Академический Документы

Профессиональный Документы

Культура Документы

Clarkson Lumber

Загружено:

cypheriousИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Clarkson Lumber

Загружено:

cypheriousАвторское право:

Доступные форматы

The Clarkson Lumber Company Documentation of Financial Analysis

Clarkson Lumber

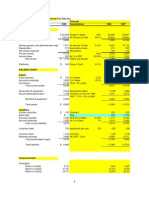

Income Statement

Years Ending December 31, 1993-1996

1st Quarter

1993

1994

1995

1996

Net sales

Cost of goods sold

Trade Discounts

Fixed salaries [estimated]

Other operating expenses

EBIT

Interest

Earnings before tax

Income tax

Net Income

$ 2,921.00 $ 3,477.00 $ 4,519.00 $

2,202.00

2,634.00

3,424.00

0.00

0.00

0.00

115.00

130.00

128.00

507.00

587.00

812.00

97.00

126.00

155.00

23.00

42.00

56.00

74.00

84.00

99.00

14.00

17.00

22.00

$

60.00 $

67.00 $

77.00 $

1,062.00

799.00

0.00

34.00

210.00

19.00

13.00

6.00

1.00

5.00

% of Sales Pro-Forma

1993-1995

1996

$

75.7% $

$

3.42% $

17.46% $

$

$

$

$

$

5,500.00

4,161.40

(66.20)

187.92

960.25

256.64

105.50

151.14

42.19

108.95

Clarkson_Lumber_Income_Smt

The Clarkson Lumber Company Documentation of Financial Analysis

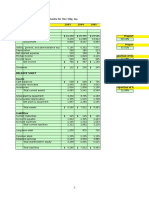

Clarkston Lumber

Balance Sheet

Years Ending December 31, 1993-1996

Assets

Cash

Accounts receivable

Inventory

Total current assets

Property Plant & Equipment

Total Assets

Liabilities

Notes payable, bank

NP, Holtz, current portion

Notes payable, trade

Accounts payable

Accruals

Current portion, term loan

Current liabilities

Term loan

Notes payable, Holtz

Total liabilities

Shareholder Equity

Total Shareholder Equity

Liabilities+Shareholder Equity

1993

1994

1995

% of Sales Pro-Forma

1996 1993-1995

1996

$43.00

$52.00

$56.00

$53.00

306.00

411.00

606.00

583.00

337.00

432.00

587.00

607.00

686.00

895.00 1,249.00 1,243.00

233.00

262.00

388.00

384.00

$919.00 $1,157.00 $1,637.00 $1,627.00

$0.00

0.00

0.00

213.00

42.00

20.00

$275.00

140.00

0.00

$415.00

$60.00 $390.00

$399.00

100.00

100.00

100.00

0.00

127.00

123.00

340.00

376.00

364.00

45.00

75.00

67.00

20.00

20.00

20.00

$565.00 $1,088.00 $1,073.00

120.00

100.00

100.00

100.00

0.00

0.00

$785.00 $1,188.00 $1,173.00

504.00

372.00

449.00

454.00

$919.00 $1,157.00 $1,637.00 $1,627.00

1.38%

12.12%

25.92%

8.09%

EFN=

1.48%

$76.07

666.53

619.23

1,361.83

444.86

$1,806.69

$949.00

0.00

0.00

113.13

81.62

20.00

$1,163.74

80.00

0.00

$1,243.74

562.95

$1,806.69

Clarkson_Lumber_Balance_Sheet

The Clarkson Lumber Company Documentation of Financial Analysis

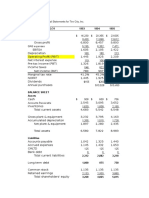

Ratio:

Current

Quick

Cash

NWC to Total Assets

Short Term Solvency Ratios

1993

1994

1995

249%

127%

16%

44.72%

158%

82%

9%

28.52%

115%

61%

5%

9.84%

Financial Leverage/Long Term Solvency Ratios

Ratio:

1993

1994

1995

Total Debt

45%

68%

73%

Debt-Equity

82%

184%

265%

Equity Multiplier

1.82

3.11

3.65

Long-Term Debt

22%

37%

18%

Times Earned Interest

4.22

3.00

2.77

Cash Covered

4.15

0.61

0.21

1996

117%

64%

7%

10.96%

1996

69%

221%

3.21

12%

2.43

0.22

Profitability Ratios

1993

1994

2.05%

1.93%

6.53%

5.79%

11.90%

18.01%

1995

1.70%

4.70%

17.15%

1996

1.98%

6.03%

19.35%

Asset Utilization Ratios

Ratio:

