Академический Документы

Профессиональный Документы

Культура Документы

Er 20111014 Bull Ausconshsepriceexp

Загружено:

david_llewellyn4726Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Er 20111014 Bull Ausconshsepriceexp

Загружено:

david_llewellyn4726Авторское право:

Доступные форматы

Bulletin

14 October 2011

Australian consumers uncertain on direction for house prices

Optimists still outnumber pessimists but only just, with the median view 'no change'

Price Expectations Index fell from 15.3 in July to 9.0 in October. The Index is at its lowest level since May 2009 although the pace at which price expectations are being marked down has moderated compared to Apr-Jul surveys. Consumers appear highly uncertain about the outlook for house prices. However, most still expect prices to either rise or stay the same over the next year. Just under 39% expect house prices to be higher, 32% expect prices to be unchanged and 26% expect prices to decline. In May 2009 the split was almost exactly a third each way, while a similar survey conducted in Nov 2008, in the immediate aftermath of the Lehman Brothers collapse, showed 55% expected house price declines at the time. Judged against this, the current reading is not too bad although price expectations have been cut dramatically from their Apr 2010 high when 84% expected house prices to rise. The median expectation in Oct is for no change in house prices over the next year. That is the same as Jul and compares to an implied median forecast price rise of +1.2% in Apr and +1.9% in Jan. Expectations for price gains may have evaporated but the mix is still a long way from implying a median forecast price decline that would take a further 11pt increase in the proportion of consumers expecting price falls. The state detail shows some notable divergences. Pessimists outnumber optimists in Qld, where housing markets have been considerably weaker (although even here the median forecast is still for no change). Consumers are more optimistic in WA, NSW and Vic, with these last two states having a significantly higher proportion of house price 'bulls' expecting 10%+ growth. Other detail showed price expectations were more positive for younger age-groups. Indeed, the age-group mix suggests potential first home buyers are significantly more optimistic about price prospects than potential investors. Current conditions appear to have a strong bearing on consumers' house price expectations. The downshift in price expectations over the last 18mths has coincided with, or lagged slightly behind, a similar turnaround in actual price growth. After hitting 14%yr in early 2010, price growth across all dwellings nationally dropped to be about flat in Mar 2011 and to 3.2% in Aug according to RP Data-Rismark figures. These latest readings are significantly weaker than the modest price growth consumers expected a year prior. Continued price weakness may see further mark downs in expectations. However, this will be balanced against the rising prospect of interest rate cuts from the RBA. The net effect will likely depend on how 'threatening' consumers see the situation in housing markets. It is notable that the weak read in May 2009 came despite mortgage rates being slashed to 40yr lows. Matthew Hassan, Senior Economist, ph (61-2) 8254 2100

The Westpac-Melbourne Institute Consumer House

Consumer house price expectations October 2011

% responses expecting: Rise Aus NSW Vic Qld SA WA 9.3 11.1 12.7 4.9 2.8 2.2 29.4 30.5 29.2 21.5 39.5 32.2 No 31.5 29.4 28.2 37.5 30.4 41.2 Fall 24.8 24.2 25.4 31.0 23.5 16.1 5.0 4.9 4.5 5.1 3.8 8.3 >10% 010% change 010% >10% House Price Expectation Index* Jul 15.3 23.7 20.1 -6.2 1.3 24.8 Oct 9.0 12.5 12.1 -9.8 15.0 10.1

*% expecting rise minus % expecting fall. Figures exclude those reporting "no opinion".

Source: WestpacMelbourne Institute

Consumer expectations for house prices

100 220 75 200 180 50 160 25 0 140 -25 120 100 -50 80 60 40 20 0 %responses

net percent expecting house prices to rise *Mortgage choice survey

%responses

Source: Westpac-Melbourne Institute, Mortgage Choice

fall

no change

rise

Nov- May- Jul-09 Oct- Jan- Apr- Jul-10 Oct- Jan- Apr- Jul-11 Oct08* 09 09 10 10 10 11 11 11

