Академический Документы

Профессиональный Документы

Культура Документы

Lip Per

Загружено:

educasadoИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Lip Per

Загружено:

educasadoАвторское право:

Доступные форматы

Community Development INVESTMENT REVIEW

37

State Governments Start Investing Capital for Entrepreneurs to Grow the Local Economy and Keep Jobs

George Lipper

National Association of Seed and Venture Funds

quity capital for entrepreneurs is a scarce commodity in most of states in the United States. This is particularly true for states that are predominantly rural. The extraordinary concentration, both geographically and by stage of development, of venture capital investing over the past two decades has dramatically altered the economic landscape for entrepreneurial start-ups in the United States. While the venture capital industry often portrays itself as the fount of economic growth, basking in the glow of such wealth- and job-creating giants as Fed-Ex, Microsoft, and Dell, statistics show clearly that as the industry has aged, so has its appetite for larger funds, from which it invests larger amounts of money into later-stage companies. Upon careful reflection, that change presents no great surprise. As the venture capital industrys success stories gathered media attention, it was able to raise larger funds, requiring fewer, larger investments for more lucrative and manageable portfolios. And the industry tended to concentrate its work closer to the centers for research and entrepreneurship: the San Francisco Bay Area, Bostons Route 128, North Carolinas Research Triangle, and Seattle. Institutional venture capital, as measured by the Money Tree, the most commonly used reference, has now nearly abandoned the start-upseed-capital stage of investing, placing only 2 percent or 3 percent of its capital in such firms. In fact, roughly 80 percent of all venture capital is invested in expansion and later-stage companies.1 The average-size venture capital fund has nearly tripled to more than $200 million of capital under management (thats other peoples capital), exacting more efficiency in its investing practices, translating into later-stage, larger deals that are geographically concentrated. So, while the venture capital industrys trend lines are perfectly logical, the consequence for that portion of the nation that has come to be known as fly-over states is a brain drain, a loss of prospective high-growth entrepreneurial companies, and an array of economic challenges. Just as U.S. Supreme Court Justice Louis Brandeis nearly a century ago envisioned state legislatures as laboratories of democracy, willing to tackle new and innovative approaches in meeting the needs of the citizenry, once again the states are obliged to step to the plate, launching a variety of ideas for making equity capital available for their entrepreneurs. Economic development, job creation, and retention of talent are most frequently cited as reasons for the state to get involved. And after more than a decade of experience with

Annual reports of 1995 and 2005 of the PricewaterhouseCoopers, National Venture Capital Association, Thomson Financial survey of institutional venture capital investments.

FEDERAL RESERVE BANK OF SAN FRANCISCO

38

Community Development INVESTMENT REVIEW

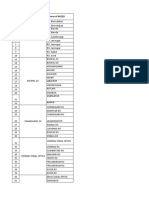

1995 Venture Capital Investment by Stage

2005 Venture Capital Investment by Stage Startup/Seed

Later Stage Early Stage Startup/Seed Expansion Early Stage Expansion Later Stage

such programs, many states have come to recognize that it is appropriate, even desirable, to include a profit motive, that is, to treat the states investment, whether it be direct or by tax credit, in a manner similar to how venture capitalists treat their limited partners. Connecticut often is credited with launching the first initiative, then called the Connecticut Product Development Corporation, a program by which entrepreneurs with compelling ideas could obtain state equity capital investments to create a company. It proved to be a success, and eventually was copied and massaged by other states that found themselves challenged to retain their more capable entrepreneurs. During the past few months, the National Association of Seed and Venture Funds (NASVF) conducted a study to get a picture of what state governments are doing today to promote or create equity capital. Our researchers uncovered more than 150 programs in 45 states with a combined $5.8 billion in committed capital. Such programs are scattered through the bureaucracies of state governmentsgovernors offices, treasury departments, departments of economic development, state pension systems, and special objectives funds, such as clean energy. Most target early-stage investments in companies aligned with the states priorities (job creation, for example). Only about 40 percent of the programs, however, provide the state with an equity position for its investments. Many funds are restrained by constitutional prohibitions. Additionally, state universities, particularly those with research programs, have increasingly recognized an economic-development responsibility to their states and have created programs to assist both the transfer of technologies and the creation of businesses. State involvement in creating equity capital to finance entrepreneurial businesses continues on an evolutionary path as state legislators look for more effective ways to retain their entrepreneurial talent. As such, the process commands continued scrutiny to identify and share best practices.

