Академический Документы

Профессиональный Документы

Культура Документы

Reverse Mortgage

Загружено:

Pavan BetdurИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Reverse Mortgage

Загружено:

Pavan BetdurАвторское право:

Доступные форматы

Reverse Mortgage: What is it? A reverse mortgage (or lifetime mortgage) is a loan available to senior citizens.

Reverse mortgage, as its name suggests, is exactly opposite of a typical mortgage, such as a home loan. How does it work? In a typical mortgage, you borrow money in lump sum right at the beginning and then pay it back over a period of time using Equated Monthly Instalments (EMIs). In reverse mortgage, you pledge a property you already own (with no existing loan outstanding against it). The bank, in turn, gives you a series of cash-flows for a fixed tenure. These can be thought of as reverse EMIs. The specific format National Housing Board (the facilitator for housing finance in India) is promoting is one in which, the tenure is 15 years and the owner of the house and his/her spouse continue to live in the house till their death -- which can occur later than the tenure of the reverse mortgage. Simply put, any senior citizen, opting for reverse mortgage will get annuity (the reverse EMI) from the bank for 15 years. After that, the annuity payments stop. However, they can continue to live in the house. What are the features of this loan? The draft guidelines of reverse mortgage in India prepared by the Reserve Bank of India [ Get Quote ] have the following features: Any house owner over 60 years of age is eligible for a reverse mortgage. The maximum loan is up to 60 per cent of the value of the residential property. The maximum period of property mortgage is 15 years with a bank or HFC (housing finance company). The borrower can opt for a monthly, quarterly, annual or lump sum payments at any point, as per his discretion. The revaluation of the property has to be undertaken by the bank or HFC once every 5 years. The amount received through reverse mortgage is considered as loan and not income; hence the same will not attract any tax liability.

Reverse mortgage rates can be fixed or floating and hence will vary according to market conditions depending on the interest rate regime chosen by the borrower. How is the loan paid? With a reverse home mortgage, no payments are made during the life of the borrower(s). Since no payments are made during the term of the reverse home mortgage loan, the loan balance rises over time. In most areas where appreciation is good, the value of the home grows at a much faster rate than the loan balance. Therefore, the remaining equity continues to grow. When the last borrower passes, or it is decided to sell the home and move, the loan becomes due. The ownership of the home is then passed to the estate or directed by a living will or will to the beneficiaries. The beneficiaries now own the home and have to sell the home or pay off the loan. If the home is sold, the reverse home mortgage lender is paid off and the beneficiaries keep the remaining equity of the home. What happens after the death of one or both of the spouses? If one of the spouses dies, the other can still continue living in the house. If both die, the bank will give their heirs two options -- settle the overall outstanding loan and retain the house, or the bank will sell the house, use the proceeds to settle the outstanding loan and give the rest to the heirs. How much of an annuity income can my house generate using reverse mortgage? The banks have so far not indicated the interest rates. However, we can safely assume that it will not exceed the interest rates used for loan against property -- which is currently in the region of 12 per cent to 14 per cent. What is a loan to value ratio? Loan to value ratio means the percentage of loan that you will get for the value of the property that you pledge. The typical rate loan to value ratio is 60 per cent. So, for e.g., if you pledge a property worth Rs 60 lakh (Rs 6 million), then the loan amount that you can get is Rs 36 lakh (Rs 3.6 million). Does a person's age affect the amount of annuity paid? It certainly does. Higher the age, higher the annuity! Everything else remains the same. Why is this scheme not popular?

Recent reports seem to indicate that a very small percentage of senior citizens only seem to have taken advantage of the facility since its inception. This could be perhaps because better awareness had not been created about the product. Secondly, the Indian banking industry caps the available loan amount at Rs 50 lakh (Rs 5 million), instead of providing for an equitable percentage of the property's value, and limits the loan period to a tenure of 15 years. The product is still evolving and may take on new dimensions depending on how the banks wish to present its consumer appeal.

