Академический Документы

Профессиональный Документы

Культура Документы

Weekly Update 24 Sept 2011

Загружено:

Mitesh ThackerАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Weekly Update 24 Sept 2011

Загружено:

Mitesh ThackerАвторское право:

Доступные форматы

WEEKLY TRADING HIGHLIGHTS & OUTLOOK

24 Sept, 11

S&P CNX NIFTY

OPEN

5068.40

HIGH

5168.40

LOW

4829.60

CLOSE

4867.75

Change(pts)

-216.50

Change (%)

-4.26%

MARKET OUTLOOK The NIFTY opened the week on tentative note and registered an intraweek high of 5168 levels. The Index witnessed selling pressure from the higher level which led it to decline to an intraweek low of 4829 levels. The Nifty finally closed at 4867 with a loss of 216 points. The most important observation is that the index has registered a breakdown from its trading range of 4900 -5170. This breakdown suggests that the index is likely to decline towards the level of 4840 /4800 /4750-4720 (recent swing low) levels in the near term. Further it is to be noted that the index has witnessed a sharp fall of more than 250 points in the last 2 sessions which has stretched the short term indicators into an oversold territory.Hence a pullback from the current level cannot be ruled out. Any up move from the current level is likely to face stiff resistance around the 4910 followed by the 4970 / 5025 /5060 levels. A close below the recent swing low of 4720 levels would accentuate the declining momentum towards the level of 4675 /4600 levels.

WEEKLY TRADING HIGHLIGHTS & OUTLOOK

24 Sept, 11

BSE - SENSEX

OPEN HIGH 16865.93 17191.12

LOW

16052.47

CLOSE

16162.06

Change(pts)

771.77

Change (%)

-4.56%

MARKET OUTLOOK The Sensex opened the week on tentative and registered an intraweek high of 17191 levels. The Index witnessed selling pressure from the higher level which led it to decline to an intraweek low of 16052 levels. The Sensex finally closed at 16162 with a loss of 771 points. The most important observation is that the index has registered a breakdown from its trading range of 16380 -17360. This breakdown suggests that the index is likely to decline towards the level of 16070 / 15850 -15765 (recent swing low) levels in the near term. Further it is to be noted that the index has witnessed a sharp fall of more than 900 points in the last 2 sessions which has stretched the short term indicators into an oversold territory.Hence a pullback from the current level cannot be ruled out. Any up move from the current level is likely to face stiff resistance around the 16400 followed by the 16545/16720 /16830 levels. A close below the recent swing low of 15765 levels would accentuate the declining momentum towards the level of 15650 /15360 levels. Key Levels & Averages

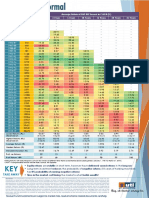

INDEX SENSEX NIFTY BANK-NIFTY Close Support-1 Support-2 Resistance-1 Resistance-2 8 DMA 34 DMA 200 DMA

16162 4867 9375

16070 4800 9260

15850 4720 9100

16400 4910 9570

16545 4970 9760

16639 5003 9600

16932 5087 9828

18397 5520 10814

WEEKLY TRADING HIGHLIGHTS & OUTLOOK

TRADING RECOMMENDATIONS

24 Sept, 11

CLOSE (CMP)

9375.70

SUPPORT-1

9260

SUPPORT-2

9100

RESISTANCE-1

9570

RESISTANCE-2

9760

Bank NIFTY Ltd. CMP 9375.70 Technical Outlook & Trading Strategy:The overall movement of bank nifty has taken the form of double top Bearish reversal pattern. This pattern would be confirmed once the index breaks the support level of 9260 levels. The measuring implication of the pattern suggests that the index could decline towards the level of 9100 / 8960 /8920(recent swing low) / 8700 levels. In case the index manages to hold on to the support level of 9260 then it could be confined in a range of 9200 -9970.

