Академический Документы

Профессиональный Документы

Культура Документы

B@NK

Загружено:

Anushka TamtaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

B@NK

Загружено:

Anushka TamtaАвторское право:

Доступные форматы

Jan 24, 2012 Third Quarter Review of Monetary Policy for 2011-12

Dec 16, 2011 Mid-Quarter Review of Monetary Policy for 2011-12

Oct 28, 2011 Second Quarter Review of Statement on Monetary Policy for the Year 2011-12 Edited Transcript of Post-Policy Conference Call with Researchers/Analysts Oct 26, 2011 Second Quarter Review of Statement on Monetary Policy for the Year 2011-12 Audio recording of Governors Post-Policy teleconference with Researchers and Analysts Edited Transcript of Governor's Post Policy Press Conference Oct 25, 2011 Second Quarter Review of Statement on Monetary Policy for the Year 2011-12

Statement by Dr. D. Subbarao, Governor, Reserve Bank of India on the Second Quarter Review of Monetary Policy for the Year 2011-12 Governor's Press Statement Full Document

Webcasting of Governor's Press Conference Audio recording of Governor's Press Conference Oct 24, 2011 Macroeconomic and Monetary Developments - Second Quarter Review 2011-12

Macroeconomic and Monetary Developments - Second Quarter Review 2011-12 Press Release Full Document

Sep 16, 2011

Mid-Quarter Monetary Policy Review: September 2011 Press Release Aug 02, 2011 First Quarter Review of Statement on Monetary Policy for the Year 2011-12 Edited Transcript of Teleconference with Researchers and Analysts Jul 29, 2011 First Quarter Review of Statement on Monetary Policy for the Year 2011-12 Transcript of Governor's Post Policy Press Conference Jul 27, 2011 First Quarter Review of Statement on Monetary Policy for the Year 2011-12 Audio recording of Governors Post-Policy teleconference with Researchers and Analysts Jul 26, 2011 First Quarter Review of Statement on Monetary Policy for the Year 2011-12

Statement by Dr. D. Subbarao, Governor, Reserve Bank of India on the First Quarter Review of Monetary Policy for the Year 2011-12 Governor's Press Statement Full Document

Webcasting of Governor's Press Conference Audio recording of Governor's Press Conference Jul 25, 2011 Macroeconomic and Monetary Developments - First Quarter Review 2011-12

Macroeconomic and Monetary Developments - First Quarter Review 2011-12 Press Release Full Document

Jun 16, 2011 Mid-Quarter Monetary Policy Review: June 2011

Press Release May 07, 2011 Annual Policy Statement for the Year 2011-12 Edited Transcript of Post-Policy Conference Call with Researchers/Analysts May 04, 2011 Annual Policy Statement for the Year 2011-12 Edited transcript of Governor's Post Policy Press Conference Audio recording of Governors Post-Policy teleconference with Researchers and Analysts May 03, 2011 Annual Policy Statement for the Year 2011-12

RBI Governor announces Annual Policy Statement for the year 2011-12 Governor's Press Statement Full Document

Webcasting of Governor's Press Conference Audio recording of Governor's Press Conference May 02, 2011 Macroeconomic and Monetary Developments in 2010-11

Repo Rate 59. It has been decided to:

increase the repo rate under the liquidity adjustment facility (LAF) by 50 basis points from 6.75 per cent to 7.25 per cent with immediate effect.

Reverse Repo Rate 60. The reverse repo rate under the LAF, determined with a spread of 100 basis point below the repo rate, automatically adjusts to 6.25 per cent with immediate effect. Marginal Standing Facility (MSF) Rate 61. The Marginal Standing Facility (MSF) rate, determined with a spread of 100 basis points above the repo rate, stands calibrated at 8.25 per cent. This rate will come into effect on operationalisation of the MSF. Bank Rate 62. The Bank Rate has been retained at 6.0 per cent. Cash Reserve Ratio 63. The cash reserve ratio (CRR) of scheduled banks has been retained at 6.0 per cent of their NDTL. Savings Bank Deposit Interest Rate 64. As indicated in the Second Quarter Review of Monetary Policy 2010-11, the discussion paper delineating the pros and cons of deregulating the savings bank deposit interest rate was placed on the Reserve Banks website on April 28, 2011 for feedback from the general public. 65. In the recent period, the spread between the savings deposit and term deposit rates has widened significantly. Therefore, pending a final decision on the issue of deregulation of savings bank deposit interest rate, it has been decided to :

increase the savings bank deposit interest rate from the present 3.5 per cent to 4.0 per cent with immediate effect.