FEDERAL RESERVE BANK OF SAN FRANCISCO

Community Development INVESTMENT REVIEW

39

Among the more promising approaches is a program originally launched in Oklahoma in the mid-1990s. The program, frequently called a fund of funds, uses contingent tax credits to raise funds that are, in turn, invested in established venture capital firms willing to evaluate and invest in potential Oklahoma growth companies. Variations of the model have also been established in Arkansas, Iowa, Oregon, Ohio, South Carolina, and Michigan. NASVFs study also illuminated what we do not know about state involvement in equity capital formation. States often showcase anecdotal data about successful and failed programs. And just as radio stations are wont to claim, Were number one, so also do states like to pronounce their claims of success. Responses to the NASVF survey suggest that a more detailed examination of programs would be valuable in determining what really works well in creating economic benefits from state-sponsored equity-investment programs. In fact, a more critical analysis could provide vital information for state policymakers, particularly in the fly-over states, as to what works and what does not. Taxpayers as well as entrepreneurs would welcome more clarity. One of the more revealing responses to the NASVF survey is that many of the states operating equity capital programs do not consider return-on-investment a priority for the state. Most look to job creation or other economic-development measures as their metric.

Lessons Learned

States tried many experiments to increase capital access in recent years and have learned much from both the failures and the successes. What has become clear is that initiatives of government support and policy direction combined with private-sector market discipline appear to offer an effective formula for creating equity capital for local entrepreneurs. Government as the direct investor engendered a poor track record. State officials are rarely in a position to make disciplined business investment decisions. The reward system in a bureaucracy punishes risk-taking, a critical factor in early-stage investing. State direct-investment programs are also challenged to fit an investment manager into their pay-classification programs. However, relying exclusively on the private sector to meet the changing needs of todays entrepreneur leaves many states watching and waiting while other regions jump ahead. Based on our research of all the state-sponsored venture capital funds, we have identified nine key themes that are necessary for success. Consider the following: Demonstrate Leadership In the best programs, state leaders take the initiative in getting a program launched, and they help set a long-term direction. In Iowa, for instance, a coalition of the Iowa Bankers Association, the Greater Des Moines Partnership, the Iowa Taxpayers Association, and others organized a statewide campaign to establish a fund of funds venture capital program. It is supported by contingent state tax credits and successfully attracts out-of-state institutional venture capital to the Hawkeye State. The contingent tax-credit approach to creating statesponsored venture capital, first developed in Oklahoma, is also being tried in Arkansas, South

