Академический Документы

Профессиональный Документы

Культура Документы

Doc100273 TR Tomato Paste Update Sept09

Загружено:

Hakan AktaşИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Doc100273 TR Tomato Paste Update Sept09

Загружено:

Hakan AktaşАвторское право:

Доступные форматы

Tomato Paste In Iraq

Updated Industry Analysis

September 8, 2009

This report was produced for review by the U.S. Agency for International Development (USAID). It was prepared by the Inma Agribusiness Program a consortium led by The Louis Berger Group, Inc. Contract No. 267-C-00-07-00500-00

Tomato Paste In Iraq

Updated Industry Analysis

September 8, 2009

The Inma Agribusiness Program and this report are made possible by the support of the American people through the U. S. Agency for International Development USAID. Inma is implemented by a consortium led by The Louis Berger Group, Inc. under Contract No. 267-C-00-07-00500-00.

Tomato Paste In Iraq

Inma Agribusiness Program

The Tomato Paste Industry and Market: Overview

Tomato derivatives are various products with different characteristics. Tomatoes can be boiled to evaporate the water they contain. Depending on how much water is removed, and what other ingredients are mixed into the pulp, it is possible to obtain a large number of products. With regard to the purpose of this short study, only tomato paste will be taken into consideration. Tomato paste is made from whole processing tomatoes generally containing between 4.5 to 6.0 percent tomato solid.1 With regard to solid content, the industry normally refers to TSS (total soluble solids), a measure which excludes all insoluble solids. In accordance with generally accepted market standards, tomato paste must contain at least 14 percent TSS. On average, 6kg of fresh tomatoes are required to make1 kg of tomato paste 26-28 Brix.2 Most common tomato paste in is concentrate2 or double concentrate with 26-28 Brix, but concentrate3 or triple concentrate with 36-38 Brix is also present in the market. Triple concentrate is especially popular in China where it is exported to the markets where it is diluted and resold. High density paste can save freight, and this is a major reason why TSS 36-38 dominates Chinas export oriented production. Processing tomatoes have lower value (commonly 7-8 per kg) than fresh tomatoes (55-60 per kg). Tomato paste is a commodity in a competitive global market. Worldwide, there are three major players in tomato paste production: the United States, Europe (mainly Italy and Spain) and China. US production remains stable and is mainly reserved for the domestic consumption. International prices for tomato paste are basically set by Europe and above all China. The market price for tomato paste in 2009 is experiencing a record high: $1,130/MT (Tomato Paste 3 Brix 35-38) representing a 69% increase vs. 2008 and double vs. 2007 price of $598/MT.3 The soaring price experienced in the last two years resulted from a poor Chinese harvest in 2007 4 and from Europes steep decline in production due to low profitability in the years 2003 2007 and in response to a fundamental reform of the EU Common Agricultural Policy (CAP) that drastically reduced EU tomatoes subsidies in 2008 (a reduction on average of 20/MT). 5

1 2

Commonly expressed in Brix. In countries such as Italy, Spain and Iran characterized by the presence of specific high TSS values (6%) 1 kg of tomato paste may require as little as 5 kg of tomatoes. 3 FOB price in China. 4 A fungal disease destroyed 60% of the Inner Mongolia crop, causing a drop in Chinas processing tomato production of almost 1 million MT vs. expected. 5 Europeans farmers received a subsidy of 34.5 euro/ton for processing tomatoes before 2008. The average subsidy decreased to 16 euro/ton in 2008, when the traditional production subsidy (by tons produced) was replaced by area payments (by acreage planted).

