Академический Документы

Профессиональный Документы

Культура Документы

You Can Learn From This - Californians Not Getting Any Traction in Court

Загружено:

83jjmackОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

You Can Learn From This - Californians Not Getting Any Traction in Court

Загружено:

83jjmackАвторское право:

Доступные форматы

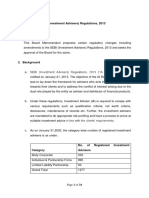

CALIFORNIAWHAT THE COURTS ARE DOING For week of 10/17/2011 * TENTATIVE RULING: * Demurer -- Overrule The Complaint is for

unlawful detainer. Plaintiff alleges it purchased the property at a trustees sale. The Defendant is unlawfully detaining the property because he has refused to deliver possession of the property after receiving a notice to quit. This hearing concerns the Defendants demurrer to the complaint. The Defendants argue that there are grounds for a demurrer because the pleadings are uncertain and the complaint does not plead sufficient facts to show that the Plaintiff has standing or capacity. 1. Uncertainty A demurrer for uncertainty is strictly construed, even where a complaint is in some respects uncertain, because ambiguities can be clarified under modern discovery procedures. Khoury v. Maly's of California Inc. (1993) 14 Cal.App.4th 612, 616. Accordingly, a demurrer for uncertainty will be sustained only when the complaint is so bad that the defendant cannot reasonably respond because the defendant cannot reasonably determine what issues must be admitted or denied, or what counts or claims are directed against the defendant. Id. Here, the Defendant can reasonably respond because the Defendant can reasonably determine that the Plaintiff claims that it has title to the real property and that the Defendant is improperly in possession of the property. Since the Defendant can reasonably determine whether to admit or deny that he is unlawfully detaining the real property, there are no grounds for a demurrer based on uncertainty. 2. Standing and Capacity The Defendant argues that the complaint lacks sufficient facts to demonstrate that the property was sold properly or that the Plaintiff has standing. In ruling on a demurrer based on the failure to state sufficient facts, the Court examines the allegations in order to determine whether they contain the essential facts necessary to plead a valid cause of action. Quelimane Co. v. Stewart Title Guaranty Co. (1998) 19 Cal. 4th 26, 38-39. The Court assumes the truth of all material facts properly pleaded and gives the complaint a reasonable interpretation, reading it as a whole and its parts

in their context. Id. If a complaint does not state a cause of action, but there is a reasonable possibility that the defect can be cured by amendment, leave to amend must be granted. Id. There is a difference between the capacity to sue, which is the right to come into court, and the standing to sue, which is the right to relief in court. Color-Vue, Inc. v. Abrams (1996) 44 Cal. App. 4th 1599, 1603-1605. Lack of capacity is merely a legal disability, such as infancy, insanity, or the failure to pay corporate taxes, which deprives a party of the right to come into court. A plaintiff's capacity to sue is not an element of a cause of action. Id. Standing and the right to relief, on the other hand, goes to the existence of a cause of action. Id. With regards to capacity, the Defendant does not offer any basis to find that the Plaintiff has no right to come into Court. The Defendant does not identify any legal disability and demonstrate that the Plaintiff has no right to come into Court due to this legal disability. Further, the Plaintiff alleges in paragraph 1 that it is qualified to commence this action. Since this is assumed true for the purposes of the demurrer, the Defendants argument based on lack of capacity does not demonstrate any grounds for a demurrer. With regards to standing, California law provides that upon sale under a trust deed the purchaser has an immediate right to possession. Farris v. Pacific States Auxiliary Corp. (1935) 4 Cal. 2d 103, 105. Under CCP section 1161a(b)(3), after a sale upon a trust deed, the purchaser may bring an unlawful detainer action against any person who remains in possession after a three day notice to quit has been served. The Plaintiffs complaint for unlawful detainer must allege the following: 1) the property was sold in accordance with Civil Code section 2924; and 2) a three-day notice to quit was served on the Defendant. CCP section 1161a(b)(3); Evans v. Superior Court (1977) 67 Cal. App. 3d 162, 169-171. The Plaintiff alleges facts in paragraph 4 to demonstrate that the Plaintiff is the owner of the property because it purchased the property in a sale held in accordance with Civil Code section 2924. This allegation is assumed true for the purposes of ruling on the demurrer and demonstrates that the Plaintiff has standing to bring these claims because it is the owner of the property and it is the real party in interest. Therefore, the Court overrules the Defendants demurrer because the complaint is not uncertain and because it pleads sufficient facts.

* TENTATIVE RULING: * SUSTAIN demurrers to first, second, third, fourth, and sixth causes of action with 10 days leave to amend. TAKE OFF CALENDAR motion to strike. The Plaintiff alleges she was fraudulently induced into a loan agreement in which she received over $551,500. The loan agreement was secured by a deed of trust on her property. The Plaintiff seeks an order declaring the contract and the deed of trust void. The gravamen of her claim is that the Note did not contain all the terms of her payment obligations, the Deed of Trust improperly contained terms that should be in the Note and fails to contain a beneficiary, and that MERS could not be the beneficiary so could not appoint a trustee to enforce the terms of the Note. In addition, the Plaintiff seeks to set aside the trustees sale under which her property was sold in 2009. The Complaint contains eight causes of action. These are: 1) Fraud; 2) Void Contract; 3) Void and Cancel Deed of Trust; 4) Violation of Business and Professions Code section 17200; 5) Injunctive Relief; 6) Restitution (Unjust Enrichment); 7) Set Aside Trustees Sale; 8) Void or Cancel Trustees Deed upon Sale Before the Court is Defendant Metrocities Mortgages Demurrer to the first, second, third, fourth, and sixth causes of action and its Motion to Strike portions of Plaintiffs complaint seeking an award of special damages and punitive damages. 1. Demurrer a. First Cause of Action for Fraud Defendant argues that this cause of action lack sufficient, particular facts. Facts constituting each element of fraud must be alleged with particularity; the claim cannot be saved by referring to the policy favoring liberal construction of pleadings. Committee on Children's Television, Inc. v. General Foods Corp. (1983) 35 Cal.3d 197, 216. The first cause of action for fraud includes the following elements: 1) a representation, usually of fact, which is false; 2) knowledge of its falsity; 3) intent to defraud;

4) justifiable reliance upon the misrepresentation; and 5) damage resulting from that justifiable reliance Stansfield v. Starkey (1990) 220 Cal. App. 3d 59, 72-73. Since fraud must be pleaded with particularity, the complaint must allege facts showing how, when, where, to whom, and by what means the representations were tendered. Stansfield v. Starkey (1990) 220 Cal.App.3d 59, 73. In addition, fraud pleadings against a corporation must allege the names of the persons who made the misrepresentations, their authority to speak for the corporation, to whom they spoke, what they said or wrote, and when it was said or written. Tarmann v. State Farm Mutual Automobile Insurance Co. (1991) 2 Cal.App.4th 153, 157. A review of the first cause of action reveals that it does not contain sufficient particular facts regarding the nature of the fraud and Defendant. The Plaintiff alleges in paragraphs 21 and 22 that she was instructed by a Doe Defendant, a notary, to sign the document and that, based on the representations of the Doe Defendant, she believed the documents contained the terms and conditions of the loan that she had been told that she was receiving. The Plaintiff does not identify the name of the person who made representation or the persons authority to speak for the Defendant, Prospect Mortgage, LLC. The Plaintiff does not identify when the representations were made. The Plaintiff does not allege where the representations were made. The Plaintiff does not allege how or by what means the representations were tendered. The Plaintiff does not allege with particularity the representations, i.e., the terms and conditions that the Doe Defendant falsely represented were in the loan agreement. The Plaintiff does not allege that the moving Defendant had an intent to defraud the Plaintiff. This is not sufficient to plead a fraud claim. Therefore, the Court sustains the demurrer to the first cause of action. Since it is reasonably possible for the Plaintiff to add allegations to correct these defects, the Court grants 10 days leave to amend. b. Second Cause of Action for Void Contract and Third Cause of Action to Void and Cancel the Deed of Trust Defendant argues that the Plaintiff does not allege any facts identifying any grounds to find that the contract or the deed of trust is void. California law provides that contracts opposed to law or public policy are not enforceable. Sistare-Meyer v. Young Men's Christian Ass'n (1997) 58 Cal. App. 4th 10, 16. However, public policy requires and encourages the making of contracts by competent parties upon all valid and lawful considerations and courts allow parties the widest latitude in this regard. Id. Accordingly, a Court will

