Академический Документы

Профессиональный Документы

Культура Документы

JK Cement (JKCEME) : Realisation Gain Leads To Spurt in Earnings

Загружено:

Ritesh GvalaniИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

JK Cement (JKCEME) : Realisation Gain Leads To Spurt in Earnings

Загружено:

Ritesh GvalaniАвторское право:

Доступные форматы

ICICI Securities Limited

Result Update

August 2, 2011

Rating matrix

Rating Target Target Period Potential Upside : : : : Hold | 123 12 months 9%

JK Cement (JKCEME)

| 113

WHATS CHANGED

PRICE TARGET....................................................................................................Unchanged

FY12E 2315.3 351.0 15.2 83.5 11.9 FY13E 2697.4 411.7 15.3 108.6 15.5

Key Financials

FY10 Net Sales EBITDA EBITDA Margin (%) Net Profit EPS (|) 1826.7 439.1 24.0 225.7 32.3 FY11 2080.8 264.2 12.7 64.1 9.2

EPS (FY12E)......................................................................... Changed from | 10.2 to | 11.9 EPS (FY13E)......................................................................... Changed from | 11.3 to | 15.5 RATING....................................................................................... Changed from Buy to Hold

Realisation gain leads to spurt in earnings

JK Cements Q1FY12 net sales of | 605 crore and net profit of | 49.9 crore were ahead of our respective estimates of | 564 crore and | 22 crore. This was on account of higher-than-expected blended realisation, which increased ~10% YoY (~5% QoQ) to | 4273/tonne against our estimate of | 3930/tonne. Blended EBITDA improved ~36% YoY (~30% QoQ) to | 908/tonne (our estimate: | 625/tonne) due to a significant rise in realisation. Grey cement volumes remained muted in Q1FY12 as it increased ~4% YoY and declined ~13% QoQ. Going forward, we expect the blended sales volume to increase ~6% YoY in FY12E and ~11% YoY in FY13E. Also, the company is setting up a 3.5 MT brownfield expansion at Mangrol, Rajasthan, which would take the companys grey cement capacity to 11 MTPA by FY14E. Blended cement volume up ~5% YoY, realisation up ~10% YoY Grey cement sales volumes increased ~4% YoY to 1.33 MT but declined ~13% QoQ. Grey cement realisation improved ~8% YoY (~5% QoQ) to | 3650/tonne due to significant price hikes across its markets during March-April 2011. White cement sales volume increased ~26% YoY (declined ~17% QoQ) to 0.09 lakh tonnes while white cement realisation improved ~6% YoY (~9% QoQ). Blended EBITDA improves ~36% YoY (~30% QoQ) to | 908/tonne The blended EBITDA has improved significantly by ~36% YoY (~30% QoQ) to | 908/tonne on the back of a sharp increase in realisations. Thus, the OPM has improved by 404 bps YoY (398 bps QoQ) to 21.3%.

Valuation summary

FY10 PE (x) Target PE (x) EV to EBITDA (x) EV/Tonne(US$) Price to book (x) RoNW (%) RoCE (%) 3.5 3.8 3.9 55 0.6 16.7 14.6 FY11 12.3 13.5 6.8 49 0.6 4.7 5.8 FY12E 9.5 10.3 5.8 51 0.6 5.9 7.3 FY13E 7.3 7.9 6.3 57 0.5 7.4 6.7

Stock data

Mcap Debt (FY11) Cash & Invest (FY11) EV 52 week H/L Equity cap Face value MF Holding(%) FII Holding(%) | 790 crore | 1254 crore | 236 crore | 1808 crore | 199 / 101 | 69.9 crore | 10 7.0 12.8

Price movement

200 150 100 50 0 Sep-10 Jan-11 May-11 Jul-10 Mar-11 Nov-10 Jul-11 7500 6000 4500 3000 1500 0

Valuation

At the CMP of | 113, the stock is trading at 9.5x and 7.3x its FY12E and FY13E earnings, respectively. The stock is trading at an EV/EBITDA of 5.8x and 6.3x FY12E and FY13E EBITDA, respectively. On an EV/tonne basis, the stock is trading at $51 and $57 its FY12E and FY13E capacities, respectively. We have valued the stock at $75/tonne (~40% discount to the replacement cost) at its FY13E blended capacity of 7.5 MT. We have assigned a HOLD rating to the stock with a target price of | 123/share.