Contract No. 267-C-00-07-00500-00

Tomato Paste In Iraq

Inma Agribusiness Program

China is filling the gap left by Europeans and more and more Chinese farmers shifted from cotton to processing tomatoes because of higher returns. Chinese supply has already started (planted crop 2009) to react to the high price for the commodity in the market and Chinas industry is expecting a record 7.6MMT of processing tomato production in 2009, a 20% increase from the 6.4MMT in 2008. Assuming normal weather conditions continue through the end of the marketing year, Chinas tomato paste production is expected to reach 1.1 MMT in 2009, this record production is mainly due to acreage expansion in the major producing provinces of Xinjiang and Inner Mongolia. Needless to say an expansion of Chinese tomato paste production, of the size expected in 2009, will affect international price for the commodity now at an ever high price of almost $1,130/MT (Tomato Paste 3 Brix 3538).

Tomato Paste in Iraq

The tomato paste industry in Iraq was created in the late 70s under Saddam with heavy subsidies and protection from imported competitor products. Traditionally, Gulf countries such as UAE and Saudi Arabia, heavily depend on imports of concentrate3 to produce their tomato paste (reconstituted). Saudi Arabia and United Arab Emirates are both in the top ten import countries of tomato paste from China with respectively 28,800 and 35,100MT, in the year 2008. 6 Recent years in Iraq have been characterized by a limited amount of tomato paste production using domestically grown tomatoes. Over the last decade the Iraqi tomato paste industry has heavily relied on imports of finished products (from Iran and Turkey) or imports of concentrate3 from China subsequently reconstituted, packaged and marketed in Iraq. Since the year 2008 there has been a renewed interest for tomato paste production in Iraq following the unusual high price in the international market for concentrate3. Currently two factories (the Hariri factory in Kurdistan region and the Balad factory in Salah ad Din province) have reported some production in Iraq made out of locally grown tomatoes. However quantity produced and price paid for the tomatoes at farm gate have not been disclosed. Historically the Iraqi tomato paste industry has not enjoyed structural competitive advantages for the following reasons: High costs in tomatoes production. Inma estimates 7 current production cost of tomatoes in Iraq is around ID 260/kg ($22 per kg), much higher than Iran, Spain, USA and China where the production costs is between $5 and $10 per kg. 8 Lack of specific varieties for processing. Iraq has not specific varieties for tomato processing (solid contents >5.0%) meaning it uses dual varieties suitable primarily for table tomatoes and, residually for processing. Dual varieties used in Iraq have on average only 4.5% solid content (specific processing tomatoes variety have TSS>5.5%) meaning processing costs are high due to the higher amount of energy required for evaporation, and yields lower (ratio tomato/tomato paste).

Italy is current the biggest importer of tomato paste from China with 90,600MT, followed by Russia (83,440), Japan and Nigeria. 7 Based on Inma tomato Project in Wassit, 2008. Refer to Appendix A for detailed calculations. 8 Star Group source and Tomatoland 2009.

Contract No. 267-C-00-07-00500-00

Tomato Paste In Iraq

Inma Agribusiness Program

Low tomato yields. Yields in Iraq, are low (frequently <20MT/ha). Tomato paste competitiveness depends essentially from the cost of raw material (60% of the total production cost). Usually, 70-80MT/ha is widely regarded by the tomato industry as the minimum yield required for a sustainable operation. Low Iraqi yields are attributed to poor seeds and soil salinity. High energy costs. After raw material energy is the most important cost in tomato processing (approximately 12% to 20% of the full cost depending on the source of energy). The lack of cheap grid electricity and natural gas and the necessity of using expensive diesel generators means Iraq has an additional cost ($55-$60/MT) in energy as compared to neighboring or competing countries such as Iran, China, the Gulf countries and even Turkey (although to a lesser extent). Competition from the fresh/table tomatoes market. Farmers in Iraq do not grow tomatoes specifically for processing; the table market is the main focus since prices are higher although very volatile. Frequently, excluding the harvesting peak periods, table tomatoes crowd out processing tomatoes generating abrupt fall in supply that disrupt production in continuous tomato processing production lines.9 High financial expenses. Tomato paste is typically a product with potentially significant stocking costs because of the high seasonal manufacturing. Interest rates, although declining, are still very high in Iraq as compared to other countries and generate a burden in an industry such as tomato paste that has a high seasonality and requires huge working capital. Tomato processing season could in fact last 2-3 months at the best in Iraq. Lack of economies of scale. Economies of scale also play against Iraq where most of the factories would work with a capacity of 300 tons/day (raw material). Turkey and Iran work with capacity of 700 MT/day (the exporters), China and USA with capacity exceeding 2,000 MT/day. Relatively high packaging costs. Packaging is also likely (and usually) to be a disadvantage for Iraq since factories commonly must import all the packaging material with the exception of carton boxes.

