Академический Документы

Профессиональный Документы

Культура Документы

Earnings Release 3Q11: EBITDA of R$277 Million in 3Q11

Загружено:

Klabin_RIИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Earnings Release 3Q11: EBITDA of R$277 Million in 3Q11

Загружено:

Klabin_RIАвторское право:

Доступные форматы

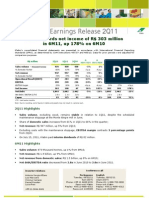

Earnings Release 3Q11

EBITDA of R$277 million in 3Q11,

the highest quarterly result since 3Q04

Klabin's consolidated financial statements are presented in accordance with International Financial Reporting Standards (IFRS), as determined by CVM Instructions 457/07 and 485/10.

R$ million Sales volume - thousand tonnes

% Domestic Market

3Q11 434

71%

2Q11 435

66%

3Q10 436

71%

3Q11/2Q11 3Q11/3Q10

9M11 1,306

66%

9M10 1,299

68%

9M11/9M10

0%

5 p.p.

0%

0 p.p.

1%

-2 p.p.

Net revenue

% Domestic Market

991

81%

947

78%

983

79%

5%

3 p.p.

1%

2 p.p.

2,895

78%

2,732

78%

6%

0 p.p.

Operational Result (EBIT) EBITDA

EBITDA Margin

147 277

28%

177 190

20%

203 252

26%

-17% 46%

8 p.p.

-28% 10%

2 p.p.

527 717

25%

506 731

27%

4% -2%

-2 p.p.

Net Income (loss) Net Debt

Net Debt / EBITDA (LTM)

(243) 2,313

2.4 x

163 1,893

2.0 x

226 2,106

2.2 x

60 22% 3% 10% -12% 2,313

2.4 x

335 2,106

2.2 x

-82% 10% 23%

Capex

LTM - last twelve months / N/A - not applicable

96

93

109

305

248

Note: Due to rounding, some figures in tables and graphs may not result in a precise sum.

3Q11 Highlights

Share of domestic sales increased from 66% in 2Q11 to 71% in the quarter; Net revenue: R$ 991 million, up 5% from 2Q11. Domestic market accounted for 81% of total net revenue; EBITDA: R$277 million, up 46% from 2Q11 and 10% from 3Q10; the best result since 3Q04, when exchange rate was R$ 2.98/US$. EBITDA margin of 28%, up 8 percentage points on 2Q11; Net foreign exchange loss, although with no cash effect, of R$501 million, due to the 19% appreciation of the U.S. dollar. Extraordinary Meeting of the Board of Directors approved a complete revision of Klabin S.A.s executive compensation system.

9M11 Highlights

Net revenue: R$2.9 billion, up 6% on 9M10; Net income: R$60 million, impacted by the foreign exchange variation in September; Net debt/EBITDA ratio increased from 2.2x in December 2010 to 2.4x in September 2011 due to the foreign exchange variation.

Investor relations Antonio Sergio Alfano Vinicius Campos Daniel Rosolen Lucia Reis +55 11 3046 8401 Conference call Portuguese Tuesday, 01/11/11 8am (EDT) Phone: +55 11 4688 -6331 Password: Klabin Replay: +55 11 46886312 Password: 659952 English Tuesday, 01/11/11 9am (EDT) Phone US: 1-888-700-0802 Password: Klabin Replay: +55 11 46886312 Password: 1131859

3Q11 Results October 31st, 2011

3Q11 Summary

Klabin, Brazils largest paper producer, exporter and recycler and the leader in the paper, coated boards for packaging, corrugated boxes, industrial bags and wood logs for sawmills and planer mills markets, closed 3Q11 with EBITDA of R$ 277 million, accompanied by EBITDA margin of 28%. EBITDA, which is earnings before interest, taxes, depreciation and amortization, was the highest recorded by the Company since 3Q04 (when the exchange rate was R$ 2.98/US$), and was 46% higher than in 2Q11, driven by an improved sales mix and reduced cash cost.

500 450 400 350 300 250 200 150 100 50

EBITDA and EBITDA margin

(R$ million)

28% 26% 277 20% 190 252

35% 30% 25% 20% 15% 10% 5% 0%

3Q11

2Q11

3Q10

Sales volume, excluding wood, reached 434 thousand tonnes in the third quarter, in line with the 436 thousand tonnes sold in the same period of 2010. Sales in 9M11 totaled 1,306 thousand tonnes, 1% more than in the same period in 2010. Domestic sales accounted for 71% in 3Q11, a 5 percentage point increase over the second quarter. Klabin ended 3Q11 with net revenue of R$ 991 million, up 1% on the same quarter of the prior year. Net revenue in 9M11 totaled R$ 2,985 million, 6% higher than in 9M10. The domestic market accounted for R$ 803 million and exports R$ 188 million (US$ 115 million) in the third quarter. In 9M11, net revenue from exports totaled R$ 639 million (US$ 391 million), up 4% from 9M10.

Paper sales volume

(excluding wood) 991

Net revenue

(R$ million)

947 205 983 204

(thousand tonnes)

434 EM 126 435 147 436 EM 128 803

188

DM

308

288

308

DM

742

779

3Q11

2Q11

3Q10

3Q11

2Q11

3Q10

At the close of September, Klabins financial investments(1) totaled R$ 3,030 million, corresponding approximately to over 3.3x of short-term gross debt. Net debt at the close of September was R$ 2,313 million, R$ 185 million higher than R$ 2,128 million at the close of December 2010, resulting from the foreign exchange variation. The net debt/EBITDA ratio rose from 2.2x on December 31st, 2010 to 2.4x on September 30th, 2011. Net income in the quarter was affected by the foreign exchange variation in September, in this regard, net income in 9M11 decreased to R$ 60 million. Klabins foreign exchange exposure is basically related to prepayment of long-term exports and hence export revenues more than compensate for future payables. The Extraordinary Meeting of the Board of Directors held on September 22nd, 2011 approved the payment of interim dividends amounting to R$ 55 million, to be paid at R$ 58.22 per lot of thousand common shares and R$ 64.04 per lot of thousand preferred shares. The Meeting also approved the complete revision of the Klabin S.A.s executive compensation system in order to modernize it, making it more closely pegged to results and better aligned with shareholder interests (see page 15).

(1) Includes cash and cash equivalents.

3Q11 Results October 31st, 2011

Markets and Exchange Rate

The economic crisis in Europe and the slowdown in global industrial production extended into the third quarter of 2011. Important Eurozone countries were affected by the Greek crisis and the health of their economies was brought into question. The Greek governments fiscal austerity program failed to produce the effects expected by the European Central Bank and did not stave off the risk of the country's moratorium. Global industrial production declined in 3Q11, mainly influenced by the negative results from the Eurozone countries, signaling a contraction of the world economy. Chinas industrial production slowed down moderately in the quarter, reducing previous estimates for the countrys GDP growth in 2011. The high unemployment levels and bleak outlook regarding the European crisis were reflected in the U.S. economy in 3Q11. In Brazil, foreign currency inflows remained strong during the first half of the quarter. However, this scenario changed at the beginning of September with the worsening of the crisis in Europe, resulting in a sharp rise of the U.S. dollar to the record levels of July 2009. The 50bps reduction in the Selic interest rate in August also helped push the dollar, making Brazilian capital markets less attractive to foreigners. Brazils industrial production followed the global trend and declined in the third quarter. Inflation indicators once again started moving up in 3Q11, for a total increase of 7.3% in the past 12 months. The dollar (sell, end of period), which closed at R$ 1.56/US$ on June 30th, 2011, appreciated 19% in the quarter to reach R$ 1.85/US$ on September 30th, 2011. Compared with December 31st, 2010, the dollar increase was 11%. Average exchange rate in 3Q11 was R$ 1.64/US$, 7% lower than in 3Q10, but 2% higher than in 2Q11. Between 9M10 and 9M11, average rate fell 8%.