Exhibit 1: Financial Performance

(| Crore) Net Sales EBITDA EBITDA Margin (%) Depreciation Interest Other Income Reported PAT EPS (|) Q1FY12 605.5 128.7 21.3 30.5 28.1 3.7 49.9 7.1 Q1FY12E 563.9 89.7 15.9 31.1 31.0 6.0 22.5 3.2 Q1FY11 521.8 89.8 17.2 27.0 22.9 4.2 29.4 4.2 Q4FY11 666.1 115.1 17.3 31.0 29.4 13.4 53.6 7.7 QoQ (Chg %) -9.1 11.8 398 bps -1.6 -4.6 -72.1 -6.9 -6.9 YoY (Chg %) 16.0 43.3 404 bps 12.9 22.5 -10.8 69.7 69.7

JKCEME (LHS)

NIFTY (RHS)

Analysts name

Vijay Goel vijay.goel@icicisecurities.com Rashesh Shah rashes.shah@icicisecurities.com Hitesh Taunk hitesh.taunk@icicisecurities.com

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

ICICI Securities Limited

Net sales increase ~16% YoY on better volumes and realisations

Net sales increased ~16% YoY to | 605.5 crore in Q1FY12 on account of an increase in cement sales volumes and realisations. Blended sales volume (grey & white) increased ~5% YoY (declined ~14% QoQ) to 1.42 MT while blended realisation improved ~10% YoY (~5% QoQ) to | 4273/tonne. Grey cement sales increased ~12% YoY to | 485.5 crore as the grey cement volume increased ~4% YoY to 1.33 MT and realisation improved ~8% YoY (~17% QoQ) to | 3650/tonne. Sequentially, the sales from the grey cement business declined ~9% as the ~9% decline in grey cement volume negated the impact of ~5% QoQ increase in grey realisation. In the white cement segment, the company has reported revenues of | 120.0 crore, which increased ~34% YoY aided by ~26% YoY increase in white cement volume to 0.09 MT and ~6% YoY increase in white cement realisation to | 13793/tonne. Sequentially, revenues from the segment declined ~9% on the back of ~17% decline in sales volume.

Exhibit 2: Sales volume and realisation of grey & white cement

Q1FY12 Grey Cement Sales Volume (MT) Realisation (| per tonne) Net Sales (| Cr) White Cement (including wall putty) Sales Volume (MT) Realisation (| per tonne) Net Sales (| Cr) 0.09 13793 120.0 0.07 13014 89.8 26.1 6.0 33.6 0.11 12600 132.3 -17.1 9.5 -9.3 1.33 3650 485.5 1.27 3389 432.0 4.3 7.7 12.4 1.54 3473 533.8 -13.5 5.1 -9.1 Q1FY11 YoY (%) Q4FY11 QoQ (%)

Source: Company, ICICIdirect.com Research

Blended EBITDA/tonne jumps ~36% YoY, ~30% QoQ on higher realisation

The blended EBITDA/tonne increased ~36% YoY (~30% QoQ) to | 908/tonne in Q1FY12 on account of a ~10% YoY (~5% QoQ) increase in blended realisation. The blended total cost/tonne increased ~5% YoY to | 3365/tonne but increased marginally on a QoQ basis. The power & fuel cost increased ~20% YoY and ~33% QoQ to | 1235/tonne on the back of increase in petcoke prices and higher clinker production during the quarter.

