Академический Документы

Профессиональный Документы

Культура Документы

B8 Accounting With Tally

Загружено:

michele983Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

B8 Accounting With Tally

Загружено:

michele983Авторское право:

Доступные форматы

ITKC

COURSE DETAILS

Course Name: Accounting with Tally

Course Code: B8

Address: Sh No BSH 1,2,3 Almedia residency, Xetia Waddo Duler Mapusa Goa E-mail Id: ITKP@3i-infotech.com Tel: (0832) 2465556 (0832) 6454066

Accounting with Tally

Course Code: B8 3i Infotech Limited 1

ITKC

COURSE DETAILS

Introduction:

Business support tools are crucial to every organizations well being. A business support tool like enables industries to manage their day-to-day accounting and monitor the financial health of the organization. The growing popularity of Tally software in enterprises across the world has resulted in an increased demand for the persons having domain knowledge of package as a Tally, accountancy blended with IT. The curriculum designed has strong industry relevance and will be frequently updated and validated to ensure that students are ready to work, on completion of the course. These courses are designed to make students completely competent in accounting on computers or Tally Technologies and opens up job opportunities in various enterprises, around the world, enabling professionals to capitalize on huge demand.

Eligibility:

A minimum educational qualification of 10th Pass or B1/B2 from ITKC

Duration:

120 Hours (twelve weeks). Two Hours each day, six days a week. The total duration of the course is 120 hours consisting of

Theory Practical

30 hours 90 hours

Course Code: B8

3i Infotech Limited

ITKC

COURSE DETAILS

Course Details:

Type of Professional course with Tally as a package course Syllabus 1) Starting with Tally 9.0 :-Introduction to Tally 9.0, Installation, Installing Tally, Whats New in Tally 9.0, Running Tally, Items on the Tally Screen, Create a Company, Basic Currency Information, Accounting Features, Inventory Features, Statutory and Taxation Features, Configuring Tally, Number Symbols, Accts/Inv Info Menu, Voucher Entry, Invoice/Orders Entry, Payroll Configuration, Printing, Connectivity, Licensing, Shop 2) Creating Accounts Masters:- Creating Account Masters, Accounts Information, Creating an Accounts Group, Creating a Ledger, Display of Individual Ledger, Alteration of Group Account, Deletion of Ledger, Creating Multiple Ledger, Altering Multiple Ledger, Buttons in Alter Ledger screen 3) Creating Inventory Masters:- Creating Inventory Masters, Stock Groups, Creating a Stock Group, Creating Multiple Stock Groups, Display or Alter a Stock Group, Delete a Stock Group, Stock Items, Creating a Stock Item, Creating Multiple Stock Items, Advanced Stock Item Creation, Units of measure 4) Entering Accounts Vouchers:- Vouchers the Main Inputs, Voucher Types, Simple Voucher Entry, The Voucher Entry Screen, How to Enter Vouchers, Buttons in a Typical Entry Screen, Contra Voucher, Memo Voucher, Optional Voucher, Reversing Journals, Sales Vouchers, Purchase Vouchers, Credit Notes, Debit Note 5) Entering Inventory Vouchers:- Entering Inventory Vouchers, Sales and Purchase Voucher Entry, Voucher Classes, Default Accounting Allocations, Types of Calculation, Explanation of Types of Calculation, Pure Inventory Vouchers, Default Voucher Number, Stock Journal, Common Information, Bill of Materials, Alter a Purchase Order, How to Create Sales Orders, Alter a Sales Order, Delete a Sales Order 6) Value Added Tax (VAT):- What is VAT?, General Terminologies Used in VAT, Business Processes, Computation of VAT, VAT Classification, VAT Documents, VAT Records, Statutory Returns, Dealer Status, Vouchers and Transactions, Computation of VAT, Interstate Sales and Purchases, Inter-state Sales, Imports and Exports, Exports, Exempted Purchases and Sales, VAT Documents, Reports, VAT Control Ledger, Group Summary, Sales Register, Reorganizing VAT Group, VAT Computation, Statutory VAT Returns, Inventory Records 7) Tax Deducted at Source (TDS):- Introduction to TDS, Features of TDS in Tally 9.0, TDS Accounts, TDS Transactions, Configuring Tally for TDS, Creation of Masters, Voucher Entry for TDS, Purchase Voucher, Advance Voucher, Advance Payment, TDS Reports, TDS Computation Report 8) Service Tax in Tally:- Service Tax, Creation of Party Ledger, Service Income/Expenses Ledger A/c Creation, Service Tax Reports, Input Service Tax 9) Payroll Accounting:- Introduction, Enabling Payroll in Tally, Four Easy Steps to Generate a Pay slip, Payroll Configuration, Payroll Info, Creating an Earning Pay