not declare a contract void unless it is plain that the contract violates public policy. Id. Plaintiff alleges in the second cause of action that the note was void because it was not, in fact, a note. The Plaintiff alleges in the third cause of action that the deed of trust is void because the Plaintiff was fraudulent induced into the loan. However, there are no allegations identifying any law or public policy that makes the contract and the deed of trust void. Further, as noted above, the Plaintiff has not pleaded sufficient facts to state a cause of action for fraud, which could have been the basis for rescinding the contract. Also, the Plaintiffs opposition does not cite to any legal authority under which the Court could find that the contract or the deed of trust are void. Finally, Plaintiff does not allege that she has done equity by restoring or offering to restore the amounts that she received under the contract. The Plaintiff is seeking an order that would rescind the contract. Under Civil Code section 1691, to obtain a rescission of a contract, the party must give notice and restore or offer to restore everything of value which the party has received under the contract. The Plaintiff does not allege any facts demonstrating that she has offered to restore the benefits that she received under the contract, which was the $551,000 loan that was secured by the deed of trust on her property. Therefore, the Court sustains the demurrers to the second and third causes of action because the Plaintiff does not plead any facts showing that the contract and deed of trust are void and because Plaintiff has not plead facts showing that she restored or offered to restore the $551,000 that she received under the loan agreement. c. Fourth Cause of Action for Violation of Business and Professions Code section 17200 Defendant argues that Plaintiff has not pleaded the particular facts needed to state this statutory cause of action for the violation of Business and Professions Code section 17200. This section broadly prohibits any unlawful, unfair, or fraudulent business act or practice. In order to plead a claim under Business and Professions Code section 17200, there must be allegations showing an unlawful, unfair, or fraudulent business act or practice. Paulus v. Bob Lynch Ford, Inc. (2006) 139 Cal. App. 4th 659, 676-677. This includes anything that can properly be called a business practice and that at the same time is forbidden by law. Id. An unlawful business act or practice is one that is prohibited by law, where possible sources of law are defined broadly. Cel-Tech Comms., Inc. v. Los Angeles Cellular Tel. Co. (1999) 20 Cal. 4th 163, 180 (holding that section 17200 borrows violations of other

laws and makes them independently actionable). In addition, the pleadings must state with reasonable particularity the facts supporting the statutory elements of the violation. Khoury v. Maly's of California, Inc. (1993) 14 Cal. App. 4th 612, 619. This includes the particular section of a statutory scheme that was violated and the particular facts showing that the statute was violated. Id. The Plaintiff alleges in paragraphs 41 to 43 that the Defendants made false representations to the Plaintiff as part of a scheme to qualify mortgage loan borrowers for loans to help inflate the demand for and price of housing in California. The Plaintiff does not identify any statutory scheme and does not plead any particular facts showing the manner in which the identified statute was violated. This is not sufficient to plead a cause of action for the violation of Business and Professions Code section 17200. In addition, in paragraph 45, the Plaintiff alleges that the Defendants deceptive practices included material misrepresentations of the facts of the transaction when they were negotiating with the Plaintiff. An action under Business and Professions Code section 17200 is not an all-purpose substitute for a tort or contract action. Paulus v. Bob Lynch Ford, Inc. (2006) 139 Cal. App. 4th 659, 676-677. Here, the Plaintiff appears to be pleading an unfair business practices claim as a result of alleged fraud by defendants and unknown parties. But the elements of the fraud claim are not specific and particularized. Therefore, the Court sustains the demurrer to the fourth cause of action. The Court grants the Plaintiff 10 days leave to amend to articulate a manner in which she can plead this as a claim for the violation of Business and Professions Code section 17200. e. Sixth Cause of Action for Restitution (Unjust Enrichment) The Defendant argues that this cause of action does not allege any facts demonstrating that the Defendant obtained benefits unjustly. In order to plead a claim for unjust enrichment, the Plaintiff must allege the following: 1) the Defendant received a benefit from the Plaintiffs; 2) it would be unjust for the Defendant to retain the benefit Lucky Auto Supply v. Turner (1966) 244 Cal. App. 2d 872, 885. The Plaintiff alleges in paragraphs 52 and 53 that the Defendants were enriched by the contract and that they received payments and fees from the Plaintiff. However, there are no allegations demonstrating that it would be

unjust for the Defendant to retain these payments and fees because the Plaintiff made these payments under a loan agreement with the Defendant. A review of the deed of trust attached within untabbed exhibit A to the Plaintiffs First Amended Complaint reveals that she owed $551,500 under the loan agreement. The Plaintiff does not allege any facts demonstrating that she did not receive the loan. This is not sufficient because it does not demonstrate that it would be unjust for the Defendant to retain the payments and fees that were made under the loan agreement. Therefore, the Court sustains the demurrer to the sixth cause of action. The Court grants 10 days leave to amend to correct this defect. 2. Motion to Strike The Defendant requests that the Court strike the requests for special damages and for punitive damages from the First Amended Complaint. In light of the tentative ruled to sustain the demurrer to each cause of action directed at this Defendant, this request is moot because these portions of the complaint will be removed by the Courts order on the demurrer. Therefore, the Court takes the motion to strike off calendar as moot. * TENTATIVE RULING: * Motion seeking: 1. Order imposing terminating sanctions on the Defendant by striking his answer and entering a default against him. 2. Order imposing monetary sanctions of $1,540 on the Defendant. Grant motion for terminating sanctions Deny request for monetary sanctions. This case arises from the Plaintiffs claim that the Defendant breached an agreement to purchase a boat. The Plaintiff repossessed the boat and sold it. The Plaintiff brought this action to seek the amount that remains unpaid after the proceeds from the sale are subtracted. Trial is set for November 21, 2011. This hearing concerns the Plaintiffs request for an order imposing terminating and monetary sanctions on the Defendant. CCP section 2023.030 permits the Court to impose terminating sanctions for discovery misuses, which are defined by CCP section 2023.010 to include the failure to respond to discovery and the failure to comply with a Court discovery order. Under California law, a discovery order cannot go further than is necessary

to accomplish the purpose of discovery. Newland v. Superior Court (1995) 40 Cal. App. 4th 608, 613. The purpose of discovery sanctions is to prevent abuse of the discovery process and correct the problem presented. McGinty v. Superior Court (1994) 26 Cal. App. 4th 204, 210. In addition, an order imposing terminating sanctions must be preceded by the disobedience of an order compelling a party to do that which the party should have done in the first instance. Kravitz v. Superior Court (2001) 91 Cal. App. 4th 1015, 1021. The Plaintiffs motion includes facts in the declaration of its attorney, Karel Rocha, to demonstrate that the Defendant has misused discovery by failing to comply with his discovery obligations in the following manner: 1) the Defendant failed to serve any responses to the form interrogatories and requests for admissions that the Plaintiff served on October 1, 2010; and 2) the Defendant failed to comply with the Courts January 14, 2011 order directing the Defendant to serve responses to the form interrogatories. These facts demonstrate that the Defendant has misused discovery by failing to serve responses to the Plaintiffs form interrogatories and requests for admissions and by failing to comply with the Court's January 14, 2011 discovery order. The Defendant has not filed any opposition papers to demonstrate that he is willing to correct his past discovery misuse and to comply with future discovery. Accordingly, it appears necessary to impose terminating sanctions because no sanction less than terminating sanctions will accomplish the purpose of discovery. Since the Defendant has failed to show any willingness to comply with his discovery obligations, it does not appear that any sanctions other than terminating sanctions will correct the problem presented by his continuing failure to engage in discovery. In addition, since the Defendant failed to comply with the Courts January 14, 2011 discovery order, terminating sanctions may be imposed under California law. Therefore, the Court imposes terminating sanctions on the Defendant by striking his answer and by entering a default against him. Finally, the Plaintiff requests that the Court award monetary sanctions for this discovery misuse. Since the Court should impose terminating sanctions on the Defendant, an order imposing monetary sanctions would go further than is necessary to correct the problem presented by the Defendants continuing failure to engage in discovery. Therefore, the Court denies the Plaintiffs request for monetary sanctions.

