Академический Документы

Профессиональный Документы

Культура Документы

Friedberg Mercantile Quarterly Report Q3 2011

Загружено:

richardck61Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Friedberg Mercantile Quarterly Report Q3 2011

Загружено:

richardck61Авторское право:

Доступные форматы

3

3

Third

Quairii

Riioir

:c::

,

Dear Investor,

It gives me great pleasure to report to you on the financial activities of our hedge funds for the quarter

ended September 30, 2011.

The Friedberg Global-Macro Hedge Fund and the Friedberg Global-Macro Hedge Fund Ltd. gained 57.2%

and 60% for the quarter respectively, bringing their year-to-date gains to 47.6% and 54.4%. More

importantly, we have managed once again to move the year-over-year results to the plus side, now showing

gains of 32.7% and 45% respectively. (All figures are in U.S. dollars.) The statistics we present are drawn

from the larger Friedberg Global-Macro Hedge Fund Ltd., but the comments apply equally to the Canadian

version. Newly introduced Ontario government taxes on financial services have significantly affected results,

explaining part of the wide performance gap between the funds.

As I write these lines, the fund has lost 18.60% for the month of October thus far, reducing gains to date to

31.40%. While still respectable, these reduced gains are no doubt a disappointment when viewed from their

peak attainment. Still, matters need to be put in context. My hope is that if I succeed in properly describing

this context, the reader/investor will get a better grasp of the nature of the enterprise and will thus come to

better appreciate the gains as well as the retracements of these violent fluctuations.

Its no news for those who follow markets on a daily basis that volatility across assets and across a wide

geographic area has literally exploded in recent months. Standard yardsticks of volatility for U.S. stocks,

bonds and gold, for example, have nearly tripled from the lows of the last six months and remain at the

highest levels since early 2009 and well above historic levels. Compounding this unpleasant state of affairs is

the fact that correlation between all types of assets is extreme. Markets are betting on a binary outcome:

either the globe solves its problems (or kicks the proverbial can down the road far enough, like two or three

months!), in which case risk is on, or we cant muddle through and we head towards an economic abyss,

in which case risk is said to be off. In this environment, unfortunately, money managers cannot ply their

trade in a prudent manner; that is, they cant find (buy) positions they like and simultaneously establish

others (sell) they dont like to balance their bets. As a result, they find themselves fully on one side of the

binary divide. A manager, convinced as we are that policy-makers continue to fall behind the curve and that

events are likely to overtake them and who wishes to take advantage of the scenario, must therefore be

willing to suffer the consequences of this extreme volatility. The best he can do is to calibrate, quite

Third Quairii

Riioir

:c::

imperfectly at that, the degree of volatility that he is willing to entertain for any given level of profit. This

calibration is best measured as a multiple of existing market volatility. For example, we can think of

ourselves as being twice as volatile as the market, or half as volatile.

Whatever multiple he wishes to attain and again I must emphasize the intuitive rather than the scientific

nature of this adjustment will have a distinct impact on profits, everything else being equal. Those

wishing to achieve above-average gains must be willing to accept above-average relative volatility. Over the

past nine and three months, the funds volatility, measured as a 10-day moving average of daily percentage

moves, has equaled 1.81x and 1.56x respectively of the S&P 500, arguably the best proxy for combined

global asset markets. This means that a sudden and rapid adverse move of, say, 10% in the S&P 500 would

be expected to translate into a loss of 15% to 18%, given the almost perfect correlation between assets

noted earlier.

This is, in fact, what roughly happened between September 30 and October 14, 2011. The S&P 500

gained 8.2% in 10 short trading days, and our fund lost 18.6%. But this holds true only in the short term.

To prove this, we suggest that the reader imagine leveraging a short S&P 500 position 1.5x from the

beginning of the year to October 14. That portfolio would show a loss of 3.9% compared with the funds

gain of 31.40%. This is, of course, where the other factors come into play, because an effective manager

must not only adjust his leverage and, consequently, his daily volatility but must also be able to select assets

that will best express, over the medium term, the favorable or negative outlook, whichever happens to be

the case.

It is here where we believe we added most value to the portfolio, by speculating that certain markets were

likely to be more affected than others that Brazil and Indias stock markets, for example, would perform

worse than North American stock markets, that European banks would fall faster and more dramatically

than industrial stocks, and so on. This simple explanation should serve to explain the rollercoaster but

essentially upward ride of the funds NAV over the past nine and a half months. To repeat, if we want to

obtain outsized gains, we must be willing to endure outsized volatility, especially under present conditions

where historically high volatility and historically high correlation between assets have become a fact of life.

Provided the manager continues to correctly assess the situation, sharp adverse movements in our NAVs will

turn out to be of a temporary nature.

This seemingly reassuring conclusion unfortunately provides little or no comfort since the negative effects are

not only magnified but also become permanent if the manager fails to catch the changing winds. Because of

this problem, I have attempted to diversify risks across a number of different markets whose performances

are (ignoring short-term market correlation) as dependent on local conditions as they are on global ones.

