Академический Документы

Профессиональный Документы

Культура Документы

Weekly Pulse 11

Загружено:

Chirag JainАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Weekly Pulse 11

Загружено:

Chirag JainАвторское право:

Доступные форматы

SEBI REVISES BIDDING NORMS FOR FIIS IN INFRA BONDS ......

Issue 11

Sep 26 Oc t 2

2011

K INGFISHER ABOUT TO EXIT LOW FARE SEGMENT

......2

ONGC GIVES CONSENT FOR CAIRN-VEDANTA DEAL.....3

AN ECONOMIST IS AN EXPERT WHO WILL KNOW TOMORROW WHY THE THINGS HE PREDICTED YESTERDAY DIDNT HAPPEN TODAY.

Weekly

Website: www.finx.in Email: finx@sscbsdu.ac.in

pulse

L aurence J. Peter

SEBI revises bidding norms for FIIs in infra bonds

Securities and Exchange Board of India (SEBI) has revised its norms for foreign institutional investors (FII) in the infrastructure debt bonds and has lowered the minimum bidding and allocation amounts for such investors. As per the revised guidelines, the government has allowed FIIs to invest up to $5 billion in infrastructure bonds with reduction of lock-in period to one year from earlier three years. These revised norms are likely to attract a higher number of FIIs into the infrastructure bond segment unlike the last time when there was cold response from FIIs to such bonds.

BHEL files papers for FPO with SEBI

Bharat Heavy Electricals (BHEL) has filed initial papers with market regulator the Securities and Exchange Board of India (SEBI) for the follow-on public offer (FPO) that will see the government offloading its 5% stake in the company. Its sale is expected to fetch over ` 4,000 crore. A price discount of 5% would be given for retail investors, as part of efforts to encourage greater public ownership.

Gold edges up, but in worst month since July 2010

Gold jumped more than 1% after Germany's approval for expanding the euro zone bailout fund offered temporary relief to investors, but the it is heading for its worst monthly decline in three years. Investors have stayed away from the market due to the recent volatility in gold prices, adversely impacting volumes and turnover. Also, investors have been buying dollars, preferring to sit on cash, rather than investing in gold.

SEBI questions USE on trade concentration

The United Stock Exchange has come under the regulatory scanner for alleged concentration of trades by a single member. The effectiveness of exchanges surveillance and risk management is questioned as they failed to take note that Jaypee Capital, a shareholder in USE, accounted for nearly 80% volume on USE which is considered to be a breach of FUTP(Fraudulent and Unfair Trade Practices) as one cannot be a broker with trading rights.

Banks turn against RBI on prepayment reforms on loans

The Indian Banks association (IBA) on behalf of all banks argues against RBI on the issue Banks must not recover prepayment charges in floating rate loans, which are 2-4% of the loan outstanding. They say prepayment by a customer would lead to maturity mismatches, impacting banks liquidity as when prepayment happens, there is a time gap before banks can redeploy the funds.

Kingfisher about to exit low fare segment

Vijay Mallya intends to withdraw Kingfisher Red low fare unit, which it got by acquiring Deccan Aviation during mid-2007, to take care of the debts of India's second largest airline(in terms of passengers carried). Kingfisher has run up a debt of ` 6,000 crore, accumulated losses of ` 5,000 crore and pays out an interest of ` 1,300 crore more than its market capitalization of ` 1,232 crore. He wants to run a full service airline and claims that there are "enough" passengers for the same.

Shale Gas fuels GAILs US market entry

GAIL India has become the first government owned Energy Company to get a foothold in the US market. It has entered into a deal with Carrizo Oil and Gas Inc for acquiring 20% stake in Eagle Ford shale acreage. It will pay $95 million to Houston based Carrizo most of it in cash and rest for developing the area in the Eagle Ford deposits in Texas. GAIL proposes to invest $ 205 million over the next five years through its subsidiary GAIL Global (USA) Inc. The joint venture is expected to drill an additional 139 wells in acreage.

Merchant bankers to disclose past performance

From Nov 1, 2011 merchant bankers will have to disclose the performance of their past issues in all draft documents. Its an attempt to make investors better informed and would disclose data for all issues managed in the last three years. It would include the issue price, share performance on the day of listing, the price movement on the 10th, 20th and 30th day to enable comparison with the movement of the benchmark index and the summary statement.