Course Code: B8

3i Infotech Limited

ITKC

COURSE DETAILS

Head, Creating a Deduction Pay Head, Creating Salary Payable Ledger, Creating Gratuity Pay Head, Employee Group, Creating an Employee Group, Employee, Creating an Employee, Salary Details, Creating Salary Details for an Employee Group, Creating Salary Details for an Employee, Units (Work), Vouchers Types in Tally Payroll, Payroll Reports, Advance Features 10) Multilingual Features of Tally 9.0:- Introduction, Features of Tally Multilingual, User Interface in Tally, Configuring F12: Configure for Multilingual 11) Display/Reports in Tally:- Output and printing Reports, Cash and Fund Flows, Aged Stock Analysis (Ageing Analysis) 12) Fringe Benefit Tax in Tally:- , Fringe Benefit Tax, Salient Features of FBT, Important Points Relating to Fringe Benefit Tax, Characteristics of FBT, Classification of Employer for FBT, Classification of Employer not Under FBT, Direct Fringe Benefit, Payment of FBT to the Government, Filing of FBT Return, Enable FBT in Tally, Creating Tax Ledger, Creating a Party ledger, Creating/Altering FBT Voucher Type, Creating FBT Vouchers, , FBT Computation, FBT Ledger Category 13) The Collaborative Tally:- Exporting Data from Tally, Export Master Data, Import of Data, Import of Masters, Import of Vouchers, Tally ODBC, Inward Connectivity, Creating the Client Rule for the Client Machine, Activating the Server Rule from the Server Machine, Synchronizing Back dated Vouchers, E-capabilities, Web Publishing 14) The Administrative Tally:- Security Levels-Types of Security, Users and Passwords, Tally Audit, Tally Vault, Backup, Restore, Split Financial Years, How to Split Financial Years? 15) Keyboard Shortcuts:- Shortcuts Keys in Tally

1.

Fee:

Rs. 3,000 (exclusive of Service Tax)

Course Code: B8

3i Infotech Limited

Вам также может понравиться

- Tally Question For InterviewДокумент7 страницTally Question For InterviewSANTOSH KUMARОценок пока нет

- Top 30 Tally Interview QuestionsДокумент8 страницTop 30 Tally Interview Questionsprajai kumarОценок пока нет

- Tally NotesДокумент24 страницыTally NotesLeela Mohan0% (1)

- Tally InterviewДокумент6 страницTally InterviewGST Point Taxation & Accounting ServicesОценок пока нет

- Tally Unit - 1Документ10 страницTally Unit - 1muniОценок пока нет

- Tally - Erp 9 - Post-Dated Voucher of Accounting & Inventory Vouchers Creation, Modification, DeletionsДокумент5 страницTally - Erp 9 - Post-Dated Voucher of Accounting & Inventory Vouchers Creation, Modification, DeletionsHeemanshu ShahОценок пока нет

- Tally Interview Questions PDFДокумент6 страницTally Interview Questions PDFRuqaya AhadОценок пока нет

- Accounting Package Tally Erp 9: Department of CommerceДокумент11 страницAccounting Package Tally Erp 9: Department of CommerceN AzhaguvelОценок пока нет

- GST Module 1 Compiled PDFДокумент285 страницGST Module 1 Compiled PDFRahul DoshiОценок пока нет

- Final Account BBAДокумент37 страницFinal Account BBAgrivand100% (1)

- Tally - Business Accounts Question BankДокумент9 страницTally - Business Accounts Question BankBhaskar bhaskarОценок пока нет

- Accountancy Higher Secondary - Second Year Volume IДокумент132 страницыAccountancy Higher Secondary - Second Year Volume Iakvssakthivel100% (1)

- Accounting Reports in TallyДокумент49 страницAccounting Reports in TallyBackiyalakshmi VenkatramanОценок пока нет

- Tally-1Документ61 страницаTally-1vidya gubbala100% (1)

- Tally ERAДокумент5 страницTally ERAOlivia OwenОценок пока нет

- Reading Material AccountantДокумент123 страницыReading Material Accountantsatyanweshi truthseeker100% (1)

- Tally QuestionsДокумент73 страницыTally QuestionsVishal Shah100% (1)

- Tally QuestionДокумент59 страницTally Questionkiranmayi 2705Оценок пока нет

- Bcom 6 Sem Imp Questions - All SubsДокумент5 страницBcom 6 Sem Imp Questions - All SubsAbdul RaheemОценок пока нет

- Workshop On TALLY - 8th Jan2014Документ128 страницWorkshop On TALLY - 8th Jan2014Senthil KannanОценок пока нет

