able to concentrate on their core activity rather than

engaging in avoidable paper work, while ensuring observance of Know-Your-Customer (KYC)

guidelines.

The details of the various initiatives taken by the Reserve Bank will be discussed later by other

speakers. Let me, for the sake of completeness, present a quick run-down of the significant policy

measures in this context:

1

Remarks on Capital Account Liberalisation and capital controls by Dr. Y. V. Reddy, Governor, Central Bank Governors'

Symposium, 2004, Bank of England, June 25, 2004.

BIS Review 9/2005 3

Investment overseas

To further the process of capital account liberalisation, steps were taken to encourage the strategic

presence of the Indian corporates overseas. Overseas investment are also permitted for undertaking

agricultural activities including purchase of land incidental to this activity either directly or through the

overseas offices. These measures would enable the Indian companies to take advantage of global

opportunities and also acquire technological and other skills for their adoption in India. Indian

companies are now free to invest up to their net worth outside India without any ceiling.

External commercial borrowing

Keeping in view India’s external sector position, as reflected in country’s various external debt

sustainability indicators, a comprehensive review of the ECB guidelines was carried out in consultation

with the Government and revised ECB guidelines, effective February 1, 2004, were announced to

encourage corporates to access ECB for undertaking real investment activity in India and for overseas

direct investment in JVs and Wholly Owned Subsidiary (WOS). The maximum amount of ECB that can

be accessed under the Automatic Route is enhanced to USD 500 million (from USD 50 million

previously) per financial year. Further, transparency in policy implementation is evident from the fact

that the Reserve Bank now posts data of all ECB raised, both through the automatic route and the

approval route in the public domain on its website for information of all concerned. The thrust of the

new policy is to encourage investment in the real sector including infrastructure, while restricting debt

flows for purposes other than those adding to the country’s capital stock. Higher amount can be

accessed with prior approval of the RBI.

Foreign Direct Investment: The FDI policy followed has been to encourage investment in

manufacturing and infrastructure. A person resident outside India or an incorporated entity outside

India can invest either with the specific prior approval of the Government of India (12 activities), or

under the Automatic route (21 activities). There are 11 activities in which investment is not permissible.

Investment under automatic route is permissible without approval of the Government or the Reserve

Bank subject to the prescribed sectoral cap.

Portfolio Investment: Foreign Institutional Investors (FIIs) registered with SEBI and Non-resident

Indians are eligible to purchase shares and convertible debentures under the Portfolio Investment

Scheme subject to certain limits.

ADR / GDR: An Indian corporate can raise foreign currency resources abroad through the issue of

American Depository Receipts (ADRs) or Global Depository Receipts (GDRs) subject to certain

conditions. Two-way fungibility of ADRs/GDRs was operationalised to bring about alignment in the

prices of Indian stocks in the domestic vis-à-vis international markets.

Non-Resident Deposits: There have been significant changes in the policy framework for non-resident

Indian (NRI) deposits held by the Indian banking system, which constitute a major portion of external

debt for India. The interest rate on the deposits were rationalized and linked to international

benchmark LIBOR.

Liberalised remittance of USD 25,000 p.a. by Resident Individual: In order to provide hassle free

remittance facility based on a declaration resident individuals were allowed in early 2004 to remit up to

USD 25,000 per annum for any permitted purpose both under current and capital account or

combination of both. Resident individuals were also permitted to acquire property overseas and open

accounts with banks outside India.

Students: Indian students studying abroad are treated as Non-Resident Indians. As non-residents,

they are eligible for all the facilities available to NRIs, in addition to remittance facilities presently

available to students as residents.

Procedural simplifications

No liberalisation effort is complete unless the customers or the end-users of the forex market can

access the same through simple and transparent procedures. A number of initiatives have been taken

towards procedural simplification with an objective of reducing the transaction cost. In the case of

individuals, foreign exchange for current account transactions such as education, medical, travel,

emigration, maintenance of close relatives abroad can be drawn from the Authorised dealer based on

simple declaration up to certain indicated limits. Having regard to the liberalised approach in trade

matters, specific steps were taken to allow exporters greater flexibility and freedom in the matter of

4 BIS Review 9/2005

seeking regulatory compliances. The system of self write off and self extension of due date for export

realisation for exporters was introduced followed by raising the threshold limit for GR declaration.

