Академический Документы

Профессиональный Документы

Культура Документы

Filing Instructions: Please Follow These Instructions Carefully

Загружено:

Mafer ChavezОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Filing Instructions: Please Follow These Instructions Carefully

Загружено:

Mafer ChavezАвторское право:

Доступные форматы

PLEASE FOLLOW THESE INSTRUCTIONS CAREFULLY

FILING INSTRUCTIONS

QUARTERLY IFTA RETURN

You are now ready to file your IFTA return with your state. Please carefully follow these general filing instructions. It is recommended that you print this page with your return to use this sheet as a pre-filing checklist. 1. Review your return for accuracy. Pay special attention to the following data on your return. a. Company Name and Address b. Mileage and Fuel Purchase Totals and MPG c. Refund and/or Balance Due Amount d. All Identification Numbers which may include one or more of the following i. Your Federal Employer Tax ID Number (EIN or TIN) ii. Your State Employer Tax ID Number iii. Your DOT Number iv. Your ProRate Number v. Your IFTA ID vi. Your SSN Number vii. Other Permit Numbers 2. Review your return for missing information. Some states have non-standard blanks or questions on the return that can be marked with a ink pen. You may be required to fill-in this information that was not requested or provided during the preparation process. These may include items like lease arrangements, amendments, cancelation dates. It is possible that your return does not need any additional information. 3. Completely fill in the signature section of your return. It may ask for information like Name, Title, Phone, Date and Signature. If any of these data are missing or incorrect, your return may be rejected or delayed in processing. 4. Sign your IFTA Return. It is imperative that you sign your return. 5. Mail your completed, signed and dated return. The due date for filing is the last day of the month following the end of previous calendar quarter.

Thank you for choosing us to prepare your IFTA return.

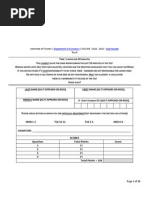

DR 0122 (10/16/06) COLORADO DEPARTMENT OF REVENUE DENVER CO 80261-0009

Departmental Use Only

INTERNATIONAL FUEL TAX AGREEMENT TAX REPORT

Show below change of ownership, name and/or address

magadan auto llc 6650 e arizonz ave denver CO 80224

RETURN THIS COPY

Photocopy and keep for your own records.

Colorado Account Number IFTA Account No. (FEIN or SSN) Period Due Date

261902903

A. Total miles traveled in all jurisdictions\ B. Total fuel consumed in all jurisdictions\ C. Average miles per gallon

Q1 2011

04/30/2011

5600-100

5834 _______ 1. Miles/gallon during this quarter 602 _______ (Line A divided by Line B equals 9.69 _______ Line C; use two decimal places 0.00) 2. LPG 8. Methanol 3. Gasoline 9. E-85

8. Net Taxable Gallons (6-7)

2. Fuel Type 6. CNG

3. Jurisdiction 4. Total Miles

1. Diesel 7. Ethanol

5. Total Taxable Miles

4. Gasohol 10. M-85

9. Tax Rate (per gallon) 10. Tax (8 x 9)

5. LNG (Natural Gas) 11. A55

11. Interest Due 12. Total (10 + 11)

IFTA TAX COMPUTATIONS (round to the nearest whole gallon and mile) - Continued on the Reverse Side

6. Taxable Gallons 7. Tax Paid Gallons

AL AR AZ CA CO CT DE FL GA IA ID IL IN INx KS KY KYx LA MA MD ME MI MN MO MS MT NC ND

77 0 0 0 251 0 0 1189 357 0 0 361 110 110 463 192 192 371 0 0 0 615 0 360 0 0 0 0

77 0 0 0 251 0 0 1189 357 0 0 361 110 110 463 192 192 371 0 0 0 615 0 360 0 0 0 0

8 0 0 0 26 0 0 123 37 0 0 37 11 11 48 20 20 38 0 0 0 63 0 37 0 0 0 0

0 0 0 0 35 0 0 135 40 0 0 40 30 n/a 50 0 n/a 40 0 0 0 70 0 40 0 0 0 0

8 0 0 0 -9 0 0 -12 -3 0 0 -3 -19 -2 20 20 -2 0 0 0 -7 0 -3 0 0 0 0

.1900 .2250 .2600 .3970 .2050 .3960 .2200 .3207 .1600 .2250 .2500 .3780 .1600 .1100 .2600 .2150 .1020 .2000 .2100 .2425 .3070 .3400 .2750 .1700 .1800 .2775 .3250 .2300