100 75 50 25 0 -25 -50 80 -75 60 -100 40 -125 20 -150 -175 0

House price expectations by state

100 80 60 40 20 0

*% reporting expected rise minus % reporting expected fall

net % NSW Vic SA Qld WA

net %

100 80 60 40 20 0

-20 Jan-09

Source: Westpac-Melbourne Institute

-20

Jan-10

Jan-11

Jan-09

Jan-10

Jan-11

Westpac Institutional Bank is a division of Westpac Banking Corporation ABN 33 007 457 141. Information current as at date above. This information has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation or needs. Westpacs financial services guide can be obtained by calling 132 032, visiting www.westpac.com.au or visiting any Westpac Branch. The information may contain material provided directly by third parties, and while such material is published with permission, Westpac accepts no responsibility for the accuracy or completeness of any such material. Except where contrary to law, Westpac intends by this notice to exclude liability for the information. The information is subject to change without notice and Westpac is under no obligation to update the information or correct any inaccuracy which may become apparent at a later date. Westpac Banking Corporation is registered in England as a branch (branch number BR000106) and is authorised and regulated by The Financial Services Authority. Westpac Europe Limited is a company registered in England (number 05660023) and is authorised and regulated by The Financial Services Authority. If you wish to be removed from our e-mail, fax or mailing list please send an e-mail to economics@westpac.com.au or fax us on +61 2 8254 6934 or write to Westpac Economics at Level 2, 275 Kent Street, Sydney NSW 2000. Please state your full name, telephone/fax number and company details on all correspondence. 2011 Westpac Banking Corporation. Past performance is not a reliable indicator of future performance. The forecasts given in this document are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from these forecasts.

14 October 2011

House price expectations by age group

net % 100 80 60 40 20 0

*% expecting rise minus % expecting fall

Source: WestpacMelbourne Institute

House price expectations by buyer*

net % 100 100 80 60 40 20 0 -20 40 20 0 -20 May-09

Source: Westpac-Melbourne Institute

net %

net %

*composite based on weighted responses by age-group; % reporting expected rise minus % reporting expected fall

18-24 25-34

35-44 50-54

45-49

55-64 65+

100 80 60

80 60 FHBs upgraders investors

40 20 0 -20

-20 Jan-09

Jul-10

Apr-10

Oct-11

Jan-10

Jul-11

Nov-09

May-10

Nov-10

May-11

Nov-11

House prices, actual vs expected

150 125 100 75 50 25 0 -25

Source: RP Data-Rismark, Mortgage Choice, Westpac-Melbourne Institute

House prices: actual vs expected by state

140 120 100 80 60 40 20 0 -20

Aus

Source: Westpac, Melbourne Institute, RP Data-Rismark

net%* ann% 30 expectations, next 12mths (Westpac-MI survey, lhs) expectations, next 12mths (Mortgage Choice survey, lhs) 25 actual dwelling prices, previous 12mths (rhs) 20

*% expecting prices to rise minus % expecting prices to fall

ann %

ann% expectations next 12 months (lhs)* actual last 12 months (rhs)^

*net% expecting prices to rise, ^capital cities, all dwellings

30 25 20 15 10 5 0 -5 -10

15 10 5 0 -5

-50 -10 Nov-04 Nov-05 Nov-06 Nov-07 Nov-08 Nov-09 Nov-10 Nov-11

NSW

Vic

Qld

SA

WA

Consumer expectations for house prices

100 90 80 70 60 50 40 30 20 10 0 Nov-08* Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 %responses Fall No-change

Sources: WestpacMelbourne Institute, Mortgage Choice

Consumer sentiment: housing

100 90 80 70 60 50 40 30 20 10 0 100 80 60 40 20 0 -20 -40 -60 -80 -100 Oct-89 time to buy a dwelling (rhs) price expectations next 12mths (lhs) wisest place for savings: real estate (rhs) Oct-93 Oct-97 Oct-01 Oct-05 Oct-09 index

Sources: Melbourne Institute, Westpac Economics

%responses Rise

regular survey months are Jan, Apr, Jul, Oct *Nov-08 figures are from a similar survey conducted by Mortgage Choice

index

*deviation from long run avg, price measure is net % expecting prices to rise price outlook subdued mixed on time to buy ... ... and not keen on investing

25 20 15 10 5 0 -5 -10 -15 -20 -25

Finance by borrower

12 10 8 6 4

3.4%

Auction clearance rates sub-50%

AUDbn/mth

Sources: ABS, Westpac Economics

AUDbn/mth

Value of housing finance

12 10

90 80 70 60 50 40 30 20 10

%

period average

90 80 70 60 50 40

Upgraders, ex-refinancing Investor finance FHBs

7.0%

8 6 4 2

6.5%

2

2011, to date

Sydney Melbourne

latest 3 weekends *seasonally adjusted by Westpac

Sources: APM, RP Data Rismark, Westpac Economics

30 20 10 0

0 Aug-01

0 Aug-03 Aug-05 Aug-07 Aug-09 Aug-11

0 Jul-88 Jul-91 Jul-94 Jul-97 Jul-00 Jul-03 Jul-06 Jul-09

Past performance is not a reliable indicator of future performance. The forecasts given above are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The results ultimately achieved may differ substantially from these forecasts.