Exhibit 3: Per tonne analysis (blended)

The blended realisation has improved ~10% YoY (~5% QoQ) to | 4273/tonne. The total cost has remained almost flat QoQ at | 3365/tonne. The EBITDA/tonne improved significantly ~36% YoY (~30% QoQ) to | 908/tonne

| per tonne Sales Volume (MTPA) Net Realisation Total Expenditure Stock Adj Raw material Power & fuel Freight Employees Others EBITDA per Tonne Q1FY12 1.42 4273 3365 -211 514 1235 794 263 769 908 Q1FY11 1.34 3884 3215 -263 496 1030 918 237 797 668 YoY (%) 5.5 10.0 4.6 NA 3.7 19.9 -13.5 11.0 -3.5 35.9 Q4FY11 1.6 4057 3356 161 479 932 905 217 662 701 QoQ (%) -13.7 5.3 0.3 NA 7.2 32.6 -12.3 21.6 16.2 29.6

Source: Company, ICICIdirect.com Research

Net profit surges ~70% YoY on significant improvement in operating margin

The company has reported ~70% YoY jump in net profit of | 49.9 crore on account of ~404 bps YoY improvement in the operating margin, led by higher realisations.

ICICIdirect.com | Equity Research

Page 2

ICICI Securities Limited

Exhibit 4: Grey cement sales volume and realisation trend

Grey cement sales volumes rose ~4% YoY but declined ~13% QoQ to 1.33 MT in Q1FY12 as against 1.27 MT in Q1FY11 and 1.54 MT in Q4FY11

Million tonnes 12.00 10.00 8.00 6.00 4.00 2.00 0.00 FY12E Q1FY11 Q2FY11 Q3FY11 Q4FY11 Q1FY12 FY13E FY11 1.27 1.13 1.18 1.54 1.33 5.12 5.46 3389 2876 2977 3473 3650 3206 3374 3606 4000 3000 6.09 2000 1000 0 | per tonne

| per tonne

Grey Cement Sales Volume (LHS)

Realisation (RHS)

Source: Company, ICICIdirect.com Research

Exhibit 5: White cement sales volume and realisation trend

12.00 15000 14069 13014 13249 12600 3.32 0.69 Q1FY11 0.71 Q2FY11 0.87 Q3FY11 1.05 0.87 FY12E Q1FY12 FY13E

15.2 12.7 8.0 1.3 Q1FY11 Q2FY11 0.4 Q3FY11 Q4FY11 3.1 Q1FY12 FY11 8.2 3.6

White cement (including wall putty) sales volumes rose ~26% YoY to 0.87 lakh tonne in Q1FY12 as against 0.69 increased ~6% YoY (~9% QoQ) to | 13793/tonne

Lakh tonnes

10.00 8.00 6.00 4.00 2.00 0.00

13793 13209

14000 13654 14000 13000 3.47 3.58 12000 11000

lakh tonne in Q1FY11. White cement realisations

Q4FY11

White Cement Sales Volume (LHS)

FY11

Realisation (RHS)

Source: Company, ICICIdirect.com Research *including wall putty

Exhibit 6: EBITDA margin (%) and PAT margin (%) trend

25.0 20.0 21.3 17.2 11.4 5.6 17.3 15.3

The EBITDA margin has improved by 404 bps YoY and 393 bps QoQ to 21.3% in Q1FY12 as against 17.2% in Q1FY11

%

15.0 10.0 5.0 0.0 -5.0 -10.0 -4.9

and 17.3% in Q4FY11

4.0

FY12E

EBITDA Margin (LHS)

PAT Margin (RHS)

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 3

FY13E

ICICI Securities Limited

Capex plan

The company is increasing its grey cement capacity by 3.5 MTPA through the brownfield expansion at Mangrol, Rajasthan. This is expected to get commissioned by Q3FY14 and would increase the grey cement capacity to 11 MTPA by FY14E. The total capex for the project is ~| 2300 crore, which would be spent over FY12-14E.

Valuations

On account of an improvement in utilisation rates, we expect the blended sales volume to increase ~6% YoY in FY12E to 5.81 MT and ~11% YoY in FY13E to 6.43 MT from 5.45 MT in FY11. We expect grey cement realisation to increase ~5% YoY in FY12E to | 3374/tonne and ~7% YoY FY13E to | 3606/tonne in FY13E. We estimate EBITDA/tonne will improve to | 605/tonne in FY12E and | 639/tonne in FY13E from | 484/tonne in FY11. At the CMP of | 113, the stock is trading at 9.5x and 7.3x its FY12E and FY13E earnings, respectively. The stock is trading at an EV/EBITDA of 5.8x and 6.3x FY12E and FY13E EBITDA, respectively. On an EV/tonne basis, the stock is trading at $51 and $57 its FY12E and FY13E capacities, respectively. We have valued the stock at $75/tonne (~40% discount to the replacement cost) at its FY13E blended capacity of 7.5 MT. We have assigned a HOLD rating to the stock with a target price of | 123/share.