1.52 0.00 0.00 0.00 (1.84) 0.00 0.00 (3.85) (0.48) 0.00 0.00 (1.13) (3.04) 1.21 (0.52) 4.30 2.04 (0.40) 0.00 0.00 0.00 (2.38) 0.00 (0.51) 0.00 0.00 0.00 0.00

0.02 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.01 0.00 0.04 0.02 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

1.54 0.00 0.00 0.00 (1.84) 0.00 0.00 (3.85) (0.48) 0.00 0.00 (1.13) (3.04) 1.22 (0.52) 4.34 2.06 (0.40) 0.00 0.00 0.00 (2.38) 0.00 (0.51) 0.00 0.00 0.00 0.00

Prepared using www.iftaplus.com

3. Jurisdiction

4. Total Miles

5. Total Taxable Miles

6. Taxable Gallons

7. Tax Paid Gallons

8. Net Taxable Gallons (6-7)

9. Tax Rate (per gallon)

10. Tax (8 x 9)

11. Interest Due

12. Total (10 + 11)

NE NJ NM NV NY OH OK PA RI SC SD TN TX UT VA VAx VT WA WI WV WY AK DC OR

0 0 0 0 0 184 0 0 0 0 0 0 1304 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 184 0 0 0 0 0 0 1304 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 19 0 0 0 0 0 0 135 0 0 0 0 0 0 0 0 n/a n/a n/a

0 0 0 0 0 50 0 0 0 0 0 0 72 0 0 n/a 0 0 0 0 0 0 0 0

0 0 0 0 0 -31 0 0 0 0 0 0 63 0 0 0 0 0 0 0 0 n/a n/a n/a

.2640 .1750 .2100 .2700 .3925 .2800 .1300 .3810 .3200 .1600 .2200 .1700 .2000 .2450 .1750 .0350 .2900 .3750 .3290 .3220 .1400 n/a n/a n/a

0.00 0.00 0.00 0.00 0.00 (8.68) 0.00 0.00 0.00 0.00 0.00 0.00 12.60 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 n/a n/a n/a

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.13 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 n/a n/a n/a

0.00 0.00 0.00 0.00 0.00 (8.68) 0.00 0.00 0.00 0.00 0.00 0.00 12.73 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 n/a n/a n/a

Record the total for each column below

Totals

OTHER

5834 0

MAKE CHECK PAYABLE AND MAIL REPORT TO: Colorado Department of Revenue 1375 Sherman St. Denver, CO 80261-0016 (303) 205-8205

5834

602

602

n/a

-1.16

0.22

(100) (105) (200) (300) (410)

-0.94 -0.94 0.00 50.00 0.22 0.00

Enter the total miles traveled in all jurisdictions that are not members of IFTA

13. Net Tax DUE (Total Column 10) Note: Enter total net tax amount on Line 13 or 14 14. Net Tax CREDIT (Total Column 10) 15. PENALTY ($50.00 or 10% of Column 10, whichever is greater) 16. INTEREST (Total Column 11) 17. Amount of TAX CREDIT to be refunded this period Paid via EFT

Signature Title

18. TOTAL REMITTANCE (A separate check must accompany each return submitted) (355) The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically. I certify under penalty of perjury in the second degree that to the best of my knowledge the above information is true and correct.

Photocopy and keep for your own records.

49.06

Date

Telephone Number

Prepared using www.iftaplus.com

IFTA Quarterly Canadian Fuel Use Schedule

Attach this schedule to your state return Licensee IFTA ID 261902903 Licensee Name magadan auto llc Fuel Type DIESEL

Canadian Operations for the Quarter Ending

03/31/2011

Jurisdiction

Rate Code

Total Miles (1)

Taxable Miles (1)

MPG (1) (2)

Taxable Gallons (2)

Tax Paid Gallons (2)

Net Taxable Gallons (2)

Tax Rate

Tax (Credit) Due (3)

Interest Due (3)

Total Due (3)

Alberta British Columbia Manitoba New Brunswick Newfoundland Nova Scotia Ontario PR Edward Island Quebec Saskatchewan

061 060 062 059 059 059 055 060 061 061

0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0

9.69 9.69 9.69 9.69 9.69 9.69 9.69 9.69 9.69 9.69

0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0

.3348 .7480 .4278 .6286 .6137 .5728 .5319 .7514 .6397 .5580

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Northwest Terr Nunavut Yukon

n/a n/a n/a

0 0 0

n/a n/a n/a

n/a n/a n/a

n/a n/a n/a

0 0 0

n/a n/a n/a

n/a n/a n/a

n/a n/a n/a

n/a n/a n/a

TOTALS (1) All distances in Miles (2) All fuel in US Gallons (3) All amounts in US Dollars

NOTE: Totals for Canadian activity, if any, are included in the Grand Totals in the main section of this state return.

