Академический Документы

Профессиональный Документы

Культура Документы

Weekly Report

Загружено:

Angel BrokingИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Weekly Report

Загружено:

Angel BrokingАвторское право:

Доступные форматы

Technical Picks | October 22, 2011

All Eyes on the Euro Zone

Sensex (16786) / Nifty (5050)

Markets opened with a neutral bias on Monday's session and traded in a range throughout the week. As stated in our earlier report, markets faced strong resistance near the multiple resistance zone of 17260 - 17200 / 5198 - 5177 Hence, 5177. every attempt of scaling this level failed during the week and a selling pressure dragged indices lower to register a weekly close around the daily "20 EMA". This average is currently placed at 16714 / 5038 level. As expected, 16510 / 5034 acted as a 6714 decent support level for the week. On the sector front, the correction was mainly led by IT, Realty and Oil & Gas counters. The Sensex ended with a nominal loss of 1.74%, whereas the Nifty lost 1.60%, vis--vis the previous week.

Source: Falcon

Exhibit 1: Sensex weekly chart

Exhibit 2: Sensex daily chart

Pattern Formation

We are observing a positive crossover in Weekly "RSI - Smoothened" momentum oscillator. On the Weekly chart, there is a "Horizontal Line" resistance at 17256 / 5198 level. The "20 EMA" on the Weekly chart is now placed at 17215 / 5172 level. On the Daily chart, the "20 EMA" is placed at 16714 / 5025 level.

(Note: All technical evidences mentioned last week are almost unchanged; therefore, we continue to mention them along with a single addition of Daily "20 EMA") Source: Falcon

gap area of 17358 - 17665 / 5230 - 5323 created on August 5, 2011. On the other hand, indices have a decent support of Daily "20 EMA", which is now placed around 16714 - 16669 / 5025 - 5011 levels. Indices are likely to test 16460 - 16300 / 4944 - 4890 levels if indices manage to sustain below 16669 / 5011 level. Broadly speaking, indices have a trading range of 17256 to 16669 / 5198 to 5011 A violation of this 5011. range on either side would lead to a clear direction of the trend. Moreover, traders should take a note that the markets may react to various global and domestic events in the coming week. The decision of the European Union on the EFSF and monetary policy coupled with derivative expiry on Tuesday would lead to increased volatility in the markets. Therefore, we advise traders to stay light on positions and trade with strict stop losses.

Future Outlook

Yet another week ended with a failure of crossing the strong resistance zone of 17260 / 5198 We reiterate that the bulls 5198. are facing a major hurdle of this Weekly "Horizontal Line" and "20 EMA" near 17256 / 5198 levels. Therefore, we are of the opinion that unless we get some strong positive trigger on the global or domestic front, our markets may not cross this stiff resistance zone. On an optimistic note, a positive crossover in Weekly "RSI - smoothened" oscillator is still intact, which may come into action if indices manage to cross and sustain above 17256 / 5198 level. In this case, indices may rally towards the

For Private Circulation Only |

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP00000154 6 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Technical Picks | October 22, 2011

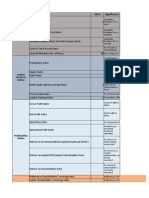

Weekly Pivot Levels For Nifty 50 Stocks

SCRIPS

SENSEX NIFTY BANKNIFTY ACC AMBUJACEM AXISBANK BAJAJ-AUTO BHARTIARTL BHEL BPCL CAIRN CIPLA DLF DRREDDY GAIL HCLTECH HDFC HDFCBANK HEROHONDA HINDALCO HINDUNILVR ICICIBANK IDFC INFOSYSTCH ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RCOM RELCAPITAL RELIANCE RELINFRA RPOWER SAIL SBIN SESAGOA SIEMENS STER SUNPHARMA SUZLON TATAMOTORS TATAPOWER TATASTEEL TCS WIPRO R2 17,401 5,223 10,058 1,153 160 1,178 1,727 401 346 672 312 295 247 1,589 440 465 698 507 2,166 135 339 923 131 2,802 210 569 76 488 1,454 836 1,182 176 275 1,020 102 531 81 368 896 438 90 112 2,047 232 868 125 515 40 196 103 456 1,208 378 R1 17,093 5,136 9,876 1,135 155 1,153 1,684 390 333 658 300 291 236 1,559 429 439 666 497 2,109 128 333 897 126 2,763 207 550 73 477 1,394 819 1,138 173 270 1,001 101 514 78 351 866 419 88 109 1,998 219 846 120 501 38 187 100 444 1,129 366 PIVO PIVOT 16,881 5,074 9,685 1,117 151 1,115 1,620 380 324 644 291 287 229 1,526 418 419 648 485 2,036 125 329 882 123 2,725 205 524 71 469 1,360 803 1,074 170 267 979 99 499 76 336 839 408 86 106 1,918 212 825 117 483 37 182 98 434 1,075 354 S1 16,574 4,987 9,504 1,099 147 1,090 1,577 369 312 630 279 284 218 1,496 407 393 616 474 1,979 118 322 855 118 2,685 202 504 67 458 1,301 786 1,031 167 262 960 97 483 72 319 808 388 83 103 1,868 199 802 112 469 35 173 95 422 996 342 S2 16,362 4,925 9,312 1,081 143 1,052 1,512 360 303 615 271 280 211 1,463 395 373 598 462 1,906 115 319 840 116 2,648 200 479 65 451 1,266 770 967 164 258 937 95 468 70 304 781 377 81 100 1,788 192 781 109 451 34 168 94 412 941 331

