Академический Документы

Профессиональный Документы

Культура Документы

Ê Ê ! "C!!#!!!$% "C!!#!!!$%ê C &!#!!! C!#!!!ê ' (!#!!!) !#!!!Ê) ) !#!!! (!#!!!Ê (C!#!!! !#!!!Ê + Ê, ! C ') (

Загружено:

Islam IssaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ê Ê ! "C!!#!!!$% "C!!#!!!$%ê C &!#!!! C!#!!!ê ' (!#!!!) !#!!!Ê) ) !#!!! (!#!!!Ê (C!#!!! !#!!!Ê + Ê, ! C ') (

Загружено:

Islam IssaАвторское право:

Доступные форматы

1)

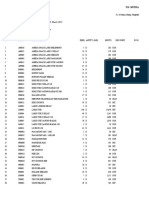

As the d|rector of cap|ta| budget|ng for A8C Corporat|on you are eva|uat|ng two mutua||y exc|us|ve

pro[ects w|th the fo||ow|ng net cash f|ows

ear ro[ect k ro[ect

0 100000 LL 100000 LL

1 S0000 10000

2 40000 30000

3 30000 40000

4 10000 60000

Wr|te br|ef|y wh|ch of the two pro[ects wou|d you recommend and why

Ior pro[ect k

ear 0 1 2 3 4

NCI $ (100000) $ 30000 $ 40000 $ 30000 $ 10000

Cumm NCI $ (100000) $ (30000) $ (10000) $ 20000 $ 30000

ro[ect k ayback per|od 2 + (10000]30000) 2333 years

Ior pro[ect

ear 0 1 2 3 4

NCI $ (100000) $ 10000 $ 30000 $ 40000 $ 60000

Cumm NCI $ (100000) $ (90000) $ (60000) $ (20000) $ 40000

ro[ect ayback per|od 3 + (20000]60000) 3333 years

## Accord|ng|y pro[ect k |s better for |ower payback per|od ##

2)

ro[ect k has a cost of 5S212S |ts expected net cash |nf|ows are 512000 per year for 8 years What |s

the pro[ect's payback per|od?

ear 0 1 2 3 4 S 6 7 8

NCI

$

(32123)

$

12000

$

12000

$

12000

$

12000

$

12000

$

12000

$

12000

$

12000

Cumm

NCI

$

(32123)

$

(40123)

$

(28123)

$

(16123)

$

(4123)

$

7873

$

19873

$

31873

$

43873

ro[ect k ayback per|od 4 + (412S]12000) 4344 years

3)

G|ven the fo||ow|ng cash f|ows for a cap|ta| pro[ect ca|cu|ate the NV and Ikk 1he requ|red rate of

return |s 8 percent

ear Cash I|ow

0 S0000 LL

1 1S000

2 1S000

3 20000

4 10000

S S000

I|nd the pro[ect's

a) ayback per|od

b) D|scounted payback per|od

c) NV

d) Ikk

a) ayback per|od

ear 0 1 2 3 4 S

NCI

$

(30000)

$

13000

$

13000

$

20000

$

10000

$ 3000

Cumm NCI

$

(30000)

$

(33000)

$

(20000)

$

0

$

10000

$ 13000

ro[ect ayback per|od 2 + (20000]20000) 3 years

b) D|scounted payback per|od

ear 0 1 2 3 4 S

NCI $

(30000)

$

13000

$

13000

$

20000

$

10000

$

3000

VII

(008n)

0926 0837 0794 0733 0681

D|sc

NCI

$

(30000)

$

13890

$

12833

$

13880

$

7330

$

3403

D|sc

Com

NCI

$

(30000)

$

(36110)

$

(23233)

$

(7373)

$

(23)

$

3380

ro[ect d|scounted payback per|od 4 + (2S]340S) 4007 years

c) NV

ear 0 1 2 3 4 S

NCI $

(30000)

$

13000

$

13000

$

20000

$

10000

$

3000

VII

(008n)

0926 0837 0794 0733 0681

D|sc

NCI

$

(30000)

$

13890

$

12833

$

13880

$

7330

$

3403

NV S0000 + 13890 + 128SS + 1S880 + 73S0 + 340S 3380

d) Ikk

ear 0 1 2 3 4 S

NCI

$

(30000)

$

13000

$

13000

$

20000

$

10000

$

3000

Ikk 1088

4)