* TENTATIVE RULING: * Motion for Judgment on the Pleadings -- Denied. The Complaint alleges that the Plaintiff entered into a purchase agreement with Defendant, Sovereign Properties, under which the Plaintiff agreed to purchase a condominium from the Defendant. Under the purchase agreement, the Plaintiff had the option to demand that the Defendant repurchase the unit at the same price that the buyer paid plus the price for seller installed options or upgrades less 6%. The Defendant breached the agreement by refusing to repurchase the condominium. In addition, Defendant, Cardiff Equities, Inc., is liable for the breach of contract because Sovereign Properties was its alter ego. The Complaint alleges causes of action for: 1) Breach of Contract; 2) Specific Performance; 3) Intentional Misrepresentation; and 4) Negligent Misrepresentation This hearing concerns the motion for a judgment on the pleadings filed by Defendant, Cardiff Equities, Inc. A motion for judgment on the pleadings has the purpose and effect of a general demurrer and is filed because the time to file a demurrer has expired. Smiley v. Citibank (S.D.), N.A. (1995) 11 Cal. 4th 138, 145-146. Just as on a demurrer, the Court examines the allegations in order to determine whether they contain the essential facts necessary to plead a valid cause of action and accepts as true all material facts alleged therein. Id. The Defendant argues that the Plaintiff's first and second causes of action do not state sufficient facts. The Defendant argues that there are insufficient facts to plead the alter ego doctrine or that the Plaintiff can seek specific performance because it has no adequate legal remedy. The Court has already considered these arguments when it heard and overruled the demurrers brought by Defendants, Sovereign Properties and Cardiff Equities, Inc., on November 5, 2010. 1. First Cause of Action for Breach of Contract The Defendant argues that the pleadings do not allege that a contractual relationship existed with the Plaintiff and that the allegations are insufficient to plead the alter ego doctrine. The Court has already rejected this argument when it overruled the Defendant's demurrer on November 5, 2010. The Defendant offers no explanation for raising the issue again in what should be considered an untimely motion for reconsideration of the Court's prior order.

The Plaintiff alleges in paragraph 10 that it entered into a purchase agreement with Defendant, Sovereign Properties II. However, the Plaintiff alleges in paragraph 6 that the Defendant, Cardiff Equities, was using Sovereign Properties II as an alter ego. Under the alter ego doctrine, when the corporate form is used to perpetrate a fraud, circumvent a statute, or accomplish some other wrongful or inequitable purpose, the Courts will ignore the corporate entity and deem the corporation's acts to be those of the persons actually controlling the corporation. Sonora Diamond Corp. v. Superior Court (2000) 83 Cal. App. 4th 523, 538. The alter ego doctrine prevents individuals from misusing the corporate laws by the device of a sham corporate entity formed for the purpose of committing fraud or other misdeeds. Id. Accordingly, if the Plaintiff establishes that the alter ego doctrine should be applied, the Defendant, Cardiff Equities, could be liable under the contract with Sovereign Properties II because the acts of Sovereign Properties II will be deemed to be the acts of Cardiff Equities. Courts liberally apply the alter ego doctrine when the equities and justice of the situation call for it rather than restricting it to technical requirements of pleading and procedure. First Western Bank & Trust Co. v. Bookasta (1968) 267 Cal. App. 2d 910, 915. It is essential principally that a showing be made that there is a unity of interest and that permitting the fiction of corporate separate existence is unjust. Id. The Plaintiff alleges in paragraphs 6 facts demonstrating that there was a unity of interest between the Defendants, Cardiff Equities, Faruq Jurjis, and Clyde Lane, and Sovereign Properties II because they were the only shareholders, directors, officers, and persons in control. Further, the Plaintiff alleges that it would be unjust to recognize the separate existence of Sovereign Properties II because it was inadequately capitalized when it failed to repurchase the Plaintiff's condominium. These allegations are sufficient to demonstrate the existence of a contract with Defendant, Cardiff Equities, because under the doctrine of alter ego, it can be deemed to be parties to the contract if the separate existence of Sovereign Properties II is ignored. Accordingly, the Court denies the motion with respect to the first cause of action. 2. Second Cause of Action for Specific Performance The Defendant argues that this cause of action lacks sufficient facts because the pleadings demonstrate that the Plaintiff has an adequate remedy in law. Specific performance is a remedy for the breach of a contract that may be

awarded in the alternative to damages for the breach of a contract. Mycogen Corp. v. Monsanto Co. (2002) 28 Cal. 4th 888, 905-906 (holding that a party cannot be awarded both damages and specific performance for the same breach). A claim for specific performance must include allegations showing that the plaintiff cannot adequately be compensated in money. Sheppard v. Banner Food Products, Inc. (1947) 78 Cal. App. 2d 808, 813. The Plaintiff alleges that in paragraph 28 that he has no adequate remedy at law because the contract was for the sale of real property. Civil Code section 3387 provides the following: It is to be presumed that the breach of an agreement to transfer real property cannot be adequately relieved by pecuniary compensation. In the case of a single-family dwelling which the party seeking performance intends to occupy, this presumption is conclusive. In all other cases, this presumption is a presumption affecting the burden of proof. Here the Plaintiff wants to sell the property to the Defendant. Under California law, he may sue for specific performance or treat the contract as breached and sue for damages resulting from the breach. BD Inns v. Pooley (1990) 218 Cal. App. 3d 289, 296 (holding that a seller of real property may sue for specific performance or damages from breach of contract). Since Plaintiff, as the seller of real property, may sue for specific performance or damages from the breach of contract, the Plaintiff may bring this cause of action for specific performance. The Defendant argues that the Plaintiff cannot bring the first cause of action for breach of contract and the second cause of action for specific performance because they are different remedies for the same breach. However, case law permits plaintiffs to plead inconsistent or alternative counts. Rader Co. v. Stone (1986) 178 Cal. App. 3d 10, 29. Here, the Plaintiff may seek damages in its first cause of action and then seek specific performance in its second cause of action as an alternative count. Accordingly, the Plaintiff has pleaded sufficient facts to show that he has no adequate remedy at law and the Court should deny the Defendants motion for a judgment on the pleadings with regards to the second cause of action. Therefore, the Court denies the Defendants motion for a judgment on the pleadings in its entirety. * TENTATIVE RULING: *

Case Management Conference The Complaint alleges that the Defendants are improperly attempting to foreclose on the Plaintiffs property because the Defendants do not have the right to foreclose. Further, the Defendants failed to attempt to contact the Plaintiffs before they began to initiate the foreclosure proceeding. The Complaint alleges causes of action for: 1) Breach of Contract (against OneWest and MERS); 2) Declaratory Relief (against all Defendants); 3) Breach of Covenant of Good Faith and Fair Dealing (against OneWest and MERS); 4) Unlawful, Unfair, and Fraudulent Business Practice (against OneWest and MERS); 5) Quiet Title (against OneWest and MERS); 6) Accounting (against OneWest and MERS). The Plaintiffs filed their complaint on October 15, 2010. The Plaintiffs then filed on October 18, 2010 an ex parte application for a temporary restraining order and an OSC regarding a preliminary injunction to prevent the sale of the Plaintiffs property. The Defendants had set the sale date for October 19, 2010. On October 18, 2010, the Court issued a temporary restraining order to prevent the sale of the property. On November 19, 2010, the Court issued a preliminary injunction and ordered the Plaintiff to pay a $5,000 undertaking plus make monthly payments of $1,268.21 to One West Bank, commencing on December 1, 2010. This hearing concerns the demurrer of Defendants, Onewest Bank, FSB and MERS, to each of the causes of action in the complaint. 1. Tender Rule To plead any cause of action for irregularity in the sale procedure, there must be allegations showing that the plaintiff tendered the amount of the secured indebtedness to the Defendant. Abdallah v. United Sav. Bank (1996) 43 Cal. App. 4th 1101, 1109 (affirming an order sustaining a demurrer without leave to amend in a case claiming that the foreclosure and sale of a home was improper). There are federal cases interpreting California law that find that plaintiffs must plead that they tendered their debt to enjoin a pending foreclosure. In Anaya v. Advisors Lending Group, 2009 U.S. Dist. LEXIS 68373 (E.D. Cal. Aug. 3, 2009), the plaintiff sought to halt a pending foreclosure sale and to quiet title in her property. The Court found that the complaint's absence of allegations of a tender to cure defaults made it defective and subject to