3Q11 Average Rate End Rate

Source: Bacen

2Q11 1.60 1.56

3Q10 1.75 1.69

3Q11/2Q11

3Q11/3Q10

9M11 1.63 1.85

9M10 1.78 1.69

9M11/9M10

1.64 1.85

2% 19%

-7% 9%

-8% 9%

International kraftliner demand remained stable in the quarter, though international prices continued to drop. In Europe, according to data published by FOEX, the list price of kraftliner brown 175 g/m fell from 582/tonne in June to 573/tonne in September. In Brazil, kraftliner and scrap prices remained stable between July and September. The domestic paper market witnessed the typical seasonality and delivered results stronger than in the two first quarters of the year. According to the Brazilian Association of Pulp and Paper Producers (Bracelpa), Brazilian shipments of coated boards, excluding liquid packaging boards, in 3Q11 increased 9% from 2Q11 to 136 thousand tonnes, while decreasing 12% from 3Q10. The corrugated boxes market expanded in relation to 2Q11, influenced by the market seasonality. According to data from the Brazilian Corrugated Boxes Association (ABPO), Brazilian corrugated boxes shipments reached 828 thousand tonnes from July through September, for growth of 2% over the second quarter of the year. In 9M11, domestic demand for corrugated boxes remained stable, growing 1% over 9M10 to reach 2,397 thousand tonnes. Preliminary data from the National Cement Industry Trade Union (SNIC), which include bulk and bag cement, indicate that consolidated cement sales in 9M11 grew 8% over 9M10. With the aim of improving the sales mix and the margins, the Company remained selective in the sale of conversion products during the quarter.

3Q11 Results October 31st, 2011

Operating and Financial Performance

Sales volume

Sales volume, excluding wood, totaled 434 thousand tonnes in 3Q11. In 9M11, sales volume totaled 1,306 thousand tonnes, 1% up year-on-year. Domestic sales volume in 3Q11 came to 308 thousand tonnes, stable in relation to 3Q10 and up 7% (20 thousand tonnes) from 2Q11, led by the growth in paper (kraftliner and coated boards) sales, accompanied by the typical seasonality in the Brazilian market. In 9M11, domestic sales volume was 865 thousand tonnes, 2% lower than in 9M10. Export volume in 3Q11 came was 126 thousand tonnes, down 1% from 3Q10. In 9M11, exports came to 442 thousand tonnes, 5% higher than in 9M10.

Sales volume (excluding wood) (thousand tonnes) 1,306

34%

Sales volume by product 9M11

1,299

32%

Kraftliner 24%

Ind. Bags 8%

Others 2%

Coated Boards 37%

434

29% 71%

435

34% 66%

436

29% 71%

66%

68%

3Q11

2Q11

3Q10

9M11

9M10 Total

does not include wood

Corrugat. Boxes 29%

Domestic Market

Export Market

Net Revenue

Net revenue, including wood, came to R$ 991 million in 3Q11, up 1% from 3Q10 and 5% from 2Q11, driven by the higher share of domestic sales and the impact of the stronger dollar on export volumes in September. In 9M11, net revenue came to R$ 2,895 million, up 6% from 9M10.

Net revenue (R$ milliion) 2,895

22% 22%

Net Revenue by Product 9M11

2,732

Wood Others 1% 7% Ind bags 12% Coated Boards 34%

991

19% 81%

947

22% 78%

983

21% 79%

78%

78%

Kraftliner 14%

3Q11

2Q11

3Q10

9M11 Export Market

9M10

includes wood

Corrugat. Boxes 32%

Domestic Market Total

3Q11 Results October 31st, 2011

Domestic net revenue stood at R$ 803 million, 3% and 8% higher than in 3Q10 and 2Q11, respectively. The domestic markets share of total revenue was 81% in 3Q11, versus 78% in 2Q11. In 9M11, net revenue from domestic sales was R$ 2,257 million, 6% higher than in the same period of 2010. In 3Q11, exports totaled R$ 188 million (US$ 115 million), down 8% from 3Q10, due to the products mix and the exchange rate. In 9M11, net revenue from exports totaled R$639 million (US$ 391 million), up 4% from 9M10. Exports The seasonality of the Brazilian market increased the percentage of domestic paper sales in 3Q11. As a result, the Company directed a lower volume for exports than in the previous quarter. The share of domestic sales increased from 66% in 2Q11 to 71% in the quarter. The 17% appreciation of the dollar in September compared with late August reflected in higher real prices and partially offset the 14% drop in exports in 3Q11. As a result, export revenues in the quarter were 9% lower than in 2Q11. Klabins export revenues were lower in comparison with 3Q10 due to the 7% lower dollar on average between the periods. Latin America remains Klabin's key export market, accounting for 42% of the Company's sales volume and 41% of its net export revenue in 9M11, followed by Asia, which concentrates its exports of liquid packaging boards.

Sales Volume - 9M11 Net Revenue - 9M11

Africa 11%

North America 4%

Africa 9%

North Americ a 4%

Latin America 42% Europe 19%

Europe 19%

Latin America 41%

Asia 24%

Asia 26%

Operational Costs and Expenses

Unit cash cost in the quarter, including fixed and variable costs as well as operational expenses, stood at R$ 1,644/t, and was impacted by non-recurring expenses relating to cost-cutting measures, which included dismissals, by the maintenance stoppages in Correa Pinto (SC) in July and by the gain from the sale of land. Excluding non-recurring expenses and revenues as well as costs with maintenance stoppages, unit cash cost in 3Q11 came to R$ 1,612/t, down 2% and 1% from 3Q10 and 2Q11, respectively. Note that the effect of the reduced cash cost in the quarter was concentrated in September, reflecting the launch of cost-cutting measures being implemented by the Company. Cost of goods sold in 3Q11 was R$ 729 million, down 6% from 2Q11 and in 9M11 was R$ 2,214 million, up 3% on 9M10. Selling expenses in 3Q11 were R$ 77 million, remaining stable in relation to 3Q10 and 2Q11. Freight costs totaled R$ 47 million, up R$ 2 million on 2Q11, due to higher sales directed to northeast Brazil

3Q11 Results October 31st, 2011

with the onset of the fruit harvest season in August. In 9M11, selling expenses were R$ 239 million, up 7% from 9M10. General and administrative expenses totaled R$ 64 million in the quarter, up 12% and 13% on 3Q10 and 2Q11, respectively. The increase was due to higher spending on labor, third-party services relating to the Companys reorganization processes and dismissals. In 9M11, general and administrative expenses amounted to R$ 176 million, up 11% from 9M10, also impacted by the collective bargaining agreement. Other operating revenue (expenses) was revenue of R$ 7 million in 3Q11, compared to an expense of R$ 1 million in 3Q10, impacted by the gain of R$ 8 million from the sale of land in Mato Grosso do Sul. In 9M11, other operating revenue (expenses) was an expense of R$ 11 million, compared to revenue of R$ 3 million in 9M10.