Вам также может понравиться

- Er 20120413 Bull Ausconhsepriceexpt AprДокумент2 страницыEr 20120413 Bull Ausconhsepriceexpt AprChrisBeckerОценок пока нет

- Bulletin: Australian Consumers: House Price Expectations Heating UpДокумент4 страницыBulletin: Australian Consumers: House Price Expectations Heating UpBelinda WinkelmanОценок пока нет

- Er 20130712 Bull Consumer House Price ExpectationsДокумент4 страницыEr 20130712 Bull Consumer House Price ExpectationsDavid SmithОценок пока нет

- Bulletin: Australians Temper House Price ExpectationsДокумент3 страницыBulletin: Australians Temper House Price ExpectationsBelinda WinkelmanОценок пока нет

- Bulletin: Most Australians See Mortgage Rates Flat or Higher Over The Next 12mthsДокумент4 страницыBulletin: Most Australians See Mortgage Rates Flat or Higher Over The Next 12mthsLauren FrazierОценок пока нет

- The Red Book: Westpac Economics With TheДокумент24 страницыThe Red Book: Westpac Economics With TheDavid4564654Оценок пока нет

- Er 20120815 Bull Consumer SentimentДокумент2 страницыEr 20120815 Bull Consumer SentimentChrisBeckerОценок пока нет

- Westpac Wage ExpectationsДокумент2 страницыWestpac Wage ExpectationsChrisBeckerОценок пока нет

- Er 20121010 Bull Consumer SentimentДокумент2 страницыEr 20121010 Bull Consumer SentimentBelinda WinkelmanОценок пока нет

- Er 20130712 Bull Housing Finance MayДокумент4 страницыEr 20130712 Bull Housing Finance MayDavid SmithОценок пока нет

- Er 20111220 Bull Consumer Holiday Travel PlansДокумент2 страницыEr 20111220 Bull Consumer Holiday Travel PlansChrisBeckerОценок пока нет

- Westpac Red Book July 2013Документ28 страницWestpac Red Book July 2013David SmithОценок пока нет

- Er 20120912 Bull Consumer SentimentДокумент2 страницыEr 20120912 Bull Consumer SentimentLuke Campbell-SmithОценок пока нет

- Er 20111012 Bull Consumer SentimentДокумент1 страницаEr 20111012 Bull Consumer Sentimentdavid_llewellyn5758Оценок пока нет

- BIS Shrapnel OutlookДокумент64 страницыBIS Shrapnel OutlookshengizОценок пока нет

- Despondent Consumers Home Loans Sink: Economic InsightsДокумент3 страницыDespondent Consumers Home Loans Sink: Economic Insightsapi-138048686Оценок пока нет

- The Red Book: Westpac Economics With TheДокумент26 страницThe Red Book: Westpac Economics With TheBelinda WinkelmanОценок пока нет

- er20130213BullAusConsumerSentiment PDFДокумент2 страницыer20130213BullAusConsumerSentiment PDFAmanda MooreОценок пока нет

- Er 20130228 Bull Phat DragonДокумент2 страницыEr 20130228 Bull Phat DragonBelinda WinkelmanОценок пока нет

- er20130211BullAusHousingfinanceDec12 PDFДокумент3 страницыer20130211BullAusHousingfinanceDec12 PDFAmanda MooreОценок пока нет

- Er 20130612 Bull Consumer SentimentДокумент4 страницыEr 20130612 Bull Consumer SentimentDavid SmithОценок пока нет

- Property Report MelbourneДокумент0 страницProperty Report MelbourneMichael JordanОценок пока нет

- West Pac Redbook February 2013Документ28 страницWest Pac Redbook February 2013Belinda WinkelmanОценок пока нет

- Economic NewsEconomic News of The Wiregrass - 10 Jun 10Документ4 страницыEconomic NewsEconomic News of The Wiregrass - 10 Jun 10webwisetomОценок пока нет

- er20130409BullPhatDragon PDFДокумент3 страницыer20130409BullPhatDragon PDFCatherine LawrenceОценок пока нет

- er20130322BullPhatDragon PDFДокумент3 страницыer20130322BullPhatDragon PDFHeidi TaylorОценок пока нет

- Santa Clara County Market Update - November 2011Документ4 страницыSanta Clara County Market Update - November 2011Gwen WangОценок пока нет