1993

1994

Inventory Turnover

6.53

6.10

Days Sales Inventory

55.86

59.86

Receivables Turnover

9.55

8.46

Days Sales Receivables

38.24

43.14

NWC Turnover

7.11

10.54

Fixed Asset Turnover

12.54

13.27

Total Asset Turnover

3.18

3.01

1995

5.83

62.57

7.46

48.95

28.07

11.65

2.76

1996

6.72

54.31

8.25

44.23

27.77

12.36

3.04

Weighted Average Cost of Capital

1993

1994

1995

11.90%

18.01%

17.15%

54.84%

32.15%

27.43%

14.38%

10.50%

7.60%

45.16%

67.85%

72.57%

13.02%

12.91%

10.22%

1996

19.35%

31.16%

10.06%

68.84%

12.95%

Ratio:

Profit Margin (Net)

ROA

ROE

Ratio:

ROE

E/A

Cost of Debt

D/A

WACC

Relevant_Fin_Ratios

The Clarkson Lumber Company Documentation of Financial Analysis

Liability

NP to Holtz, current portion

Term loan, current portion

Term Loan

Northrup National Bank $750,000

Interest Calculation For 1996

Stated Rate

Subject To Interest Charge

11%

10%

10%

11%

$100.00

20.00

100.00

750.00

Interest

$11.00

2.00

10.00

82.50

1996_Interest_Calc

The Clarkson Lumber Company Documentation of Financial Analysis

Tax Bracket

$0-$50,000

$50,000-75,000

75,000-100,000

above 100,000

1996 Tax Liability

Rate

Taxable Amount

15%

25%

34%

39%

$50.00

25.00

25.00

51.14

Total Taxes Due

Tax Bill

$7.50

6.25

8.50

19.94

$42.19

1996_Taxes

The Clarkson Lumber Company Documentation of Financial Analysis

N10 Discount At 2% Savings

1995 Ending Inventory

1996 COGS

1996 Ending Inventory

1996 Purchases

1996 1st Qtr Inventory Purchases (Given in case)

Subject to N10 Discounts

Total Savings N10@2%

Ending Inventory Calculation For 1996

Cost of Goods Sold 1995

Average Inventory 1995

Inventory Turnover 1995

Cost of Goods Sold 1996

Ending Inventory 1996

$587.00

4,161.40

(619.23)

4,129.17

819.00

3,310.17

-$66.20

$3,424.00

509.50

6.72

4,161.40

$619.23

Purchase_Discount

Вам также может понравиться

- Clarkson Lumber Co (Calculations) For StudentsДокумент18 страницClarkson Lumber Co (Calculations) For StudentsShahid Iqbal100% (5)

- Clarkson Lumber Case AnalysisДокумент7 страницClarkson Lumber Case AnalysisSharon RasheedОценок пока нет

- Clarkson Lumber Co Calculations1560944145Документ9 страницClarkson Lumber Co Calculations1560944145lauraОценок пока нет

- Tire City AnalysisДокумент3 страницыTire City AnalysisKailash HegdeОценок пока нет

- Clarkson Lumber SolutionДокумент8 страницClarkson Lumber Solutionpawangadiya1210Оценок пока нет

- Clarkson Lumber CompanyДокумент6 страницClarkson Lumber Companymehreen samiОценок пока нет

- ClarksonДокумент2 страницыClarksonYang Pu100% (3)

- Lecture 6 Clarkson LumberДокумент8 страницLecture 6 Clarkson LumberDevdatta Bhattacharyya100% (1)

- Clarkson Lumber Case 1 Write UpДокумент9 страницClarkson Lumber Case 1 Write UpStefan Radisavljevic100% (1)

- Clarkson QuestionsДокумент5 страницClarkson QuestionssharonulyssesОценок пока нет

- ClarksonДокумент22 страницыClarksonfrankstandaert8714Оценок пока нет

- Group 3 - Clarkson Write UpДокумент7 страницGroup 3 - Clarkson Write UpCarlos Eduardo Ventura GonçalvesОценок пока нет

- Assignment 7 - Clarkson LumberДокумент5 страницAssignment 7 - Clarkson Lumbertesttest1Оценок пока нет

- Clarkson Lumber Company (7.0)Документ17 страницClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Clarkson Lumber Case Study - SolДокумент5 страницClarkson Lumber Case Study - SolWaqar Azeem73% (11)

- Assignment #2 Workgroup E IttnerДокумент8 страницAssignment #2 Workgroup E IttnerAziz Abi AadОценок пока нет

- Clarkson Lumber Cash Flows and Pro FormaДокумент6 страницClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniОценок пока нет