Effect of variations in the fair value of biological assets

The effect of variation in the fair value of biological assets was a positive R$ 19 million in 3Q11, quite lower than in 3Q10 and 2Q11, due to stable wood prices and lower contingent of forests that was recognized at fair value than in previous periods. In 9M11, this effect came to R$ 272 million, down 10% from 9M10. The effect of the depletion of the fair value of biological assets on cost of goods sold was R$ 80 million in the quarter, down 25% and 13% from 3Q10 and 2Q11, respectively. In 9M11, the effect from depletion was R$ 257 million, down 24% from 9M10. As a result, the effect of the fair value of biological assets on the operating result (EBIT) was a loss of R$ 61 million in 3Q11, compared to gains of R$ 53 million and R$17 million in 2Q11 and 3Q10, respectively.

Operating Income

Operating income before financial result (EBIT) was R$ 147 million in 3Q11, down 28% and 17% from 3Q10 and 2Q11, respectively, affected by the effect of the variation in the fair value of biological asset, as mentioned earlier. In 9M11, EBIT was R$ 527 million, increasing by 4% from 9M10.

Operating cash flow (EBITDA)

Operating cash flow (EBITDA) was R$ 277 million in the third quarter, increasing by 10% and 46% from 3Q10 and 2Q11, respectively. EBITDA margin stood at 28% in 3Q11, compared with 26% in 2Q10 and 20% in 2Q11. In 9M11, EBITDA totaled R$ 717 million, with margin of 25%, versus R$ 730 million in 2010, with margin of 27%. EBITDA in the quarter was the highest since the third quarter of 2004, when the exchange rate was R$ 2.98/US$, and the growth was main driven by the higher share of domestic sales and the reduction in costs. Exports were also positively impacted by the appreciation of the dollar in September.

EBITDA Composition R$ million Operational result (after financial result) (+) Financial result (+) Depreciation, amortization, depletion (-) Biological assets adjust EBITDA EBITDA Margin

N / A - Not applicable

3Q11 (371) 517 150 (19) 277 28%

2Q11 246 (69) 159 (145) 190 20%

3Q10 347 (144) 173 (124) 252 26%

3Q11/2Q11 3Q11/3Q10

9M11 113 414 462 (272) 717 25%

9M10 524 (18) 525 (301) 730 27%

9M11/9M10

N/A N/A -6% -87% 46% 8 p.p.

N/A N/A -13% -85% 10% 2 p.p.

-78% N/A -12% -10% -2% -2 p.p.

3Q11 Results October 31st, 2011

Indebtedness and financial investments

Gross debt stood at R$ 5,343 million on September 30th, 2011, compared with R$ 4,857 million on December 31st, 2010, of which R$ 3,487 million (US$ 1,880 million), or 65%, was denominated in foreign currency (primarily export pre-payment facilities). At the close of September, cash totaled R$ 3,030 million, corresponding to approximately 3.3x the volume of short-term gross debt. Net debt stood at R$ 2,313 million at the end of September, R$ 185 million higher than the net debt of R$ 2,128 million recorded in December 2010, impacted by the foreign exchange variation. The Net Debt/EBITDA ratio, which stood at 2.2x on December 31st, 2010, ended September 2011 at 2.4x. Considering that a substantial portion of its net foreign exchange exposure of US$ 1,745 million consists of export pre-payment facilities with average maturity of more than 4 years, the Company will benefit from the depreciation in the real with its exports before the payment of its debt. Therefore, the effect of the reals depreciation in the results at the end of September had an exclusively accounting impact and does not represent actual loss.

Net Debt / EBITDA (R$ million)

6.0 5.5 5.0 4.4 4,500 4.5 3.7 3.6 4.0 3.1 3.5 3,500 2.8 3.0 2.4 2.2 2.2 2.1 2.5 2.0 2,500 2.0 1.5 1.0 1,500 0.5 0.0 -0.5 500 -1.0 -1.5 (500) Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 -2.0 5,500

3,192

2,886

2,676

2,528

2,462

2,106

2,128

2,002

Net Debt (R$ million)

Net Debt / EBITDA (LTM)

The average debt term stood at 43 months, or 30 months for debt denominated in local currency and 50 months for debt denominated in foreign currency. At end-September, short-term debt accounted for 17% of total debt. The average borrowing cost stood at 8.7% p.a. in local currency and 3.8% p.a. in foreign currency.

Debt (R$ million) Short term

Local currency Foreign currency

09/30/11 930

522 408

1,893

12/31/10 842

496 346

17% 10% 8% 83% 25% 58% 100% 35% 65%

2,313

17% 10% 7% 83% 31% 52% 100% 41% 59%

Long term

Local currency Foreign currency

4,413

1,334 3,079

4,015

1,506 2,509

Gross debt

Local currency total Foreign currency total

5,343

1,856 3,487

4,857

2,002 2,855

(-) Cash Net debt Net debt / EBITDA

3,030 2,313 2,4 x

2,729 2,128 2,2 x

3Q11 Results October 31st, 2011

Financial Result

Financial expenses in totaled R$ 106 million in 3Q11, 43% higher than in 3Q10, due to the increase in gross debt denominated in foreign currency and the monetary variation on the part of BNDES financing in the currency basket. Financial revenues totaled R$ 89 million in the quarter, 35% more than in the same period the year earlier, due to the raise in the Selic rate in July and August, and the higher volume of investments. The effect of net foreign exchange variations was R$ 501 million and mainly reflected the appreciation of the dollar on the Companys debt. This effect is purely accounting in nature and does not involve any cash disbursement. The financial result in 3Q11 was a loss of R$ 517 million, due to the foreign exchange variation, versus a net financial gain of R$ 144 million in 3Q10. In 9M11, the financial result was negative at R$ 414 million, due to financial revenues of R$ 242 million, which was more than offset by financial expenses of R$ 316 million and negative net foreign exchange variations of R$ 340 million, due to the 9% appreciation of the dollar.

Net Income

The net result in 3Q11 was loss of R$ 243 million, impacted by the devaluation of the real in September, whose effect was negative in R$ 331 million, compared to net income of R$ 226 million in 3Q10 and R$ 163 million in 2Q11. Net income in 9M11 was R$ 60 million.

Business Performance

Consolidated information by operational segment in 9M11

R$ million Net revenue

Domestic market Exports 213 825 575 1,219 63 2,257 638

Forestry

Papers

Conversion

Consolidation adjustments

Total

Third part revenue

Segments revenue

213

352

1,400

641

1,282

10

(1,003)

2,895

-

Total net revenue

Change in fair value - biological assets Cost of goods sold

565

272 (632)

2,041

(1,559)

1,292

(1,030)

(1,003)

1,008

2,895

272 (2,213)

Gross income

Operating expenses

205

(40)

482

(223)

262

(144)

5

(20)

954

(427)

Operating results before financial results

165

259

118

(15)

527

Note: The figures in the table for total net sales include sales of other products.

3Q11 Results October 31st, 2011 BUSINESS UNIT FORESTRY

The volume of wood sales to third parties in 3Q11 increased 3% over 2Q11 to 688 thousand tonnes. The wood market in Brazil has been shrinking during 2011. In addition, the heavy rains in Santa Catarina state have affected Klabins harvest. In 9M11, wood sales totaled 2,091 thousand tonnes, 11% lower than in the same period last year. Net revenue from log sales to third parties in 3Q11 was R$ 69 million, 8% higher than in 2Q11. Benefiting from an improved product mix, the Company focused its efforts on sales of higher value added products. In 9M11, net revenue reached R$ 201 million, up 4% on 9M10.