he reverse mortgage scheme offered by some of the leading banks in India could bring the required answers to the suffering senior citizens. Most of the people in the senior age groups, either by inheritance or by virtue of building assets have properties in names, but they were not able to convert it into instant and regular income stream due to its illiquid nature. The Union Budget 2007-2008 had a great proposal which introduced the Reverse Mortgage' scheme. The concept is simple, a senior citizen who holds a house or property, but lacks a regular source of income can put mortgage his property with a bank or housing finance company (HFC) and the bank or HFC pays the person a regular payment. The good thing is that the person who reverse mortgages' his property can stay in the house for his life and continue to receive the much needed regular payments. So, effectively the property now pays for the owner. So, effectively you continue to stay at the same place and also get paid for it. Where is the catch? The way reverse mortgage works is that the bank will have the right to sell off the property after the incumbent passes away or leaves the placce, and to recover the loan. It passes on any extra amount to the legal heirs. The whole idea is entirely opposite to the regular mortgage process where a person pays the bank for a mortgaged property. Hence it is called reverse mortgage. This concept is particularly popular in the west. The draft guidelines of reverse mortgage in India prepared by RBI have the following salient features:

Any house owner over 60 years of age is eligible for a reverse mortgage. The maximum loan is up to 60% of the value of residential property. The maximum period of property mortgage is 15 years with a bank or HFC. The borrower can opt for a monthly, quarterly, annual or lump sum payments at any point, as per his discretion. The revaluation of the property has to be undertaken by the Bank or HFC once every 5 years. The amount received through reverse mortgage is considered as loan and not income; hence the same will not attract any tax liability

Reverse mortgage rates can be fixed or floating and hence will vary according to market conditions depending on the interest rate regime chosen by the borrower.

The lender will recover the loan along with the accumulated interest by selling the house after the death of the borrower or earlier, if the borrower leaves the mortgaged residential property permanently. Any excess amount will be remitted back to the borrower or his heirs. Reverse mortgage thus, is very beneficial for senior citizens who want a regular income to meet their everyday needs, without leaving their houses.

Reverse Mortgage India

Reverse Mortgage in India still at an infancy stage. The reverse mortgage came into existence in the UK during the crash of 1929. Having evolved genetically from the developed countries and mainly the USA, reverse mortgage is a scheme formulated to benefit the senior citizens the most. Although applicable for the younger people also, reverse mortgage loan products for senior citizens is the basic that every bank of financial institution follows.

Reverse Mortagage Information

Reverse mortgage information that will help you in understanding the concept of reverse mortgage loan is listed below.

Definition Of Reverse Mortgage:Reverse mortgage is a Home Loan product designed for the senior citizens by converting their fixed asset their home or in banking terms their equity in any house property into an income channel without having to liquidify your equity in case of any requirement. The Dealing Parties: Reverse mortgage loan involves two parties, the borrower the senior citizen and the lender any bank or housing finance institution. Security for the Lender: The borrower pledge their home property to a lender Payment of the Loan to the Borrower: In return of the house property pledged, the borrower gets a lump sum amount or periodic payments spread over the borrowers lifetime that can be utilized by the borrower (senior citizen) as per needs and not for speculative purposes. Repayment of Reverse Mortgage Loan: The homeowner and now the borrower will not be required to repay the loan during his lifetime. On his death or leaving the house permanently, the loan along with the accumulated interest is repaid through the sale of the property pledged. Home Value Falling Short: In case the accumulated interest and loan amount is larger than the value of the mortgaged property, the mortgage loan is capped at the value of the home equity only and the lender is the party at loss.

Home Value in Excess: Any excess amount by the sale of the property is duly remitted to the borrower incase of permanent leaving of the house or his heirs in case of the death of the borrower. Freeing the property from reverse mortgage: In case you get an additional income and accumulate an amount to repay your loan, you can free your property in mid term and can also apply for re-reverse mortgage if required on the same property.

In the usual mortgage loan, the borrower begins with a large loan and lower equity in his house. In reverse mortgage however, the borrower has a very high equity in his house and a nonrecourse loan secured by the home property. In the usual mortgage system, as the regular mortgage payments are made the outstanding loan decreases and the house equity increases. Reverse is the case in reverse mortgage, the loan amount increases with time and the home equity decreases with time.

Reverse Mortgage Pros and Cons

The reverse mortgage pros and cons should be measured carefully before subscribing to it. Since, the bulk of the savings for the average Indian are typically locked away in a house or other property at the time of retirement, and in case of requirement it cannot be encashed except by selling the home or moving out. This is where reverse mortgage comes as an answer. Taking the usual mortgage loans in lieu of your home as a security will not be feasible in the age above 50 as the repayment of the loan is not feasible. The Banks And Financial Institutions also wont be of any help in case of no income source. This is where the house property proves as an asset and brings in reverse mortgage that allows you to be the home owner as long as you live. Home ownership is an area most Indians are sensitive about and reverse mortgage entitles you your house throughout your remaining life. According to demographic projections, reverse mortgage loan products could be a hit among the metros and also in areas like Kerala, Tamil Nadu, Goa and Chandigarh in India. With hardly any old age social security schemes and financial helplines, reverse mortgages have a potential market. Loans are available in the form of reverse mortgage without any income criteria at an age where normal loans are not available. Reverse mortgage for senior citizens is a social assurance post-retirement.