CLOSE (`CMP) SUPPORT-1 625.00 600.00

SUPPORT-2 RESISTANCE-1

582.00 636.00

RESISTANCE-2 52 week-High

645.60 860.80

52 week-Low

582.30

Housing Development Finance Corporation Ltd (HDFC) CMP` 625.00 Technical Outlook & Trading Strategy:The Share price of HDFC Ltd has been consolidating within broad ranges of `612.4 to `732 levels. But, the key observation to be made is that the price of HDFC Ltd has formed a head and shoulder pattern on the Daily charts. A breakdown from the said pattern would be confirmed when the price breaks below the neckline level of `623.5 levels. The momentum indicator is also in sell mode. The prices of HDFC Ltd will face severe selling pressure once it starts trading below the neckline level of `623.5 levels. We recommend traders to sell 50% below `623.5 and again in the range of `632 `636levels with a stop loss placed above `645.6 levels for targets of `600 `582 levels, expected to be achieved in coming few Sessions

WEEKLY TRADING HIGHLIGHTS & OUTLOOK

24 Sept, 11

CLOSE (`CMP) SUPPORT-1

103.00 96.00

SUPPORT-2

92.00

RESISTANCE-1

106.20

RESISTANCE-2 52 week-High

108 202.25

52 week-Low

101.65

IDBI Bank Ltd. CMP - ` 103.00 Technical Outlook & Trading Strategy:On the weekly chart of the IDBI BANK the stock is forming a reverse Flag formation. Traders should note that Reverse Flags generally occur as consolidation pattern during a down trend and a breakdown suggests continuation of the recent down move. Once the stock sustains below 101.8 then the stock is likely to test the levels of ` 90/ `82. We recommend traders to sell 50% below`101.8 and again in the range of `103-- `104 levels with a stop loss placed above `106.2 levels for targets of `96 `92 levels, expected to be achieved in coming few Sessions.

CLOSE (`CMP) SUPPORT-1 770.60 742.00

SUPPORT-2

720.00

RESISTANCE1

785.00

RESISTANCE2

795.60

52 week-High

1124.90

52 week-Low

712.00

Reliance Industries Ltd. CMP` 770.60 Technical Outlook & Trading Strategy:The price of Reliance Ind. has made a double top formation and fell sharply from a high of `853.8 levels during last week. The double top formation is also backed by a heavy volume in the stock. The momentum indicator is also in bearish zone. Thus, all of the above technical evidence is suggesting a trend reversal. We recommend traders to sell 50% now and again in the range of `780-- `785 levels with a stop loss placed above `795.6 levels for targets of `742 `720 levels, expected to be achieved in coming few Sessions.

WEEKLY TRADING HIGHLIGHTS & OUTLOOK

24 Sept, 11

CLOSE (`CMP) SUPPORT-1

1069.25 1055

SUPPORT-2

1037

RESISTANCE1

1110

RESISTANCE2

1140

52 week-High

1144.00

52 week-Low

917.60

ACC Ltd. CMP` 1069.25 Technical Outlook & Trading Strategy:The share price of ACC Ltd has already been moving up for the last few days and is very likely that the stock price will test its immediate resistance of ` 1135 - ` 1142.5 in the next few days. The momentum indicators remain in the rising trajectory and indicate strength in the current up-move. The stock is also sustaining above its Cluster moving averages. We recommend traders to buy only in the case of any pullback in the market , buy 50% now and again on dips up to 1060--1055 levels with a stop loss placed below `1037.8 levels for targets of `1110 `1140 levels.