Under the current circumstances (year 2009) of unusually high international prices for concentrated tomato paste, it is economic and competitive to produce tomato paste in Iraq with locally grown tomatoes as follows: Currently tomato paste concentrate2 made in Iraq is sold at retail for ID 2,000 per kg ($1.66/kg). Ex-factory price for packaged product is around $1.16/kg. Imported Chinese tomato paste is delivered in Iraq at $1,250/MT (concentrate 3) meaning equivalent concentrate2 would be around $928/MT. ($0.93/kg). Ex-factory price, for finished product, using concentrate from China would be around $1.45-$1.50/kg therefore more expensive than Iraqi tomato paste ($1.15-$1.20/kg) made with locally grown tomatoes. Iranian product (a country with a price for tomato paste almost as competitive as China) 10 has a price similar to China as a result of a higher production cost (on average +8%/kg) and a lower transportation costs (on average -82%).

All the existing tomato processing production lines in Iraq are continuous, rather than batches, meaning production can only be stopped at a very high costs (cleaning of the entire line). Typically tomato paste line in USA, Europe and China work three shifts a day in the short harvesting season. 10 Source: Gallina Blanca Star Company.

Contract No. 267-C-00-07-00500-00

Tomato Paste In Iraq

Inma Agribusiness Program

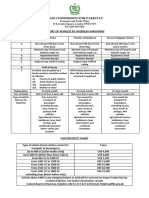

Table 1: Comparison Price and Cost Tomato Paste from Imported Concentrate and Locally procured Tomatoes (Iraq, 2007 2009) Iraq Type of Tomato Paste Concentrate3/MT FOB Concentrate3/MT Delivered Iraq Equivalent Concentrate2 Finished Product from concentrate imported Finished Product from Local tomatoes (Estimate) Retail Price Source: Inma Values in $ per MT 2007 700 520 800 1,160 1,550 Values in $ per MT 2009 1,250 930 1,450 1,200 1,700 China Values in $ Values in $ per MT per MT 2007 2009 598 1,150 -

At a price of $1.16/kg (ex-factory) tomato paste processors in Iraq cannot afford to pay farmers more than $10 per kg for the tomatoes, when the production costs for tomatoes in Iraq is on average 22 per kg. Farmers may consider 10 per kg for the tomatoes an attractive price when there is a surplus of production with virtually no value in the market, nevertheless this level of price will not cover their production cost although increasing their total income. In other countries big producers of tomato paste (Italy, USA, Turkey) typically tomatoes are sold to processors at full costs (no profit) in the worst scenario. Production costs in these countries are around 7 per kg, and margins slim (in EU, a reduction of the subsidy of 20/MT was sufficient to push many tomatoes growers out of business). Nevertheless the medium/ long term competitiveness of tomato paste made in Iraq depends, on farmers acceptance of very low price for the raw material and on the existence, in the market, of significant surpluses due to a low demand from the more lucrative table tomatoes sector. Currently, in the absence of farmers specialized on tomato processing, surpluses in Iraq are still limited and unable to regularly feed big tomato paste processing lines. In the current model tomatoes for processing are residual crop that utilizes surplus tomatoes not absorbed by the table market, availability of this surplus is limited in quantity and time. The long term sustainability of a strong tomato paste industry in Iraq will depend basically on two factors: 1. The drastic reduction of tomato production costs (from $22 per kg to approximately $10 per kg, achieved through improved productivity and specialization with farmers dedicated 100% to tomato processing using varieties specific to tomato processing rather than double purpose.11 2. An international (FOB) price of Chinese concentrate3 tomato paste no lower than $850/MT.