Reverse Mortgage Lenders in India

The major reverse mortgage lenders in India or the banks and financial institutions providing reverse mortgage in India include:

National Housing Bank (NHB) Dewan Housing Finance Limited (DHFL) State Bank of India (SBI) Punjab National Bank (PNB) Indian Bank Central Bank of India

Reverse mortgage is a way of getting the benefits of your home equity by retaining the home ownership and also without having to make any repayments. The senior citizens in India will definitely find reverse mortgage a solution for their financial needs after retirement and help them in regaining their feeling of independence.

RBI Axis Bank Barclays Bank Citibank Deutsche Bank HSBC Indiabulls Financial Services ING Vysya National Housing Bank Punjab & Sind Bank Standard Chartered United Bank of India

List of Banks in India ABN AMRO Bank Andhra Bank Bank of Baroda Bank Of India Canara Bank Central Bank of India Corporation Bank Dena Bank GE Financial HDFC ICICI IDBI Indian Bank Indian Overseas Bank Kotak Mahindra Bank Oriental Bank of Commerce Reliance Money Syndicate Bank LIC Housing Finance Corporation PNB SBI Union Bank of India

Reverse Mortgage Loan: An innovative retirement solution

By : Parizad Sirwalla, Executive Director Tax and Rambir Dalal, Associate Director Tax, KPMG Four socio-economic and demographic trends are clearly discernible in India. At the societal level, the intergenerational contract is changing and with more and more neutral families, some children no longer feel the obligation to care for their parents. At the economic level, the standard of living is constantly going up and people need more income to meet their aspirations. At the demographic level the birth rate is declining and life expectancy is going up. On the policy front, only 10% of the population has access to a credible pension plan. If we put all these trends together, we have a situation of insufficient income for a sizable elderly population in

India. As a result, providing income security to the countrys retired population has become a major challenge for the Government. To combat this situation, the government of India has been striving to provide a secure postretirement life to its citizens and introduction of reverse mortgage loan (RML) scheme constitutes one of such attempts. This scheme, after its introduction via Budget 2007-08, is being regulated by National Housing Bank (NHB) which plays the role of regulator as well as instructor by issuing continual guidelines to the Primary Lending Institutions (PLIs) who are the service providers. Some of the service providers of reverse mortgage loan scheme are Punjab National Bank, State Bank of India, Bank of Baroda, Dewan Housing Finance limited, and Union Bank of India. Under this scheme, citizens aged 60 years or above will be able to mortgage their house and derive an income either in lump sum or monthly payments while living in it. If one goes for the lump sum amount, one can deposit it in a bank, withdraw from the account according to requirements and keep earning interest on the balance. Thus, reverse mortgage seeks to monetize the value of the house as an asset (without actually selling the house) and specifically the owners equity in the house. In this scheme, the senior citizens mortgage their house property to a lender in return for payments of the decided loan amount during their post-retirement years. The reverse mortgage loan scheme has various facets such as determination of loan amount, modes of receiving payment, ulitization of funds, valuation of residential property, loan disbursement procedure, settlement of loan etc. Important Features: Only senior citizens of India are eligible to opt for RML scheme by mortgaging their self owned as well as self acquired residential house property situated in India. Moreover, married couples can also take a reverse mortgage loan as joint borrowers for financial assistance for which the age criteria would be at the discretion of the Primary Lending Institution. The loan can be availed for a maximum period of 20 years and the amount that can be disbursed as loan shall be determined by PLI depending on various factors like market value of the house property, age of borrower, rate of interest or any other criterion, varying from lender to lender. RML is a flexible avenue for meeting the expenses in old age as the borrower has the option to pick any mode of payment from three available modes viz. lump-sum payment, periodic payments or Line of credit. This scheme has tax incentives for elderly as periodic payments received by them are tax exempt and only final sale of the house at the end of the loan duration is taxable as a capital gain income.