Bearish pressures on the Asian, Australian and Latam equity markets, to give one example, are to some

,

extent independent of the European debt crisis, even though the impact on these markets will be magnified

when and if the European crisis comes to a head.

Similarly, I have stepped up efforts to identify asset markets that will benefit from a resolution of todays

greatest problems those being the European debt crisis, the persistent and seemingly intractable lack of

competitiveness of some of the Eurozone members and the persistence of inflation in the BRIC countries

but that will demonstrate resilience under the worst of conditions. All this while maintaining an

aggressive bearish posture on other markets betting on what I consider for now to be the most likely

outcome: a serious credit implosion whose epicenter lies in Europe, followed by a severe global depression.

Last, I am leaning to the idea of lowering volatility even before the full extent of the crisis plays itself out, if

and when I am able to determine that policy-makers have caught up with the problem; that is, that they

understand it and have the political courage to implement whatever painful measures are necessary to

overcome it.

As I indicate below, I dont believe we have come to this point yet. I should note that I reduced gold and

bond positions significantly as the quarter progressed and, in fact, achieved a significant overall decrease in

exposure but used part of this reduction to re-allocate and focus our bets on areas that I thought would

maximize returns for the given risks. This led to a 50% increase in our short global equity exposure and an

increase in short commodity positions, particularly the two most important industrial commodities, copper

and oil. There was no noticeable change in our portfolios volatility, as lower leverage was offset by greater

exposure to higher beta assets.

All four pockets were profitable during the past quarter. By far the largest contribution to the fund

(almost 85%) came from the global opportunities section, mostly accounted for, in turn, by gains in long

positions in TIPS and gold and short positions in crude oil, Brazilian and Indian equities, and European,

American and Australian banks positions. While we continue to believe that long-term real rates will fall

towards zero, we nonetheless reduced the position in TIPS to an exposure equal to 30% of the funds net

assets from as high as 110% and replaced it only partially by a long position on nominal 30-year U.S.

Treasuries. The switch was motivated by a concern that break-evens would fall significantly with the

expected decline in commodities.

The gold position was reduced to almost insignificant levels by the end of the quarter (from an exposure

equal to as high as 70% of net assets), in the belief that the market had become dangerously overbought

and was passing into the hands of weak individual speculators and highly unstable hedge funds. We firmly

believe that the secular uptrend remains in place, provided real interest rates continue to stay close to zero.

Nevertheless, the ongoing correction is likely to extend for some time, providing the necessary technical

base for an eventual move to new highs.

o

Our currency section returned a very sizeable 45.8% and contributed almost 7% of the funds quarterly

profits. All positions long U.S. dollars versus a short position in the Brazilian real, New Zealand dollars,

British pounds, Australian dollars and Swedish krona were profitable. We continue to maintain a bullish

U.S. dollar stance in view of the deepening European recession and the developing stagflation in Asia and

Latin America.

The market-neutral equity portfolio gained 18% for the quarter, making it the fourth profitable quarter in a

row, and contributed almost 5% to the funds overall profits. Total gross leverage ranged between 2.96x and

2.29x, and the ratio of longs to shorts ranged from as high as 55/45 to as low as 49/51. The number of

stocks in the portfolio remained under 20 at all times, in line with a decision made last year to maintain a

relatively low number of stocks in the portfolio and thus overcome the problem of low dispersion.

Now, for a few kind words for our Asset Allocation funds. The Cayman version is up 6.9% for the quarter

(6.25% for the Canadian one), 9.9% year-to-date (8.8%) and 13.5% year-over-year (11.9%). These results

were achieved with extremely low daily, weekly and monthly volatility, an extraordinary achievement given

the global markets extreme volatility noted earlier. The funds reflected and continue to reflect our

macroeconomic views, namely a deepening global crisis centered in Europe and aggravated by efforts to

contain excessive credit problems in the major emerging countries, themselves the direct result of the nave

and populist monetary policy conducted by the U.S. Federal Reserve. A quick look at the portfolios asset

allocation will demonstrate the managers extraordinarily high degree of risk aversion.

While I have eliminated gold bullion holdings for now for reasons stated earlier, I have maintained and even

built up slightly the allocation to gold miners. Good values prevail in that area though it is clear that (a)

following the creation of gold ETFs, gold equities will never again trade at the earnings multiples that

prevailed in the 20th century, and (b) increased financing difficulties will make it difficult for many of these

miners to extract gold from the ground and justify higher valuations, despite their extraordinarily rich

resources. Investors wishing to avoid the volatility rollercoaster described in gory detail above while

prospectively accepting lower returns would do well to consider the Asset Allocation funds.

In recent days, European leaders have begun to recognize that at least one debtor country is not likely to

make it and announced plans that have given markets a reason to mount another dramatic rally. In the

jargon of the day, risk is back on.