FEDERAL RESERVE BANK OF SAN FRANCISCO

40

Community Development INVESTMENT REVIEW

Carolina, Oregon, and several other rural states. It relies on experienced, private managers to make day-to-day investment decisions. States must be actively involved in selecting managers, using rigorous standards common in the venture capital industry, and then regularly monitoring the progress and performance of the managers over time. Promoting Knowledge Is as Important as Providing Capital The best programs recognize that the challenge of capital formation is not so much about money as it is about knowledgehow the business community understands seed and venture capital, the steps involved, the dos and donts, and what it looks like and feels like to build a world-class company. Creating visible access to an abundant source of capital is just one key to supporting the growth of this culture and helping young people develop the courage to venture. In every state, someone is doing good work in this arena. State leaders should take care to build on this existing momentum. Insist on a Long-Term Perspective Making good investments takes a lot of time, and building an industry that is prepared to make and manage these investments takes even longer. The state should expect no measurable impact for at least five years and should do nothing that would compromise the integrity of the investment process. Many states have taken shortcuts, only to be embarrassed. A fund must take all the time needed to find the right people, and all the time needed to make the right investments. The good deals are there. Be Financially Fair The best programs treat the state as a valued financial partner. When states commit capital, or support programs with tax incentives, or bear risk in any way, they should be compensated for this financial commitment with an opportunity for financial returns commensurate with the risk they take. This may seem counterintuitive, but in this form of economic development, when capital or tax credits are simply given away, the integrity of the program gets compromised and the results become disappointing. Do Not Be Afraid to Make Money The best programs focus on access to capital, not cost of capital, and adopt the philosophy that the most effective economic development is produced by those firms that are growing rapidly and are profitable. These are good investments, the type that disciplined investors want to find. Do Not Oversell the Program, and Be Mindful of Competing Interests Policymakers must recognize that the varied expectations of stakeholders and customers may be at odds. The business customers may expect that state-sponsored funds will be a source of low-cost money; the investment community may see them as a competitor; and economic development organizations will expect them to create jobs quickly. There is no way that any program can satisfy all those expectations at once.

FEDERAL RESERVE BANK OF SAN FRANCISCO

Community Development INVESTMENT REVIEW

41

Be Big to Be Effective The best programs are large enough to make a difference. Big funds and little funds all require the same processes and, ultimately, the same amount of work (little funds often take more work). Creating a substantial, visible source of seed and venture capital will help generate a willingness on the part of would-be entrepreneurs to take the plunge. This is not to say that a large program must deploy its capital within a fixed time frame. Build In a System of Evaluation The best programs build in achievable outcome measures from the beginning. Keep track of program results and evolve as conditions change. Be Flexible Finally, the best programs are governed not by encoded rules but by the exercise of discretion by trained professionals and experienced laymen. Statutory programs often get packed with details and constraints, to the point that the best investment managers will want nothing to do with them. Quality programs are built on carefully selected, quality people. Do everything possible to get capable professionals on board from the very start.

On the Wings of Angels

Too important to ignore is another relatively recent development regarding state government involvement in creating equity capital for entrepreneursthe rapid growth in the creation of angel investing groups. Angel investors have gone from being isolated individuals to well-organized teams of investors. Many states are using tax credits to encourage the formation of angel investment groups, which now number more than 200. For more detail on this phenomenon, see the article by Steve Mercil in this issue of the Review. Angel groups are important for two reasons. By their very existence, more equity capital becomes available to more worthy entrepreneurs. And greater public awareness sends a message to worthy entrepreneurs that the opportunity to fund their enterprises exists locally. While angel group activity is highly encouraging, it is too recent a phenomenon to provide measured results. But clearly there is economic benefit for angels, working in teams, to offer more in-depth analysis regarding the potential of a business plan, as well as to mentor the entrepreneur in executing it. The shared responsibility for due diligence and mentoring reduces the burden and increases the prospects for creating successful new companies. Angel investing is extremely important in aggregating capital for entrepreneurs. The Center for Venture Research at the University of New Hampshire estimates that angels provide more equity capital for entrepreneurs than institutional venture capital. State tax credit involvement offers a relatively small risk for taxpayers in exchange for more visibility for both entrepreneurs and investors.2

Jeffrey Sohl, The Angel Investor Market in 2005, Center for Venture Research, University of New Hampshire, March 2006.