How is it different from conventional mortgage? The conventional mortgage requires borrower to make monthly payments until the mortgage is paid off whereas in Reverse mortgage no payments are to be done until the borrower sells the home or dies. In conventional mortgage the interest is charged and paid over the life of the loan. In reverse mortgage, interest is charged starting at the day borrower begins to receive the loan proceeds but not paid, until the reverse mortgage loan becomes due. A conventional mortgage is like a true mortgage loan, while reverse mortgage is more like a home equity loan. Conclusion Despite being such a lucrative and beneficial scheme, not many senior citizens have opted for RML in India. The reasons for the model not taking off include emotional attachment with one's house, real estate price correction, absence of clear guidance against legal complications and inadequate marketing by the PLIs. With the increasing need of post retirement liquid compensation in India, RML can be viewed as a potential alternative as the scheme is beneficial to both the borrowers and lender simultaneously. It is being projected that, RML is expected to gain popularity with the changing mindset of Indian citizens and increasing need of cash flows in old age. Needless to say that if more awareness is actually created about the scheme and more robust marketing of the product undertaken by PLIs , this scheme can ameliorate the rundown condition of elderly people in India.

No Downside: With a Reverse Mortgage you will never owe more than your home's value at the time the loan is repaid, even if the Reverse Mortgage lenders have paid you more money than the value of the home. This is a particularly interesting advantage if you secure a Reverse Mortgage and then home price declines. Tax Free: The money from a Reverse Mortgage is typically tax free, since its a loan when the homeowner receives the funds, as either additional fixed income or a lump sum. No Restrictions: How you use the funds from a Reverse Mortgage is not restricted - go traveling, get a hearing aid, purchase long term care insurance, pay for your childrens college education - anything goes. Flexible Payment Options: You can receive the Reverse Mortgage loan money in the form of a lump sum, annuity, credit line or some combination of the above. Easy Pre-Qualifications: There are no income qualifications to get a Reverse Mortgage. Home Ownership: With a Reverse Mortgage, you retain home ownership and the ability to live in your home. Guaranteed Place to Live: You can live in your home for as long as you want when you secure a Reverse Mortgage. Federally Insured: The Home Equity Conversion Mortgages (HECM) is the most widely available Reverse Mortgage. It is managed by the Department of Housing and Urban Affairs

and is federally insured. This is important since even if your Reverse Mortgage lender defaults, you'll still receive your payments. Recently Increased Lending Limits: As of Nov. 6, 2008 the Department of Housing and Urban Affairs increased the loan limit on the HECM to $417,000. And, for loans written in 2009, the loan limit is $625,500.

Disadvantages of a Reverse Mortgage

A Reverse Mortgage may not be for everyone, consider the following:

Beware if You are Eligible for Low-Income Assistance: If you are currently or will be eligible to receive low-income assistance from the Federal or State government (like Medicaid), you will want to be careful that income from a Reverse Mortgage does not disqualify you from that assistance. (NOTE: Social Security and Medicare are not impacted by a Reverse Mortgage.) Reconsider if You Are Planning to Move in the Near Term: Since a Reverse Home Mortgage loan is due if your home is no longer your primary residence and the up front closing costs are typically higher than other loans, it is not a good tool for those than plan to move soon to another residence. Evaluate if You are Willing to Reduce Your Heirs Inheritance: Many people dismiss a Reverse Mortgage as a retirement option because they want to be sure their home goes to their heirs. And it is true, a Reverse Mortgage decreases your home equity - affecting your estate. However, you can still leave your home to your heirs and they will have the option of keeping the home and refinancing or paying off the mortgage or selling the home if the home is worth more than the amount owed on it. There are numerous potential Estate and Retirement Planning benefits to a Reverse Mortgage - see Innovative Uses of a Reverse Mortgage for more information on these options.

Вам также может понравиться

- Financial Services in India - An IntroductionДокумент14 страницFinancial Services in India - An IntroductionProfessor Tarun DasОценок пока нет

- Failure of MergersДокумент2 страницыFailure of MergersPavan BetdurОценок пока нет

- Trading and Profit and Loss AccountДокумент20 страницTrading and Profit and Loss AccountPavan BetdurОценок пока нет

- Investment Banking GlobalДокумент2 страницыInvestment Banking GlobalKhudadad NabizadaОценок пока нет

- Electronic Industry Over ViewДокумент1 страницаElectronic Industry Over ViewPavan BetdurОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Vdocuments - MX Internship Report On Askari Bank 5685e2e32007bДокумент127 страницVdocuments - MX Internship Report On Askari Bank 5685e2e32007bqwe100% (1)

- I 4 UX1 C9 GTVe FR5 D MДокумент6 страницI 4 UX1 C9 GTVe FR5 D MsriОценок пока нет

