Академический Документы

Профессиональный Документы

Культура Документы

The Parameters Which We Choose For Conducting Comparative Analysis Are As Follows

Загружено:

DELHI73965Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Parameters Which We Choose For Conducting Comparative Analysis Are As Follows

Загружено:

DELHI73965Авторское право:

Доступные форматы

INTRODUCTION Today is the world of competition, in this scenario each and every company has to keep an eye on his

competitor to help this out we done the comparative analysis of different private banks and their services. The banks which we have taken to conduct our comparative analysis are: ICICI HDFC KOTAK MAHINDRA AXIS

The parameters which we choose for conducting comparative analysis are as follows:

On the basis casa On the basis of loan provided On the basis of financial statements On the basis of market shares On the basis of services provided

Corporate Profile ICICI Bank is India's second-largest bank with total assets of Rs. 4,062.34 billion (US$ 91 billion) at March 31, 2011 and profit after tax Rs. 51.51 billion (US$ 1,155 million) for the year ended March 31, 2011. The Bank has a network of 2,533 branches and about 6,700 ATMs in India, and has a presence in 19 countries, including India. ICICI Bank offers a wide range of banking products and financial services to corporate and retail customers through a variety of delivery channels and through its specialized subsidiaries in the areas of investment banking, life and non-life insurance, venture capital and asset management. The Bank currently has subsidiaries in the United Kingdom, Russia and Canada, branches in United States, Singapore, Bahrain, Hong Kong, Sri Lanka, Qatar and Dubai International Finance Centre and representative offices in United Arab Emirates, China, South Africa,

Bangladesh, Thailand, Malaysia and Indonesia. Our UK subsidiary has established branches in Belgium and Germany. ICICI Bank's equity shares are listed in India on Bombay Stock Exchange and the National Stock Exchange of India Limited and its American Depositary Receipts (ADRs) are listed on the New York Stock Exchange (NYSE).

CORPORATE PROFILE HDFC Bank was incorporated in August 1994, and, currently has an nationwide network of 2000 Branches and 5,998 ATM's in 1996 Indian towns and cities. The Bank operates in four segments: treasury, retail banking, wholesale banking and other banking business. For the quarter ended 30 June 2011 bank total income was rs.7098 crore an increase of 31.2% over rs.5410.6 crore for the quarter ended on June 30 2010.net revenues (net interest income plus other income) was rs.3968 crore for the quarter ended June 30 2011 as compare to 3391.6 crore for previous year. it has branches all over the world including singapur, kwait, united kingdom, U.A.E. KOTAK MAHINDRA

Kotak Mahindra is one of India's leading financial institutions, offering complete financial solutions that encompass every sphere of life. From commercial banking, to stock broking, to mutual funds, to life insurance, to investment banking, the group caters to the financial needs of individuals and corporate. The group has a net worth of Rs.7,911 crore and employs around 20,000 employees across its various businesses, servicing around 7 million customer accounts through a distribution network of 1,716 branches, franchisees and satellite offices across more than 470 cities and towns in India and offices in New York, California, an Francisco, London, Dubai, Mauritius and Singapore. Kotak Mahindra Asset Management Company Limited (KMAMC), a wholly owned subsidiary

of KMBL, is the Asset Manager for Kotak Mahindra Mutual Fund (KMMF). Presently it is engaged in commercial banking, stock broking, mutual funds, life insurance and investment banking. It caters to the financial needs of individuals and corporate. Kotak Mahindra Bank is part of the Kotak Mahindra Group with a net worth of over Rs. 5,997 crore.