ICICIdirect.com | Equity Research

Page 4

ICICI Securities Limited

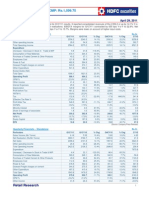

ICICIdirect.com coverage universe (Cement)

ACC Idirect Code MCap Ambuja Cements Idirect Code MCap UltraTech Cements Idirect Code MCap Shree Cement Idirect Code MCap India Cements Idirect Code MCap JK Cement Idirect Code MCap JK Lakshmi Idirect Code MCap JKCORP 561 CMP Target % Upside Orient Paper & Industries Idirect Code MCap Mangalam Cement Idirect Code MCap Birla Corporation Idirect Code MCap Heidelberg Cement Idirect Code MCap MYSCEM 816 CMP Target % Upside 36 51 42% CY10 CY11E CY12E 865.5 917.8 1,448.9 2.8 1.7 3.2 12.9 21.7 11.2 6.0 13.7 6.5 8.1 4.6 8.2 8.9 3.7 9.5 BIRCOR 2472 CMP Target % Upside 321 379 18% FY11 FY12E FY13E 2,127.4 2,471.6 2,932.5 41.5 35.7 47.0 7.7 9.0 6.8 4.6 5.9 3.5 15.5 12.1 14.0 11.7 9.2 11.3 MANCEM 280 CMP Target % Upside 105 139 32% FY11 FY12E FY13E 491.6 556.5 683.2 14.3 12.2 16.7 7.3 8.6 6.3 4.5 4.3 5.1 9.7 8.0 10.2 7.7 8.5 10.2 ORIPAP 1217 CMP Target % Upside 60 67 12% FY11 FY12E FY13E 1,958.9 2,184.5 2,511.2 7.4 11.6 12.9 8.1 5.2 4.7 5.5 3.2 3.2 15.8 16.6 15.8 14.7 16.9 18.4 45 61 36% FY11 FY12E FY13E 1,318.8 1,444.7 1,687.1 4.8 7.2 7.3 9.3 6.3 6.2 5.2 5.8 6.9 5.7 7.9 7.5 4.8 6.0 5.2 JKCEME 790 CMP Target % Upside 113 123 9% FY11 FY12E FY13E 2,080.8 2,315.3 2,697.4 9.2 11.9 15.5 12.3 9.5 7.3 6.8 5.8 6.3 4.7 5.9 7.4 5.8 7.3 6.7 INDCEM 2120 CMP Target % Upside 69 97 41% FY11 FY12E FY13E 3,500.7 4,068.7 4,492.4 2.2 4.5 8.3 31.2 15.5 8.3 10.1 6.6 5.1 1.6 3.2 5.6 2.9 6.2 7.6 SHRCEM 6191 CMP Target % Upside 1796 2068 15% FY11 FY12E FY13E 3,511.8 4,352.5 4,784.9 59.9 16.9 187.8 30.0 106.5 9.6 7.1 5.5 4.3 10.9 3.0 25.3 5.3 4.2 21.5 ULTCEM 28215 CMP Target % Upside 1029 1081 5% FY11 FY12E FY13E 13,209.9 17,568.6 19,295.9 51.2 71.2 74.9 20.1 14.5 13.7 11.2 8.1 7.6 13.2 15.7 14.4 12.0 15.0 14.7 GUJAMB 19737 CMP Target % Upside 129 139 8% CY10 CY11E CY12E 7,390.2 8,410.6 9,313.9 8.3 7.9 8.9 15.6 16.3 14.5 9.6 8.5 7.3 17.2 15.0 15.2 19.4 19.0 18.7 ACC 18959 CMP Target % Upside 1009 1105 10% CY10 CY11E CY12E Sales (| Crore) 7,717.3 9,241.6 10,205.8 EPS (|) 59.6 52.8 62.7 PE (x) 16.9 19.1 16.1 EV/EBITDA (x) 10.8 9.9 8.4 RoNW (%) 17.4 14.4 15.5 RoCE (%) 16.7 16.9 17.9