FEDERAL RESERVE BANK OF SAN FRANCISCO

42

Community Development INVESTMENT REVIEW

Creating or encouraging the creation of equity capital for entrepreneurs is a challenge for state governments, especially for rural states that have experienced an out-migration of people, jobs, and capital. The blend of state sponsorship, market discipline, and a growing albeit inchoateculture of entrepreneurship appears to be a winning combination to develop businesses in rural communities. George Lipper is editor of NASVF Net News, the popular weekly newsletter of the National Association of Seed and Venture Funds. Net News is a free weekly electronic newsletter aggregating current stories dealing with capital formation, seed and early stage venture and angel investing, technology transfer and other subjects related to technology-based entrepreneurial activity. He is a former broadcast journalist. Lipper worked at radio and television stations in Texas, Michigan, Iowa and Illinois. He has been involved in both civic and political activities and currently resides in Las Vegas.

FEDERAL RESERVE BANK OF SAN FRANCISCO

Вам также может понравиться

- Growing New Businesses S V C:: With Eed and Enture ApitalДокумент51 страницаGrowing New Businesses S V C:: With Eed and Enture Apitalboilerup07Оценок пока нет

- Minneapolis Saint Paul: Regional Entrepreneurship Action PlanДокумент8 страницMinneapolis Saint Paul: Regional Entrepreneurship Action PlanEdward BryantОценок пока нет

- N E G S E: Urturing Ntrepreneurial Rowth IN Tate ConomiesДокумент23 страницыN E G S E: Urturing Ntrepreneurial Rowth IN Tate ConomiesfadligmailОценок пока нет

- USA's Dominant Startup Ecosystem Fueled by Venture Capital, Incubators and Government SupportДокумент9 страницUSA's Dominant Startup Ecosystem Fueled by Venture Capital, Incubators and Government SupportCac SiguerОценок пока нет

- REAP Executive Summary - New YorkДокумент7 страницREAP Executive Summary - New YorkEdward BryantОценок пока нет

- VC and Economic GrowthДокумент40 страницVC and Economic GrowthMario TodorovОценок пока нет

- Surveying The Financing of The Social Economy: Demand, Supply Ad GapsДокумент8 страницSurveying The Financing of The Social Economy: Demand, Supply Ad GapsStephen MooreОценок пока нет

- Leveraging Private Equity With Government Business Incentive Programs The FollowingДокумент5 страницLeveraging Private Equity With Government Business Incentive Programs The FollowingleonnoxОценок пока нет

- Government Incentives For EntrepreneurshipДокумент3 страницыGovernment Incentives For EntrepreneurshipCato InstituteОценок пока нет

- Solving Unemployment: by Dina ShalabДокумент7 страницSolving Unemployment: by Dina ShalabDina ShalabОценок пока нет

- Entrepreneurship Skills AssignmentДокумент12 страницEntrepreneurship Skills AssignmentOgutuEricJeanОценок пока нет

- Strengthening State Economic Development Systems: A Framework For ChangeДокумент10 страницStrengthening State Economic Development Systems: A Framework For ChangeMarco RamirezОценок пока нет

- Economic Capital 2 Venture Capital, Entrepreneurshipm and Economic GrowthДокумент12 страницEconomic Capital 2 Venture Capital, Entrepreneurshipm and Economic GrowthAxel William SetiawanОценок пока нет

- Proposed Ecosystem Model For Economic Development IAДокумент38 страницProposed Ecosystem Model For Economic Development IAAshley WhiteОценок пока нет

- Development BankingДокумент7 страницDevelopment BankingBenjamin KimaniОценок пока нет

- Enterprising States 2012 WebДокумент90 страницEnterprising States 2012 WebDavid LombardoОценок пока нет

- Entrepreneurship Policy Digest June 2014Документ2 страницыEntrepreneurship Policy Digest June 2014zkОценок пока нет

- Enterprising States 2011Документ135 страницEnterprising States 2011U.S. Chamber of CommerceОценок пока нет

- The Journal of Finance - 2023 - DENESДокумент71 страницаThe Journal of Finance - 2023 - DENESMary Avila CaroОценок пока нет

- Thesis On Debt FinancingДокумент8 страницThesis On Debt Financingheidimaestassaltlakecity100% (2)