dismissal. Further, the Court found that the plaintiff had offered nothing to indicate that she is able to tender her debt to warrant disruption of nonjudicial foreclosure. Accordingly, the Court dismissed the plaintiffs complaint. In Alicea v. GE Money Bank, 2009 U.S. Dist. LEXIS 60813, 7-8 (N.D. Cal. July 15, 2009), the Court held when a debtor is in default of a home mortgage loan, and a foreclosure is either pending or has taken place, the debtor must allege a credible tender of the amount of the secured debt to maintain any cause of action for wrongful foreclosure. Since the plaintiff had not pleaded tender, the Court dismissed her claims. A review of the pleadings reveals that the Plaintiffs allege in paragraphs 27, 36, and 45 that they offer to tender any amounts due on the note. This is insufficient to plead tender because a valid tender must be nothing short of the full amount due the creditor. Gaffney v. Downey Sav. & Loan Ass'n (1988) 200 Cal. App. 3d 1154, 1165. The Court of Appeal found that the following summary of the tender rule describes this requirement: The rules which govern tenders are strict and are strictly applied, and where the rules are prescribed by statute or rules of court, the tender must be in such form as to comply therewith. The tenderer must do and offer everything that is necessary on his part to complete the transaction, and must fairly make known his purpose without ambiguity, and the act of tender must be such that it needs only acceptance by the one to whom it is made to complete the transaction. Id. The Plaintiffs allegation is not a tender of the full amount due without ambiguity. The Plaintiff does not identify the amount and then plead that that she tendered this amount to the Defendant. Without such details, it is not possible for the Defendant to accept the tender because it cannot determine what, if anything, the Plaintiff has tendered. Further, the Plaintiff does not allege that they had the ability to tender the full amount due. The Plaintiff cannot circumvent the tender rule with a conclusory allegation that they offer to tender the full amount due because the act of tender must be such that it needs only acceptance by the Defendant to complete the transaction. Accordingly, the Plaintiffs have not satisfied the tender rule. Therefore, the Plaintiffs failure to satisfy the tender rule is grounds for a demurrer to the first, third and fifth cause of action to the complaint.

2. Second Cause of Action for Declaratory Relief (against all Defendants) The Defendants argue that the cause of action does not plead sufficient facts to identify an actual controversy. It is general rule that in an action for declaratory relief, the complaint is sufficient if it sets forth facts showing the existence of an actual controversy relating to the legal rights and duties of the respective parties under a contract or to property and requests that the rights and duties be adjudged. City Of Tiburon v. Northwestern Pac. R.R. Co. (1970) 4 Cal. App. 3d 160, 170. If these requirements are met, the Court must declare the rights of the parties whether or not the facts alleged establish that the plaintiff is entitled to a favorable declaration. Declaratory relief is a broad remedy, and the rule that a complaint is to be liberally construed is particularly applicable to one for declaratory relief. Further, a demurrer is a procedurally inappropriate method for disposing of a complaint for declaratory relief. Lockheed Martin Corp. v. Continental Ins. Co. (2005) 134 Cal. App. 4th 187, 221. This is based on the reasoning that an order sustaining the demurrer would leave the parties where they were, with no binding determination of their rights, to await an actual breach and ensuing litigation. This would defeat a fundamental purpose of declaratory relief, which is to remove uncertainties as to legal rights and duties before breach and without the risks and delays that it involves. The object of declaratory relief is not necessarily a beneficial judgment; instead, it is a determination, favorable or unfavorable, that enables the plaintiff to act with safety. This reasoning has established the rule that the defendant cannot, on demurrer, attack the merits of the plaintiff's claim. Thus, a complaint is sufficient if it shows an actual controversy; it need not show that plaintiff is in the right. In paragraph 25, the Plaintiff alleges that an actual controversy exists between the Plaintiffs and Defendants regarding the subject property. This controversy is based on allegations regarding the Plaintiffs payments on the note and whether the foreclosure proceedings are proper. In paragraph 26, the Plaintiff requests that the Court adjudge the rights and duties of the parties to the property. This is sufficient to plead the cause of action because, as noted above, the complaint need not show that the Plaintiff is in the right. Therefore, the Court overrules the demurrer to the second cause of action. 3. Fourth Cause of Action for Unlawful, Unfair, and Fraudulent Business Practice (against OneWest and MERS)

The Defendant argues that this cause of action lacks allegations identifying a statute that was violated. The Plaintiffs seek relief under Business and Professions Code section 17200, which defines unfair competition to be any unlawful, unfair, or fraudulent business practice. In order to plead a claim under Business and Professions Code section 17200, there must be allegations showing an unlawful, unfair, or fraudulent business act or practice. Paulus v. Bob Lynch Ford, Inc. (2006) 139 Cal. App. 4th 659, 676677. This includes anything that can properly be called a business practice and that at the same time is forbidden by law. Id. Finally, the pleadings must state with reasonable particularity the facts supporting the statutory elements of the violation. Khoury v. Maly's of California, Inc. (1993) 14 Cal. App. 4th 612, 619. This includes the particular section of a statutory scheme that was violated and the particular facts showing that the statute was violated. Id. The Plaintiff alleges in paragraph 33 that the acts that violated section 17200 were the following: 1) the Defendants failure to comply with Civil Code section 2923.5; 2) the Defendants act of continuing to engage in foreclosure proceedings after accepting monies from the Plaintiffs in violation of Civil Code section 2924 et seq. First, the Plaintiffs cannot rely upon Civil Code section 2923.5 because subsection (i) provides that section 2923.5 shall apply only to mortgages or deeds of trust recorded from January 1, 2003, to December 31, 2007, inclusive. A review of the deed of trust in exhibit 3 of the pleadings reveals that it is dated January 23, 2008. Accordingly, the Defendants were not required to comply with this section. Second, a review of Civil Code section 2924 et seq. reveals no code section that prevents the Defendants from continue to engage in foreclosure proceedings after accepting monies from the Plaintiffs. Civil Code section 2924c provides that a trustor has a right to cure a default and reinstate a loan at any time within the period commencing with the date of recordation of the notice of default until five business days prior to the date of sale set forth in the initial recorded notice of sale. The Plaintiffs, however, do not plead that they cured the default. Acceptance of a partial payment after declaration of acceleration does not preclude the completion of a pending foreclosure. Bisno v. Sax (1959) 175 Cal. App. 2d 714, 724. Since the Plaintiffs do not plead that they cured the default, the payment of monies to the Defendants did not preclude them from completing the pending foreclosure. Accordingly, the Plaintiffs fourth

cause of action fails to state sufficient facts because they do not identify a code section that the Defendants violated. Therefore, the Court sustains the demurrer to the fourth cause of action because the Plaintiffs do not plead any particular facts identifying a statute and the manner in which the Defendants violated the statute. The Plaintiffs did not file any opposition papers to demonstrate that they can correct these defects by amendment 4. Sixth Cause of Action for Accounting (against OneWest and MERS) The Defendants argue that there is no basis for an accounting in this action. The sixth cause of action for accounting claims that the amount that the Plaintiffs owed to the Defendants is unknown. It identifies no other basis for an accounting. Under California law, a request for an accounting may be dispensed with unless the right to an accounting is established. Baxter v. Krieger (1958) 157 Cal. App. 2d 730, 732. . In order to plead a cause of action for accounting, the pleadings must state facts showing the existence of the relationship which requires an accounting and the statement that some balance is due the plaintiff. Raymond v. Independent Growers, Inc. (1955) 133 Cal. App. 2d 154, 160. The Plaintiffs cause of action does not identify any relationship that requires an accounting. Further, it does not plead that some balance is due to the Plaintiffs. Instead, the Plaintiffs allege that the amount that the Plaintiffs owe to the Defendants is unknown and that the Defendants owe the Plaintiffs is unknown. Since there are no allegations identifying any basis to find that the Defendants owe money to the Plaintiffs in circumstances in which the Defendants are foreclosing on the Plaintiffs property because the Plaintiffs failed to pay all amounts due, the Plaintiffs have failed to state sufficient facts to support their cause of action for an accounting. Therefore, the Court sustains the demurrer to the sixth cause of action because the Plaintiffs do not plead any facts demonstrating that they had a relationship with the Defendants that required an accounting or that some balance is due to the Plaintiffs. The Court will grant 10 days leave to amend this cause of action. * TENTATIVE RULING: * Demurrer to the first cause of action for violation of Civil Code sections 2923.5 and 2934a is overruled. Plaintiff has adequately alleged that the