ICICIdirect.com | Equity Research

Page 5

ICICI Securities Limited

Exhibit 7: Recommendation History

250 200 150 100 50 0 Apr-11 Feb-11 Jan-11 Dec-10 Dec-10 Dec-10 Jan-11 Feb-11 Apr-11 Oct-10 Oct-10 May-11 May-11 Mar-11 Mar-11 Jul-11 Jul-11 Jun-11 Nov-10 Nov-10 Jun-11 Jul-11 Rating BUY BUY STRONG BUY ADD HOLD HOLD BUY

Price

Target Price

Source: Bloomberg, ICICIdirect.com Research

Exhibit 8: Recent Releases

Date 8-Oct-10 16-Nov-10 10-Jan-11 16-Feb-11 8-Apr-11 2-Jun-11 5-Jul-11 Event Q2FY11 Preview Q2FY11 Result Update Q3FY11 Preview Q3FY11 Result Update Q4FY11 Preview Q4FY11 Result Update Q1FY12 Preview CMP 170 166 144 137 138 115 108 Target Price 195 195 180 149 149 123 123

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 6

ICICI Securities Limited

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns ratings to its stocks according to their notional target price vs. current market price and then categorises them as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts' valuation for a stock. Strong Buy: >15%/20% for large caps / midcaps, respectively; Buy: Between 10% and 15%/20% for large caps / midcaps, respectively; Hold: Up to +/-10%; Sell: -10% or more; Pankaj Pandey Head Research ICICIdirect.com Research Desk, ICICI Securities Limited, 7th Floor, Akruti Centre Point, MIDC Main Road, Marol Naka, Andheri (East) Mumbai 400 093 research@icicidirect.com ANALYST CERTIFICATION

We /I, Vijay Goel MBA FINANCE Rashesh Shah CA Hitesh Taunk MBA FINANCE research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc.

pankaj.pandey@icicisecurities.com

Disclosures:

ICICI Securities Limited (ICICI Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on reasonable basis, ICICI Securities, its subsidiaries and associated companies, their directors and employees (ICICI Securities and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities is acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. ICICI Securities and affiliates might have received compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific transaction. ICICI Securities and affiliates expect to receive compensation from the companies mentioned in the report within a period of three months following the date of publication of the research report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific transaction. It is confirmed that Vijay Goel MBA FINANCE Rashesh Shah CA Hitesh Taunk MBA FINANCE research analysts and the authors of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of ICICI Securities, which include earnings from Investment Banking and other business. ICICI Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. It is confirmed that Vijay Goel MBA FINANCE Rashesh Shah CA Hitesh Taunk MBA FINANCE research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member of the companies mentioned in the report. ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. ICICI Securities and affiliates may act upon or make use of information contained in the report prior to the publication thereof. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICIdirect.com | Equity Research

Page 7

Вам также может понравиться

- Madras Cements 4Q FY 2013Документ10 страницMadras Cements 4Q FY 2013Angel BrokingОценок пока нет

- Ambuja Cement 3QC15 Result Review 29-10-15Документ6 страницAmbuja Cement 3QC15 Result Review 29-10-15MEERAОценок пока нет

- Ambuja Cements Result UpdatedДокумент11 страницAmbuja Cements Result UpdatedAngel BrokingОценок пока нет

- JK Lakshmi Cement, 12th February, 2013Документ10 страницJK Lakshmi Cement, 12th February, 2013Angel BrokingОценок пока нет

- NMDC (Natmin) : Outlook Remains BleakДокумент10 страницNMDC (Natmin) : Outlook Remains BleakGauriGanОценок пока нет

- Moil 1qfy2013ruДокумент10 страницMoil 1qfy2013ruAngel BrokingОценок пока нет

- Market Outlook 12th August 2011Документ6 страницMarket Outlook 12th August 2011Angel BrokingОценок пока нет

- Market Outlook Market Outlook: Dealer's DiaryДокумент9 страницMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryДокумент11 страницPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingОценок пока нет