- Johansson BBR 2012Документ6 страницJohansson BBR 2012Anonymous Feglbx5Оценок пока нет

- Family Office ReportДокумент64 страницыFamily Office Reportconfidentialgent100% (1)

- DrivingGrowth WEBДокумент357 страницDrivingGrowth WEBKal ChakalakondaОценок пока нет

- Washington Innovation Partnership Zones - 2012 CSG Innovations Award WinnerДокумент4 страницыWashington Innovation Partnership Zones - 2012 CSG Innovations Award Winnerbvoit1895Оценок пока нет

- Setting Up Accounts Receivable Policies For Business in CanadaДокумент24 страницыSetting Up Accounts Receivable Policies For Business in CanadaasdefenceОценок пока нет

- Report On The Competitiveness: of Puerto Rico'S EconomyДокумент40 страницReport On The Competitiveness: of Puerto Rico'S Economypetere056Оценок пока нет

- Research Paper On Finance in PakistanДокумент6 страницResearch Paper On Finance in Pakistanfvf6r3ar100% (1)

- Literature Review On Financial DeepeningДокумент5 страницLiterature Review On Financial Deepeningafmzadevfeeeat100% (2)

- Trevor Loy Testimony 9-23-09Документ16 страницTrevor Loy Testimony 9-23-09debgageОценок пока нет

- Global Entrepreneurship Week Policy Survey 2013Документ42 страницыGlobal Entrepreneurship Week Policy Survey 2013The Ewing Marion Kauffman FoundationОценок пока нет

- Finance Term Paper IdeasДокумент8 страницFinance Term Paper Ideasc5q1thnj100% (1)

- Conjoined Wealth FundsДокумент16 страницConjoined Wealth FundsJames Felton KeithОценок пока нет

- Nontraditional Venture Capital Institutions: Filling A Financial Market GapДокумент12 страницNontraditional Venture Capital Institutions: Filling A Financial Market GapallfinОценок пока нет

- Research Paper Government AccountingДокумент8 страницResearch Paper Government Accountingfzhw508n100% (1)

- New Donor Partnerships to Support Women EntrepreneursДокумент29 страницNew Donor Partnerships to Support Women EntrepreneursInfoОценок пока нет

- Entrepreneurship in Developing Countries PDFДокумент10 страницEntrepreneurship in Developing Countries PDFSorenaRadОценок пока нет

- Funding For Social Enterprise & NonprofitsДокумент37 страницFunding For Social Enterprise & NonprofitsJeff GrossbergОценок пока нет

- Corporate Financialization and Worker Prosperity: A Broken LinkДокумент22 страницыCorporate Financialization and Worker Prosperity: A Broken LinkRoosevelt Institute100% (4)

- Tunrayo 1-3Документ34 страницыTunrayo 1-3Ibrahim AlabiОценок пока нет

- Effect of Private Equity on Economic Growth in Unaitas Savings and Credit CoДокумент4 страницыEffect of Private Equity on Economic Growth in Unaitas Savings and Credit CoVICTOR MATITIОценок пока нет

- Minorities VC ReportДокумент16 страницMinorities VC Report48powersОценок пока нет

- Topics For Term Paper in Public FinanceДокумент7 страницTopics For Term Paper in Public Financeaflsmperk100% (1)

- Venture Financing in India PDFДокумент12 страницVenture Financing in India PDFChandni Makhijani100% (1)

- Contemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaДокумент5 страницContemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaJERRALYN ALVAОценок пока нет

- Growing Local Economies Through EntrepreneurshipДокумент5 страницGrowing Local Economies Through EntrepreneurshipconawayhaskinsОценок пока нет

- Unit 3: New Venture Planning: Startup Long-Term GrowthДокумент14 страницUnit 3: New Venture Planning: Startup Long-Term GrowthSam SharmaОценок пока нет

- Privatization of Public Enterprises and Its Implication On Economic Policy and DevelopmentДокумент10 страницPrivatization of Public Enterprises and Its Implication On Economic Policy and DevelopmentIPROJECCTОценок пока нет