Technical Research Team

For Private Circulation Only |

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP00000154 6 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Derivatives Review | October 22, 2011

Rollover Long positions and sit tight on it

Nifty spot closed at 5049.95 this week, against a close of 5132.30 last week. The Put-Call Ratio decreased from 1.56 to 1.40 levels and the annualized Cost of Carry is positive 7.32 The Open Interest of Nifty Futures increased by 14.67 7.32%. 14.67%.

Put-Call Ratio Analysis

PCR-OI has decreased from 1.56 levels to 1.40 levels and maximum of that has happened in last three trading sessions. We have witnessed some unwinding in put options but decline in ratio is mainly due to built-up in calls ranging from 5000 to 5200 and especially 5200 call. In same period FII's have also bought index options approximately worth `5000 cr.

Implied Volatility Analysis

Implied Volatility (IV) has being increased from 22.67% to 25.67%. HV for BANKNIFTY is trading at 37.60%. Liquid counters having very high Historical Volatility are JUBLFOOD, KFA, CHAMBLFERT, CROMGREAV and ABAN. Stocks where HV are on lower side are BRFL, BOSCHLTD, NHPC, GLAXO and DIVISLAB.

Open Interest Analysis

Total open interest of market has increased from `1,25,671.70 crores to `1,38,302.40 crores. Stock futures open interest has increased from `30,043/- crores to `32,215/- crores. Frontline counters which added considerable open interest are ITC, HDFC, TCS, LT and HEROMOTOCO. Open interest was shed in big names like LUPIN, RELCAPITAL, PUNJLLOYD, CENTURYTEX and CAIRN.

Cost-of-Carry Analysis

Nifty futures closed at a Premium of 4.05 points against the Premium of 11.05 points to its spot. Next month future is trading with premium of 24.10 points. Counters where CoC is high are OPTOCIRCUI, BOSCHLTD, GMRINFRA, AREVAT&D and TECHM. Stocks with negative CoC are GITANJALI, HINDZINC, ASIANPAINT, TATASTEEL and BANKBARODA.

Derivative Strategy

Scrip : NIFTY View: Mildly Bullish Buy/Sell Buy

BEP: BEP: 5125 Max. Risk: `1250/If NIFTY closes on or below the strike price.

CMP : 5049.95/-

Lot Size : 50

Exercise Date (F & O) : 25th Oct, 2011 Expected Payoff

Strategy: Long Call Scrip NIFTY Strike Price 5100 Series OCT Option Type Call Buy Rate (`) 25.00

Qty 50

Price Closing Price

Expected rofit/Loss Profit/Loss

5275 5200 5125

`150.00 `75.00 0.00 (`25.00) (`25.00) (`25.00)

Profit: Max. Profit: Unlimited

If NIFTY continues to move above BEP .

5050 4975 4900

NOTE TE: NOTE : Profit can be booked before expiry if NIFTY moves in the favorable direction.

For Private Circulation Only |

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP00000154 6 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Weekly

Disclaimer

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Ratings (Returns) :