In our opinion, however, the latest plans continue to run well behind the curve. With every passing day,

liquidity is being drained out of most European banks and substantial damage is being inflicted on their

assets. Sovereign debts will continue to pile up across countries in southern and central Europe, much as

Greeces debt has grown beyond all expectations, because the true problems have not as yet been recognized

to wit, the 30%-to-40% loss of competitiveness that these countries have experienced. In other words,

other than Ireland, the midget republics of the Baltic and Iceland, none of the affected countries have

;

managed to adjust their cost structure even as they experience high and rising unemployment. In fact, EU

financing, promises of support and misguided fiscal policies have vitiated their need to adjust. No European

fund, regardless of size, can cope with the ever mounting level of financing required by Portugal, Spain,

Italy, and now Belgium, and at the same time cope with the financing needed to recapitalize Europes

largest lenders.

The full and prospective losses on all sovereign debt, and not just that of Greece, must be taken now.

National jurisdictions, and not the artificial European Financial Stability Facility, must underwrite the rights

offering of all the banks operating in their own jurisdictions and the recapitalization must be sufficiently

large to absorb losses on all sovereign debts, realistically assessed. Simultaneously, an exit plan must be

devised for countries that have not been able to adjust their cost structures and that exit plan must contain a

return to some local currency (or perhaps a euro II?), a sharp devaluation, and an optional return

mechanism to the euro if the European project is still deemed to be a desirable objective.

Because European leaders lack the vision and the courage to jump ahead of market fears, the real risk is that

the above will happen, for happen it must, by accident if not by design, in a chaotic and panicky

atmosphere, causing a run on banks, followed by their closing and a full-fledged credit implosion. Sad to

say, forceful and realistic action two years ago could easily have averted the tragedy. The impact will be felt

across the globe, given the extraordinary interconnectedness of the world financial system. In the meantime,

Chinas inflation rages on while the economy appears to be wilting, India responds too slowly to the (now)

aggressive tightening moves (interest rates have just started to bite!) and Brazil is slowing down while private

debt is choking the consumer. Only the U.S. economy seems to be growing, though at a very modest pace,

aided no doubt by the short-term elixir of a rapidly expanding money supply. Negative fiscal impulses,

tightening profit margins and the global slowdown will nevertheless cause growth to go negative in the not-

too-distant future.

Odds for another worldwide Great Depression of a length and magnitude similar to the one begun

almost 80 years ago have risen considerably. I do not believe that markets have properly discounted this

horrifying prospect.

Thanking you for your trust,

Albert D. Friedberg

CONTENTS

FRIEDBERG GLoBAL

mAcRo hEDGE FuNDs

FRIEDBERG AssEt ALLocAtIoN FuNDs

FIXED INcomE FuNDs

cuRRENcY FuNDs

cLosED FuNDs

All statements made herein, while not guaranteed, are based on

information considered reliable and are believed by us to be accurate.

Futures and options trading is speculative and involves risk of loss.

Past trading results are not indicative of future profits.

,

PERFORMANCE

1

as of september 30, 2011

Year three Five

NAV Quarterly over Year

2

Years

2

Years

2

Friedberg Global-macro hedge Fund Ltd. 6,527.27 59.95% 33.27% 26.07% 25.08%

Friedberg Global-macro hedge Fund 38.64

3

57.52% 30.35% 31.95% N.A.

csFB/tremont hedge Fund Index N.A. 8.28% 3.35% 4.88%

1

Net of fees

2

compounded annual rate of return through August 2011

3

NAV adjusted to reflect distributions reinvested in the fund

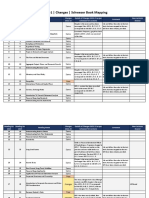

capital allocation of the Friedberg Global-macro hedge Fund Ltd. as of september 30, 2011 is as follows:

FUND CURRENT ALLOCATION TARGET

Fixed Income 5.33% 7.00%

u.s. Equities market Neutral strategy 16.19% 15.00%

currency Program 10.88% 8.00%

Global opportunities 58.81% 70.00%

cash 8.79% 0.00%

100.00% 100.00%

FRIEDBERG GLOBAL-MACRO HEDGE FUNDS

A single manager multi-strategy fund.

Allocations are reviewed periodically.

FRIEDBERG GLoBAL-mAcRo hEDGE FuND LtD.

FRIEDBERG GLoBAL-mAcRo hEDGE FuND

FRIEDBERG GLoBAL-mAcRo hEDGE FuND LtD.

Monthly Performance (%) Net of Fees

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year

2011 -10.28% 7.67% -0.71% 9.53% -5.06% -3.23% 15.96% 16.22% 18.62% 54.30%

2010 2.99% 0.36% -7.34% 3.76% 13.22% 4.75% -13.76% 6.95% 9.11% 1.69% -1.61% -6.16% 11.36%

2009 -5.85% -3.88% 3.65% -7.15% 14.90% -7.85% 9.47% 1.97% 5.02% -2.21% 9.56% -3.34% 12.02%

2008 7.37% 9.57% -1.04% -6.48% 4.51% 8.58% -0.24% -6.85% 4.18% -5.96% 5.85% 19.06% 41.77%

2007 -1.01% 1.07% -3.44% -1.28% -0.80% 1.57% 10.06% 2.80% -1.33% 5.89% 7.91% 2.82% 26.04%