- Crockers Market Research: Further Growth For House Sales, in TimeДокумент2 страницыCrockers Market Research: Further Growth For House Sales, in Timepathanfor786Оценок пока нет

- Er 20111026 Bull PhatdragonДокумент1 страницаEr 20111026 Bull Phatdragondavid_llewellyn3788Оценок пока нет

- er20130306BullPhatDragon PDFДокумент2 страницыer20130306BullPhatDragon PDFBrian FordОценок пока нет

- ANZ Property Focus Survey Finds Investor Confidence Remains HighДокумент16 страницANZ Property Focus Survey Finds Investor Confidence Remains HighshreyakarОценок пока нет

- Westpac Red Book (September 2013)Документ28 страницWestpac Red Book (September 2013)leithvanonselenОценок пока нет

- Consumer Expectations: Inflation & Unemployment Expectation Chart PackДокумент24 страницыConsumer Expectations: Inflation & Unemployment Expectation Chart PackBelinda WinkelmanОценок пока нет

- Australian Housing Chartbook July 2012Документ13 страницAustralian Housing Chartbook July 2012scribdooОценок пока нет

- RP Data Equity Report: June Quarter, 2011Документ26 страницRP Data Equity Report: June Quarter, 2011economicdelusionОценок пока нет

- Er 20130507 Bull Phat DragonДокумент3 страницыEr 20130507 Bull Phat DragonBelinda WinkelmanОценок пока нет

- er20130411BullPhatDragon PDFДокумент3 страницыer20130411BullPhatDragon PDFJennifer PerezОценок пока нет

- NZ External Imbalances RevealedДокумент3 страницыNZ External Imbalances RevealedleithvanonselenОценок пока нет

- Er 20130404 Bull Phat DragonДокумент3 страницыEr 20130404 Bull Phat DragonBelinda WinkelmanОценок пока нет

- Housing Snapshot - October 2011Документ11 страницHousing Snapshot - October 2011economicdelusionОценок пока нет

- er20130624BullPhatDragon PDFДокумент3 страницыer20130624BullPhatDragon PDFJesse BarnesОценок пока нет

- Er 20111027 Bull PhatdragonДокумент1 страницаEr 20111027 Bull Phatdragondavid_llewellyn9804Оценок пока нет

- Er 20130222 Bull Phat DragonДокумент2 страницыEr 20130222 Bull Phat DragonBelinda WinkelmanОценок пока нет

- Phat Dragons (Westpac) Weekly Chronicle of The Chinese Economy 16.01.2013Документ2 страницыPhat Dragons (Westpac) Weekly Chronicle of The Chinese Economy 16.01.2013leithvanonselenОценок пока нет

- Weekend Market Summary Week Ending 2014 November 9Документ3 страницыWeekend Market Summary Week Ending 2014 November 9Australian Property ForumОценок пока нет

- PRDnationwide Quarterly Economic and Property Report Ed 2 2012Документ28 страницPRDnationwide Quarterly Economic and Property Report Ed 2 2012ashd9410Оценок пока нет

- 2011-06-10 LLOY UK Consumer Discretionary Sector AnalysisДокумент3 страницы2011-06-10 LLOY UK Consumer Discretionary Sector AnalysiskjlaqiОценок пока нет

- Local Market Trends: The Real Estate ReportДокумент4 страницыLocal Market Trends: The Real Estate ReportSusan StrouseОценок пока нет

- er20130619BullLeadingIndex PDFДокумент3 страницыer20130619BullLeadingIndex PDFShaun SalasОценок пока нет

- Aust House Prices OI 21 2012Документ2 страницыAust House Prices OI 21 2012TihoОценок пока нет

- NZ Housing Outlook Drives InflationДокумент3 страницыNZ Housing Outlook Drives InflationjomanousОценок пока нет

- Media Release: First Rate Cut Boosts Consumer SentimentДокумент4 страницыMedia Release: First Rate Cut Boosts Consumer SentimentDavid4564654Оценок пока нет

- Er 20130513 Bull Phat DragonДокумент3 страницыEr 20130513 Bull Phat DragonBelinda WinkelmanОценок пока нет

- Depressed Housing and Stressed Community Banks Will Hurt US Economic GrowthДокумент5 страницDepressed Housing and Stressed Community Banks Will Hurt US Economic GrowthValuEngine.comОценок пока нет

- QLD Housing and Economy 2Q 2011Документ23 страницыQLD Housing and Economy 2Q 2011livermore666Оценок пока нет