Disclaimer

The views expressed are based purely on Technical studies. The calls made herein are for information purpose only. The information and views presented here are prepared by Matrix Solutions and his associates. The information contained herein is based on their analysis of the Charts and up on sources that are considered reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any loss incurred based upon it. The investments discussed or recommended on this Website may not be suitable for all investors. Past performance may not be indicative of future performance. Some of the securities/commodities presented herein should be considered speculative with a high degree of volatility and risk. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advice, as they believe necessary. You specifically agree to consult with a registered investment advisor, which we are not, prior to making any trading decision of any kind. While acting upon any information or analysis mentioned on this website, investors may please note that neither Matrix Solutions nor any person connected with him accepts any liability arising from the use of this information and views mentioned herein. Matrix Solutions and his affiliates may hold long or short positions in the securities/commodities discussed herein from time to time the services are intended for a restricted audience and we are not soliciting any action based on it. Neither the information nor any opinion expressed herein constitutes an offer or an invitation to make an offer, to buy or sell any securities/commodities, or any options, futures or other derivatives related to such securities/commodities. Part of this website may contain advertising and other material submitted to us by third parties. We do not accept liability in respect of any advertisements. You acknowledge that any warranty that is provided in connection with any of the products or services advertised on this website described herein is provided solely by the owner, advertiser, manufacturer or supplier of that product and/or service, and not by us. We do not warrant that your access to the Website and/or related services will be uninterrupted or error-free, that defects will be corrected, or that this site or the server that makes it available is free of viruses or other harmful components. Subscribers are advised to understand that the services can fail due to failure of hardware, software, and Internet connection. Access to and use of this site and the information is at your risk and we do not undertake any accountability for any irregularities, viruses or damage to any computer or Mobiles that results from accessing, availing or downloading of any information from this site. We do not warrant or make any representations regarding the use or the results of the use of any product and/or service purchased in terms of its compatibility, correctness, accuracy, reliability or otherwise. You assume total responsibility and risk for your use of this site and site-related services. A possibility exists that the site could include inaccuracies or errors. Additionally, a possibility exists that unauthorized additions, deletions or alterations could be made by third parties to the site. Although we attempt to ensure the integrity, correctness and authenticity of the site, it makes no guarantees whatsoever as to its completeness, correctness or accuracy. In the event that such an inaccuracy arises, please inform our staff so that it can be corrected. Price and availability of products and services offered on the site are subject to change without prior notice. To the extent we provide information on the availability of products or services you should not rely on such information. We will not be liable for any lack of availability of products and services you may order through the site. Transactions shall be governed by and construed in accordance with the laws of India, without regard to the laws regarding conflicts of law. Any litigation or any action at law or in equity arising out of or relating to these agreement or transaction shall be subject to Mumbai jurisdiction only and the customer hereby agrees consents and submits to the jurisdiction of such courts for the purpose of litigating any such action. A CALL ON SMS is a service given only to members with the sole intention to aid their information means. We do not guarantee any accuracy of generation, databases, delivery timings etc. while giving this facility. Depending on your location, service provider, medium of communication and delivery, the service may be at times slow or not there at all. We do not guarantee completion of delivery. We shall in no way be responsible for delays in receiving SMS on the mobile caused due to delivery methods chosen by the Service Provider, rush on the Service Providers Servers or any other reason whatsoever that may cause such a delay. Use of this website and its services constitutes acceptance of Disclaimer, Privacy Policy and Terms of Use.

Вам также может понравиться

- Weekly Update 10nd Dec 2011Документ5 страницWeekly Update 10nd Dec 2011Devang VisariaОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- Weekly Update 3rd Dec 2011Документ5 страницWeekly Update 3rd Dec 2011Devang VisariaОценок пока нет

- Weekly Update 31 Dec 2011Документ5 страницWeekly Update 31 Dec 2011Devang VisariaОценок пока нет

- Weekly Update 17th Dec 2011Документ6 страницWeekly Update 17th Dec 2011Devang VisariaОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- Weekly Update 26th Nov 2011Документ5 страницWeekly Update 26th Nov 2011Devang VisariaОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- Technical Report 14th November 2011Документ5 страницTechnical Report 14th November 2011Angel BrokingОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-234732356Оценок пока нет

- Technical Report 5th December 2011Документ5 страницTechnical Report 5th December 2011Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (16213) / NIFTY (4867)Документ5 страницDaily Technical Report: Sensex (16213) / NIFTY (4867)Angel BrokingОценок пока нет

- Technical Report 9th November 2011Документ5 страницTechnical Report 9th November 2011Angel BrokingОценок пока нет

- Daily Morning Update 26 Sept 2011Документ2 страницыDaily Morning Update 26 Sept 2011Mitesh ThackerОценок пока нет

- Definedge Diwali NewsletterДокумент10 страницDefinedge Diwali NewsletterSubbarayudu PasupulaОценок пока нет

- Technical Report 16th December 2011Документ5 страницTechnical Report 16th December 2011Angel BrokingОценок пока нет

- Technical Report 23rd April 2012Документ5 страницTechnical Report 23rd April 2012Angel BrokingОценок пока нет

- Stock Option Latest News by Theequicom For Today 09 September 2014Документ7 страницStock Option Latest News by Theequicom For Today 09 September 2014Riya VermaОценок пока нет

- Technical Report 12th October 2011Документ4 страницыTechnical Report 12th October 2011Angel BrokingОценок пока нет