Sales volume (thousand tonnes) Net revenue (R$ million)

2,352 2,091

201

194

688

666

817

69

64

72

3Q11

2Q11

3Q10

9M11

9M10

3Q11

2Q11

3Q10

9M11

9M10

At the close of September, own and third-party planted areas totaled 211 thousand hectares, of which 129 thousand hectares were planted with pine and 82 thousand hectares with eucalyptus trees. In addition to its planted areas, Klabin has 190 thousand hectares of permanent preservation and legal reserve areas.

BUSINESS UNIT PAPER

Paper and coated boards sales (kraftliner, white top liner, testliner, sack kraft, folding box board, carrier board and liquid packaging board) to third parties totaled 261 thousand tonnes in 3Q11 and 802 thousand tonnes in 9M11, up 3% on 9M10. In 9M11, domestic sales totaled 380 thousand tonnes, while exports totaled 422 thousand tonnes. Compared with 9M10, domestic sales remained stable while exports grew 6%. Net revenue from paper and board was R$ 460 million in 3Q10, 2% higher year on year, and R$ 1,371 million in 9M11, 7% more than in 9M10.

Kraftliner

Kraftliner sales in 3Q11 came to 100 thousand tonnes, 18% higher than in 3Q10. Sales in 9M11 totaled 314 thousand tonnes, 13% higher than in 9M10. The sales growth is related to the greater operational stability of the plant in Monte Alegre. Domestic sales totaled 44 thousand tonnes in 3Q11 and accounted for 44% of total kraftliner sales. In 9M11, domestic kraftliner sales totaled 115 thousand tonnes, 2 thousand tonnes lower than in 9M10 when there was a buildup of inventories. Exports totaled 56 thousand tonnes in 3Q11 and 200 thousand tonnes in 9M11. The growth in exports in relation to 9M10 was 38 thousand tonnes (23%).

3Q11 Results October 31st, 2011

Net revenue from kraftliner sales came to R$ 132 million in 3Q11, up 8% and 4% on 3Q10 and 2Q11, respectively, reflecting the better sales mix and the average appreciation in the U.S. dollar in the period. In 9M11, net revenue from kraftliner sales was R$ 399 million, up 17% from 9M10.

Sales volume (thousand tonnes) 314 279 Net revenue (R$ million) 399 343

64% 58%

100

56% 44%

104

73% 37%

85

48% 52% 36% 42%

132

127

122

3Q11

2Q11

3Q10

9M11 Export Market

9M10

3Q11

2Q11

3Q10

9M11

9M10

Domestic Market

According to data from FOEX, the average list price in euros of kraftliner brown 175g/m in Europe fell 2% during the third quarter to an average of 577/tonne. The list price in real averaged R$ 1,332/tonne in 3Q11, 1% lower than in 2Q11, but 10% higher than in 3Q10.

Kraftliner Brown 175 g/m list price (/tonne and R$/tonne)

1,459 1,217

1,392 1,162 1,029 1,038 1,207 1,079 1,089

1,364

1,373

1,352

1,332

487

486

462

411

385

404

433

478

533

592

602

588

577

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

Quarter average

Source: FOEX and BAC EN

Kraftliner ( / tonne)

Kraftliner (R$ / tonne)

Coated boards

Coated boards sales volume in 3Q11 was 161 thousand tonnes, down 6% from 3Q10 and up 1% against 2Q11. Although data disclosed by Bracelpa indicate lower demand in Brazil in relation to 3Q10, Klabins domestic sales grew 5%, driven mainly by the greater diversification of the coated boards line. Sales volume in 9M11 totaled 266 thousand tonnes, up 1% from 9M10. Coated boards exports totaled 63 thousand tonnes in 3Q11, down 19% and 15% from 3Q10 and 2Q11, respectively, due to the efforts to achieve better sales mix. Net revenue from coated boards sales amounted to R$ 972 million in 9M11, up 3% from 9M10.

10

10

3Q11 Results October 31st, 2011

Sales volume (thousand tonnes) 488 499

Net revenue (R$ million)

972

46% 47%

941

161

39% 61%

159

47% 53%

171

46% 54% 54% 53%

328

312

330

3Q11

2Q11

3Q10

9M11 Export Market

9M10

3Q11

2Q11

3Q10

9M11

9M10

Domestic Market

According to Bracelpa data, domestic sales of coated boards, excluding liquid packaging board, totaled 136 thousand tonnes in 3Q11. Though sales were lower than in the previous year, domestic demand in the quarter increased 9% over 2Q11, accompanying the seasonality typical of this market. Domestic coated boards sales in 9M11 totaled 381 thousand tonnes, 12% lower than in 9M10.

BUSINESS UNIT - CONVERSION

Sales of conversion products (corrugated boxes and industrial bags) totaled 163 thousand tonnes in 3Q11 and 480 thousand tonnes in 9M11, down 3% year over year. Net revenue from conversion products totaled R$ 446 million in 3Q11. In 9M11, net revenue was R$ 1,278 million, up 6% from 9M10.

Corrugated boxes

Sales of corrugated boxes reached 130 thousand tonnes in 3Q11, 2% lower than in 3Q10, but 1% higher than in 2Q11. Sales in 9M11 came to 379 thousand tonnes, down 2% from 9M10, mainly due to the increase in selectiveness by the Companys in pursuit of higher margins in this segment. Net revenue in 3Q11 totaled R$ 323 million, growing by 3% and 5% from 3Q10 and 2Q11, respectively. In 9M11, net revenue came to R$ 919 million, up 8% from 9M10.

Sales Volume (thousand tonnes)

Net revenue (R$ million)

379

386

919

853

130

129

132

323

308

314

3Q11

2Q11

3Q10

9M11

9M10

3Q11

2Q11

3Q10

9M11

9M10

11

11

3Q11 Results October 31st, 2011

According to the Brazilian Corrugated Boxes Association (ABPO), corrugated boxes and board shipments totaled 828 thousand tonnes in 3Q11, 3% and 2% higher than in 3Q10 and 2Q11, respectively. In 9M11, shipments of these totaled 2,397 thousand tonnes, up 1% from 9M10.

Brazilian Corrugated Shipments thousand tonnes

271 249 232 212 232 265 251 249 268 266 253 270 276

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

Quarter average

Source: Brazilian C orrugated Boxes Association

Monthly volume

Note: In June 2011, ABPO revised its figures for corrugated box shipments disclosed previously.

Industrial Bags

Sales volume of industrial bags for the plants in Brazil and Argentina, in the domestic and export markets, totaled 34 thousand tonnes in 3Q11, down 11% and 1% from 3Q10 and 2Q11, respectively. Industrial bag sales in 9M10 totaled 101 thousand tonnes, 6% lower than in 9M10. To optimize its sales mix and focus on markets with higher margins, the Company continued to use selective sales practices in the industrial bags in the quarter.

Net revenue (R$ million) 108 359 356

Sales volume (thousand tonnes)

101

34

34

38

123

121

128

3Q11

2Q11

3Q10

9M11

9M10

3Q11

2Q11

3Q10

9M11

9M10

Net revenue came to R$ 123 million in the quarter, down 4% from 3Q10 and up 2% from 2Q11. Net revenue in 9M11 was R$ 359 million, 1% more than in 9M10. Preliminary data from the National Cement Industry Trade Union (SNIC), which include bulk and bag cement, indicate that cement sales in 9M11 grew 8% over 9M10.