- Tally 036Документ191 страницаTally 036anjalishah7Оценок пока нет

- Paper 11 NEW GST PDFДокумент399 страницPaper 11 NEW GST PDFsomaanvithaОценок пока нет

- Differences Between Trading and NonДокумент2 страницыDifferences Between Trading and NonEdcel Joy Fernandez Zolina100% (1)

- Tally ERP 9.0 Material Basics of Accounting 01Документ10 страницTally ERP 9.0 Material Basics of Accounting 01Raghavendra yadav KM100% (1)

- BcomДокумент334 страницыBcomPrasanth KumarОценок пока нет

- Fundamentals of TallyДокумент81 страницаFundamentals of TallyRishabh chaudhary100% (1)

- GST Practical Record 40-50Документ48 страницGST Practical Record 40-50Aditya raj ojhaОценок пока нет

- Inventory VouchersДокумент7 страницInventory VouchersSubhanshu MathurОценок пока нет

- Tally Workshop NotesДокумент13 страницTally Workshop NotesPatel SagarОценок пока нет

- GST Entries For Every Month SalesДокумент3 страницыGST Entries For Every Month SalesGiri Sukumar100% (1)

- Trading Account PDFДокумент9 страницTrading Account PDFVijayaraj Jeyabalan100% (1)

- What Is GST?: Multi-StageДокумент10 страницWhat Is GST?: Multi-StagexyzОценок пока нет

- Questions and AnswersДокумент44 страницыQuestions and AnswersSanjay KumarОценок пока нет

- Computerize Accounting Package Tally 9.0: Tally 9 Note With Practice QuestionsДокумент20 страницComputerize Accounting Package Tally 9.0: Tally 9 Note With Practice Questionssandip rajakОценок пока нет

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyОт EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyРейтинг: 5 из 5 звезд5/5 (1)

- Accounting Revision - TRADING AND PROFIT AND LOSS ACCOUNT PDFДокумент7 страницAccounting Revision - TRADING AND PROFIT AND LOSS ACCOUNT PDFshevon mhlangaОценок пока нет

- CA Foundation Accounting Notes by Bharadwaj InstituteДокумент127 страницCA Foundation Accounting Notes by Bharadwaj Institutenasiransar26Оценок пока нет

- It SiaДокумент180 страницIt Siasupriya guptaОценок пока нет

- Payroll Reports in Tally - Erp 9Документ43 страницыPayroll Reports in Tally - Erp 9Sahil JainОценок пока нет

- Chapter 1Документ5 страницChapter 1palash khannaОценок пока нет

- NCERT Class 11 Accountancy Book (Part I)Документ288 страницNCERT Class 11 Accountancy Book (Part I)Aashu DhalwalОценок пока нет

- Interview Question AnswersДокумент2 страницыInterview Question AnswersSushilSinghОценок пока нет

- Key Words: Multiple Choice QuestionsДокумент7 страницKey Words: Multiple Choice QuestionsMOHAMMED AMIN SHAIKHОценок пока нет

- How To Categorize The Shortcut Keys in TallyДокумент4 страницыHow To Categorize The Shortcut Keys in TallyNvn SainiОценок пока нет

- Banking - Ledgers, Deposit Slips & Payment AdviceДокумент33 страницыBanking - Ledgers, Deposit Slips & Payment AdviceNiladri Sen100% (1)

- Tally - ERP9 Book With GSTДокумент1 843 страницыTally - ERP9 Book With GSThatimОценок пока нет

- "Trial Balance ": by Srinivas Methuku Asst. Professor, SLS HyderabadДокумент17 страниц"Trial Balance ": by Srinivas Methuku Asst. Professor, SLS HyderabadMuthu KonarОценок пока нет

- 42 Implementation of Tds in Tallyerp 9Документ171 страница42 Implementation of Tds in Tallyerp 9P VenkatesanОценок пока нет

- Items of Trading AccountДокумент4 страницыItems of Trading AccountXaka UllahОценок пока нет

- Tally Q&AДокумент6 страницTally Q&AkumarbcomcaОценок пока нет

- Accountancy XiiДокумент122 страницыAccountancy XiiNancy Ekka100% (1)

- Question No.1: Write The Steps To: Create CompanyДокумент15 страницQuestion No.1: Write The Steps To: Create Companykoshalk88% (8)

- GB Training & Placement Centre: Tally ERP 9 Certificate CourseДокумент2 страницыGB Training & Placement Centre: Tally ERP 9 Certificate CourseswayamОценок пока нет

- Top 30 Tally Interview QuestionsДокумент30 страницTop 30 Tally Interview QuestionsSanjay Kumar40% (5)