Prepared using www.iftaplus.com

Вам также может понравиться

- Att BillДокумент34 страницыAtt BillAngel Junito Rodriguez100% (3)

- Case study solution: Water company financial projectionsДокумент15 страницCase study solution: Water company financial projectionsRahul Tiwari100% (2)

- Jordan Stryder's ATT BillДокумент4 страницыJordan Stryder's ATT BillEmilyFykОценок пока нет

- A Look at The STX Deal With GhanaДокумент12 страницA Look at The STX Deal With GhanaGabriel Owusu AnsahОценок пока нет

- CH 02 Tool KitДокумент9 страницCH 02 Tool KitDhanraj VenugopalОценок пока нет

- Foreclosure Injunction TroДокумент15 страницForeclosure Injunction TroAndrey Ybanez86% (7)

- IFM Assignment On International Business Finance 2009Документ10 страницIFM Assignment On International Business Finance 2009Melese ewnetie89% (9)

- Allied Bank Limited Internship ReportДокумент39 страницAllied Bank Limited Internship Reportbbaahmad89100% (2)

- Comcast Bill For S.S.W.D.Документ3 страницыComcast Bill For S.S.W.D.Brad WashburnОценок пока нет

- 21 Usefulcharts 2012-13Документ20 страниц21 Usefulcharts 2012-13sharmaji23Оценок пока нет

- Rizal Ave.Документ10 страницRizal Ave.Inimitable_AnneОценок пока нет

- Jde F0006Документ2 страницыJde F0006Sina BahramiОценок пока нет

- PACS Module Working ManualДокумент10 страницPACS Module Working ManualKhushrajОценок пока нет

- Ifta 3Документ8 страницIfta 3api-277676712Оценок пока нет

- File 3Документ3 страницыFile 3Ivan GrahamОценок пока нет

- Charlotte Web AMERICAS Market Beat Industrial 3page Q12012Документ3 страницыCharlotte Web AMERICAS Market Beat Industrial 3page Q12012Anonymous Feglbx5Оценок пока нет

- Philippines BOT and BOP trends over 15 yearsДокумент24 страницыPhilippines BOT and BOP trends over 15 yearsGausty NituОценок пока нет

- Total EstimateДокумент26 страницTotal EstimateTokla XenОценок пока нет

- FICO TransactionsДокумент34 страницыFICO TransactionsusasidharОценок пока нет

- Automated Refund of An Electronic Ticket)Документ4 страницыAutomated Refund of An Electronic Ticket)AHMED ALRADAEEОценок пока нет

- Income tax calculator for salaryДокумент19 страницIncome tax calculator for salaryAlok SaxenaОценок пока нет

- Tax ReturnДокумент7 страницTax Returnsyedfaisal_sОценок пока нет

- DNB - Wescam PDFДокумент5 страницDNB - Wescam PDFJack58Оценок пока нет

- Your Airtel Duplicate StatementДокумент59 страницYour Airtel Duplicate StatementScheherazade SandhuОценок пока нет

- International Fuel Tax Agreement (Ifta) Tax Return: Reset PrintДокумент4 страницыInternational Fuel Tax Agreement (Ifta) Tax Return: Reset Printmarypriya_1984Оценок пока нет

- OTS TSF Return Form v02 PDFДокумент1 страницаOTS TSF Return Form v02 PDFamirhdlОценок пока нет

- Statement On Page 20Документ57 страницStatement On Page 20WXYZ-TV Channel 7 DetroitОценок пока нет

- Akhtar Tax ReturnДокумент7 страницAkhtar Tax Returnsyedfaisal_sОценок пока нет

- l3 QuestionДокумент2 страницыl3 QuestionshanecarlОценок пока нет

- 2010 IRS Notifications To The City of Lauderdake LakesДокумент8 страниц2010 IRS Notifications To The City of Lauderdake LakesMy-Acts Of-SeditionОценок пока нет