66. Detailed instructions in this regard to banks are being issued separately.

table of Content Previous Solved Papers, 2010 Previous Solved Papers, 2009 Test of Reasoning Ability (Verbal) Test of Reasoning Ability (Non-Verbal) Test of Numerical Ability Test of Clerical Aptitude Test of English Language Descriptive English

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Levacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesДокумент14 страницLevacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesAlvaro MedinaОценок пока нет

- © 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenДокумент62 страницы© 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenHIỀN LÊ THỊОценок пока нет

- Business Plan SampleДокумент14 страницBusiness Plan SampleGwyneth MuegaОценок пока нет

- MBBcurrent 564548147990 2022-12-31 PDFДокумент10 страницMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinОценок пока нет

- Nike Pestle AnalysisДокумент10 страницNike Pestle AnalysisAchal GoyalОценок пока нет

- DSE at A GlanceДокумент27 страницDSE at A GlanceMahbubul HaqueОценок пока нет

- Percentage and Its ApplicationsДокумент6 страницPercentage and Its ApplicationsSahil KalaОценок пока нет

- Aus Tin 20105575Документ120 страницAus Tin 20105575beawinkОценок пока нет

- Monsoon 2023 Registration NoticeДокумент2 страницыMonsoon 2023 Registration NoticeAbhinav AbhiОценок пока нет

- Global Supply Chain Planning at IKEA: ArticleДокумент15 страницGlobal Supply Chain Planning at IKEA: ArticleyashОценок пока нет

- Asiawide Franchise Consultant (AFC)Документ8 страницAsiawide Franchise Consultant (AFC)strawberryktОценок пока нет

- Calander of Events 18 3 2020-21Документ67 страницCalander of Events 18 3 2020-21Ekta Tractor Agency KhetasaraiОценок пока нет

- Dog and Cat Food Packaging in ColombiaДокумент4 страницыDog and Cat Food Packaging in ColombiaCamilo CahuanaОценок пока нет

- Democratic Developmental StateДокумент4 страницыDemocratic Developmental StateAndres OlayaОценок пока нет

- GST Rate-: Type of Vehicle GST Rate Compensation Cess Total Tax PayableДокумент3 страницыGST Rate-: Type of Vehicle GST Rate Compensation Cess Total Tax PayableAryanОценок пока нет

- EOQ HomeworkДокумент4 страницыEOQ HomeworkCésar Vázquez ArzateОценок пока нет

- Factors Affecting SME'sДокумент63 страницыFactors Affecting SME'sMubeen Shaikh50% (2)

- Project ReportДокумент110 страницProject ReportAlaji Bah CireОценок пока нет

- JДокумент2 страницыJDMDace Mae BantilanОценок пока нет

- Use CaseДокумент4 страницыUse CasemeriiОценок пока нет

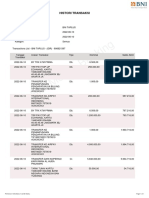

- BNI Mobile Banking: Histori TransaksiДокумент1 страницаBNI Mobile Banking: Histori TransaksiWebi SuprayogiОценок пока нет

- QQy 5 N OKBej DP 2 U 8 MДокумент4 страницыQQy 5 N OKBej DP 2 U 8 MAaditi yadavОценок пока нет

- Final - APP Project Report Script 2017Документ9 страницFinal - APP Project Report Script 2017Jhe LoОценок пока нет

- Ifland Engineers, Inc.-Civil Engineers - RedactedДокумент18 страницIfland Engineers, Inc.-Civil Engineers - RedactedL. A. PatersonОценок пока нет

- Accounting CycleДокумент6 страницAccounting CycleElla Acosta0% (1)

- Fabozzi Ch13 BMAS 7thedДокумент36 страницFabozzi Ch13 BMAS 7thedAvinash KumarОценок пока нет

- Strategic Planning For The Oil and Gas IДокумент17 страницStrategic Planning For The Oil and Gas ISR Rao50% (2)

- BAIN REPORT Global Private Equity Report 2017Документ76 страницBAIN REPORT Global Private Equity Report 2017baashii4Оценок пока нет

- India of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andДокумент2 страницыIndia of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDITSAОценок пока нет

- Kennedy 11 Day Pre GeneralДокумент16 страницKennedy 11 Day Pre GeneralRiverheadLOCALОценок пока нет