Axis Bank was the first of the new private banks to have begun operations in 1994, after the Government of India allowed new private banks to be established. The Bank was promoted jointly by the Administrator of the specified undertaking of the Unit Trust of India (UTI - I), Life Insurance Corporation of India (LIC) and General Insurance Corporation of India (GIC) and other four PSU insurance companies, i.e. National Insurance Company Ltd., The Bank as on 30th June, 2011 is capitalized to the extent of Rs. 411.88 crores with the public holding (other than promoters and GDRs) at 52.87%.. The Bank has a very wide network of more than 1281 branches (including 169 Service Branches/CPCs as on 31st March, 2011). The Bank has a network of over 6270 ATMs (as on 31st March, 2011) providing 24 hrs a day banking convenience to its customers. This is one of the largest ATM networks in the country. The Bank has strengths in both retail and corporate banking and is committed to adopting the best industry practices internationally in order to achieve excellence. COMPARATIVE

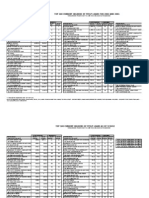

ANALYSIS OF SAVINGS ACCOUNTS

FEATURES / BANK

MIN AQB

ICICI

HDFC

UTI

IDBI

HSBC

KOTAK

10,000

10,000

5,000

5,000

10,000

10,000

2 WAY SWEEP

NO

YES

NO

NO

YES

NO

YES

HOME BANKING

YES

FREE

NO

CHARGED

YES

DEMAND DRAFT

CHARGED CHARGED

FREE

YES

FREE

FREE

ECS

YES

YES

YES

YES

YES

YES

DEBIT CARD

ICICI

HDFC

UTI

IDBI

HSBC

VISA DOMESTIC

PHONE BANKING

YES

YES

YES

YES

YES

YES

NET BANKING

YES

YES

YES

YES

YES

YES

MOBILE BANKING

YES

YES

YES

YES

YES

YES

TRADING A/C

CHARGED CHARGED CHARGED

NO

CHARGED

FREE

COMPARITIVE ANALYSIS OF CURRENT ACCOUNTS

FEATURES / BANK

MIN AQB 100000 40000 100000 100000 100000 50000

ICICI

HDFC

UTI

IDBI

HSBC

KOTAK

2 WAY SWEEP

NO

NO

NO

NO

NO

YES

HOME BANKING

YES

YES

YES

YES

FREE

FREE

DEMAND DRAFT

UPTO A LIMIT

FREE

UPTO Rs.

FREE

UPTO A UNLIMITED FOR LIMIT BRANCH LOCATION .FREE FOR NON-

UPTO A 20 LAKH LIMIT (P.M)

BRANCH LOCATION UPTO Rs.30 LAKHS. DEBIT CARD ICICI HDFC UTI IDBI HSBC ALL VISA

DOMESTIC AND INTERNATIONAL ATMs

PHONE BANKING

FREE

FREE

FREE

YES

FREE

FREE

NET BANKING

FREE

FREE

FREE

YES

FREE

FREE

MOBILE BANKING

FREE

FREE

FREE

YES

FREE

FREE

AT PAR CHEQUE BOOK

FREE

FIRST FREE THEN CHARGED

UPTO Rs.75 LAKH (P.M)

UPTO Rs.5Cr. P.M free

FREE

UNLIMITED FREE

Вам также может понравиться

- Competitor BanksДокумент6 страницCompetitor BanksAshish KumarОценок пока нет

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)От EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Оценок пока нет

- CRM in Icici BankДокумент23 страницыCRM in Icici BankManindar SinghОценок пока нет

- Marketing of Consumer Financial Products: Insights From Service MarketingОт EverandMarketing of Consumer Financial Products: Insights From Service MarketingОценок пока нет

- Introduction To Banking SectorДокумент6 страницIntroduction To Banking Sectorshweta khamarОценок пока нет

- Ratio Analysis ProjectДокумент40 страницRatio Analysis ProjectAnonymous g7uPednIОценок пока нет

- Working Capital Management of INDIAN OVERSEAS bANK. Completed by Sarath NairdocДокумент66 страницWorking Capital Management of INDIAN OVERSEAS bANK. Completed by Sarath Nairdocsarathspark100% (5)

- Reviving The Resignation of Adviser in HDFCДокумент77 страницReviving The Resignation of Adviser in HDFCnavitharagОценок пока нет