11

Double purpose varieties are those suitable for table and processing tomatoes. (Usually skewed on table characteristics but acceptable for processing).

Contract No. 267-C-00-07-00500-00

Tomato Paste In Iraq

Inma Agribusiness Program

The reduction in production costs will mainly depend on yields increase to a minimum level of 70-80MT/ha12 , something feasible on principle in Iraq but still far from the current scenario (average yields for tomatoes are<30MT/ha).13 With regard to the international price of tomato paste, Chinas leading producers express concern that the current high price (unthinkable only two years ago), could bring the resurgence of Europes small factories, and the rapid expansion of local production capacity in China. According to industry sources, the ideal price for Chinas tomato paste industry is $800900/MT, as opposed to the current $1,130/MT and an average price of only $600/MT in the period 2003 - 2007. A return of concentrate3 tomato paste international price to the level of the years 2000 2007 is likely to crowd out the Iraqi tomato paste industry (local procurement of tomato). International price for concentrate3 around $800-$900/MT will probably generate a mix model with production split between reconstituted and, probably in a limited quantity, and from locally procured tomatoes. Only international price for tomato paste concentrate3 above $1,100/MT will guarantee the Iraqi tomato processors a competitive edge in costs, provided farmers will be willing to accept price for tomatoes around $10 per kg.

12

Countries with competitive tomato paste industries all have, on average, minimum yields of at least 70MT/ha and frequently >100MT/ha. 13 In particular is imperative to adopt in Iraq new hybrids varieties.

Contract No. 267-C-00-07-00500-00

Tomato Paste In Iraq

Inma Agribusiness Program

Appendix A Gross Margin per Donum Tomato Wasit Project

TOMATO

Crop produce: Tomato Crop produce:

Unit

kg kg kg ID Liter Liter Liter kg kg kg Box ID Dunum Dunum Dunum Ton person/day ID

N Units

6,000 0

Price/Unit (ID)

500 0

Total Cost (ID)

2,430,000 0 2,430,000 50,000 75,000

Total ($)

2,025 0 2,025 42 63 63 0 0 125 125 0 42 192 67 0 125 0 625 42 1,129 180 1,309 896

Total Revenue

Seed/seedling

Total Chemicals

- Pesticides - Insecticides - Fungicides

3 3 3 100 80

50,000 10,000 50,000 650 300

75,000 0 0 150,000 150,000 0 50,000 230,000

Total mineral fertilizer

DAP Urea Packing boxes Cost of hired machinery - Land preparation - Irrigation - harvesting - Plastic and Steal Frame Manual labor Transportation

1 1 1 0.00 50

32,000 60,000 180,000 0 15,000

80,000 0 150,000 0 750,000 50,000 1,355,000 216,000 1,571,000

Total Variable Costs Financial Expenses Total Costs Gross Margin

Gross Margin on Revenue %

ID

1,075,000 44.2%

Total costs of $1309 / 6000 kg = .218 or 22 cents per kg

Contract No. 267-C-00-07-00500-00

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 8AДокумент17 страниц8Aselene50% (2)

- Article Family FarmДокумент3 страницыArticle Family FarmknappnlktjqvensОценок пока нет

- Re InsuranceДокумент26 страницRe Insurancepankajgupta100% (2)

- 1.02 Introduction To HPI Sub-ConceptsДокумент38 страниц1.02 Introduction To HPI Sub-ConceptsNurmalinda SihombingОценок пока нет

- Third Party InsuranceДокумент22 страницыThird Party InsurancePulkit Mago 1703887Оценок пока нет