- Group2 - Clarkson Lumber Company Case AnalysisДокумент3 страницыGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbОценок пока нет

- Clarkson Lumber Co Calculations For StudentsДокумент27 страницClarkson Lumber Co Calculations For StudentsQuetzi AguirreОценок пока нет

- Clarkson Lumber CompanyДокумент6 страницClarkson Lumber Companymalishka1025Оценок пока нет

- Clarkson TemplateДокумент7 страницClarkson TemplateJeffery KaoОценок пока нет

- Tire City IncДокумент12 страницTire City IncMahesh Kumar Meena100% (1)

- Excel Clarkson LumberДокумент9 страницExcel Clarkson LumberCesareo2008Оценок пока нет

- Hampton Suggested AnswersДокумент5 страницHampton Suggested Answersenkay12100% (3)

- Toy World CaseДокумент9 страницToy World Casedwchief100% (1)

- Toy World, Inc. Case SolutionДокумент23 страницыToy World, Inc. Case SolutionArjun Jayaprakash Thirukonda80% (5)

- Tire City Inc. Case StudyДокумент8 страницTire City Inc. Case StudyKyeli TanОценок пока нет

- Tire City AssignmentДокумент7 страницTire City AssignmentShivam Kanojia100% (1)

- Tire City Spreadsheet SolutionДокумент7 страницTire City Spreadsheet SolutionSyed Ali MurtuzaОценок пока нет

- Tire City Case SolutionДокумент6 страницTire City Case SolutionShivam Bhasin60% (10)

- Tire City Spreadsheet SolutionДокумент6 страницTire City Spreadsheet Solutionalmasy99100% (1)

- Toy World - ExhibitsДокумент9 страницToy World - Exhibitsakhilkrishnan007Оценок пока нет

- Clarkson LumberДокумент3 страницыClarkson Lumbermds89Оценок пока нет

- BBB Case Write-UpДокумент2 страницыBBB Case Write-UpNeal Karski100% (1)

- Blaine Excel HWДокумент5 страницBlaine Excel HWBoone LewisОценок пока нет

- Case BBBYДокумент7 страницCase BBBYgregordejong100% (1)

- Case Background: Kaustav Dey B18088Документ9 страницCase Background: Kaustav Dey B18088Kaustav DeyОценок пока нет

- Tire - City AnalysisДокумент17 страницTire - City AnalysisJustin HoОценок пока нет

- Exhibit 1Документ2 страницыExhibit 1Natasha PerryОценок пока нет

- Economy Shipping Co Case SolutionДокумент7 страницEconomy Shipping Co Case SolutionPaco Colín100% (2)

- Case Analysis Toy WorldДокумент11 страницCase Analysis Toy WorldNiketa Jaiswal100% (1)

- Hampton Machine Tool CompanyДокумент2 страницыHampton Machine Tool CompanySam Sheehan100% (1)

- Economy Shipping Case AnswersДокумент72 страницыEconomy Shipping Case Answersreduay67% (3)

- Sampa Video CaseДокумент6 страницSampa Video CaseRahul BhatnagarОценок пока нет

- 93-Tire-City 22 22Документ26 страниц93-Tire-City 22 22Daniel InfanteОценок пока нет

- Tire City CaseДокумент14 страницTire City CaseXRiloXОценок пока нет

- Tire City SolutionДокумент2 страницыTire City Solutionadityaintouch60% (5)

- Tire City CaseДокумент12 страницTire City CaseAngela ThorntonОценок пока нет

- Sears Vs Wal-Mart Case ExhibitsДокумент8 страницSears Vs Wal-Mart Case ExhibitscharlietoneyОценок пока нет

- Exhibit 1 Financial Statements For Tire City, IncДокумент4 страницыExhibit 1 Financial Statements For Tire City, IncvelusnОценок пока нет

- Paramount Valuation - 1993: Cash Flow ForecastДокумент9 страницParamount Valuation - 1993: Cash Flow ForecastaishwaryapОценок пока нет

- Tire CityДокумент5 страницTire CitySudip BrahmacharyОценок пока нет

- 03 Tire City, Inc. - ExhibitsДокумент2 страницы03 Tire City, Inc. - ExhibitsLalit DeoОценок пока нет

- Bibliography and Ane KumaranДокумент6 страницBibliography and Ane KumaranG.KISHORE KUMARОценок пока нет

- Xls004 Xls EngДокумент25 страницXls004 Xls EngMaría José Hernández FaríasОценок пока нет

- Price Per Share: AssumptionsДокумент4 страницыPrice Per Share: Assumptions87018701Оценок пока нет