- Technical Report 4th November 2011Документ5 страницTechnical Report 4th November 2011Angel BrokingОценок пока нет

- Technical Report 3rd November 2011Документ5 страницTechnical Report 3rd November 2011Angel BrokingОценок пока нет

- Daily Morning Update 5dec 2011Документ3 страницыDaily Morning Update 5dec 2011Devang VisariaОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-234732356Оценок пока нет

- Technical Report 30th January 2012Документ5 страницTechnical Report 30th January 2012Angel BrokingОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-234732356Оценок пока нет

- Technical Report 14th February 2012Документ5 страницTechnical Report 14th February 2012Angel BrokingОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-256777091Оценок пока нет

- Daily Option News Letter 05 July 2013Документ7 страницDaily Option News Letter 05 July 2013Rakhi Sharma Tips ProviderОценок пока нет

- Technical Report 10th October 2011Документ4 страницыTechnical Report 10th October 2011Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (17430) / NIFTY (5279)Документ4 страницыDaily Technical Report: Sensex (17430) / NIFTY (5279)Angel BrokingОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-234732356Оценок пока нет

- Daily Technical Report: Sensex (17691) / NIFTY (5366)Документ4 страницыDaily Technical Report: Sensex (17691) / NIFTY (5366)Angel BrokingОценок пока нет

- Commodity Outlook 11.10Документ3 страницыCommodity Outlook 11.10Devang VisariaОценок пока нет

- Technical Report 31st January 2012Документ5 страницTechnical Report 31st January 2012Angel BrokingОценок пока нет

- Deirvatives Report 27th DecДокумент3 страницыDeirvatives Report 27th DecAngel BrokingОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-256777091Оценок пока нет

- Daily Morning Update 15 Dec 2011Документ3 страницыDaily Morning Update 15 Dec 2011Devang VisariaОценок пока нет

- Commodity Outlook 14.10.11Документ3 страницыCommodity Outlook 14.10.11Devang VisariaОценок пока нет

- Technical Report 2nd December 2011Документ5 страницTechnical Report 2nd December 2011Angel BrokingОценок пока нет

- ReportДокумент4 страницыReportHimanshuОценок пока нет

- ReportДокумент6 страницReportumaganОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-256777091Оценок пока нет

- Daily Technical Report: Sensex (16973) / NIFTY (5146)Документ4 страницыDaily Technical Report: Sensex (16973) / NIFTY (5146)Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (17233) / NIFTY (5235)Документ4 страницыDaily Technical Report: Sensex (17233) / NIFTY (5235)Angel BrokingОценок пока нет

- Weekly Technical ReportДокумент5 страницWeekly Technical ReportumaganОценок пока нет

- Technical Report 20th December 2011Документ5 страницTechnical Report 20th December 2011Angel BrokingОценок пока нет

- Technical Report 16th January 2012Документ5 страницTechnical Report 16th January 2012Angel BrokingОценок пока нет

- Technical Report 13th February 2012Документ5 страницTechnical Report 13th February 2012Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (17783) / NIFTY (5387)Документ4 страницыDaily Technical Report: Sensex (17783) / NIFTY (5387)Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (17214) / NIFTY (5227)Документ4 страницыDaily Technical Report: Sensex (17214) / NIFTY (5227)Angel BrokingОценок пока нет

- Technical Report 9th March 2012Документ5 страницTechnical Report 9th March 2012Angel BrokingОценок пока нет

- Sector Technical Watch: Retail ResearchДокумент6 страницSector Technical Watch: Retail ResearchGauriGanОценок пока нет

- Daily Morning Update 22 Dec 2011Документ3 страницыDaily Morning Update 22 Dec 2011Devang VisariaОценок пока нет

- Technical Format With Stock 20.09Документ4 страницыTechnical Format With Stock 20.09Angel BrokingОценок пока нет

- Daily Option News Letter: 25/june/2014Документ7 страницDaily Option News Letter: 25/june/2014api-256777091Оценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-234732356Оценок пока нет

- Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-17-July-2014Документ7 страницStock-Option-Trading-Tips-Provided-By-Theequicom-For Today-17-July-2014Riya VermaОценок пока нет