- BCN DSC07Документ3 страницыBCN DSC07selvamОценок пока нет

- Top 30 Tally Interview Questions & Answers: 1) Explain What Is Tally and Where It Can Be Used?Документ7 страницTop 30 Tally Interview Questions & Answers: 1) Explain What Is Tally and Where It Can Be Used?saboxaОценок пока нет

- Tally ProjectДокумент42 страницыTally Projectnavjotsingh_nanua100% (3)

- Project ON Tally: Compiled By: Akshita Modi Roll No: E-23Документ13 страницProject ON Tally: Compiled By: Akshita Modi Roll No: E-23Akshita Modi50% (4)

- 58 Itt Project Cum Presentation TallyДокумент36 страниц58 Itt Project Cum Presentation Tallytarutaneja50% (4)

- Syllabus B Com Sem-4 CE203D Computer Applications ECommerceДокумент3 страницыSyllabus B Com Sem-4 CE203D Computer Applications ECommerceDОценок пока нет

- Problem Set3Документ4 страницыProblem Set3Jack JacintoОценок пока нет

- Roll of Entrepreneurs in Indian EconomyДокумент14 страницRoll of Entrepreneurs in Indian EconomySāĦılKukrējāОценок пока нет

- Betma Cluster RevisedДокумент5 страницBetma Cluster RevisedSanjay KaithwasОценок пока нет

- Case Study 1 - GilletteДокумент1 страницаCase Study 1 - GilletteLex JonesОценок пока нет

- Ananda KrishnanДокумент4 страницыAnanda KrishnanKheng How LimОценок пока нет

- Joint Product PricingДокумент2 страницыJoint Product PricingAmit Manhas100% (1)

- Chp14 StudentДокумент72 страницыChp14 StudentChan ChanОценок пока нет

- CH 12Документ27 страницCH 12DewiRatihYunusОценок пока нет

- Fundamentals of AccountingДокумент5 страницFundamentals of AccountingJayelleОценок пока нет

- Variable & Absorption CostingДокумент23 страницыVariable & Absorption CostingRobin DasОценок пока нет

- About Feathers Fashion (1st Emirates Brand)Документ15 страницAbout Feathers Fashion (1st Emirates Brand)MufeezRanaОценок пока нет

- SpmeДокумент27 страницSpmeRajiv RanjanОценок пока нет

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageДокумент1 страницаIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagecachandhiranОценок пока нет

- Product Life CycleДокумент19 страницProduct Life CycleTamana Gupta100% (2)

- Answer Scheme Question 1 (30 Marks) A.: Bkam3023 Management Accounting IiДокумент14 страницAnswer Scheme Question 1 (30 Marks) A.: Bkam3023 Management Accounting IiTeh Chu LeongОценок пока нет

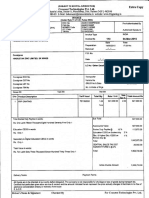

- HZL 4100070676 Inv Pay Slip PDFДокумент12 страницHZL 4100070676 Inv Pay Slip PDFRakshit KeswaniОценок пока нет

- Month To Go Moving ChecklistДокумент9 страницMonth To Go Moving ChecklistTJ MehanОценок пока нет

- Evolution of International BusinessДокумент6 страницEvolution of International Businessabhijeetpatil150% (1)

- Grove RT870 PDFДокумент22 страницыGrove RT870 PDFjcpullupaxi50% (2)

- Lorenzo Shipping V ChubbДокумент1 страницаLorenzo Shipping V Chubbd2015member0% (1)

- CA FirmsДокумент5 страницCA FirmsbobbydebОценок пока нет

- 3 Sem EcoДокумент10 страниц3 Sem EcoKushagra SrivastavaОценок пока нет

- mgm3180 1328088793Документ12 страницmgm3180 1328088793epymaliОценок пока нет

- INterviewsДокумент3 страницыINterviewsJanina SerranoОценок пока нет

- Continue or Eliminate AnalysisДокумент3 страницыContinue or Eliminate AnalysisMaryОценок пока нет

- RSKMGT NIBM Module Operational Risk Under Basel IIIДокумент6 страницRSKMGT NIBM Module Operational Risk Under Basel IIIKumar SkandaОценок пока нет

- Managenet AC - Question Bank SSДокумент18 страницManagenet AC - Question Bank SSDharshanОценок пока нет

- TRH 14 ManualДокумент22 страницыTRH 14 ManualNelson KachaliОценок пока нет

- FRBM Act: The Fiscal Responsibility and Budget Management ActДокумент12 страницFRBM Act: The Fiscal Responsibility and Budget Management ActNaveen DsouzaОценок пока нет

- ReshapeДокумент4 страницыReshapearnab1988ghoshОценок пока нет