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

Weekly

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 39357800

Research Team Fundamental: Sarabjit Kour Nangra Vaibhav Agrawal Shailesh Kanani Srishti Anand Bhavesh Chauhan Sharan Lillaney V Srinivasan Yaresh Kothari Shrinivas Bhutda Sreekanth P .V.S Hemang Thaker Nitin Arora Ankita Somani Varun Varma Saurabh Taparia Technicals: Shardul Kulkarni Sameet Chavan Derivatives: Siddarth Bhamre Institutional Sales Team: Mayuresh Joshi Hiten Sampat Meenakshi Chavan Gaurang Tisani Akshay Shah Production Team: Simran Kaur Dilip Patel Research Editor Production simran.kaur@angelbroking.com dilipm.patel@angelbroking.com VP - Institutional Sales Sr. A.V.P- Institution sales Dealer Dealer Dealer mayuresh.joshi@angelbroking.com Hiten.Sampat@angelbroking.com meenakshis.chavan@angelbroking.com gaurangp.tisani@angelbroking.com akshayr.shah@angelbroking.com Head - Derivatives siddarth.bhamre@angelbroking.com Sr. Technical Analyst Technical Analyst shardul.kulkarni@angelbroking.com sameet.chavan@angelbroking.com VP-Research, Pharmaceutical VP-Research, Banking Infrastructure IT, Telecom Metals & Mining Mid-cap Research Associate (Cement, Power) Research Associate (Automobile) Research Associate (Banking) Research Associate (FMCG, Media) Research Associate (Capital Goods) Research Associate (Infra, Real Estate) Research Associate (IT, Telecom) Research Associate (Banking) Research Associate (Cement, Power) sarabjit@angelbroking.com vaibhav.agrawal@angelbroking.com shailesh.kanani@angelbroking.com srishti.anand@angelbroking.com bhaveshu.chauhan@angelbroking.com sharanb.lillaney@angelbroking.com v.srinivasan@angelbroking.com yareshb.kothari@angelbroking.com shrinivas.bhutda@angelbroking.com sreekanth.s@angelbroking.com hemang.thaker@angelbroking.com nitin.arora@angelbroking.com ankita.somani@angelbroking.com varun.varma@angelbroking.com Sourabh.taparia@angelbroking.com

CSO & Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.Tel.: (022) 3083 7700. Angel Broking Ltd: BSE Sebi Regn No: INB010996539 / PMS Regd Code: PM/INP000001546 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / NSE Sebi Regn Nos: Cash: INB231279838 / NSE F&O: INF231279838/ Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500 / Angel Commodities Broking Pvt. Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Вам также может понравиться

- Oilseeds and Edible Oil UpdateДокумент9 страницOilseeds and Edible Oil UpdateAngel BrokingОценок пока нет

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertДокумент4 страницыRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingОценок пока нет

- WPIInflation August2013Документ5 страницWPIInflation August2013Angel BrokingОценок пока нет

- Daily Agri Report September 16 2013Документ9 страницDaily Agri Report September 16 2013Angel BrokingОценок пока нет

- Daily Agri Tech Report September 16 2013Документ2 страницыDaily Agri Tech Report September 16 2013Angel BrokingОценок пока нет

- Daily Metals and Energy Report September 16 2013Документ6 страницDaily Metals and Energy Report September 16 2013Angel BrokingОценок пока нет

- International Commodities Evening Update September 16 2013Документ3 страницыInternational Commodities Evening Update September 16 2013Angel BrokingОценок пока нет

- Derivatives Report 8th JanДокумент3 страницыDerivatives Report 8th JanAngel BrokingОценок пока нет

- Daily Agri Tech Report September 14 2013Документ2 страницыDaily Agri Tech Report September 14 2013Angel BrokingОценок пока нет

- Market Outlook: Dealer's DiaryДокумент13 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Metal and Energy Tech Report Sept 13Документ2 страницыMetal and Energy Tech Report Sept 13Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Документ4 страницыDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingОценок пока нет

- Currency Daily Report September 16 2013Документ4 страницыCurrency Daily Report September 16 2013Angel BrokingОценок пока нет

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressДокумент1 страницаPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingОценок пока нет

- Market Outlook: Dealer's DiaryДокумент12 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Currency Daily Report September 13 2013Документ4 страницыCurrency Daily Report September 13 2013Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Документ4 страницыDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateДокумент6 страницTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingОценок пока нет

- Daily Metals and Energy Report September 12 2013Документ6 страницDaily Metals and Energy Report September 12 2013Angel BrokingОценок пока нет

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechДокумент4 страницыJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingОценок пока нет

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Документ4 страницыDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingОценок пока нет

- Daily Agri Tech Report September 12 2013Документ2 страницыDaily Agri Tech Report September 12 2013Angel BrokingОценок пока нет

- Market Outlook: Dealer's DiaryДокумент13 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Metal and Energy Tech Report Sept 12Документ2 страницыMetal and Energy Tech Report Sept 12Angel BrokingОценок пока нет

- Currency Daily Report September 12 2013Документ4 страницыCurrency Daily Report September 12 2013Angel BrokingОценок пока нет