ONGC gives consent for CairnVedanta deal

ONGC has given a go ahead to Cairn India for the proposed multibillion dollar share sale to Vedanta Resources. ONGC has given the no -objection certificate and has cleared all pending regulatory hurdles. Cairn and Vedanta have executed a formal agreement with ONGC agreeing to royalty and cess conditions i.e. cost recovery of royalty of ONGC and withdrawal of the arbitration petition in international courts against payment of at least 15%.

WEEKLY MARKET STATUS

SENSEX NIFTY DOW JONES

16453.76* 4943.25 10913.38 17592.41 5128.48 48.97 65.86 25989 79.2

+291.7 (+1.80%) +75.5 (+1.55%) +141.9 (+1.32%) -76.42 (-0.43%) +61.67 (+1.22%) -0.7 (-1.67%)*** -1.12 (-1.67%) -1319 (-4.83%) -0.76 (-0.95%)

HANG SENG FTSE

FinX comes with yet another edition of crossword. First 3 correct entries will get their name featured on the Facebook page and the next Weekly Pulse.

BRAIN SCRATCHER

US$ EURO GOLD MCX (spot price) WTI CRUDE OIL ($/BARREL)

*CLOSING SPOT PRICES AS ON LAST FRIDAY i.e. 30/09/2011 **RISE/FALL OVER WHOLE WEEK; FROM 23 Sep to 30 Sep ***NEGATIVE SIGN INDICATE STRENGTHENING OF RUPEE AGAINST $/EURO

LAST WEEKS ANSWERS: The Winner for last week is: Adish Jain & Narotam Garg

ACROSS

DOWN

4. Management style where manager interacts with employees only to criticize their work or when a problem arises. (7) 5. The idea that a country should be self-sufficient and not take part in international trade. (7)

1. Author of book One Minute Manager. (3,9) 2. The sum of a countrys inflation and unemployment rates. (6,5)

6. Wall Street is the only place that people ride to in a Rolls Royce 3. The transition point between economic recession to get advice from those who take the subway. -quote by which and recovery. (6) famous personality?? (6,7)

Вам также может понравиться

- Section - D Group - 5: A New Mandate For Human ResourcesДокумент5 страницSection - D Group - 5: A New Mandate For Human ResourcesChirag JainОценок пока нет

- Angel Broking Coverage On Q4 of Navin Fluorine InternationalДокумент19 страницAngel Broking Coverage On Q4 of Navin Fluorine InternationalChirag JainОценок пока нет

- QuizДокумент7 страницQuizChirag JainОценок пока нет

- SaleSoft Case Study AnalysisДокумент5 страницSaleSoft Case Study Analysisbinzidd00775% (4)

- Weekly Pulse 15Документ3 страницыWeekly Pulse 15Chirag JainОценок пока нет

- Weekly Pulse 12Документ3 страницыWeekly Pulse 12Chirag JainОценок пока нет

- Weekly Pulse 12Документ3 страницыWeekly Pulse 12Chirag JainОценок пока нет

- Weekly Pulse 08Документ3 страницыWeekly Pulse 08Chirag JainОценок пока нет

- Weekly Pulse 06Документ3 страницыWeekly Pulse 06Chirag JainОценок пока нет

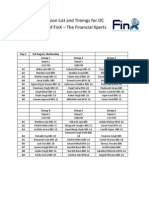

- Group Discussion List and Timings For Oc Recruitments of Finx - The Financial XpertsДокумент4 страницыGroup Discussion List and Timings For Oc Recruitments of Finx - The Financial XpertsChirag JainОценок пока нет

- Weekly Pulse 05Документ3 страницыWeekly Pulse 05Chirag JainОценок пока нет

- Weekly Pulse 03Документ3 страницыWeekly Pulse 03Chirag JainОценок пока нет

- Shortlisted Candidates For FinX InterviewsДокумент1 страницаShortlisted Candidates For FinX InterviewsChirag JainОценок пока нет

- Weekly Pulse 02Документ3 страницыWeekly Pulse 02amarinder270192Оценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Balance Sheet and P&L of CiplaДокумент2 страницыBalance Sheet and P&L of CiplaPratik AhluwaliaОценок пока нет

- Cost of CapitalДокумент8 страницCost of CapitalSiva KotiОценок пока нет

- Steelcast Limited: Website WW. Steel Cast NetДокумент5 страницSteelcast Limited: Website WW. Steel Cast NetRahul PambharОценок пока нет