requirements of those statutes were not met and the court, on demurrer, is required to assume the truth of the allegations. Demurrer to the second cause of action for fraud is sustained. There are no allegations of misrepresentations or false promises made to plaintiff, upon which plaintiff justifiably relied. Nor does the complaint plead how, what, where, to whom and by what means (orally or in writing) that defendants made the misrepresentations. In addition, as to the corporate defendants, the complaint fails to allege the name of the person who made the misrepresentation and his or her authority to speak for the corporation. See generally, Lazar v. Superior Court (1996) 12 Cal.4th 631. Demurrer to the third cause of action for violation of Business & Professions Code section 17200 is sustained for failure to allege that plaintiff has suffered injury in fact due to the alleged unfair practice. Ten days leave to amend. CRC Rule 3.1320(g). * TENTATIVE RULING: * The hearing on the motion of Defendant County of Los Angeles to compel appearance at deposition by custodian of records for R. Rex Parris Law Firm per deposition subpoena is CONTINUED to ______________________________ at 8:30 a.m. in Department A-11. The hearing on the motion of defendant County of Los Angeles to compel production of documents per deposition subpoena from nonparty witness XXXXXXXX is CONTINUED to ____________________________ at 8:30 a.m. in Department A-11. The Court orders the R. Rex Parris Law Firm, through one of its custodians of records, to produce any and all correspondence from R. Rex Parris Law Firm to plaintiff XXXXXXXXXXXXXX and/or third party YYYYYYYYY during the months of April 2007 and May 2007 for an in camera review by the Court on ___________________________ at 8:30 a.m. in Department A-11. Should the Court find all or part of the information contained in such correspondence, if any, to be relevant and discoverable, such information shall be disclosed in the course of the litigation with the Court conducting further proceedings as necessary and appropriate. STATEMENT OF DECISION: 1. On December 13, 2010,Plaintiff filed her first amended complaint against

defendants County of Los Angeles and Does 1 to 100, asserting one cause of action in negligence with counts sounding in negligent roadway design, dangerous condition of public property and failure to inspect. Plaintiff alleged the defendants negligently designed, constructed and maintained a stretch of roadway near the intersection of Palmdale Boulevard and 230th Street East in the Antelope Valley, causing Plaintiffs vehicle to overturn after she lost control of the vehicle while traveling on the roadway on April 21, 2007. 2. On September 14, 2011, Defendant County of Los Angeles (Defendant) filed a motion to compel production of documents per deposition subpoena from non-party witness Celina XXXXXXX (XXXXXXX), Plaintiffs mother. 3. On September 20, 2011, Defendant filed a motion to compel appearance at a deposition by the custodian of records for the R. Rex Parris Law Firm (the Parris firm) per deposition subpoena. 4. On October 06, 2011, Plaintiff filed her oppositions to Defendants motions to compel production of documents per deposition subpoena from non-party witness Celina XXXXXXX and to compel appearance at deposition by custodian of records for the Parris firm per deposition subpoena. 5. On October 06, 2011, the Parris firm filed its opposition to Defendants motion to compel appearance at deposition by custodian of records for the Parris firm per deposition subpoena. 6. Discussion Code of Civil Procedure 2025.480 provides: (a) If a deponent fails to answer any question or to produce any document or tangible thing under the deponents control that is specified in the deposition notice or a deposition subpoena, the party seeking discovery may move the court for an order compelling that answer or production. [] (b) This motion shall be made no later than 60 days after the completion of the record of the deposition . . . . [] (c) Notice of this motion shall be given to all parties and to the deponent either orally at the examination, or by subsequent service in writing . . . . [] (d) Not less than five days prior to the hearing on this motion, the moving party shall lodge with the court a certified copy of any parts of the stenographic transcript of the deposition that are relevant to the motion . . . . In particular, Defendant requests that XXXXXXX be ordered to produce correspondence from the Parris firm in which the firm, pursuant to a consultation with XXXXXXX, declined to represent Plaintiff. 7. Defendant concedes the attorney-client privilege attaches to an attorneys communications with a prospective client when the clients dominant purpose in attempting to retain the attorney was to obtain a legal opinion or legal advice (see Evid. Code 952, 954), but argues the privilege has been

waived. Plaintiff and the Parris firm assert the correspondence sought is absolutely privileged and that no waiver has occurred here. Having reviewed the record and all competent and admissible evidence submitted, the Court is compelled to agree with Defendant. 8. As a threshold matter, Defendant contends XXXXXXX waived the privilege by testifying at her deposition that she had consulted with the Parris firm regarding her daughters accident. Not necessarily. Evidence Code 912 provides in pertinent part, (a) Except as otherwise provided in this section, the right of any person to claim a privilege provided by Section 954 (lawyerclient privilege) . . . is waived with respect to a communication protected by the privilege if any holder of the privilege, without coercion, has disclosed a significant part of the communication or has consented to disclosure made by anyone. Consent to disclosure is manifested by any statement or other conduct of the holder of the privilege indicating consent to the disclosure, including failure to claim the privilege in any proceeding in which the holder has the legal standing and opportunity to claim the privilege. (Emphasis added.) While the evidence clearly shows XXXXXX communicated with the Parris firm, there is no evidence in the record that XXXXXXX or Plaintiff consented to disclosure of a significant part of those communications, and nothing in the portion of the transcript submitted as evidence by Defendant suggests XXXXXXX disclosed a significant part of those communications at her deposition. (The Court is confident that if some portion of the transcript had evidenced such a disclosure, Defendant would have provided it.) Therefore, inasmuch as XXXXXXs deposition testimony is concerned, the Court finds XXXXXXX has waived the privilege only to the extent of the portions of the subject correspondence referencing the Parris firms refusal to represent Plaintiff, but not to any portions of the correspondence relating to legal opinions or legal advice the firm may have given to Plaintiff or XXXXXXX. 9. However, Plaintiff waived the privilege as to the entirety of the correspondence by filing a petition for relief from the Tort Claims Act filing requirement. 10. Plaintiff filed her petition for relief in Department 85 (the Honorable James C. Chalfant, presiding) on July 17, 2008, arguing her failure to present a timely claim was due to excusable neglect and/or incapacity under Government Code 946.6. Judge Chalfant denied the petition and the Court of Appeal reversed. XXXXXX v. County of Los Angeles, 184 Cal.App.4th 1373 (2010). 11. One of the questions presented to the XXXXXX court was whether a bright-line rule applies barring a finding of excusable neglect if the claimant

did not attempt to contact an attorney within the six-month [limitations] period [of Government Code 911.2, subdivision (a)]. XXXXXX, supra, 184 Cal.App.4th at 1381. Distinguishing People ex rel. Dept. of Transportation v. Superior Court, 105 Cal.App.4th 39 (2003) (Isenhower), which held that a relatively short stay in the hospital and cursory, unsubstantiated allusions to self-diagnosed post-accident depression by an injured plaintiff were insufficient to warrant relief on ground of excusable neglect (id. at 46), the XXXXXXX court concluded there was not: [T]here is no absolute rule barring excusable neglect when the claimant has failed to obtain counsel during the six-month period. If a claimant can establish that physical and/or mental disability so limited the claimants ability to function and seek out counsel such that the failure to seek counsel could itself be considered the act of a reasonably prudent person under the same or similar circumstances, excusable neglect is established. We recognize, however, that every claimant is likely to be suffering from some degree of emotional upset, and it takes an exceptional showing for a claimant to establish that his or her disability reasonably prevented the taking of necessary steps. XXXXXXX, supra, 184 Cal.App.4th at 1385. From this the court reasoned: XXXXXXX spent the first three months in the hospital, and the remainder of the sixmonth period confined to her bed at home. Depressed, in pain, and under the influence of medication, XXXXXXXs attention was directed toward relearning the basic tasks of everyday life, such as eating, holding a toothbrush, and controlling her elimination of waste. During that six-month period, she was unable to even sit up without assistance, and did not so much as leave her bedroom to watch television . . . . We therefore conclude that excusable neglect has been established. Id. at 1385-86. 12. Problematically for Plaintiff, the recitation of facts in the Second Districts opinion suggests that the record on appeal did not contain evidence of the April/May 2007 communications between XXXXXXX and the Parris firm, most likely because such evidence was never presented to Judge Chalfant. (Exhibits submitted by Defendant suggest the communications were first disclosed in declarations executed by XXXXXXX and Robert Parris of the Parris Firm on February 10, 2010 and submitted as part of Plaintiffs motion for limited remand on February 16, 2010 well after the record on appeal was filed on September 25, 2009.) Indeed, the language of the opinion suggests the Second District was operating under the impression that Plaintiff decided to contact an attorney about her accident only after seeing a commercial for attorneys in February 2008. XXXXXXX, supra, 184 Cal.App.4th at 1379. Plaintiffs failure to disclose evidence of her mothers communications with the Parris firm with her petition for relief and appeal of the trial courts denial of that petition could be construed as a fraud on the courts and, depending on what the Parris firm told XXXXXXX, is potentially a basis for reconsideration of Judge Chalfants order granting relief on remand.