- Bank Confirmation FormatДокумент4 страницыBank Confirmation FormatTasdik MahmudОценок пока нет

- View transaction history and account balanceДокумент4 страницыView transaction history and account balanceManu ChopraОценок пока нет

- Ak Epfo PassbookДокумент2 страницыAk Epfo PassbookPranat BajajОценок пока нет

- JYSKE Bank AUG 09 Market Drivers CurrenciesДокумент5 страницJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirОценок пока нет

- 1559 East Amar Road, Suite U, West Covina, CA 91792 Tel.: (626) 363-9808 Fax: (626) 363-9811Документ1 страница1559 East Amar Road, Suite U, West Covina, CA 91792 Tel.: (626) 363-9808 Fax: (626) 363-9811Rheajin DelfinОценок пока нет

- Monetary Authority Formulates and Implements Monetary Policy as Regulator of Financial SystemДокумент13 страницMonetary Authority Formulates and Implements Monetary Policy as Regulator of Financial SystemSarthak Priyank VermaОценок пока нет

- Holy Child Multi-Purpose Cooperative (Holy Child MPC)Документ1 страницаHoly Child Multi-Purpose Cooperative (Holy Child MPC)Jezzene Gail R. Paler0% (1)

- Bank charges schedule breakdownДокумент26 страницBank charges schedule breakdownMaria FayyazОценок пока нет

- Chapter 3 - Classification of BanksДокумент8 страницChapter 3 - Classification of BanksShasharu Fei-fei LimОценок пока нет

- Basel III Important SectionsДокумент22 страницыBasel III Important SectionsGeorge Lekatis100% (1)

- Bank Management CIA 1 AДокумент19 страницBank Management CIA 1 AShrikaran BeecharajuОценок пока нет

- Understanding Customer Behavior at SCBДокумент78 страницUnderstanding Customer Behavior at SCBHimanshu Saini0% (1)

- Checking Summary: David Johnson 8233 Tomlinson CT SEVERN MD 21144Документ3 страницыChecking Summary: David Johnson 8233 Tomlinson CT SEVERN MD 21144jeffery lamarОценок пока нет

- Banks of BangladeshДокумент3 страницыBanks of Bangladeshroolll56100% (1)

- Account Statement From 1 Apr 2022 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент15 страницAccount Statement From 1 Apr 2022 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSuryakiran kallaОценок пока нет

- 2 Exchange Rate DeterminationДокумент28 страниц2 Exchange Rate Determinationshakil zibranОценок пока нет

- The Money Paid To Jamii BusinessДокумент2 страницыThe Money Paid To Jamii Businessnetspheretechnologies254Оценок пока нет

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент20 страницDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceTavamani Gracy J.Оценок пока нет

- BPI Card's Express Start Program Marketing CampaignДокумент32 страницыBPI Card's Express Start Program Marketing CampaignJanella Reigne TiozonОценок пока нет

- Principles of Managerial Finance 13th Edition Gitman Test BankДокумент25 страницPrinciples of Managerial Finance 13th Edition Gitman Test BankSheilaEllisgxsnОценок пока нет

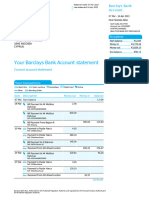

- Barclays Bank UPDATEДокумент32 страницыBarclays Bank UPDATEAbdul wahidОценок пока нет

- Í Np10È Alvero Jevanniâââââââ R Ça, 02?Î Mr. Jevanni Rodriguez AlveroДокумент3 страницыÍ Np10È Alvero Jevanniâââââââ R Ça, 02?Î Mr. Jevanni Rodriguez AlveroJevanni AlveroОценок пока нет

- Unit Test 4Документ12 страницUnit Test 4Tin Nguyen0% (1)

- The Debt Collection PolicyДокумент3 страницыThe Debt Collection PolicyGulshan KumarОценок пока нет

- NACA Cease and Desist Letter To RamosДокумент3 страницыNACA Cease and Desist Letter To RamosAdam Thompson100% (1)

- TFS New 22Документ2 385 страницTFS New 22darshil thakkerОценок пока нет

- SWIFT Message Support in T24Документ24 страницыSWIFT Message Support in T24babasakthiОценок пока нет

- Embassy of India Addis Ababa List of Banks in Ethiopia: Abyssinia@ethionet - EtДокумент15 страницEmbassy of India Addis Ababa List of Banks in Ethiopia: Abyssinia@ethionet - EtCE CERTIFICATEОценок пока нет