- Class 9 SST WorksheetДокумент3 страницыClass 9 SST WorksheetBharat GundОценок пока нет

- Daftar Pustaka: LILIK YULIANTO N, Prof. Dr. Bambang Riyanto L.S., MBA., Ak, CAДокумент3 страницыDaftar Pustaka: LILIK YULIANTO N, Prof. Dr. Bambang Riyanto L.S., MBA., Ak, CAAnggit Jaya MuktiОценок пока нет

- Pestle Analysis of Bangladesh: AssignmentДокумент8 страницPestle Analysis of Bangladesh: AssignmentSrinivasan KCОценок пока нет

- ClothingДокумент2 страницыClothingFHKОценок пока нет

- Hutti Gold Mines 02 Mar 2012Документ3 страницыHutti Gold Mines 02 Mar 2012Chandrakumar87Оценок пока нет

- LP 1T Pipes Critical Crane Lift Plan 25T Crane CPFДокумент1 страницаLP 1T Pipes Critical Crane Lift Plan 25T Crane CPFMPS PSKОценок пока нет

- Melbourne Itinerary PDFДокумент7 страницMelbourne Itinerary PDFdawna25Оценок пока нет

- Semirara Mining and Power Corporation-ScriptДокумент8 страницSemirara Mining and Power Corporation-ScriptYan's Senora BescoroОценок пока нет

- Impact of Globalization On Pharmaceutical IndustryДокумент15 страницImpact of Globalization On Pharmaceutical IndustrySneha Tawsalkar50% (2)

- Form For Cargo Information For Solid Bulk Cargoes: E.g., Class & UN No. or "MHB"Документ2 страницыForm For Cargo Information For Solid Bulk Cargoes: E.g., Class & UN No. or "MHB"Jayme LemОценок пока нет

- Surat Chennai EMT59092244Документ2 страницыSurat Chennai EMT59092244nik1111Оценок пока нет

- Custom Seat Rail FormДокумент1 страницаCustom Seat Rail FormIvan Ezequiel CastilloОценок пока нет

- Beck Daniel ResumeДокумент1 страницаBeck Daniel Resumeapi-278118064Оценок пока нет

- Preliminary Assessment SEAM 3Документ14 страницPreliminary Assessment SEAM 3nerissa belloОценок пока нет

- Capital Formation in Agriculture PDFДокумент17 страницCapital Formation in Agriculture PDFArya SenapatiОценок пока нет

- Metro Manila PhilippinesДокумент27 страницMetro Manila PhilippinesRaymond AnactaОценок пока нет

- Construction On Rivonia Road Rea Vaya BRT Station CommencesДокумент3 страницыConstruction On Rivonia Road Rea Vaya BRT Station CommencesJDAОценок пока нет

- Tugas Bahasa Inggris Retail Banking: By: Group EightДокумент5 страницTugas Bahasa Inggris Retail Banking: By: Group EightOka HagaОценок пока нет

- Dutch Flower Cluster v2Документ9 страницDutch Flower Cluster v2gagafikОценок пока нет

- Green Peace Lincoln College: IntroductionДокумент36 страницGreen Peace Lincoln College: IntroductionLucas lopezОценок пока нет

- Steel Industry in LahoreДокумент6 страницSteel Industry in LahoreEngr Muhammad Haider Ali100% (1)

- Haitian Jupiter SeriesДокумент4 страницыHaitian Jupiter SeriesRenardОценок пока нет

- High Commission For Pakistan: Import of Vehicles by Overseas PakistanisДокумент1 страницаHigh Commission For Pakistan: Import of Vehicles by Overseas Pakistaniszeeshan tanveerОценок пока нет

- Angola Offshore - MagДокумент52 страницыAngola Offshore - Magrieza_fОценок пока нет

- gr8 Business-Ch2 Classification of Business Notes With Case StudyДокумент8 страницgr8 Business-Ch2 Classification of Business Notes With Case StudyTariqul Islam0% (2)