- Research ObjectiveДокумент17 страницResearch ObjectivePrincy Mariam PeterОценок пока нет

- Axis Bank: Talk Page An Advertisement VerificationДокумент5 страницAxis Bank: Talk Page An Advertisement VerificationakshathОценок пока нет

- Outlook Task2Документ79 страницOutlook Task2Rajveer singh PariharОценок пока нет

- MCS Project On ICICI Bank: Submitted To: Prof C AnandДокумент20 страницMCS Project On ICICI Bank: Submitted To: Prof C AnandSayan ChatterjeeОценок пока нет

- ICICI Bank Is IndiaДокумент1 страницаICICI Bank Is IndiatirupathianilkanthОценок пока нет

- HDFC BankДокумент3 страницыHDFC BankKaran MahtoОценок пока нет

- Project Vijaya Bank FinalДокумент62 страницыProject Vijaya Bank FinalNalina Gs G100% (1)

- Ads by Google: Submit Your Resume Malayalam GirlДокумент14 страницAds by Google: Submit Your Resume Malayalam GirlDavinder RajputОценок пока нет

- Icici BNK Imp New ALL OVER FileДокумент18 страницIcici BNK Imp New ALL OVER Fileakshay gavarkarОценок пока нет

- Amity Business School Uttar Pradesh: IciciДокумент6 страницAmity Business School Uttar Pradesh: IcicirjОценок пока нет

- State Bank of IndiaДокумент5 страницState Bank of IndiaMitisha GaurОценок пока нет

- Project On Icici BankДокумент85 страницProject On Icici BankAman PrajapatiОценок пока нет

- EXECUTIVE SUMMARY On Icici BankДокумент24 страницыEXECUTIVE SUMMARY On Icici BankSri Harsha100% (1)

- Axis Bank - WikipediaДокумент58 страницAxis Bank - WikipediaPrathamesh Sawant100% (1)

- Icici BankДокумент5 страницIcici Bank8861250340Оценок пока нет

- An Advertisement: Industry Founded Headquarters Area Served Key PeopleДокумент1 страницаAn Advertisement: Industry Founded Headquarters Area Served Key PeopleJagjot KaurОценок пока нет

- A Study On A Financial Performance Analysis of Private Banks in IndiaДокумент26 страницA Study On A Financial Performance Analysis of Private Banks in Indiashrisha sharma100% (1)

- A Study On Cash Management Anaiysis in Sri Angalamman Finance LTDДокумент77 страницA Study On Cash Management Anaiysis in Sri Angalamman Finance LTDJayaprabhu PrabhuОценок пока нет

- ICICI Bank Is IndiaДокумент2 страницыICICI Bank Is IndiaParitosh ChaudharyОценок пока нет

- HDFC Bank: Navigation SearchДокумент4 страницыHDFC Bank: Navigation SearchMukesh JakharОценок пока нет

- Icici Bank Business Overview: Kunal Gandhi 5kunalg 6175Документ2 страницыIcici Bank Business Overview: Kunal Gandhi 5kunalg 6175fecaxeyivuОценок пока нет

- Brief Analysis of Some Merchant Banks in IndiaДокумент6 страницBrief Analysis of Some Merchant Banks in IndiaParul PrasadОценок пока нет

- BAnking SectorДокумент16 страницBAnking Sectorvineetb553Оценок пока нет

- HDFC BankДокумент16 страницHDFC BankAnkit YadavОценок пока нет

- AXIS BANK Company ProfileДокумент7 страницAXIS BANK Company ProfileAnjali Angel ThakurОценок пока нет

- History of AXIS BankДокумент47 страницHistory of AXIS Banksnehalcp48Оценок пока нет

- History: 500180 Hdfcbank HDB HDBДокумент3 страницыHistory: 500180 Hdfcbank HDB HDBDeepa KashappaОценок пока нет