- 07 Chapter 1Документ37 страниц07 Chapter 1bjoshna0% (1)

- Venture Capital in IndiaДокумент32 страницыVenture Capital in IndiasumancallsОценок пока нет

- Finance and Fiscal Policy For DevelopmentДокумент7 страницFinance and Fiscal Policy For DevelopmentLouise Phillip Labing-isaОценок пока нет

- Entrepreneurship ScenarioДокумент4 страницыEntrepreneurship ScenarioPepper StarkОценок пока нет

- Financial Literature ReviewДокумент5 страницFinancial Literature Reviewmpymspvkg100% (1)

- Law, Finance, and Firm Growth: Asli Demirgüç-Kunt and Vojislav MaksimovicДокумент31 страницаLaw, Finance, and Firm Growth: Asli Demirgüç-Kunt and Vojislav MaksimovicYumi Sri AndriatiОценок пока нет

- C.D. Howe Shadow Budget 2015Документ28 страницC.D. Howe Shadow Budget 2015ishmael daroОценок пока нет

- The Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsОт EverandThe Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsОценок пока нет

- Economic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsОт EverandEconomic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsОценок пока нет

- EIB Working Papers 2019/10 - Structural and cyclical determinants of access to finance: Evidence from EgyptОт EverandEIB Working Papers 2019/10 - Structural and cyclical determinants of access to finance: Evidence from EgyptОценок пока нет

- Summary of Makers and Takers: by Rana Foroohar | Includes AnalysisОт EverandSummary of Makers and Takers: by Rana Foroohar | Includes AnalysisОценок пока нет

- High Tech Start Up, Revised And Updated: The Complete Handbook For Creating Successful New High Tech CompaniesОт EverandHigh Tech Start Up, Revised And Updated: The Complete Handbook For Creating Successful New High Tech CompaniesРейтинг: 4 из 5 звезд4/5 (31)

- MYДокумент1 страницаMYeducasadoОценок пока нет

- Extraterrestrial Life - Aryeh KaplanДокумент5 страницExtraterrestrial Life - Aryeh Kaplan56ukdbn7fo100% (2)

- Fundamental Analysis as a Traditional Austrian ApproachДокумент16 страницFundamental Analysis as a Traditional Austrian ApproacheducasadoОценок пока нет

- Hello World Is A Test Program Hello World Is A Test ProgramДокумент1 страницаHello World Is A Test Program Hello World Is A Test ProgrameducasadoОценок пока нет

- Sample RepresentationДокумент6 страницSample RepresentationeducasadoОценок пока нет

- Latex BibleДокумент2 страницыLatex BibleLesPam Brenes100% (1)

- 01stable Matching 2x2Документ10 страниц01stable Matching 2x2Pintu DasОценок пока нет

- Trig Cheat SheetДокумент4 страницыTrig Cheat Sheetapi-284574585Оценок пока нет

- The Kite Runner E-BookДокумент374 страницыThe Kite Runner E-BookAsri Sudarmiyanti100% (4)

- The Effect of Strategic Planning On Organisation ProductivityДокумент19 страницThe Effect of Strategic Planning On Organisation ProductivityAdeyemo Adetoye100% (3)

- Gensoc Module BodyДокумент164 страницыGensoc Module BodyMaga-ao CharlesОценок пока нет

- Law, Politics and Society - Course OutlineДокумент7 страницLaw, Politics and Society - Course OutlineKiryuu KanameОценок пока нет

- PUP Ultimate Frisbee IntramuralsДокумент6 страницPUP Ultimate Frisbee IntramuralsSecret SecretОценок пока нет

- 2011 Great House Tour PamphletДокумент16 страниц2011 Great House Tour Pamphletadmin843Оценок пока нет