2006 1.94% 1.06% -1.81% 2.07% -0.75% 1.27% 2.04% -0.09% -0.56% 3.10% 2.43% 0.54% 11.70%

2005 1.05% 0.84% -1.13% 1.31% 1.06% 2.47% 0.08% 0.95% 2.75% -1.38% 2.56% 2.14% 13.35%

2004 4.03% 3.44% 1.36% -7.84% -0.39% 0.27% 1.02% 1.90% 1.45% 1.67% 2.76% 3.24% 13.07%

2003 3.10% 3.06% -4.58% -1.15% 9.26% -3.77% -8.04% 2.91% 5.49% 1.69% 1.49% 1.10% 9.76%

2002 -1.46% 2.04% -2.22% 4.41% 5.41% 6.16% -2.42% 4.45% 2.80% -6.70% 3.30% 7.57% 21.18%

2001 0.00% 0.00% -0.40% -0.40%

***Past Performance is not indicative of future results***

:c

Commodity Strategy 51%

Global Opportunities Strategy 36%

Currencies 8%

U.S. Equities-Market

Neutral Strategy 5%

Fixed Income Portfolio 0%

Cash 0%

Total Exposure per dollar of capital: 5.65x

GLoBAL-mAcRo hEDGE FuND (cANADA)

Breakdown by total Gross Exposure

Commodity Strategy 48%

Global Opportunities Strategy 35%

Currencies 8%

U.S. Equities-Market

Neutral Strategy 6%

Cash 2%

Fixed Income Portfolio 1%

Total Exposure per dollar of capital: 5.85x

GLoBAL-mAcRo hEDGE FuND LtD. (cAYmAN)

Breakdown by total Gross Exposure

FRIEDBERG GLOBAL-MACRO HEDGE FUNDS (contd)

::

PERFORMANCE as of september 30, 2011

NAV (notional) Quarter

u.s. Equities market Neutral strategy

of the Global-macro hedge Fund 1,614.26 15.23%

INVEstmENt ALLocAtIoN

30-Jun-11 31-Jul-11 31-Aug-11 30-sep-11

LoNGs 49.04% 52.08% 51.06% 55.38%

shoRts 50.96% 47.92% 48.94% 44.62%

totAL GRoss LEVERAGE 2.85x 2.91x 2.96x 2.29x

LARGEst sEctoRs (LoNGs) LARGEst sEctoRs (shoRts)

Aerospace & Defense 10.25% Industrials Large caps 9.90%

utilities 10.15% semiconductors 7.08%

Internet software & services 8.42% household Appliances 6.37%

LARGEst LoNG PosItIoNs LARGEst shoRt PosItIoNs

utilities sector sPDR s&P 500 Futures

Google Inc. Whirlpool corp.

International Business machines corp. chesapeake Energy corp.

united technologies corp. First solar Inc.

Regeneron Pharmaceuticals united states steel corp.

BEst QuARtERLY PERFoRmANcE LoNGs shoRts

utilities sector sPDR 3.81% united states steel corp. 52.19%

Regeneron Pharmaceuticals 2.63% Bank of America corp. 44.16%

International Business machines corp. 2.03% Whirlpool corp. 38.63%

WoRst QuARtERLY PERFoRmANcE LoNGs shoRts

Ericsson ADR -33.59% Apple Inc. -10.02%

mcDermott International Inc. -33.24% molycorp Inc. 9.34%

Esterline technologies corp. -26.65% Nokia corp. ADR 11.84%

An equity strategy that seeks absolute returns through the judicious selection of

long and short positions while maintaining a market neutral posture.

u.s. EQuItIEs mARKEt NEutRAL stRAtEGY

FRIEDBERG GLOBAL-MACRO HEDGE FUNDS (contd)

::

PERFORMANCE

1

as of september 30, 2011

NAV Quarterly Year over Year

2

two Years

2

Friedberg Asset Allocation Fund Ltd. 1,405.14 6.90% 21.46% 18.44%

Friedberg Asset Allocation Fund 14.78 3 6.25% 20.68% 20.10%

csFB/tremont hedge Fund Index N.A. 8.28% 8.58%

1

Net of fees

2

compounded annual rate of return through August 2011

3

NAV adjusted to reflect distributions reinvested in the fund

capital allocation of the Friedberg Asset Allocation Fund Ltd. as of september 30, 2011 is as follows:

INVESTMENT CURRENT ALLOCATION TARGET

FIXED INcomE 34.70% 30.00%

U.S. TIPS 19.50%

U.S. Treasuries 15.20%

EQuItIEs 7.70% 10.00%

U.S. Equities 1.00%

Foreign Equities 6.70%

u.s. moNEY mARKEt 45.00% 45.00%

U.S. Treasuries 45.00%

GoLD mINING shAREs 12.60% 15.00%

Market Vectors Jr. Gold Miners ETF 12.60%

100.00% 100.00%

FRIEDBERG ASSET ALLOCATION FUNDS

the Fund is a multi-strategy fund whose investment objective is to seek

significant total investment returns, consisting of a combination of interest

income, dividend income, currency gains and capital appreciation. Allocations are

reviewed periodically.

modest risk: Absolute return.