13. A person or entity seeking to discover privileged information can show [an implied] waiver by demonstrating that the client has put the otherwise privileged communication directly at issue and that disclosure is essential for a fair adjudication of the action. Southern Cal. Gas Co. v. Public Utilities Com., 50 Cal.3d 31, 40 (1990). In her first amended complaint, Plaintiff asserted that Defendant was negligent, and one of the allegations supporting her claim for damages was that she complied with the claims notice provisions of Government Code, s. 954.4, by presenting a claim to the County and having that claim rejected by the County prior to filing this action. (While Defendant asserts the claim filing requirement may be raised as an affirmative statute of limitations defense, the requirement is actually a condition precedent to maintaining a cause of action and is therefore an element of a plaintiffs cause of action. K.J. v. Arcadia Unified School Dist., 172 Cal.App.4th 1229, 1238 (2009).) Plaintiff then filed a petition for relief from the claim filing requirement on ground of excusable neglect and incapacity, arguing she was ignorant of the filing requirement, had no reason to suspect she had a claim against Defendant and that her physical and mental condition were so significant as to preclude her from filing a claim or authorizing someone to file a claim on her behalf until April 2008. 14. However, the evidence now shows XXXXXXXX communicated with the Parris firm regarding Plaintiffs accident as early as April 2007. Under these circumstances, disclosure of the substance of these communications is essential to a fair adjudication of the action because if, for example, the evidence showed Plaintiff was able to authorize XXXXXXX to contact attorneys on her behalf, and that such attorneys had informed XXXXXXX or Plaintiff of any impending claim filing deadlines with which they were required to comply, Plaintiff could not have justifiably claimed excusable neglect or incapacity in her petition for relief. It is difficult for this Court to envision how Plaintiffs assertions would have been consistent with a claim of excusable neglect (or even ignorance) if the Parris firm had informed her or other mother they had to file a timely claim in order to preserve any causes of action they may have had against Defendant. Therefore, having put the circumstances surrounding her petition for relief at issue, including what she or XXXXXXX may have been told by the Parris firm attorneys (i.e., the attorneys mental states), Plaintiff has waived any privilege with respect to the subject correspondence. See Merritt v. Superior Court, 9 Cal.App.3d 721, 730 (1970); see also Chicago Title Ins. Co. v. Superior Court, 174 Cal.App.3d 1142, 1150 (1985)(doctrine of implied waiver is applicable to the situation in which a client has placed in issue the decisions, conclusions, and mental state of the attorney who will be called as a witness to prove such matters).

15. Based on the foregoing, the hearing on the motion of defendant County of Los Angeles to compel appearance at deposition by custodian of records for R. Rex Parris Law Firm per deposition subpoena is CONTINUED to ______________________________ at 8:30 a.m. in Department A-11. 16. The hearing on the motion of defendant County of Los Angeles to compel production of documents per deposition subpoena from nonparty witness Celina XXXXXXX is CONTINUED to ____________________________ at 8:30 a.m. in Department A-11. 17. The Court orders the R. Rex Parris Law Firm, through one of its custodians of records, to produce any and all correspondence from R. Rex Parris Law Firm to plaintiff Veronica XXXXXXX and/or third party Celina XXXXXXX during the months of April 2007 and May 2007 for an in camera review by the Court on ___________________________ at 8:30 a.m. in Department A-11. 18. Should the Court find all or part of the information contained in such correspondence, if any, to be relevant and discoverable, such information shall be disclosed in the course of the litigation with the Court conducting further proceedings as necessary and appropriate. * TENTATIVE RULING: * The motion of plaintiff Capital One Bank (USA), N.A., for summary judgment is GRANTED. STATEMENT OF DECISION: 1. On February 04, 2011, plaintiff Capital One Bank (USA), N.A. (hereinafter referred to as Plaintiff), filed its complaint for money against Defendant and Does 1 through 5, inclusive. 2. On August 10, 2011, Plaintiff filed a motion for summary judgment. 3. On October 11, 2011, Defendant filed his opposition to Plaintiffs motion for summary judgment. 4. Standard for summary judgment A party may move for summary judgment in any action or proceeding if it is contended that the action has no merit or that there is no defense to the action or proceeding. Code Civ. Proc., 437c(a). To prevail on a motion for summary judgment, the evidence submitted must show there is no triable issue as to any material fact and that the moving party is entitled to judgment as a matter of law.

Code Civ. Proc., 437c(c). In other words, the opposing party cannot present contrary admissible evidence to raise a triable factual dispute. For purposes of motions for summary judgment and summary adjudication: [] (1) A plaintiff or cross-complainant has met his or her burden of showing that there is no defense to a cause of action if that party has proved each element of the cause of action entitling the party to judgment on that cause of action. Once the plaintiff or cross-complainant has met that burden, the burden shifts to the defendant or cross-defendant to show that a triable issue of one or more material facts exists as to that cause of action or a defense thereto. The defendant or cross-defendant may not rely upon the mere allegations or denials of its pleadings to show that a triable issue of material fact exists but, instead, shall set forth the specific facts showing that a triable issue of material fact exists as to that cause of action or a defense thereto. Code Civ. Proc., 437c(p)(1). 5. [H]ow the parties moving for, and opposing, summary judgment may each carry their burden of persuasion and/or production depends on which would bear what burden of proof at trial. Again, in Readers Digest Assn. v. Superior Court (1984) 37 Cal.3d 244, 208 Cal.Rptr. 137, 690 P.2d 610, we held to the effect that the placement and quantum of the burden of proof at trial were crucial for purposes of summary judgment. [Citation.] . . . Thus, if a plaintiff who would bear the burden of proof by a preponderance of evidence at trial moves for summary judgment, he must present evidence that would require a reasonable trier of fact to find any underlying material fact more likely than not otherwise, he would not be entitled to judgment as a matter of law, but would have to present his evidence to a trier of fact. Aguilar v. Atlantic Richfield Co., 25 Cal.4th 826, 851 (2001). Summary judgment law in this state no longer requires a plaintiff moving for summary judgment to disprove any defense asserted by the defendant as well as prove each element of his own cause of action . . . . All that the plaintiff need do is to prove[ ] each element of the cause of action[.] Id. at 841. 6. The burden of persuasion remains with the party moving for summary judgment. Aguilar, supra, 25 Cal.4th at 850, 861. When the defendant moves for summary judgment in those circumstances in which the plaintiff would have the burden of proof by a preponderance of the evidence, the defendant must accomplish at least one of two things. First, the defendant must present evidence that would preclude a reasonable trier of fact from finding it was more likely than not that the material fact was true. Id. at 851. In the alternative, the defendant must demonstrate that an element of the claim cannot be established, by presenting evidence that the plaintiff does not possess and cannot reasonably obtain needed evidence. Id. To obtain summary judgment, a defendant may conclusively negate an essential element of plaintiffs causes of action. However, a defendant is not

required to do so. Aguilar, supra, 25 Cal.4th at 853. Summary judgment in favor of the defendant will be upheld when the evidentiary submissions conclusively negate a necessary element of the plaintiff's cause of action or show that under no hypothesis is there a material issue of fact requiring the process of a trial. Biscotti v. Yuba City Unified School Dist., 158 Cal.App.4th 554, 557-58 (2007). 7. When ruling on a summary judgment motion, the trial court must consider all inferences from the evidence, even those contradicted by the moving partys evidence. The motion cannot succeed unless the evidence leaves no room for conflicting inferences as to material facts; the court has no power to weigh one inference against another or against other evidence. Murillo v. Rite Stuff Food Inc., 65 Cal.App.4th 833, 841 (1998). In determining whether the facts give rise to a triable issue of material fact, [a]ll doubts as to whether any material, triable, issues of fact exist are to be resolved in favor of the party opposing summary judgment . . . . Gold v. Weissman, 114 Cal.App.4th 1195, 1198-99 (2004). In other words, the facts alleged in the evidence of the party opposing summary judgment and the reasonable inferences there from must be accepted as true. Jackson v. County of Los Angeles, 60 Cal.App.4th 171, 179 (1997). 8. Having reviewed the moving and opposing papers and all competent and admissible evidence submitted, the Court finds there are no triable issues of material fact and Plaintiff is entitled to judgment as a matter of law. The Court bases its ruling on Plaintiffs separate statement of undisputed facts, nos. 1 through 11 and the evidence referred to therein. 9. Based on the foregoing, the motion of plaintiff Capital One Bank (USA), N.A., for summary judgment is GRANTED. * TENTATIVE RULING: * Defendant DEUTSCHE BANK NATIONAL TRUST COMPANY as trustee etc.'s demurrer is ORDERED OFF CALENDAR. The right to dismiss with or without prejudice exists "at any time before the actual commencement of the trial". CCP 581(b)(1). Plaintiff requested dismissal without prejudice on October 20, 2011. Even though an unopposed dispositive motion was pending, the ruling had not been made. Plaintiff retains the right to dismiss until the trial court rules on a pending motion. Kyle v. Cannon (1999) 71 Cal. App. 4th 901, 915 (referring to the Supreme Court's comment in Wells v. Marina City Properties, Inc. (1986) 29 Cal. 3d 781, 789, that the right of voluntary dismissal "would also not be impaired prior to a decision sustaining a demurrer.")