- Daily Agri Report September 12 2013Документ9 страницDaily Agri Report September 12 2013Angel BrokingОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- ManagementДокумент195 страницManagementFahad KhalidОценок пока нет

- 01 Valuation ModelsДокумент24 страницы01 Valuation ModelsMarinaGorobeţchiОценок пока нет

- TB Chapter02Документ53 страницыTB Chapter02sanchezthekingswaydragonОценок пока нет

- Pump Up The Volume: BOOM LogisticsДокумент8 страницPump Up The Volume: BOOM LogisticsNicholas AngОценок пока нет

- Assets Management in Botswana Wealth Creation or Wealth Dissipation?Документ65 страницAssets Management in Botswana Wealth Creation or Wealth Dissipation?Tsehay SenghorОценок пока нет

- Chap016 Financial Reporting AnalysisДокумент15 страницChap016 Financial Reporting AnalysisThalia SandersОценок пока нет

- FINC3019 Semester 2 2016 UoSДокумент5 страницFINC3019 Semester 2 2016 UoSRyan LinОценок пока нет

- Fundamental Accounting Principles Volume Canadian 15th Edition by Larson Jensen Dieckmann ISBN Solution ManualДокумент8 страницFundamental Accounting Principles Volume Canadian 15th Edition by Larson Jensen Dieckmann ISBN Solution Manualstephen100% (27)

- Cecchetti 6e Chapter13 SMДокумент8 страницCecchetti 6e Chapter13 SMyuyu4416Оценок пока нет

- Ichimoku LearningДокумент5 страницIchimoku Learningecz1979100% (1)

- Please Fill Up Clearly in BLOCK LETTERS and Affix Signature(s) - This Form Is Only Applicable For Individual and In-Trust-For (ITF) AccountsДокумент1 страницаPlease Fill Up Clearly in BLOCK LETTERS and Affix Signature(s) - This Form Is Only Applicable For Individual and In-Trust-For (ITF) AccountsAimniel CacapОценок пока нет

- Chapter 14 - Firms in Competitive MarketsДокумент3 страницыChapter 14 - Firms in Competitive Marketsminh leОценок пока нет

- Marketing 11th Edition Lamb Test BankДокумент25 страницMarketing 11th Edition Lamb Test BankMrScottPowelltgry100% (59)

- Testbank: Applying IFRS Standards 4eДокумент11 страницTestbank: Applying IFRS Standards 4eDyana AlkarmiОценок пока нет

- Breakout Candlestick PatternsДокумент28 страницBreakout Candlestick Patternsvipuldata100% (1)

- IC Detailed Financial Projections Template 8821 UpdatedДокумент27 страницIC Detailed Financial Projections Template 8821 UpdatedRozh SammedОценок пока нет

- Pricing Strategy: Midterm ExaminationДокумент6 страницPricing Strategy: Midterm ExaminationAndrea Jane M. BEDAÑOОценок пока нет

- Literature Review SalmanДокумент3 страницыLiterature Review SalmanvdocxОценок пока нет

- Journal EntryДокумент8 страницJournal EntryAnklesh kumar GuptaОценок пока нет

- Fundamental Equity Analysis - SPI Index - The Top 100 Companies of The Swiss Performance IndexДокумент205 страницFundamental Equity Analysis - SPI Index - The Top 100 Companies of The Swiss Performance IndexQ.M.S Advisors LLCОценок пока нет

- Business Finance Q2 W1 D1 D2 MODULE 1Документ18 страницBusiness Finance Q2 W1 D1 D2 MODULE 1stevenbathan0Оценок пока нет

- BPS Question BankДокумент6 страницBPS Question BankhimanshuОценок пока нет

- Additional Information: Ratio AnalysisДокумент7 страницAdditional Information: Ratio Analysisashokdb2kОценок пока нет

- PT Japfa Comfeed Indonesia TBK (Audited) PDFДокумент140 страницPT Japfa Comfeed Indonesia TBK (Audited) PDFdudul pudlianОценок пока нет

- Ratio AnalysisДокумент26 страницRatio AnalysisDeep KrishnaОценок пока нет

- Derivatives - 1 - Introduction To DerivativesДокумент50 страницDerivatives - 1 - Introduction To DerivativesHins LeeОценок пока нет

- Gann Astrological PDFДокумент1 страницаGann Astrological PDFGenesis TradingОценок пока нет

- Assignment Week 2 - Maya Wulansari - 09111840000040Документ4 страницыAssignment Week 2 - Maya Wulansari - 09111840000040mayasari50% (2)

- Management of Marketable SecuritiesДокумент6 страницManagement of Marketable Securitiesarchana_anuragi50% (2)