- MIS Financials FormatДокумент23 страницыMIS Financials FormatTango BoxОценок пока нет

- COLLECTION INSTRUCTIONSДокумент6 страницCOLLECTION INSTRUCTIONSJithin Krishnan100% (1)

- Galileo Quick Reference Tins ReportДокумент27 страницGalileo Quick Reference Tins ReportMomin QadirОценок пока нет

- ACT00348 - Analysis DocumentДокумент6 страницACT00348 - Analysis DocumentBharat SahniОценок пока нет

- NY Quarterly ST-100 Sales Tax FilingДокумент4 страницыNY Quarterly ST-100 Sales Tax FilingzilchhourОценок пока нет

- Hulpak BemlДокумент34 страницыHulpak BemlrushabhОценок пока нет

- Income Tax Chart 2016-17Документ1 страницаIncome Tax Chart 2016-17Basavaraju K R100% (1)

- SAP Shortcut KeyДокумент19 страницSAP Shortcut KeyPhani PatibandlaОценок пока нет

- University of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz HussainДокумент20 страницUniversity of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz HussainexamkillerОценок пока нет

- Monthly Operating Report Summary For Month 2012: WesternДокумент9 страницMonthly Operating Report Summary For Month 2012: WesternChapter 11 DocketsОценок пока нет

- Emi Calculator: Instruction Loan AmountДокумент3 страницыEmi Calculator: Instruction Loan Amountsankuj5354Оценок пока нет

- Bassett - Mulhall Homestead Fraud ComplaintДокумент116 страницBassett - Mulhall Homestead Fraud Complaintreef_galОценок пока нет

- 08 Integer Programming 1 PrintДокумент35 страниц08 Integer Programming 1 PrinteviroyerОценок пока нет

- Reliance Trends Chennai tax invoiceДокумент3 страницыReliance Trends Chennai tax invoiceKarthik sankarОценок пока нет

- Toll Road Financial AnalysisДокумент17 страницToll Road Financial AnalysisNguyen Phuong ThaoОценок пока нет

- Driver Settlement Statement For 2112326 Ontario Inc., .: Period DetailsДокумент5 страницDriver Settlement Statement For 2112326 Ontario Inc., .: Period Detailspeppa pigОценок пока нет

- Misc Reporting ConfigДокумент4 страницыMisc Reporting ConfigTitus GeorgeОценок пока нет

- 10000006490Документ17 страниц10000006490Chapter 11 DocketsОценок пока нет

- 3Q16 Presentation of ResultsДокумент20 страниц3Q16 Presentation of ResultsMillsRIОценок пока нет

- Group 5 FinalДокумент20 страницGroup 5 FinalShashank ShrivastavaОценок пока нет

- World Bank Road Use Costs Study Results: June 9, 2006Документ12 страницWorld Bank Road Use Costs Study Results: June 9, 2006namanewoawwwОценок пока нет

- Chapter 4-6 Advanced Accounting 5009: Roger Mayer 7:00 PM & 8:30 PMДокумент43 страницыChapter 4-6 Advanced Accounting 5009: Roger Mayer 7:00 PM & 8:30 PMalejandra_giraldo_3Оценок пока нет

- IT-2 2011 With Formula and Surcharge and Annex DДокумент15 страницIT-2 2011 With Formula and Surcharge and Annex DPatti DaudОценок пока нет

- License Plate Rate Chart: ClassificationДокумент4 страницыLicense Plate Rate Chart: Classificationsmray2307Оценок пока нет

- Reliance Retail tax invoice summary with iPhone purchaseДокумент3 страницыReliance Retail tax invoice summary with iPhone purchaseRAJU JANAОценок пока нет

- Month March 11-2012 CДокумент30 страницMonth March 11-2012 Calinazim55Оценок пока нет

- Proof of Address PDFДокумент3 страницыProof of Address PDFAnonymous 4GspDTUuuОценок пока нет

- Ashok Kumar Paul 2010Документ5 страницAshok Kumar Paul 2010LoveSahilSharmaОценок пока нет

- 11Документ60 страниц11San JayОценок пока нет

- Digital Channel Support of Contact CenterДокумент17 страницDigital Channel Support of Contact Centerኣስፋ ሙሉОценок пока нет