FRIEDBERG AssEt ALLocAtIoN FuND LtD.

FRIEDBERG AssEt ALLocAtIoN FuND

Monthly Performance (%) Net of Fees

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year

2011 -4.11% 4.18% 1.11% 5.56% -1.67% -1.98% 4.65% 5.15% -2.82% 9.89%

2010 -0.27% 0.99% 0.56% 3.47% 1.10% 0.99% -2.23% 3.36% 3.91% 2.57% -0.06% 0.83% 16.13%

2009 0.38% 2.62% 0.09% 2.91% 0.53% 7.15% -3.63% 10.14%

***Past Performance is not indicative of future results***

FRIEDBERG AssEt ALLocAtIoN FuND LtD.

:,

the funds seek total investment return, consisting of a combination of interest income,

currency gains, and capital appreciation, by investing in both investment grade and

non-investment grade fixed income obligations denominated in a variety of currencies.

LoW RIsK. objective: Absolute returns

FIXED INCOME FUNDS

FRIEDBERG totAL REtuRN FIXED INcomE FuND L.P.

PERFORMANCE

1

as of september 30, 2011

Year two threee Five

NAV Quarter over Year

2

Years

2

Years

2

Years

2

Friedberg total Return Fixed Income Fund L.P. 314.34 12.80% 7.66% 14.62% 9.35% 7.24%

Benchmark

3

N.A. 8.73% 9.38% 9.06% 7.76%

1

Net of fees

2

compounded annual rate of return through August 2011

3

70% merrill Lynch Broad market Index (Bloomberg GBmI), 30% Global high Yield and Emerging markets Plus

Index (Bloomberg hAoo)

Currency Exposure

Adjusted modified duration 5.47

Approximate overall credit rating AAA

Bond rating breakdown: AAA 93.94%

Unrated 6.06%

U.S. Dollar

U.S. Treasury Inflation Protected

2.125% 2/15/2040 55.74%

U.S. 10 Year Note Futures 32.54%

SPDR Gold Shares 6.06%

U.S. Cash 5.66%

Portfolio Allocation

Weighted average yield to maturity 0.85%

Weighted average current yield 1.22%

FRIEDBERG TOTAL RETURN FIXED INCOME FUND L.P.

:

speculative trading in currency futures instruments, currency forwards and options.

PERFORMANCE

1

as of september 30, 2011

Year three Five

NAV Quarter over Year

3

Years

3

Years

3

Friedberg currency Fund

2

15.63 40.43% -26.28% -0.46% -2.98%

Friedberg Forex L.P. 12.76 28.37% -18.27% -9.13% -2.45%

Barclay currency traders Index N.A. 0.90% 2.18% 2.22%

1

Net of fees

2

Priced in canadian Dollars

3

compounded annual rate of return through August 2011

OPEN POSITIONS september 30, 2011

times dedicated capital

short British Pound 1.99

short Brazilian Real Futures 0.76

short New Zealand Dollar 0.69

short Australia Dollar 0.63

total gross leverage at December 31, 2007 4.06 x

maximum gross leverage during quarter 8.64 x

ACTIVITY REPORT Third Quarter 2011

PRoFItABLE tRANsActIoNs profit as percentage percentage

of average equity of total profits

short Brazilian Real 8.45 27.47

short New Zealand Dollar 6.34 20.60

short British Pound 6.12 19.89

short Australian Dollar 5.26 17.11

short swedish Krona 4.15 13.48

Long cAD / short mXN 0.44 1.44

LosING tRANsActIoNs profit as percentage percentage

of average equity of total losses

Long Asia Dollar Index -1.39 100.00

FRIEDBERG cuRRENcY FuND

FRIEDBERG FoREX L.P.

CURRENCY FUNDS

:,

CLOSED FUNDS

Fund Inception Inception Liquidation Liquidation Size of Fund Annual %

Date NAV Date NAV at Liquidation Rate of Return

Friedberg Diversified Fund 13-sep-96 10.00 31-oct-06 48.43 $4,642,228 16.90%

Friedberg Global opportunities Fund Ltd. 13-may-97 1000.00 28-Feb-05 501.89 $5,700,000 -8.46%

Friedberg Equity hedge Fund L.P. 15-Feb-98 10.00 31-oct-06 22.12 $6,784,836 9.50%

Friedberg International securities Fund 31-mar-98 10.00 30-Nov-05 11.49 $4,500,000 1.83%

Friedberg Futures Fund 8-may-98 10.00 31-oct-06 19.59 $1,126,409 8.10%

Friedberg Global macro hedge Fund L.P. 31-may-02 10.00 31-oct-06 19.00 $30,691,202 15.64%

Friedberg Equity hedge Fund Ltd. 16-oct-96 1000.00 30-Apr-07 2951.78 $31,540,284 10.81%

Friedberg currency Fund II Ltd. 6-mar-97 1000.00 30-Jun-08 1019.23 $35,599,879 0.17%

Friedberg total Return Fixed

Income Fund Ltd. 2-oct-96 1000.00 31-Jul-09 2155.93 $94,686,020 6.17%

First mercantile currency Fund 7-sep-85 10.00 30-Dec-09 8.29 $848,443 N.A.