- JKLakshmi Cement 4Q FY 2013Документ10 страницJKLakshmi Cement 4Q FY 2013Angel BrokingОценок пока нет

- Igl 4Q Fy 2013Документ10 страницIgl 4Q Fy 2013Angel BrokingОценок пока нет

- Ceat Result UpdatedДокумент11 страницCeat Result UpdatedAngel BrokingОценок пока нет

- MOIL Result UpdatedДокумент10 страницMOIL Result UpdatedAngel BrokingОценок пока нет

- Ambuja Cements Result UpdatedДокумент11 страницAmbuja Cements Result UpdatedAngel BrokingОценок пока нет

- Gail LTD: Better Than Expected, AccumulateДокумент5 страницGail LTD: Better Than Expected, AccumulateAn PОценок пока нет

- Performance Highlights: Company Update - AutomobileДокумент13 страницPerformance Highlights: Company Update - AutomobileZacharia VincentОценок пока нет

- Shree Cement: CMP: INR9,253 TP: INR9,778 BuyДокумент8 страницShree Cement: CMP: INR9,253 TP: INR9,778 BuyAshish NaikОценок пока нет

- Acc 2Q Cy 2013Документ10 страницAcc 2Q Cy 2013Angel BrokingОценок пока нет

- Balkrishna Industries (BALIND) : Margins vs. Guidance! What Do You Prefer?Документ9 страницBalkrishna Industries (BALIND) : Margins vs. Guidance! What Do You Prefer?drsivaprasad7Оценок пока нет

- India Cements Result UpdatedДокумент12 страницIndia Cements Result UpdatedAngel BrokingОценок пока нет

- ONGC Result UpdatedДокумент11 страницONGC Result UpdatedAngel BrokingОценок пока нет

- NTPC - Edelweiss - May 2011Документ8 страницNTPC - Edelweiss - May 2011Deepti_Deshpan_7988Оценок пока нет

- Ambuja, 15th February 2013Документ10 страницAmbuja, 15th February 2013Angel BrokingОценок пока нет

- MRF 1Q Fy2013Документ12 страницMRF 1Q Fy2013Angel BrokingОценок пока нет

- Petronet LNG: Performance HighlightsДокумент10 страницPetronet LNG: Performance HighlightsAngel BrokingОценок пока нет

- Automobiles: CMP: INR3,390 TP: INR4,800 BuyДокумент8 страницAutomobiles: CMP: INR3,390 TP: INR4,800 BuyAsif ShaikhОценок пока нет

- India Cements Result UpdatedДокумент10 страницIndia Cements Result UpdatedAngel BrokingОценок пока нет

- Tata Motors: AccumulateДокумент5 страницTata Motors: AccumulatepaanksОценок пока нет

- Shree Cement: Performance HighlightsДокумент10 страницShree Cement: Performance HighlightsAngel BrokingОценок пока нет

- Greenply Result UpdatedДокумент10 страницGreenply Result UpdatedAngel BrokingОценок пока нет

- Grasim Q1FY05 Results PresentationДокумент46 страницGrasim Q1FY05 Results PresentationDebalina BanerjeeОценок пока нет

- Madras Cements: Performance HighlightsДокумент10 страницMadras Cements: Performance HighlightsAngel BrokingОценок пока нет

- MRF 2Q Sy 2013Документ12 страницMRF 2Q Sy 2013Angel BrokingОценок пока нет

- Ambuja Cements: Performance HighlightsДокумент11 страницAmbuja Cements: Performance HighlightsAngel BrokingОценок пока нет

- Maruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsДокумент9 страницMaruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsAmritanshu SinhaОценок пока нет

- Ambuja Cements Result UpdatedДокумент11 страницAmbuja Cements Result UpdatedAngel BrokingОценок пока нет

- ACC Result UpdatedДокумент11 страницACC Result UpdatedAngel BrokingОценок пока нет

- Acc 1Q CY 2013Документ10 страницAcc 1Q CY 2013Angel BrokingОценок пока нет

- Acc LTD (Acc) CMP: Rs.1,099.75: Q1CY11 Result Update April 29, 2011Документ4 страницыAcc LTD (Acc) CMP: Rs.1,099.75: Q1CY11 Result Update April 29, 2011Mohammed Asif ValsangkarОценок пока нет