- Summary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterОт EverandSummary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterОценок пока нет

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationОт EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationОценок пока нет

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsОт EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsРейтинг: 4 из 5 звезд4/5 (1)

- Cocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsОт EverandCocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsОценок пока нет

- Urban PlanBrochure Parkview 253 NEW PDFДокумент2 страницыUrban PlanBrochure Parkview 253 NEW PDFMaria Rose Giltendez - BartianaОценок пока нет

- Worksheet ExerciseДокумент21 страницаWorksheet ExerciseVhia Rashelle GalzoteОценок пока нет

- Salary 2018Документ8 страницSalary 2018akhmadmarufnurОценок пока нет

- 0809-01 Interconversion of FreenessДокумент5 страниц0809-01 Interconversion of FreenessbgpinuОценок пока нет

- Assignment6 - CostAcc - Re Do Exercise - VanessaДокумент5 страницAssignment6 - CostAcc - Re Do Exercise - VanessaVanessa vnssОценок пока нет

- Screen B5V MRДокумент2 страницыScreen B5V MRSoldequipo Cia LtdaОценок пока нет

- Business Objectives: Multiple-Choice QuestionsДокумент2 страницыBusiness Objectives: Multiple-Choice Questionsno dont look at meОценок пока нет

- Goat & Ram Fattening Business PlanДокумент10 страницGoat & Ram Fattening Business PlanUmarSaboBabaDoguwaОценок пока нет

- CT 1Документ3 страницыCT 1Necole Ira BautistaОценок пока нет

- Introduction of Business Government & SocietyДокумент30 страницIntroduction of Business Government & Societyamit chavariaОценок пока нет

- Transaction HistoryДокумент2 страницыTransaction HistoryMuhammad Johari Noor AzharОценок пока нет

- IFM Chapter 1 Overview Agency Costs MNCs Comparative AdvantageДокумент2 страницыIFM Chapter 1 Overview Agency Costs MNCs Comparative AdvantageJhonathan ArguelloОценок пока нет

- 7J11-3163F SS 1xTAL850 AHДокумент1 страница7J11-3163F SS 1xTAL850 AHOktovianus TeguhОценок пока нет

- Invoice 783152170704943174Документ1 страницаInvoice 783152170704943174sagar.gandeshaОценок пока нет

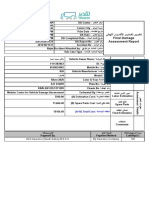

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportДокумент2 страницыا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment Reportراكان العزبОценок пока нет

- ImpactДокумент7 страницImpactMyat KhantОценок пока нет

- Pro Btcturk UserTradeHistoryReport 2023 12 12 12 25Документ114 страницPro Btcturk UserTradeHistoryReport 2023 12 12 12 25Rasim HuseinОценок пока нет

- PRICE LIST FOR RESIDENTIAL PROJECTДокумент2 страницыPRICE LIST FOR RESIDENTIAL PROJECTrahulОценок пока нет

- BBA - VI Sem. Fundamentals of Banking ImportanceДокумент2 страницыBBA - VI Sem. Fundamentals of Banking ImportanceAnswering WAITОценок пока нет

- ClientsДокумент24 страницыClientsmohammeddashtiОценок пока нет

- Comparative Economic SystemsДокумент67 страницComparative Economic SystemsMay FlowerОценок пока нет

- Sl8 Form NCSLДокумент4 страницыSl8 Form NCSLLaso IlaОценок пока нет

- Electronic Ticket Receipt, November 04 For MR HUMAYUN AWANДокумент2 страницыElectronic Ticket Receipt, November 04 For MR HUMAYUN AWANHumayun MalikОценок пока нет

- Tutorial 4 - SolutionsДокумент7 страницTutorial 4 - SolutionsstoryОценок пока нет

- CAPE Economics 2016 U1 P2Документ20 страницCAPE Economics 2016 U1 P2roxanne taylorОценок пока нет

- Annex 1-7 (ID) PDFДокумент27 страницAnnex 1-7 (ID) PDFMuhammad FaisalОценок пока нет

- Door HandlingДокумент316 страницDoor HandlingdipinnediyaparambathОценок пока нет

- EconДокумент3 страницыEconWarqa ZakaОценок пока нет

- Utility Bill TemplateДокумент3 страницыUtility Bill Templatecathy clark100% (2)

- Basu Anesthesia Log 2016 - UpdatedДокумент25 страницBasu Anesthesia Log 2016 - UpdatedrosinaОценок пока нет