Friedberg Foreign Bond Fund 19-Aug-96 10.00 30-Jul-10 9.84 $13,336,465 6.91%

FRIEDBERG MERCANTILE GROUP LTD.

Brookfield Place, :: Bay Street, Suite :,c

Toronto, Ontario x,; :r,

Tel.: (:o) 364-2700

Fax: (:o) 364-0572

www.friedberg.ca

e-mail: funds@friedberg.ca

Вам также может понравиться

- Review of The Second Quarter 2015: Investment NoteДокумент3 страницыReview of The Second Quarter 2015: Investment NoteStephanieОценок пока нет

- Third Q Uarter R Eport 2010Документ16 страницThird Q Uarter R Eport 2010richardck50Оценок пока нет

- Fourth Q Uarter R Eport 2010Документ16 страницFourth Q Uarter R Eport 2010richardck61Оценок пока нет

- TomT Stock Market Model 2012-05-20Документ20 страницTomT Stock Market Model 2012-05-20Tom TiedemanОценок пока нет

- Friedberg 3Q ReportДокумент16 страницFriedberg 3Q Reportrichardck61Оценок пока нет

- FPA Crescent Qtrly Commentary 0911Документ4 страницыFPA Crescent Qtrly Commentary 0911James HouОценок пока нет

- The End of Buy and Hold ... and Hope Brian ReznyДокумент16 страницThe End of Buy and Hold ... and Hope Brian ReznyAlbert L. PeiaОценок пока нет

- GIC On The MarketsДокумент18 страницGIC On The MarketsDD97Оценок пока нет

- Asia Maxima (Delirium) - 3Q14 20140703Документ100 страницAsia Maxima (Delirium) - 3Q14 20140703Hans WidjajaОценок пока нет

- Gryphon 2015 OutlookupdateДокумент10 страницGryphon 2015 Outlookupdateapi-314576946Оценок пока нет

- Major Themes - TGSF AdvisorsДокумент95 страницMajor Themes - TGSF AdvisorsZerohedge0% (1)

- Burch Wealth Management 05.09.11Документ3 страницыBurch Wealth Management 05.09.11admin866Оценок пока нет

- Bar Cap 3Документ11 страницBar Cap 3Aquila99999Оценок пока нет

- Greenlight Capital Letter (1-Oct-08)Документ0 страницGreenlight Capital Letter (1-Oct-08)brunomarz12345Оценок пока нет

- Bii 2016 Outlook Us VersionДокумент20 страницBii 2016 Outlook Us VersionEmil Biobelemoye Hirai-GarubaОценок пока нет

- Ulman Financial Fourth Quarter Newsletter - 2018-10Документ8 страницUlman Financial Fourth Quarter Newsletter - 2018-10Clay Ulman, CFP®Оценок пока нет

- Tilson - t2 Annual LetterДокумент27 страницTilson - t2 Annual Lettermwolcott4Оценок пока нет

- April 2011 CommentaryДокумент4 страницыApril 2011 CommentaryMKC GlobalОценок пока нет

- Newsletter 11232011Документ11 страницNewsletter 11232011api-244253657Оценок пока нет

- X-Factor 102211 - Market Is Not CheapДокумент11 страницX-Factor 102211 - Market Is Not CheapmathewmiypeОценок пока нет

- Wally Weitz Letter To ShareholdersДокумент2 страницыWally Weitz Letter To ShareholdersAnonymous j5tXg7onОценок пока нет

- Mason Hawkins 11q3letterДокумент4 страницыMason Hawkins 11q3letterrodrigoescobarn142Оценок пока нет

- C CC CCCДокумент7 страницC CC CCCKelvingrove Partners, LLCОценок пока нет

- Managed Futures and A Bond Bubble: September 13, 2010Документ6 страницManaged Futures and A Bond Bubble: September 13, 2010intercontiОценок пока нет

- The List Market Outlook en UsДокумент12 страницThe List Market Outlook en UsothergregОценок пока нет

- Olivers Insights - Share CorrectionДокумент2 страницыOlivers Insights - Share CorrectionAnthony WrightОценок пока нет

- Glenview Q4 14Документ23 страницыGlenview Q4 14marketfolly.comОценок пока нет

- Project On Stock MarketsДокумент70 страницProject On Stock MarketsVivian ClementОценок пока нет

- Deteriorating Financial Conditions Threaten To Escalate The European Debt CrisisДокумент2 страницыDeteriorating Financial Conditions Threaten To Escalate The European Debt CrisisKevin A. Lenox, CFAОценок пока нет

- Quarterly: Third QuarterДокумент16 страницQuarterly: Third Quarterrichardck61Оценок пока нет