- JKLakshmi Cement, 1Q FY 2014Документ10 страницJKLakshmi Cement, 1Q FY 2014Angel BrokingОценок пока нет

- Rallis India Result UpdatedДокумент10 страницRallis India Result UpdatedAngel BrokingОценок пока нет

- India Cements, 1Q FY 2014Документ10 страницIndia Cements, 1Q FY 2014Angel BrokingОценок пока нет

- Asian Paints 4Q FY 2013Документ10 страницAsian Paints 4Q FY 2013Angel BrokingОценок пока нет

- Tata Steel (TISCO) : Inventory Write-Down Impacts PerformanceДокумент8 страницTata Steel (TISCO) : Inventory Write-Down Impacts PerformanceSajith PratapОценок пока нет

- Ultratech 4Q FY 2013Документ10 страницUltratech 4Q FY 2013Angel BrokingОценок пока нет

- Petronet LNG: Performance HighlightsДокумент10 страницPetronet LNG: Performance HighlightsAngel BrokingОценок пока нет

- India Cement (INDCEM) : Focus Shifts Towards Non-Southern RegionДокумент11 страницIndia Cement (INDCEM) : Focus Shifts Towards Non-Southern RegionumaganОценок пока нет

- Idirect Sail Q4fy16Документ9 страницIdirect Sail Q4fy16Binod Kumar PadhiОценок пока нет

- Madras Cements: Performance HighlightsДокумент12 страницMadras Cements: Performance HighlightsAngel BrokingОценок пока нет

- IDirect HindalcoInds Q1FY17Документ11 страницIDirect HindalcoInds Q1FY17arun_algoОценок пока нет

- Godawari Power, 12th February 2013Документ10 страницGodawari Power, 12th February 2013Angel BrokingОценок пока нет

- Hindustan Petroleum Corporation: Proxy For Marketing PlayДокумент9 страницHindustan Petroleum Corporation: Proxy For Marketing PlayAnonymous y3hYf50mTОценок пока нет

- Indraprastha GasДокумент11 страницIndraprastha GasAngel BrokingОценок пока нет

- Indraprasth Gas Result UpdatedДокумент10 страницIndraprasth Gas Result UpdatedAngel BrokingОценок пока нет

- UltraTech Result UpdatedДокумент10 страницUltraTech Result UpdatedAngel BrokingОценок пока нет

- Neutral: Performance HighlightsДокумент10 страницNeutral: Performance HighlightsAngel BrokingОценок пока нет

- India Cements: Performance HighlightsДокумент10 страницIndia Cements: Performance HighlightsAngel BrokingОценок пока нет

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryОт EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Silicon Carbide Solid & Grains & Powders & Flour Abrasives World Summary: Market Sector Values & Financials by CountryОт EverandSilicon Carbide Solid & Grains & Powders & Flour Abrasives World Summary: Market Sector Values & Financials by CountryОценок пока нет

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryОт EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Motivational Speech About Our Dreams and AmbitionsДокумент2 страницыMotivational Speech About Our Dreams and AmbitionsÇhärlöttë Çhrístíñë Dë ÇöldëОценок пока нет

- Master Books ListДокумент32 страницыMaster Books ListfhaskellОценок пока нет

- Facilitation TheoryДокумент2 страницыFacilitation TheoryYessamin Valerie PergisОценок пока нет

- Upload A Document To Access Your Download: The Psychology Book, Big Ideas Simply Explained - Nigel Benson PDFДокумент3 страницыUpload A Document To Access Your Download: The Psychology Book, Big Ideas Simply Explained - Nigel Benson PDFchondroc11Оценок пока нет

- The Handmaid's Tale - Chapter 2.2Документ1 страницаThe Handmaid's Tale - Chapter 2.2amber_straussОценок пока нет

- Seismic Response of Elevated Liquid Storage Steel Tanks Isolated by VCFPS at Top of Tower Under Near-Fault Ground MotionsДокумент6 страницSeismic Response of Elevated Liquid Storage Steel Tanks Isolated by VCFPS at Top of Tower Under Near-Fault Ground MotionsciscoОценок пока нет