Similarly, the simplifications of procedures for import remittances have also been introduced. Overall,

measures for simplification of procedures have been made subject to KYC and Anti Money Laundering

guidelines.

In keeping with its commitment to ensure hassle-free service to the customers the Reserve Bank has

constituted the Committee on Procedures and Performance Audit on Public Services (CPPAPS)

(Chairman: Shri S.S. Tarapore) in December 2003 to address the difficulties faced by common

persons in getting services from the banking sector. The Reserve Bank also advised banks to

constitute an adhoc committee in each of them to review the procedure followed by them and to

ensure that the instructions issued by the Reserve Bank are properly implemented. The CPPAPS, in

its Report No.1 on Exchange Controls relating to the Individuals, focused its attention on the

assessment of facilities and procedures for both residents and non-resident individuals. The

recommendations of the CPPAPS have been examined by the Reserve Bank and a number of steps

had already been taken for their implementation, securing procedural simplification. Further, measures

have been initiated to institutionalise the system for procedural simplification in respect of foreign

exchange transactions both at the level of the Reserve Bank and authorised dealers.

In recent years, the Reserve Bank has delegated authorities to authorised dealers to such an extent

that there is hardly any need for the individuals to approach the Reserve Bank for any approval.

However, we have come across instances where the liberalised procedures have not permeated to the

grassroot level in banks possibly due to lack of knowledge about various rules and regulations and

also procedures to be followed for various types of forex transactions. While, we at the Reserve Bank

would continue our efforts to improve the customer service rendered at the Reserve Bank and banks, I

request that any difficulties in getting facilities which are permissible may be brought to the notice of

the Reserve Bank.

Way ahead

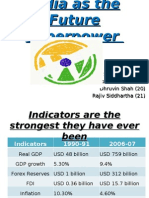

India’s capital account liberalisation measures have been largely effective. Among other factors,

suitable policy measures in respect of the external sector insulated India from the 1997 Asian crisis.

We have moved forward gradually towards Capital Account Convertibility with a broad reform agenda

that encompasses trade, competition, reform of the financial system and industrial restructuring.

As evident from various economic indicators, the liberalisation process that has been underway for

some time created a more competitive environment for Indian industry vis-à-vis what existed earlier.

Consequently, the Indian companies have upgraded their technology and expanded to more efficient

scales of production and refocused their activities to areas of competence. Increasingly, Indian

companies are looking to become global players. Reform measures in the external sector, including

dismantling of exchange control have been a contributor to this development.

We would continue to participate actively in the process of economic and financial globalisation,

accelerate domestic economic reform and continue with our firm commitment to liberalisation so as to

serve the needs of economic growth and development of the country. An increasingly liberalising

foreign exchange regulatory regime will be an essential ingredient to this vision.

Thank You.

BIS Review 9/2005 5

Вам также может понравиться

- C F E R: Ontext OF Oreign Xchange EgulationsДокумент10 страницC F E R: Ontext OF Oreign Xchange EgulationsrahluvОценок пока нет

- Rbi Fema PDFДокумент22 страницыRbi Fema PDFPriyahemani100% (1)

- Foreign Exchange Management Act, 1999Документ8 страницForeign Exchange Management Act, 1999amluxavier100% (1)

- Fathoming FEMA (Overview of Provisions of Foreign Exchange Management Act, 1999 (FEMA) and Rules and Regulations There Under) by Rajkumar S Adukia 4Документ16 страницFathoming FEMA (Overview of Provisions of Foreign Exchange Management Act, 1999 (FEMA) and Rules and Regulations There Under) by Rajkumar S Adukia 4Apoorv GogarОценок пока нет

- Role of FedaiДокумент221 страницаRole of Fedaianon_565902225Оценок пока нет

- Rahul Company LawДокумент26 страницRahul Company LawSanyam MishraОценок пока нет

- Impact of Fema On ForexДокумент6 страницImpact of Fema On ForexEsha GuptaОценок пока нет

- FERA to FEMA: Understanding India's Foreign Exchange LawsДокумент14 страницFERA to FEMA: Understanding India's Foreign Exchange Lawsjoy parimalaОценок пока нет