- The Quaker Oats Company and Subsidiaries Consolidated Statements of IncomeДокумент3 страницыThe Quaker Oats Company and Subsidiaries Consolidated Statements of IncomeNaseer AhmedОценок пока нет

- Rosario Acero S.A - LarryДокумент12 страницRosario Acero S.A - LarryStevano Rafael RobothОценок пока нет

- Sears Vs Walmart - v01Документ37 страницSears Vs Walmart - v01chansjoy100% (1)

- Boston BeerДокумент23 страницыBoston BeerarnabpramanikОценок пока нет

- Soal Process Costing 1Документ5 страницSoal Process Costing 1Mita PutryanaОценок пока нет

- 11 - Fahrur Rozie - F0321088 - Tugas Chapter 6 Variable Costing and Segment Reporting Tools For ManagementДокумент3 страницы11 - Fahrur Rozie - F0321088 - Tugas Chapter 6 Variable Costing and Segment Reporting Tools For ManagementFahrur RozieОценок пока нет

- Cambridge International AS and A Level Accounting Coursebook Answer Section PDFДокумент223 страницыCambridge International AS and A Level Accounting Coursebook Answer Section PDFKasparov T Mhangami80% (5)

- Principles of Accounting Lecture 1Документ9 страницPrinciples of Accounting Lecture 1Masum HossainОценок пока нет

- Fundamentals Accounting ReferencesДокумент7 страницFundamentals Accounting ReferencesRengie GaloОценок пока нет

- AccountsДокумент100 страницAccountskaran kОценок пока нет

- PPSAS 3 - Accounting Policies Changes in Accounting EstimatesДокумент24 страницыPPSAS 3 - Accounting Policies Changes in Accounting EstimatesLeonardo Don Alis CordovaОценок пока нет

- Chap 008Документ100 страницChap 008avivdechner83% (6)

- Marginal Costing & Absorption Costing - SolvedДокумент12 страницMarginal Costing & Absorption Costing - SolvedfizzaОценок пока нет

- PO Setup and Defaulting of Accounts in A Purchasing EnvironmentДокумент5 страницPO Setup and Defaulting of Accounts in A Purchasing EnvironmentharishОценок пока нет

- Trac Nghiem Tieng AnhДокумент4 страницыTrac Nghiem Tieng AnhLê KhánhОценок пока нет

- Case Study Sap For Atlam: Group Member Name Matric NoДокумент30 страницCase Study Sap For Atlam: Group Member Name Matric NoKennedy NgОценок пока нет

- Sec Reportorial RequirementsДокумент2 страницыSec Reportorial RequirementsAnonymous qDb8S3koEОценок пока нет

- Apex Spinning Annual Report-2016-17Документ50 страницApex Spinning Annual Report-2016-17SayeedMdAzaharulIslamОценок пока нет

- Mangezvo Joseline C20141931C Industrial Attachment Report 2023Документ30 страницMangezvo Joseline C20141931C Industrial Attachment Report 2023ronald anesuОценок пока нет

- Accounting For Sole Proprietorship Problem1-5Документ8 страницAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- CMA Sample Questions and Answers 2020Документ25 страницCMA Sample Questions and Answers 2020LhenОценок пока нет

- A Exam SampleДокумент20 страницA Exam Sampledanchinh100% (1)

- TDU Research Proposal 2Документ9 страницTDU Research Proposal 2usheОценок пока нет

- TallyДокумент1 199 страницTallyVikram Ullal100% (3)

- Accounting What The Numbers Mean 11th Edition Marshall Solutions ManualДокумент25 страницAccounting What The Numbers Mean 11th Edition Marshall Solutions ManualElizabethBautistadazi100% (46)

- IFRS Learning Resources October 2014 PDFДокумент14 страницIFRS Learning Resources October 2014 PDFolooaОценок пока нет

- Introduction To AuditingДокумент16 страницIntroduction To AuditingMark Lawrence YusiОценок пока нет

- SAP ReportsДокумент4 страницыSAP Reportsbalaji.amubanОценок пока нет

- Dmba104 Financial Management and AccountingДокумент9 страницDmba104 Financial Management and AccountingShashi SainiОценок пока нет

- Ind As 24 Related Party DisclosuresДокумент30 страницInd As 24 Related Party DisclosuresAkhil AkhyОценок пока нет

- Acc 411Документ10 страницAcc 411green bothОценок пока нет

- Principles of AccountingДокумент5 страницPrinciples of AccountingDanish MuradОценок пока нет

- Project RAR IntegerationДокумент25 страницProject RAR IntegerationAl-Mahad International School100% (1)

- Problem 1 4Документ1 страницаProblem 1 4Olaysa BacusОценок пока нет