- Adm Best Practices Guide: Version 2.0 - November 2020Документ13 страницAdm Best Practices Guide: Version 2.0 - November 2020Swazon HossainОценок пока нет

- Far Eastern University-Institute of Nursing In-House NursingДокумент25 страницFar Eastern University-Institute of Nursing In-House Nursingjonasdelacruz1111Оценок пока нет

- Test Statistics Fact SheetДокумент4 страницыTest Statistics Fact SheetIra CervoОценок пока нет

- Memoire On Edgar Allan PoeДокумент16 страницMemoire On Edgar Allan PoeFarhaa AbdiОценок пока нет

- Reported Speech Step by Step Step 7 Reported QuestionsДокумент4 страницыReported Speech Step by Step Step 7 Reported QuestionsDaniela TorresОценок пока нет

- Spring94 Exam - Civ ProДокумент4 страницыSpring94 Exam - Civ ProGenUp SportsОценок пока нет

- Syllabus For B.A. (Philosophy) Semester-Wise Titles of The Papers in BA (Philosophy)Документ26 страницSyllabus For B.A. (Philosophy) Semester-Wise Titles of The Papers in BA (Philosophy)Ayan AhmadОценок пока нет

- English Lesson Plan 6 AugustДокумент10 страницEnglish Lesson Plan 6 AugustKhairunnisa FazilОценок пока нет

- TOPIC I: Moral and Non-Moral ProblemsДокумент6 страницTOPIC I: Moral and Non-Moral ProblemsHaydee Christine SisonОценок пока нет

- Cum in Mouth ScriptsДокумент10 страницCum in Mouth Scriptsdeudaerlvincent72Оценок пока нет

- Lesson Plan MP-2Документ7 страницLesson Plan MP-2VeereshGodiОценок пока нет

- The Music of OhanaДокумент31 страницаThe Music of OhanaSquaw100% (3)

- Sucesos de Las Islas Filipinas PPT Content - Carlos 1Документ2 страницыSucesos de Las Islas Filipinas PPT Content - Carlos 1A Mi YaОценок пока нет

- Form No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBДокумент1 страницаForm No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBIam KarthikeyanОценок пока нет

- The Cognitive Enterprise For HCM in Retail Powered by Ibm and Oracle - 46027146USENДокумент29 страницThe Cognitive Enterprise For HCM in Retail Powered by Ibm and Oracle - 46027146USENByte MeОценок пока нет

- Designing A Peace Building InfrastructureДокумент253 страницыDesigning A Peace Building InfrastructureAditya SinghОценок пока нет

- Promising Anti Convulsant Effect of A Herbal Drug in Wistar Albino RatsДокумент6 страницPromising Anti Convulsant Effect of A Herbal Drug in Wistar Albino RatsIJAR JOURNALОценок пока нет

- Short-Term Load Forecasting by Artificial Intelligent Technologies PDFДокумент446 страницShort-Term Load Forecasting by Artificial Intelligent Technologies PDFnssnitОценок пока нет

- University of Dar Es Salaam MT 261 Tutorial 1Документ4 страницыUniversity of Dar Es Salaam MT 261 Tutorial 1Gilbert FuriaОценок пока нет

- Dr. A. Aziz Bazoune: King Fahd University of Petroleum & MineralsДокумент37 страницDr. A. Aziz Bazoune: King Fahd University of Petroleum & MineralsJoe Jeba RajanОценок пока нет

- Faith-Based Organisational Development (OD) With Churches in MalawiДокумент10 страницFaith-Based Organisational Development (OD) With Churches in MalawiTransbugoyОценок пока нет

- Easter in RomaniaДокумент5 страницEaster in RomaniaDragos IonutОценок пока нет

- Discussion #3: The Concept of Culture Learning ObjectivesДокумент4 страницыDiscussion #3: The Concept of Culture Learning ObjectivesJohn Lery SurellОценок пока нет

- Sophia Vyzoviti - Super SurfacesДокумент73 страницыSophia Vyzoviti - Super SurfacesOptickall Rmx100% (1)