- Type Private BSE NSE Nyse Industrial Credit and Investment Corporation of India Mumbai India K.V. Kamath Chanda KochharДокумент13 страницType Private BSE NSE Nyse Industrial Credit and Investment Corporation of India Mumbai India K.V. Kamath Chanda KochharSSONI2Оценок пока нет

- Service Marketing of Icici BankДокумент41 страницаService Marketing of Icici BankIshan VyasОценок пока нет

- Axis BankДокумент87 страницAxis BankImran ShaikhОценок пока нет

- Chapter 1DFVДокумент21 страницаChapter 1DFVAsif KhanОценок пока нет

- Investment Banking Prospects in IndiaДокумент17 страницInvestment Banking Prospects in Indiajagadeesh143Оценок пока нет

- Finlatics Research Insight 1Документ7 страницFinlatics Research Insight 1Aishwarya GangawaneОценок пока нет

- Project SBIДокумент66 страницProject SBIsourabh tyagiОценок пока нет

- BankДокумент94 страницыBankNaren JangirОценок пока нет

- SAMIMAДокумент37 страницSAMIMASamima ShaikhОценок пока нет

- Axis Bank Annual Report.-2Документ17 страницAxis Bank Annual Report.-2GitanshОценок пока нет

- A Study On Attrition Rate in Standard Chartered BankДокумент55 страницA Study On Attrition Rate in Standard Chartered BankAjay RohillaОценок пока нет

- Company Profile BoiДокумент29 страницCompany Profile BoiPrince Satish ReddyОценок пока нет

- Banking SectorДокумент12 страницBanking SectorVijay RaghunathanОценок пока нет

- Group 3 - Section D - MANAC-I ProjectДокумент33 страницыGroup 3 - Section D - MANAC-I ProjectNaveen K. JindalОценок пока нет

- Comparative Study of Top 5 Banks in IndiaДокумент11 страницComparative Study of Top 5 Banks in Indiajakharpardeepjakhar_Оценок пока нет

- Chapter 1-Introduction: 1.1 The Topic: "Opening Savings Accounts by Meeting Customers"Документ40 страницChapter 1-Introduction: 1.1 The Topic: "Opening Savings Accounts by Meeting Customers"Sanchi JainОценок пока нет

- AcknowlegdementДокумент29 страницAcknowlegdementYamini MehtaОценок пока нет

- Chapter - 1Документ8 страницChapter - 1aditya kothekarОценок пока нет

- Credit Appraisal in Sbi Bank Project6 ReportДокумент106 страницCredit Appraisal in Sbi Bank Project6 ReportVenu S100% (1)

- Mba Finance Project Report Synopsis PDFДокумент11 страницMba Finance Project Report Synopsis PDFVIVEK KUMAR TIWARI89% (9)

- Prathima RajanДокумент20 страницPrathima RajanSubrahmanyasarma ManthaОценок пока нет

- Icici Bank and Bank of MaduraДокумент2 страницыIcici Bank and Bank of MaduraKrupa ShahОценок пока нет

- Axis BankДокумент17 страницAxis BankRoopa ShreeОценок пока нет

- (Batch 2020 - 2022) : Prestige Institute of Management and Research, IndoreДокумент14 страниц(Batch 2020 - 2022) : Prestige Institute of Management and Research, IndoreanjaliОценок пока нет

- Merger and Acquisition in Bank Sector in IndiaДокумент63 страницыMerger and Acquisition in Bank Sector in IndiaOmkar Chavan0% (1)

- Carbon Finance: Memae Master in Economics and Management of Environment and EnergyДокумент39 страницCarbon Finance: Memae Master in Economics and Management of Environment and EnergyRicardo Muscari ScacchettiОценок пока нет

- Employee HandbookДокумент32 страницыEmployee HandbookKarl LabagalaОценок пока нет

- Madina Book1 Arabic TextДокумент7 страницMadina Book1 Arabic TextChetan ChoudharyОценок пока нет