* TENTATIVE RULING: * Demurring Party: Defendants Bank of America, ReconTrust Company, N.A., and U.S. Bank, N.A. Responding Party: None on File (Due by October 11, 2011 to be timely) SUSTAIN DEMURRER ANALYSIS Defendants Bank of America N.A., in its own right and as successor by merger to BAC Home Loans Servicing, LP, ReconTrust Company, N.A and U.S. Bank, National Association as Trustee for the Benefit of Harborview 2005-12 Trust Fund (collectively defendants) demur to the complaint filed in this action against defendants by plaintiff Aruna Sharma, and to each causes of action asserted therein against defendants. The demurrer is brought pursuant to CCP 430.10(e) on the grounds that the complaint fails to state facts sufficient to constitute any cause of action against defendants. Demurrer based on Uncertainty: Defendants demur to the complaint and each of the causes of action therein on the ground that the pleading is uncertain. The complaint herein asserts five causes of action against all four defendants named in the complaint, but the allegations are general, without any specific factual allegations to demonstrate how each defendant is responsible for the causes of action asserted. The complaint is so uncertain that defendants cannot reasonably determine what issues must be admitted or denied, or what counts or claims are directed against defendants. (Khoury v. Maly's of Calif., Inc. (1993) 14 Cal.App.4th 612, 616. Thus, demurrer based on uncertainty is sustained. First Cause of Action for Violation of CC 2923.5: CC 2923.5, requires a lender or its agent to attempt to contact a defaulted borrower prior to foreclosure. Section 2923.5(a)(2) requires a mortgagee, beneficiary or authorized agent to contact the borrower in person or by telephone in order to assess the borrower's financial situation and explore options for the borrower to avoid foreclosure. Section 2923.5(b) requires a default notice to include a declaration from the mortgagee, beneficiary, or authorized agent of compliance with section 2923.5, including attempt with due diligence to contact the borrower as required by this section. The complaint herein fails to adequately allege facts demonstrating that

defendants violated the CC 2923.5. While the complaint alleges that defendants have used deceitful measures and have not worked diligently on the loan modification within the last year, CC 2923.5 does not require defendants to modify plaintiffs loan. Thus, the demurrer to the first cause of action is sustained. Second Cause of Action for Misrepresentation/Fraud: The elements of fraud are: (1) misrepresentation (false representation, concealment, or nondisclosure); (2) knowledge of falsity (scienter); (3) intent to defraud or induce reliance; (4) justifiable reliance; and (5) damages. (See CC 1709.) Fraud actions are subject to strict requirements of particularity in pleading. (Committee on Childrens Television, Inc. v. General Foods Corp. (1983) 35 Cal.3d 197, 216.) A plaintiff must allege what was said, by whom, in what manner (i.e. oral or in writing), when, and, in the case of a corporate defendant, under what authority to bind the corporation. (See Goldrich v. Natural Y Surgical Specialties, Inc. (1994) 25 Cal.App.4th 772, 782.) The complaint fails to adequately allege fraud with the required specificity. The complaint fails to identify what was said, by whom, when, and under what authority to bind the corporation. The complaint also fails to adequately allege an actionable misrepresentation, plaintiffs reliance and damages. Thus, the demurrer to the second cause of action is sustained. Third Cause of Action for Validity of Loan: Plaintiff appears to allege that the subject loan is invalid as a result of the beneficial interest to U.S. Bank. However, the judicially noticed documents demonstrate that the proper procedures for non-judicial foreclosure were followed. (RJN, Exhibits 1-4.) Plaintiff also alleges that MERS is prohibited by Law. However, California courts have repeatedly upheld the ability of MERS to institute non-judicial foreclosures. The authority of the lender's (beneficiary's) nominee to initiate nonjudicial foreclosure proceedings is beyond judicial challenge notwithstanding the fact the nominee merely holds legal title to the subject property and is not the owner of the underlying promissory note. (Gomes v. Countrywide Home Loans, Inc. (2011) 192 Cal.App.4th 1149, 1154authority of lender's nominee (MERS) to initiate foreclosure proceedings could not be challenged where trust deed named lender's nominee and granted it foreclosure rights; see also Ferguson v. Avelo Mortgage, LLC (2011) 195 Cal.App.4th 1618, 16261627not only may lender's nominee initiate foreclosure without possessing note, nominee may invoke tender rule against any defaulting borrower who challenges proceeding (i.e., require borrower to make unconditional offer to fully

perform with intent to extinguish obligation); Fontenot v. Wells Fargo Bank, N.A. (2011) 198 Cal.App.4th 256, 271trust deed beneficiary (MERS), acting as lender's nominee, had authority to assign lender's interest in both trust deed and underlying note, thereby empowering assignee to initiate foreclosure proceeding.) Thus, the demurrer to the third cause of action is sustained. Fourth Cause of Action for Extortion of Loan and Property: Plaintiffs forth cause of action appears to be derivative of her other claims and thus, fails for the same reasons. Accordingly, the demurrer to the fourth cause of action is sustained. Fifth Cause of Action for Injunctive Relief: Injunctive relief requires a wrongful act stating a cause of action and basis for equitable relief (e.g., ordinarily irreparable harm must be threatened, or a remedy at law is inadequate). (Brownfield v. Daniel Freeman Marina Hosp. (1989) 208 Cal. App. 3d 405, 410.) The complaint fails to adequately allege a wrongful act by defendants as a basis for the injunction. Thus, the demurrer to the fifth cause of action is sustained. Based on the above, plaintiff shall have 10 days leave to amend causes of action one, two, three, four and five. * TENTATIVE RULING: * MOVING PARTY: Defendant JP Morgan Chase Bank N.A. as Successor in Interest to EMC Mortgage Company RESPONDING: Plaintiff Defendants demurrer is overruled. I. Discussion Chase demurs primarily that Plaintiff cannot prevail on his complaint because Plaintiff alleges that he conveyed the property to Fadila Spahi in April 5, 2007 (Complaint, 8), and according to the deed of trust, In the event the herein described property or any part thereof, or any interest therein is sold, agreed to be sold, conveyed or alienated by the Trustor, or by the operation of law or otherwise, all obligations secured by this instrument, irrespective of the maturity dates expressed therein, at the option of the Beneficiary hereof and without demand or notice shall immediately become due and payable. RJN, Exh. 1, at 1. Chase argues that there is no actual controversy and that Plaintiff fails to seek adjudication of