- Address by S.P. Talwar Deputy Governor Reserve Bank of IndiaДокумент5 страницAddress by S.P. Talwar Deputy Governor Reserve Bank of Indiaprasshantv1Оценок пока нет

- Project (1) Ib FinanceДокумент14 страницProject (1) Ib FinanceamitОценок пока нет

- Role of Foreign Exchange Management Act 2000Документ34 страницыRole of Foreign Exchange Management Act 2000Ronaldo Louis100% (1)

- Capital Account Convertibility in Bangladesh v2Документ32 страницыCapital Account Convertibility in Bangladesh v2Nahid HawkОценок пока нет

- Fera To FemaДокумент53 страницыFera To FemaJay BarchhaОценок пока нет

- MF0016 - Treasury ManagementДокумент7 страницMF0016 - Treasury ManagementHimanshu MittalОценок пока нет

- Financial Management of Courts BudgetДокумент16 страницFinancial Management of Courts BudgetJhodheen HerreraОценок пока нет

- Fema ActДокумент12 страницFema ActTarun UpadhyayОценок пока нет

- Capital Account ConvertibilityДокумент9 страницCapital Account ConvertibilityShihas Muhammed AshrafОценок пока нет

- Role of FedaiДокумент2 страницыRole of Fedaikrissh_87Оценок пока нет

- Implementation of The Recommendations of Sodhani CommitteeДокумент2 страницыImplementation of The Recommendations of Sodhani Committeekrissh_87Оценок пока нет

- Congress July 2018 Box Eng 2Документ3 страницыCongress July 2018 Box Eng 2ATHIОценок пока нет

- Khanna Committee IonsДокумент15 страницKhanna Committee Ionsvikas1978Оценок пока нет

- New Microsoft Word DocumentДокумент5 страницNew Microsoft Word Documentsherlschris43Оценок пока нет

- 32financial MarketДокумент30 страниц32financial MarketEndrias EyanoОценок пока нет

- Chapter Five Regulation of Financial Markets and Institutions and Financial InnovationДокумент22 страницыChapter Five Regulation of Financial Markets and Institutions and Financial InnovationMikias DegwaleОценок пока нет

- 2.4.1 Fera - Fema 2Документ4 страницы2.4.1 Fera - Fema 2Khushi IngaleОценок пока нет

- The Capital Account and Pakistani Rupee Convertibility: Macroeconomic Policy Challenges Irfan Ul HaqueДокумент27 страницThe Capital Account and Pakistani Rupee Convertibility: Macroeconomic Policy Challenges Irfan Ul HaqueMaria ChaudhryОценок пока нет

- Uva-Dare (Digital Academic Repository)Документ30 страницUva-Dare (Digital Academic Repository)Bizu AtnafuОценок пока нет

- Audit of Forex TransactionsДокумент4 страницыAudit of Forex Transactionsnamcheang100% (2)

- Abstract:: Main Job of IMF: 1) SurveillanceДокумент10 страницAbstract:: Main Job of IMF: 1) SurveillancePrafulla TekriwalОценок пока нет

- IFM InsightsДокумент37 страницIFM Insights9832155922Оценок пока нет

- Strengthening Tanzania's Financial Sector Through ReformsДокумент5 страницStrengthening Tanzania's Financial Sector Through ReformsMussa AthanasОценок пока нет

- Financial Sector Reform: Review and Prospects (Part 1 of 2)Документ10 страницFinancial Sector Reform: Review and Prospects (Part 1 of 2)ravidingyОценок пока нет

- Economics Omkar JoshiДокумент7 страницEconomics Omkar JoshiYash AgarwalОценок пока нет

- BE 3rd UnitДокумент9 страницBE 3rd UnitShashi KantОценок пока нет

- Islamic Banking FAQs GuideДокумент9 страницIslamic Banking FAQs Guidefixa khalidОценок пока нет

- Capital MarketsДокумент75 страницCapital MarketsnyawirahОценок пока нет

- Updates On JAIIB/CAIIB Papers Note:: Module AДокумент15 страницUpdates On JAIIB/CAIIB Papers Note:: Module ARamasundaram TОценок пока нет

- Analysis of The International Monetary Regime in The Age of CryptocurrenciesДокумент11 страницAnalysis of The International Monetary Regime in The Age of CryptocurrenciesVarun AgarwalОценок пока нет