1he Costa k|can Coffee Company |s eva|uat|ng the w|th|np|ant d|str|but|on system for |ts new

roast|ng gr|nd|ng and packag|ng p|ant 1he two a|ternat|ves are (1) a conveyor system w|th a h|gh

|n|t|a| cost but |ow annua| operat|ng costs and (2) severa| fork||ft trucks wh|ch cost |ess but have

cons|derab|y h|gher operat|ng costs 1he dec|s|on to construct the p|ant has a|ready been made and

the cho|ce here w||| have no effect on the overa|| revenues of the pro[ect 1he cost of cap|ta| for the

p|ant |s 9 percent and the pro[ects' expected net costs are as fo||ows

ear Conveyor Iork||fts

0 (5300000) (5120000)

1 (66000) (96000)

2 (66000) (96000)

3 (66000) (96000)

4 (66000) (96000)

S (66000) (96000)

What |s the V of costs for each a|ternat|ve? Wh|ch one shou|d be chosen?

ear Conveyor VII(009n) Conveyor NV Iork||fts VII(009n)

Iork||fts

NV

0

$

(300000)

$

(300000)

$

(120000)

$

(120000)

1

$

(66000)

0917

$

(60322)

$

(96000)

0917

$

(88032)

2

$

(66000)

0842

$

(33372)

$

(96000)

0842

$

(80832)

3

$

(66000)

0772

$

(30932)

$

(96000)

0772

$

(74112)

4

$

(66000)

0708

$

(46728)

$

(96000)

0708

$

(67968)

S

$

(66000)

0630

$

(42900)

$

(96000)

0630

$

(62400)

1ota| conveyor cash out f|ows NV 5 SS6674

1ota| fork||fts cash out f|ows NV 5 493344 ## 8est Cpt|on##

Вам также может понравиться

- Practical Variable Speed Drives and Power ElectronicsОт EverandPractical Variable Speed Drives and Power ElectronicsРейтинг: 5 из 5 звезд5/5 (3)

- Wllkerson Company operating results valves pumps flow controllersДокумент2 страницыWllkerson Company operating results valves pumps flow controllersdp14Оценок пока нет

- Compress SPPДокумент3 страницыCompress SPPlordknОценок пока нет

- Submitted By:: Qaisar Shahzad Submitted To: Dr. Haroon Hussain Sb. Roll NoДокумент8 страницSubmitted By:: Qaisar Shahzad Submitted To: Dr. Haroon Hussain Sb. Roll NoFaaiz YousafОценок пока нет

- Engineering Economics Final QSДокумент6 страницEngineering Economics Final QSAyugma Acharya0% (1)

- Nro. Unidades 350,000 280,000 350,000 420,000 Precio Unitario $ 580 $ 609 $ 639 $ 671 Costo Unitario $ 319 $ 335 $ 352 $ 369Документ3 страницыNro. Unidades 350,000 280,000 350,000 420,000 Precio Unitario $ 580 $ 609 $ 639 $ 671 Costo Unitario $ 319 $ 335 $ 352 $ 369cruzОценок пока нет

- GATLABAYAN - Activity #1 M3Документ4 страницыGATLABAYAN - Activity #1 M3Al Dominic GatlabayanОценок пока нет

- SampleДокумент39 страницSampleHoàng TriềuОценок пока нет

- CapbdgtДокумент25 страницCapbdgtmajidОценок пока нет

- Machine Investment Cash Flow Analysis and NPV CalculationДокумент22 страницыMachine Investment Cash Flow Analysis and NPV CalculationNadya RizkitaОценок пока нет

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Документ19 страницBajaj Finserv Investor Presentation - Q2 FY2018-19AmarОценок пока нет

- Waste Management in IndiaДокумент26 страницWaste Management in IndiaAndre SuitoОценок пока нет

- BILANT 2015: Romania JUDETUL Teleorman Comuna Galateni Anexa 1 (Anexa 1 La Normele Metodologice)Документ13 страницBILANT 2015: Romania JUDETUL Teleorman Comuna Galateni Anexa 1 (Anexa 1 La Normele Metodologice)Sorin GeorgianОценок пока нет

- ABC Company Is Considering The Replacement of Old Machine That Is 3 Three Years Old With A NewДокумент9 страницABC Company Is Considering The Replacement of Old Machine That Is 3 Three Years Old With A Newrajaroma45Оценок пока нет