- Greenstone Distressed Debt Investing Letter DEC 2010Документ10 страницGreenstone Distressed Debt Investing Letter DEC 2010oo2011Оценок пока нет

- TomT Stock Market Model October 30 2011Документ20 страницTomT Stock Market Model October 30 2011Tom TiedemanОценок пока нет

- The Absolute Return Letter 10/11Документ8 страницThe Absolute Return Letter 10/11pick6Оценок пока нет

- Deutsche Bank ResearchДокумент3 страницыDeutsche Bank ResearchMichael GreenОценок пока нет

- Coronavirus and Its Impact On Global Financial MarketsДокумент3 страницыCoronavirus and Its Impact On Global Financial MarketsAnkur ShardaОценок пока нет

- BlackRock Midyear Investment Outlook 2014Документ8 страницBlackRock Midyear Investment Outlook 2014w24nyОценок пока нет

- Investment Commentar Y: Initial Thinking Another Update Investor CallДокумент9 страницInvestment Commentar Y: Initial Thinking Another Update Investor CallAnil GowdaОценок пока нет

- Hussman Funds - Stocks Extreme Conditions and Typical Outcomes - May 2, 2011Документ6 страницHussman Funds - Stocks Extreme Conditions and Typical Outcomes - May 2, 2011KoalaCapitalSICAVОценок пока нет

- LTR To Investors Jan 11Документ6 страницLTR To Investors Jan 11the_knowledge_pileОценок пока нет

- Adaptive Asset AllocationДокумент14 страницAdaptive Asset AllocationQuasiОценок пока нет

- Hussman Funds 2009-07-27Документ2 страницыHussman Funds 2009-07-27rodmorley100% (2)

- Volume 2.10 The Artificial Economic Recovery July 23 2010Документ12 страницVolume 2.10 The Artificial Economic Recovery July 23 2010Denis OuelletОценок пока нет

- Dave Rosenberg 2018 Economic OutlookДокумент9 страницDave Rosenberg 2018 Economic OutlooksandipktОценок пока нет

- First Q Uarter R Eport 2010Документ16 страницFirst Q Uarter R Eport 2010richardck20Оценок пока нет

- FMG Q2 2013Документ16 страницFMG Q2 2013richardck61Оценок пока нет

- Lane Asset Management Stock Market Commentary September 2015Документ10 страницLane Asset Management Stock Market Commentary September 2015Edward C LaneОценок пока нет

- Elliot Investor LetterДокумент1 страницаElliot Investor LetterArjun KharpalОценок пока нет

- Credit Suisse, Market Focus, Jan 17,2013Документ12 страницCredit Suisse, Market Focus, Jan 17,2013Glenn ViklundОценок пока нет

- Stocks Have Rallied and Will Now Return Less. Hip Hip Hooray! But Now What?Документ5 страницStocks Have Rallied and Will Now Return Less. Hip Hip Hooray! But Now What?saif_shakeelОценок пока нет

- Bam 2012 q2 LTR To ShareholdersДокумент7 страницBam 2012 q2 LTR To ShareholdersDan-S. ErmicioiОценок пока нет

- Annual Report: March 31, 2011Документ23 страницыAnnual Report: March 31, 2011VALUEWALK LLCОценок пока нет

- Ecfp March 2015Документ2 страницыEcfp March 2015dpbasicОценок пока нет

- EPF March 2015Документ2 страницыEPF March 2015dpbasicОценок пока нет

- Warsh Speech 20100628Документ11 страницWarsh Speech 20100628Samy SudanОценок пока нет

- Essential Info Q1 2016Документ25 страницEssential Info Q1 2016mirceastnОценок пока нет

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsОт EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsРейтинг: 4 из 5 звезд4/5 (1)

- Applied Financial Macroeconomics and Investment Strategy: A Practitioner’s Guide to Tactical Asset AllocationОт EverandApplied Financial Macroeconomics and Investment Strategy: A Practitioner’s Guide to Tactical Asset AllocationОценок пока нет

- Mauldin October 12Документ5 страницMauldin October 12richardck61Оценок пока нет

- Six Ways NIRP Is Economically NegativeДокумент14 страницSix Ways NIRP Is Economically Negativerichardck61Оценок пока нет

- ODT Note 1 Unloved TreasuriesДокумент2 страницыODT Note 1 Unloved Treasuriesrichardck61Оценок пока нет

- Keynote SacksДокумент7 страницKeynote Sacksrichardck61Оценок пока нет

- Degussa Marktreport Engl 22-07-2016Документ11 страницDegussa Marktreport Engl 22-07-2016richardck61Оценок пока нет

- Mauldin June 4Документ15 страницMauldin June 4richardck61Оценок пока нет

- TrumpedДокумент12 страницTrumpedrichardck61Оценок пока нет

- Report From Abu Dhabi ... and DallasДокумент13 страницReport From Abu Dhabi ... and Dallasrichardck61Оценок пока нет

- An Open Letter To The Next President: Newport Beach, New York, and An SIC Conference UpdateДокумент16 страницAn Open Letter To The Next President: Newport Beach, New York, and An SIC Conference Updaterichardck61Оценок пока нет