- FEMA Replaced FERA to Liberalize Foreign Exchange Management in IndiaДокумент14 страницFEMA Replaced FERA to Liberalize Foreign Exchange Management in IndiaHeena ShaikhОценок пока нет

- Global LinkagesДокумент36 страницGlobal Linkagesraashid91Оценок пока нет

- Company LawДокумент16 страницCompany LawHarshita NegiОценок пока нет

- Financial Markets AND Financial Services: Recent Trends in The Capital MarketДокумент8 страницFinancial Markets AND Financial Services: Recent Trends in The Capital MarketAmit PandeyОценок пока нет

- Final Exam - International FinanceДокумент59 страницFinal Exam - International FinanceSusan ArafatОценок пока нет

- Dre Been: What Are Type of Facili. Es Offered by Housing Finance Companies. What Are Some ofДокумент10 страницDre Been: What Are Type of Facili. Es Offered by Housing Finance Companies. What Are Some oframdayal kumawatОценок пока нет

- Managing Foreign Debt and Liquidity: India's Experience: Payments Chaired by DR C Rangarajan. The Committee RecommendedДокумент6 страницManaging Foreign Debt and Liquidity: India's Experience: Payments Chaired by DR C Rangarajan. The Committee RecommendedSaurav SinghОценок пока нет

- Fema Act 1999Документ13 страницFema Act 1999Arun ArunОценок пока нет

- REGULATION OF INDIAN FOREIGN EXCHANGEДокумент21 страницаREGULATION OF INDIAN FOREIGN EXCHANGEankit_vardhan25Оценок пока нет

- Final PPT Reforms in Financial SystemДокумент25 страницFinal PPT Reforms in Financial SystemUSDavidОценок пока нет

- Capital Markets AuthorityДокумент26 страницCapital Markets AuthorityjmarendexОценок пока нет

- Fema FeraДокумент9 страницFema FeraJaya Geet KwatraОценок пока нет

- The Impact of International Corporate Law in EgyptДокумент20 страницThe Impact of International Corporate Law in EgyptshroukОценок пока нет

- Modernization of Indian Stock MarketsДокумент9 страницModernization of Indian Stock MarketsKulraj SinghОценок пока нет

- Securitisation in India: Next StepsДокумент9 страницSecuritisation in India: Next StepsSaurabh TripathiОценок пока нет

- SEBI Advisory Report on Development of Derivative Markets in IndiaДокумент27 страницSEBI Advisory Report on Development of Derivative Markets in IndiaAnna AnandОценок пока нет

- F.E.R.A. AND F.E.M.A. GUIDEДокумент23 страницыF.E.R.A. AND F.E.M.A. GUIDESmriti SinghОценок пока нет

- Project Report: P.G.D.F.MДокумент13 страницProject Report: P.G.D.F.MgurudevgaytriОценок пока нет

- Financial Regulation in South AfricaДокумент202 страницыFinancial Regulation in South AfricaCoastal Roy100% (4)

- Transcript of "Fera and Fema"Документ8 страницTranscript of "Fera and Fema"tukuОценок пока нет

- Final An Introduction To MRTPДокумент9 страницFinal An Introduction To MRTPRitesh RaoОценок пока нет

- WEight Training ScheduleДокумент2 страницыWEight Training Scheduleapi-3712367100% (1)

- Just in TimeДокумент3 страницыJust in Timeapi-3712367Оценок пока нет

- 8086 Cpu ArchitectureДокумент9 страниц8086 Cpu Architectureapi-371236783% (6)

- L & TДокумент9 страницL & Tapi-3712367Оценок пока нет

- Foreign Exchange Management Policy in IndiaДокумент6 страницForeign Exchange Management Policy in Indiaapi-371236767% (3)

- 72903Документ11 страниц72903api-3712367Оценок пока нет

- Anti-Inflationary Policy in IndiaДокумент14 страницAnti-Inflationary Policy in Indiaapi-3712367Оценок пока нет

- India As SuperpowerДокумент21 страницаIndia As Superpowerapi-3712367Оценок пока нет

- Fiscal Deficit 2003 FormatДокумент19 страницFiscal Deficit 2003 Formatapi-3712367Оценок пока нет