- Solution Assignment Chapter 9 10 1Документ14 страницSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuОценок пока нет

- Assignment 4 - Contemporary Engineering BookДокумент9 страницAssignment 4 - Contemporary Engineering BookDhiraj NayakОценок пока нет

- Assignment-1 - Full SolutionДокумент14 страницAssignment-1 - Full SolutionKhaalid MaxamedОценок пока нет

- Solutions Manual Management Accounting Sixth Canadian Edition 6th Edition HorngrenДокумент33 страницыSolutions Manual Management Accounting Sixth Canadian Edition 6th Edition HorngrenErika LanezОценок пока нет

- Chemallte FinancialsДокумент7 страницChemallte FinancialsTara AkinteweОценок пока нет

- Capital Budgeting DCFДокумент38 страницCapital Budgeting DCFNadya Rizkita100% (4)

- W11.Corporate Finance - Assignment#5Документ1 страницаW11.Corporate Finance - Assignment#5Islam IssaОценок пока нет

- Project Finance: Valuing Unlevered ProjectsДокумент32 страницыProject Finance: Valuing Unlevered ProjectsKelsey GaoОценок пока нет

- Corporate Finance Project Analysis and Machine Replacement DecisionДокумент9 страницCorporate Finance Project Analysis and Machine Replacement DecisionFaaiz YousafОценок пока нет

- Costs and Revenue of Tarangelic Riz:: Production & Cost Case StudyДокумент3 страницыCosts and Revenue of Tarangelic Riz:: Production & Cost Case StudyVicky Kuroi BaraОценок пока нет

- Annual profits and salaries from vehicle fleet operations over 40 yearsДокумент9 страницAnnual profits and salaries from vehicle fleet operations over 40 yearsLaika AerospaceОценок пока нет

- F.M Rev 2019Документ17 страницF.M Rev 2019AA BB MMОценок пока нет

- EE - Assignment Chapter 9-10 SolutionДокумент11 страницEE - Assignment Chapter 9-10 SolutionXuân ThànhОценок пока нет

- Cost of ProjectДокумент45 страницCost of ProjectRohit SinghОценок пока нет

- Amravati Municipal Corporation: For Municipal Solid Waste Treatment ProjectДокумент6 страницAmravati Municipal Corporation: For Municipal Solid Waste Treatment ProjectGaurav kumarОценок пока нет

- Finance&Accounts T3 SolutionДокумент4 страницыFinance&Accounts T3 Solutionkanika thakurОценок пока нет

- Capital Lease Analysis and Amortization SchedulesДокумент5 страницCapital Lease Analysis and Amortization SchedulesZihad Al AminОценок пока нет

- Chapter 9-1Документ5 страницChapter 9-1jou20220354Оценок пока нет

- Exel Calculation (Version 1)Документ10 страницExel Calculation (Version 1)Timotius AnggaraОценок пока нет

- AssignmentДокумент5 страницAssignmentPrashanthRameshОценок пока нет

- EC design business plan analysisДокумент7 страницEC design business plan analysisAmal SalhiОценок пока нет

- Inventory and Logistics Exam QuestionsДокумент10 страницInventory and Logistics Exam Questionsطه احمدОценок пока нет

- Rekening Koran Page SummaryДокумент1 страницаRekening Koran Page SummaryLidia'dije DjoeddawiОценок пока нет

- FY18 GPA Preliminary CompareДокумент37 страницFY18 GPA Preliminary CompareMaine Trust For Local NewsОценок пока нет

- DepreciationДокумент5 страницDepreciationsofyan samОценок пока нет

- EEE Assignment 6Документ5 страницEEE Assignment 6shirleyОценок пока нет

- EEE Assignment 6Документ5 страницEEE Assignment 6shirleyОценок пока нет

- 2.11Lpg Gas-Cylinder ROIДокумент1 страница2.11Lpg Gas-Cylinder ROIKeroz NazriОценок пока нет

- CAPCOST ProjectДокумент16 страницCAPCOST ProjectJonathanОценок пока нет

- 7 JBRG 0 RДокумент4 страницы7 JBRG 0 RMentariОценок пока нет

- Assignment 3 Case Study 1. 16th August 2020Документ9 страницAssignment 3 Case Study 1. 16th August 2020Shivam AgarwalОценок пока нет