- PNB Special Chalan For Burial DepositДокумент1 страницаPNB Special Chalan For Burial DepositPeehuoo Tamu LamaОценок пока нет

- ZTBLДокумент52 страницыZTBLSheikh Aqeel50% (2)

- Bank Reconciliation StatementДокумент40 страницBank Reconciliation StatementPrashant100% (1)

- Case Stdy AntДокумент5 страницCase Stdy AntGayathiri Dorai SingamОценок пока нет

- Customer Satisfaction in BanksДокумент20 страницCustomer Satisfaction in Banksp_chopra1010957088% (48)

- Transaction-Related Audit Objective Possible Internal Controls Common Tests of ControlsДокумент3 страницыTransaction-Related Audit Objective Possible Internal Controls Common Tests of ControlsJustin DavenportОценок пока нет

- Chap12 Purchases Cash Disbursements TransactionsДокумент111 страницChap12 Purchases Cash Disbursements TransactionsStefany Mie MosendeОценок пока нет

- Effects of ""Susu"" - A Traditional Micro-Finance Mechanism On Organized and Unorganized Micro and Small Enterprises (Mses) in GhanaДокумент8 страницEffects of ""Susu"" - A Traditional Micro-Finance Mechanism On Organized and Unorganized Micro and Small Enterprises (Mses) in GhanaMoses DumayiriОценок пока нет

- Rmo 21-2000Документ15 страницRmo 21-2000jef comendadorОценок пока нет

- Research Paper On Banker As An Agent: Critical Study: Banking and Insurance LawДокумент16 страницResearch Paper On Banker As An Agent: Critical Study: Banking and Insurance LawGyanendra kumarОценок пока нет

- Bank Reconciliation PDFДокумент3 страницыBank Reconciliation PDFEunjina MoОценок пока нет

- The Role of Ceo in The Strategic PlanningДокумент18 страницThe Role of Ceo in The Strategic PlanningmanofhonourОценок пока нет

- Simón PolilloДокумент28 страницSimón PolilloDavid Enrique ValenciaОценок пока нет

- Digital WalletДокумент22 страницыDigital WalletPriyankaGuruswamy100% (1)

- CBSR - Review&LearningAssessmentДокумент26 страницCBSR - Review&LearningAssessmentmohanp716515Оценок пока нет

- MCTC Refund FormДокумент1 страницаMCTC Refund FormdsdsОценок пока нет

- Bank Reconciliation StatementsДокумент3 страницыBank Reconciliation StatementsPatrick Prem GomesОценок пока нет

- Account Activity Generated Through HBL MobileДокумент2 страницыAccount Activity Generated Through HBL MobileAðnan YasinОценок пока нет

- 1.bank NationalisationДокумент5 страниц1.bank Nationalisationsanamja1Оценок пока нет

- PAT Agency Digest3Документ6 страницPAT Agency Digest3bcarОценок пока нет

- Confirmation and Acknowledgment - OfW Signing The Docs v2.0Документ1 страницаConfirmation and Acknowledgment - OfW Signing The Docs v2.0Carlo Josef TabulogОценок пока нет

- Description: Tags: Top 100 Current Holders Cor Vers1Документ4 страницыDescription: Tags: Top 100 Current Holders Cor Vers1anon-20972Оценок пока нет

- Development Financial InstitutionsДокумент21 страницаDevelopment Financial Institutionsviveksharma51Оценок пока нет

- E Micro Gold Futures FAQsДокумент6 страницE Micro Gold Futures FAQsjavgeekОценок пока нет

- NRV Faq PDFДокумент2 страницыNRV Faq PDFKhushbu ShahОценок пока нет

- Name of The Treasury/Sub-Treasury/Bank/Bank Branch - State Bank of India (Payment Gateway)Документ1 страницаName of The Treasury/Sub-Treasury/Bank/Bank Branch - State Bank of India (Payment Gateway)Shasvat DhoundiyalОценок пока нет