- Manging Foreign ExchnageДокумент6 страницManging Foreign Exchnageapi-3712367Оценок пока нет

- Policybrief Nov05Документ6 страницPolicybrief Nov05api-3712367Оценок пока нет

- FFRChange HistoryДокумент1 страницаFFRChange Historyapi-3712367Оценок пока нет

- Manging Foreign ExchnageДокумент6 страницManging Foreign Exchnageapi-3712367Оценок пока нет

- Report OnДокумент9 страницReport Onapi-3712367Оценок пока нет

- Macroeconomics AssignmentsДокумент15 страницMacroeconomics Assignmentsapi-3712367Оценок пока нет

- Macro Economics OutlineДокумент2 страницыMacro Economics Outlineapi-3712367100% (1)

- Subprime Toxic Debt - Bloomberg July07Документ10 страницSubprime Toxic Debt - Bloomberg July07api-3712367Оценок пока нет

- D&B Economy Observer November 07Документ3 страницыD&B Economy Observer November 07api-3712367Оценок пока нет

- Subprime FinalДокумент34 страницыSubprime Finalapi-3712367Оценок пока нет

- SubPrime Mortgage MarketДокумент6 страницSubPrime Mortgage Marketapi-3712367Оценок пока нет

- FOREX Management Versus SingaporeДокумент3 страницыFOREX Management Versus Singaporeapi-3712367Оценок пока нет

- US Subprime 070817Документ6 страницUS Subprime 070817api-3712367Оценок пока нет

- SubprimeДокумент31 страницаSubprimeapi-3712367Оценок пока нет

- Sebi TocДокумент33 страницыSebi Tocapi-3712367Оценок пока нет

- Global Economics - IndiaДокумент2 страницыGlobal Economics - Indiaapi-3712367Оценок пока нет

- BSC & Knowledge ManagementДокумент3 страницыBSC & Knowledge Managementapi-3712367100% (1)

- Balanced Scorecard Elearning - PresentationДокумент39 страницBalanced Scorecard Elearning - Presentationapi-3712367Оценок пока нет

- Balanced ScorecardДокумент13 страницBalanced Scorecardapi-3712367Оценок пока нет

- Balanced Scorecard 02Документ7 страницBalanced Scorecard 02api-3712367100% (2)

- Linder's Theory of Demand and Trade Pattern - EconomicsДокумент6 страницLinder's Theory of Demand and Trade Pattern - EconomicsMarjorie Cabauatan BirungОценок пока нет

- The Marriott WayДокумент4 страницыThe Marriott WayDevesh RathoreОценок пока нет

- MPU 2163 - ExerciseДокумент7 страницMPU 2163 - ExerciseReen Zaza ZareenОценок пока нет

- Employee Complaint FormДокумент4 страницыEmployee Complaint FormShah NidaОценок пока нет

- Field Study-1 Learning Episode:1 4 Activity 14: The Teacher As A Person and As A ProfessionalДокумент5 страницField Study-1 Learning Episode:1 4 Activity 14: The Teacher As A Person and As A ProfessionalIlex Avena Masilang100% (3)

- Tamanna Garg Roll No - 19-14 6 Sem 3rd Year Assignment of Modern Political PhilosophyДокумент17 страницTamanna Garg Roll No - 19-14 6 Sem 3rd Year Assignment of Modern Political PhilosophytamannaОценок пока нет

- Masturbation Atonal World ZizekДокумент7 страницMasturbation Atonal World ZizekSoren EvinsonОценок пока нет

- Approaching Ottoman HistoryДокумент274 страницыApproaching Ottoman HistoryTurcology Tirana100% (4)

- Broward Sheriffs Office Voting Trespass AgreementДокумент20 страницBroward Sheriffs Office Voting Trespass AgreementMichelle SolomonОценок пока нет

- Warren Harding Error - Shreyas InputsДокумент2 страницыWarren Harding Error - Shreyas InputsShreyОценок пока нет

- Words: BrazenДокумент16 страницWords: BrazenRohit ChoudharyОценок пока нет

- Jawaharlal Nehru Best Thesis Award 2014Документ5 страницJawaharlal Nehru Best Thesis Award 2014BuyResumePaperUK100% (2)