- Value-in-Use Pricing AnalysisДокумент11 страницValue-in-Use Pricing AnalysisramanОценок пока нет

- Class Work 19.10.11Документ4 страницыClass Work 19.10.11Shaan Yeat Amin RatulОценок пока нет

- EE - Assignment Chapter 7 SolutionДокумент7 страницEE - Assignment Chapter 7 SolutionXuân ThànhОценок пока нет

- Optimal distribution of shipments from plants to distribution centersДокумент11 страницOptimal distribution of shipments from plants to distribution centersMateo NietoОценок пока нет

- Replacement Analysis: Economic Life of AssetsДокумент9 страницReplacement Analysis: Economic Life of AssetsMustafa Gökhan YavuzОценок пока нет

- Tuscany Year 1 Year 2Документ9 страницTuscany Year 1 Year 2juri kimОценок пока нет

- Assignment 10 - ShivaДокумент21 страницаAssignment 10 - ShivaShiva KashyapОценок пока нет

- E Street Development Waterfall - Fall 2020 Part 2 - MasterДокумент38 страницE Street Development Waterfall - Fall 2020 Part 2 - Masterapi-544095773Оценок пока нет

- RinstallationДокумент16 страницRinstallationTRISHA ISOBELLE ARBOLEDAОценок пока нет

- Final Practrice (Unit 4 and 5)Документ9 страницFinal Practrice (Unit 4 and 5)mjlОценок пока нет

- Methods For Determining DepreciationДокумент16 страницMethods For Determining DepreciationIyer VasundharaОценок пока нет

- (MCOF19M018) CF ProjectДокумент8 страниц(MCOF19M018) CF ProjectFaaiz YousafОценок пока нет

- Solution Assignment 4 Chapter 7Документ9 страницSolution Assignment 4 Chapter 7Huynh Ng Quynh NhuОценок пока нет

- DAY 04 Compound Interest (21 Days 21 Marathon)Документ5 страницDAY 04 Compound Interest (21 Days 21 Marathon)bomihij827Оценок пока нет

- UCMDB10.10 Support MatrixДокумент32 страницыUCMDB10.10 Support MatrixIslam IssaОценок пока нет

- HP Man D2C ConceptConfigurationGuide PDFДокумент127 страницHP Man D2C ConceptConfigurationGuide PDFIslam IssaОценок пока нет

- MGMT 501 V.lab Boody Report 5Документ20 страницMGMT 501 V.lab Boody Report 5Islam IssaОценок пока нет

- Manzana 2Документ5 страницManzana 2Islam IssaОценок пока нет

- Middle East Banking Finance BrochureДокумент11 страницMiddle East Banking Finance BrochureIslam IssaОценок пока нет

- FINC 527 Project Notes MoatazДокумент1 страницаFINC 527 Project Notes MoatazIslam IssaОценок пока нет

- Project Status Report: Presenter Name Presentation DateДокумент11 страницProject Status Report: Presenter Name Presentation DateG Chandra SekharОценок пока нет

- Auc Grad App Checklist 2012-13Документ3 страницыAuc Grad App Checklist 2012-13Islam IssaОценок пока нет

- Waiting Line TheoryДокумент48 страницWaiting Line TheoryDeepti Borikar100% (1)

- Economics Lecture 1 - 1 PDFДокумент3 страницыEconomics Lecture 1 - 1 PDFIslam IssaОценок пока нет

- The Donner Company Case Analysis V0R1 - Template 1Документ11 страницThe Donner Company Case Analysis V0R1 - Template 1Islam Issa0% (2)

- CA Service Desk Manager Switzerland ENGДокумент4 страницыCA Service Desk Manager Switzerland ENGIslam IssaОценок пока нет

- Economics Lecture 1 - 1 PDFДокумент3 страницыEconomics Lecture 1 - 1 PDFIslam IssaОценок пока нет

- Donner Company Process Flow Case AnalysisДокумент2 страницыDonner Company Process Flow Case AnalysisIslam IssaОценок пока нет

- SSR Odd Solutions 2 9eДокумент7 страницSSR Odd Solutions 2 9eIslam IssaОценок пока нет

- TestДокумент1 страницаTestIslam IssaОценок пока нет

- W11.Corporate Finance - Assignment#5Документ1 страницаW11.Corporate Finance - Assignment#5Islam IssaОценок пока нет