- The Illustrated Guide to Technical Analysis Signals and PhrasesОт EverandThe Illustrated Guide to Technical Analysis Signals and PhrasesОценок пока нет

- Market Report-Commodity 26.12Документ4 страницыMarket Report-Commodity 26.12Mitesh ThackerОценок пока нет

- MT-Daily Morning Update 6th - June 2012Документ4 страницыMT-Daily Morning Update 6th - June 2012Mitesh ThackerОценок пока нет

- MT-Daily Equity Morning Update 27 Dec 2011Документ4 страницыMT-Daily Equity Morning Update 27 Dec 2011Mitesh ThackerОценок пока нет

- MT-Daily Morning Update 30 Dec 2011Документ4 страницыMT-Daily Morning Update 30 Dec 2011Mitesh ThackerОценок пока нет

- This Is The Daily Morning Commodity Repost of 26 Dec 2011. For More Details VisiДокумент1 страницаThis Is The Daily Morning Commodity Repost of 26 Dec 2011. For More Details VisiMitesh ThackerОценок пока нет

- Commodity Trading Market Report and TipsДокумент4 страницыCommodity Trading Market Report and TipsMitesh ThackerОценок пока нет

- Commodity Outlook 28.10.11Документ3 страницыCommodity Outlook 28.10.11Devang VisariaОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- Commodity Outlook 02 Nov 2011Документ3 страницыCommodity Outlook 02 Nov 2011Mitesh ThackerОценок пока нет

- Weekly Performance of Nifty Calls 29 OctДокумент1 страницаWeekly Performance of Nifty Calls 29 OctDevang VisariaОценок пока нет

- Weekly Performance of Trading Calls 29 OctДокумент1 страницаWeekly Performance of Trading Calls 29 OctDevang VisariaОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- Daily Morning Update 31st Oct 2011Документ2 страницыDaily Morning Update 31st Oct 2011Devang VisariaОценок пока нет

- Weekly Performance of Intraday Calls 29 OctДокумент1 страницаWeekly Performance of Intraday Calls 29 OctDevang VisariaОценок пока нет

- Daily Morning Update 24 Oct 2011Документ2 страницыDaily Morning Update 24 Oct 2011Devang VisariaОценок пока нет

- Commodity Outlook 25.10.11Документ3 страницыCommodity Outlook 25.10.11Devang VisariaОценок пока нет

- Daily Morning Update 26 Oct 2011Документ2 страницыDaily Morning Update 26 Oct 2011Devang VisariaОценок пока нет

- MCX PerformanceДокумент1 страницаMCX PerformanceMitesh ThackerОценок пока нет

- NCDEX PerformanceДокумент1 страницаNCDEX PerformanceMitesh ThackerОценок пока нет

- Weekly Performance of Til Date of 22 OctДокумент1 страницаWeekly Performance of Til Date of 22 OctMitesh ThackerОценок пока нет

- Daily Morning Update 21 Oct 2011Документ2 страницыDaily Morning Update 21 Oct 2011Devang VisariaОценок пока нет

- Daily Morning Update 20 Oct 2011Документ2 страницыDaily Morning Update 20 Oct 2011Devang VisariaОценок пока нет

- Daily Morning Update 18 Oct 2011Документ2 страницыDaily Morning Update 18 Oct 2011Devang VisariaОценок пока нет

- Daily Morning Update 25 Oct 2011Документ2 страницыDaily Morning Update 25 Oct 2011Devang VisariaОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- Weekly Performance of Nifty Calls 15 OctДокумент1 страницаWeekly Performance of Nifty Calls 15 OctDevang VisariaОценок пока нет

- Daily Morning Update 17 Oct 2011Документ3 страницыDaily Morning Update 17 Oct 2011Devang VisariaОценок пока нет

- Daily Morning Update 13 Oct 2011Документ2 страницыDaily Morning Update 13 Oct 2011Devang VisariaОценок пока нет

- Weekly Performance of Trading Calls 15 OctДокумент1 страницаWeekly Performance of Trading Calls 15 OctDevang VisariaОценок пока нет

- Commodity Outlook 13.10.11Документ3 страницыCommodity Outlook 13.10.11Devang VisariaОценок пока нет

- MBFM4001 Investment and Portfolio ManagementДокумент3 страницыMBFM4001 Investment and Portfolio ManagementShakthi RaghaviОценок пока нет