- PIL NotesДокумент19 страницPIL NotesGoldie-goldAyomaОценок пока нет

- Care Zambia 20th Anniversary BookДокумент70 страницCare Zambia 20th Anniversary BookCAREZAMBIAОценок пока нет

- Ict Slac MatrixДокумент3 страницыIct Slac Matrixarmand resquir jrОценок пока нет

- East European Politics & SocietiesДокумент40 страницEast European Politics & SocietiesLiviu NeagoeОценок пока нет

- Statcon - Week2 Readings 2Документ142 страницыStatcon - Week2 Readings 2Kê MilanОценок пока нет

- Kenya Law Internal Launch: Issue 22, July - September 2013Документ248 страницKenya Law Internal Launch: Issue 22, July - September 2013ohmslaw_Arigi100% (1)

- Special Power of AttorneyДокумент2 страницыSpecial Power of AttorneySharmaine ValenzuelaОценок пока нет

- Rizal's works promote nationalism and patriotismДокумент5 страницRizal's works promote nationalism and patriotismEleanor RamosОценок пока нет

- Subhadra Kumari Chauhan - BiographyДокумент3 страницыSubhadra Kumari Chauhan - Biographyamarsingh1001Оценок пока нет

- 13 Feb 2021 Daily DoseДокумент13 страниц13 Feb 2021 Daily DoseShehzad khanОценок пока нет

- PMBR Flash Cards - Constitutional Law - 2007 PDFДокумент106 страницPMBR Flash Cards - Constitutional Law - 2007 PDFjackojidemasiado100% (1)

- Cooperative Learning: Case StudyДокумент3 страницыCooperative Learning: Case StudyEdith Zoe Lipura RoblesОценок пока нет

- Inspiring Freedom FightersДокумент6 страницInspiring Freedom FightersAjitОценок пока нет

- FC - FVДокумент88 страницFC - FVandrea higueraОценок пока нет

- PIL Past Exam CompilationДокумент8 страницPIL Past Exam CompilationMarkonitchee Semper FidelisОценок пока нет

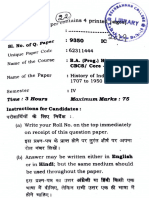

- B.A (Prog) History 4th Semester 2019Документ22 страницыB.A (Prog) History 4th Semester 2019lakshyadeep2232004Оценок пока нет

- William C. Pond's Ministry Among Chinese Immigrants in San FranciscoДокумент2 страницыWilliam C. Pond's Ministry Among Chinese Immigrants in San FranciscoMichael AllardОценок пока нет

- Philippines laws on referendum and initiativeДокумент17 страницPhilippines laws on referendum and initiativeGeorge Carmona100% (1)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Joy of Agility: How to Solve Problems and Succeed SoonerОт EverandJoy of Agility: How to Solve Problems and Succeed SoonerРейтинг: 4 из 5 звезд4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОценок пока нет

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistОт EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistРейтинг: 4.5 из 5 звезд4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsОт EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsОценок пока нет

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityОт EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanОт EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanРейтинг: 4.5 из 5 звезд4.5/5 (79)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthОт EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthОценок пока нет

- Value: The Four Cornerstones of Corporate FinanceОт EverandValue: The Four Cornerstones of Corporate FinanceРейтинг: 4.5 из 5 звезд4.5/5 (18)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000От EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Рейтинг: 4.5 из 5 звезд4.5/5 (86)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorОт EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorОценок пока нет

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)От EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Рейтинг: 4.5 из 5 звезд4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- LLC or Corporation?: Choose the Right Form for Your BusinessОт EverandLLC or Corporation?: Choose the Right Form for Your BusinessРейтинг: 3.5 из 5 звезд3.5/5 (4)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsОт EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsОценок пока нет

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionОт EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionРейтинг: 5 из 5 звезд5/5 (3)

- Financial Management: The Basic Knowledge of Financial Management for StudentОт EverandFinancial Management: The Basic Knowledge of Financial Management for StudentОценок пока нет

- Will Work for Pie: Building Your Startup Using Equity Instead of CashОт EverandWill Work for Pie: Building Your Startup Using Equity Instead of CashОценок пока нет

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EОт EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EРейтинг: 4.5 из 5 звезд4.5/5 (6)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionОт EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionРейтинг: 5 из 5 звезд5/5 (1)