- Driver settlement earnings statement for period Jan 8-14Документ5 страницDriver settlement earnings statement for period Jan 8-14peppa pigОценок пока нет

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryОт EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Cooling Systems, Radiators & Associated Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryОт EverandCooling Systems, Radiators & Associated Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryОценок пока нет

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryОт EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Placement Record 2018-19Документ10 страницPlacement Record 2018-19Anand Kumar SinghОценок пока нет

- Pefindo Beta Saham Edition October 24 2013Документ12 страницPefindo Beta Saham Edition October 24 2013Fendy ArzunataОценок пока нет

- Ju 1Документ1 страницаJu 1lesly malebrancheОценок пока нет

- Real Estate MarketsДокумент21 страницаReal Estate MarketsPriyanka DargadОценок пока нет

- Urn - Isbn - 978 952 61 0299 3Документ286 страницUrn - Isbn - 978 952 61 0299 3Roy Bhardwaj100% (1)

- Ba 55293Документ10 страницBa 55293Abdu MohammedОценок пока нет

- Table of Content: Chapter Number 1Документ46 страницTable of Content: Chapter Number 1Hssan Ali0% (1)

- PPP Corporate KYC FormatДокумент13 страницPPP Corporate KYC FormatBappa Maitra100% (1)

- Downies Auction CatalogueДокумент144 страницыDownies Auction CatalogueAnonymous f6goFflg3TОценок пока нет

- David Trandel July 29, 2019, Letter To Winnetka Village Attorney Peter FriedmanДокумент4 страницыDavid Trandel July 29, 2019, Letter To Winnetka Village Attorney Peter FriedmanJonah MeadowsОценок пока нет

- KYC Non IndividualДокумент2 страницыKYC Non Individualapi-3849142Оценок пока нет

- Bop Format and NumericalsДокумент10 страницBop Format and NumericalsShikha AgarwalОценок пока нет

- RFBT Handout Bank Secrecy and Unclaimed Balances - Batch 2019Документ3 страницыRFBT Handout Bank Secrecy and Unclaimed Balances - Batch 2019E.D.JОценок пока нет

- Becsr Assignment 3 - 19202065 - Sec AДокумент3 страницыBecsr Assignment 3 - 19202065 - Sec AViresh Gupta100% (1)

- MR - Chijioke Nwokike's CVДокумент2 страницыMR - Chijioke Nwokike's CVPrinceezenniaОценок пока нет

- HSBC vs CIR DST Ruling on Electronic MessagesДокумент3 страницыHSBC vs CIR DST Ruling on Electronic MessagesMary Joyce Lacambra AquinoОценок пока нет

- Companies Guide 2010 - 11-24-2010 11 - 22 - 43 AMДокумент157 страницCompanies Guide 2010 - 11-24-2010 11 - 22 - 43 AMChandrashekar KumarОценок пока нет

- Eugenicsandpandemics - Wordpress.2016!11!23.002 - EditorДокумент8 302 страницыEugenicsandpandemics - Wordpress.2016!11!23.002 - EditorsligomcОценок пока нет

- MANAGING PERSONAL FINANCES AND INVESTMENT PLANNINGДокумент15 страницMANAGING PERSONAL FINANCES AND INVESTMENT PLANNINGRAJU ANILARORAОценок пока нет

- Simple and Compound Interest ExplainedДокумент1 страницаSimple and Compound Interest ExplainedBern Balingit-ArnaizОценок пока нет

- Passport Rules ImpДокумент42 страницыPassport Rules ImpvinodsingoriaОценок пока нет

- Habib Bank LimitedДокумент16 страницHabib Bank Limitedhasanqureshi3949100% (2)

- Types of Bank DepositeДокумент4 страницыTypes of Bank DepositeShailendrasingh DikitОценок пока нет

- SemiДокумент252 страницыSemiGОценок пока нет

- Challan Form for Treasury, Sales Tax, and Tax Payer DepartmentsДокумент1 страницаChallan Form for Treasury, Sales Tax, and Tax Payer Departmentsca_kamalОценок пока нет

- Rural Financial Services and Effects On Livestock Production in EthiopiaДокумент12 страницRural Financial Services and Effects On Livestock Production in EthiopiaSikandar KhattakОценок пока нет