- Global Macro Commentary March 15 - BamboozledДокумент3 страницыGlobal Macro Commentary March 15 - Bamboozledrichardck61Оценок пока нет

- Mauldin May 9Документ18 страницMauldin May 9richardck61Оценок пока нет

- Growth Is The Answer To EverythingДокумент11 страницGrowth Is The Answer To Everythingrichardck61Оценок пока нет

- GoldMoney Insights Feb 2016 Buffets Math Trumped by GoldДокумент9 страницGoldMoney Insights Feb 2016 Buffets Math Trumped by Goldrichardck61Оценок пока нет

- The Federal Reserve and Sound Money: National Center For Policy AnalysisДокумент4 страницыThe Federal Reserve and Sound Money: National Center For Policy Analysisrichardck61Оценок пока нет

- ZIRP & NIRP: Killing Retirement As We Know ItДокумент15 страницZIRP & NIRP: Killing Retirement As We Know Itrichardck61Оценок пока нет

- CFA Level 3 - Formula Sheet (NO PRINT)Документ35 страницCFA Level 3 - Formula Sheet (NO PRINT)Denis DikarevОценок пока нет

- 4.287 Master of Management Studies MMS Sem III IV PDFДокумент224 страницы4.287 Master of Management Studies MMS Sem III IV PDFSayali Utekar100% (1)

- Barclays US Futures H3-M3 Treasury Futures Roll Outlook PDFДокумент9 страницBarclays US Futures H3-M3 Treasury Futures Roll Outlook PDFLorenzo RossiОценок пока нет

- Finance L6Документ39 страницFinance L6Rida Rehman100% (1)

- M06 Brooks266675 01 FM C06Документ63 страницыM06 Brooks266675 01 FM C06Mubashar NawazОценок пока нет

- Explaining The Basis - Cash Versus Default SwapsДокумент20 страницExplaining The Basis - Cash Versus Default SwapsdtayebconsultingОценок пока нет

- CH 09 Bonds ValuationДокумент28 страницCH 09 Bonds ValuationAbdus Salam ShaikhОценок пока нет

- Consolidated Factsheet 11 2021 151221 191957 211226 154716Документ60 страницConsolidated Factsheet 11 2021 151221 191957 211226 154716ABHISHEK GUPTAОценок пока нет

- Lecture Note 06 - Forward and Futures On BondsДокумент55 страницLecture Note 06 - Forward and Futures On Bondsben tenОценок пока нет

- MyMerrill - Article Viewer - 042020Документ19 страницMyMerrill - Article Viewer - 042020kookevОценок пока нет

- Test 8 CFA 60 CâuДокумент9 страницTest 8 CFA 60 CâuLâm NguyễnОценок пока нет

- BONDS and STOCKДокумент3 страницыBONDS and STOCKSufyan AshrafОценок пока нет

- CFA L-1 Schweser Mapping 2023Документ5 страницCFA L-1 Schweser Mapping 2023Harsh JainОценок пока нет

- Convertible Bonds DefinitionsДокумент3 страницыConvertible Bonds DefinitionsRocking LadОценок пока нет

- Corporate BondsДокумент134 страницыCorporate BondsJULIAN CAMILO CLAVIJO PEDRAZAОценок пока нет

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownДокумент79 страницInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownzeeshanОценок пока нет

- CT1 Assignment Chapter 14Документ5 страницCT1 Assignment Chapter 14Gaurav satraОценок пока нет

- CFA L1 3 Month ScheduleДокумент9 страницCFA L1 3 Month ScheduleSakura2709Оценок пока нет

- Barrons 2021-01-11Документ112 страницBarrons 2021-01-11Daniel Cetina PinoОценок пока нет

- Wolmers Assignment CoverpageДокумент9 страницWolmers Assignment Coverpagefrancisdavianna11Оценок пока нет

- Unit 3Документ40 страницUnit 322PBA132 RAVISH.TОценок пока нет

- FINS 2624 Quiz 2 AnswersДокумент2 страницыFINS 2624 Quiz 2 Answerssagarox7Оценок пока нет

- Bond Formula Cheat SheetДокумент3 страницыBond Formula Cheat SheetAbdulmalek Alduwaish50% (2)

- CISI Securities & Investment WorkbookДокумент250 страницCISI Securities & Investment WorkbookLuke PhОценок пока нет

- Fixed Income Product PresentationДокумент19 страницFixed Income Product PresentationPankaj SinghalОценок пока нет

- Tutorial For UT Exam PDFДокумент62 страницыTutorial For UT Exam PDFHanafi MansorОценок пока нет

- NJ MarsДокумент42 страницыNJ MarsajaybsinghОценок пока нет

- VL Mock Exam Set 1Документ12 страницVL Mock Exam Set 1Arvin AltamiaОценок пока нет

- Nguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceДокумент14 страницNguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceNgọc MaiОценок пока нет

- Bearer BondsДокумент16 страницBearer Bondssushantgk9Оценок пока нет