12

12

3Q11 Results October 31st, 2011

Brazilian cement consumption million tons

5.4 4.7 4.3 4.6 3.9 4.1 4.4 4.6 4.8 5.2 4.9 5.2 5.6

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

Quarter average

Source: Nation Labor Union of C ement Industry

Monthly consumption

Capital Expenditure

The following table presents a breakdown by Unit of the investments made in the quarter:

R$ million Forestry Papers Conversion Others Total 3Q11 31 43 20 2 96 93 2Q11 30 51 12 3Q10 31 68 11 109 9M11 98 167 36 3 305 9M10 84 129 34 1 248

Investments came to R$ 96 million in the quarter, which were allocated mainly to: The new biomass boiler at the plant in Correia Pinto, Santa Catarina, which is expected to start operations in early 2Q12. Construction works is already concluded and equipment installation started. The new transmission line in Monte Alegre, Paran, which is expected to start operations in 4Q11. The debottlenecking of the evaporation system at the Otaclio Costa mill in Santa Catarina with the objective of reducing steam consumption, also expected to start operations in 4Q11. Installation of a fiber fragmentation system to improve quality in the production of sack kraft paper in the Correia Pinto unit, in Santa Catarina state, with start-up scheduled for 2012. Expansion of the whitening capacity at the Monte Alegre unit in Paran, with improvements in causticizing, evaporation and in the lumber yard to reduce variable costs. Start-up is scheduled for the second half of 2012. Installation of two new corrugators at the corrugated boxes units in Goiana, Pernambuco, and in Jundia, So Paulo. Installation of a new complete valve bag production line at the plant in Lages, Santa Catarina.

13

13

3Q11 Results October 31st, 2011

Capital Markets

Stock Performance

September 30 , 2011 Preferred shares Share price (KLBN4) Book value Average daily trading volume 3Q11 Market capitalization 600.9 million R$ 5.20 R$ 5.27 R$ 12 million R$ 4.6 billion

th

In the first three months of 2011, Klabin preferred stock (KLBN4) accumulated a loss of 10%, while the IBOVESPA fell 16%. In the last 12 months, Klabin preferred stock (KLBN4) gained 11%, while the IBOVESPA lost 25%.

Performance KLBN4 x Brazilian Index (Ibovespa)

111 100 75

Mar11

Nov10

Apr11

Jan11

May11

Dec10

Sep10

Jun11

Jul11

Klabin

Ibovespa Index

Klabin stock was traded in all sessions on the BM&FBOVESPA in 3Q11, registering 298 thousand trades that involved 121 million shares, for average daily trading volume of R$ 12 million, which was 9% higher than in 3Q10 and 16% lower than in 2Q11.

Average Daily Volume (R$ million/day)

22 17 14 9 10 12 9 9 8 9 10 8 7 12 15 14 14 13 12 17

16 12 13 11 14

Jun10

Aug10

Jun11

Apr10

Apr11

Sep11

Aug11

Oct10

Feb11

May10

May11

Aug11

Jul10

Jan10

Mar10

Jan11

Sep09

Sep10

Mar11

Dec09

Dec10

Jul11

14

Sep11

Feb10

Nov09

Nov10

Feb11

Oct09

Oct10

14

3Q11 Results October 31st, 2011

Klabin stock also trades on the U.S. market. Klabin stock also trades in the U.S. market through Level I ADRs, which are listed on the over-the-counter market under the ticker KLBAY. Klabin's capital stock is represented by 918 million shares, composed of 317 million common shares and 601 million preferred shares. On September 30, 2011, the Company held 30 million preferred shares in treasury.

Dividends

The Extraordinary Board of Directors Meeting held on September 22nd, 2011 approved the payment of interim dividends in the amount of R$ 55 million, which were paid as of October 11th, 2011, corresponding to R$ 58.22 per lot of thousand common shares and R$ 64.04 per lot of thousand preferred shares. As of the disclosure date of this release, R$ 207 million had already been paid as dividends in 2011.

Acquisition of shares

Between August 5th and 10, 2011, the Company acquired 2,803,200 preferred shares, totaling R$ 13.1 million. Since then, the Company has held 30,000,000 own preferred shares in treasury. The extraordinary Board of Directors Meeting held on October 13th, 2011, approved the buyback of up to 41,954,318 preferred shares (corresponding to 10% of this class of shares outstanding on said date) during a period of 365 days, to be held in treasury and subsequently sold or cancelled, with no capital reduction.

Executive variable compensation

The extraordinary Board of Directors Meeting held on September 22nd, 2011 approved the complete revision of Klabin S.A.s executive compensation system in order to modernize it, making it more closely pegged to results and better aligned with shareholder interests. The decision came into effect for the year 2011. The new variable compensation system is subject to tough performance targets and now has greater weight on total executive compensation. A system of matching was created whereby a part of the compensation may be allocated to buy the Companys stock and the Company will provide a benefit of equal amount, conditioned on a lock up period of 3 years. The plan is currently being analyzed by the Securities and Exchange of Brazil for approval.

15

15

3Q11 Results October 31st, 2011

Conference Call

Portuguese Tuesday, November 1st, 2011 at 10:00 a.m. (Braslia) Code: Klabin Dial-in: (11) 4688-6331 Replay: +55 (11) 46886312 Code: 5659952 English Tuesday, November 1st, 2011 9:00 a.m. (EDT) Code: Klabin Dial-in: U.S. participants: 1-888-700-0802 International participants: 1-786-924-6977 Brazilian participants: (55 11) 4688-6331 Replay: +55 (11) 46886312 Code: 1131859 Webcast An audio webcast of the conference call will also be available. The conference call will also be broadcast over the internet. Access: www.ccall.com.br/klabin

With gross revenue of R$4.4 billion in 2010, Klabin is the largest integrated producer, exporter and recycler of packaging paper in Brazil, with annual production capacity of 1.9 million tonnes. Klabin has adopted a strategic focus on the following businesses: paper and coated board for packaging, corrugated boxes, industrial bags and wood logs. Klabin is the leader in all its market segments.

The statements made in this earnings release concerning the Company's business prospects, projected operating and financial results and potential growth are merely projections and were based on Management's expectations regarding the Company's future. These expectations are highly susceptible to changes in the market, in the general economic performance of the Brazilian economy, in the industry and in international markets, and therefore are subject to change.

16

16

3Q11 Results October 31st, 2011

Appendix 1 Consolidated Income Statement (Thousand R$)

3Q11

Gross Revenue Net Revenue Change in fair value - biological assets Cost of Products Sold Gross Profit Selling Expenses General & Administrative Expenses Other Revenues (Expenses) Total Operating Expenses Operating Income (before Fin. Results) Financial Expenses Financial Revenues Net Foreign Exchange Losses Net Financial Revenues Net Income before Taxes Income Tax and Soc. Contrib. Net income (loss) from continuing operations . Owners of the Company . Noncontrolling interests Depreciation and amortization Change in fair value of biological assets EBITDA 1,199,418 990,623 19,255 (729,482) 280,396 (76,594) (64,311) 7,359 (133,546) 146,850 (105,533) 89,135 (500,955) (517,353) (370,503) 134,487 (236,016) (243,055) 7,039 149,811 (19,255) 277,406

2Q11

1,145,202 947,447 145,084 (772,704) 319,827 (76,652) (56,715) (9,603) (142,970) 176,857 (116,888) 84,090 102,273 69,475 246,332 (76,956) 169,376 163,143 6,233 158,630 (145,084) 190,403

3Q10

1,187,347 982,593 124,461 (767,347) 339,707 (77,427) (57,494) (1,490) (136,411) 203,296 (73,666) 66,203 151,385 143,922 347,218 (115,664) 231,554 225,706 5,848 173,271 (124,461) 252,106