- Annual Report 2021-22 (English)Документ186 страницAnnual Report 2021-22 (English)DaveОценок пока нет

- Chapter 9: FOREX MARKET Key PointsДокумент6 страницChapter 9: FOREX MARKET Key PointsDanica AbelardoОценок пока нет

- Acctg3-7 Debt SecuritiesДокумент2 страницыAcctg3-7 Debt Securitiesflammy07Оценок пока нет

- KC1 Corporate Financial Reporting Q June 2015 - EnglishДокумент8 страницKC1 Corporate Financial Reporting Q June 2015 - EnglishSuranga PriyanandanaОценок пока нет

- Ratio AnalysisДокумент84 страницыRatio AnalysisSurendra ShuklaОценок пока нет

- CDP Darbhanga PDFДокумент16 страницCDP Darbhanga PDFSanatОценок пока нет

- Global M&A Insider: Food & Beverage ConsolidationДокумент231 страницаGlobal M&A Insider: Food & Beverage Consolidationrodmig20000% (1)

- Maruti Suzuki India 030522 KRДокумент6 страницMaruti Suzuki India 030522 KRVala UttamОценок пока нет

- Evaluating Projects With The Benefit / Cost Ratio Method: XXXXXX XXXXXX XXXXXXX XXДокумент30 страницEvaluating Projects With The Benefit / Cost Ratio Method: XXXXXX XXXXXX XXXXXXX XXRhizhail MortallaОценок пока нет

- Banyan Tree Holdings RestructuringДокумент18 страницBanyan Tree Holdings RestructuringdfghfiОценок пока нет

- Darden Case GuideДокумент123 страницыDarden Case Guidemaverick3581Оценок пока нет

- International Arbitrage and Interest Rate Parity Chapter 7 Flashcards - QuizletДокумент11 страницInternational Arbitrage and Interest Rate Parity Chapter 7 Flashcards - QuizletDa Dark PrinceОценок пока нет

- Indices StrategyДокумент27 страницIndices StrategyHaslucky Tinashe Makuwaza100% (10)

- 120113-DCCBs in Maharashtra by SunilДокумент7 страниц120113-DCCBs in Maharashtra by SunilGauresh NaikОценок пока нет

- Islamic REITsДокумент6 страницIslamic REITsfarhanОценок пока нет

- Chapter 22 - Retained EarningsДокумент8 страницChapter 22 - Retained EarningsOJERA, Allyna Rose V. BSA-1BОценок пока нет

- 20 Pip Challange - 20pipДокумент6 страниц20 Pip Challange - 20pipBlederson SantosОценок пока нет

- Trendsetter Term SheetPPTДокумент16 страницTrendsetter Term SheetPPTMary Williams100% (2)

- ch8 9 10Документ1 155 страницch8 9 10DavidОценок пока нет

- FINS1613 File 04 - All 3 Topics Practice Questions PDFДокумент16 страницFINS1613 File 04 - All 3 Topics Practice Questions PDFisy campbellОценок пока нет

- PRM Study Guide Exam 1Документ29 страницPRM Study Guide Exam 1StarLink1Оценок пока нет

- SIRA1H11Документ8 страницSIRA1H11Inde Pendent LkОценок пока нет

- Expanded Commercial Bank and PDIC: Katherine Z. Montemayor Bsba FM 2-6Документ10 страницExpanded Commercial Bank and PDIC: Katherine Z. Montemayor Bsba FM 2-6Harry DecilloОценок пока нет

- Statistical Arbitrage Pairs Trading With High-Frequency Data (#353612) - 364651Документ13 страницStatistical Arbitrage Pairs Trading With High-Frequency Data (#353612) - 364651lportoОценок пока нет

- Spring 2016 Revision Guide Fin 4050 Section B and CДокумент1 страницаSpring 2016 Revision Guide Fin 4050 Section B and CPuneetPurshotamОценок пока нет

- MIC ELECTRONICS LTD BUY OPPORTUNITYДокумент17 страницMIC ELECTRONICS LTD BUY OPPORTUNITYSudipta BoseОценок пока нет

- BB BBB BBBBBBДокумент24 страницыBB BBB BBBBBBNaomi Pizaña AmpoloquioОценок пока нет