- Lecture Notes Topic 6 Student PDFДокумент94 страницыLecture Notes Topic 6 Student PDFAnDy YiMОценок пока нет

- Financial Economics Sample QuestionsДокумент31 страницаFinancial Economics Sample QuestionsJoeKnittelОценок пока нет

- W.D .Gaan Full Study ContentДокумент2 страницыW.D .Gaan Full Study ContentAabhasОценок пока нет

- Role of Sebi in Regulating Capital Market in IndiaДокумент7 страницRole of Sebi in Regulating Capital Market in IndiaSunil KumarОценок пока нет

- LFS DetailДокумент21 страницаLFS DetailChetan LaddhaОценок пока нет

- BGFV Thomas ReutersДокумент6 страницBGFV Thomas ReutersKenОценок пока нет

- Short Term Trading - Getting Started in Momentum-Based Swing TradingДокумент8 страницShort Term Trading - Getting Started in Momentum-Based Swing Tradingdiglemar100% (1)

- Faculty Business Management 2022 Session 1 - Degree Fin542Документ4 страницыFaculty Business Management 2022 Session 1 - Degree Fin542ilmanОценок пока нет

- Al MT 202101 BBCF2013 AnswersДокумент11 страницAl MT 202101 BBCF2013 AnswersNabila Abu BakarОценок пока нет

- What Is A Mutual Fund?Документ35 страницWhat Is A Mutual Fund?Azaan KhanОценок пока нет

- Free Price Action Trading PDF GuideДокумент20 страницFree Price Action Trading PDF GuideRadical NtukОценок пока нет

- DMAДокумент53 страницыDMAAlokMishraОценок пока нет

- 237345-Article Text-573098-1-10-20221202Документ8 страниц237345-Article Text-573098-1-10-20221202saheb167Оценок пока нет

- Basel IV Calculating Ead According To The New Standardizes Approach For Counterparty Credit Risk Sa CCRДокумент48 страницBasel IV Calculating Ead According To The New Standardizes Approach For Counterparty Credit Risk Sa CCRmrinal aditya100% (1)

- How To Make Money in Intraday Trading - A Master Class by One of India - S Most Famous TradersДокумент279 страницHow To Make Money in Intraday Trading - A Master Class by One of India - S Most Famous TradersAnuj Saxena87% (99)

- ZH 1Документ523 страницыZH 1Kaizer PéterОценок пока нет

- EBIT EPS AnalysisДокумент6 страницEBIT EPS AnalysisDeepika Varshney100% (1)

- 18u3cm06 CC06Документ8 страниц18u3cm06 CC06Manoj MJОценок пока нет

- India Financial System PDFДокумент3 страницыIndia Financial System PDFRavneet KaurОценок пока нет

- Sensex Rolling ReturnsДокумент1 страницаSensex Rolling Returnsmaheshtech76Оценок пока нет

- Guide To Investing in Treasury Bills in Ghana - CediTalk PDFДокумент1 страницаGuide To Investing in Treasury Bills in Ghana - CediTalk PDFSimon SimbakkyОценок пока нет

- MCR DemoДокумент64 страницыMCR Demopramod78Оценок пока нет

- Company Law ProjectДокумент16 страницCompany Law ProjectRishabh NautiyalОценок пока нет

- SDL NSDLДокумент2 страницыSDL NSDLNeha KrishnaniОценок пока нет

- Mid. Fm2014 20152 ادارة مالية باللغة الانجليزيةДокумент5 страницMid. Fm2014 20152 ادارة مالية باللغة الانجليزيةعبدالله ماجد المطارنهОценок пока нет

- Sem 2 Week 2 Bollinger Bands Parabolic SARДокумент61 страницаSem 2 Week 2 Bollinger Bands Parabolic SARSriranga G H100% (1)

- Chapter 4 Valuation of Bonds and Cost of CspitalДокумент24 страницыChapter 4 Valuation of Bonds and Cost of Cspitalanteneh hailie100% (7)

- How To Calculate The IRR - A ManualДокумент34 страницыHow To Calculate The IRR - A Manualkees16186189Оценок пока нет

- MIDTERM FinMar 1Документ11 страницMIDTERM FinMar 1Aira ArabitОценок пока нет