9M11

3,489,050 2,895,075 272,146 (2,213,520) 953,701 (238,996) (176,367) (11,368) (426,731) 526,970 (316,344) 241,978 (339,954) (414,320) 112,650 (30,311) 82,339 60,290 22,049 462,335 (272,146) 717,159

9M10

3,305,865 2,732,377 301,013 (2,149,524) 883,866 (222,718) (158,334) 3,235 (377,817) 506,049 (231,591) 167,416 81,786 17,611 523,660 (175,767) 347,893 334,634 13,259 525,337 (301,013) 730,373

% of Net Revenue

3Q11 2Q11 3Q10 9M11

100.0%

100.0%

100.0%

100.0%

73.6% 28.3% 7.7% 6.5% 0.7% 13.5% 14.8% 10.7% 9.0% 50.6% 52.2% 37.4% 13.6% 23.8% 24.5% 0.7% 15.1%

81.6% 33.8% 8.1% 6.0% 1.0% 15.1% 18.7% 12.3% 8.9% 10.8% 7.3% 26.0% 8.1% 17.9% 17.2% 0.7% 16.7%

78.1% 34.6% 7.9% 5.9% 0.2% 13.9% 20.7% 7.5% 6.7% 15.4% 14.6% 35.3% 11.8% 23.6% 23.0% 0.6% 17.6%

76.5% 32.9% 8.3% 6.1% 0.4% 14.7% 18.2% 10.9% 8.4% 11.7% 14.3% 3.9% 1.0% 2.8% 2.1% 0.8% 16.0%

28.0%

20.1%

25.7%

24.8%

17

17

3Q11 Results October 31st, 2011

Appendix 2 Consolidated Balance Sheet (Thousand R$)

Assets

Current Assets Cash and banks Short-term investments Securities Receivables Inventories Recoverble taxes and contributions Other receivables

Sep-11

4,477,746 72,284 2,742,413 215,486 781,517 495,520 137,054 33,472

Dec-10

4,127,147 39,880 2,491,225 198,222 753,961 460,128 131,102 52,629

Liabilities and StockholdersEquity

Current Liabilities Loans and financing Suppliers Income tax and social contribution Taxes payable Salaries and payroll charges Dividends to pay Dividends to pay - minority Proviso REFIS Other accounts payable Noncurrent Liabilities Loans and financing Imp Renda e C.social diferidos

Sep-11

1,938,569 929,709 234,335 76,729 50,529 101,324 55,003.00

Dec-10

1,690,913 842,121 269,839 37,013 40,669 93,542 2,584

431,700 59,240 5,714,699 4,413,882 1,136,755 164,062 4,836,228 1,500,000 84,491 50,871 2,256,941 1,085,401 (141,476) 193,845 12,683,341

349,340 55,805 5,415,828 4,014,976 1,235,635 165,217 4,994,085 1,500,000 84,491 51,404 2,365,900 1,120,643 (128,353) 160,417 12,261,243

Noncurrent Assets Long term Taxes to compensate Judicial Deposits Other receivables Investments Property, plant & equipment, net Ativos biolgicos Intangible assets

8,205,595 134,772 102,330 155,034 11,542 4,993,181 2,801,374 7,362

8,134,096 131,621 90,698 125,678 11,542 5,004,023 2,762,879 7,655

Other accounts payable StockholdersEquity Capital Capital reserves Revaluation reserve Profit reserve Valuation adjustments to shareholders'equity Treasury stock Minority Interests

Total

12,683,341

12,261,243

Total

18

18

3Q11 Results October 31st, 2011

Appendix 3 Loan Maturity Schedule September 30th, 2011

R$ million BNDES Others Local Currency Trade Finance Fixed Assets Others Foreign Currency Gross Debt 4Q11 244 12 256 122 3 11 136 392 2012 336 17 353 451 9 45 505 858 2013 311 18 329 512 9 70 591 920 2014 304 21 325 375 7 70 453 778 2015 338 31 369 292 7 68 367 737 2016 65 25 90 114 4 132 251 340 2017 31 12 43 185 5 190 233 2018 41 12 53 222 8 230 283 2019 22 8 29 317 5 46 367 397

After 2020

Total 1,694 162 1,856 2,898 58 531 3,487 5,343

3 6 9 309 1 88 397 406

Average Cost Local Currency Foreign Currency Gross Debt 8.7 % p.y. 3.8 % p.y.

Average Tenor 30 months 50 months 43 months

R$ Million 920 858 778 737 Foreign Currency 3,487

453 367

505

591

392 340

136

397 283 233

353 369 251 190 90 43

2017

406

Gross Debt 5,343 Local Currency 1,856

367 230

397

256

329

325

53

2018

29

2019

9

After 2020

4Q11

2012

2013

2014

2015

2016

Local Currency

Foreign Currency

19

19

3Q11 Results October 31st, 2011

Appendix 4 Consolidated Cash Flow (Thousand R$)

3Q11

Cash flow from operating activities Operating activities . Net income - controlling shareholders . Net income - noncontrolling interests . Depreciation and amortization . Depletion in biological assets . Change in fair value - biolgical assets . Fixed assets costs result . Deferred income taxes and social contribution . Income taxes and social contribution . Interest and exchange variation on loans and financing . REFIS Reserve . Interest Payment . Others Variations in Assets and Liabilities . Receivables . Inventories . Recoverable taxes . Marketable Securities . Prepaid expenses . Other receivables . Suppliers . Taxes and payable . Salaries, vacation and payroll charges . Other payables Net Cash Investing Activities . Purchase of property, plant and equipment . Purchase of biological assets . Sale of property, plant and equipment . Others Net Cash Financing Activities . New loans and financing . Amortization of financing . Payment of capital at subsidiaries by minority shareholders . Acquisition of minority shares in subsidiaries . Dividends Paid . Stocks repurchase Increase (Decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 241,901 257,986 (243,055) 7,039 59,567 90,244 (19,255) (11,115) (183,514) (2,230) 621,727 12,758 (64,745) (9,435) (16,085) (20,332) (489) (14,047) (6,306) 7,191 (2,133) (39,336) 47,106 13,271 (1,010) (16,430) (38,369) (27,644) 49,583 107,176 363,055 (160,422) 350 (686) (81,998) (13,123) 332,647 2,482,050 2,814,697

9M11

543,967 533,160 60,290 22,049 175,887 286,448 (272,146) (11,116) (105,193) (84,780) 562,529 86,806 (192,455) 4,841 10,807 (29,378) (2,907) 91,904 (17,264) 13,191 (35,022) (65,408) 49,576 7,782 (1,667) (223,051) (186,430) (88,403) 51,782 (37,324) 577,453 (461,033) 13,002 (1,623) (152,000) (13,123) 283,592 2,531,105 2,814,697

3Q10

273,058 176,884 225,706 5,848 57,736 113,901 (124,460) 2,645 80,879 (12,228) (112,816) 7,802 (64,608) (3,521) 96,174 (42,310) (17,065) 52,584 (4,929) 9,120 (10,933) 18,257 58,843 21,601 11,006 (104,865) (74,592) (30,273)

9M10

724,446 527,202 334,634 13,259 165,359 358,346 (301,012) 2,751 97,828 (22,485) 92,633 13,161 (219,881) (7,391) 197,244 (137,413) (15,046) 163,716 16,612 7,772 (8,930) 79,186 99,636 25,368 (33,657) (247,725) (169,296) (76,049) (3,013) 633 219,662 759,162 (509,585) 80,261 (2,436) (107,740) 696,383 1,841,652 2,538,035