- SPOC ListДокумент12 страницSPOC ListNitish YadavОценок пока нет

- Types of Business Ownership ExplainedДокумент27 страницTypes of Business Ownership Explainedmaria cacaoОценок пока нет

- Sa Pula, Sa Puti by Francisco RodrigoДокумент5 страницSa Pula, Sa Puti by Francisco Rodrigoandres corpuzОценок пока нет

- Making Big Impacts With Small Acts: SolarMyPlace Launches This Black FridayДокумент3 страницыMaking Big Impacts With Small Acts: SolarMyPlace Launches This Black FridayPR.comОценок пока нет

- EU and NAFTA trade overviewДокумент38 страницEU and NAFTA trade overviewAyushi GuptaОценок пока нет

- Mcdonalds Corporation: Mariano Marcos State University College of Business, Economics and Accountancy Batac, Ilocos NorteДокумент16 страницMcdonalds Corporation: Mariano Marcos State University College of Business, Economics and Accountancy Batac, Ilocos NorteChristian Jay S. de la CruzОценок пока нет

- 1 ChroniclesДокумент166 страниц1 ChroniclesAlex IordanОценок пока нет

- Lesson 1 - Defining Key TermsДокумент44 страницыLesson 1 - Defining Key TermsTeacher FloОценок пока нет

- Under The Law Episode 3 To 5 Cases Final Last 5Документ35 страницUnder The Law Episode 3 To 5 Cases Final Last 5Mox HyОценок пока нет

- Complaint Against Hazel Paragua Final DraftДокумент26 страницComplaint Against Hazel Paragua Final DraftChin ConsueloОценок пока нет

- Scholars Challenge Jared Diamond's Views on Why Societies CollapseДокумент4 страницыScholars Challenge Jared Diamond's Views on Why Societies CollapseBüşra Özlem YağanОценок пока нет

- Applications of Positive PsychologyДокумент7 страницApplications of Positive PsychologySarah SmithОценок пока нет

- School uniforms promote disciplineДокумент3 страницыSchool uniforms promote disciplineArista DewiОценок пока нет

- Office Name Office Status Pincode Telephone No. Taluk (The Information Is Sorted District and Taluk Wise)Документ86 страницOffice Name Office Status Pincode Telephone No. Taluk (The Information Is Sorted District and Taluk Wise)Rishi WadhwaniОценок пока нет

- Counseling and Psychotherapy Theories and Interventions 6th Edition Ebook PDFДокумент28 страницCounseling and Psychotherapy Theories and Interventions 6th Edition Ebook PDFmargaret.hernandez8120% (1)

- CHUYÊN ĐỀ 14 liên từДокумент15 страницCHUYÊN ĐỀ 14 liên từHạnhhОценок пока нет

- Company Profile Axle Asia 17 Jan 2012Документ21 страницаCompany Profile Axle Asia 17 Jan 2012Donny WinardiОценок пока нет

- Na IstamДокумент1 страницаNa IstamVijay THALAPATHYОценок пока нет

- Accounting for Receivables, Freight Charges, and Sales DiscountsДокумент2 страницыAccounting for Receivables, Freight Charges, and Sales DiscountsJEFFERSON CUTEОценок пока нет

- Conflict Management in Nigerian Construction IndustryДокумент40 страницConflict Management in Nigerian Construction IndustryO. O100% (1)

- Types: Lia: Poem Sad I AmsДокумент8 страницTypes: Lia: Poem Sad I AmsLilian AmbinОценок пока нет

- Bucharest Otopeni (LROP) Procedures: QNH TA TRL 994 995 - 1012 1013 - 1031 1032Документ2 страницыBucharest Otopeni (LROP) Procedures: QNH TA TRL 994 995 - 1012 1013 - 1031 1032Armağan B.Оценок пока нет

- Vodafone HutchДокумент12 страницVodafone Hutchkushalnadekar0% (1)

- Caretaker AgreementДокумент2 страницыCaretaker AgreementWenceslao MagallanesОценок пока нет