future rights and liabilities (as opposed to past wrongs) as required to state a cause of action for declaratory relief here because Plaintiff sold the Subject Property to Fadila Spahi in 200[7] but failed to inform the lender of the sale and failed to inform the lender of the assignment to Fadila Spahi and further, that Plaintiff had no right to assign his rights without the lender[s] approval and that Plaintiff failed to obtain that approval. See Demurrer, 6:8-8:5. The demurrer is overruled for two reasons. The first reason is that Plaintiff seeks declaratory relief on more than just the sole issue of whether the promissory note is enforceable against him, though the court agrees that that is the main issue presented. Complaint, 12-19, 24-26; see also Opposition, 4:1-9. Plaintiff also seeks declaratory relief, however, on whether the loan is voidable because EMC failed to comply with Corporations Code section 2011, as well as whether EMC engaged in activities requiring a real estate brokers license, and therefore whether the notice of default against Plaintiff is proper. Complaint, 20, 26. A demurrer does not lie to a portion of a cause of action. PH II, Inc. v. Superior Court (1995) 33 Cal.App.4th 1680, 1682. Second, a demurrer is limited to objections appearing on the face of the complaint, or from any matter of which the court is required to or may take judicial notice. CCP 430.30. It is not the appropriate procedure for determining the truth of disputed facts. Unruh-Haxton v. Regents of University of California (2008) 162 Cal.App.4th 343, 364-65 (quoting Fremont Indemnity Co. v. Fremont General Corp. (2007) 148 Cal.App.4th 97, 113). Plaintiff does allege that after he purchased the property in 2005, he assigned his interest in Unit 1103B at 201 Ocean to nonparty Fadila Spahi as Trustee of the Cacciatori Trust on April 5, 2007, with Spahi agreeing to assume the obligation incurred by Joseph Plaintiff . . . . Complaint, 8. Plaintiff also alleges that when Fadila Spahi passed on December 22, 2007, Omar Spahi became the successor trustee to the Cacciatori Trust. Id., 9. And that Omar Spahi eventually transferred the property to himself, as an individual on November 20, 2009. Id., 11. Plaintiff does not allege or admit, however, that he did not inform the lender of the sale or inform the lender of the assignment to Fadila Spahi or that Plaintiff did not obtain approval from defendant for the sale/assignment. Cf. Demurrer, 6:8-8:5. These are facts that Chase is introducing, for the first time in this action, by demurrer. When, however, any ground for objection to a complaint or cross-complaint does not appear on the face of the pleading, the objection may be taken by answer, not by demurrer which is limited to the face of the pleading. CCP 430.30. Furthermore, Plaintiff alleges that defendant ratified the sale/assignment after the fact. Complaint, 12-18, 24-26. So even if Plaintiffs promissory note because due and payable per the deed of trust provision cited upon sale, Plaintiff has alleged adequate facts to show that there is an actual and justiciable controversy under the promissory note

and securing deed of trust which will affect the future rights and liabilities between the parties. Chase fails to cite or discuss authority where a court, faced with a provision like the one in the deed of trust here (RJN, Exh. 1, at 1) and a competing ratification/estoppel claim, refused to consider the ratification claim based on the parties subsequent conduct and dismissed the complaint on demurrer. On reply, Chase argues that if there was an oral agreement to modify the promissory note it is not enforceable. See Civ. Code 1698(a). It is unclear from the complaint, however, whether plaintiff is alleging the written promissory note was modified by an oral agreement. Further, assuming plaintiff is alleging an oral modification, written contracts may be modified by an oral agreement to the extent the oral agreement is executed. Civ. Code 1698(b). Plaintiff alleges that the parties performed the oral modification, as evidenced substantively by defendants acceptance of continuing payments from the assignee, and failure to object at the assignees bankruptcy. Chase does not cite or discuss authority justifying the relief it seeks under the circumstances. Chase also moves to strike paragraph 6 of the plaintiffs prayer for relief, seeking attorneys fees. Plaintiff has not filed an opposition to the motion to strike to offer any contractual or other legal basis for such recovery. CCP 1021, 1033.5(a)(10). Chases motion to strike the reference to the recovery of attorneys fees in paragraph 6 of the prayer is unopposed and granted. * TENTATIVE RULING: * TRUST HOLDING v CHASE The demurrer of defendants JP Morgan Chase Bank N.A. and California Reconveyance Company to the complaint is SUSTAINED without leave to amend. Defense counsel is ordered to give notice. A valid and viable tender of payment of the indebtedness owing is essential to an action to cancel a voidable sale under a deed of trust. (Karlsen v. American Sav. & Loan Assn. (1971) 15 Cal.App.3d 112,117.) When a debtor is in default of a home mortgage loan, and a foreclosure is either pending or has taken place, the debtor must allege a credible tender of the amount of the secured debt to maintain any cause of action for foreclosure. (Alicea v. GE Money Bank (N.D.Cal. 2009) 2009 U.S. Dist. LEXIS 60813, 2009 WL 2136969.) Under California law, the tender rule requires that as a precondition to challenging a foreclosure sale, or any cause of action implicitly integrated to the sale, the borrower must make a valid and viable tender of payment of the secured debt. The application of the tender rule prevents a court from uselessly setting aside a foreclosure sale on a technical ground when the party making the challenge has not established

his ability to purchase the property. (Williams v. Countrywide Home Loans (N.D.Cal. 1999) 1999 U.S. Dist. LEXIS 14550, 1999 WL 740375.) The main relief sought by plaintiff is an order enjoining the non-judicial trustees sale of the property and an order declaring plaintiff the rightful owner of the property. Plaintiff has not opposed the demurrer and, as such, has cited no authority to show that tender of the indebtedness is not required in order to obtain such relief. Allegations that plaintiff was willing and able to tender funds and was prepared to make that tender if necessary to stop a foreclosure sale is not enough. Each of the four causes of action is based upon CHASEs alleged agreement with previous owner Shin to postpone the foreclosure sale upon plaintiffs submission of a complete Short Sale Offer. Plaintiff alleges that it performed all terms and conditions of the agreement, but CHASE has failed to honor the contract. Issues may arise as to whether a lender entered into a sufficiently ascertainable agreement to modify loan terms, or to forebear as to a loan, as opposed to preliminary negotiations or an incomplete agreement. Unless a so-called forbearance agreement embodies definite terms, capable of enforcement, it is not a legally valid contract. Preliminary negotiations or an agreement for future negotiations are not the functional equivalent of a valid, subsisting agreement. (Price v. Wells Fargo Bank (1989) 213 Cal.App.3d 465, 483; accord Keen v. Amer. Home Mortg. Servicing, Inc. (E.D.Cal. 2009) 664 F.Supp.2d 1086, 1099-1100.) A gratuitous oral promise to postpone a sale of property is unenforceable under the statute of frauds (Civil Code section 1698) in the absence of consideration. (Raedeke v. Gibraltar Sav. & Loan Assn. (1974) 10 Cal.3d 665, 673, citing Karlsen v. American Sav. & Loan Assn. (1971) 15 Cal.App.3d 112, 121.) Moreover, there is nothing to show that plaintiff suffered actual damages, as a matter of law, from any oral promise of postponement. Misrepresentation, even maliciously committed, does not support a cause of action unless the plaintiff suffered consequential damages. (Conrad v. Bank of America (1996) 45 Cal.App.4th 133, 159.) Any preliminary negotiations between previous owner Han Shin and CHASE only resulted in a Conditional Approval of Sales Contract. There is no allegation of a contract between CHASE and the Trust or that CHASE was ever notified that Ms. Shin had transferred the property to the Trust in June 2010. Plaintiffs claimed damages all relate to Shins inability to repay the loan, rather than any detriment caused by CHASEs agreement to the short sale if numerous conditions precedent were met. [I]f plaintiffs could not have redeemed the property had the sale procedures been proper, any irregularities in the sale did not result in damage to the plaintiffs. (FPCI REHAB 01 v. E & G Investments, Ltd. (1989) 207 Cal.App.3d 1018, 1022.) Plaintiff has not alleged any definite terms capable of enforcement, only that CHASE would not proceed or continue with the foreclosure process while the

previous owner Shin was attempting to comply with the conditions precedent for a short sale. The allegations demonstrate that the parties were in negotiations to avoid foreclosure, not that there are enforceable contractual obligations on either side. Second, there are no facts demonstrating the type of detrimental reliance needed to support promissory estoppel i.e., that plaintiff substantially changed its position either by act or forbearance in reliance on CHASEs alleged promise(s). Plaintiff alleges that it found two different short sale buyers, the first which was apparently rejected by CHASE after the Conditional Approval of Sales Contract letter was sent by CHASE on November 1, 2010. (Complaint, Exhibit C.) There is nothing to show that CHASE was somehow obligated to accept either short sale offer. There is also nothing to show that CHASE had any contract with plaintiff, that CHASE was notified of Ms. SHINs transfer of the property to plaintiff or that the conditional approval of the first alleged short sale applied to the subsequent short sale submitted in January 2011. These deficiencies result in a failure of each cause of action alleged in the complaint. Therefore, the demurrer is SUSTAINED without leave to amend. It is not up to the Court to figure out how the complaint can be amended to state a cause of action. Rather, the burden is on the plaintiff to show in what manner he or she can amend the complaint, and how that amendment will change the legal effect of the pleading. (Goodman v. Kennedy (1976) 18 Cal.3d 335, 349; Hendy v. Losse (1991) 54 Cal.3d 723, 742.) Plaintiff has not opposed the demurrer and, as such, has failed to show what additional facts can be alleged to state proper causes of action.

MORE CALIFORNIA TENTATIVE RULINGS UD AND FORECLOSURES For the week of 10/17/2011 --