188,043 300,524 (118,389) 58,510 (1,864) (50,738) 356,236 2,181,799 2,538,035

20

Вам также может понравиться

- VC Framework Evaluating Start Ups KaplanДокумент60 страницVC Framework Evaluating Start Ups Kaplanerigonatti9102100% (1)

- Laughing at Wall Street How I Beat The Pros at Investing (By Reading Tabloids, Shopping at The Mall, and Connecting On Facebook) and How You Can, TooДокумент10 страницLaughing at Wall Street How I Beat The Pros at Investing (By Reading Tabloids, Shopping at The Mall, and Connecting On Facebook) and How You Can, TooMacmillan Publishers0% (2)

- 57984c89bf389 (BPI CAP) Account Opening Form and Client Agreement 04-06-2016Документ15 страниц57984c89bf389 (BPI CAP) Account Opening Form and Client Agreement 04-06-2016Nancy Hernandez- TurlaОценок пока нет

- A Study On Commodity DerivativeДокумент22 страницыA Study On Commodity DerivativeCm Chugh100% (1)

- Ultimate Candlestick Reversal PatternДокумент19 страницUltimate Candlestick Reversal PatternWang Qiang80% (10)

- Klabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Документ20 страницKlabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Klabin_RIОценок пока нет

- EBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Документ18 страницEBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Klabin_RIОценок пока нет

- EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryДокумент21 страницаEBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryKlabin_RIОценок пока нет

- Release 3Q12Документ17 страницRelease 3Q12Klabin_RIОценок пока нет

- 2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineДокумент19 страниц2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineKlabin_RIОценок пока нет

- Relatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseДокумент17 страницRelatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseKlabin_RIОценок пока нет

- Release 3Q13Документ16 страницRelease 3Q13Klabin_RIОценок пока нет

- Quarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginДокумент18 страницQuarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginKlabin_RIОценок пока нет

- Release 4Q12Документ18 страницRelease 4Q12Klabin_RIОценок пока нет

- Quarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Документ16 страницQuarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Klabin_RIОценок пока нет

- 1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Документ18 страниц1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Klabin_RIОценок пока нет

- Ebitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Документ17 страницEbitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Klabin_RIОценок пока нет

- Quarterly Release: Start Up of Paper Machine # 9Документ19 страницQuarterly Release: Start Up of Paper Machine # 9Klabin_RIОценок пока нет

- Release 2Q15Документ17 страницRelease 2Q15Klabin_RIОценок пока нет

- Cash Generation Grows by 12% in The Third Quarter: July/September 2001Документ13 страницCash Generation Grows by 12% in The Third Quarter: July/September 2001Klabin_RIОценок пока нет

- Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionДокумент15 страницQuarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionKlabin_RIОценок пока нет

- 4Q09 Quarterly Report: Record Coated Board Sales in 2009Документ19 страниц4Q09 Quarterly Report: Record Coated Board Sales in 2009Klabin_RIОценок пока нет

- First Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Документ10 страницFirst Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Klabin_RIОценок пока нет

- Klabin Reports A Net Profit of R$ 366 Million Up To September 2004Документ16 страницKlabin Reports A Net Profit of R$ 366 Million Up To September 2004Klabin_RIОценок пока нет

- iKRelease2005 2qДокумент16 страницiKRelease2005 2qKlabin_RIОценок пока нет

- Quarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioДокумент18 страницQuarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioKlabin_RIОценок пока нет

- Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateДокумент15 страницQuarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateKlabin_RIОценок пока нет

- Klabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsДокумент10 страницKlabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsKlabin_RIОценок пока нет

- Release 1Q15Документ17 страницRelease 1Q15Klabin_RIОценок пока нет

- Klabin Webcast 3 Q11 INGДокумент8 страницKlabin Webcast 3 Q11 INGKlabin_RIОценок пока нет

- Cash Generation Reaches R$ 613 Million in 2002: July/September 2002Документ15 страницCash Generation Reaches R$ 613 Million in 2002: July/September 2002Klabin_RIОценок пока нет

- Quarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginДокумент19 страницQuarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginKlabin_RIОценок пока нет

- 3q2009release BRGAAP InglesnaДокумент24 страницы3q2009release BRGAAP InglesnaFibriaRIОценок пока нет

- IIFA Country Reports 2010Документ271 страницаIIFA Country Reports 2010alper55kОценок пока нет

- Klabin Reports A Net Profit of R$ 940 Million Up To September 2003Документ16 страницKlabin Reports A Net Profit of R$ 940 Million Up To September 2003Klabin_RIОценок пока нет

- Sound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Документ18 страницSound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Klabin_RIОценок пока нет

- Release 3Q15Документ17 страницRelease 3Q15Klabin_RIОценок пока нет

- iKRelease2005 1qДокумент16 страницiKRelease2005 1qKlabin_RIОценок пока нет

- Cash Generation Exceeds R$ 181 Million: January/March 2002Документ10 страницCash Generation Exceeds R$ 181 Million: January/March 2002Klabin_RIОценок пока нет

- Signet Reports Third Quarter Profit: WWW - Hsamuel.co - Uk WWW - Ernestjones.co - UkДокумент25 страницSignet Reports Third Quarter Profit: WWW - Hsamuel.co - Uk WWW - Ernestjones.co - Ukpatburchall6278Оценок пока нет

- PR Fibria 2T11 v7 EngfinalДокумент21 страницаPR Fibria 2T11 v7 EngfinalFibriaRIОценок пока нет

- Asian Weekly Debt Highlights - September 05, 2011Документ12 страницAsian Weekly Debt Highlights - September 05, 2011rryan123123Оценок пока нет

- Klabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Документ15 страницKlabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Klabin_RIОценок пока нет

- Klabin Webcast 20092 Q09Документ10 страницKlabin Webcast 20092 Q09Klabin_RIОценок пока нет

- Quarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Документ17 страницQuarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Klabin_RIОценок пока нет

- CapitalДокумент19 страницCapitalshaileshbhoiОценок пока нет

- Klabin Reports Gross Revenues of US$ 1.1 Billion in 2004: Oct / Nov / Dec 2004Документ19 страницKlabin Reports Gross Revenues of US$ 1.1 Billion in 2004: Oct / Nov / Dec 2004Klabin_RIОценок пока нет

- iKRelease2000 1qДокумент6 страницiKRelease2000 1qKlabin_RIОценок пока нет

- 9m11 PPT FinalДокумент29 страниц9m11 PPT FinalMarcelo FrancoОценок пока нет

- Klabin S.A.: Anagement EportДокумент9 страницKlabin S.A.: Anagement EportKlabin_RIОценок пока нет

- Bank of Kigali Announces Q2 2011 & 1H 2011 ResultsДокумент9 страницBank of Kigali Announces Q2 2011 & 1H 2011 ResultsBank of KigaliОценок пока нет

- 19.india - Monthly Economic Report - Jan 2011Документ12 страниц19.india - Monthly Economic Report - Jan 2011Rajesh AgriОценок пока нет

- Klabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Документ15 страницKlabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Klabin_RIОценок пока нет

- Klabin Reduces Debt: April/June 2003Документ16 страницKlabin Reduces Debt: April/June 2003Klabin_RIОценок пока нет

- Docum 444Документ84 страницыDocum 444Dheeman BaruaОценок пока нет

- Report On Economic and Financial Developments: 4th QUARTER 2001Документ45 страницReport On Economic and Financial Developments: 4th QUARTER 2001Jemarie AlamonОценок пока нет

- Klabin Webcast 20083 Q08Документ9 страницKlabin Webcast 20083 Q08Klabin_RIОценок пока нет

- Regional Socio-Economic REPORT 2010: Western Visayas RegionДокумент24 страницыRegional Socio-Economic REPORT 2010: Western Visayas RegionAngela ZalazarОценок пока нет

- Phil. GOV.Документ5 страницPhil. GOV.Sheryl Balbido PagaОценок пока нет

- Sri Lanka's economy rebounds from warДокумент4 страницыSri Lanka's economy rebounds from warNeha FomraОценок пока нет

- PHP WKPF BKДокумент5 страницPHP WKPF BKfred607Оценок пока нет

- Klabin Webcast 20111 Q11Документ8 страницKlabin Webcast 20111 Q11Klabin_RIОценок пока нет

- Quarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Документ19 страницQuarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Klabin_RIОценок пока нет

- Assign 1Документ3 страницыAssign 1Irycka Dela CruzОценок пока нет

- Itr 1Q17Документ70 страницItr 1Q17Klabin_RIОценок пока нет

- Rating Klabin - Fitch RatingsДокумент1 страницаRating Klabin - Fitch RatingsKlabin_RIОценок пока нет

- Press Klabin Downgrade Mai17Документ5 страницPress Klabin Downgrade Mai17Klabin_RIОценок пока нет

- Release 1Q17Документ19 страницRelease 1Q17Klabin_RIОценок пока нет

- Notice To Debentures HoldersДокумент1 страницаNotice To Debentures HoldersKlabin_RIОценок пока нет

- Management Change (MATERIAL FACT)Документ1 страницаManagement Change (MATERIAL FACT)Klabin_RIОценок пока нет

- Notice To Shareholders - Payment of DividendsДокумент2 страницыNotice To Shareholders - Payment of DividendsKlabin_RIОценок пока нет

- Free Translation Klabin 31 03 2017 Arquivado Na CVMДокумент70 страницFree Translation Klabin 31 03 2017 Arquivado Na CVMKlabin_RIОценок пока нет

- DFP Klabin S A 2016 EM INGLSДокумент87 страницDFP Klabin S A 2016 EM INGLSKlabin_RIОценок пока нет

- Notice To Debentures HoldersДокумент1 страницаNotice To Debentures HoldersKlabin_RIОценок пока нет

- Recommedation To New Chief Executive OfficerДокумент1 страницаRecommedation To New Chief Executive OfficerKlabin_RIОценок пока нет

- UntitledДокумент75 страницUntitledKlabin_RIОценок пока нет

- Notice To Shareholders - Dividend PaymentДокумент2 страницыNotice To Shareholders - Dividend PaymentKlabin_RIОценок пока нет

- Notice To Debentures HoldersДокумент1 страницаNotice To Debentures HoldersKlabin_RIОценок пока нет

- DFP Klabin S A 2016 EM INGLSДокумент87 страницDFP Klabin S A 2016 EM INGLSKlabin_RIОценок пока нет

- Institutional Presentation 2016Документ28 страницInstitutional Presentation 2016Klabin_RIОценок пока нет

- DFP 2016Документ87 страницDFP 2016Klabin_RIОценок пока нет

- Notice To Debenture HoldersДокумент1 страницаNotice To Debenture HoldersKlabin_RIОценок пока нет

- Release 4Q16Документ18 страницRelease 4Q16Klabin_RIОценок пока нет

- Notice To Shareholders - Dividend PaymentДокумент2 страницыNotice To Shareholders - Dividend PaymentKlabin_RIОценок пока нет

- Notice To Shareholders - Payment of DividendsДокумент2 страницыNotice To Shareholders - Payment of DividendsKlabin_RIОценок пока нет

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumДокумент30 страницComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RIОценок пока нет

- Presentation APIMEC 2016Документ44 страницыPresentation APIMEC 2016Klabin_RIОценок пока нет

- Notice To The Market - New Structure of The Executive BoardДокумент2 страницыNotice To The Market - New Structure of The Executive BoardKlabin_RIОценок пока нет

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumДокумент30 страницComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RIОценок пока нет

- UntitledДокумент75 страницUntitledKlabin_RIОценок пока нет

- Release 3Q16Документ19 страницRelease 3Q16Klabin_RIОценок пока нет

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCДокумент26 страницComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RIОценок пока нет

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumДокумент30 страницComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RIОценок пока нет

- Notice To Debentures HoldersДокумент1 страницаNotice To Debentures HoldersKlabin_RIОценок пока нет

- Alpha Portfolio Seeks Superior Stock SelectionДокумент2 страницыAlpha Portfolio Seeks Superior Stock SelectionDhirendra PradhanОценок пока нет

- HWAL V Blackbridge Original ComplaintДокумент52 страницыHWAL V Blackbridge Original ComplaintsmallcapsmarketОценок пока нет

- Executive Summary ReportДокумент26 страницExecutive Summary Reportsharan ChowdaryОценок пока нет

- Endava PLCДокумент274 страницыEndava PLCvicr100Оценок пока нет

- FIN-365 SyllabusДокумент7 страницFIN-365 SyllabusJohnny GonzalezОценок пока нет

- The Structure of The Egyptian Securities MarketДокумент10 страницThe Structure of The Egyptian Securities MarketZakaria HegazyОценок пока нет

- Ashok LeylandДокумент76 страницAshok LeylandvikasatmarsОценок пока нет

- Mutual Funds in ICICI Bank: Bachelor of Management StudiesДокумент19 страницMutual Funds in ICICI Bank: Bachelor of Management StudiesGanganiya GauravОценок пока нет

- Open Branches 17Документ4 страницыOpen Branches 17YASIR ALIОценок пока нет

- MACD HistogramДокумент66 страницMACD Histogrammkd36cal100% (4)

- Corporate Finance Till Test 1Документ39 страницCorporate Finance Till Test 1YogeeshОценок пока нет

- International ParityДокумент28 страницInternational Paritypankajbhatt1993Оценок пока нет

- SIP Presentation On AU Small Finance BankДокумент13 страницSIP Presentation On AU Small Finance BankMadhurОценок пока нет

- Cash Flow Statement ExampleДокумент9 страницCash Flow Statement Examplegunawan refiadiОценок пока нет

- Private PlacementДокумент50 страницPrivate PlacementRajesh ChavanОценок пока нет

- 7Документ7 страниц7Lyza Molina ParadoОценок пока нет

- Insider Trading Is of Two TypesДокумент5 страницInsider Trading Is of Two Typessaadm123Оценок пока нет

- SCRAДокумент33 страницыSCRAAnmol KhuranaОценок пока нет

- Krakatau A - CGAR, BUMN, DupontДокумент27 страницKrakatau A - CGAR, BUMN, DupontJavadNurIslamiОценок пока нет

- Instability in Indian Stock Market DraftДокумент53 страницыInstability in Indian Stock Market Draftrushabh1819Оценок пока нет

- Australian Sharemarket: TablesДокумент17 страницAustralian Sharemarket: TablesallegreОценок пока нет

- Advanced Accounting May 2015 Suggested Answers PDFДокумент26 страницAdvanced Accounting May 2015 Suggested Answers PDFanupОценок пока нет

- Aliceblue Digital FormДокумент29 страницAliceblue Digital Formshemanth123Оценок пока нет

- SPA IndividualДокумент1 страницаSPA IndividualNupОценок пока нет

- Comparative Study of Liquidity and Profitability Within The Company and Industry: Evidence From Indian Tea IndustryДокумент8 страницComparative Study of Liquidity and Profitability Within The Company and Industry: Evidence From Indian Tea IndustrysubhaseduОценок пока нет